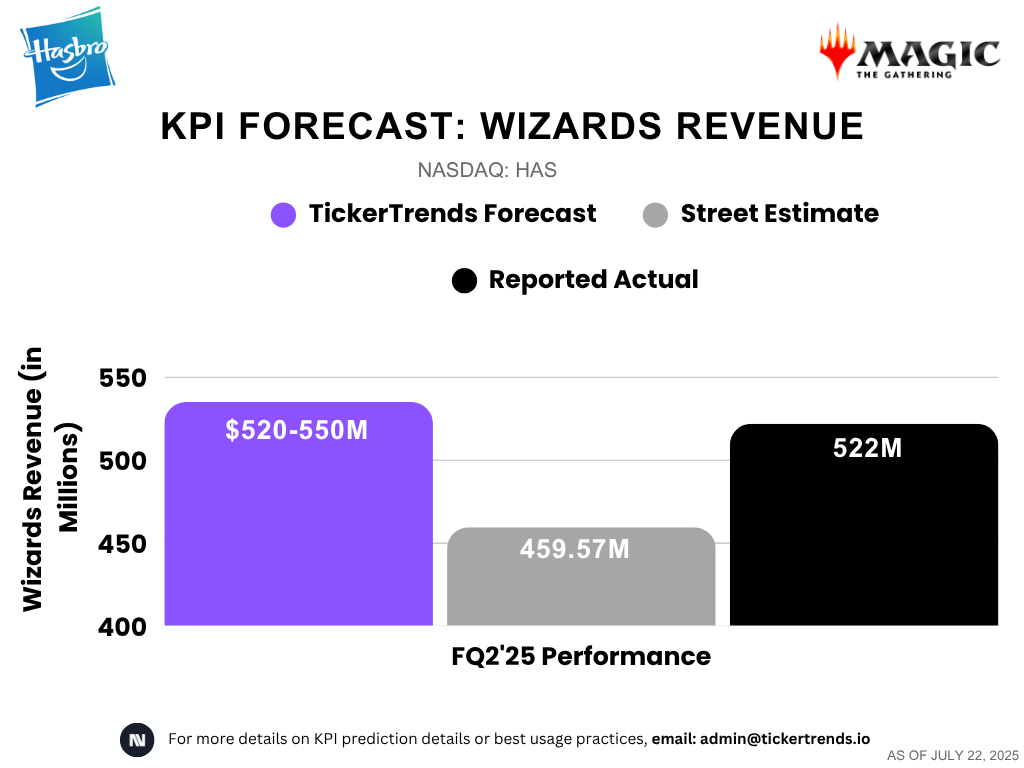

"Street Consensus Structurally Disconnected From Reality": TickerTrends Nailed $HAS Wizards Revenue at $522M

Magic: The Gathering's Final Fantasy collaboration delivered exactly as our engagement metrics forecasted—$522M vs. our $520-550M prediction range

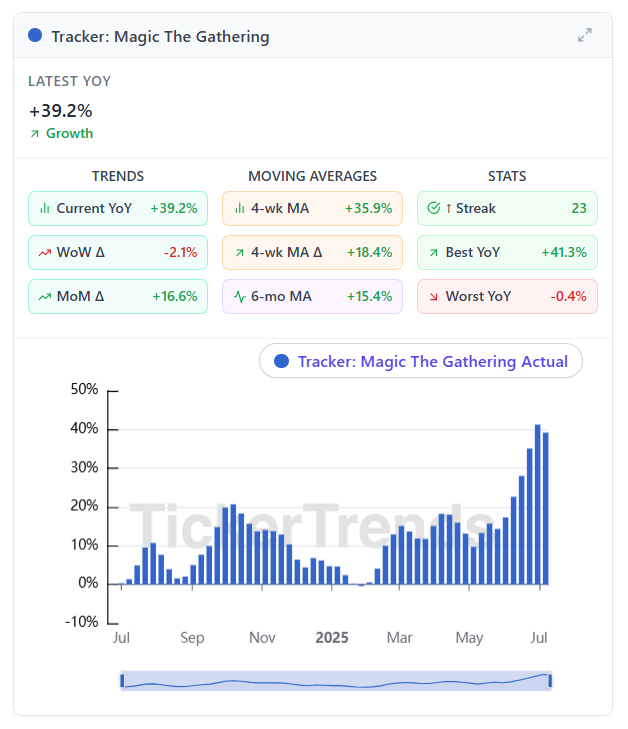

Pre-earnings, we published a deep-dive analysis predicting Hasbro's Wizards segment would deliver $520-550M in Q2 2025 revenue — a bold call that flew in the face of consensus expectations calling for minimal growth. Our thesis centered on one key insight: Magic: The Gathering's Final Fantasy collaboration had triggered an "engagement renaissance" that traditional analysts were completely missing. Peak viewership, exploding social mentions, sustained aftermarket pricing premiums, and secondary market traffic spikes all pointed to the same conclusion—this wasn't just another product launch, it was a fundamental reset of MTG's demand profile. Today, Hasbro reported Wizards segment revenue of $522M, landing squarely in our predicted range and validating our alternative data approach. Here's how we saw it coming when everyone else was looking the other way.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise

$HAS Hasbro - Executive Summary

Investment Thesis

Magic: The Gathering's Final Fantasy collaboration has catalyzed an unprecedented engagement renaissance that positions Hasbro for a material Q2 2025 earnings beat. Multiple leading indicators suggest Wizards segment revenue of $520-550M (+15-20% above $459.57M consensus), driven by Final Fantasy's crossover appeal expanding MTG's addressable market beyond core players.

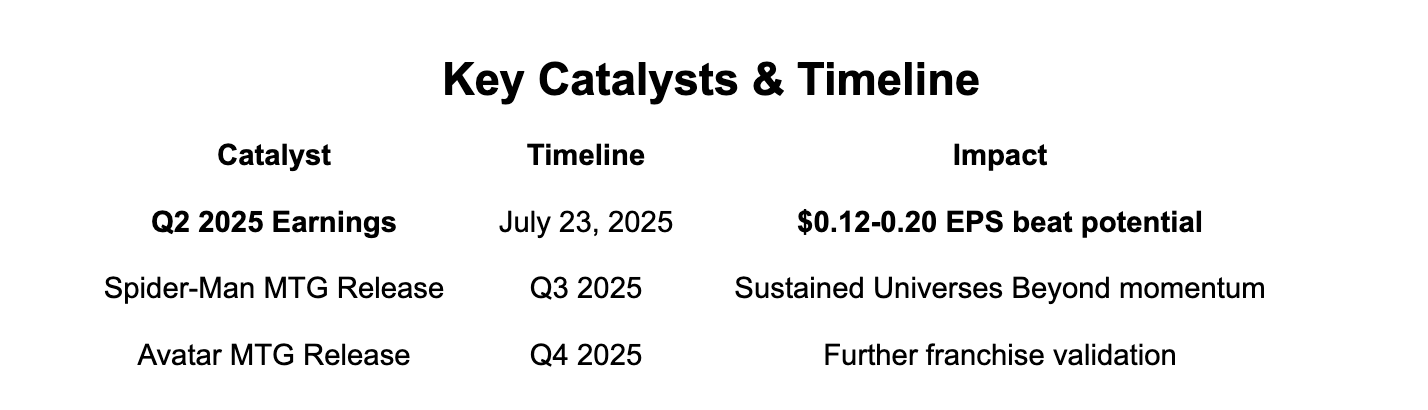

Key Catalysts & Timeline

Supporting Evidence

Engagement Explosion (Preview):

Viewership: Significant viewership surge

Social mentions: substantial social media engagement growth

Aftermarket pricing: Sustained 2.5x MSRP premium ($1,000+ vs $400 retail)

Management Validation:

"Final Fantasy will be the best selling set of all time. On day one. It already is" - CEO Chris Cocks

Financial Impact

Revenue Gap Analysis: $60-90M above consensus driven by:

Final Fantasy Direct Impact: $<Preview>M (vs ~$175M implied in consensus)

Brand Momentum Spillover: $<Preview>M (catalog sales lift + accessories growth)

Cross-Segment Digital Uplift: $<Preview>M (MTG Arena integration)

Margin Profile: Despite royalty expense step-up, revenue mix shift toward higher-margin tabletop gaming should generate $21-36M incremental operating profit.

Key Risks

Channel Inventory: Risk of distributor loading vs. genuine retail sell-through

Royalty Pressure: Square Enix licensing costs could exceed estimates

Difficult Comps: Q2 2024 delivered exceptional 20% Wizards growth via Modern Horizons 3

Execution Risk: Production/distribution bottlenecks for hot product

Bottom Line

The convergence of peak viewership, social media explosion, and sustained aftermarket premiums indicates Final Fantasy has fundamentally reset MTG's demand profile. Street consensus appears structurally disconnected from observable engagement metrics, creating an asymmetric risk/reward opportunity ahead of Q2 earnings.

Next Catalyst: Q2 2025 Earnings (Expected July 23, 2025 AM)

Long Form Explanation

—( ONLY AVAILABLE TO ENTERPRISE SUBSCRIBERS )—

Conclusion ( Preview )

The analyst consensus of +1.7% Wizards growth appears structurally disconnected from reality. While Q2 2024's 20% growth driven by Modern Horizons 3 creates a challenging comparison, management's assertion that Final Fantasy is already "the best selling set of all time" suggests performance potentially exceeding even that record-breaking benchmark.

The timing gap between management's April guidance and Final Fantasy's June release has created an information asymmetry. The unprecedented engagement acceleration that materialized post-launch indicates Q2 spillover effects significantly beyond what management could forecast during earnings season.

Investment Thesis: Expect Wizards segment revenue of $520-550M in Q2 2025 (15-20% above consensus), driven by Final Fantasy's demonstrated ability to expand the player base while commanding premium pricing. The combination of engagement metrics acceleration and conservative analyst positioning creates an asymmetric risk/reward opportunity for investors positioning ahead of earnings.

Bottom Line: Final Fantasy appears to be delivering the transformational Universes Beyond success that validates Hasbro's multi-franchise strategy, positioning the Wizards segment for sustained outperformance as the strategy scales through Spider-Man and Avatar releases in the back half of 2025.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise