Using Alternative Financial Data as a Short-Term Day Trader | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

What is Alternative Financial Data?

Alternative financial data relating to stocks refers to non-traditional sources of information that investors and analysts use to gain insights about a company’s performance, market trends, or the broader economy. Unlike traditional data, such as financial statements or regulatory filings, alternative data can offer a more timely and granular view of factors that impact stock prices. Some examples of alternative financial data include:

Social Media Sentiment: Analyzing posts on platforms like Twitter, Reddit, and Instagram to gauge public sentiment toward a company or stock. This can reveal how consumer or investor sentiment may impact a stock’s price movement.

Web Traffic and App Usage: Monitoring website visits and app downloads to estimate consumer interest in a company’s products or services. This can provide early signals of rising or falling demand before earnings reports.

Credit Card or Transaction Data: Aggregated data from consumer spending patterns can provide insights into a company’s sales trends in real time. For example, increased credit card spending at a retailer could indicate a strong quarter.

Satellite Imagery: Satellite photos of store parking lots, factory activity, or supply chain data can help analysts estimate a company’s sales, inventory, or production levels.

Google Trends: Search volume data from Google can give an indication of rising consumer interest or curiosity about certain products, brands, or even market events.

Shipping and Supply Chain Data: Insights from shipping logistics, such as port activity or freight shipping data, can indicate production levels, delivery speeds, or disruptions in a company’s supply chain.

Job Listings and Hiring Trends: Analyzing job postings or hiring activity can reveal insights into a company’s growth or contraction, especially in technology or operational roles.

Product Reviews and Ratings: Customer feedback on platforms like Amazon can provide insights into product quality, consumer satisfaction, and potential future revenue.

Mobile Geolocation Data: Data from mobile devices can show foot traffic to physical stores, which can be used to estimate sales and performance for retail or hospitality stocks.

These alternative data sources are often used by hedge funds, institutional investors, and increasingly retail investors to gain an edge by understanding trends and risks that aren’t immediately visible through traditional financial reports.

As a short-term swing investor, why should you care about alternative data at all?

As a short-term swing trader, correctly utilizing alternative financial data can be the difference between a successful trading strategy and an unsuccessful one!

Understanding and leveraging this data helps you spot emerging opportunities, manage risk, and sharpen your timing in the market. Whether you’re holding a stock for days or weeks, alternative financial data allows you to better gauge short term trends that could directly impact your positions.

Using an alternative data platform like TickerTrends (tickertrends.io) can serve as a valuable tool in organizing your stock watchlist and monitoring short term trends in keywords related to the products and services they operate within.

Company Analysis for Short Term Traders

For example, let’s say you’re interested in trading energy drink stocks. You think Celsius Energy ($CELH) is gaining share and doing well. The issue is, that with such a high growth stock, the expectations for growth embedded are also equally as high. As a short-term trader, understanding these expectations and being highly attentive to short term trend fluctuations will be really important.

Traditional stock analysis would involve waiting for 3 months at a time to wait for company earnings to come out. This is too long of a period to know whether the company is still growing enough to justify the high expectations it has. This is where alternative financial data comes into the mix to save the day!

By using an alternative data platform like TickerTrends (tickertrends.io), you can type in “celsius drink (trend)” and instantly track how global consumers’ Google search interest in the keyword. As a short-term swing trader, it will be helpful to select the “Get 3 Month Daily Trend Data” option in the data as shown.

This real-time data is valuable because, as a short-term trader, you’re looking for trends that could move the stock price over the next few days or weeks. Seeing data break down or break up on a short-term basis can be a strong indicator of a ticker’s price action trend going forward. This level of data granularity helps display very short-term trends to monitor for inflection points, super important in any trader’s decision making process.

Fast Feedback on Company Controversy

Alternative financial data is pivotal in understanding the short-term impact of social media trends on a company’s financial performance. Let’s take the example of the Chipotle portion size controversy earlier in 2024. Tiktok viral videos garnered millions of views claiming that portion sizes at Chipotle were shrinking. What did the data say? Tiktok hashtag volume of “Chipotle” soared to new heights while iOS app rankings actually rose initially. (All publicity is good publicity?) However, it quickly turned in May 2024 and so did the stock about a month later.

Only through alternative financial data were we able to track in real-time what was likely happening to company revenue, in a data-driven way. That’s what makes this kind of analysis a powerful tool that all traders should be actively using.

Pre and Post-Earnings Trend Analysis

Alternative financial data, such as website traffic, search trends, and social media mentions, can provide early signals about a company’s performance before the official earnings report is released. For instance, if a company you’re watching has experienced a surge in web traffic or search volume leading up to the earnings report, it might suggest increased consumer interest or demand, hinting at a potential earnings beat. Be careful to always analyze the growth rates in alternative data you see with analyst expectations though!

I’ve found the earnings calendar on TickerTrends useful for cementing a list I can filter by and quickly analyze before earnings. Just select the earnings dates and geographies one is interested in!

As a short-term trader, spotting these signals early allows you to position yourself ahead of the earnings release, optimizing your entry point. By the time traditional data sources catch on, you could already be in a strong position to profit from the post-earnings price reaction.

If the data shows ongoing strength after an earnings report, it could indicate that the stock is likely to maintain its upward trend, making it a great candidate for a short-term trade. By using alternative data to validate or challenge what’s presented in the earnings report, you can make more informed decisions on whether to hold or exit your position after the earnings event.

Short-Term Notifications

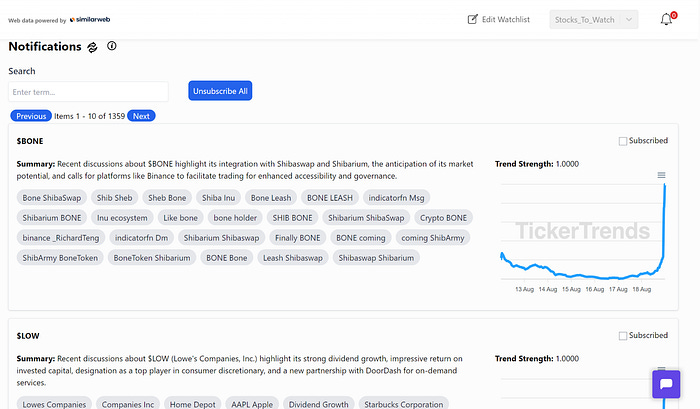

For short-term traders, the Notifications Page on TickerTrends is the place to be! Traders can view daily what the highest social discussion ticker being discussed is. This spans all social media platforms and scans for user discussion volumes relative to the ticker’s historical social volume.

This makes the Notifications section of TickerTrends super useful for day traders looking to see which tickers across crypto and stocks have social traction.

Conclusion

All-in-all, short-term traders can greatly benefit from inter-quarter alternative data analysis to stay on top of the latest consumer social trends. This type of data has vast applications for analyzing the short-term and even longer term trends. Alternative financial data helps traders see the impact of social trends in real-time and helps traders make quick decisions in a data-driven way. Being organized and staying on top of consumer trends is important to know, especially if the company soon reports earnings.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus