$VITL Vital Farms Earnings Review | Complex Egg Environment | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io.

Ticker: $VITL

Sector: Consumer Defensive

Share Price: $ 31.63

Market Cap: $ 1.39B

Results

Financial Performance

Vital Farms reported a robust Q4 2024, with net revenue of $166.0 million, a 22.2% increase year-over-year, surpassing the expected $160.32 million. Net income was $10.6 million, with an EPS of $0.242, exceeding the estimate of $0.17. For the full year FY2024, net revenue reached $606.3 million, up 28.5%, with Adjusted EBITDA at $86.7 million.

Future Guidance and Market Reaction

The company provided FY2025 guidance, projecting net revenue of at least $740 million (22% growth) and Adjusted EBITDA of at least $100 million (15% growth), with capital expenditures between $50-60 million.

Analyst Estimates

$740M Rev estimate vs $707M expected for FY2025

$100M+ EBITA estimate vs $93.61M expected for FY2025

Market Reaction

Some factors that may have contributed to the perceived negative market reaction, despite the earnings beat:

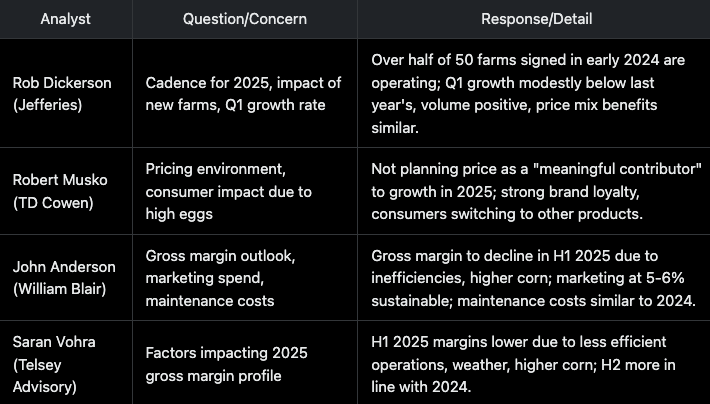

Gross Margin Concerns: Analysts expressed concerns during the earnings call about gross margin declines in the first half of FY2025, attributed to operational inefficiencies, weather disruptions at EggCentral Station (ECS), and higher corn costs (up 18% since Q4 bottom), as per the transcript. This was expected to impact profitability, with margins lower in H1 2025 compared to H2, which might have worried investors.

Review

Vital Farms’ Q4 2024 earnings showcased a company delivering impressive results, though not without facing market scrutiny over specific operational challenges. The quarter was a clear success, with net revenue hitting $166.0 million—a 22.2% year-over-year increase that topped the $160.32 million consensus estimate—and an EPS of $0.242, well above the forecasted $0.17. For FY2024, revenue climbed 28.5% to $606.3 million, with net income soaring 108.8% to $53.4 million and Adjusted EBITDA reaching $86.7 million. Strategic highlights included the butter segment’s 11% annual growth (nearly doubling in Q4) and the expansion of the farm network by 125 new family farms, bringing the total to over 425, reinforcing Vital Farms’ operational strength and market position.

Despite these positives, the market reaction was tempered by concerns raised during the earnings call about profitability pressures. Analysts pointed to anticipated gross margin declines in the first half of FY2025, driven by operational inefficiencies, weather disruptions at EggCentral Station, and a significant rise in corn prices (up 18% since Q4’s bottom). The acknowledgment of a tight premium egg market supply also suggested potential scalability challenges, casting a shadow over the otherwise strong performance, even as the company outlined plans for a new facility in Seymour, Indiana, to bolster its supply chain.

In summary, Vital Farms’ Q4 and FY2024 results underscored its leadership in the premium egg and butter markets, with standout financials and strategic progress. However, the market’s focus on near-term margin risks and supply constraints highlighted lingering uncertainties, despite the company exceeding expectations with its FY2025 revenue guidance of at least $740 million. This earnings release positions Vital Farms as a robust performer tasked with addressing operational hurdles to maintain investor confidence moving forward.

We believe the market experienced an unnecessary over-reaction to H1-2025 concerns. Vital farms continues to set itself up for market surprises as continued pressure and scrutiny plagues the brand from analysts.