Tickertrends Community Recap: Celebrating Big Wins and Smart Insights from Our Super Users | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io.

The Tickertrends community continues to showcase its knack for identifying market opportunities and navigating challenges with precision. This week’s analysis highlights the standout successes and strategic insights that define our group of savvy investors. From uncovering companies capitalizing on evolving consumer trends to navigating headwinds faced by iconic brands, the community’s expertise shines through. These deep dives into the performance of key stocks not only validate the strength of our collective intelligence but also offer valuable lessons for anyone looking to stay ahead in an ever-changing market. Here's a look at how our members' picks performed and the insights that fueled their strategies.

@bb.bojangles:

Deckers Outdoor Corp ($DECK):

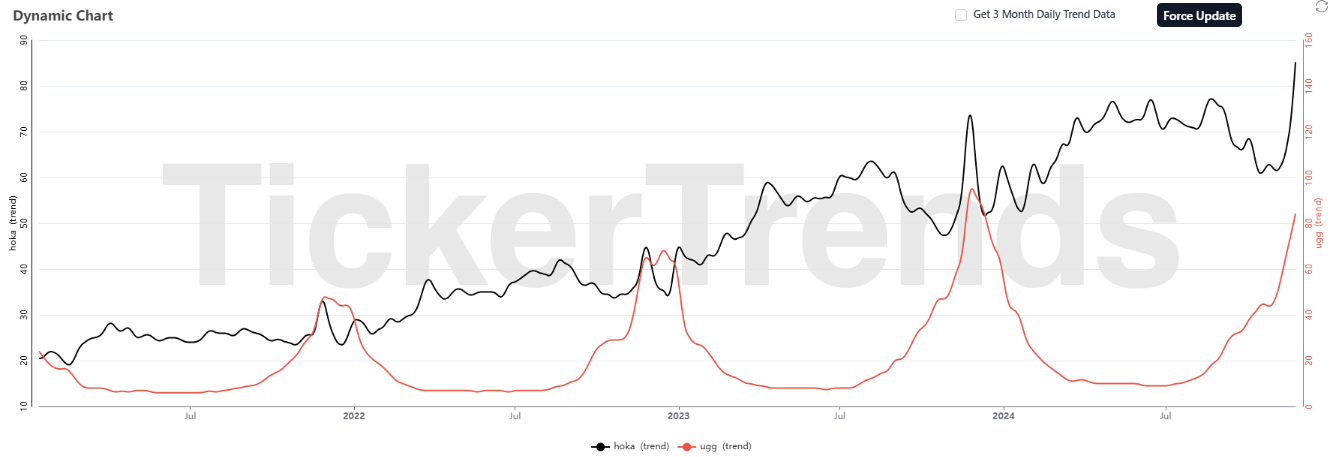

Deckers Brands had an exceptional year, showcasing the strength of its portfolio, particularly with the standout performance of HOKA and UGG.

Over the past year, Deckers consistently highlighted several factors that underpinned this robust performance and explained why it was such a strong year for the company and, specifically, for HOKA—a major win for Barry in your Discord community.

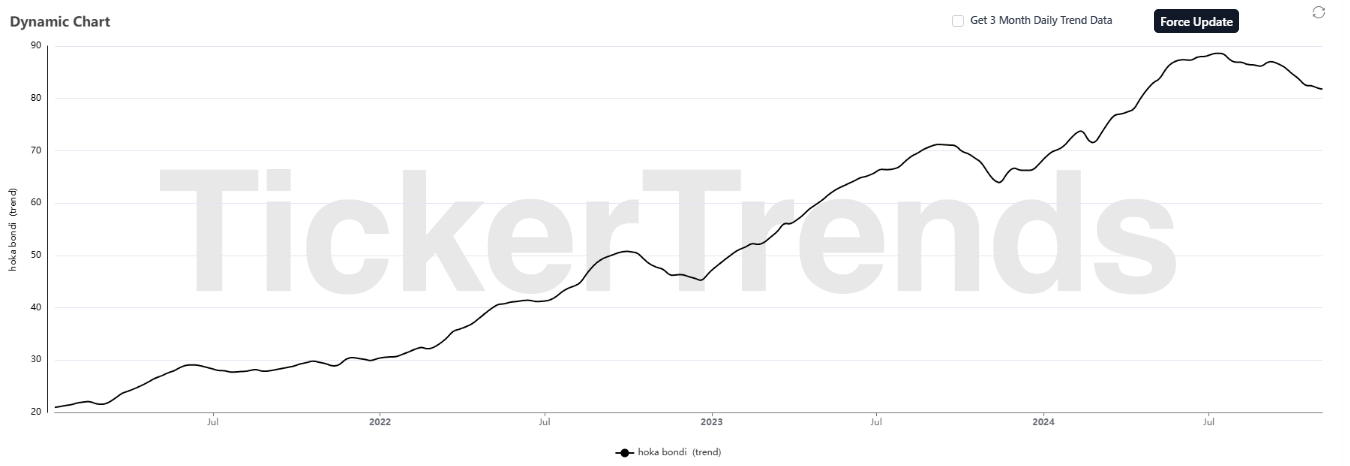

Firstly, HOKA's performance has been transformative. The brand achieved record-breaking milestones, such as surpassing $2 billion in trailing twelve-month revenue. Growth was fueled by a balanced mix of innovation, global expansion, and strong consumer demand. Key product launches, including the Skyward X, Mach X2, and updates to bestsellers like the Clifton and Bondi, resonated with both hardcore runners and casual fitness enthusiasts. HOKA's ability to segment its product lineup to cater to performance-focused and lifestyle consumers allowed it to expand its reach without diluting its brand identity. The introduction of premium styles like the Skyward X also improved margins while reinforcing HOKA's position as a leader in athletic performance footwear.

The international growth of HOKA has been another major highlight. While the U.S. remains the largest market, international revenue outpaced domestic growth, particularly in Europe and Asia. Enhanced marketing campaigns, like the "FLY HUMAN FLY" initiative, and sponsorships of high-profile running events like the Berlin and Tokyo Marathons, elevated global brand awareness. The addition of strategic retail locations in key cities such as Paris further bolstered HOKA's presence in underpenetrated markets.

From a financial perspective, Deckers showcased disciplined marketplace management, maintaining a pull model that supported high full-price sell-through rates and minimized discounting. This approach, coupled with strategic inventory control, ensured robust margins. Gross margins for the fiscal year improved to over 55%, driven by favorable brand mix, the expansion of DTC channels, and premium product pricing.

The broader portfolio also contributed to Deckers' stellar year. UGG, once viewed as a seasonal brand, achieved consistent year-round relevance through product innovation and new launches, such as the Golden Collection and the Tasman franchise. Collaborations with high-profile influencers and designers, like Post Malone, expanded its appeal, especially among younger demographics. Meanwhile, lean inventory management and international market focus allowed UGG to sustain high levels of consumer demand globally.

Deckers' strong operational execution also played a role. The company managed to balance wholesale expansion with a growing emphasis on its DTC channels. Notably, DTC revenue grew significantly, accounting for 43% of the company’s total revenue. This strategic shift not only boosted profitability but also strengthened Deckers’ direct relationship with consumers.

Barry’s pick of Deckers aligns with these performance drivers. The combination of HOKA’s exponential growth, UGG’s transformation into a year-round brand, disciplined financial management, and strategic international expansion made Deckers a top performer. These elements reflect a company not only riding high on current trends but also positioning itself for sustained long-term success. This win underscores the importance of identifying companies that can execute on brand strength and leverage innovation to capture market share and expand margins.

Starbucks Corp ($SBUX):

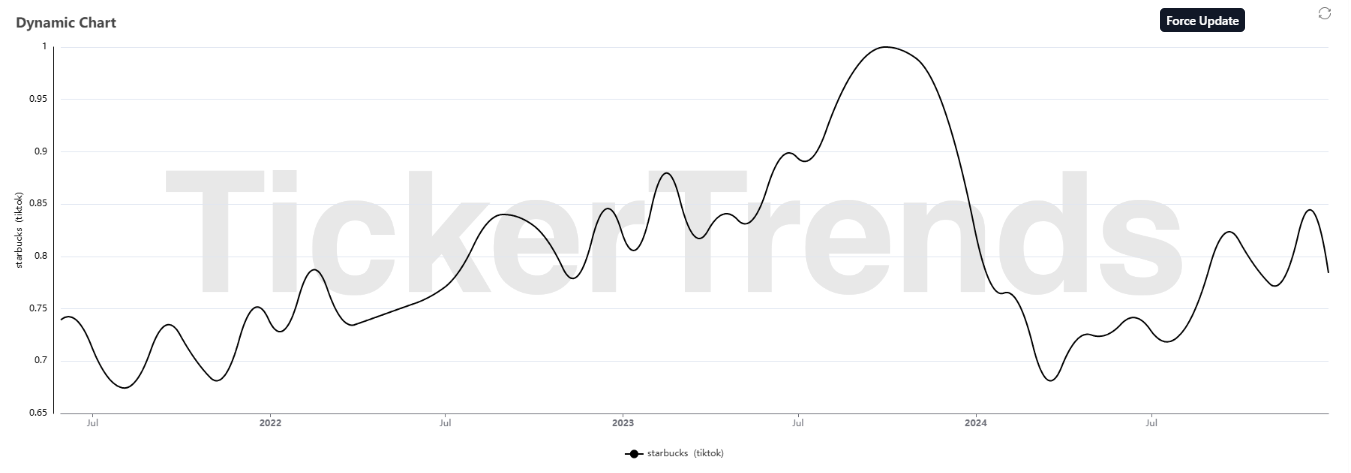

Starbucks faced significant challenges this year, underscoring fundamental issues within the company’s operations and market positioning. While the brand remains iconic, recent earnings calls highlight areas of concern that have tempered growth and raised questions about the sustainability of Starbucks’ long-term strategy.

One of the central issues was declining traffic, particularly among non-Starbucks Rewards (SR) members, who represent 40% of the U.S. business. This segment saw double-digit declines in transactions as economic pressures prompted more occasional customers to reevaluate discretionary spending. Management acknowledged that the company’s premium pricing strategy and lack of compelling offers for non-SR members left it vulnerable to consumer trade-offs in a cost-conscious environment. Compounding the issue, the company’s over-reliance on promotions for SR members further highlighted an imbalance in its customer acquisition and retention strategy.

Operational inefficiencies became another focal point, particularly in the U.S. The complexity of Starbucks' menu and customization options contributed to longer wait times and lower throughput, frustrating customers and baristas alike. Mobile Order & Pay (MOP), which drives over 30% of transactions, often overwhelms stores, especially during peak hours. Despite investments in the Siren Craft system and other process improvements, these initiatives appeared fragmented, lacking the coordinated rollout needed to address bottlenecks comprehensively.

Internationally, Starbucks faced uneven performance. While markets like Japan and parts of Latin America demonstrated resilience, China, a key growth market, struggled. Comparable store sales in China fell 14% in the most recent quarter, driven by macroeconomic headwinds, aggressive competition, and a sluggish recovery post-pandemic. The mass-market price wars among competitors eroded Starbucks’ ability to differentiate itself in the premium segment. Although management emphasized the long-term potential of China, short-term results and the need for strategic partnerships raised questions about the viability of its aggressive expansion plans in lower-tier cities.

The company's financial performance reflected these challenges. Margins contracted due to higher wages, benefits, and promotional activities, while revenue growth was tepid, offset by declining comparable store sales. Management’s revised guidance acknowledged the prolonged impact of these headwinds, emphasizing the need for structural changes rather than quick fixes.

From a product perspective, Starbucks struggled to consistently execute innovations that resonated with consumers. Some new offerings, such as the Lavender platform, saw initial success but failed to sustain momentum. The lack of alignment between supply chain capabilities and product launches exacerbated the problem, leading to stockouts and missed opportunities. Furthermore, the emphasis on rapid innovation diluted focus on core coffee offerings, creating complexity without clear customer benefits.

Starbucks’ challenges this year stemmed from a combination of operational inefficiencies, inconsistent product strategy, and weak customer engagement outside its loyalty ecosystem. While the company’s brand equity remains strong, the need for a more disciplined approach to execution, pricing, and customer segmentation is evident. Starbucks faces a critical juncture where its ability to streamline operations and reestablish its identity as a premium coffeehouse will determine whether it can regain its footing in a competitive and cautious consumer market.

@soot25

Eli Lilly And Co ($LLY):

Eli Lilly has had a banner year, showcasing exceptional execution across its portfolio and laying the groundwork for sustained growth in the years ahead. The company’s performance in 2024 highlights its leadership in innovation, operational excellence, and strategic positioning within some of the most lucrative segments in the pharmaceutical industry.

The growth of Lilly’s incretin medicines, Mounjaro and Zepbound, has been nothing short of transformational. These products have demonstrated robust demand, driving a 36% year-over-year increase in Q2 revenue, with new products contributing significantly to overall sales. The exceptional uptake of these incretins underscores the strength of Lilly’s pipeline, which continues to address some of the most pressing health challenges globally, including obesity and Type 2 diabetes. Mounjaro alone achieved $3.1 billion in global sales during Q2, solidifying its status as a market leader and reflecting its unparalleled efficacy in weight loss and glycemic control.

Lilly’s operational strategy has also been a major factor in its success. The company has been executing one of the most ambitious manufacturing expansion plans in its history, investing more than $18 billion since 2020 to build and upgrade facilities in the U.S. and Europe. This aggressive approach to capacity-building ensures that Lilly is well-positioned to meet surging demand for its products, particularly in the incretin space. The recent approval of the multidose KwikPen for Mounjaro in Europe further expands supply capabilities, reflecting the company’s agility in addressing capacity constraints and scaling its operations.

International growth has been another key highlight. Lilly has successfully launched Mounjaro and Zepbound in multiple markets outside the U.S., including the U.K., Germany, and Japan. These launches have been met with strong initial uptake, demonstrating the universal appeal of these innovative treatments. Lilly’s ability to penetrate self-pay markets, such as Saudi Arabia and the UAE, underscores its ability to adapt its strategy to diverse market dynamics. The expansion of reimbursement for obesity treatments in key regions also opens up additional avenues for growth.

The company’s commitment to innovation extends beyond its existing product portfolio. Lilly’s pipeline is among the most exciting in the industry, with 11 molecules targeting obesity and related comorbidities currently in clinical trials. The development of orforglipron, a promising oral GLP-1 receptor agonist, could revolutionize the obesity treatment landscape by offering an injectable-level efficacy in a more convenient oral format. Additionally, Lilly continues to broaden the scope of its incretin portfolio by exploring applications in obstructive sleep apnea and heart failure with preserved ejection fraction, further enhancing its market potential.

Financially, Lilly has delivered impressive results, demonstrating strong operating leverage while continuing to invest in its future. Gross margins have expanded significantly, driven by favorable product mix and pricing dynamics. The company has also shown discipline in managing its expenses while accelerating investments in R&D and manufacturing capacity. With an updated full-year revenue guidance of up to $46 billion, Lilly is on track to deliver approximately 50% year-over-year growth in Q4 2024, further solidifying its position as an industry leader.

Lilly’s strategic vision is clear: to be the leader in addressing metabolic diseases and their associated complications. Its investments in groundbreaking therapies, unparalleled commitment to expanding capacity, and a clear focus on delivering for patients have set the stage for sustained growth. As the company continues to execute on its ambitious plans, Eli Lilly is not just thriving in 2024—it is shaping the future of healthcare on a global scale.

Broadcom Inc ($AVGO):

Broadcom had an outstanding year, driven by transformative growth across its AI and semiconductor segments, as well as its successful integration of VMware into its infrastructure software business. The company showcased its ability to execute on multiple fronts, positioning itself as a dominant force in both established and emerging technology markets.

A significant driver of Broadcom’s success in 2024 was its surging AI revenue, which grew an extraordinary 220% year-over-year to $12.2 billion. This growth was fueled by robust demand for its custom AI accelerators and advanced networking solutions. Broadcom has cemented its position as a critical partner for leading hyperscalers, providing the next-generation XPUs and high-bandwidth networking components needed for large-scale AI clusters. The company’s Tomahawk and Jericho product lines were particularly impactful, enabling hyperscalers to build AI data centers with unprecedented scalability and performance. Broadcom's ability to innovate rapidly, such as delivering 3-nanometer XPUs and transitioning to 800-gigabit optical connectivity, underscores its leadership in the AI infrastructure space.

The integration of VMware marked another significant milestone. Broadcom successfully realigned VMware’s business model, shifting towards high-margin subscription services like VMware Cloud Foundation (VCF). This comprehensive software stack, which virtualizes entire data centers, drove strong adoption among enterprise customers seeking on-premises private cloud solutions as an alternative to public cloud environments. VMware's operating margin reached an impressive 70% by the end of 2024, surpassing initial expectations and setting the stage for sustained growth in Broadcom’s software segment. The company’s ability to execute such a rapid and successful transformation speaks to the strength of its operational discipline.

Broadcom’s financial performance was equally impressive. Consolidated revenue soared to $51.6 billion, a 44% increase year-over-year, with semiconductor revenue alone reaching $30.1 billion. The company also returned a record $22 billion to shareholders through dividends and buybacks, demonstrating its commitment to maximizing shareholder value. Despite substantial investments in manufacturing and R&D, Broadcom maintained strong margins, with adjusted EBITDA representing 62% of total revenue.

Looking ahead, Broadcom’s focus on AI positions it to capture an even larger share of the growing market. The company expects its AI-related serviceable addressable market (SAM) to expand to $60-$90 billion by 2027, driven by hyperscalers deploying massive XPU clusters. With established relationships with three major hyperscalers and plans to onboard two more, Broadcom is well-positioned to lead this transformation.

In summary, Broadcom's strong execution across its semiconductor and software segments, coupled with its strategic investments in AI and cloud infrastructure, has solidified its position as a market leader. The company's ability to drive both innovation and operational efficiency ensures it remains at the forefront of technological advancements, making it one of the most compelling growth stories in the tech sector.

Tapestry Inc ($TPR):

Read our in-depth analysis on Tapestry Inc. here: https://blog.tickertrends.io/p/tpr-coachs-cultural-revival-navigating?r=4ioql1&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

Ralph Lauren Corp ($RL):

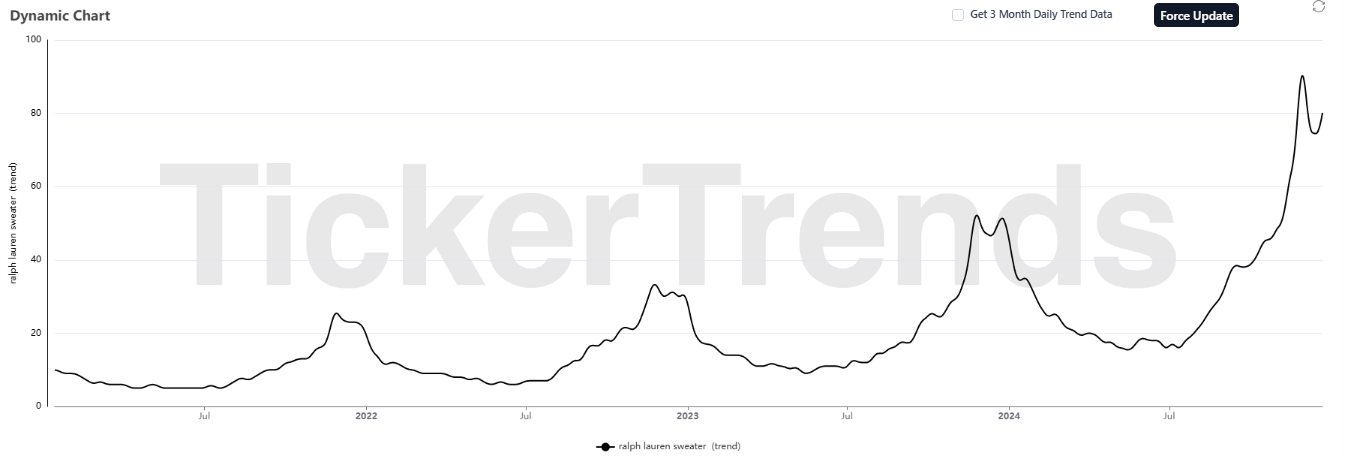

Ralph Lauren has had a remarkable year, underpinned by its ability to seamlessly align its brand with evolving consumer preferences while capitalizing on timeless design principles. The company’s success is a testament to its ability to execute on its “Next Great Chapter: Accelerate” strategy, which has focused on brand elevation, product innovation, and geographical expansion. These efforts have not only driven financial growth but also cemented Ralph Lauren’s position as a leader in the luxury lifestyle market.

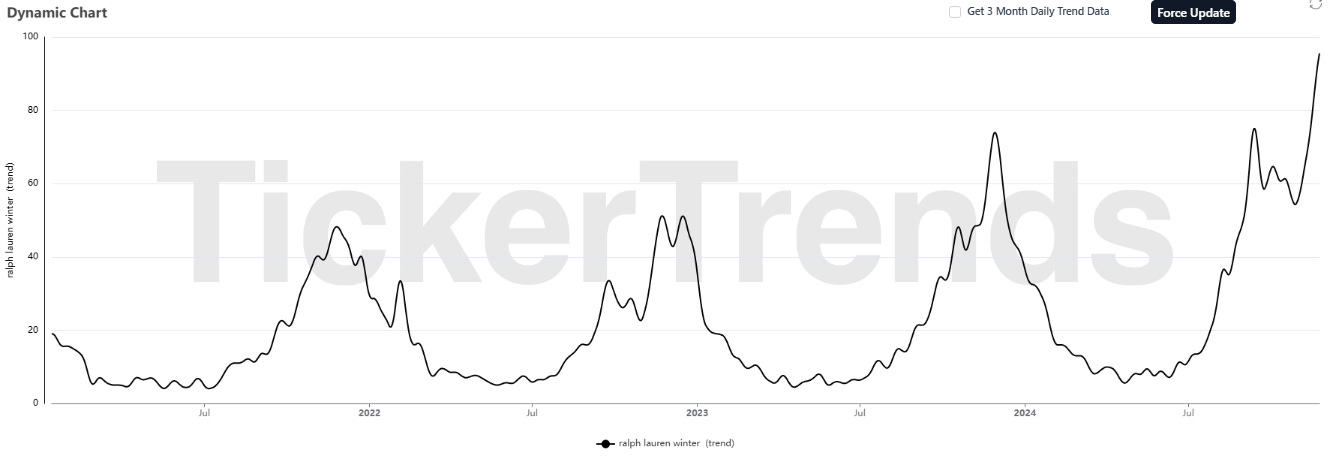

A key driver of Ralph Lauren’s success has been its ability to resonate with cultural and aesthetic trends, particularly the resurgence of the "old money" and "quiet luxury" movements. These trends, which emphasize understated elegance, quality craftsmanship, and timeless design, align perfectly with Ralph Lauren’s brand ethos.

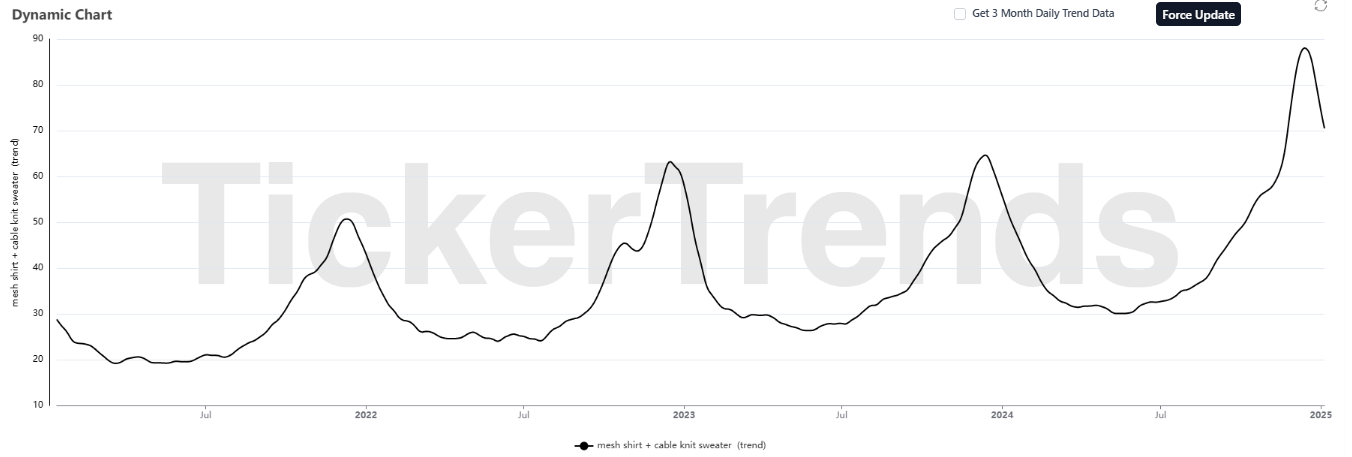

The company’s core offerings—such as tailored blazers, cable-knit sweaters, and Oxford shirts—are quintessential representations of this aesthetic. The growing consumer preference for authenticity and heritage in fashion has elevated Ralph Lauren as a go-to brand for those seeking understated sophistication. This has been particularly evident in key markets like China, where the brand’s alignment with these trends has driven strong double-digit growth.

From a marketing perspective, Ralph Lauren has been highly effective in maintaining and enhancing its cultural relevance. By partnering with global events such as the Paris Olympics, Wimbledon, and the U.S. Open, the brand has positioned itself at the intersection of luxury, sports, and culture. These high-profile activations generated more than 142 billion global PR impressions during the summer, far exceeding expectations.

Furthermore, the brand’s collaborations with celebrities like Beyoncé, Naomi Campbell, and Jennifer Lawrence, alongside activations with influencers in younger demographics, have strengthened its appeal across generations. This strategy has driven robust engagement on social media platforms, with Ralph Lauren surpassing 62 million followers and experiencing double-digit growth in online search interest.

Financially, Ralph Lauren’s results reflect disciplined execution across its operations. Gross margin expanded to 67.1% in the second quarter of fiscal 2025, bolstered by a 10% increase in average unit revenue (AUR). This growth was achieved through reduced discounting, an elevated product mix, and strategic pricing power. Notably, the company’s ability to drive full-price sales has been a critical factor in its success, with retail comps increasing 10% globally. This performance underscores the growing desirability of the Ralph Lauren brand, which continues to resonate with consumers despite macroeconomic headwinds.

The company’s geographical expansion has also been a standout success. Asia led the way with 10% revenue growth, driven by a low-teens increase in China, where Ralph Lauren’s focus on local marketing, DTC expansion, and tailored product assortments has delivered exceptional results. Europe followed closely with mid-single-digit growth, supported by strong retail performance and robust AUR increases. Even in North America, a traditionally more mature market, the company achieved positive growth, with comps increasing by 6% in the second quarter. This broad-based growth highlights the effectiveness of Ralph Lauren’s consumer ecosystem strategy, which integrates physical retail, digital channels, and local marketing to deliver consistent and elevated brand experiences.

Product innovation has also been a key contributor to Ralph Lauren’s success. The company has effectively leveraged its iconic core products, such as mesh polo shirts and cable-knit sweaters, which represent 70% of its business and achieved double-digit growth. High-potential categories, including women’s apparel, outerwear, and handbags, have outpaced overall company growth.

The Polo ID handbag collection, in particular, has been a standout, resonating strongly with younger, high-value consumers. Meanwhile, the brand’s efforts to position outerwear as a year-round category have further diversified its product mix and bolstered margins.

Ralph Lauren appears to be well-positioned to sustain its momentum. The company’s ability to marry timeless design with contemporary cultural relevance ensures it remains at the forefront of luxury fashion. Its investments in DTC channels, geographical expansion, and product innovation provide a solid foundation for growth. As the old money and quiet luxury trends continue to dominate consumer preferences, Ralph Lauren’s iconic brand and strategic execution make it uniquely equipped to capitalize on these shifts.

@Matt95

Garmin Ltd ($GRMN):

Read our in-depth analysis on Garmin Ltd here: https://blog.tickertrends.io/p/grmn-redefining-fitness-tech-empowering?r=4ioql1&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

Nike Inc ($NKE):

Nike's challenges this year reflect deeper struggles with execution, market positioning, and adapting to a shifting consumer landscape. While the brand retains its global recognition and cultural cachet, its recent performance reveals several underlying issues that have hampered growth and competitiveness.

One of the primary areas of concern for Nike has been its overreliance on its iconic lifestyle franchises—Air Force 1, Air Jordan 1, and Dunk—which have shown significant declines. Nike's strategy to aggressively scale back these franchises, particularly in its Direct and Digital channels, has created a pronounced revenue headwind.

While this move aims to rebalance the portfolio and focus on innovation, the transition has been disruptive, with sales of these franchises on Nike Digital reportedly declining by nearly 50% year-over-year in the most recent quarter. This reset highlights Nike's overdependence on a few classic products and the challenges of pivoting away from them without a robust pipeline of replacements at scale.

In the digital space, Nike's performance has been underwhelming. Nike Digital saw a 20% decline in revenue during the quarter, driven by softer traffic and an increased reliance on promotions. This reflects a broader issue of diminishing consumer engagement, where the digital channel has shifted from creating demand to merely capturing it. Nike's challenge in this area is compounded by the intense competition within the direct-to-consumer (DTC) ecosystem, which has eroded its pricing power and margins.

Geographically, Nike has faced headwinds in several key markets. In North America, its largest market, Direct sales declined by 15%, driven by sluggish store traffic and promotional pressures. Similarly, in Greater China, revenue fell by 11%, impacted by weaker consumer demand and heightened competition from both international and local brands. These regional struggles underscore the broader difficulty Nike faces in navigating a challenging macroeconomic environment and recalibrating its global operations to meet localized needs.

Operationally, Nike has struggled with inventory management, leading to elevated supply levels in key regions such as North America and Greater China. These inventory challenges have necessitated higher promotional activity, further pressuring margins and diluting the brand's premium positioning. While Nike has made efforts to manage partner inventory and reduce aged stock, the marketplace remains overly promotional, complicating efforts to maintain brand equity and profitability.

Despite these issues, Nike's innovation pipeline has yet to deliver the kind of breakthrough products that could offset the declines in its core franchises. While there have been some successes, such as the Pegasus 41 and the Sabrina basketball line, these have not scaled quickly enough to fill the revenue gap. Moreover, Nike's emphasis on performance categories like running and basketball has not fully capitalized on broader consumer trends, such as the continued growth of athleisure and lifestyle-driven apparel.

Nike's struggles this year highlight a combination of strategic missteps, operational inefficiencies, and external challenges. While the company has taken steps to reset its portfolio and refocus on innovation, these efforts will require time to materialize. In the interim, Nike faces the dual challenge of maintaining consumer trust and sustaining financial performance in an increasingly competitive and volatile marketplace.