Shopify’s Q3 Acceleration Story Might Just Be Getting Started

Alternative Data Signals Reacceleration in Shopify GMV Growth Ahead of Earnings

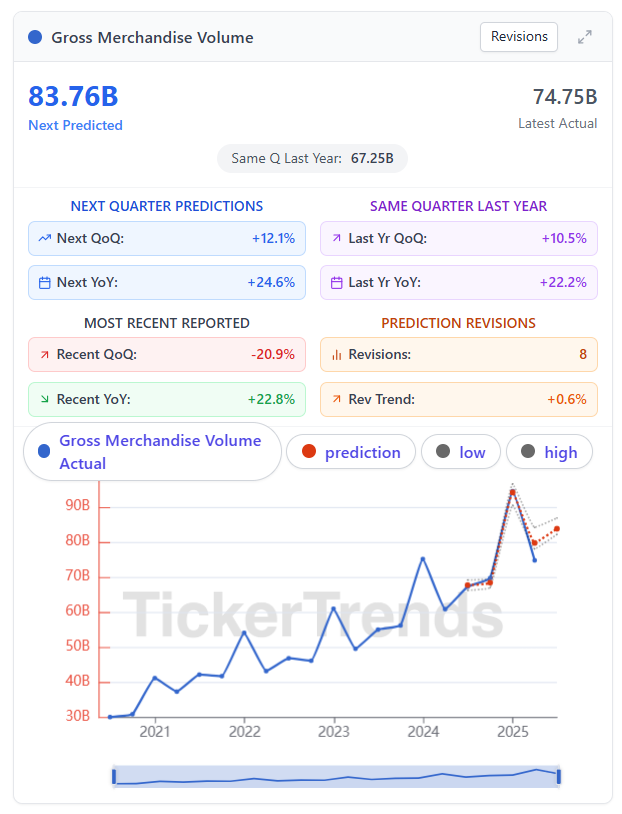

Shopify is currently forecast to post around +25% YoY GMV growth for this quarter, in line with both analyst consensus and our own GMV tracker. But the bigger divergence between our view and the Street shows up just ahead: while consensus expects GMV growth to moderate into the +20% range and lower for FQ3’25 and beyond, our alternative data is telling a very different story.

GMV Forecast: TickerTrends vs. Analysts

Q2 2025 GMV Forecast:

Q2 2024 GMV: $67.25B

Analyst Estimate FQ2’25: $81.63B (+21.4% YoY)

TickerTrends Forecast FQ2’25: $83.76B (+24.6% YoY)

Delta: +3.2 percentage points

Q3 2025 GMV Forecast (based sustained/accelerating alt data signals as of 8/4/2025)

Q3 2024 GMV: $69.72B

Analyst Estimate: $83.27B (+19.40% YoY)

TickerTrends Forecast: $85.90B (+24.0% YoY)

Delta: +4.6 percentage points

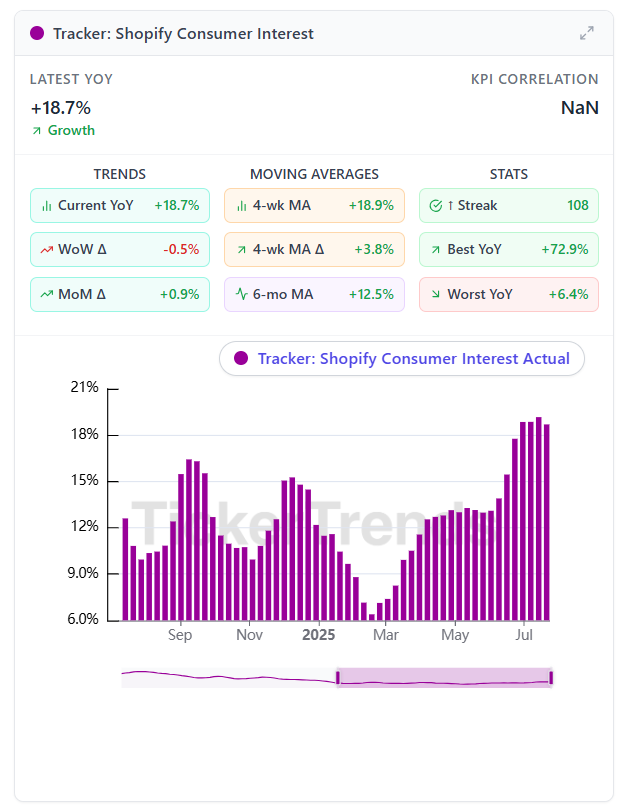

Since early June, our Consumer Interest Tracker has jumped by about 5.5 percentage points YoY.

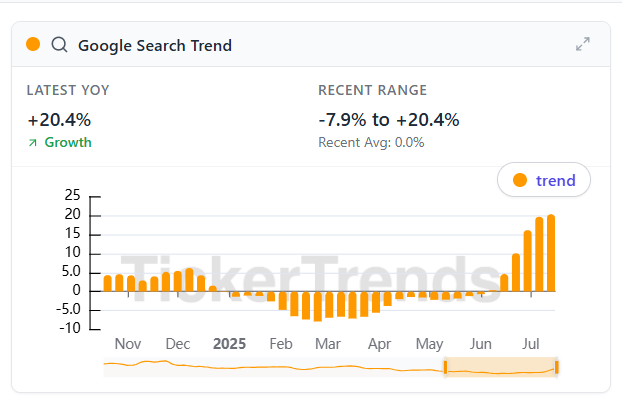

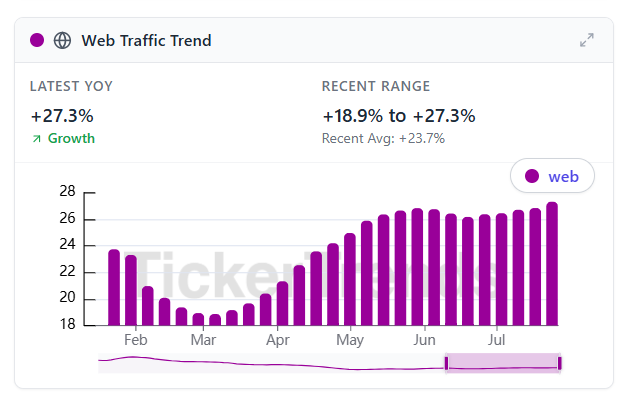

That reacceleration is also echoed across multiple independent data streams:

Google Search Trends for Shopify hit a new yearly high in July, up +20.4% YoY

Website traffic remains strong, climbing to +27.3% YoY, with a consistent plateau at elevated levels since late May

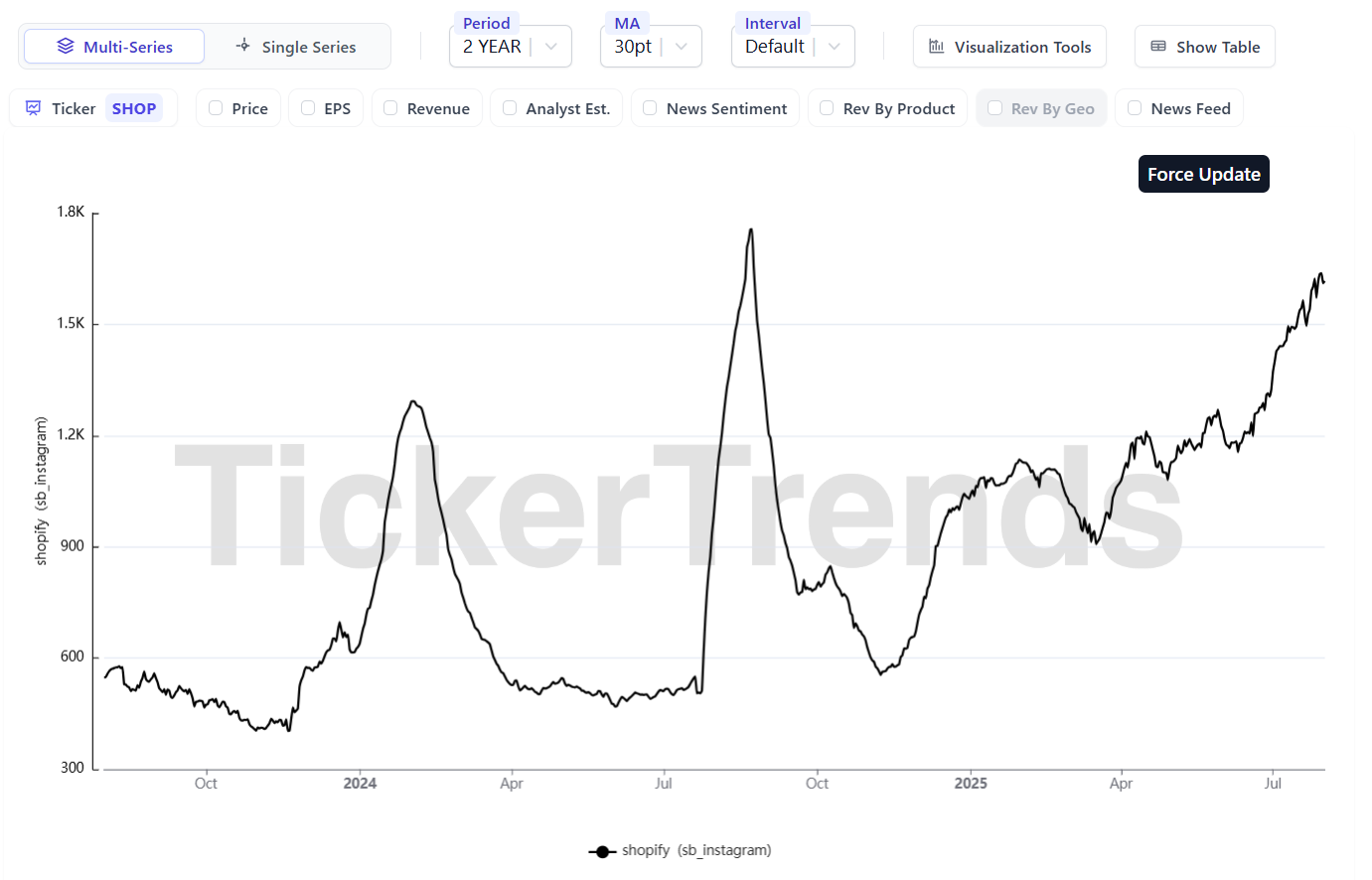

Consumer sentiment and visibility are also trending higher on platforms like Instagram, with the “@shopify” Instagram gaining >1,500 followers/day compared to ~1,000/day before this traction.

This positive momentum comes just as Shopify is deepening its exposure to the AI ecosystem. Three weeks ago, OpenAI quietly added Shopify as a shopping search partner, positioning the company to capture AI-enabled consumer intent across conversational platforms. If successful, this could allow Shopify to pick up high-intent traffic at a lower acquisition cost, an especially important lever as DTC competition remains tight.

This also positions, SHOP 0.00%↑ as an AI winner in a sea of software losers.

So while analysts are penciling in a cooldown, the digital pulse we track is heating up. Q3 might not be the slowdown quarter many analysts expect. A topline acceleration may excite the Street. SHOP 0.00%↑ is certainly not cheap at 49x FY’27E FCF, but a revenue acceleration could push their topline and FCF margins even higher sustaining this elevated multiple. Earnings are on deck for August 6, 2025 in the morning and with much strength across digital ad names so far this earnings season, this stock is one to watch for their commentary on the outlook.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 200 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise