Social Arbitrage: Understanding Market Inefficiencies

Social arbitrage uses social and cultural data - like trends on TikTok, Reddit, and Google Search - to identify market inefficiencies before they reflect in stock prices. By spotting early signals, investors can capitalize on mispriced assets caused by delayed market reactions.

Key Takeaways:

What is Social Arbitrage? A method to find investment opportunities using social media trends, search data, and consumer behavior shifts.

How It Works: Tools like TickerTrends analyze alternative data (e.g., social media sentiment, search volume) to uncover trends early.

Example: In 2019, Chris Camillo predicted E.L.F. Beauty's stock surge after a viral influencer review, doubling its price in six months.

Challenges: Risks include data quality issues, biases, manipulation, and regulatory concerns like GDPR compliance.

Social arbitrage combines speed, alternative data, and risk management to help investors act on trends before the market catches up.

Social Arbitrage Hedge Fund

Understanding Market Inefficiencies

Market inefficiencies happen when asset prices don't fully reflect all available information, opening the door for investors to profit from mispriced assets.

What Causes Market Inefficiencies

These inefficiencies arise from two main factors: gaps in information and behavioral biases. Information gaps occur when some market participants have better access to data than others. For instance, during the 2008 financial crisis, herd behavior caused investors to overvalue mortgage-backed securities, ignoring clear risks [2]. Similarly, in markets like used cars, sellers often know more about product quality than buyers, leading to pricing mismatches and missed opportunities [2].

Behavioral biases, such as emotions driving irrational decisions, also play a role. Investors often follow the crowd or make decisions based on fear or greed, which can distort asset prices.

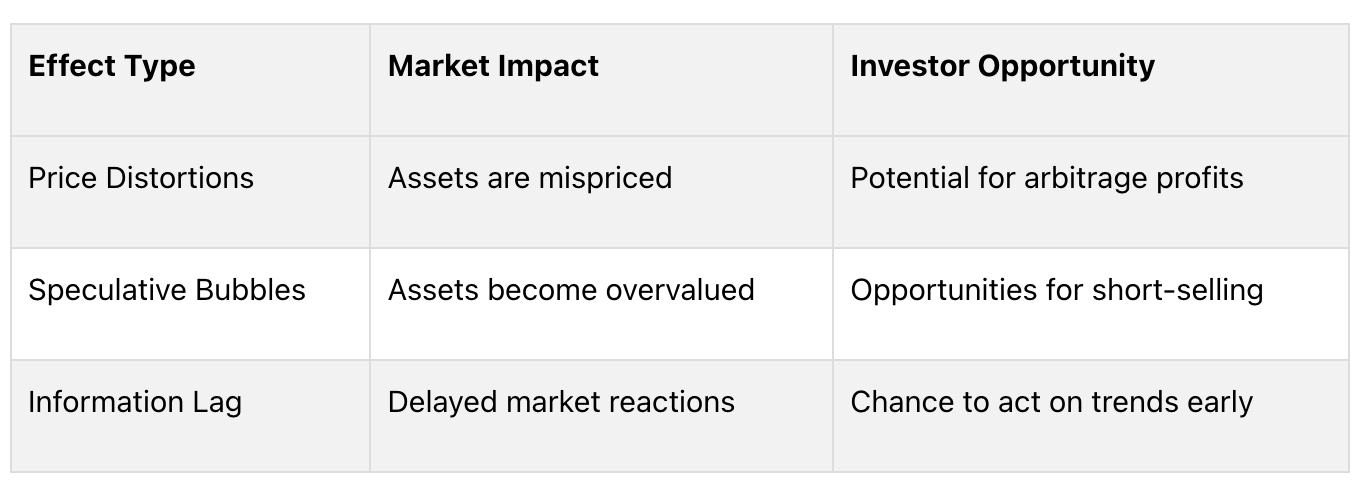

Effects of Market Inefficiencies on Financial Markets

Market inefficiencies can create both challenges and opportunities for investors. Here's how they play out:

For example, speculative bubbles like the dot-com boom show how identifying mispriced assets early can be advantageous. Social arbitrage investors often rely on alternative data to spot these inefficiencies before the market corrects itself [3]. Behavioral patterns, such as herd mentality during the 2008 crisis, further delay rational price adjustments and amplify these inefficiencies [3].

To succeed with strategies like social arbitrage, investors need to spot situations where social or cultural changes aren't yet reflected in asset prices. But recognizing inefficiencies is just the start - using alternative data effectively is what turns them into real opportunities.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

Using Alternative Data for Social Arbitrage

Alternative data has become a game-changer for spotting market inefficiencies before they show up in traditional financial metrics. By diving into non-traditional data sources, investors can uncover insights that others might overlook.

Types of Alternative Data

Social arbitrage thrives on a mix of data sources that highlight changing consumer habits and market trends:

Tools and Methods for Social Arbitrage

Social arbitrage is all about gathering varied data, spotting trends, and validating findings. Tools like TickerTrends make this process easier by combining social media, web traffic, and consumer behavior data. Their Alternative Data Terminal provides real-time insights through metrics like the Social Arbitrage Score and Investor Saturation Score.

For success, the process typically involves:

Collecting data from a variety of sources

Spotting emerging trends

Cross-checking to confirm findings

Ensuring regular updates to maintain data quality

Examples of Social Arbitrage

Take Chris Camillo, for example. He used social media data to recognize undervalued stocks like E.L.F. Beauty Inc. early on, showing how alternative data can uncover opportunities before they hit the mainstream.

"Alternative data can provide valuable context and interpretation, helping investors to better understand market trends and make more informed decisions" [1][4]

AI and machine learning are now speeding up the analysis of alternative data, making it easier for investors to detect market inefficiencies. Platforms like TickerTrends pull signals from TikTok, Reddit, Google Search, Amazon, and YouTube, offering a well-rounded view of market sentiment.

Of course, while alternative data opens up new possibilities, it also comes with challenges like ensuring reliable data quality and addressing regulatory concerns - topics we'll dive into next.

Challenges and Risks in Social Arbitrage

Social arbitrage offers exciting possibilities, but it also comes with hurdles that investors need to tackle. Successfully navigating these challenges is key to making informed decisions in today’s dynamic markets.

Data Quality and Bias Issues

Problems with data quality - like inaccuracies, biases, or manipulation - can derail social arbitrage strategies. These issues can show up in various ways:

For example, during the COVID-19 pandemic, a surge in product searches led some investors to misread temporary panic-buying as long-term demand. Those who relied solely on unverified social media data risked acting too quickly without considering the broader context.

Addressing these issues helps investors interpret market trends more accurately and avoid costly missteps.

Regulatory and Compliance Concerns

The evolving regulatory landscape around alternative data presents another layer of complexity for social arbitrage investors. Key areas to watch include:

Data Privacy Rules: Laws like GDPR impose strict limits on data usage, with penalties for violations reaching up to 4% of global revenue [5]. Proper handling of sensitive data is non-negotiable.

Security Practices: Methods like web scraping are increasingly scrutinized. Investors must ensure their data collection complies with legal standards while maintaining accuracy.

Market Manipulation Risks: The SEC closely monitors alternative data to prevent misuse. Transparent sourcing and clear documentation of analysis methods are essential.

Conclusion: Using Social Arbitrage to Find Market Opportunities

Social arbitrage focuses on spotting market inefficiencies by analyzing social trends, consumer habits, and cultural changes. This method allows investors to identify opportunities that traditional analysis might miss, especially when paired with modern tools and platforms.

Platforms like TickerTrends make this process easier by gathering data from various alternative sources. These tools help investors analyze trends effectively by providing insights such as:

Practical examples, like finding undervalued stocks through social media signals, highlight the effectiveness of this approach. Combining alternative data with traditional market research has shown strong results, especially when quick and informed decisions are made.

However, success with social arbitrage requires more than just access to data. It demands careful strategy and proper risk management. While there are challenges (as discussed earlier), those who can effectively apply social arbitrage gain a powerful edge in today’s competitive investment world.