What’s Trending in China with TickerTrends #1

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io.

TickerTrends is proud to be the **only** financial alternative data platform offering Baidu search trend data. As China’s leading search engine, Baidu provides exclusive insights into consumer and business demand across one of the world’s largest economies. This groundbreaking addition gives institutional investors a unique edge in identifying emerging trends before they materialize in financial markets.

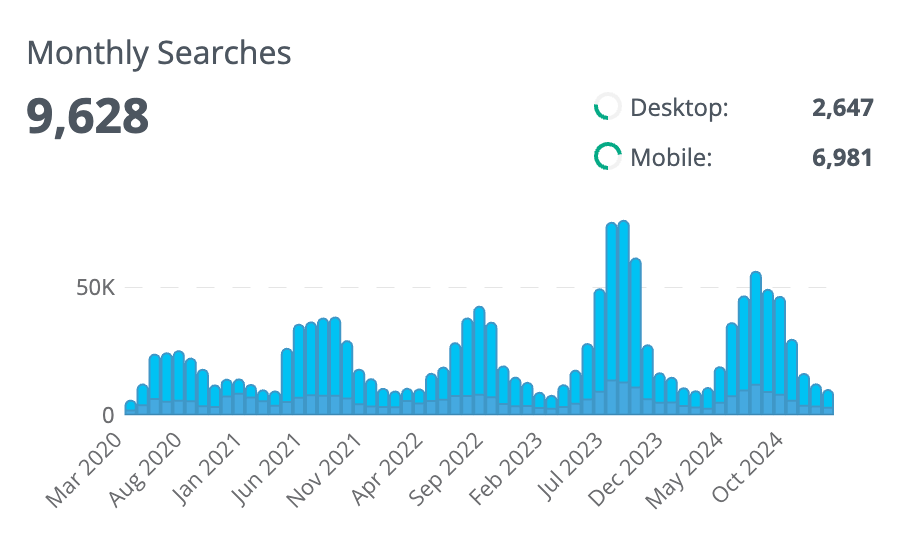

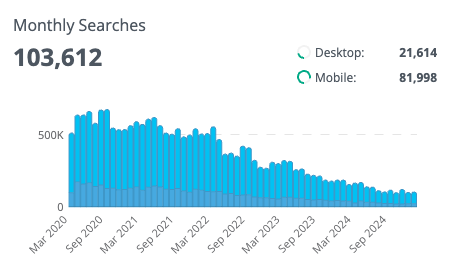

Example “crocs” on Baidu:

With Baidu data, TickerTrends Enterprise clients can track real-time shifts in Chinese consumer behavior, industry interest, and market sentiment. This dataset complements our existing alternative data sources offering an unparalleled global demand perspective.

TickerTrends Enterprise clients can now access Baidu search trends immediately through our API and enterprise dashboard as an add-on service. Contact our team at admin@tickertrends.io today to learn how this exclusive data can enhance your investment research.

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Estee Lauder Companies Inc ($EL):

This week, Estée Lauder Companies Inc. made headlines with the strategic debut of its science-driven skincare brand, The Ordinary, in China. Launched exclusively at Sephora this month, the brand is set to expand to e-commerce giants Tmall and Douyin by July, signaling a shift from cautious cross-border trials to a full-scale localized operation. Known for its high-potency, no-nonsense formulations like “Niacinamide 10% + Zinc 1%,” The Ordinary has disrupted the global skincare market since its inception in 2016 under Deciem, a subsidiary of Estée Lauder since 2017. Now, as it steps into the world’s second-largest beauty market, the move could redefine Estée Lauder’s trajectory amid a turbulent financial landscape.

China’s beauty market, valued at over $50 billion annually, is a critical battleground for global players. Historically, Estée Lauder has thrived there with its tiered portfolio—luxury heavyweights like La Mer and mid-tier staples like Clinique have cemented its dominance over three decades. Yet, the landscape is shifting. Luxury beauty has cooled as economic uncertainty fuels a trend toward “rational consumption,” with consumers prioritizing value over prestige. L’Oréal’s 2024 earnings underscore this pivot: its mass beauty segment soared to $17.2 billion, up 5.4% year-over-year, while luxury sales grew a tepid 2.7%. Meanwhile, domestic brands like Winona and Proya have seized the mid-to-mass segment with agile digital strategies and competitive pricing, leaving late entrants like The Ordinary with a steep hill to climb.

The Ordinary’s entry comes at a precarious moment for Estée Lauder. The company’s fiscal 2025 second-quarter results, released on February 4, revealed a 6% decline in net sales to $4 billion, down from $4.28 billion the previous year. The Asia Pacific region, including China, saw an 11% sales drop, driven by weak consumer sentiment and travel retail softness. In response, management unveiled “Beauty Reimagined,” a transformation plan targeting double-digit operating margins through innovation, consumer-facing investments, and an expanded Profit Recovery and Growth Plan (PRGP) aiming for $1.1 billion to $1.4 billion in savings. Yet, with plans to cut 5,800 to 7,000 jobs globally—twice the original estimate—the company is navigating choppy waters.

During the Q2 2025 earnings call, President and CEO Stéphane de La Faverie framed The Ordinary’s China launch by saying, “We are thrilled that The Ordinary is debuting in Mainland China this month with its proven disruptive launch strategy,” he said, highlighting its potential to capture a new consumer base. Jesper Rasmussen, Deciem’s Global Brand President, echoed this optimism in a media statement: “China is the second-largest beauty market in the world behind the U.S., and it took time to make sure we were big enough to get to that level. We are launching with a very strong assortment in China with some adaptation of the products and some new ones as well.”

Essentially, the Ordinary’s China push is a high-stakes gamble with transformative potential. For the first time, Estée Lauder is targeting China’s mass skincare segment, a departure from its luxury and mid-tier focus. With net sales estimated between $500 million and $1 billion in 2023, The Ordinary is already a growth engine. A successful rollout could propel it into Estée Lauder’s billion-dollar brand club—think M.A.C or La Mer—bolstering the company’s bottom line amid Asia Pacific struggles.

The Ordinary’s affordable, transparent model appeals to younger consumers, a demographic Estée Lauder has struggled to capture as competitors like Puig and nimble domestic players gain ground. By drawing them into its ecosystem, the brand could funnel loyalty upstream to pricier labels over time.

The company is also trying to reduce expenses by employing some cost-cutting measures—including job reductions and operational efficiencies. The Ordinary’s scalability, proven in markets like India (where it drove 50% growth in 2023), could provide that boost. However it is important to note that risks such as an expected double-digit sales decline projected for China’s travel retail in H2 2025 remain. Moreover, stiff competition from local giants like Proya who dominate with aggressive digital marketing could lead to growth being slower than expected in a saturated market.

Laopu Gold Co Ltd ($6181.HK):

Laopu Gold Co. Ltd. (6181.HK), dubbed the “first stock of ancient gold,” is making waves in the luxury jewelry sector. On February 20, the Beijing-based high-end jeweler released its unaudited 2024 financials, projecting a net profit of 1.4 billion to 1.5 billion yuan ($193 million to $207 million)—a staggering 236% to 260% leap from the 416.3 million yuan recorded in 2023. This more-than-tripling of profit has propelled its stock price to HK$548.5 as of February 21, up 17.1% in a single day, pushing its market value to HK$92.3 billion ($11.86 billion). Since its Hong Kong IPO in June 2024 at HK$40.50 per share, Laopu’s stock has skyrocketed by 1258%, cementing its status as a standout performer.

Laopu Gold’s meteoric rise can be attributed to its carefully crafted strategy that blends cultural resonance, premium positioning, and operational agility. The company, founded in 2009 with its first Beijing store and formally incorporated in 2016, has tapped into China’s growing appetite for luxury gold items, particularly its signature “ancient gold” style inspired by imperial Chinese craftsmanship.

Unlike mass-market peers like Chow Tai Fook, which price jewelry by gram weight, Laopu adopts a fixed-price model, with many pieces exceeding 10,000 yuan ($1,380). This positions it as a direct competitor to global luxury titans like Cartier and Tiffany, targeting affluent consumers who value exclusivity and artistry over commodity gold.

Laopu management credits its profit surge to three key drivers: a significant boost in brand influence driving revenue growth across existing stores (both online and offline), continuous product innovation, and strategic expansion. In 2024, it added seven new stores and optimized four existing ones, bringing its total to 38 boutique outlets nationwide. These aren’t your average jewelry shops—Laopu plants its flag in high-end shopping malls like Beijing’s SKP and Hangzhou’s MIXC, cultivating an aura of exclusivity. During the recent Chinese New Year, customers queued for over six hours at its Beijing flagship to snap up diamond-inlaid gourd jewelry and vajra crosses, underscoring the brand’s cult-like following among China’s wealthy elite.

While mass-market jewelry demand wanes amid rising gold prices, Laopu thrives by catering to high-net-worth clients who see its pieces as both status symbols and value-preserving investments. Its market share in China’s ancient gold jewelry segment hit 2.0% in 2023, per Frost & Sullivan, a modest but growing slice of a niche projected to reach 421.4 billion yuan ($58 billion) by 2028.

Laopu’s product strategy is another pillar of its success. The company relentlessly optimizes and iterates its offerings, blending traditional techniques like filigree inlays and heat-treated enameling with modern flair. Standout items—like a Pixiu fortune bead bracelet priced at 128,000 yuan ($17,600) or a coiling branch Baoxianghua gold bowl at 378,000 yuan ($52,000)—command premium prices that dwarf mass-market rivals. This fixed-price approach, rare in a market obsessed with per-gram costs, allows Laopu to capture margins far above industry norms. Its 2023 gross margin hovered at 41.9%, trouncing competitors like Chow Tai Fook and Chow Sang Sang who have roughly 25% margins. .

Expansion is the third leg of the stool. While its 38 stores pale beside Chow Tai Fook’s 7,000-plus, Laopu’s focus on quality over quantity pays off. Revenue per store averaged 93.9 million yuan ($12.9 million) in 2023, tripling year-over-year. The seven new outlets and four upgrades in 2024 added incremental revenue.

Laopu’s trajectory suggests it’s just getting started. Management’s outlook is bullish, underpinned by a planned price hike on February 25, 2025, announced alongside the financials. This move, likely tied to soaring gold prices and rising production costs, tests its pricing power among affluent buyers. Some industry experts see Laopu as a contender to become “China’s first luxury brand,” a feat Chow Tai Fook has chased but never fully achieved. The broader context bolsters its case. China’s luxury market remains resilient despite economic headwinds, with gold jewelry doubling as a hedge against uncertainty. Laopu’s high-end positioning insulates it from the mass-market slowdown hitting peers like Luk Fook, whose sales dropped 16% in Q2 2025.

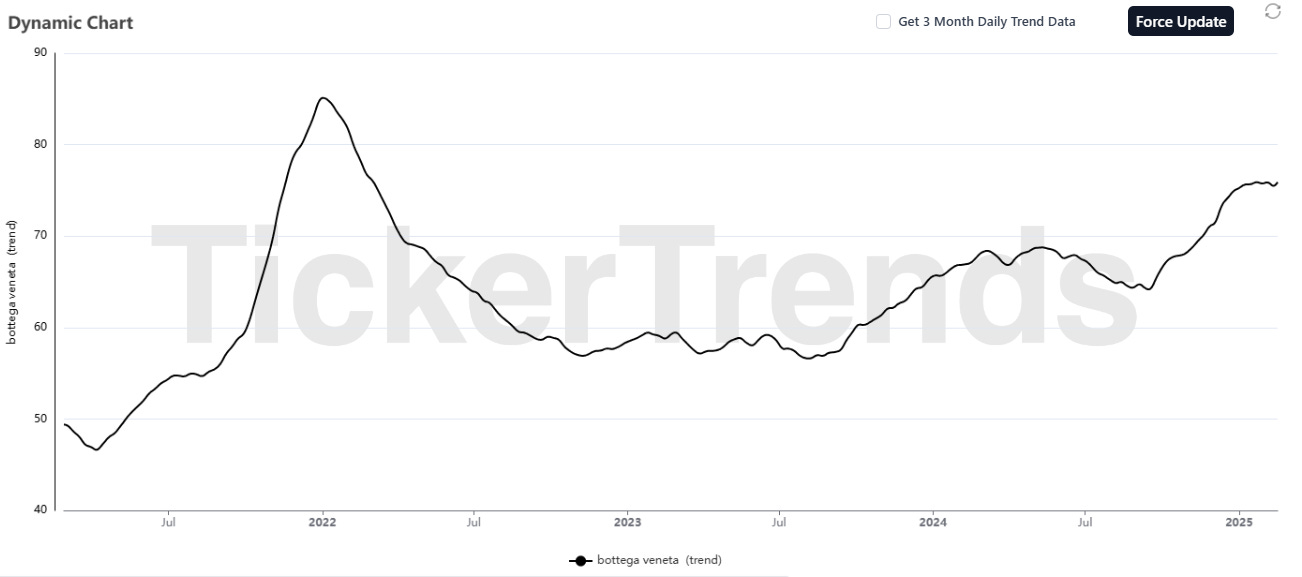

Kering SA ($KER.PA):

Kering, the French luxury conglomerate behind Gucci, Yves Saint Laurent, and Bottega Veneta appears to be faltering with its flagship brand, Gucci facing significant headwinds due to China’s cooling luxury market.

The group’s latest financials, released this week, reveal a steep decline—full-year profit dropped 62% year-over-year to 1.1 billion euros ($1.2 billion), with Gucci’s fourth-quarter sales plunging 24% to 1.92 billion euros ($2.1 billion), missing analyst forecasts of a 19% dip. Overall group revenue fell 12% to 4.39 billion euros ($4.53 billion), a stark sign of Gucci’s struggles, given its historical heft as Kering’s golden goose, driving nearly half of sales and two-thirds of profits. With China’s luxury demand slowing down, Kering is racing to steady Gucci amid a creative leadership shake-up and a broader strategic overhaul.

China, once the powerhouse of global luxury growth, has hit a rough patch. A property crisis, high youth unemployment, and deflationary pressures have shaken consumer confidence, especially among the aspirational middle class that once flocked to Gucci’s bold offerings.

Bain & Co estimates China’s luxury market contracted by about one-fifth in 2024, a sharp reversal from 12% growth in 2023, and Kering felt the sting with a 24% sales drop in Asia (excluding Japan) in Q4, as noted in industry reports. Unlike Hermès or LVMH’s Louis Vuitton, which cater to ultra-wealthy clients less rattled by economic shifts, Gucci’s mid-tier luxury stance—think $2,500 handbags and $1,000 belts—has left it vulnerable. Gucci’s Tmall and direct online sales have reportedly cratered, with one users pointing to an “identity crisis” as the brand shifted from youthful exuberance to minimalist “quiet luxury”—a pivot that’s failed to resonate with China’s discerning shoppers now gravitating toward ultra-premium or budget-friendly local brands.

Across the web, Gucci’s China-driven slump emerges as a confluence of missteps and market forces. The brand’s recent creative direction has aimed to upscale Gucci with timeless, understated designs like $8,500 leather jackets and $11,500 lace dresses, but critics argue it alienated the brand’s core fans. Gucci’s heavy reliance on Asia-Pacific, historically averaging around 35% of Kering’s sales (now 30%), magnified the pain as China’s luxury appetite waned. Rivals like Louis Vuitton and Dior have held steady by leaning on heritage and exclusivity, while Hermès boasts 34% share growth in 2024. Broader economic woes, from rising unemployment to a property bust flagged by Forbes and CNBC, have curbed discretionary spending, mirrored by a decline in Swiss watch exports to China, a luxury market bellwether.

Kering is planning to turn this around, Chairman and CEO François-Henri Pinault insists the group has hit “a point of stabilization,” with a multi-pronged plan to revive Gucci. After parting with De Sarno, Kering plans to hire a new creative director. Co-deputy CEO Francesca Bellettini has hinted that the company will aim to blend tradition and bold fashion to reignite buzz without derailing the upscale shift—new CEO Stefano Cantino, a Louis Vuitton and Prada alum, is tasked with leading this charge. In China, CFO Armelle Poulou pointed to a six-point sales uptick from Q3 to Q4, a hopeful sign that boosted shares 3% this week, with Pinault underscoring “early signs of improvement” in the earnings release. Product-wise, Kering rolled out a revamped handbag lineup, including the Blondie line, late in Q4, aiming for broader appeal with classic designs at slightly more accessible (yet still pricey) $2,000-$3,000 tags.

Beyond Gucci, Kering leans on Bottega Veneta’s 12% Q4 growth—boosted by ultra-luxe moves like an invitation-only Venetian store—and a softening decline at Saint Laurent to offset losses. The group also plans to shutter underperforming Gucci stores in China and nearby markets in 2025, while expanding in key cities to streamline its 1,700-store network for leaner demand.

Gucci’s China slump has laid bare Kering’s weak spots, but the company sees a path forward. The worst for the brand may be behind us if Cantino’s leadership delivers, though lingering macro pressures could stall gains. If Bain’s forecast of mid-single-digit luxury growth in China for 2025 holds, and Gucci’s next creative vision clicks, Kering could regain traction. For now, it’s a tightrope walk—revive Gucci, bolster its portfolio, and hope China’s luxury pulse quickens. The stakes couldn’t be higher for this luxury titan.

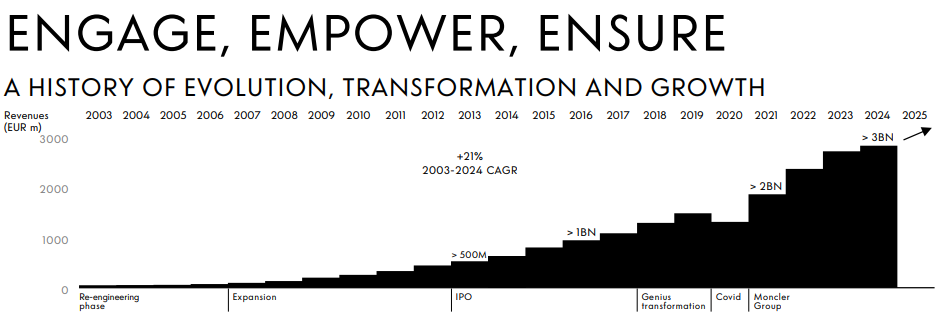

Moncler SpA ($MONC.MI):

Moncler Group, the Italian luxury powerhouse behind Moncler and Stone Island, is wrapping up 2024 with a solid performance, posting a 7% revenue increase for the year ending December 31. The group’s annual report, released on February 13, shows consolidated revenues hitting 3.11 billion euros ($3.26 billion), up from 2.98 billion euros in 2023, defying a choppy luxury market battered by economic headwinds driven by a robust recovery in China, where both brands have tapped into resilient demand for premium outerwear, particularly puffer jackets, despite a broader slowdown in the region’s luxury sector. With direct-to-consumer (DTC) sales soaring in double digits and a healthy 29.5% EBIT margin, Moncler Group is proving its mettle in a tough landscape. Here’s how it pulled it off—and what it means moving forward.

The Moncler brand, the group’s crown jewel, raked in 2.71 billion euros ($2.84 billion) in 2024, an 8% jump from the previous year. Asia, encompassing Mainland China, Japan, and South Korea, was the star performer, delivering an 11% revenue boost to 1.38 billion euros ($1.45 billion). Mainland China’s rebound stands out, especially given the macroeconomic turbulence—think property woes and shaky consumer confidence—that has tripped up competitors like Kering and Burberry.

Management credits this to a laser focus on Chinese consumers, fueled by a local team’s deep market insight, tailored product capsules, and standout events like the Moncler Genius showcase in Shanghai, dubbed by Chairman and CEO Remo Ruffini as “the most impactful one in the brand’s history.” Japan and South Korea chipped in too, accelerating growth in Q4 over Q3, bolstered by tourist spending and stable local demand. Meanwhile, EMEA (Europe, Middle East, and Africa) and the Americas saw more modest Q4 gains of 3% and 5%, respectively, reflecting a solid but less explosive performance outside Asia.

Stone Island, the group’s edgier sibling, tells a different story. Its 2024 revenue dipped 1% to 401.61 million euros ($420.87 million), down from 411.1 million euros in 2023. Asia delivered a 23% Q4 surge to 105.20 million euros ($110.26 million), powered by Japan’s tourist boom and a China uptick, though South Korea lagged. EMEA and the Americas posted 4% and 2% growth, respectively, showing steady but unspectacular progress. Stone Island’s DTC channel shone, mirroring Moncler’s strength, but its wholesale struggles—down across regions—dragged the overall tally. Still, under CEO Robert Triefus, the brand is carving its niche, with moves like its “The Compass Inside” manifesto and a first-ever global ad campaign hinting at bigger ambitions.

Moncler Group is riding a puffer jacket wave that’s gripped fashion since last winter. Premium outerwear—Moncler’s sleek down jackets and Stone Island’s rugged parkas—has become a favorite, squaring off against rivals like Canada Goose and China’s own Bosideng. Moncler’s edge lies in its “top of mind” status, as Chief Business Strategy Officer Roberto Eggs put it: “We are one of the few brands for luxury outerwear, maybe the only one, and we are top of mind, there is no real competitor.”

This confidence paid off in China, where a post-COVID appetite for quality and exclusivity has defied the luxury slowdown hitting peers. The group’s DTC focus—up 11% for Moncler and a bright spot for Stone Island—has also cushioned wholesale declines, with 286 Moncler stores and 90 Stone Island boutiques driving direct engagement.

Although Moncler results and search trends remain strong, it’s not all smooth sailing. Stone Island’s uneven performance and a forecasted mid-single-digit price hike in 2025, flagged by could weigh on the earnings as the macroeconomic situation remains weak. The Americas, a growth frontier, remain underrepresented suggesting untapped potential but also a long slog ahead. Moncler Group is doubling down on its three-pronged strategy—Grenoble’s performance gear, Collection’s everyday luxury, and Genius’s avant-garde edge—will get a marketing push, while Stone Island aims to broaden its global reach.

With a 1.3 billion euro cash pile and a 5% net profit bump to 639.6 million euros, the group has firepower to navigate uncertainty. As Ruffini put it, “We never compromise, we aim never to get bored so as not to bore others.” For now, Moncler Group’s China-led rebound has it standing tall in a luxury sector where others stumble but investors should not expect the ride to get any less bumpy.

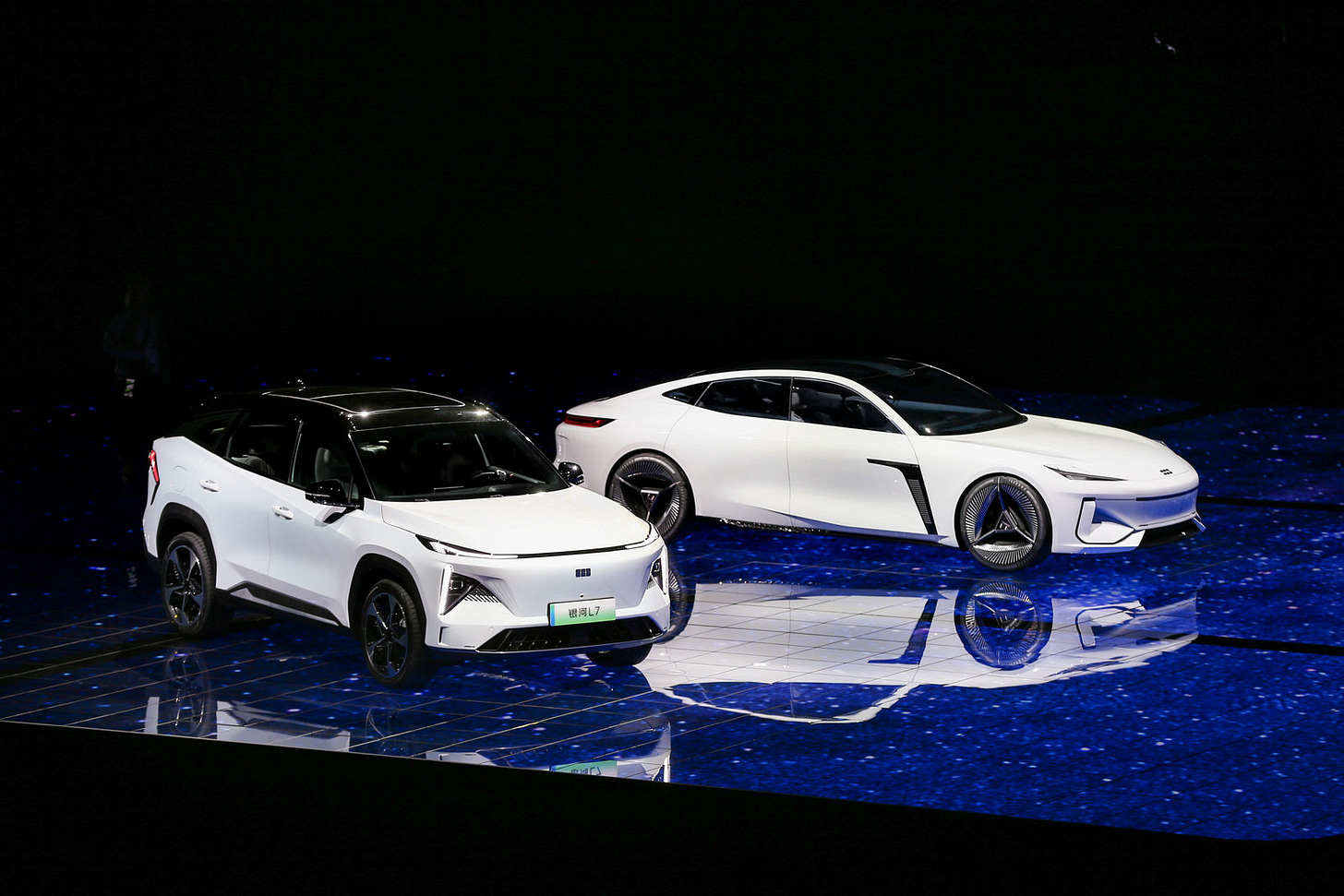

Geely Automobile Holdings Limited ($GELYF):

China’s auto market, the world’s largest, appears to be undergoing a significant shift, and foreign luxury giants like Mercedes-Benz, BMW, and Audi are hitting a wall. In January, passenger vehicle sales plummeted 32% month-on-month to 1.8 million units, a 12% drop year-over-year, according to the China Passenger Car Association (CPCA). This slump has hammered premium automakers, with the once-dominant trio seeing their combined market share erode throughout 2024. Meanwhile, domestic brands like Geely Automobile Holdings are surging ahead, outpacing even EV titan BYD in January retail sales and signaling a dramatic realignment in the luxury segment. As China’s new energy vehicle (NEV) market flexes its muscle—hitting 744,000 units in January, up 10.5% year-over-year—the story is clear: foreign luxury cars are losing their grip, and homegrown players are rewriting the rules.

The numbers tell a stark tale. China’s auto market roared to a record in 2024, claiming 41% of global share in December, per the CPCA, yet January’s cooldown exposed vulnerabilities for European marques. Mercedes-Benz saw sales in China slide 7% for the year, BMW dropped 13%, and Audi fell 11%, according to Reuters and Business Insider. Price cuts—BMW’s iX1 slashed by nearly 150,000 RMB ($20,700), Mercedes’ EQA dipping below 200,000 RMB ($27,600)—failed to stem the tide, as reported by Just Auto. Meanwhile, foreign brands’ share of the passenger vehicle market shriveled to 34.8% in 2024, down from 60.8% in 2019, per China Daily, while domestic brands soared to 65.2%. Geely, a standout, notched a 19.4% sales jump to 1.2 million units in 2024, per Focus2Move, overtaking Honda and closing in on Toyota’s 1.59 million. This isn’t just a blip—it’s a transformation, fueled by China’s rapid pivot to NEVs and a consumer base increasingly smitten with local innovation.

The reason behind the success has been due to China’s NEV boom—up 35.5% to 12.86 million units. Geely’s Zeekr marque soared 87% to 222,123 units, outpacing Volvo (down 8% to 156,000), a sibling under Geely’s umbrella, per China Daily.

Local players like Nio and Li Auto are also stealing premium buyers with cutting-edge tech—think Snapdragon 8295 chips in Leapmotor’s C10 at 128,800 RMB ($17,700) versus Mercedes’ E-Class at 450,000 RMB ($62,000). Economic jitters don’t seem to be helping either; a faltering property market and deflationary pressures, have curbed appetite for high-end foreign models like Mercedes’ S-Class.

For companies like Geely, this is a jackpot moment. Already a powerhouse with brands like Volvo, Polestar, and Zeekr, Geely’s 2024 revenue leapt 47% to 107.3 billion yuan ($14.8 billion), with net profits spiking 575% to 10.6 billion yuan ($1.46 billion). The company’s strategy of offering premium NEVs at competitive prices, rapid model releases, and global expansion (Vietnam assembly deals, a 34% stake in Renault Korea) is positioning it to capitalize on China’s luxury rethink, where “soft” strengths like smart tech now trump brand prestige.Geely’s production capacity nears 2 million annually, and its “dark” factory in Xi’an churns out high-tech EVs with AI precision. Outperforming BYD in January retail sales—a rare feat against the 3.5 million-unit juggernaut—Geely is proving it can lead the premium pack.

The upside for the company is clear: with China’s luxury car market projected to hit $187.39 billion by 2030, and NEVs claiming 40.9% of 2024 sales, Geely’s foothold in both premium and electric segments gives it runway to snag disillusioned BBA (Benz, BMW, Audi) buyers. Its diverse portfolio—Zeekr for tech-savvy elites, Lynk & Co for the trendy middle—mirrors LVMH’s multi-brand playbook, offering resilience against market swings. Although the future looks bright, the company faces intense domestic competition from BYD and Chery. Geely must keep innovating, especially as price wars erode margins. Geopolitical tensions, like EU tariffs on Chinese EVs, could trigger retaliatory levies on Geely’s Volvo exports. And while China’s ultra-wealthy still buy foreign luxury, 30% of luxury car owners favor BBA for hybrids over local upstarts, hinting at lingering prestige hurdles. For Geely, success hinges on sustaining quality, scaling globally (Thailand’s 200,000-unit plant opens late 2025), and outpacing rivals in the NEV race. If it does, it could cement China’s new luxury order—where “made in China” doesn’t just compete but dominates.

PDD Holdings Inc ($PDD):

Temu, the cross-border e-commerce giant under PDD Holdings, dropped a massive piece of news this week, launching its first semi-managed site in Southeast Asia on February 20.

The Philippines, with its youthful, internet-savvy population, is the testing ground for this new chapter in Temu’s global ambitions, after its recently announced European expansions and an upcoming UAE debut slated for February 28. Backed by Pinduoduo’s parent company, Temu’s move marks a shift from its fully-hosted roots to a hybrid model blending platform muscle with seller freedom—a strategy that could reshape PDD Holdings’ fortunes in a fiercely competitive region. As Shopee and Lazada tighten their grip on Southeast Asia’s e-commerce turf, Temu’s gambit is a high-stakes bid to carve out a slice of a market projected to hit $230 billion by 2026.

With a median age of 25, over 73% internet penetration, and a whopping 90% English fluency, Philippines could prove to be a goldmine for Temu’s low-price, high-engagement ethos. Over half its 110 million people are under 30, primed for the budget-friendly products offered by Temu. GlobalData pegs the country’s e-commerce market at $24.1 billion in 2024, growing at a blistering 22% CAGR through 2025, outpacing slower giants like Indonesia. Unlike Vietnam or Indonesia, where red tape strangles foreign players, the Philippines offers a laxer sandbox for Temu to test its semi-managed model: sellers handle listings, pricing, and logistics, while Temu provides the platform and risk controls. European data hints at the payoff—20%-30% lower seller costs and a 95% fulfillment rate—numbers that could lure small and mid-sized merchants itching to dodge Shopee’s and Lazada’s hefty fees.

Temu isn’t stepping in quietly. Facing Shopee and Lazada, which together clutch over 60% of the Philippine market per YouNetECI, Temu’s playbook is ruthlessly sharp: prices 30%-50% below Shopee’s, driven by factory-direct sourcing and hefty subsidies that gut middleman costs. It’s zeroing in on electronics like earbuds and chargers sidestepping Shopee’s fashion stronghold. And it’s borrowing Pinduoduo’s social magic, tweaking it for local tastes with regional campaigns that echo the viral “team up, price down” tactics that hooked 550 million global downloads in 2024, a 69% year-over-year spike. Delivery’s getting a boost too—down to 5-10 days via J&T Express, a leap from the 5-20 days of its early fully-hosted days. This isn’t just a toe-dip; it’s a calculated jab at a fragmented market where e-commerce penetration still lags at 15%, leaving room for a disruptor to thrive.

For PDD Holdings, this is more than a regional flex—it’s a lifeline. The Shanghai-based titan, which saw 2024 revenue soar 86% to $48.8 billion, has leaned hard on Temu’s global sprint to offset Pinduoduo’s maturing grip in China, where it holds 19% of the e-commerce pie. The semi-managed shift could be a game-changer, trimming the cash burn that hit $2-3 billion on marketing in 2023. If the Philippines proves the model, PDD could roll it out across Thailand, Vietnam, and beyond, where it’s already planted flags.

The stakes are sky-high. Success here could vault PDD’s market cap—briefly China’s top e-commerce stock at $204 billion in 2024, cementing its global clout. A foothold in Southeast Asia, where Temu’s 1.3 million monthly Philippine visits pale next to Shopee’s 50 million could unlock a new growth artery as China’s economy sputters.

Although the expansion has a lot of promise, there could be significant challenges in scaling its business in the Philippines. Shopee and Lazada, with decades-deep logistics and 71.4% and 5.9% Vietnam market shares aren’t budging—they’ve mimicked Temu’s low-price game and lean on cash-on-delivery, a Southeast Asian staple which Temu’s credit-card focus sidesteps. Indonesia’s ban on Temu, protecting local SMEs, looms as a warning—other nations could follow. However, with $7.2 billion in Q2 2023 revenue and a war chest to burn, PDD has the muscle to weather the storm. For PDD Holdings, the Philippines is a proving ground. Nail this, and it’s a blueprint for Southeast Asia’s $230 billion prize, a buffer against U.S. tariff threats and a shot at overtaking Alibaba for good. Flop, and it’s a costly misstep in a region allergic to foreign upstarts. Either way, Temu’s Southeast Asian debut has PDD at a crossroads—ready to soar or stumble in a market that doesn’t forgive latecomers lightly.

Hermes International SA ($HMI.HM):

Last Friday, before the Paris market opened, French luxury titan Hermès unveiled its 2024 full-year results, and the numbers were quite impressive. Revenue climbed 13% year-on-year to 15.2 billion euros ($16.4 billion), or 15% at constant exchange rates, cementing its status as a beacon of resilience in a sluggish luxury sector.

Every region and category—save for watches—posted growth, a feat that pushed its stock up 22% since January, nudging its market cap to a towering 302 billion euros, just 50 billion shy of rival LVMH. Over the past decade, Hermès’ revenue has ballooned by 268% and net profit by 436%, with compound annual growth rates of 13.9% and 18.3%, respectively.

At an analyst meeting following the announcement, CEO Axel Dumas, a sixth-generation family scion, provided an in-depth breakdown of the company’s enduring success.

Dumas, alongside CFO Eric du Halgouët, framed Hermès’ resilience as a mix of structural savvy and stubborn authenticity. The company’s annual report credits its “vertically integrated model” and “strong local presence,” underpinned by rigorous quality, artistic direction, and artisanal heritage. But Dumas went deeper, weaving a narrative of balance over brute expansion. “We want things to be balanced, but not artificially balanced,” he said, rejecting short-term gimmicks for long-term value. Since taking the helm in 2013, when Hermès had 313 stores, he’s trimmed that to 293—yet revenue has nearly quadrupled. Larger, better-placed stores, not more of them, have fueled this growth, a deliberate choice reflecting a shift from sales-driven to value-driven logic. In China, a steady one-store-per-year cadence since 2010 has paid off, proving patience trumps frenzy. “What we really try to do is not get caught up in the end goal, but put the way things are done at the heart of the system,” Dumas mused, spotlighting aesthetics and craft as the true drivers.

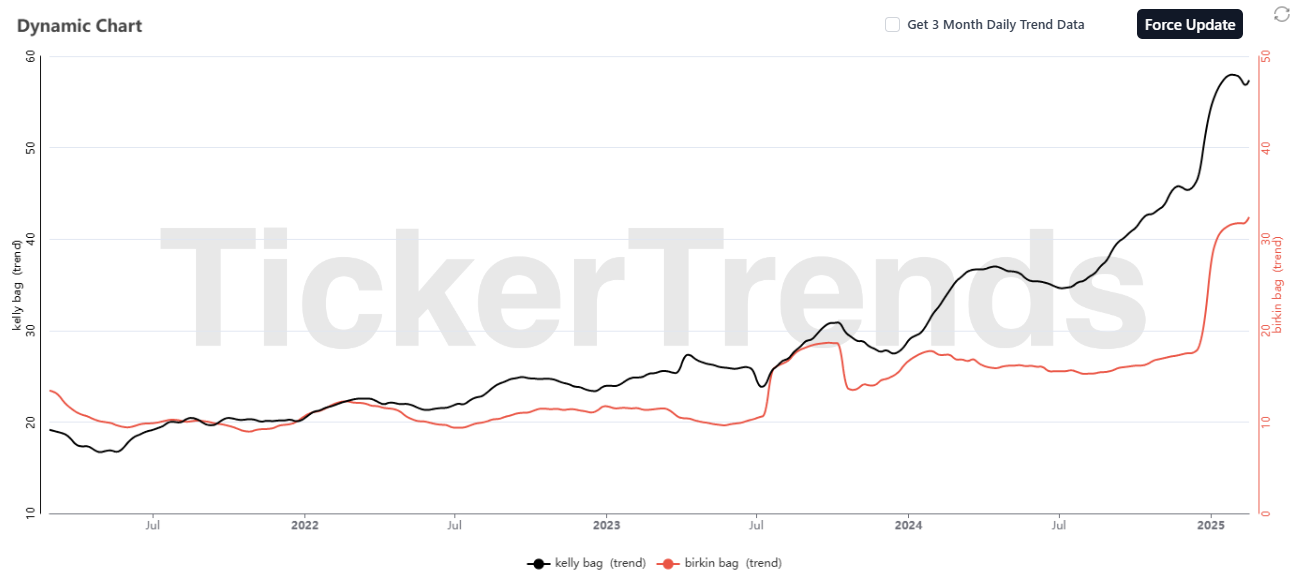

This value-first ethos shines in Hermès’ product strategy. Leather goods, the backbone at 42.6% of revenue, surged 18.3%, buoyed by expanded production and insatiable demand for Birkin and Kelly bags. Yet Dumas resists leaning on one hit—diversity across styles keeps it dynamic.

Ready-to-wear, meanwhile, has carved out a loyal, upscale clientele, potentially poaching from rivals, while jewelry thrives with its “Haute Bijouterie” approach—design-led, not stone-driven. Watches stumbled 4%, a rare blemish Dumas chalked up to a cyclical market, though he’s betting on the Hermès Cut to spark a rebound. “We sell desire and dreams, which are the soul of this industry,” he added, a mantra that keeps Hermès above mere commerce. China, a luxury bellwether, tested this resilience. Sales there grew just 7.4%, the slowest regionally, yet Dumas sees strength in local buyers over tourists.

The company is planning to hike its prices by 6-7% in 2025, less than 2024’s 8%, reflecting confidence in pricing power with its operating margins already standing at 40%+. Leather goods, at €6.5 billion, and a €12 billion cash pile underscore the company’s financial muscle. China’s volatility remains the key risk for the company. But with a model that’s “balanced out by what we do well and badly.”