Social Sentiment Analysis: A Guide for Modern Investors

Social sentiment analysis helps investors predict market movements by analyzing public opinions from sources like Twitter, Reddit, and news. It uses tools like natural language processing (NLP) to categorize sentiment as positive, negative, or neutral. Here's why it matters and how to get started:

Why Use It?

Spot trends early (e.g., retail investor behavior on Reddit).

Make decisions using real-time data, reducing emotional bias.

Tools like Brandwatch and Hootsuite track sentiment shifts.

How It Works:

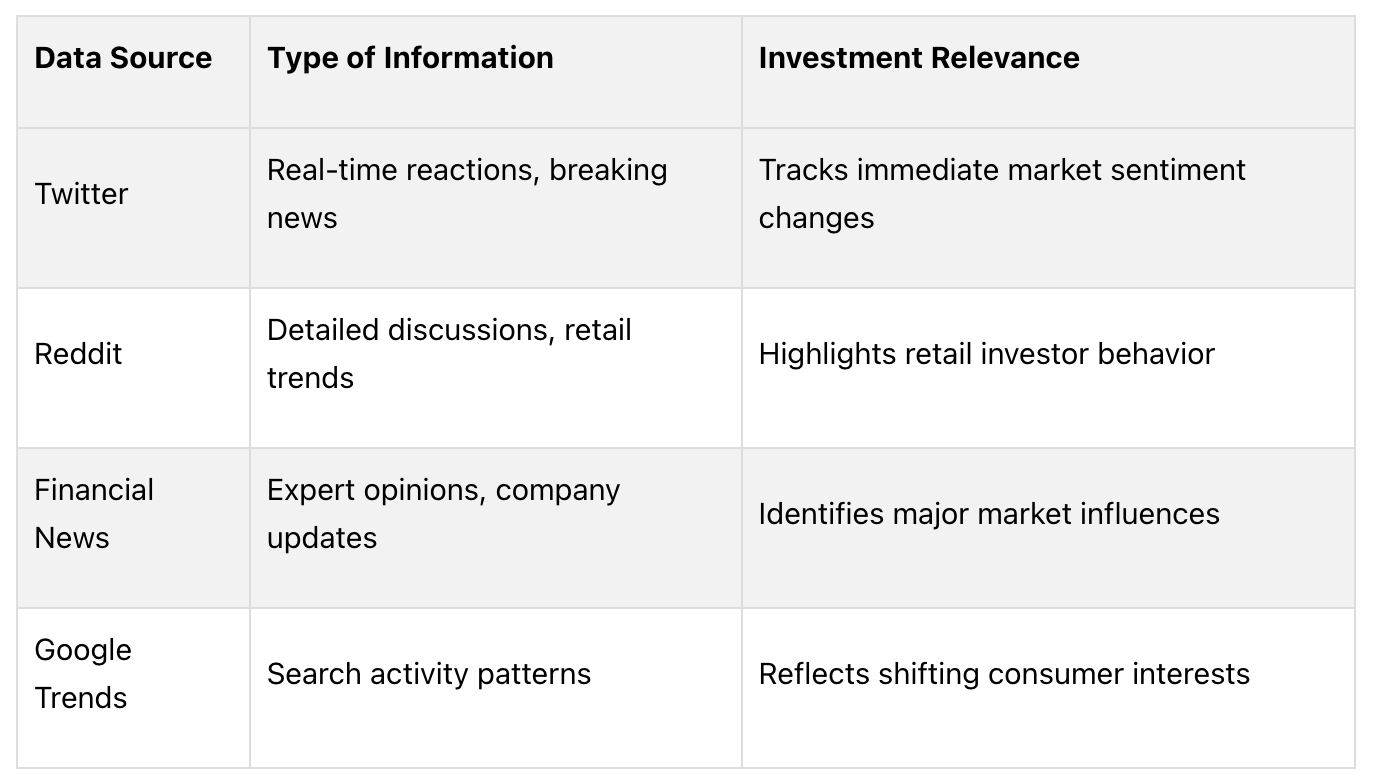

Data is collected from platforms like Twitter (real-time reactions), Reddit (detailed discussions), and Google Trends (search patterns).

Advanced tools like TickerTrends and Brandwatch analyze this data for actionable insights.

Limitations:

Challenges include language ambiguity, biased data, and social media noise.

Sentiment analysis works best when combined with traditional financial methods.

Quick Tip: Pair sentiment analysis with technical and fundamental analysis for better investment decisions. Tools like Hootsuite Insights and Keyhole offer real-time tracking but should be cross-checked with other metrics.

What is Sentiment Analysis?

How Sentiment Analysis Works

Sentiment analysis platforms sift through massive amounts of data to identify patterns in market sentiment. They turn online conversations into insights that investors can use to make decisions.

Main Sources of Sentiment Data

Financial sentiment analysis relies on various data sources to understand market psychology and investor behavior:

For example, a research team analyzed 260,000 tweets and 6,000 news articles about major tech stocks like Apple and Microsoft. They achieved an 82% accuracy rate in predicting stock movements [7].

Top Tools for Investors

Today's sentiment analysis tools are equipped with advanced features tailored for investment decisions:

TickerTrends

Combines social media and consumer trend data to provide a "Social Arbitrage Score" for sentiment tracking.Brandwatch

Offers sentiment monitoring with customizable alerts to stay ahead of market changes [6].Hootsuite

Automates real-time sentiment tracking and delivers detailed reports [4].

These tools are most effective when paired with traditional financial analysis and other data sources. Algorithms used in these platforms are designed to handle nuances like context and sarcasm, making sentiment data more dependable for investors [3].

Using Sentiment Analysis in Investing

Examples of Successful Use

During the 2020 stock market crash, some investors used sentiment analysis tools to anticipate and respond to fast-moving market shifts [3]. A notable example is the VanEck Social Sentiment ETF (BUZZ), which focuses on tracking positive sentiment to pinpoint promising U.S. large-cap stocks [5].

Another example is TickerTrends' Social Arbitrage Score. This tool taps into platforms like TikTok and Reddit to spot trends early, giving investors a chance to act before the broader market catches on.

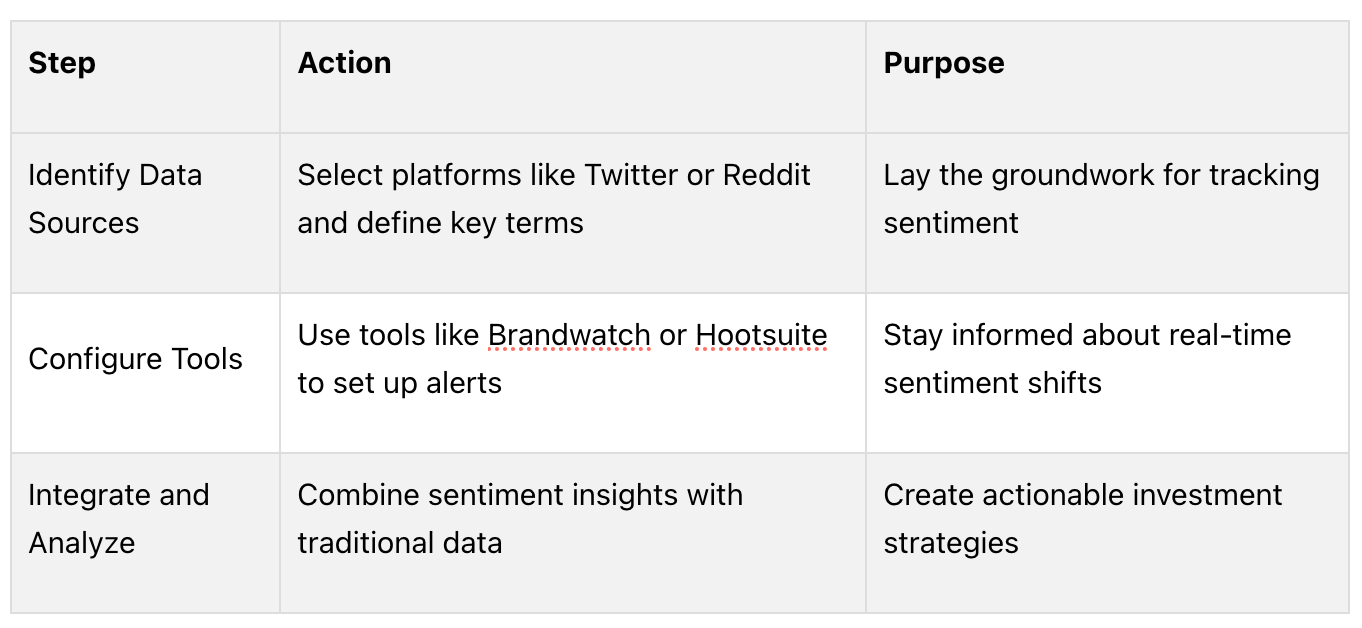

Steps for Investors to Get Started

How can investors take advantage of sentiment analysis? Here’s a simple breakdown:

"Investor sentiment has proven to be an important factor in stock performance." - VanEck [5]

To make the most of sentiment analysis, pair it with other financial metrics for a more complete view of the market. Here are some tips:

Monitor sentiment across multiple platforms to get a broader perspective.

Use tools like Brandwatch to stay updated on sudden sentiment shifts.

Validate sentiment insights by cross-checking with technical indicators.

Study historical sentiment data to find recurring patterns.

While sentiment analysis can be a powerful tool, it’s important to understand its limitations to ensure balanced and informed investment decisions.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

Limitations of Sentiment Analysis

Issues with Data and Bias

Sentiment analysis tools often struggle with challenges like linguistic subtleties, poor data quality, and the overwhelming noise from social media. These factors can skew results and lead to inaccuracies. For instance, Talkwalker's research on multilingual datasets shows how differences in language can affect sentiment accuracy [4].

A real-world example highlights this issue: Alibaba's stock price rose despite negative sentiment scores, proving that sentiment data must be carefully interpreted [7].

Combining Sentiment with Other Methods

Research on S&P 500 stocks revealed that combining sentiment analysis with traditional price indicators produces better results than relying on a single approach [7].

For investors, the best strategy is to start with fundamental analysis to evaluate a company's performance, add technical analysis to spot price trends, and then use sentiment analysis as an extra layer of insight. Tools like Hootsuite Insights and Keyhole offer real-time sentiment tracking, but their findings should always be cross-checked with other metrics [4].

These challenges emphasize the need to validate sentiment analysis findings before making decisions. While limitations exist, improvements in real-time tracking and natural language processing are helping to address them.

Advanced Methods for Sentiment Analysis

Sentiment analysis has its challenges, but advanced techniques like Natural Language Processing (NLP) and real-time monitoring are helping address these hurdles.

Using Natural Language Processing

NLP plays a key role in analyzing vast amounts of text data from diverse sources. It allows investors to gain insights from market discussions and news articles [1].

With AI-driven tools, investors can analyze everything from social media posts to financial reports, turning this data into actionable insights [2].

Monitoring Sentiment in Real Time

Real-time sentiment monitoring is now a must-have for modern investment strategies, especially for short-term traders. For example, during the 2020 market crash, these tools alerted investors to sentiment shifts, helping them adapt quickly [3].

Key components of real-time sentiment monitoring:

To get the best results, investors should combine these advanced tools with traditional analysis methods. This blend offers a broader perspective on market trends and potential opportunities [3].

These techniques are reshaping how investors approach fast-changing markets, enabling smarter and quicker decision-making.

Conclusion and Future Outlook

Key Takeaways

Social sentiment analysis is now a go-to tool for investors aiming to make smarter, data-backed decisions in fast-changing markets. Thanks to technologies like Natural Language Processing and real-time monitoring systems, investors can better interpret market signals and anticipate trends.

The rise of sentiment-focused tools and funds, such as the BUZZ ETF, highlights how this approach is reshaping modern investing. It’s changing the way market players spot and act on opportunities. Some of the driving factors behind this shift include:

Real-time monitoring for faster reactions to market changes

Multi-platform analysis that offers deeper market insights

AI-powered tools improving the accuracy of sentiment readings

The Future of Sentiment Analysis

Looking ahead, sentiment analysis is set to become even more valuable for investors as technology and data sources continue to evolve. New platforms like TikTok are being explored, AI is becoming more precise, and efforts to merge data from various sources aim to give a fuller picture of market sentiment.

"Investor sentiment has proven to be an important factor in stock performance." - VanEck [5]

As AI tools are further integrated with traditional investment strategies, investors will gain stronger insights. However, balancing these advanced tools with time-tested investment principles and solid risk management will remain key to long-term success.

FAQs

Can Twitter predict the stock market?

Twitter's real-time data can offer insights into market trends, but it isn't a foolproof predictor. Research shows that daily tweet sentiment can sometimes signal next-day market movements. However, the accuracy of these predictions depends on factors like the quality of the data, current market conditions, and external influences. When combined with other sentiment sources, Twitter data can provide additional context for market analysis.

Which is the best sentiment analysis tool?

Qualtrics (formerly Clarabridge) stands out with its Text iQ feature, which excels in analyzing sentiment across multiple sources and languages in real time. Its advanced Natural Language Processing (NLP) capabilities make it especially effective for working with unstructured data from various platforms.

Other options include tools like Brand24, Hootsuite, and Talkwalker. Choosing the right tool depends on your specific goals, budget, and the scale of analysis you need. Combining multiple tools with traditional financial analysis can help create a more complete understanding of market sentiment.

These tools can enhance investment strategies, but their success depends on how well they are integrated into a broader approach.