Using Alternative Financial Data as a Long-Term Investor | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

What is Alternative Financial Data?

Alternative financial data relating to stocks refers to non-traditional sources of information that investors and analysts use to gain insights about a company’s performance, market trends, or the broader economy. Unlike traditional data, such as financial statements or regulatory filings, alternative data can offer a more timely and granular view of factors that impact stock prices. Some examples of alternative financial data include:

Social Media Sentiment: Analyzing posts on platforms like Twitter, Reddit, and Instagram to gauge public sentiment toward a company or stock. This can reveal how consumer or investor sentiment may impact a stock’s price movement.

Web Traffic and App Usage: Monitoring website visits and app downloads to estimate consumer interest in a company’s products or services. This can provide early signals of rising or falling demand before earnings reports.

Credit Card or Transaction Data: Aggregated data from consumer spending patterns can provide insights into a company’s sales trends in real time. For example, increased credit card spending at a retailer could indicate a strong quarter.

Satellite Imagery: Satellite photos of store parking lots, factory activity, or supply chain data can help analysts estimate a company’s sales, inventory, or production levels.

Google Trends: Search volume data from Google can give an indication of rising consumer interest or curiosity about certain products, brands, or even market events.

Shipping and Supply Chain Data: Insights from shipping logistics, such as port activity or freight shipping data, can indicate production levels, delivery speeds, or disruptions in a company’s supply chain.

Job Listings and Hiring Trends: Analyzing job postings or hiring activity can reveal insights into a company’s growth or contraction, especially in technology or operational roles.

Product Reviews and Ratings: Customer feedback on platforms like Amazon can provide insights into product quality, consumer satisfaction, and potential future revenue.

Mobile Geolocation Data: Data from mobile devices can show foot traffic to physical stores, which can be used to estimate sales and performance for retail or hospitality stocks.

These alternative data sources are often used by hedge funds, institutional investors, and increasingly retail investors to gain an edge by understanding trends and risks that aren’t immediately visible through traditional financial reports.

As a long-term investor, some aspects of alternative data (i.e. inter-quarter analysis) don’t apply to you. So why should you care about alternative data at all?

Spotting long term trends is not only important for spotting future opportunities, but also for monitoring the health of existing investments in your portfolio!

Using an alternative data platform like TickerTrends (tickertrends.io) can serve as a valuable tool in organizing your stock watchlist and monitoring long term trends in keywords related to the products and services they operate within.

Sector & Company Long-Term Analysis

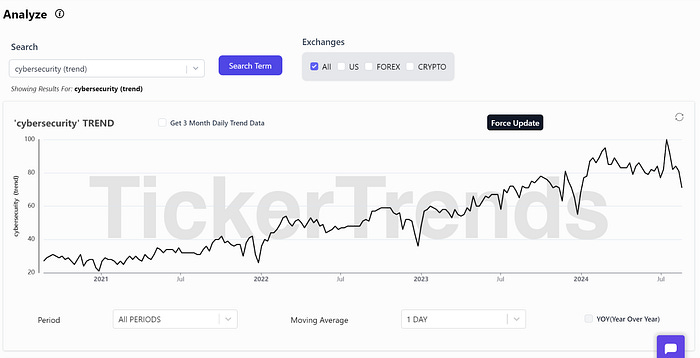

For example, maybe you hold a portfolio of cybersecurity stocks and think cybersecurity companies will continue to do well in an increasingly digital economy, especially with more AI-related cyber threats arising by the day. We can type in “cybersecurity (trend)” on the TickerTrends Platform and see the trend in Google Search volume for the keyword.

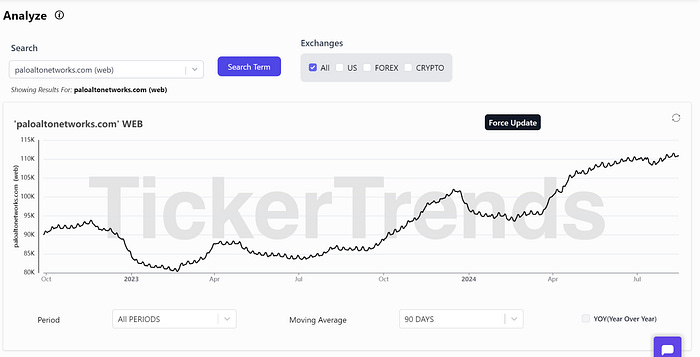

As a long term investor, knowing that this uptrend continues over the coming years will be paramount to understanding the long-term performance of your investments. If you want to see trends specific to a stock you hold, let’s say $PANW, you can very easily see the website traffic in a time series by typing “paloaltonetwords.com (web)”. Again, the key is to focus on the trajectory of the trend, as opposed to short term fluctuations. This is where “All Periods” and applying a longer term moving average to the raw data becomes important to one’s analysis.

New Long-Term Trend Discovery

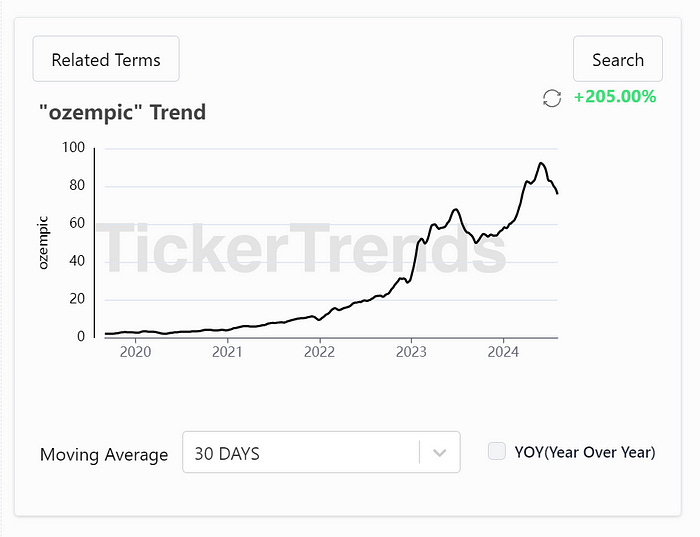

Alternative financial data is also extremely important for discovery of new long term trends. TickerTrends has a page called “Exploding Trends” that shows a curated list of thousands of terms, showcasing a 5-year view of terms. New idea discovery is always useful for finding future investments (and protecting against new consumer trends that risk existing legacy investments!) A long term investor might find on this page, GLP-1 trends as an example and be able to find stock based on the shown results to make long term investments after careful analysis of the longevity of the shown keyword.

Continuous Ticker Tracking

Alternative financial data is also useful for long-term investors because of its usefulness in tracking all existing positions one holds. Many people in this investor category typically hold a diversified set of stocks. Tracking all stocks at once is difficult as an individual investor! I’ve personally found it useful to use the “Data Screener” on TickerTrends to view all my watchlist stocks’ linked keywords at a glance. There it shows the year-over-year value of keywords you’ve added to your watchlist stocks.

Knowing that most of these values are going up year-over-year is probably quite important to determining the health of all your existing positions.

Risk Detection and Macro Insights

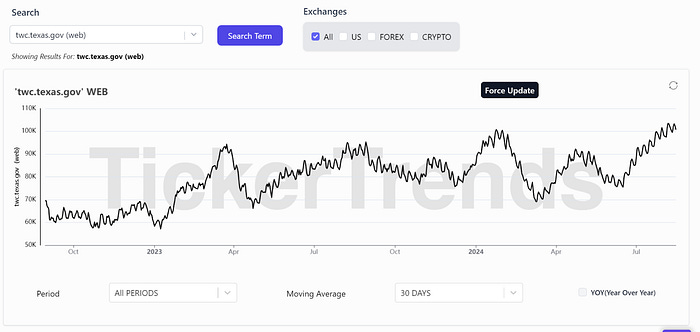

Identifying macroeconomic risk in the natural course of a business cycle is another aspect of why alternative data is important. BLS jobs data is subject to heavy revisions after the fact. If there’s a macroeconomic downturn brewing, wouldn’t you want to know? Using the TickerTrends platform, you can use website data for example to view any state’s unemployment website traffic in real-time, a game changer for real-time economic analysis.

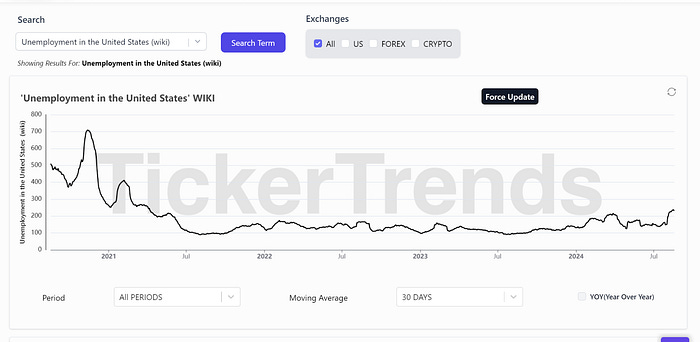

Alternative financial data spans much more than just website data though, for example viewing Wikipedia page-view data is also possible. Using this data, long-term investors can decide to allocate more or less of their portfolios in cash and know when to deploy that cash using data-driven macro insights — rather than random economist projections.

For example, we show the Wiki data for the “Unemployment in the United States” page below:

In investing, risk management is key, and navigating all parts of the economic cycle is possible with alternative financial data like this.

Conclusion

All-in-all, long-term investors oftentimes misunderstand alternative financial data because they think it is more an inter-quarter, short-term form of analysis on a company. This couldn’t be further from the truth! This type of data has vast applications for analyzing the long-term trends and health of a specific company or sector. Being organized and staying on top of long term consumer trends is important to know what long term growth rates to expect in the stocks you hold.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus