$VSCO Victoria’s Secret: From Turnaround To Test Of Execution

After a powerful rebound, the brand enters a higher-expectations phase where execution, social momentum, and cultural relevance will determine whether growth re-accelerates or normalizes

Victoria Secret is up over +100% since our positive note on Oct 15, 2025. Our Q3 2025 revenue forecast experienced a 0.8% MOE (vs 4.43% street).

For KPI forecasts and a direct view into how these trends translate into reported financials, please email admin@tickertrends.io for access to the TickerTrends KPI Forecasting Suite.

Victoria’s Secret is entering a more delicate phase of its turnaround. In our October 15, 2025 article, we highlighted how the fashion show and social interest surge would likely lead to an extremely strong Q4, which was later seen in the data and company guidance. Currently, the brand is still growing, but expectations are no longer as low. That does not mean the story is broken. It means the setup has shifted from “early recovery” to “execution under higher expectations.”

Victoria’s Secret sits at an interesting crossroads. Several of our leading indicators suggest growth may be moderating, but new collaborations with Hailey Bieber and TWICE signal that management is actively working to create the next leg of momentum. Below, we examine how these forces could shape the brand’s trajectory from here.

Expectations have moved up, and the data is starting to reflect that

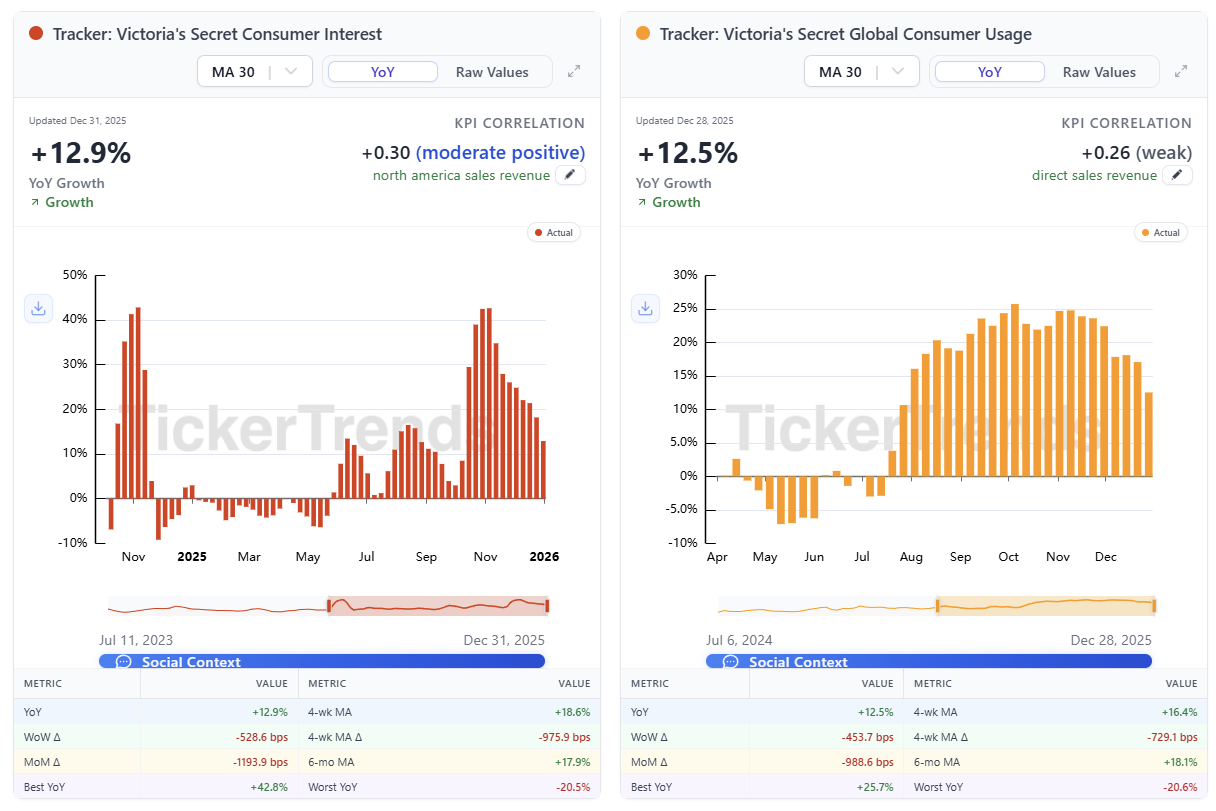

TickerTrends data shows that Victoria’s Secret Consumer Interest is still growing, but at a slower clip, currently up about 13 percent year over year. Global Consumer Usage is also positive at roughly 12 percent year over year, though the rate of acceleration has softened compared to earlier in the year.

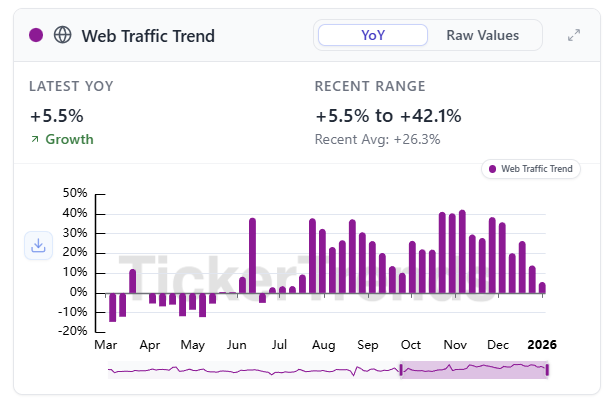

Social Interest remains positive, up mid-single digits year over year, but has gradually trended lower over recent months since the October 2025 fashion show. Website traffic tells a similar story. Traffic is still up year over year, but the slope has flattened and recent prints are closer to the low end of the recent range.

Put simply, the brand is not contracting. It is just no longer accelerating the way it was earlier in the turnaround.

This matters because expectations have adjusted. The stock has rerated off the lows, sentiment is healthier, and the bar for upside surprises is higher than it was a year ago.

Management continues to execute well on cultural relevance

Even as some of the alternative data demand signals cool, one area where Victoria’s Secret continues to stand out is brand and cultural execution.

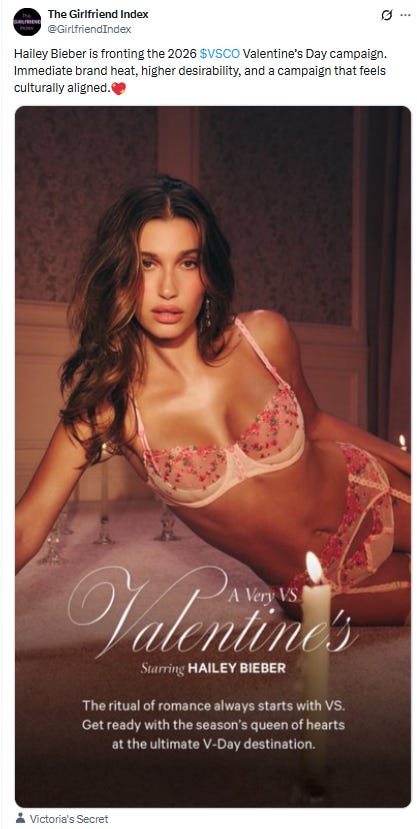

Recent collaborations point to a management team that understands modern attention dynamics.

The brand has worked with Hailey Bieber through Victoria’s Secret and PINK-related campaigns, leaning into clean aesthetics, influencer credibility, and social-native content rather than legacy glamour positioning.

More recently, Victoria’s Secret partnered with TWICE, one of the largest global K-pop acts, as brand ambassadors. This is especially important for international relevance and younger consumers, particularly in Asia, where K-pop influence translates directly into fashion and beauty purchasing behavior.

These endorsements are strategically aligned with where social attention already lives. Hailey Bieber, for example, has 55M Instagram followers and successfully led Rhode to over $200M in annual sales and a $1B exit to E.l.f. Cosmetics.

From a TickerTrends perspective, we do note that for now, there is no significant spike in social activity from these events.

What to watch next: social re-acceleration or confirmation of a plateau

Right now, our view is that Victoria’s Secret is at an inflection point.

Consumer Interest, Social Interest, Global Usage, and Web Traffic suggest the brand may be near a local peak in momentum. Growth is still there, just at a slightly lower clip. That is consistent with a brand transitioning from rebound to normalization.

The key question is whether recent collaborations can re-ignite social momentum.

If the Hailey Bieber and TWICE campaigns drive a renewed uptick in social interest, history suggests consumer interest and usage often follow.

If social remains flat or trends lower, it would confirm that demand is normalizing rather than re-accelerating.

Our current view

Victoria’s Secret remains a healthier brand than it was two years ago. The turnaround has real substance, and management has shown it can reconnect the brand with culture.

At the same time, expectations are no longer depressed, and several demand indicators suggest growth is stabilizing rather than speeding up. Our forecasts still expect a beat.

This is no longer a story about whether the brand survives. It is a story about whether management can create a second wave of momentum through smart social execution and global relevance.

The next signal will come from social, not from earnings.

We are watching closely.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 400 unique KPIs and 1,000’s of consumer interest trackers / tickers available on TickerTrends Enterprise: https://tickertrends.io/enterprise