The Impact of Churn $DUOL Duolingo Update

Churn outpacing acquisition; AI optics mask weak top-funnel growth

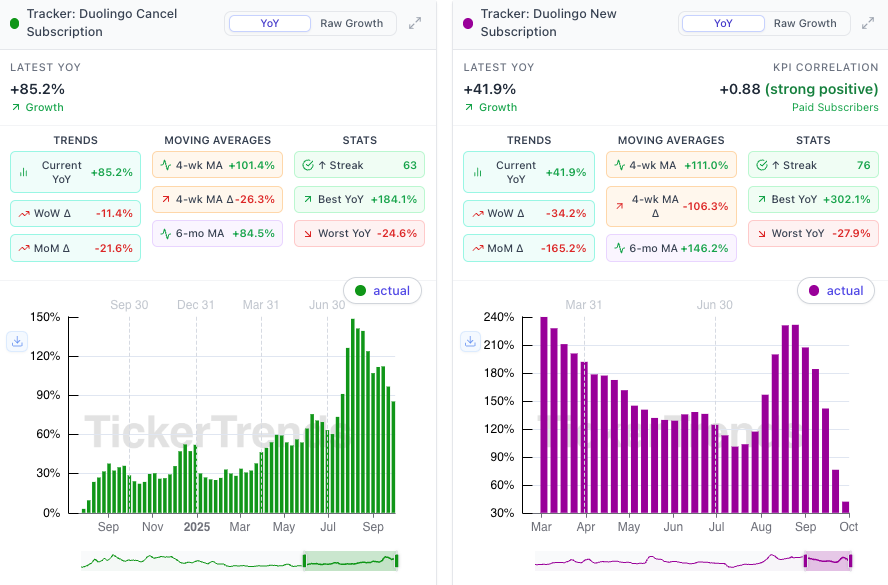

Subscription Dynamics:

New Subscriptions: +41.9% YoY but deteriorating sharply on shorter timeframes (–34.2% WoW, –165.2% MoM).

Cancellations: +85.2% YoY, only modestly easing WoW (–11.4%) and MoM (–21.6%).

The skew toward elevated cancellations versus new subs suggests mounting churn risk.

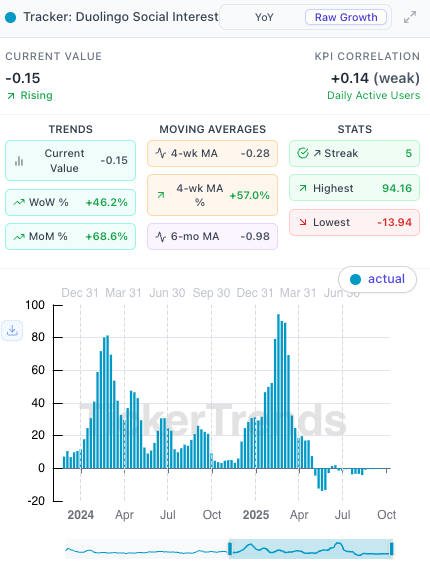

Top of Funnel Weakness:

TickerTrends’ Duolingo Social Interest Tracker shows stagnation at historical lows, signaling muted new user acquisition.

While TikTok engagement has flipped positive in September MoM after consecutive negative months, volumes remain materially below prior peaks.

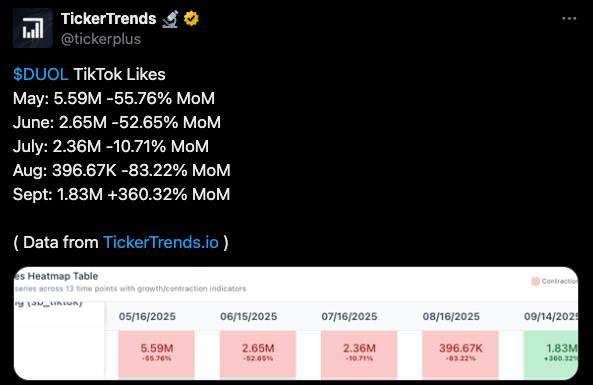

Usage Trends:

Global consumer usage shows tentative bottoming (+1.2% WoW; –2.1% MoM). U.S. usage patterns echo this stabilization, but without re-acceleration, the improvement looks more like a floor than a new leg higher.

AI Integration Optics And Duocon:

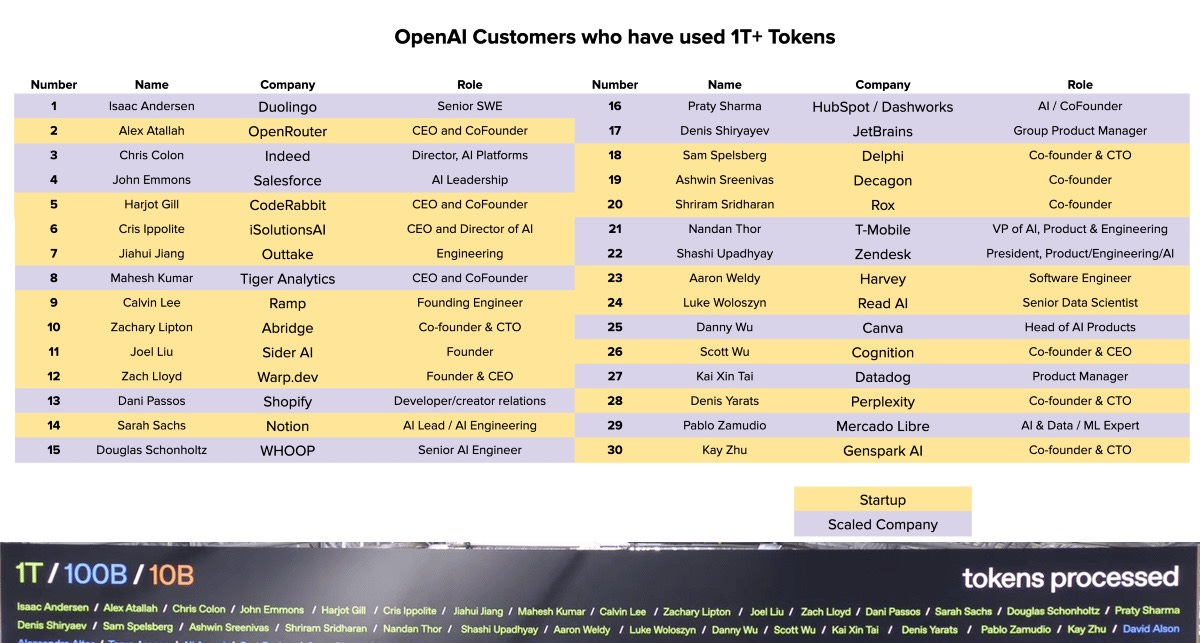

OpenAI recently cited Duolingo as a top token user, underscoring just how deeply the platform has embedded AI into its user experience. From AI-driven practice sessions to automated scoring, Duolingo is positioning AI as the backbone of its product differentiation. Investors should note that token consumption itself is not a proxy for material OpEx or monetization: certain workloads can process 10B tokens for as little as $25, meaning high usage metrics are more reflective of product reliance than financial impact.

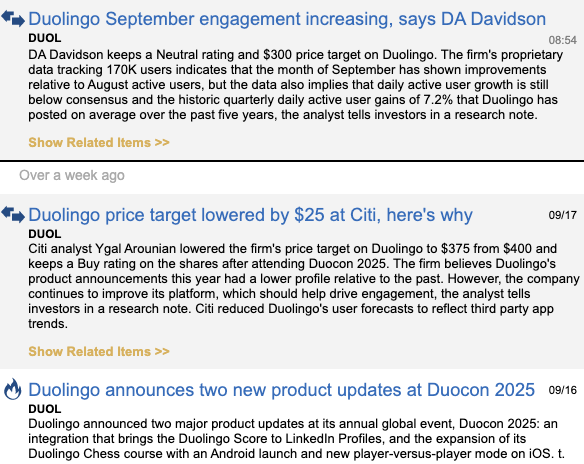

Duocon 2025, which was widely expected to serve as a product catalyst, underdelivered. Analyst sentiment has softened as the company leaned heavily on incremental AI features that appear more cosmetic than transformative.

Key announcements included:

Duolingo Scores on LinkedIn: A credentialing feature with limited monetization potential and questionable user adoption.

Duolingo Chess & Android Launch: Viewed by investors as a novelty, diluting focus from the core language-learning business.

AI-Powered Video Calls for Speaking Practice: Conceptually aligned with Duolingo’s mission, but execution risk is high, cost to scale remains unknown, and competitive moat is unclear vs foundation model competition.

Overall, Duocon reinforced the perception that Duolingo is leaning on AI optics rather than delivering material product innovation or monetizable growth avenues.

Investment View

Near-Term: Duolingo is leaning heavily on AI-driven features for differentiation. While top-of-funnel momentum remains muted, global usage and app store rankings suggest stabilization rather than outright deterioration. The key risk is that churn remains elevated until new user acquisition re-accelerates.

Medium-Term: Stabilization in usage provides a floor, but a sustained rebound in U.S. growth or social inbound will be required to drive upside. Without this, DUOL’s trajectory likely stays range-bound.

Risk: If top-funnel growth fails to reignite, revenue durability could come into question and valuation multiples may struggle to expand, even as the core user base shows signs of stability.

Actionable Takeaway

Churn vs. Growth: Elevated cancellations versus slowing new subs remain a risk factor, but current usage stability tempers downside concerns.

Demand Funnel Watchpoint: Social inbound and interest are still at trough levels; a turn higher would be the clearest sign of re-acceleration.

AI Integration: Duocon highlighted incremental AI features, underscoring management’s focus on AI as a differentiation strategy. Monetization clarity is still lacking, but reliance on AI signals where the product roadmap is headed.

Positioning: DUOL looks to have found a short-term floor with usage and rankings stabilizing. Near-term upside is capped without a clear top-funnel re-acceleration, but downside risk is also reduced compared to prior quarters. The setup favors a more neutral stance until catalysts emerge.

Excellent data-driven bearish analysis. Your subscription dynamics section captures the key concern: new subs declining sharply (-34.2% WoW, -165.2% MoM) while cancellations remain elevated (+85.2% YoY) is an ominous divergence that suggests the bottom isn't in yet. The Social Interest Tracker at historical lows is particularly troubling - top-of-funnel weakness precedes revenue deceleration by quarters. Your TikTok engagement analysis is nuanced: MoM positive but "materially below prior peaks" is the kind of granularity most analysts miss. The OpenAI token consumption point is excellent - you correctly identify that high token usage ≠ high costs or monetization, undermining the bull narrative about AI differentiation. The Duocon critique is spot on: Duolingo Scores on LinkedIn (credentialing with no monetization), Chess (novelty diluting focus), and AI video calls (high execution risk, unclear moat vs foundation models) all feel like "AI theater" rather than genuine product innovation. Your risk framing is balanced: stabilization provides a floor, but without top-funnel reacceleration, range-bound is the base case. The churn vs growth dynamic remains the critical watchpoint - if new user acquisition doesn't reignite soon, elevated churn will eventually manifest as revenue pressure. This setup favors neutral/cautious positioning until catalysts emerge. Thans for the rigorous analysis!