Using Alternative Financial Data as a Value Investor | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

What is Alternative Financial Data?

Alternative financial data relating to stocks refers to non-traditional sources of information that investors and analysts use to gain insights about a company’s performance, market trends, or the broader economy. Unlike traditional data, such as financial statements or regulatory filings, alternative data can offer a more timely and granular view of factors that impact stock prices. Some examples of alternative financial data include:

Social Media Sentiment: Analyzing posts on platforms like Twitter, Reddit, and Instagram to gauge public sentiment toward a company or stock. This can reveal how consumer or investor sentiment may impact a stock’s price movement.

Web Traffic and App Usage: Monitoring website visits and app downloads to estimate consumer interest in a company’s products or services. This can provide early signals of rising or falling demand before earnings reports.

Credit Card or Transaction Data: Aggregated data from consumer spending patterns can provide insights into a company’s sales trends in real time. For example, increased credit card spending at a retailer could indicate a strong quarter.

Satellite Imagery: Satellite photos of store parking lots, factory activity, or supply chain data can help analysts estimate a company’s sales, inventory, or production levels.

Google Trends: Search volume data from Google can give an indication of rising consumer interest or curiosity about certain products, brands, or even market events.

Shipping and Supply Chain Data: Insights from shipping logistics, such as port activity or freight shipping data, can indicate production levels, delivery speeds, or disruptions in a company’s supply chain.

Job Listings and Hiring Trends: Analyzing job postings or hiring activity can reveal insights into a company’s growth or contraction, especially in technology or operational roles.

Product Reviews and Ratings: Customer feedback on platforms like Amazon can provide insights into product quality, consumer satisfaction, and potential future revenue.

Mobile Geolocation Data: Data from mobile devices can show foot traffic to physical stores, which can be used to estimate sales and performance for retail or hospitality stocks.

These alternative data sources are often used by hedge funds, institutional investors, and increasingly retail investors to gain an edge by understanding trends and risks that aren’t immediately visible through traditional financial reports.

As a value investor, why should you care about alternative data at all?

Alternative financial data can help value investors in numerous ways — particularly on the problem of avoiding “value traps”. It is great that a stock is cheap and trades at a low PE on a historical basis… but if the company is declining in revenue and net income, the market wouldn’t truly appreciate it.

This is where alternative financial data comes in!

Understanding and leveraging this data helps you spot emerging opportunities, manage risk, and sharpen your timing in the market. Using an alternative data platform like TickerTrends (tickertrends.io) can serve as a valuable tool in organizing your stock watchlist and monitoring long term trends in keywords related to the products and services they operate within.

Why Value Investors Should Use Alternative Financial Data: The Foot Locker Example

Value investors typically focus on finding undervalued stocks with strong fundamentals, often characterized by low price-to-earnings (P/E) ratios and steady — though not necessarily high — growth. These are often companies that the market has overlooked or deemed as having limited future potential. Alternative financial data can provide value investors with crucial insights that traditional financial metrics might miss, particularly when a stock undergoes an unexpected turnaround.

Take the case of Foot Locker, for example. Historically, Foot Locker had been a low-P/E stock, with minimal to negative growth prospects due to the declining dominance of Nike, one of its key suppliers. However, by utilizing financial alternative data, value investors who were paying attention could have spotted signs of a potential turnaround far earlier than others in the market.

Spotting Turnaround Stories with Alternative Data

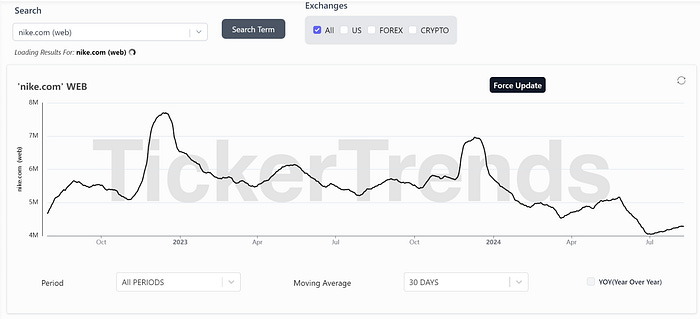

Foot Locker was long associated with Nike. It was reported that Nike at one point represented over 70% of all $FL revenue, and now although there is no exact number, is reported to be in the 50% range. Close followers of the alternative data already saw the decline in “nike.com (web)” website traffic and expected the decline of Nike as early as late 2023, when website traffic indicated a weak Christmas sales season.

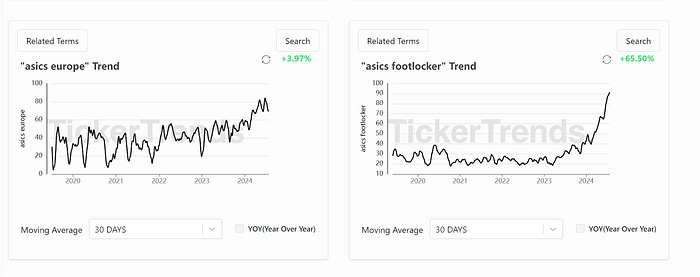

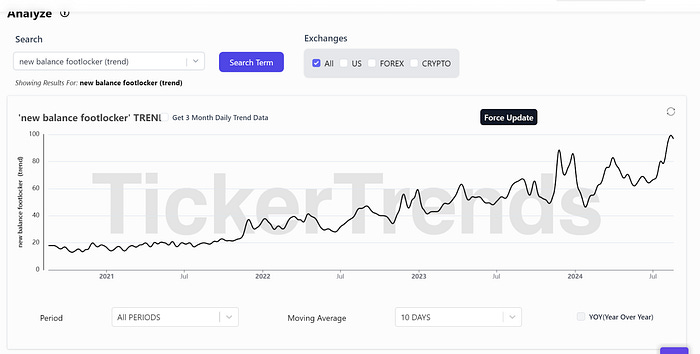

Although Footlocker has lots of Nike exposure, the downfall of Nike is ironically what is currently allowing for the sales stabilization of Footlocker revenue to date. Nike getting less popular is allowing other shoe brands to pop up and take market share. Alternative data sources like Google Trends and website traffic for brands like New Balance and Asics — the other key brands Foot Locker sells — started to show increased interest. While traditional financial analysis might have overlooked these shifts, alternative data clearly indicated that consumer demand was beginning to tilt in favor of these brands, setting the stage for Foot Locker’s turnaround.

Using Exploding Trends on TickerTrends, we are able to discover some of these other brands like Asics, New Balance, and Adidas all growing rapidly.

In this case, financial alternative data helped establish the case for a potential turnaround value play in Footlocker, based on trends the market had not fully priced in yet. Value investors would greatly benefit from tracking all data sources spanning from Google Search, website traffic, Tiktok and more for companies they hold, to ensure they are not buying value traps and potentially inform them when to buy value turnaround stories.

To sum up, in Foot Locker’s case, the declining interest in Nike could have led many investors to write off the stock as a fading business. But by tracking Google Trends and website traffic data for New Balance and Asics, value investors could have seen that these brands were gaining momentum. As the popularity of these brands increased, Foot Locker was well-positioned to benefit, creating a compelling value investment opportunity based on changing consumer preferences.

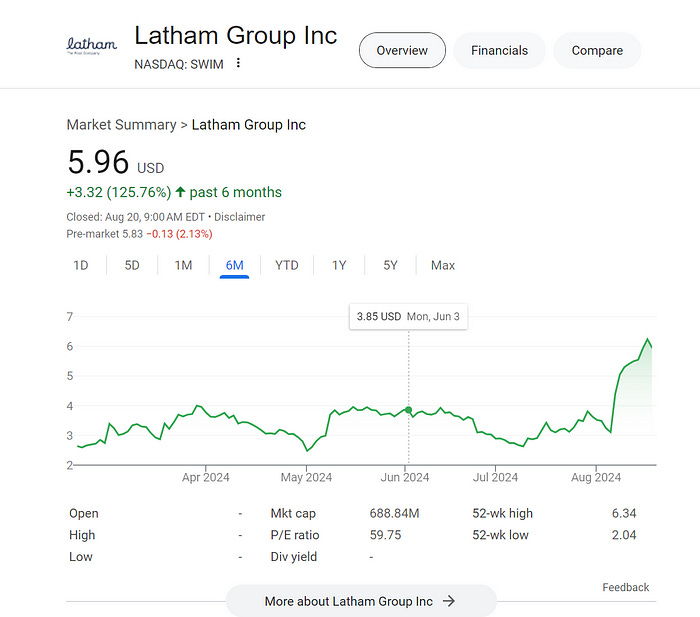

Moving Averages and YoY is a Value Investor Best Friend — Trend Alerts

Oftentimes as value investors, we are looking for value in areas of the market where others have forgotten about and left for dead. This typically happens as a previously fast growing company guides for a slower growth rate than its previous history, crushing the PE multiple of the company. Using alternative financial data can help you smooth out data via moving averages and use year-over-year comparisons to know exactly when a company’s revenue might stabilize. This is super important because this can mark inflection points in a stock’s price action as the left tails of the distribution in sales outcomes of a company’s viciously get priced out as the stock rebounds.

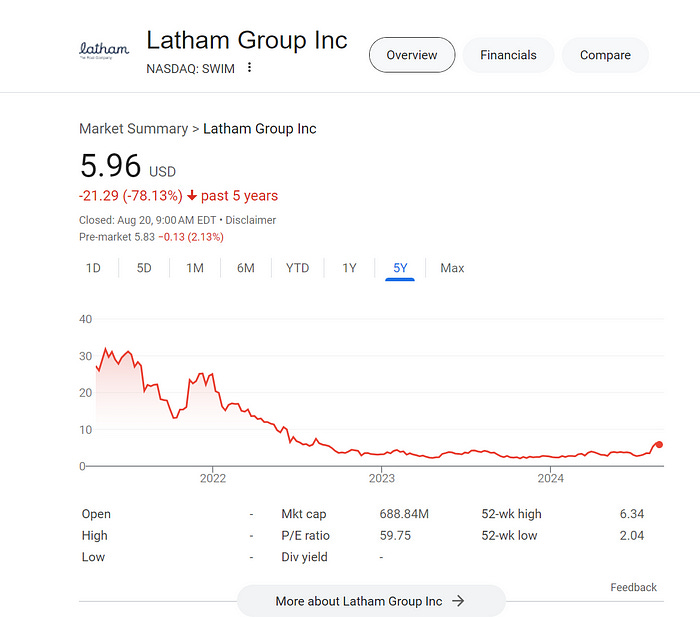

We can also utilize the TickerTrends Alert system to know when a turning point in any data source is happening. For example, Covid saw a surge in backyard pool installations. A lot of pool-related stocks experienced somewhat of a bubble as a result. Let’s take $SWIM as an example.

Without using alternative data, it would have been very difficult to know when sales would show signs of stabilization, thus potentially fooling investors into buying what looked like a cheap TEV/EBITDA multiple.

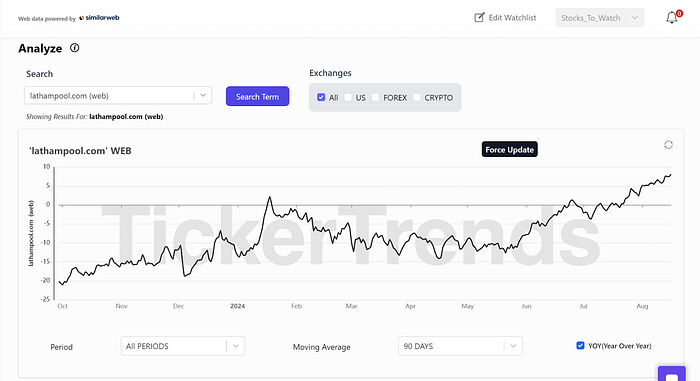

Looking at the website traffic data on TickerTrends by typing “lathampool.com (web)” investors were able to see signs of stabilization of year-over-year, moving average smoothed data.

Using Google Search data, searches for “latham pool” also seem to have its first flat summer season since Covid.

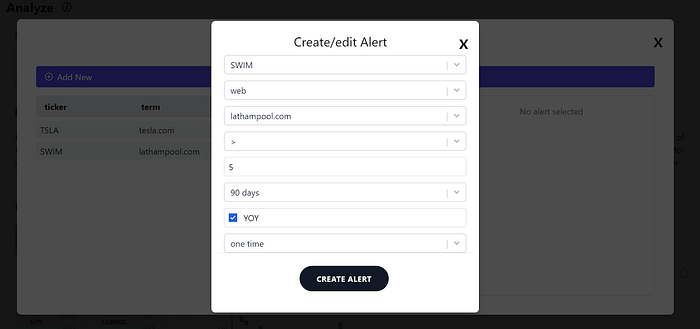

The Alerts feature is a nifty one. There’s so many other stocks to watch on a day-to-day basis and you may not have time as an investor to watch $SWIM trends everyday. Investors can simply add alerts for when the 90-day moving average of website traffic is above 5% year-over-year again and just be reminded to look at the stock again at that future date for example.

For a value investor, this type of alternative data is crucial. By digging into these kinds of alternative insights, you can spot early signs that the business is benefiting from a shift in consumer behavior as opposed to buying a business in perpetual decline.

Risk Management with Alternative Data

One of the main concerns for value investors is managing risk, particularly when investing in low-growth or declining companies. By incorporating alternative financial data into their analysis, value investors can gain a clearer picture of whether a company is still at risk of further decline or is on the cusp of recovery. This makes alternative financial data pivotal to an investors analysis — essentially answering the question: is the decline of a company temporary or permanent? In a data-driven way.

Conclusion

For value investors, financial alternative data is a powerful tool that goes beyond the traditional metrics of low P/E ratios and price-to-book values. By integrating alternative data sources like Google Trends and website traffic, value investors can better assess the long-term prospects of undervalued companies and spot early signs of recovery, avoiding potential value traps and instead spotting sustainable revenue trends making better investment decisions.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus