Upstart: Consumer Interest Spikes as AI Lending Bets Pay Off

Digital Demand Rebounds as AI Lending Model Gains Traction in a Shifting Credit Landscape

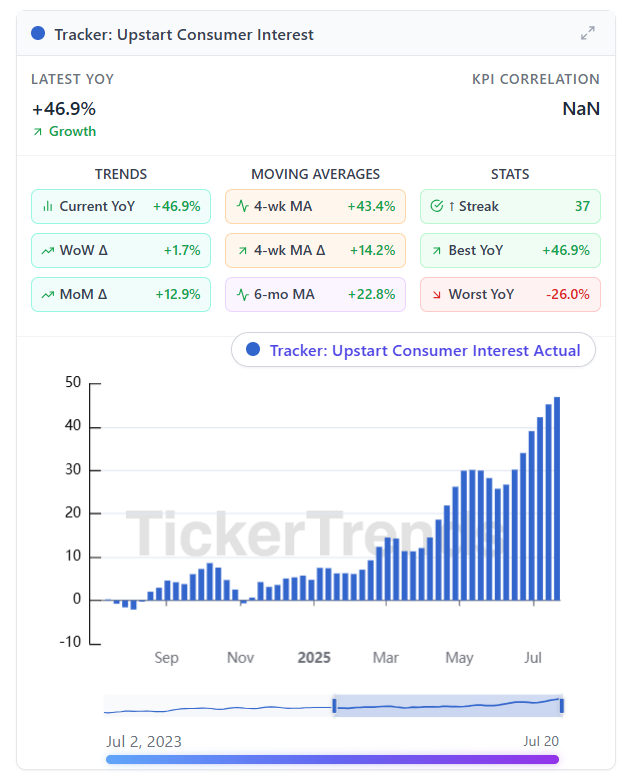

Upstart Holdings (UPST 0.00%↑) has quietly staged a major turnaround over the past few months according to our social interest trackers. Our latest TickerTrends’ data tracker shows consumer interest in Upstart is up +46.9% YoY, hitting new highs in July, accelerating 12.9% just in the last month. Website traffic, search interest, and other digital signals we track all point in the same direction… consumer attention is meaningfully rebounding.

So, what’s changed?

Upstart’s core value prop, using AI to evaluate creditworthiness beyond traditional FICO scores, is finally finding its moment again. After facing headwinds in 2023 due to rising rates and tighter bank lending standards, the company seems to be benefiting from a thawing personal loan market.

Signs of a Personal Loan Rebound

The macro backdrop is starting to shift. Banks have become more cautious, but consumer demand for credit hasn’t gone away. Many borrowers are turning to nontraditional platforms, especially those with quick, digital approval processes like Upstart. Credit card APRs remain elevated, and a growing number of consumers are shopping for personal loans to consolidate debt or cover rising expenses.

That’s where Upstart's AI underwriting comes in. Their model claims to approve more borrowers at lower default rates compared to legacy systems — a big draw when capital is tight. If investor sentiment holds, Upstart may be on track to reaccelerate both originations and revenue growth over the back half of 2025.

TickerTrends Data Signals Strength

MoM growth in consumer interest: +12.9%

4-week MA YoY: +43.4%

Streak: 37 straight weeks of consumer interest gains

While management hasn’t updated guidance just yet, trends like this tend to show up in results within a quarter or two. We’ll be watching the next earnings call closely to see if personal loan volume and marketplace take rates reflect the digital demand we’re seeing in our data.