What's Trending with TickerTrends #1

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

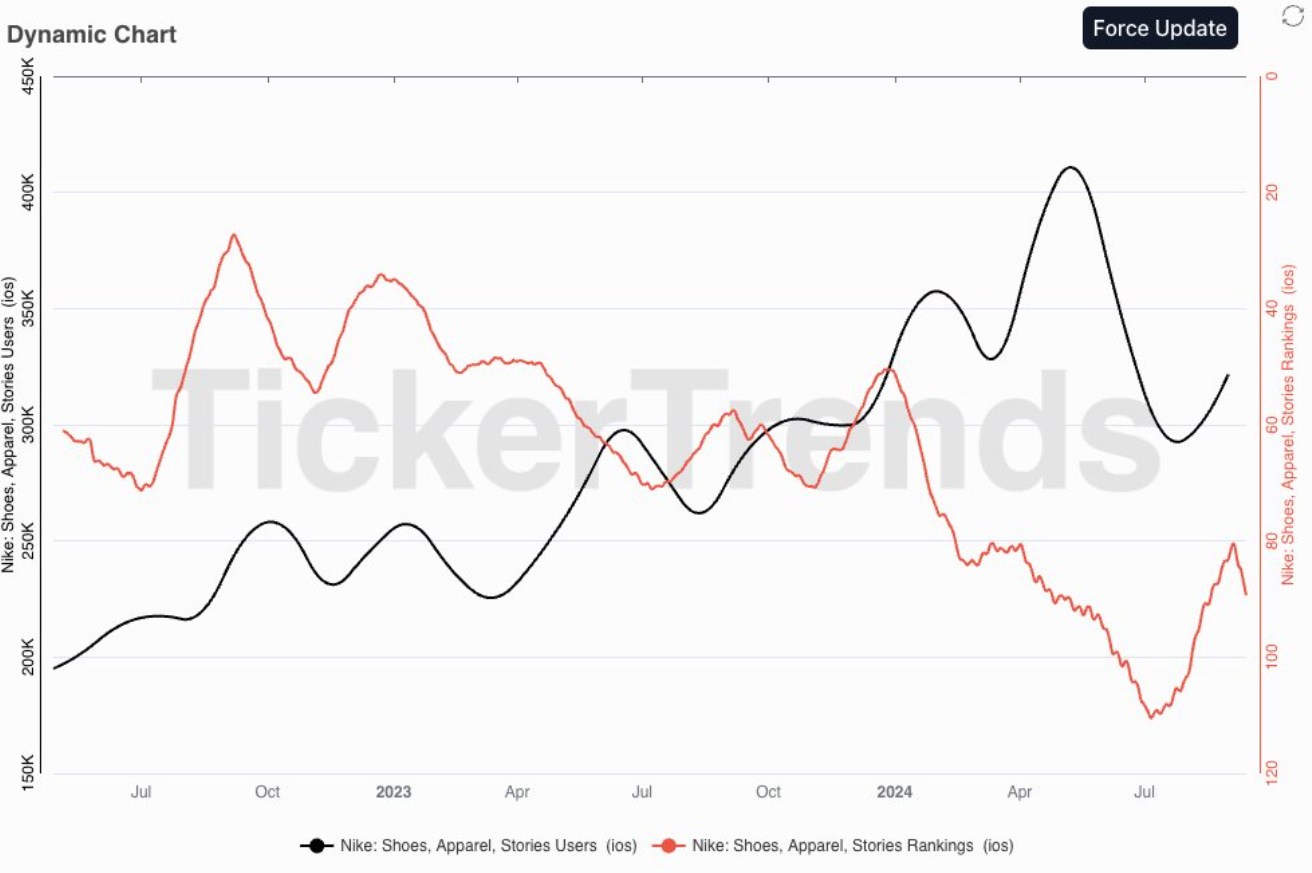

1. Nike ($NKE):

Nike shared that the company continues to face challenges, largely attributed to softness in consumer demand and inventory imbalances, particularly in Greater China and the digital space. Nike's revenue fell by 10% on a reported basis and 9% on a currency-neutral basis, with significant declines in Nike Digital (down 20%) and key classic footwear franchises such as Air Force 1, Air Jordan 1, and Dunk, which were down nearly 50%.

Key reasons for the struggle include declining foot traffic, particularly in China and the digital channels, as well as underperformance in retail sales despite strong product innovation efforts. Inventory levels remain elevated, necessitating more aggressive promotional strategies to clear excess stock.

However, there are green shoots emerging, especially in Nike’s sport-focused product lines. New product launches in running, basketball, and global football saw double-digit growth, with performance footwear such as the Pegasus 41 and the Alphafly models gaining traction. Nike remains optimistic about future growth, particularly with innovations in running footwear and apparel, and their renewed focus on driving brand momentum through sport with many analysts claiming that the worst might be behind them.

Our data continues to look weak for now. We will update if this changes. Follow us on X to receive updates and potential trade ideas.

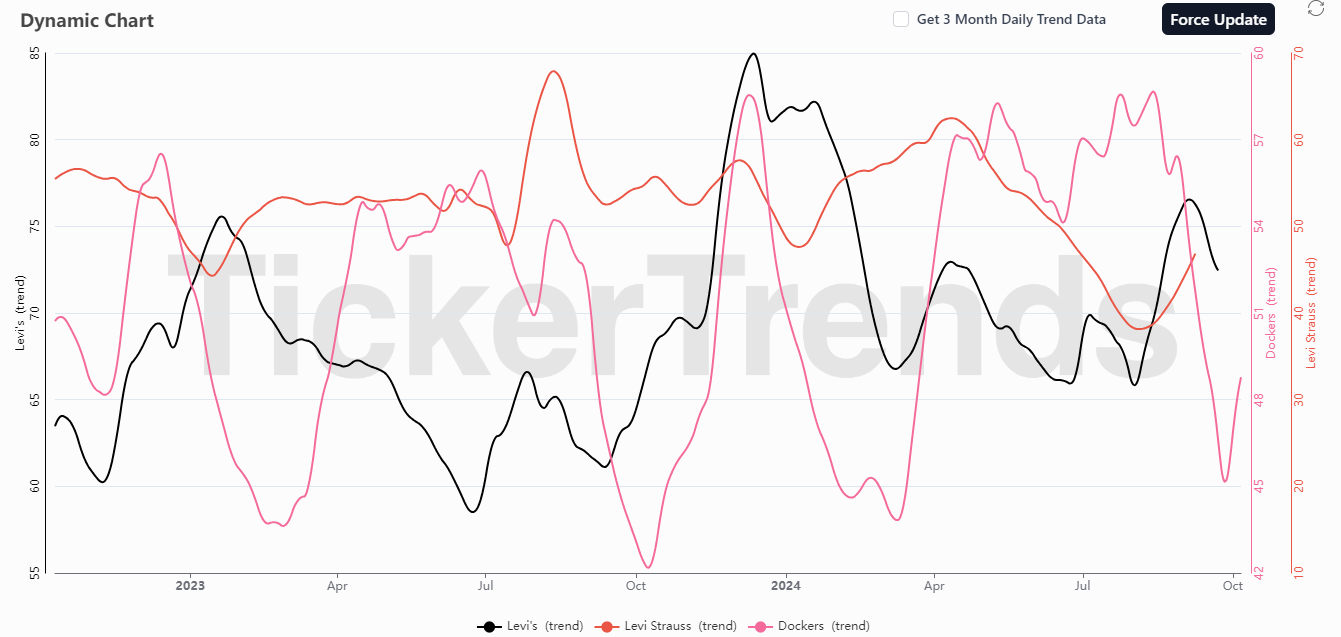

2. Levi Strauss & Co. ($LEVI):

Levi’s reported a solid Q3 performance with key financial highlights, including a 2% increase in net revenues (constant currency), 5% growth in the Levi’s brand globally, and record gross margins of 60%, demonstrating strong operational efficiency. Direct-to-consumer (DTC) sales grew 12% globally, while adjusted EBIT margin expanded by 250 basis points, leading to an 18% increase in adjusted diluted EPS to $0.33.

Despite these positives, Levi's faced challenges in wholesale channels. U.S. wholesale revenue declined 2%, and macroeconomic headwinds in China and a cybersecurity breach in Mexico negatively impacted performance. The Dockers brand underperformed, prompting the company to explore strategic alternatives, including a potential sale. However, the Beyond Yoga brand showed promise with 19% growth in Q3.

Levi’s leadership remains confident in the Q4 outlook, backed by strong DTC growth, a new partnership with Beyoncé (more on this later), and efforts to optimize the company’s wholesale strategy, particularly in the U.S. and Europe.

Positive drivers for the strong quarter include full-price sales, favorable brand and channel mix, and cost efficiencies. However, foreign exchange fluctuations, particularly the Mexican peso, posed some headwinds.

Trends this week:

1. Vital Farms ($VITL):

Our data suggested an abnormal spike in interest for Vital Farms this week. The traffic was primarily driven by various TikTokers questioning the legitimacy of ‘Pasture-Raised Eggs’ and accusing Vital Farms of Greenwashing.

The company was quick to respond to the potential backlash and cleared the air by issuing a public clarification. It would be worth keeping an eye on the situation, in case this leads to an adverse impact on consumer trust or helps raise brand awareness.

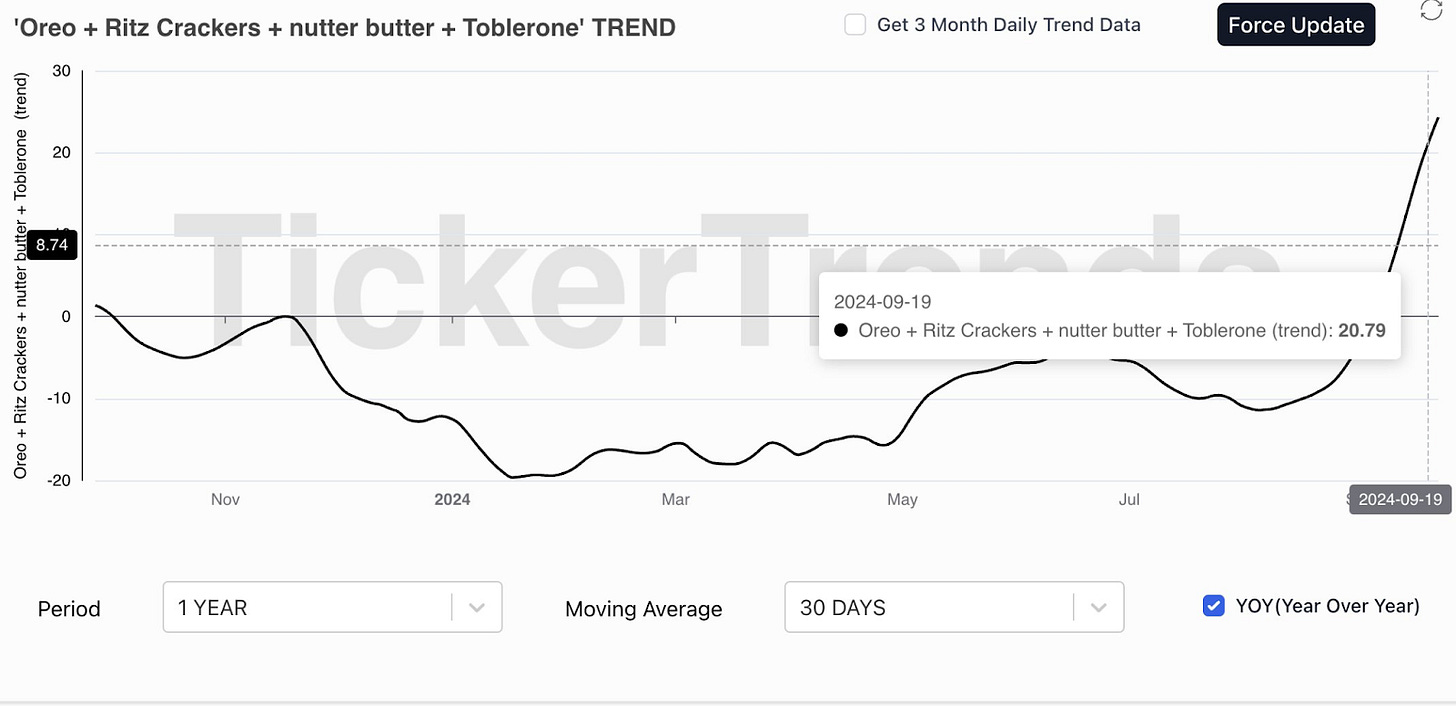

2. Nutter Butter ($MDLZ):

The brand, owned by Mondelez International, has been going viral on TikTok recently. The company took a significant risk by committing to a cryptic and bizarre content style on platforms like TikTok and Instagram, leading to viral success. This strategy included using obscure codes, deep-fried visuals, and a running narrative involving a super-fan named Aidan. The key turning point came in January 2023 when one of their posts went viral, enabling the team to continue experimenting with this offbeat style.

The social media team, led by Dentsu Creative, took risks and embraced a philosophy they called "strategic silliness." Despite initial discomfort and some underperforming posts, the team committed to their approach. Trust from Mondelez allowed them to continue pushing boundaries, which eventually led to widespread success, doubling their Instagram following and garnering millions of views on TikTok.

It would be interesting to see the virality of Nutter Butter could be needle moving for a company the size of Mondelez. The company’s overall trends also look very impressive.

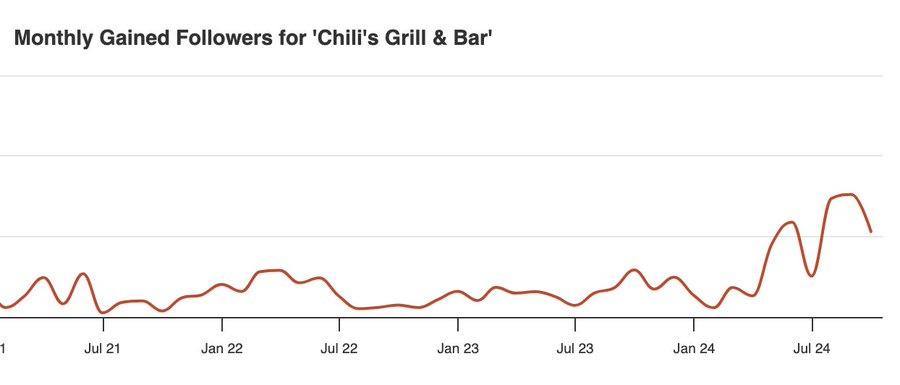

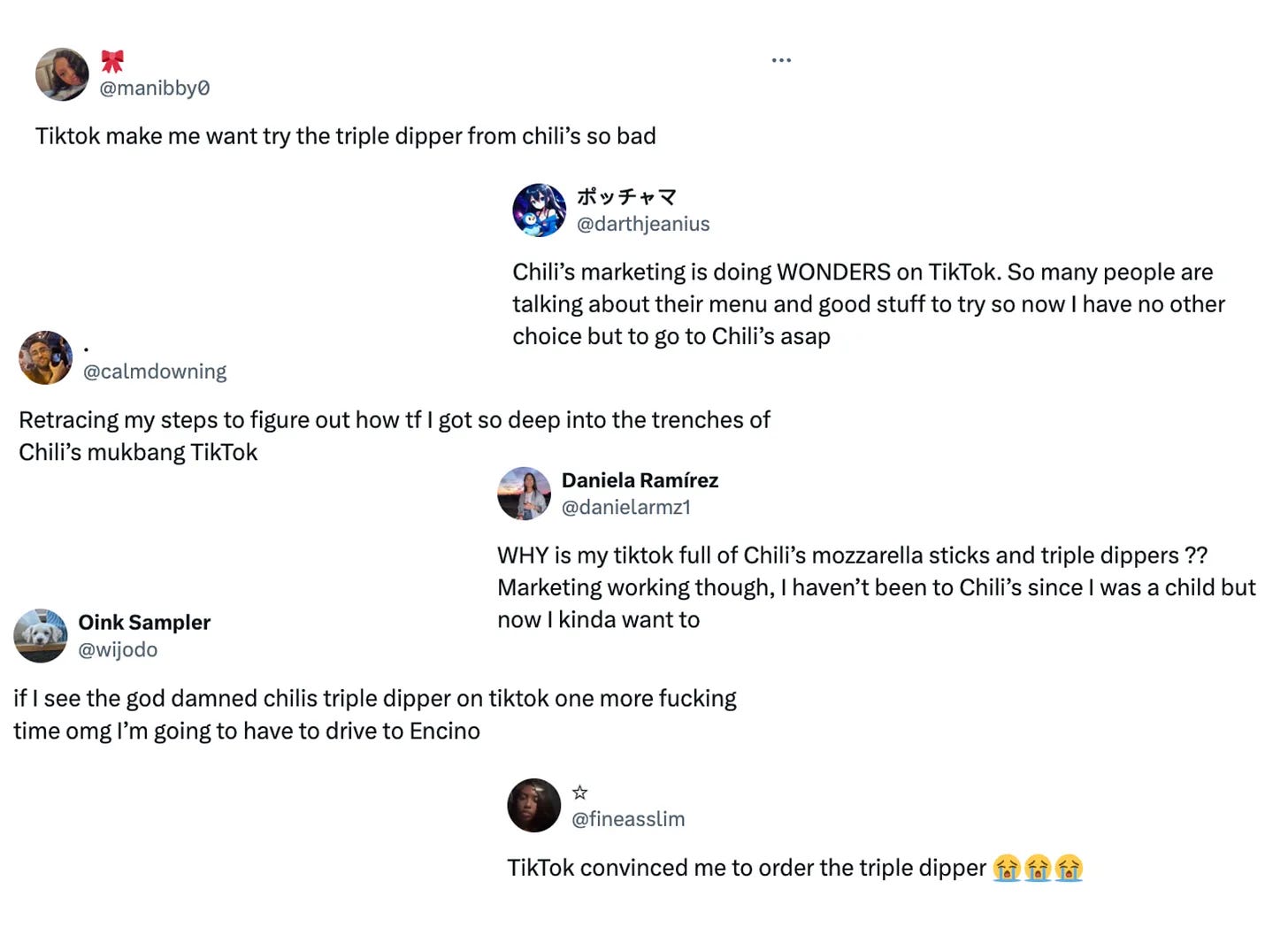

3. Chili’s ($EAT):

Chili’s is experiencing a recent surge in popularity due to menu innovations and a focus on value-driven options, like their 3 for Me deal. Combined with efforts to enhance the guest experience, including tech upgrades for digital ordering and rewards, Chili's is resonating with customers looking for both convenience and quality.

The company focuses on trying to be the first brand on viral moments online and relate it back to Chili’s which has helped them get eyeballs and in front of customers who have not tried their products in a while.

4. Build-A-Bear ($BBW):

The collectible toy market is booming, and $BBW is leading the charge! Build-A-Bear's Halloween 2024 launch has garnered significant attention, largely driven by a viral leak of new product details, which included exclusive licensed items and the return of fan-favorite Pumpkin Kitty. Originally planned for a later release, the company moved up its launch date due to the overwhelming excitement from fans. The Halloween-themed offerings, including new versions of the popular Mini Beans line and glow-in-the-dark furry friends, have resonated with both collectors and casual shoppers.

From viral Halloween launches to epic partnerships with Sanrio & Pokémon, Build-A-Bear is tapping into nostalgia and fueling collector demand. The company’s collaboration with Bluey sold out in the matter of days showing the continued traction for its products. Check out our deep dive on $BBW here: https://tickertrends.substack.com/p/bbw-build-a-bear-collectibles-boom

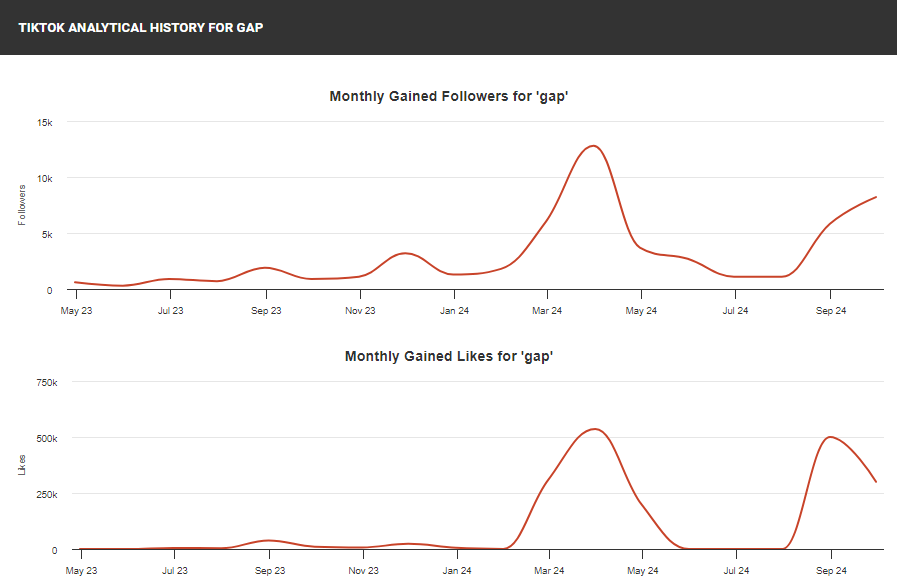

5. GAP ($GAP):

$GAP’s "Get Loose" campaign has gone viral on TikTok and has garnered millions of views. The campaign has resonated with younger, fashion-forward audiences.

The campaign's focus on relaxed, modern styles and its use of influencer, Troy Sullivan has generated significant buzz, driving both cultural relevance and consumer engagement.

By tapping into the current trend of nostalgia mixed with modern fashion, GAP is positioning itself as a key player in the social media-driven fashion landscape, offering investors a chance to capitalise on the brand's resurgence in cultural influence. With expectations not being high and the stock trading at ~ 8 times cash flow, it appears to have a good risk reward profile. Check out our write-up about it here: https://tickertrends.substack.com/p/gap-gap-inc-turnaround-tickertrendsio

6. Wendy’s ($WEN):

Wendy’s recently announced a collaboration with Spongebob releasing special limited edition items like Krabby Patty Burger and Pineapple under the Sea Frosty. The campaign has generated a massive buzz with the search volume for the Krabby Patty reaching over 200K+ in 4 days on Google.

The announcement post on Wendy’s X account garnered 4.8M views and over 80K likes.

The collaboration has been the subject of coverage by various media outfits.

Early reviews have been underwhelming, however it will be interesting to see if the massive attention can lead to a spike in sales in the upcoming quarter.

7. McDonald’s ($MCD):

The news of a Boo Buckets comeback has sparked excitement among McDonald's fans in previous years, many were far from pleased with this year's versions of the classic Halloween items as the buckets don't come with lids like they have in the past. However, the pileup of complaints shows that many customers consider them to be a far cry from the Boo Buckets of years past.

Boo Buckets aren't the only major new items dropping at McDonald's restaurants this month. This week, the chain announced that its long-awaited Chicken Big Mac will finally roll out nationwide in the United States for a limited time starting on Oct. 10. The company has launched this in collaboration with Kai Cenat and has gained significant social media attention. Though the Chicken Big Mac has previously been available for limited-time runs in other countries such as the United Kingdom and Canada, this will be the first time that it gets a wide release in the States and will be interesting to see if it can drive any meaningful growth for the company.

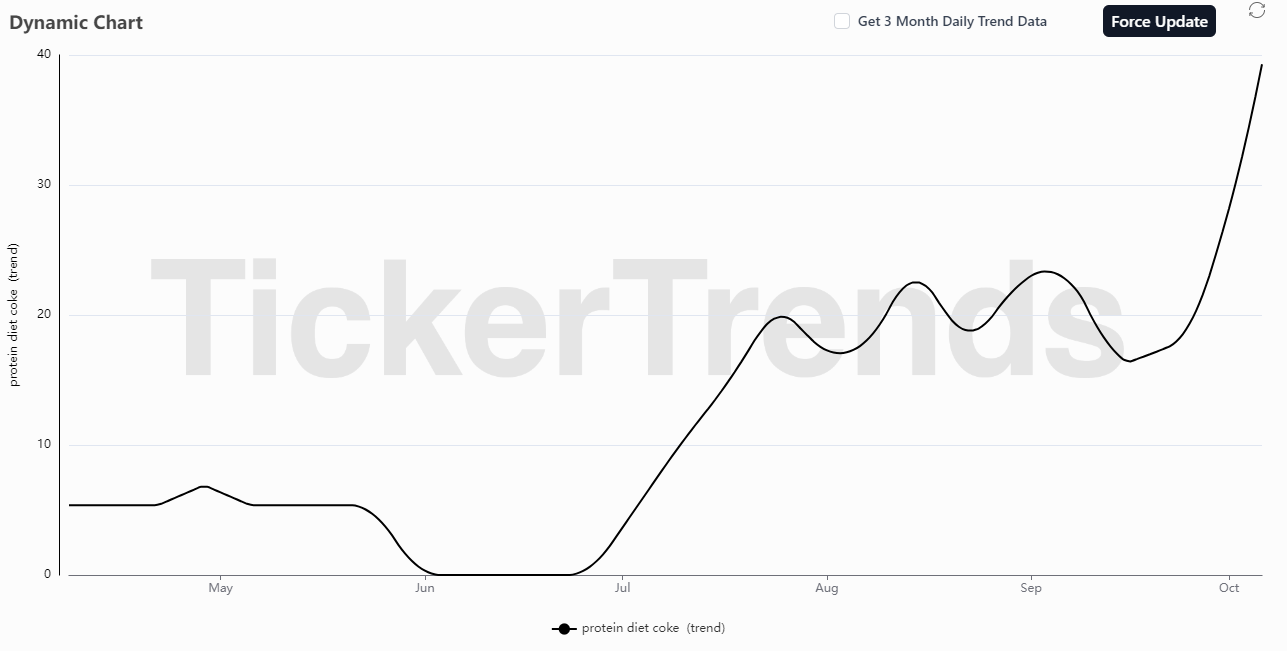

8. Protein Coke ($KO, $BEL, $SMPL):

Protein Diet Coke has seen a surge in popularity due to it going viral on TikTok. The drink went viral after Rebecca Gordon’s video garnered 2.4M views. Since then, many other TikTokers around the country have tried it and posted their own versions.

"Protein Diet Coke" combines a ready-to-drink vanilla protein shake and Diet Coke. Most videos with #proteindietcoke on TikTok seems to use Fairlife Vanilla Core Power, an ultra-filtered, high-protein vanilla milk drink owned by Coca Cola ($KO).

The other potential tradeable ideas for this trend are Bellring Brands ($BRBR) and Simply Good Foods Co ($SMPL) who both have a significant presence in this sector.

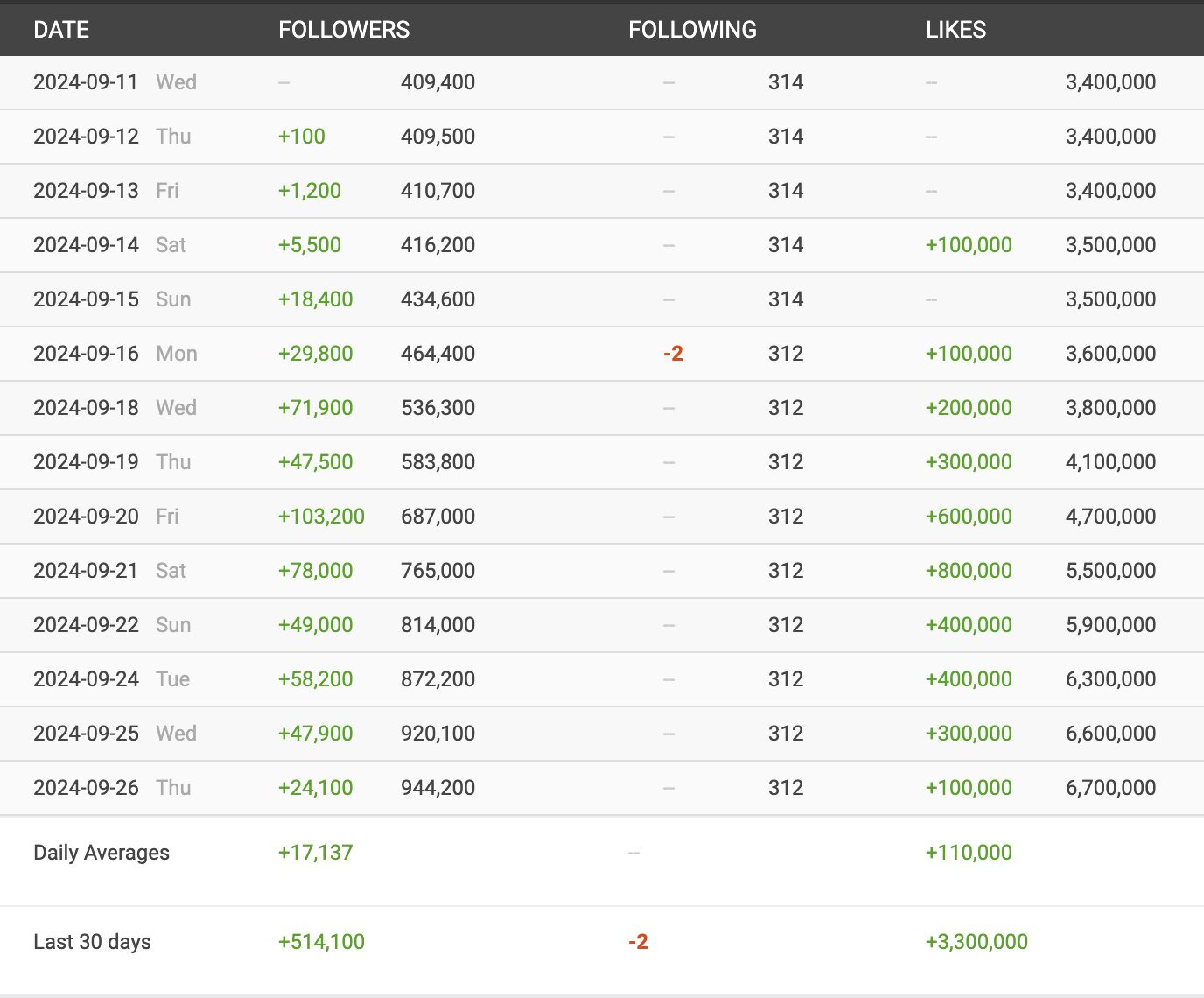

9. LEVI Strauss ($LEVI):

Levi Strauss' recent partnership with Beyoncé is an intriguing one. Levi’s launched it to fuel its growth and enhance its focus on women’s apparel, and has quickly gained viral attention, with the campaign making waves across social media platforms like Instagram and TikTok.

The cultural impact of Beyoncé, combined with Levi’s renewed push towards becoming a "head-to-toe denim lifestyle brand," creates a powerful social arbitrage opportunity, especially as the campaign resonates with younger audiences and boosts awareness around Levi's women's collections.

However, while the viral nature of the campaign presents a significant growth opportunity, there is a potential risk due to emerging conspiracy theories surrounding Beyoncé’s influence in the music industry. Viral TikTok posts claim that artists are "forced" to praise Beyoncé, and these unfounded allegations have gained traction, sparking debates online. If this narrative intensifies, it could derail the positive momentum of Levi's campaign, leading to bad press or overshadowing the brand's focus. Although these theories remain unproven, they highlight the delicate balance brands must strike when aligning with major cultural figures like Beyoncé, as public perception can quickly shift.

10. Mattel ($MAT):

Mattel’s release of a Diwali-themed Barbie, which sold out online within 24 hours. The overall search trends for Barbie remain weak overall. The rapid sell-out of the Diwali Barbie suggests strong demand for culturally relevant products, and if Mattel leverages this momentum by expanding its offerings around diverse holidays and traditions, it could reignite interest in the Barbie brand.

By continuing to collaborate with cultural figures and expanding its range of holiday-themed dolls, Mattel has the potential to broaden its appeal, not only within specific communities but also with a global audience that values diversity. This strategy could help reverse the current downtrend in search interest and drive growth, as consumers increasingly look for products that celebrate and reflect their identities. The viral success of the Diwali doll could be a turning point for Barbie, especially if Mattel sustains the buzz with similar culturally significant releases. Although, it might be too early to place any trades right now.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.