Social Media Analytics vs Web Traffic Data: Investment Insights

Want better investment insights? Combine social media analytics and web traffic data.

Social media analytics reveals consumer sentiment and trends from platforms like Twitter and Reddit, while web traffic data tracks measurable online performance like website visits and conversions. Together, these tools help investors predict trends and assess company performance.

Key Takeaways:

Social Media Analytics: Tracks sentiment, mentions, and purchase intent to spot trends early.

Web Traffic Data: Measures website visits, user engagement, and conversions for actionable insights.

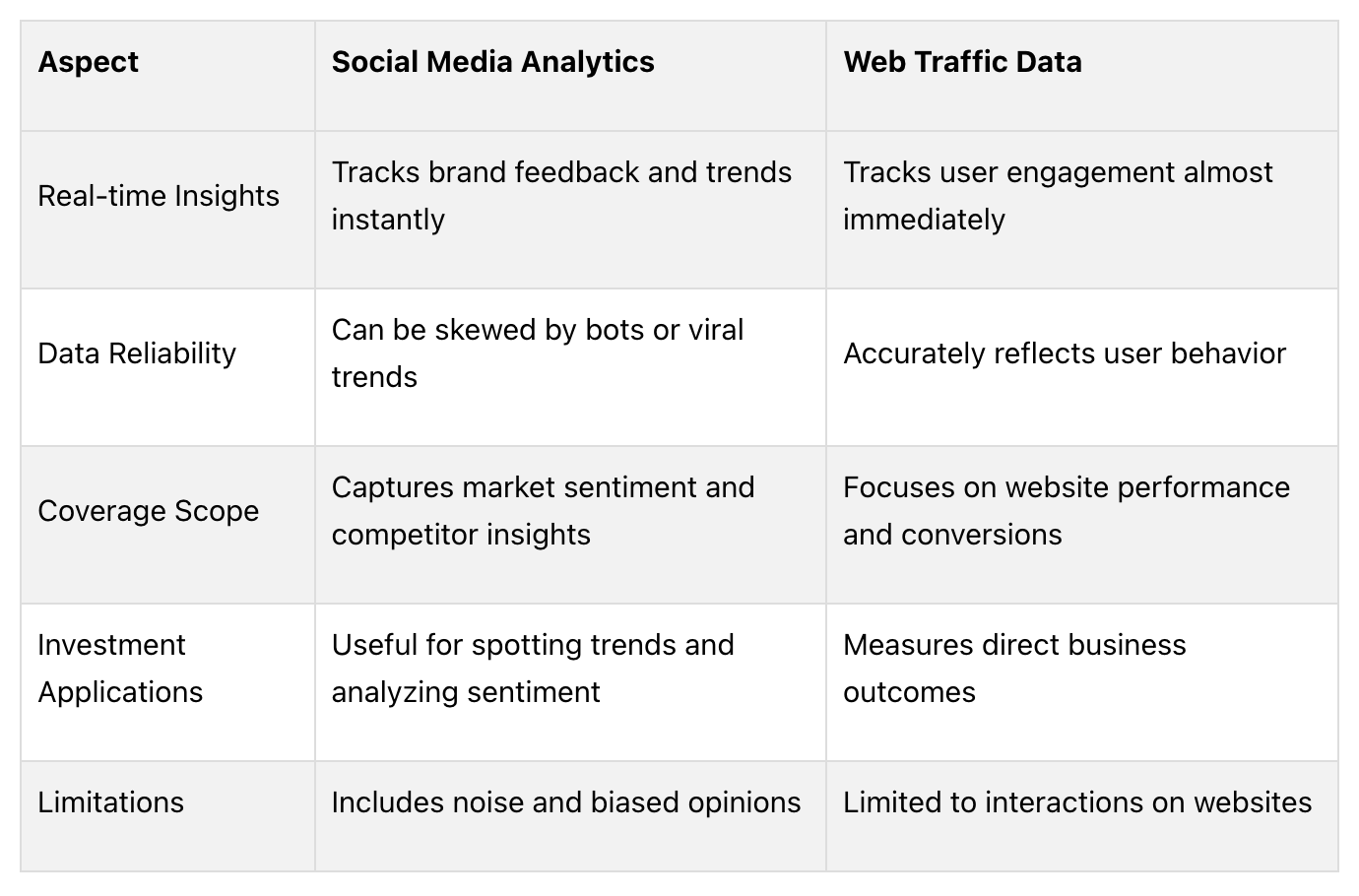

Quick Comparison:

Use tools like LikeFolio, Similarweb, and TickerTrends to combine these data sources for smarter, data-driven decisions.

What Are Social Media Analytics and Web Traffic Data?

Understanding Social Media Analytics

Social media analytics involves analyzing conversations on platforms like Twitter, Reddit, and TikTok to uncover insights for investment decisions. This analysis focuses on several key metrics:

Companies like LikeFolio sift through millions of social posts to spot trends that could influence stock performance [1].

Understanding Web Traffic Data

Web traffic data measures a company's online presence and performance, providing valuable insights for investors. Some of the main metrics include:

Website Visits: Tracks overall traffic and growth trends.

User Engagement: Measures time spent on the site and interaction levels.

Conversion Metrics: Tracks completed purchases or other goals.

Competitive Rankings: Assesses digital market share against competitors.

Interestingly, 21% of investment professionals now use web traffic data to guide their decisions [4]. This data often reveals growth patterns before quarterly financial reports are released.

With a clear understanding of these data sources, we can now look at how they differ and what each brings to the table.

How Social Media Analytics and Web Traffic Data Differ

Data Sources and Coverage

Social media analytics focuses on trends and sentiment from platforms like Twitter, while web traffic data monitors how users interact with company websites. For instance, social media might highlight growing excitement around a new product, while web traffic data shows whether that excitement translates into website visits or purchases.

Strengths and Weaknesses of Each Data Type

Both data sources have their own benefits and drawbacks when applied to investment research:

The main distinction lies in their predictive and current value. Social media analytics is great for spotting emerging trends and shifts in sentiment that could influence future markets. On the other hand, web traffic data offers concrete evidence of how a business is currently performing and engaging with its audience. Notably, 21% of investors rely on web traffic data for their decisions [4].

Combining these two data sources often leads to better investment decisions. For example, when analyzing an e-commerce company, investors might monitor social media sentiment around a product launch and use web traffic data to confirm if the buzz is driving website activity.

Tools like LikeFolio process millions of social media posts to detect consumer trends [1]. By recognizing the unique strengths and limitations of these data types, analysts can uncover actionable insights and fine-tune their strategies.

How to Use Social Media Analytics and Web Traffic Data for Investing

Using Social Media Analytics to Predict Trends

Social media analytics can offer early clues about market shifts and changes in consumer behavior. Metrics like brand sentiment, purchase intent, and competitive analysis are key indicators that may affect revenue and stock performance [1]. By analyzing real-time sentiment on platforms like Twitter, Facebook, and Reddit, investors can detect trends before they show up in financial reports.

For example, Social Standards' platform helps investors track consumer discussions and sentiment across various industries. This allows for the identification of shifts in public opinion that might influence stock prices [1].

Using Web Traffic Data for Market Insights

Web traffic data provides measurable insights into a company's performance, making it a valuable tool for investors. Platforms like Similarweb's Performance Metrics module give detailed information about customer behavior and engagement across devices and regions [3]. Key metrics to watch include:

Customer Acquisition: Changes in traffic sources and marketing effectiveness

User Engagement: Metrics like session duration and repeat visits

Market Share: Traffic comparisons between competitors

Regional Growth: Identifying emerging markets through location-based traffic data

Combining Social Media and Web Traffic Data

While each data source offers distinct insights, combining them creates a fuller picture of market dynamics. Platforms like TickerTrends integrate social media sentiment, web traffic patterns, and other alternative data to provide actionable insights for investors.

For instance, pairing social media sentiment with web traffic data can help validate trends, understand consumer behavior, and analyze how online engagement translates into sales or other outcomes. This approach shifts the focus from isolated metrics to a more holistic analysis, enabling smarter, data-driven decisions.

Tools such as LikeFolio and Social Standards allow investors to monitor consumer sentiment and trends in real time. Meanwhile, platforms like TickerTrends simplify the process of merging various data sources. Real-time tracking of social media and web traffic equips investors with the insights needed to spot emerging trends and make better-informed investment choices.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

Examples and Tools for Using These Data Sources

Examples of Successful Data-Driven Investments

Hedge funds and asset managers are increasingly turning to alternative data to stay ahead. Take LikeFolio, for example. They analyze millions of social media mentions to track consumer trends, offering real-time insights into purchasing behavior and shifts in sentiment. This approach has helped in identifying market trends before they hit the mainstream [1].

Another great example is Similarweb, which specializes in web traffic analysis. Investment managers rely on their platform to monitor transaction volumes and brand performance. This data provides early signals of changes in consumer behavior and helps validate emerging trends [2].

Tools to Combine Social Media and Web Traffic Data: TickerTrends

Several platforms make it easier for investors to leverage alternative data effectively. One standout is TickerTrends, which integrates multiple data sources into a single platform for investment analysis. Here's what it offers:

For a more focused approach, Social Standards analyzes public social media posts to track brand performance and consumer preferences, helping investors spot shifts in the market [1].

These tools empower investors to:

Cross-check trends with multiple data sources.

Detect early changes in consumer behavior.

Monitor competitive activity across digital platforms.

Evaluate brand performance with integrated metrics.

With TickerTrends' accessible pricing at $19/month, even smaller investors can tap into advanced data analysis. These platforms demonstrate how combining social media and web traffic data can give investors a clear advantage in spotting market opportunities.

Top 10 Social Media Analytics Tools

Conclusion

Investment professionals are increasingly turning to web traffic insights to better understand markets, emphasizing the growing role of alternative data in decision-making.

By combining social media analytics with web traffic data, investors can gain a well-rounded perspective on market trends. Social media provides real-time sentiment, while web traffic delivers actionable consumer behavior insights - together forming a more complete picture.

Platforms such as TickerTrends make it easier for investors to access integrated data from sources like TikTok, Reddit, and Google Search. Similarly, tools like LikeFolio and Similarweb demonstrate how alternative data can sharpen investment strategies [1][2].

Using both social media sentiment and web traffic metrics is now key to staying ahead in the market and identifying opportunities early. When used together, these tools help investors better understand shifting trends and consumer patterns.

That said, these insights should complement a broader strategy that balances multiple factors and carefully manages risk. The key to future investment success lies in smartly integrating alternative data, giving those who adopt it early a distinct edge.

For those looking to get started, platforms like TickerTrends offer an accessible way to incorporate alternative data into investment strategies and uncover new opportunities.