Shake Shack $SHAK Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker: $SHAK

Sector: Fast Food

Company Description: Shake Shack Inc. owns, operates, and licenses Shake Shack restaurants (Shacks) in the United States and internationally. Its Shacks offers hamburgers, chicken, hot dogs, crinkle cut fries, shakes, frozen custard, beer, wine, and other products. The company was founded in 2001 and is headquartered in New York, New York.

Shake Shack ($SHAK): Leveraging Gen AI and Reddit to Drive Sales

Shake Shack ($SHAK) has long been recognized for its quality burgers and vibrant dining experience, but recently, the company has taken an innovative approach to boost its sales and connect with a younger audience. Utilizing generative AI (Gen AI) and insights from Reddit, Shake Shack has managed to create a unique marketing strategy that has shown promising results, particularly in Sunday burger sales.

Harnessing Gen AI and Reddit Insights

Shake Shack’s latest marketing campaign was designed with the help of generative AI and data gleaned from Reddit discussions. They used a third-party service to collect and analyze data from over 80,000 subreddits, which allowed them to find and target the best subreddits to advertise on. Focusing on “chicken sandwich” and “gourmet burger” related terms, they were able to find their target audience across about 30 specific subreddits and focus ad dollars there. Although too much specific data isn’t available, a 10-day ad campaign in April yielded a 31% increase from baseline ad clicks, a resounding success.

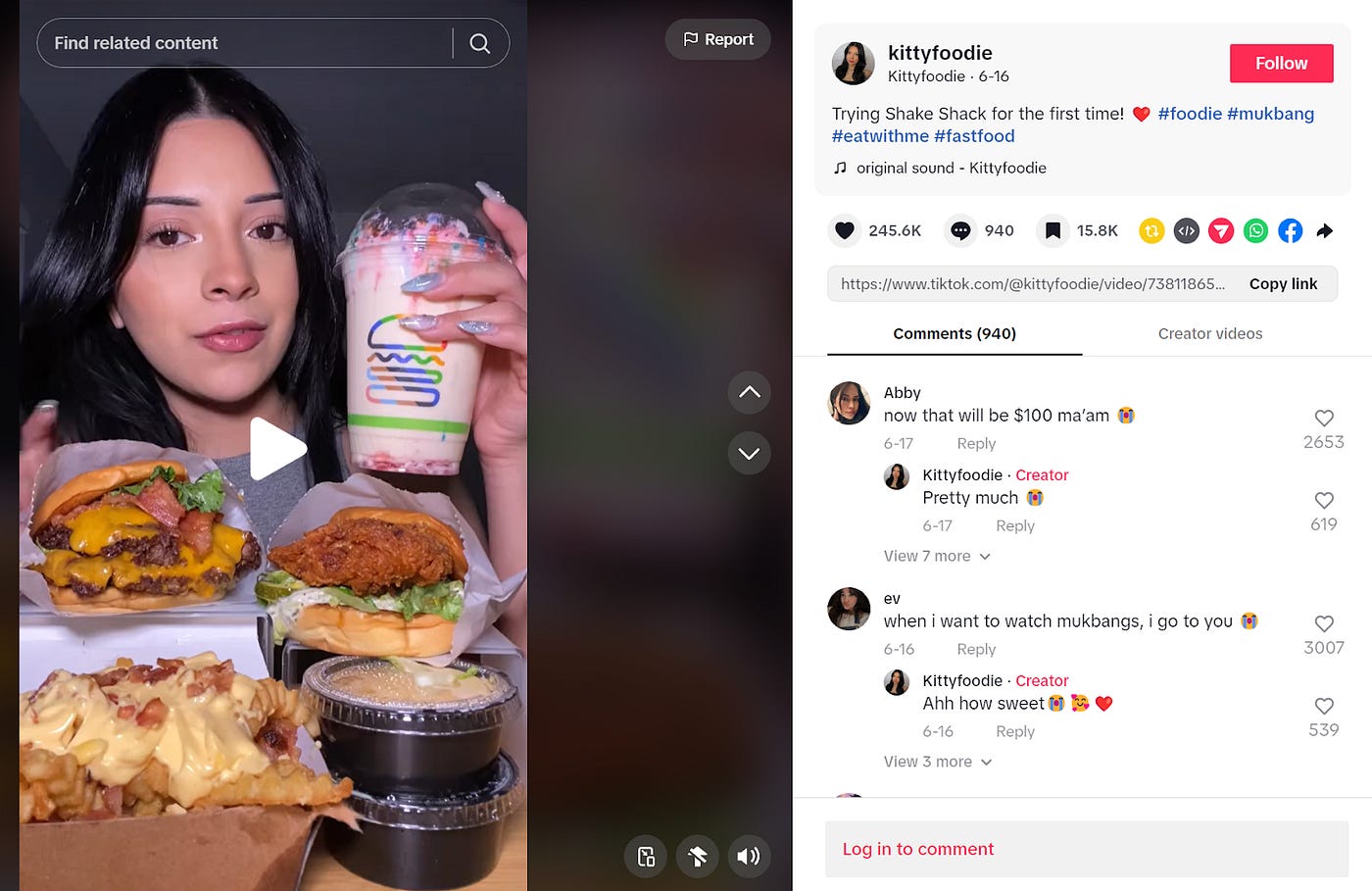

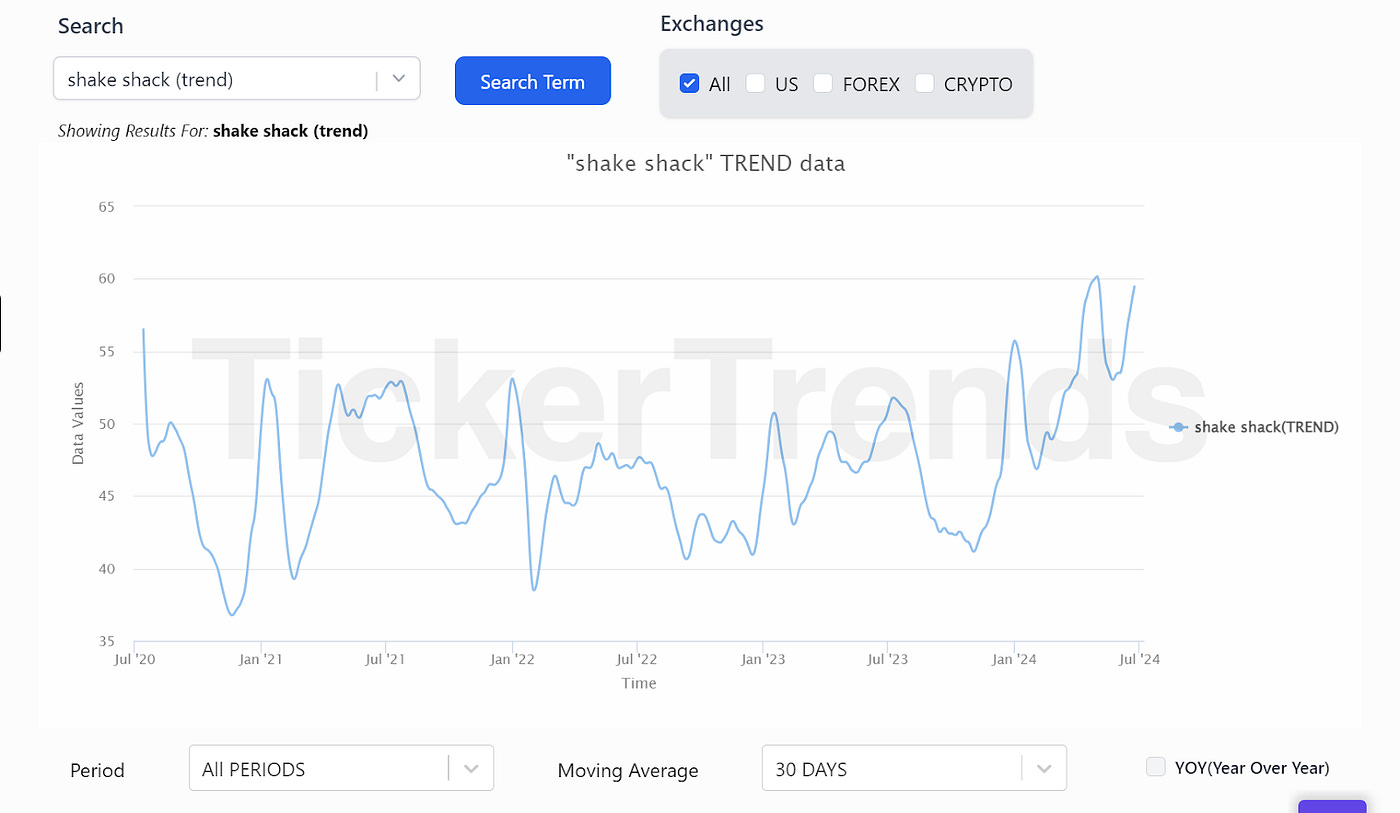

This strategy not only enhanced their online presence but also drove traffic to their website, as evidenced by an uptick in Website Traffic, Tiktok and Google Trends data.

Boost in Sunday Burger Sales

One of the most significant outcomes of this strategy has been the notable increase in Sunday burger sales. By focusing on this specific time frame in “Sunday burger store” related terms, Shake Shack capitalized on a period where many families and individuals are looking for convenient and enjoyable dining options, specifically when chains like Chick-fil-A are closed. The targeted AI-driven campaigns highlighted special Sunday offers and new menu items, which resonated well with customers.

Sugary Drink Beneficiary

We have recently written about the sugary drink trend in our Dutch Bros article and see Shake Shack also taking advantage and benefiting from it. Consumers are increasingly choosing sugary drinks, and the Shack is embracing that trend with drink items they are putting on their menu.

Challenges Ahead: Profitability Concerns

Despite the success in driving sales and increasing interest, Shake Shack historically has not sustained profitability, which is the main downside risk in the stock. While the revenue has grown substantially, the operating margin has remained somewhat stagnant and hit-or-miss most years.

Conclusion

As Shake Shack continues to refine its use of Gen AI and leverage insights from social platforms like Reddit, the potential for sustained growth and improved profitability becomes more tangible. Monitoring the company’s financial health in the coming quarters will be crucial to assess whether these strategies translate into lasting financial gains.

In conclusion, Shake Shack’s innovative approach to marketing, driven by generative AI and social media insights, has proven to be a winning strategy in driving sales, particularly on Sundays. The company is also a sugary drink trend beneficiary. While profitability challenges remain, the increased interest and engagement on social media platforms as well as advertising prowess suggests a positive trajectory for the brand overall. However, investors will be keenly watching to see if Shake Shack can turn this increased demand into consistent profitability.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus