Tariffs Are Reshaping Consumer Behavior – and Creating Surprising Winners | TickerTrends Research Report

Sign up at tickertrends.io!

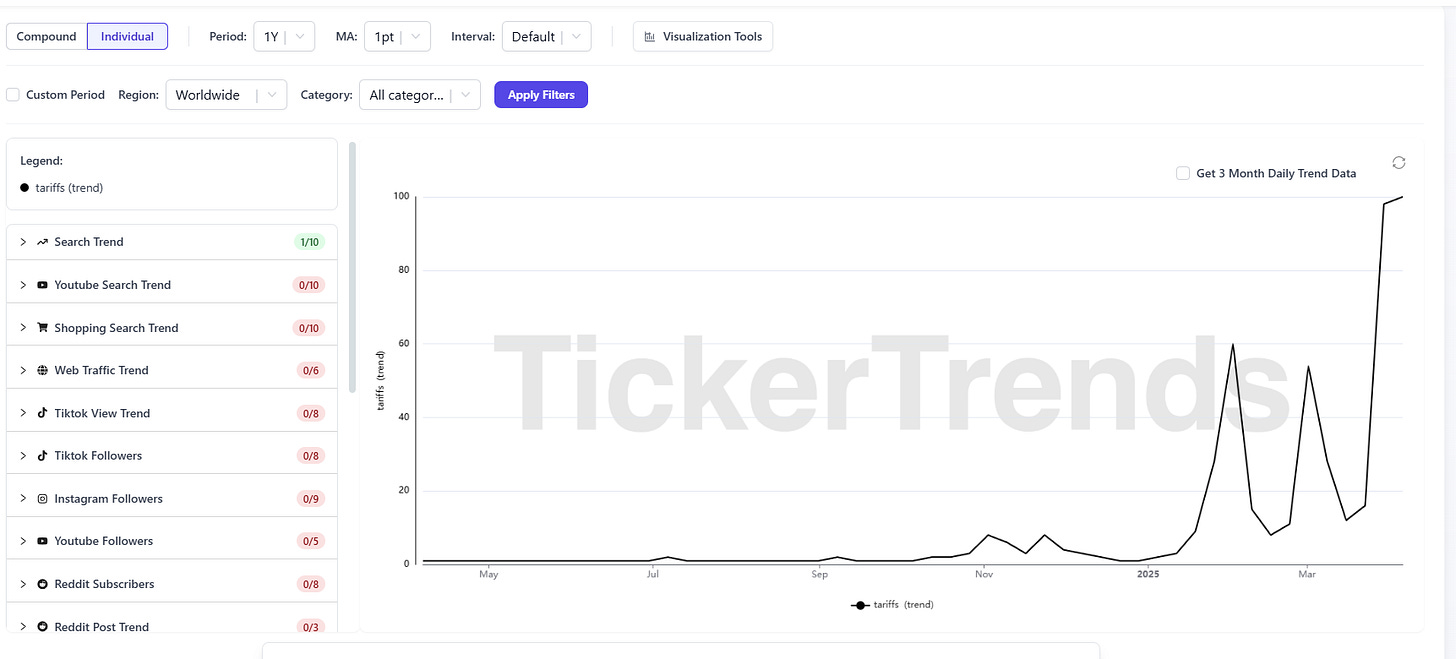

Trade Tensions Likely to Ignite New Shopping Habits: A world with permanent tariffs would represent more than just a political shift — it would trigger a lasting economic realignment. For consumers, it could mean sustained price increases in certain goods, changes in where they shop, and a rethinking of brand loyalty. For investors, this potential transition presents one of the most compelling opportunities to track behavioral change early. Using the TickerTrends platform, you can monitor emerging keyword spikes and search trends — from rising interest in "Made in XYZ country" (as consumers shop local) to frugal shopping tips, times of significant change are when alternative data research is the most important, well before they influence fundamentals. In this data-driven deep dive, we explore which sectors may quietly benefit and why certain companies might come out ahead even in a high-tariff environment. Alternative data offers a clear edge — and knowing what to watch makes all the difference.

Note that many of these outlined consumer trends have not fully occured or played out yet in the data. We simply offer users some potential keywords, data sources and businesses to monitor closely over the next few weeks to see change in the data should it materialize. The goal being to determine whether a trend emerges.

Consumers Adapt as Tariffs Hit Their Wallets

After years of inflationary pressures, the return of hefty tariffs is forcing consumers to change course yet again. Surveys show a majority of shoppers are aware that import taxes could raise prices on everything from groceries to gadgets. In the U.S., over 80% of consumers know about the latest tariffs and 64% are worried they’ll drive up everyday costs. That concern hasn’t fully translated into behavior yet — but the shift is coming. Google searches for terms like “coupons” and “Made in USA” are poised to climb. Consumers could soon face a new retail landscape should the tariffs actually take effect for an extended period of time.

Frugal Finds and “Buy Local” Booms

Consumers are may embrace new shopping behaviors in anticipation of cost increases, according to a recent Numerator survey:

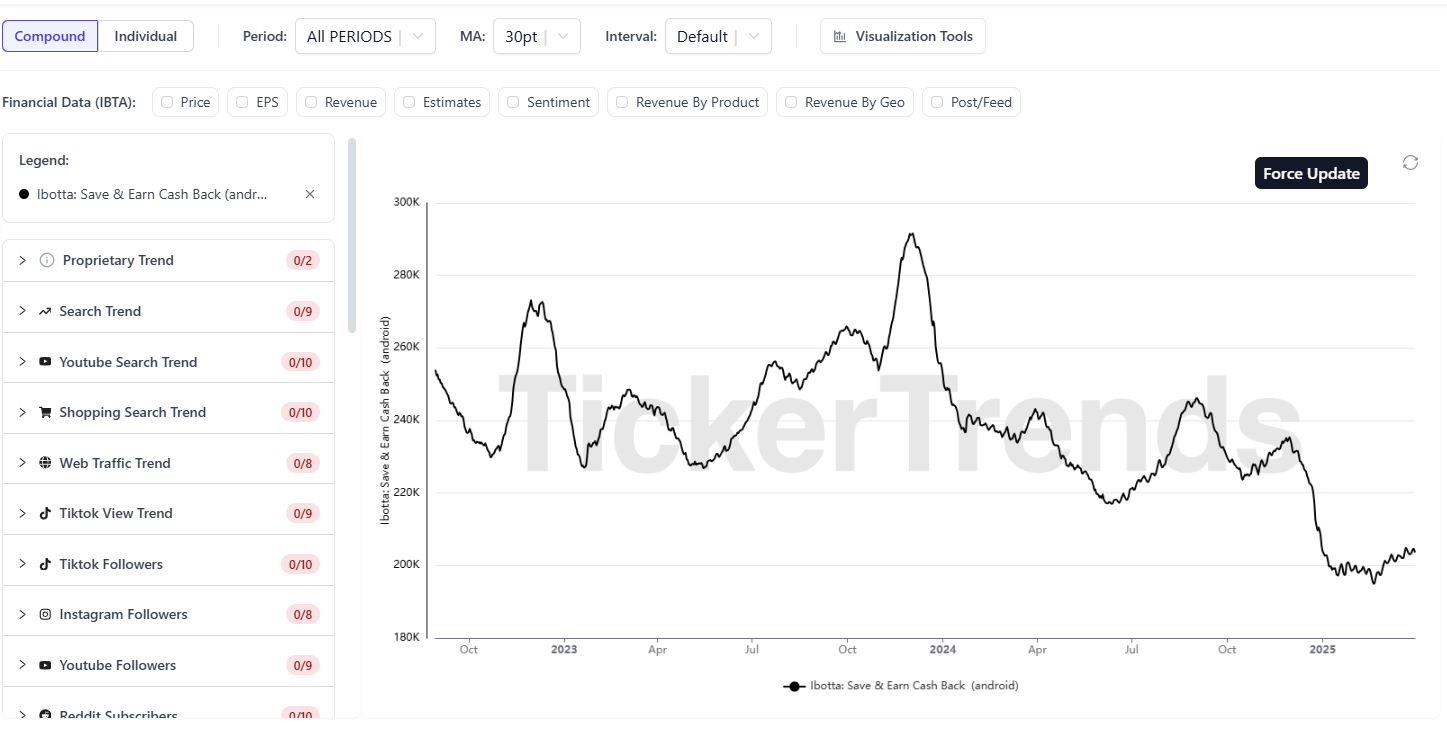

Hunting for Discounts: About 41% of Americans say they’ll seek out coupons and sales more often. Monitor Google Search keywords like “cheap groceries,” “coupon code,” and “dollar store near me” could prove to be useful. We are closely following Android and iOS Mobile App data for coupon companies like Ibotta (IBTA 0.00%↑) and Groupon (GRPN 0.00%↑) to identify in real-time if there is consumer movement towards then as a result of the bargain hunters. Also noting to follow will be discount and dollar stores like Dollar Tree (DLTR 0.00%↑), Five Below (FIVE 0.00%↑), Dollar General (DG 0.00%↑), and Ross Stores (ROST 0.00%↑) however some retail names might have margin pressure from tariffs so one must exercise caution and analyze each ticker on a deep level.

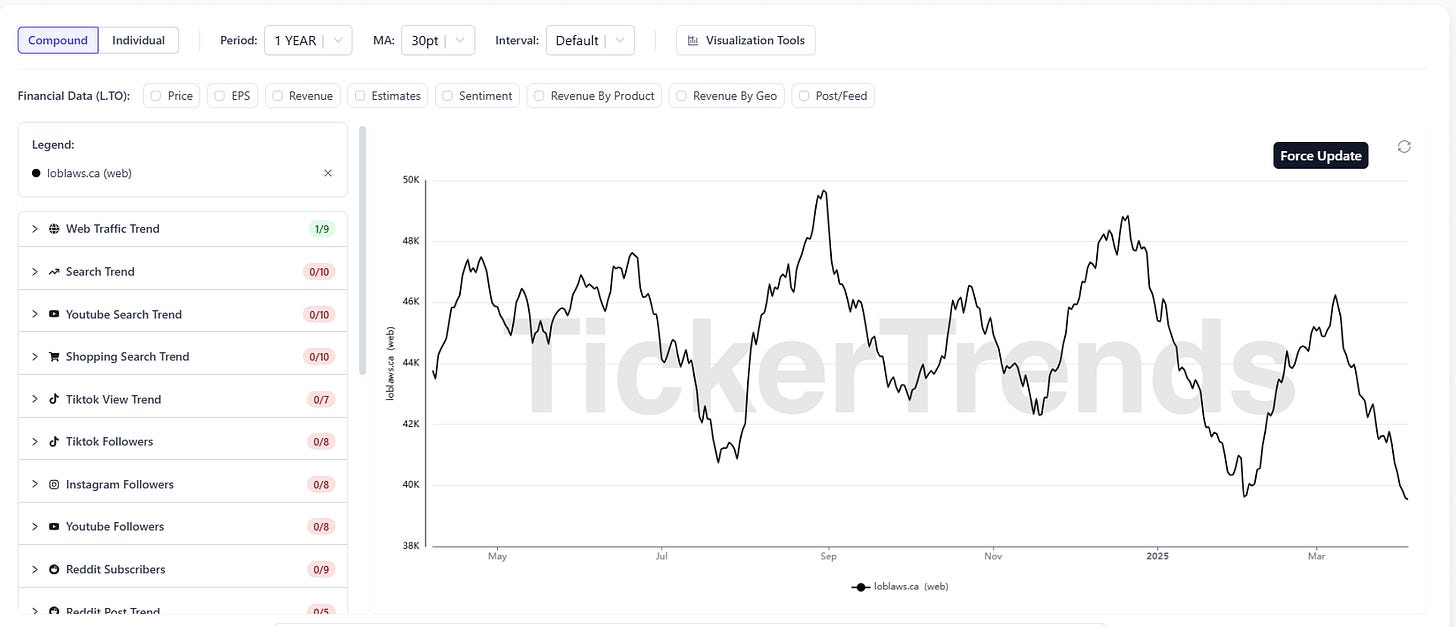

Avoiding Imports: 30% plan to buy fewer imported goods. Keep an eye on search terms indicating preference for local or regionally produced alternatives — such as "shop local," "local brands," or "boycott foreign." During periods of heightened trade tension, consumers around the world often shift behavior, choosing to support nationally sourced products over imported ones. This trend may benefit local grocers, domestic food producers, and national brands that emphasize regional supply chains. For instance, during the past wave of US -Canada trade tensions, many Canadian consumers deliberately shifted their grocery spending from US-based retailers like Costco to domestic chains such as Loblaws ($L.TSX) in a show of economic solidarity.

Timing Big Purchases: 23% plan to make large purchases now, before new tariffs hit. Monitor keywords like “stock up,” and “tariff pricing.” Large retailers like Costco (COST 0.00%↑) and Walmart (WMT 0.00%↑) could see this pull-forward in demand.

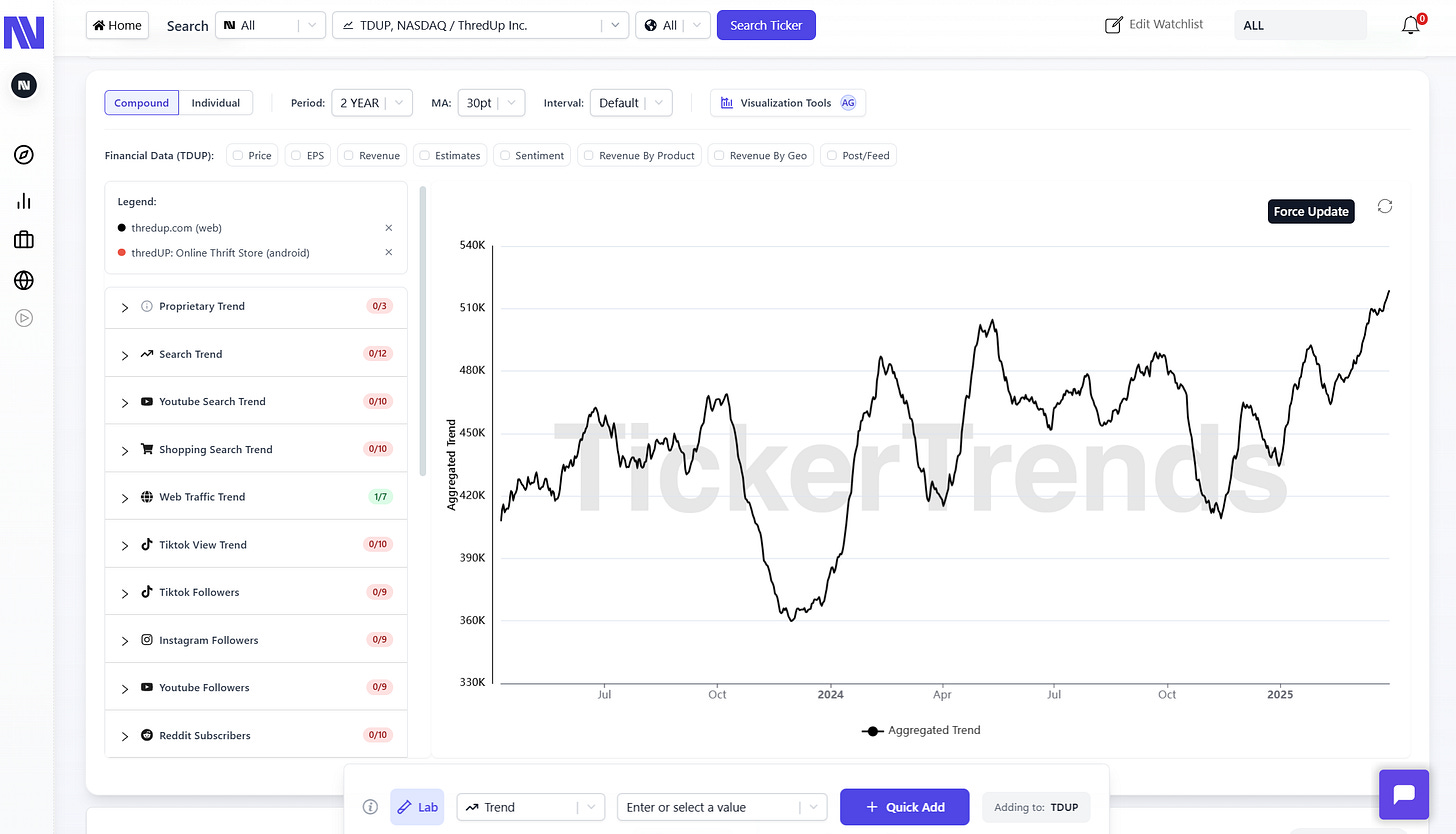

Turning to Secondhand: Over half of Millennial and Gen Z consumers say they’ll buy used goods more often, according to the same Numerator survey. Watch TikTok hashtags like #ThriftStore and search terms like “used handbag” or “discount stores near me.” Watching the website traffic to sites like “therealreal.com” (REAL 0.00%↑), "depop.com” (ETSY 0.00%↑), “thredup.com” (TDUP 0.00%↑) and more will be worth monitoring closely. With imported new items becoming much more expensive, used items can see a surge in demand, with many of these companies simply being the middleman serving as marketplaces and thus unaffected by actual margin pressure caused by tariffs.

The World Is Changing – Spot the Trends Before They Hit

The upcoming reciprocal tariffs on April 9 could reshape consumer behavior again — and the first signs will be visible in real-time keyword and platform activity. Tracking the data itself will be far more valuable than guessing what happens haphazardly!

That’s where TickerTrends comes in:

Identify exploding keywords and consumer themes across 25,000+ tickers

Monitor search volume, social chatter, and site traffic in real time

Get alerts on trend spikes before they show up in quarterly results

TickerTrends now offers yearly plans that make it easier to stay ahead of the trends:

Core Plan ($998/year): Built for trend-focused investors, this plan gives you the foundational tools to stay ahead of consumer shifts. Includes:

Google Trends, TikTok & Web Traffic Data

Platform Preview & Guided Walkthrough

Up to 10 Alternative Data Alerts

10 Pages of Exploding Trends (Outlier Detection)

Substack Research ($500/year value) — free

Just one actionable trend from this tier can pay for itself many times over.

Enterprise Plan (Contact Us for Pricing: admin@tickertrends.io)

Our most powerful solution, built for hedge funds, data teams, and serious investors looking for an edge at scale. Includes:Full API Access and Unlimited Alt Data Charting

Exploding Trends (Outlier Detection) with No Page Limits

Ticker, Social, and Sector Discovery Tools

KPI Dashboards for Individual Tickers

Access to TikTok, Instagram, YouTube Follower Tracking

Baidu Search Trends

Subdomain Web Traffic (e.g., /login or /cart)

Individual Google Trends Chart Modes

Amazon / Reddit / Wiki / Mobile App Store data

AI-powered Trend Lab Research Assistant and Time Series Social Context Awareness Overlay

Generative Sector Dashboards

Excel Export, Custom Alert Setups, Priority Analyst Support

Substack Research ($500/year value) — free

Like having a full data team and research analyst on-demand — for less than a weekly intern.

👉 Explore TickerTrends Plans: https://www.tickertrends.io/register

The Bottom Line

Consumers are adapting rapidly under tariff pressure — and the winners won’t just be low-cost providers. They’ll be the ones aligned with new behavior: local, affordable, resilient.

And with TickerTrends, you can see those winners emerge in real time — keyword by keyword, before the story hits the tape. Volatility episodes like the current environment are opportunities to do deep research and create lists of the best trends that emerge from the outcome of the negotiations.