Top 8 Web Traffic Metrics for Investment Analysis

Web traffic metrics provide real-time insights into a company's digital performance, helping investors make smarter decisions. Unlike traditional financial data, these metrics reveal trends in consumer behavior, marketing effectiveness, and competitive positioning. Here’s a quick rundown of the top 8 metrics:

Unique Visitors: Measures audience size and growth potential.

Bounce Rate: Tracks the percentage of visitors leaving after one page; lower rates suggest better engagement.

Session Duration: Indicates how long users stay on a site; longer times reflect stronger interest.

Conversion Rate: Shows how effectively traffic turns into sales or leads.

Traffic Sources: Identifies where visitors come from (organic search, paid ads, social media, etc.).

Page Views: Highlights consumer interest and content performance.

Average Pages per Session (APPS): Measures user engagement across multiple pages.

Exit Pages: Pinpoints where users leave, revealing potential issues in the user journey.

Web Analytics for Beginners: Understanding Key Traffic Metrics

What Are Web Traffic Metrics?

Web traffic metrics track how visitors interact with websites, providing valuable insights into company performance, market trends, and potential opportunities. These metrics can highlight patterns that traditional financial data might overlook, giving investors an edge.

Web traffic metrics are typically divided into three main categories:

Engagement Metrics

These include measures like bounce rate and session duration, which show how users interact with a site. For example, the average bounce rate is around 56% for B2B and 45% for B2C industries [3].

Acquisition Metrics

These metrics reveal how visitors discover and reach a website, offering insights into a company's digital marketing efforts and brand visibility.

Conversion Metrics

Conversion metrics focus on how effectively a company turns website visitors into paying customers.

"Bounce rate is a critical engagement metric that measures the percentage of visitors who leave a website after only viewing one page." - Similarweb Knowledge Center [4]

Why are these metrics important?

They allow for benchmarking against competitors and spotting risks or growth opportunities early.

Investors can compare companies within the same industry to evaluate relative performance.

They add context to traditional financial analysis, offering a more complete picture.

Tools like Google Analytics, Semrush, and Triple Whale help transform raw traffic data into insights [5]. However, it’s important to use these metrics alongside financial data rather than as a replacement.

No single metric tells the whole story. High traffic doesn’t always mean success - it needs to be paired with strong conversion rates and engagement to truly reflect performance.

Now that we’ve covered the basics, let’s dive into the specific web traffic metrics investors should keep an eye on.

1. Unique Visitors

Unique visitors are a key starting point for analyzing web traffic. This metric counts the distinct individuals visiting a website during a specific period, offering a snapshot of the site's audience size and growth potential.

Understanding Market Reach

Tracking trends in unique visitors over time can shed light on a company’s reach and brand growth. Comparing these trends to industry standards or seasonal patterns can also highlight how a business is performing in its market.

Supporting Investment Decisions

Unique visitor data can play a role in assessing investment opportunities by revealing:

Market demand

Brand visibility

Effectiveness of marketing efforts

Positioning against competitors

A growing number of unique visitors often signals successful marketing and expanding brand awareness. Seasonal shifts - whether increases or decreases - can point to revenue opportunities or potential challenges.

How to Use This Data

Google Analytics' Audience Overview is a useful tool for monitoring unique visitors. Pay attention to growth trends, seasonal changes, and geographic patterns to uncover actionable insights.

Important Context

While high unique visitor numbers are encouraging, they need to be analyzed alongside other metrics like conversion rates and engagement levels to get a full picture of performance. Factors that can impact unique visitor counts include:

Seasonal trends specific to the industry

Broader market conditions

Shifts in the competitive landscape

Timing of marketing campaigns

Although unique visitors are a strong starting point, deeper metrics - like bounce rates - are essential to understand how these visitors interact with the site.

2. Bounce Rate

Bounce rate measures the percentage of visitors who leave a website after viewing just one page without taking any further action. It's a key metric for understanding website engagement and user behavior, especially when assessing a company's digital performance.

Industry Benchmarks

On average, B2B websites have a bounce rate of around 56%, while B2C sites hover at 45%. Across industries, bounce rates typically range from 26% to 70%. A rate below 40% often points to strong user engagement, whereas rates above 55% could signal potential issues.

Why It Matters for Investors

Bounce rates can provide valuable insights into:

How competitive the market is

The effectiveness of the website's content

The quality of the user experience

The efficiency of marketing efforts

How to Analyze Bounce Rates

To get the most out of bounce rate analysis, focus on the following:

Compare bounce rates across different marketing channels

Monitor performance trends over time

Dive into specific landing pages or product sections

Benchmark results against industry competitors

What High Bounce Rates Tell You

A high bounce rate might point to problems like poor design, slow loading times, or ineffective marketing campaigns. However, it also highlights areas where improvements can make a big impact. For investors, tracking bounce rate trends can reveal how well a company attracts and retains visitors, offering early clues about growth potential or operational challenges.

Key Takeaways for Investors

Bounce rates shed light on marketing strategies, user experience, and product-market alignment. While high rates might indicate problems, a declining bounce rate can reflect a stronger digital presence. It's important to focus on trends and comparisons, rather than just the raw numbers.

Though bounce rate captures initial engagement, session duration offers a deeper look at how visitors interact with a site over time.

3. Session Duration

Session duration tracks how long visitors stay on a website during a single visit. It gives investors a time-based view of user engagement and overall digital performance. Unlike bounce rate, which focuses on single-page visits, session duration provides deeper insights into how users interact with a site.

What’s a Good Session Duration?

On average, a session duration of 2-3 minutes is seen as solid, though this can vary depending on the industry. To make sense of this metric, investors should look at trends over time, compare them to industry standards, and evaluate how different traffic sources and content types perform.

Why It Matters for Investors

Session duration gives a glimpse into how well content is connecting with users and how effective marketing efforts are. Longer sessions often suggest users are finding relevant content or are closer to making a purchase. By analyzing where traffic comes from, investors can pinpoint which marketing channels are driving the most engaged visitors.

What to Watch For

To get the full picture, it’s important to consider factors like device type and traffic source. For instance, comparing mobile vs. desktop engagement can highlight platform optimization opportunities. Similarly, looking at organic vs. paid traffic can reveal which strategies are delivering better results.

What Does It Tell You?

Short durations might signal poor content or a frustrating user experience.

Longer durations often point to better engagement and stronger strategies.

For e-commerce sites, longer sessions can mean users are more likely to make a purchase and spend more per order. While session duration is a great way to measure engagement, it’s also important to pair it with conversion rates to understand how that engagement translates into actual business results.

4. Conversion Rate

Conversion rate measures how well a website turns visitors into customers or leads. For investors, it serves as a key metric to assess a company's online performance and its ability to convert traffic into measurable business outcomes.

Understanding the Numbers

This metric provides a clear picture of revenue potential, marketing efficiency, and overall business health. It helps investors gauge how effectively a company monetizes its digital presence and responds to market needs.

Key Types of Conversions

Different businesses track specific conversions to assess their market performance. Here are some examples:

How Investors Analyze Conversion Rates

When examining conversion rates, consider the following:

Compare them to industry benchmarks.

Look for steady improvements over time.

Identify which traffic sources yield the best results.

Factor in seasonal or cyclical trends.

Helpful Tools for Analysis

Platforms like Semrush and Triple Whale offer in-depth analytics, enabling investors to compare competitors and track market trends [1][2].

Spotting Risks and Opportunities

Be on the lookout for warning signs such as:

A mismatch between the website and its audience.

Declining conversion rates over time.

Weak competitive positioning in the market.

On the flip side, improvements in conversion rates can signal:

Effective optimization efforts.

Alignment with market demand.

Well-executed marketing strategies.

While conversion rate measures how effectively a business turns traffic into results, understanding the source of that traffic is just as important - something we'll dive into next.

Discover Alternative Data Insights

Access comprehensive consumer data, track market trends, and gain actionable insights with TickerTrends' innovative data terminal and API services.

5. Traffic Sources

Traffic sources explain how users discover a website, giving investors a window into consumer behavior and market dynamics. They also provide a snapshot of marketing efforts and competitive positioning.

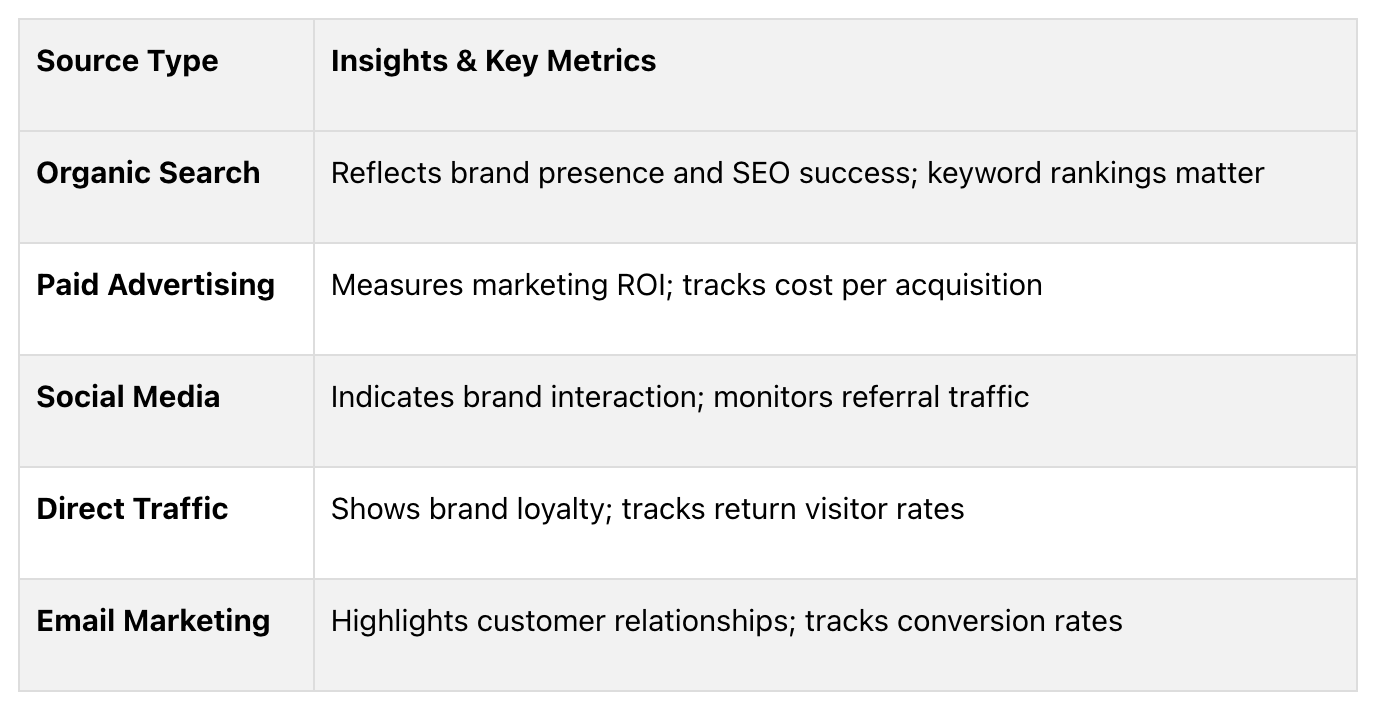

Main Categories of Traffic Sources

What Traffic Sources Reveal

Traffic sources can uncover marketing performance, regional reach, and demographic trends. For example, strong organic search traffic often points to steady growth, while heavy reliance on paid ads might signal exposure to rising costs. Investors can analyze this data to identify regional growth opportunities, competitive edges, and shifts in consumer behavior.

Risks and Growth Opportunities

Potential red flags include:

Over-dependence on a single traffic source

Falling organic traffic despite increased spending on paid ads

Sudden changes in traffic distribution patterns

New traffic sources that could signal emerging trends

How to Use This Information

When assessing traffic sources, consider the company's industry and business model. For instance, a B2B software company might prioritize organic search traffic, while a D2C brand may need a balanced mix of social media and paid ads. Tools like Google Analytics and Semrush can help analyze these patterns effectively.

6. Page Views

For investors, page views act as a basic yet important indicator of consumer interest. They can hint at market trends and shifts in competitive landscapes early on. This metric shows how users interact with website content, helping investors make more informed decisions.

What Page Views Tell Investors

Page views shed light on how well content performs, highlight seasonal trends, and give a sense of user engagement and competitive standing. When paired with other metrics, they can uncover patterns that point to new opportunities or warn of potential risks in the market.

How Investors Use Page Views

Page views can help investors pinpoint:

Consumer Interest: High traffic on certain product pages signals strong demand.

Content Success: Frequently visited sections suggest effective market positioning.

Market Shifts: Fluctuations in page view trends may point to changes in market dynamics.

Digging Deeper

Unlike conversion rates, which focus on outcomes, page views show the early stages of consumer engagement. This makes them a useful precursor to deeper conversion analysis. Comparing page view trends across competitors can reveal shifts in market share and potential advantages.

The key is to focus on patterns and what they mean for the market. By linking page views to other performance measures, investors can get a clearer picture of a company’s standing and growth prospects. Beyond just the numbers, examining how users move through a site during a visit can offer even more insight into the quality of their engagement.

7. Average Pages per Session

Average Pages per Session (APPS) tracks how many pages a visitor views during a single visit. A higher APPS often indicates that the site's content and navigation are engaging enough to keep users exploring, which can lead to better business results.

Unlike metrics like bounce rate or session duration, APPS gives insight into how effectively a site keeps users interested across multiple pages. While page views measure initial interest, APPS shows how well users interact with the site's overall content.

How It’s Useful

In e-commerce, a high APPS often points to users actively browsing products, which may indicate purchase intent. For content-focused websites, it suggests strong engagement and the potential for higher ad revenue.

Evaluating Growth and Performance

Tracking APPS growth over time - especially when compared to industry benchmarks - can highlight improved user engagement and better site navigation. For investors, it's more useful to look at APPS trends than isolated figures, as trends reveal long-term performance and revenue potential.

Using APPS with Other Metrics

When combined with session duration and bounce rate, APPS provides a fuller picture of user behavior. It helps determine not just how long visitors stay, but how well the site guides them through its content. This is key for identifying businesses that not only attract traffic but also keep users engaged and lead them toward conversions.

To make informed decisions, track APPS regularly and compare it across timeframes and market segments. This can help spot trends and opportunities early. Additionally, while APPS shows how users interact with multiple pages, analyzing exit pages can reveal where users drop off, offering ideas for further improvements.

8. Exit Pages

Exit pages help pinpoint where users leave a website, offering valuable insights into potential issues in the user journey. For investors, understanding these patterns can shed light on areas that might affect a company’s efficiency or future growth.

Key Focus Areas

Exit pages can reveal problems in user flow, highlight content performance, and identify barriers to conversion. For example, if many users leave during the checkout process, it could point to a problem in the purchasing experience. Similarly, analyzing exits on content pages can provide clues about how well the content is holding users’ attention. Investors can use this information alongside other metrics to uncover inefficiencies or potential growth areas.

Exit Page Types and Their Impact

How It Fits Into Investment Strategy

Exit page data is particularly useful for assessing e-commerce and content-driven businesses. For instance, a high exit rate on product pages, even when engagement metrics are strong, might signal pricing problems or product-related challenges. Regularly reviewing this data can help investors spot potential issues early, which could influence their decisions.

Tips for Practical Use

To get a complete view of user behavior, combine exit page data with other metrics like bounce rate and conversion rate. Analyze exit patterns on a monthly basis and compare them to industry standards. This approach can help investors better understand a company’s digital performance and identify risks or opportunities that could affect its value.

How to Analyze Web Traffic Metrics

Analyzing web traffic metrics involves examining various data points to uncover insights that can guide investment decisions. Here's a breakdown of how to approach this process effectively.

Establishing Baseline Metrics

Start by comparing a company's metrics to industry standards. This helps you spot outliers and determine whether the metrics reflect strong performance or potential red flags.

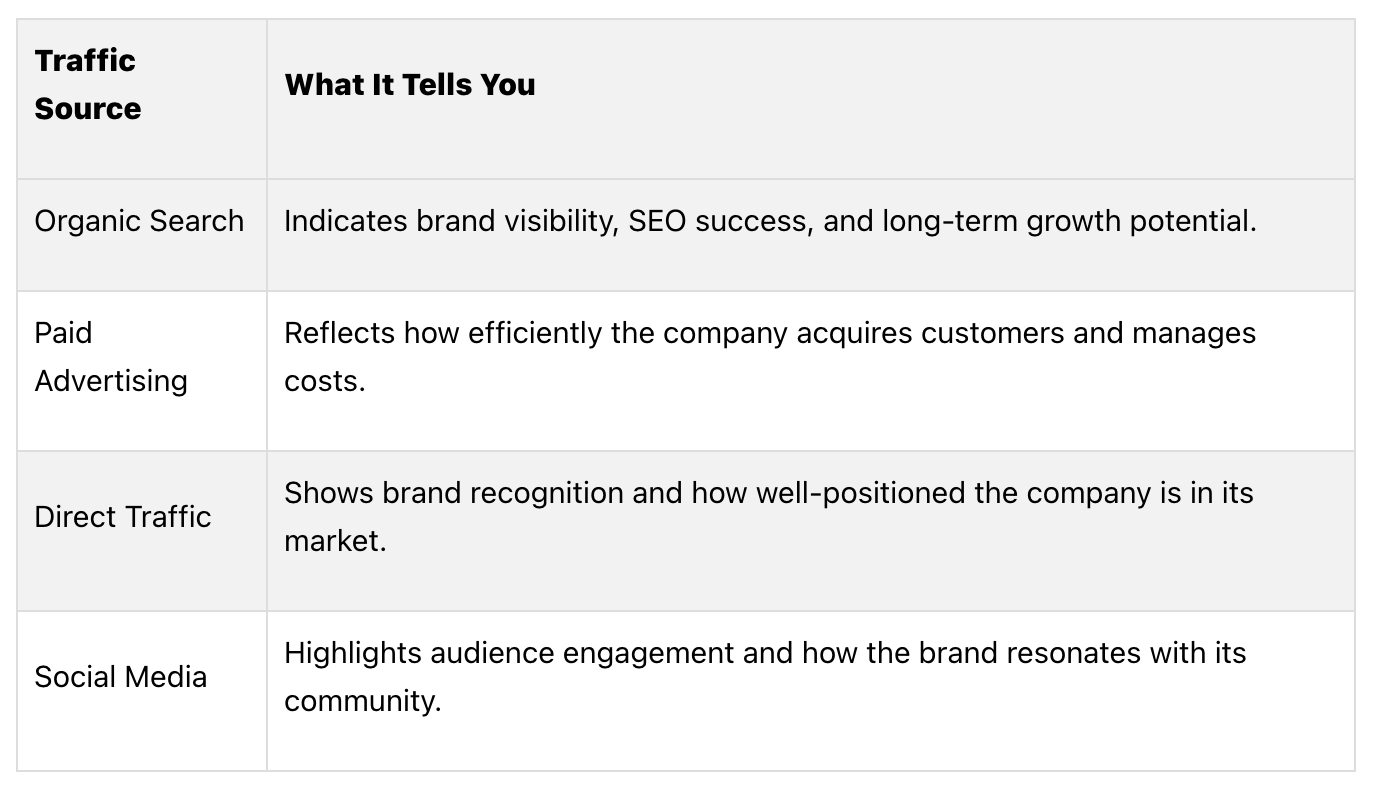

Evaluating Traffic Sources

Understanding where traffic comes from can reveal a lot about a company's marketing strategies and growth potential. Here’s a quick guide:

Spotting Patterns in Performance

Review historical data and seasonal trends to identify recurring patterns. This can help you anticipate future performance and detect market opportunities before they become obvious.

Analyzing Conversions

Traffic alone doesn’t tell the whole story. Look at how users interact with the site and how effectively traffic translates into conversions. Strong engagement often aligns with higher conversion rates, which is crucial for assessing business health.

Tying It to Investment Decisions

Combine web traffic data with financial metrics to get a fuller picture. For example, analyze:

Growth rates alongside revenue trends.

How the company stacks up against competitors.

The efficiency of customer acquisition strategies.

Indicators of brand strength.

Using Advanced Tools

Leverage analytics tools to uncover trends and predict performance changes before they show up in traditional financial reports. These tools can offer early warnings about potential opportunities or risks.

Assessing Risks

Keep an eye on warning signs like:

A sudden drop in organic traffic.

Declining engagement metrics.

Higher bounce rates.

Increasing customer acquisition costs.

Using Web Traffic Metrics in Practice

Web traffic data can be a game-changer when paired with traditional financial analysis. It gives investors an edge by uncovering trends and market opportunities early - before they become obvious to everyone else.

Tools That Make It Happen

Platforms like TickerTrends and Similarweb are invaluable for analyzing traffic patterns, spotting trends, and comparing performance across different regions. These tools turn raw data into actionable insights, helping investors stay ahead of market shifts.

How to Use Web Traffic Metrics Effectively

Here’s how you can make the most of web traffic data in your investment strategy:

Performance Analysis

Compare traffic metrics against competitors and industry standards.

Keep an eye on regional differences and how subsidiaries are performing.

Track how engagement trends evolve over time.

Risk Assessment

Look out for sudden spikes or drops in traffic.

Monitor changes in engagement metrics like time on site or bounce rates.

Check for shifts in where traffic is coming from (e.g., organic search vs. paid ads).

Combining Traffic Data with Financial Analysis

When you integrate web traffic insights with financial data, you get a more complete picture of potential investments:

Taking It to the Next Level

Experienced investors go beyond the basics by using traffic data to:

Spot new market trends as they emerge.

Pinpoint regions with untapped growth potential.

Evaluate how efficiently marketing dollars are being spent across channels.

Cross-check revenue potential by analyzing engagement metrics.

Conclusion

Web traffic metrics offer a powerful lens for investors looking to gain early insights into market trends and company performance. By providing real-time data, these metrics complement traditional financial analysis, offering a more dynamic view of opportunities that might not yet be visible in conventional datasets.

Key indicators like bounce rates (B2B: 56%, B2C: 45%), session duration, and conversion rates serve as benchmarks for assessing a company's digital presence and competitive edge. When used as part of a broader strategy, these metrics help investors evaluate performance more thoroughly and identify new trends as they emerge.

The growing use of alternative data, including web traffic metrics, is transforming how investment decisions are made. Combining insights from metrics such as unique visitors, session duration, traffic sources, and conversion rates allows for a deeper understanding of market behavior and helps predict company outcomes with greater precision.