TickerTrends Called RBLX Player Momentum Months Ahead

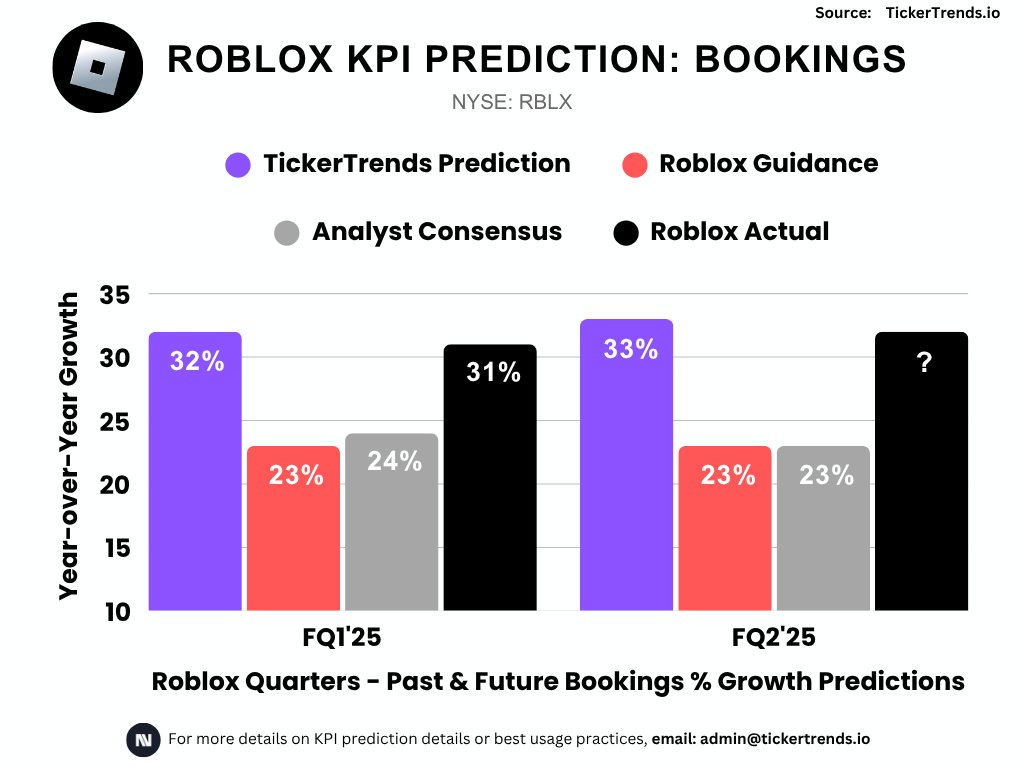

TickerTrends’ 33% YoY Roblox bookings growth forecast outpaced guidance and consensus, driven by viral custom games and early social engagement signals.

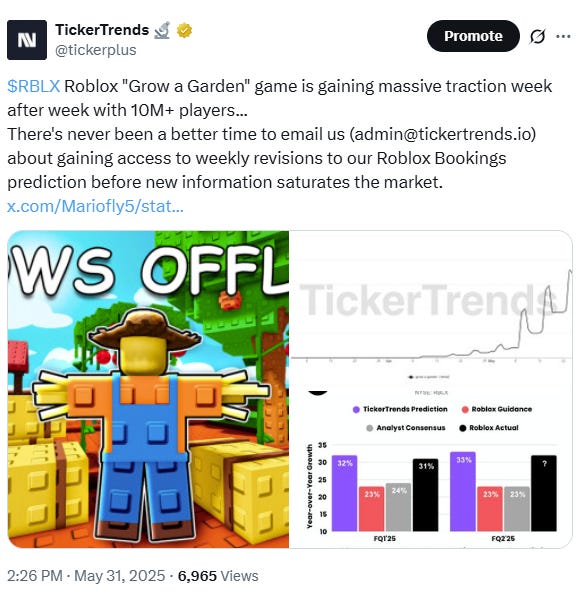

On May 29, we tweeted a bold KPI forecast for Roblox bookings growth. Our projection clearly outran the company’s guidance and Wall Street consensus at the time. In our graphic, we showed TickerTrends prediction at 33% YoY growth, compared to Roblox’s guidance of 23% and the Wall Street consensus of 24%. Even at that time, we were already ahead but momentum has only grown with exceedingly viral custom games like Grow-a-Garden and The Hatch.

That graphic got shared widely, including a feature on TMT Breakout Substack, showing we spotted the surge in social and consumer player activity far earlier than firms like M‑Sci and Yipit.

TMT Breakout on June 1, 2025 wrote the following about RBLX 0.00%↑:

TickerTrends’ forecast looked like an outlier compared to M-Science only at +29% at the time but was backed by our social indicators tracked which showed major traction, traction which continued in the following weeks as extensively and publicly documented on our Twitter.

What the Data Showed

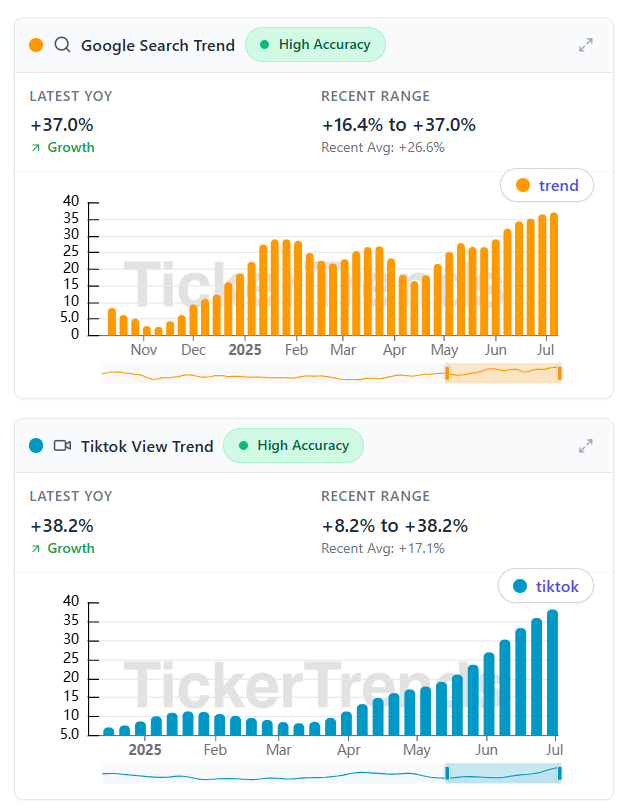

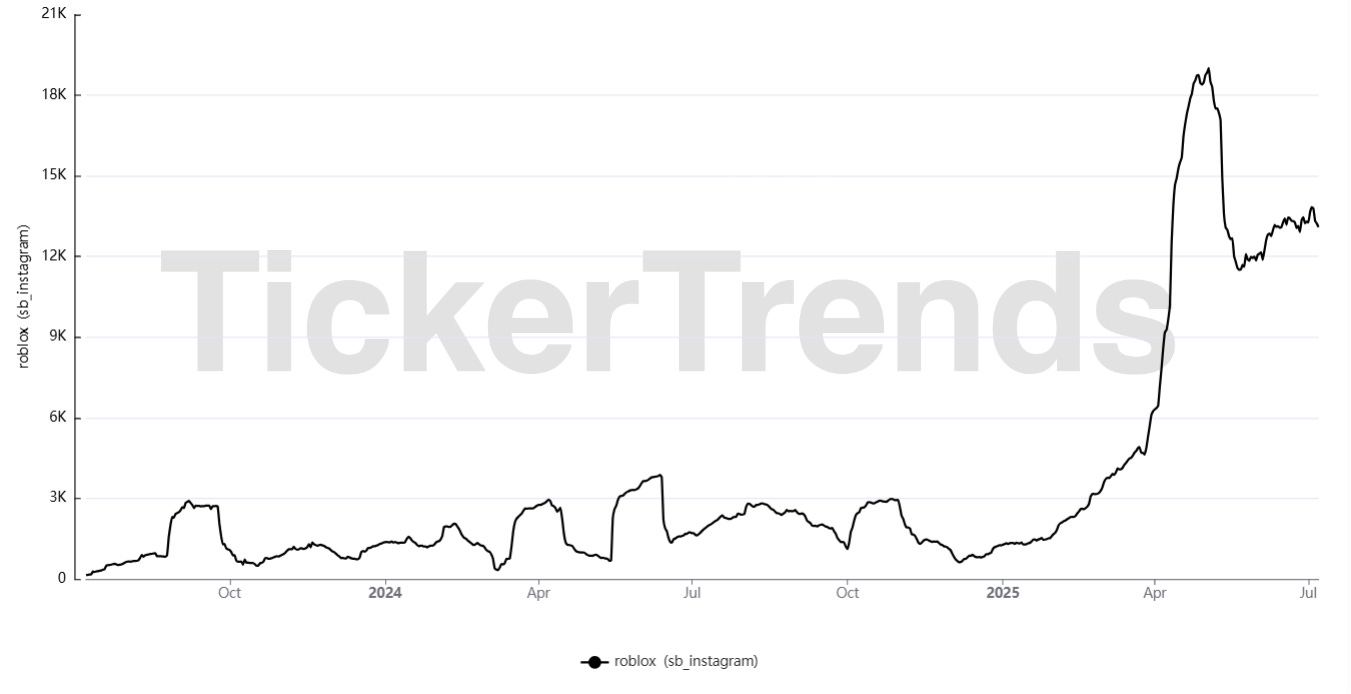

We use real-time alternative data tracking:

Social signals like TikTok hashtag interaction volume and Google Search showing strong year-over-year acceleration

Instagram follower explosion higher, April saw a surge in followers to the Roblox official Instagram account

All of these and more pointed toward accelerating user demand well before bookings growth appeared in other alternative data source tracking vendors. The trend was clear and unfolding earlier.

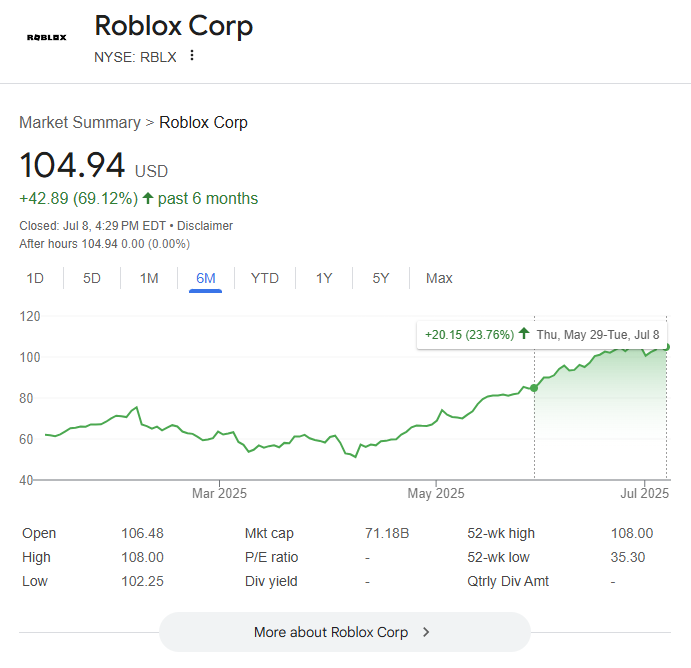

RBLX was trading at $84.79 on May 29 when we shared our forecast. Today it trades around $105 — that's a ~24% increase in two months. Investors who acted early on TickerTrends’ data captured the real move.

Why It Matters

We were early. Analysts were playing catch up to raise their price targets weeks after Grow a Garden and other exciting mini-games already began to fuel growth.

We used social engagement and app metrics to detect inflection points before other vendor’s numbers. That gave our users the advantage.

Our forecasts surprised the Street. While consensus sat around 24%, we called 33%. That gap gave the market room to react upward and quickly.

Bottom Line

In Roblox’ case, TickerTrends gave investors an actionable heads up in knowing what to expect for the company’s financial performance. We saw signs of clear consumer strength in the platform before street models caught up. We update forecasts weekly to give our Enterprise Users clear, actionable insight in revisions to our forecasts for KPIs. These revisions take into account the latest consumer interest data available!

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise