Toast’s Revenue is Heating Up: Data Points to More Room Above the Street

TickerTrends sees Toast’s FQ2’25 revenue slightly ahead of consensus—buoyed by accelerating Fintech Solutions performance and positive alternative data signals.

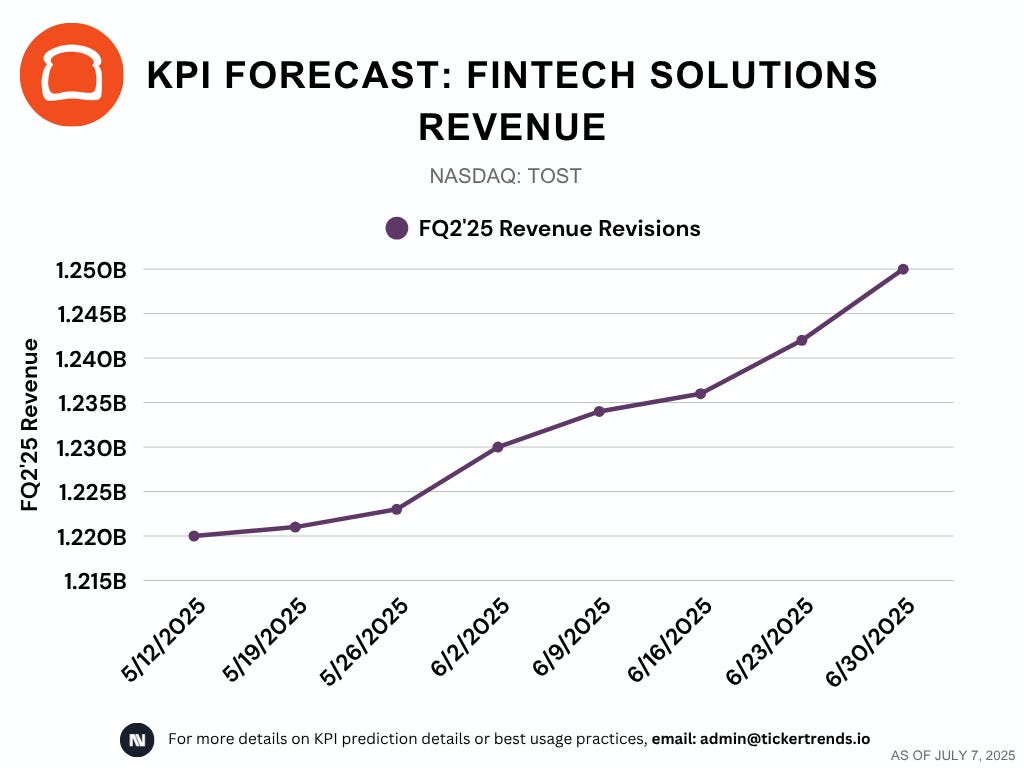

TickerTrends’ data for Toast (TOST 0.00%↑ ) is showing early signs that the company’s top-line performance may be stronger than what analysts currently expect. While Toast is only modestly above analyst expectations (+22% year-over-year growth rate this quarter), the revenue for their Fintech Solutions segment (which is the vast majority of their revenue) has seen a large string of upward revisions. Although our KPI forecast is currently only ~1% above current consensus estimate for FQ2’25, there may be upside for revenue forecasts in the back half of this year and beyond with the current momentum in alternative data channels we track.

In other words, our high-frequency revision model is flagging strong potential for future upward revisions, both for this quarter and the next.

Our conviction is based on multiple indicators flashing green:

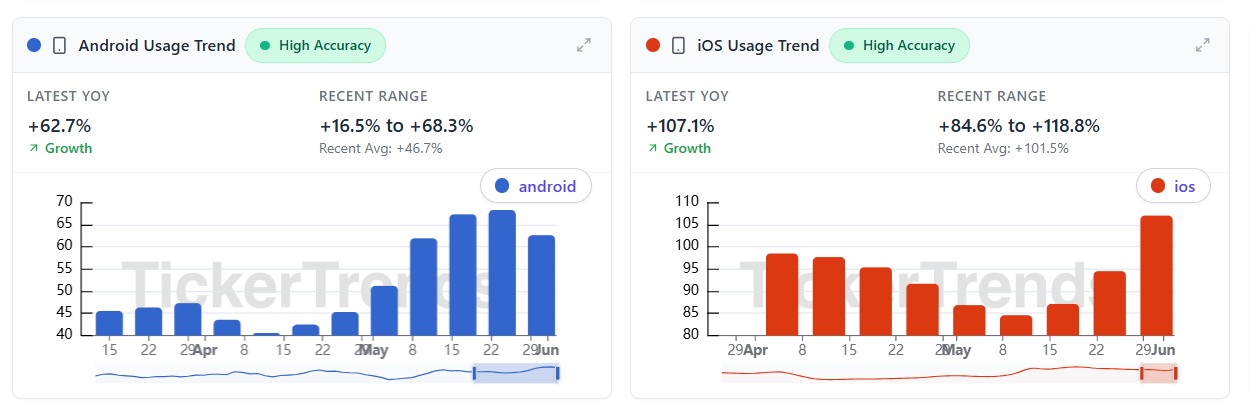

Mobile App DAUs are climbing steadily, with Toast’s user engagement rising across both merchant- and staff-facing apps.

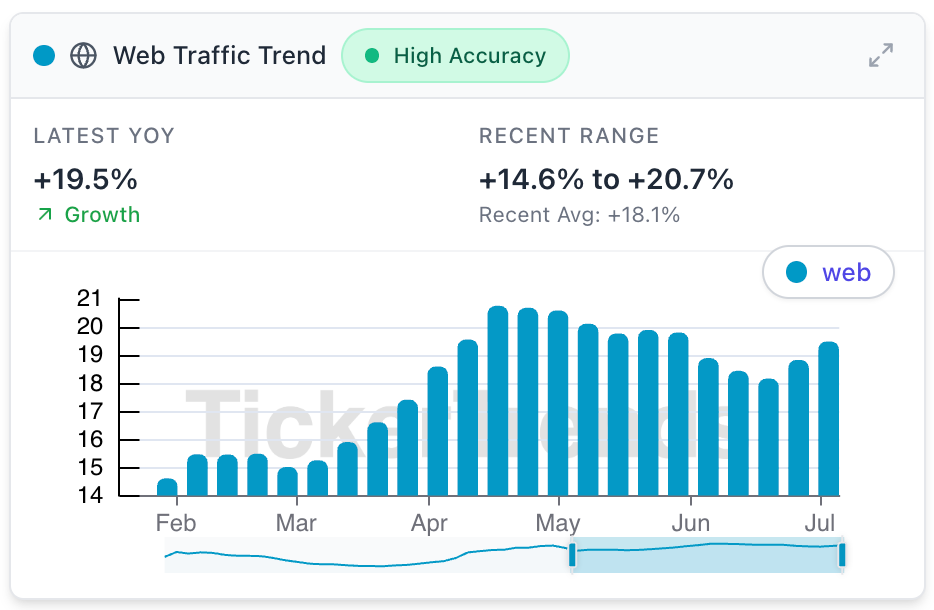

Website traffic to Toast’s point-of-sale landing pages is showing a consistent pickup, suggesting stronger inbound interest from prospective restaurant clients.

Google Search volume for key phrases indicating demand for Toast’s hardware and software products have all accelerated year-over-year and broken out to multi-month highs.

The Revision Trend

What’s notable is that this isn’t just a one-time bump. The growth appears to be sustaining and accelerating year-over-year. Demand for Toast’s POS and product suite is strong. Based on the run-rate implied by alternative data, our internal models suggest Toast could continue growing at a mid-20% YoY pace, which would imply material upside to Street expectations for +19% to +21% growth through the second half of 2025

If sustained, this kind of revision pattern has historically led to multiple quarters of earnings outperformance for names with similar digital footprint trends.

Why This Matters

In a tougher macro environment for SMB software and hardware spend, Toast appears to be holding up better than most. The growing digital signals are consistent with a company that continues to gain market share and possibly upsell into its merchant base.

We’ll be watching closely to see whether the Street catches up to this story in the next few weeks. If they do, Toast (TOST 0.00%↑ ) might be positioned for a re-rating and a continued breakout to all-time highs.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise