What’s Trending with TickerTrends #29

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Chipotle Mexican Grill Inc. ($CMG):

Chipotle Mexican Grill reported mixed first quarter 2025 results as the company grappled with mounting macroeconomic headwinds that weighed on customer traffic and comparable sales. Revenue rose over 6% year-over-year to $2.9 billion, but same-store sales declined by 0.4%, reflecting a slowdown in discretionary restaurant spending that began in February and continued into April. Management emphasized during the earnings call that internal performance metrics, including staffing levels, food quality, and brand perception, remain strong. CEO Scott Boatwright attributed the sales softness primarily to external factors, such as broader consumer caution and weather disruptions, rather than any deterioration specific to the Chipotle brand.

Despite the near-term challenges, Chipotle laid out a clear roadmap to reignite transaction growth in the second half of the year. The company pointed to strong early performance from its limited-time Chipotle Honey Chicken, which exceeded sales mix expectations and helped offset some of the transaction weakness late in the quarter. In addition, management highlighted several strategic initiatives: expanded marketing efforts focused on summer engagement, ongoing improvements to operational throughput through the rollout of produce slicers, and further innovation in menu offerings, including a potential new side or dip. Leadership reiterated confidence that these efforts, coupled with easier year-over-year comparisons, will lead to a return to positive transaction growth exiting Q2 and into the back half of 2025.

Margins faced pressure during the quarter, with restaurant-level margins declining 130 basis points to 26.2%. Higher costs for avocados, chicken, and dairy products, along with the impact of new U.S. tariffs on imported goods like beef and packaging, contributed to elevated food costs. CFO Adam Rymer noted that tariffs are expected to have an ongoing 50 basis point drag on cost of sales. However, Chipotle plans to offset much of this inflation through operational efficiencies and is still projecting full-year cost inflation in the low-single-digit range, excluding tariffs. Labor expenses also rose slightly due to lower sales leverage, though the company has successfully lapped major wage increases in California.

Chipotle’s long-term growth story remains intact, with unit expansion continuing at a rapid pace. The company opened 57 new locations during the quarter, including 48 Chipotlanes, and reaffirmed its target of 315 to 345 openings for the full year. International expansion is also gaining momentum, with strong early results from new stores in Canada and the Middle East. Chipotle announced plans to enter Mexico in early 2026 through a partnership with Alsea, signaling broader ambitions for Latin American growth. Management reiterated their confidence in reaching their long-term goal of 7,000 restaurants in North America and building a global brand footprint.

Chipotle acknowledged that the consumer environment remains uncertain, but expressed confidence that its brand strength, operational improvements, and marketing investments will position it for an acceleration as conditions normalize. The company maintained its guidance for low single-digit full-year comps and positive transaction growth in the second half of 2025. As Boatwright concluded, the near-term may be pressured by macro factors, but Chipotle’s investment in its people, food, and guest experience is designed to create a stronger brand and business for the long term.

Whirlpool Corp ($WHR):

Whirlpool Corporation reported solid first quarter 2025 results, achieving 2% organic sales growth and expanding EBIT margins by 160 basis points year-over-year to nearly 6%, despite operating in what management described as a difficult macroeconomic environment. CEO Marc Bitzer and CFO Jim Peters emphasized that the company’s focus on pricing actions, structural cost reductions, and strong product innovation helped it weather the twin headwinds of weakening consumer confidence and heavy pre-tariff inventory loading by Asian competitors. The company reiterated its full-year guidance for 3% organic sales growth, 6.8% EBIT margins, and $500–600 million in free cash flow, underscoring confidence in a stronger second half of the year.

A major focus of the call was the shifting tariff landscape and its implications for Whirlpool’s business. Management explained that recently announced U.S. tariffs targeting Asian appliance imports are expected to significantly benefit Whirlpool by leveling a long-standing cost disadvantage faced by U.S. manufacturers.

Bitzer outlined how historical tariff loopholes allowed Asian competitors to import finished appliances using cheaper Chinese steel without penalty, putting Whirlpool at a $70 per-unit cost disadvantage. The closure of these loopholes, combined with Whirlpool’s 80% U.S. manufacturing footprint, positions the company as a major winner of the new trade policies once they are fully implemented in the second half of 2025.

In the near term, however, Whirlpool acknowledged that aggressive inventory preloading by competitors ahead of tariff implementation has temporarily disrupted the U.S. market. Asian imports surged by 30% year-over-year in the fourth quarter of 2024 and continued into early 2025, leading to elevated channel inventories and price pressure. Management expects similar dynamics to persist into the second quarter before conditions normalize. Nevertheless, Whirlpool remains confident in its ability to manage through this disruption, citing strong retailer support for upcoming product launches and continued disciplined pricing strategies.

Beyond tariffs, Whirlpool’s growth initiatives were a major point of emphasis. The company is undertaking its largest product refresh in over a decade, turning over 30% of its major domestic appliance portfolio in North America this year. At the recent Kitchen & Bath Industry Show (KBIS), Whirlpool’s new KitchenAid, JennAir, Maytag, and Whirlpool brand products received highly positive feedback, winning multiple awards. Management highlighted that these new innovations, combined with aggressive marketing and stronger price realization, are expected to drive significant margin expansion in the second half, particularly in North America.

Overall, Whirlpool’s management struck a confident tone, reaffirming their strategy to offset near-term headwinds through pricing, cost initiatives, and supply chain adjustments, while laying the groundwork for stronger financial performance as the tariff tailwinds built. Despite macro uncertainty and ongoing challenges from preloaded inventories, the company’s long-term outlook remains unchanged, supported by a strengthened competitive position, a robust innovation pipeline, and a firm commitment to debt reduction and shareholder returns.

Trends this week:

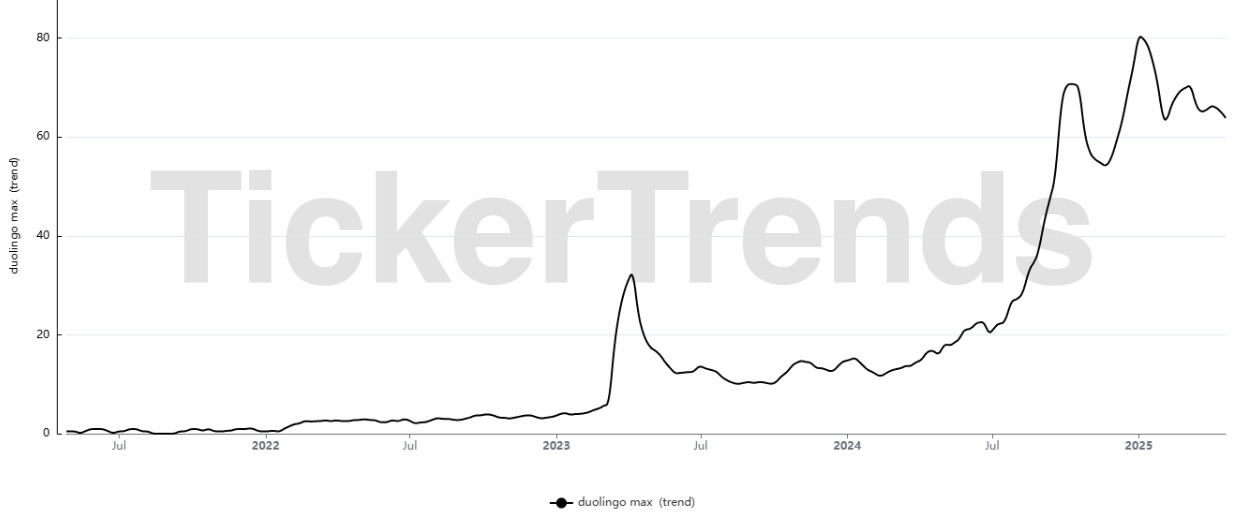

Duolingo Inc ($DUOL):

Duolingo has announced the beta launch of a new course teaching chess, marking its first major content expansion since introducing math and music lessons in 2023. The course, initially available to a limited number of iOS users starting in April, is designed to teach beginners and intermediate players the fundamentals of chess through interactive lessons, puzzles, and mini-matches against the app’s new character coach, Oscar. The rollout to all iOS users is expected over the next few months, with expansion to Android and additional languages planned later in the year. The company emphasized that the chess course aligns with Duolingo’s broader mission of making learning accessible and engaging, positioning chess as a new skill that can be improved with daily practice — much like a foreign language.

Unlike existing chess apps that cater largely to competitive players, Duolingo’s offering is aimed squarely at newcomers. Lessons start from the basics, such as how individual pieces move, and build up to more complex strategies, using the same gamified progression system familiar to users of its language courses. According to Duolingo’s product team, the goal is to remove the intimidation factor often associated with learning chess and introduce the game to millions of new players worldwide. Features like error hints, visual move guides, and AI-driven difficulty scaling are built in, though a more advanced explanation system, similar to Duolingo Max’s “Explain My Answer” feature for languages, is still under development for chess.

From a financial standpoint, analysts are optimistic about what chess could add to Duolingo’s business. D.A. Davidson estimates that the chess offering could contribute between $60 million and $150 million to total bookings by 2026, depending on adoption rates. However, most Wall Street analysts, including Morgan Stanley’s Nathan Feather, view Duolingo’s non-language offerings as “call options” rather than core growth drivers at this stage. Feather reiterated an Overweight rating and a $435 price target on the stock, emphasizing that the primary investment thesis remains grounded in the strength of Duolingo’s language platform, a market four times larger than its next biggest vertical.

The market responded positively to the chess announcement and analyst endorsements, with Duolingo’s stock jumping 10% following the news, narrowing its year-to-date losses and creating new momentum heading into its May 1 earnings report. While the addition of chess is unlikely to materially shift near-term earnings, it signals a broader ambition to deepen user engagement and expand Duolingo’s addressable market. If chess proves successful, it could open the door for further non-language educational categories, offering long-term optionality while reinforcing Duolingo’s reputation as a leader in accessible, gamified learning.

Duolingo’s move into chess is a calculated expansion rather than a transformational pivot. Early reception appears favorable, and while the financial impact is expected to be modest relative to the company’s core language business, the strategic implications are significant. By continuing to innovate thoughtfully and build adjacent learning categories, Duolingo could strengthen user loyalty, increase cross-category engagement, and position itself for broader growth opportunities in the evolving digital education market.

Nintendo Co Ltd ($NTDOY):

The Nintendo Switch 2 pre-order launch officially opened in North America on April 24, but it quickly turned into a chaotic and frustrating event for consumers. After a delay caused by tariff concerns earlier this month, Nintendo finally made pre-orders available at major retailers including GameStop, Walmart, Target, Best Buy, and its own My Nintendo Store. However, stock sold out within minutes at most outlets, with some customers experiencing long wait times, technical errors, and even abrupt order cancellations. Nintendo acknowledged the "very high demand" and warned that even users who registered directly on its site might not receive their console by the June 5 release date.

Retailers like GameStop tried to stagger pre-orders by opening in-store reservations later in the day, but their websites crashed under heavy traffic. Reports from frustrated customers described error messages, disappearing carts, and pre-orders that were canceled almost immediately after checkout, particularly at Walmart and Target. Adding to the confusion, Nintendo's own invite-only system to buy a Switch 2 has been overwhelmed, and not everyone who registered will get an invite before launch day. Nintendo confirmed that in Japan alone, 2.2 million people entered the pre-order lottery—far exceeding available supply—and it appears a similar shortage is playing out in North America.

Despite the messy rollout, demand for the Nintendo Switch 2 remains exceptionally strong, with most retail channels completely sold out within hours. The standard Switch 2, priced at $450, and the $500 Mario Kart World bundle both quickly disappeared from store inventories. Accessories for the Switch 2, such as the updated Pro Controller and Joy-Con 2 bundles, also saw brisk sales, although some price increases were quietly introduced ahead of pre-orders. Analysts speculate that supply will remain tight for months after launch, especially given ongoing tariff uncertainty and production constraints, even though Nintendo has ramped up manufacturing efforts in Vietnam to avoid higher import duties.

The Switch 2’s overwhelming early demand signals a strong potential sales cycle for Nintendo, despite concerns about the console's higher price point compared to its predecessor. Pre-orders have revealed that the broader gaming community is willing to absorb a $450-$500 price tag, even amid economic pressures and political uncertainty. While Nintendo faces risks from possible future tariff hikes and supply chain disruptions, the early momentum for Switch 2 could significantly boost the company’s hardware revenues through the back half of 2025 and into 2026, helping to offset the maturing lifecycle of the original Switch platform.

While the Switch 2’s pre-order launch was plagued by technical mishaps and customer frustration, the underlying takeaway is clear: Nintendo has another blockbuster on its hands. The company’s ability to meet pent-up demand while managing tariff impacts will be crucial in determining whether it can fully capitalize on this launch window. For now, though, investors and analysts alike will likely view the intense consumer interest as a bullish signal for Nintendo’s near-term earnings potential.

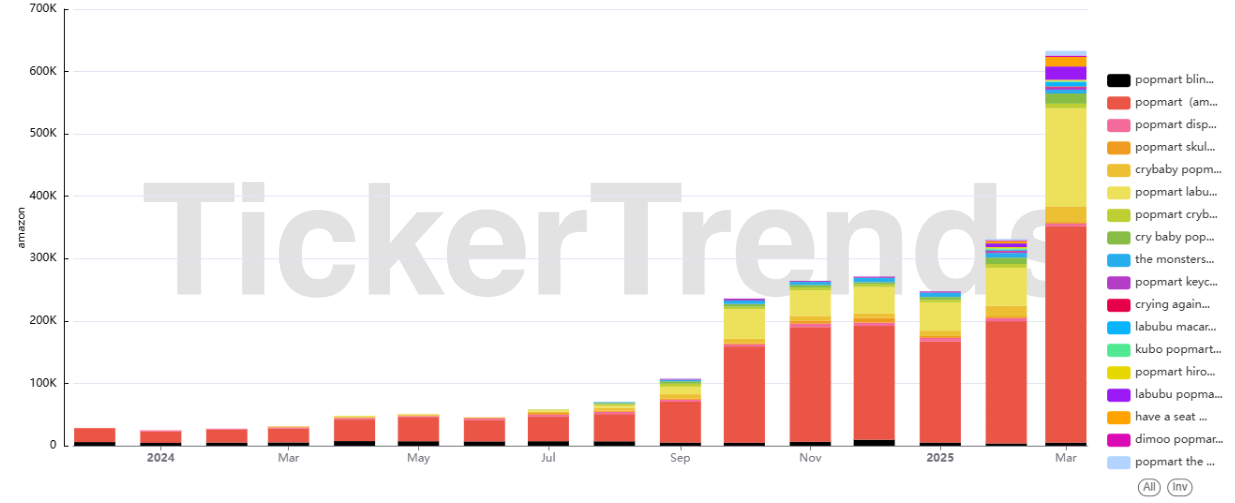

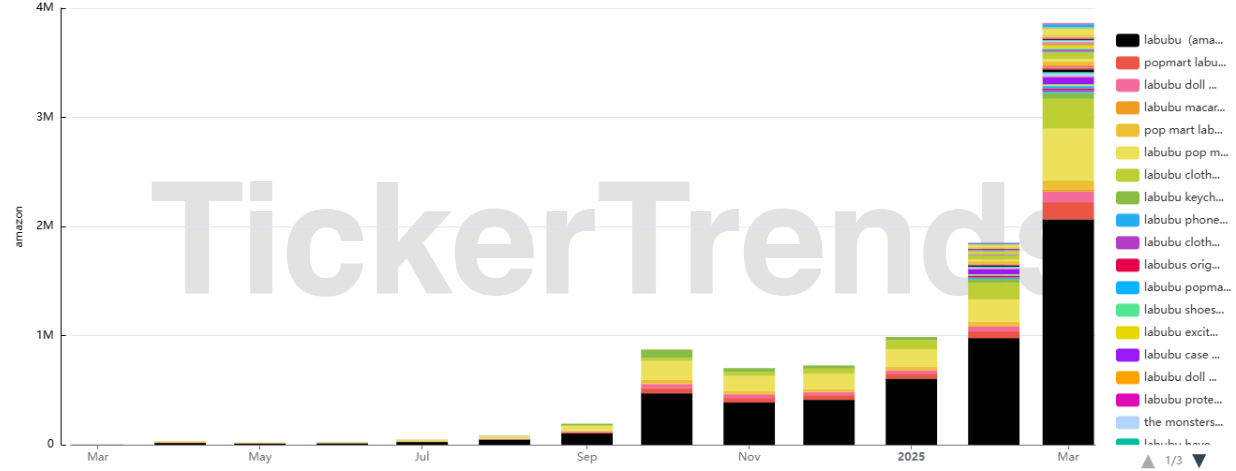

Pop Mart International Group Ltd (9992.HK):

A small, fluffy creature with a mischievous grin has become the latest must-have collectible, sending fans from Bangkok to Chicago into a buying frenzy. The plush character, known as Labubu, is part of Chinese brand Pop Mart’s popular "The Monsters" series, and recent releases have triggered scenes of chaos both online and in stores. Launched on April 25, 2025, the newest collection, “Big Into Energy,” sold out almost instantly, as collectors worldwide scrambled to secure the hand-sized blind box figurines. Retailing between $13 and $28 depending on the region and collection, Labubu dolls are now fetching double or triple those prices on resale platforms like eBay and StockX.

Labubu, first created in 2015 by Hong Kong-born illustrator Kasing Lung, draws inspiration from Nordic folklore and has recently exploded in popularity, largely fueled by celebrity endorsements. Blackpink’s Lisa has frequently showcased her Labubu charms on Instagram, calling the character her “baby,” while Rihanna has also been spotted accessorizing luxury handbags with the plush toys. Their endorsements have elevated Labubu from niche toy to a bona fide fashion accessory, seen dangling from designer bags even at Paris Fashion Week.

The "Big Into Energy" series, which features Labubu pendants representing different emotions like love, hope, and happiness, further amplified the craze. In Bangkok, shoppers lined up outside malls well before dawn, even though many had pre-registered for purchase slots. In the United States, long queues formed outside Pop Mart stores, with the Michigan Avenue location in Chicago seeing a line that wrapped around the block by 6 a.m. Some fans, armed with foldable chairs and blankets, waited overnight. The intensity of demand even sparked reports of chaotic scenes at locations like Westfield Century City in Los Angeles, where police were called to manage early morning crowds.

Pop Mart’s distribution model, selling Labubus in "blind boxes" where buyers only discover which design they received after opening, has fueled the hype by blending surprise and scarcity. Rare "secret" editions, which have just a 1-in-72 chance of appearing, are particularly sought after. This scarcity model has drawn comparisons to past collectible crazes like Beanie Babies and Squishmallows, but Labubu's rise is occurring in a much more globalized, social media-driven environment.

With soaring popularity, a booming secondary market has emerged. Some buyers are flipping their finds for $90 or more, compared to the $27.99 retail price in the U.S. Fake Labubus—nicknamed "lafufus"—have also begun circulating, leading fan communities like r/labubu on Reddit to issue warnings and tips for spotting counterfeits. In addition, fan-made outfits for Labubu dolls, available on platforms like AliExpress and through local pop-up shops, have turned dressing Labubus into a subculture of its own, further strengthening emotional attachment among collectors.

Financially, Pop Mart is reaping the rewards. The company reported over $410 million in sales for its "The Monsters" series last year, and annual revenue in Southeast Asia alone surged by 619% to more than $309 million. The Labubu craze is now beginning to take hold in the U.S., although American consumers face higher prices due to a 145% tariff on most Chinese imports, a byproduct of the ongoing U.S.–China trade war. Despite the high price tag, demand shows no signs of slowing. Pop Mart is capitalizing by selling the new series both through its own website and its official Amazon store, offering another channel for eager buyers. However, even there, stock sells out within minutes of going live, making the Labubu hunt a competitive endeavor.

In the broader cultural context, Labubu represents more than just another toy craze. Collectors often describe dressing up their Labubus and attaching them to their bags as a way to reconnect with their inner child, a form of comfort and self-expression in a stressful world. "It brings people back to their childhood," said Thania Gonzalez, a Los Angeles-based collector. "Just looking at them is healing." What began as a niche creation from a Hong Kong-born artist has rapidly morphed into a global phenomenon. The Labubu frenzy illustrates the potent combination of scarcity, celebrity endorsement, emotional connection, and social media amplification. For Pop Mart, Labubu’s meteoric rise not only validates its business model but also positions it as a major player in the increasingly lucrative global collectibles market. Whether the momentum will sustain over time remains to be seen, but for now, Labubu is not just a toy — it’s a global cultural phenomenon.

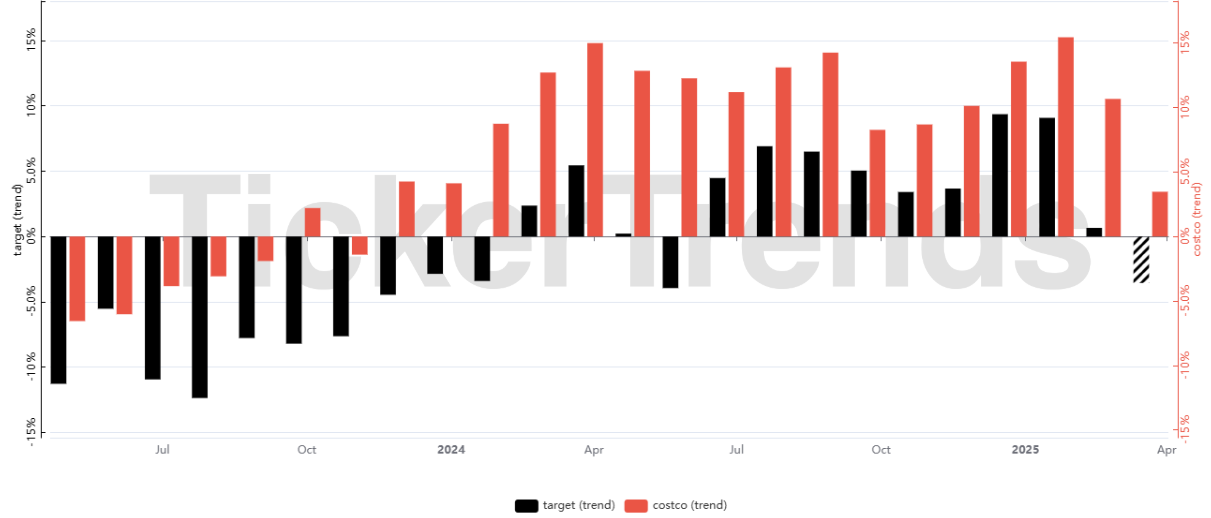

Target Corp ($TGT):

In January 2025, Target Corporation ignited a major backlash when it announced that it would be scaling back its diversity, equity, and inclusion (DEI) initiatives. The changes included eliminating hiring goals for minority employees, disbanding an executive committee focused on racial justice, and ending participation in external diversity indexes such as the Human Rights Campaign’s Corporate Equality Index. The retailer unveiled a replacement strategy dubbed “Belonging at the Bullseye,” but critics have dismissed it as a retreat from its previously strong public commitments to diversity.

Since then, the fallout has been severe and sustained. According to data from Placer.ai, Target’s foot traffic has declined for eleven consecutive weeks, with February’s traffic down 9% year-over-year and March down 6.5%. In contrast, Costco, which maintained its DEI programs despite similar political pressures, has enjoyed sixteen straight weeks of traffic growth, with March traffic up 7.5% year-over-year. The numbers reflect the extent to which Target’s decision alienated a meaningful portion of its customer base, particularly among Black and progressive shoppers.

The boycott, spearheaded by Rev. Jamal Bryant of New Birth Missionary Baptist Church near Atlanta, gathered major momentum through a 40-day “Target Fast” during Lent that reportedly involved over 200,000 participants. Bryant has since called for a full boycott until Target restores its DEI commitments and significantly reinvests in Black-owned businesses. His efforts have been bolstered by other civil rights leaders, including Rev. Al Sharpton, who met with Target CEO Brian Cornell in mid-April. Though Sharpton described the meeting as “constructive and candid,” he indicated that a larger boycott could still be on the table if Target fails to make further commitments to minority communities.

Target has responded by reaffirming its pledge to spend $2 billion with Black-owned businesses — a commitment originally made in 2021 — but critics argue that more systemic action is needed. Bryant has remained adamant that without substantial change, pressure will continue to mount, both from consumers and faith leaders. Meanwhile, online sentiment toward Target has turned sharply negative, with widespread calls for boycotts spreading across platforms.

Black Americans’ purchasing power is projected to rise to $2 trillion by 2026, and studies show that more than half of LGBTQ+ consumers — a traditionally supportive demographic for Target — are willing to boycott brands that roll back equality initiatives. Meanwhile, competitors like Walmart and McDonald's, which also pulled back DEI efforts but have different customer bases, have not seen the same magnitude of foot traffic decline. The consequences are already visible: since Tickertrends first flagged the growing DEI-related boycott pressure in our What’s Trending with Tickertrends #22 issue earlier this year, Target’s stock price has dropped ~15%. This performance lag highlights how socio-political controversies can materially impact shareholder value when they clash with a brand’s core customer identity.

Compounding Target’s woes are broader operational challenges. The company has struggled for four consecutive years to grow annual revenues meaningfully, while margins have been squeezed by a consumer shift toward essentials like groceries and away from discretionary categories such as home goods and apparel. External pressures, including theft, supply chain issues, and backlash against its Pride Month collections, have further weighed on performance. And even a well-publicized new collaboration with Kate Spade New York, launched in mid-April, appears to have done little so far to reverse the broader negative traffic trends.

While CEO Brian Cornell has attempted to frame Target’s recent moves as a realignment with “evolving external landscapes,” critics, including civil rights leaders and even descendants of Target’s founding family, have publicly decried the rollback as a betrayal of the values Target once championed after the killing of George Floyd in its hometown of Minneapolis. With continued organized boycotts, an eroded brand reputation among key customer groups, and sluggish operational fundamentals, Target now finds itself navigating one of the most precarious periods in its modern history. Whether it can win back disaffected consumers and stabilize traffic trends without further alienating either side of America’s cultural divide remains a major open question — but for now, the data suggest the consequences of its DEI retreat are still gathering momentum.

McDonald’s Corporation ($MCD):

In a move that has thrilled fans and fueled speculation about the return of another beloved item, McDonald’s officially announced last week that it is bringing back chicken strips to its U.S. menus for the first time in five years. Beginning May 5, the new McCrispy Strips — featuring 100% white meat chicken coated in a golden-brown, black pepper-seasoned breading — will be available nationwide. Alongside the strips, McDonald’s is introducing a new Creamy Chili Dip, described as a savory, tangy sauce with a hint of chili heat and a toasted sesame finish.

The McCrispy Strips mark McDonald's first permanent U.S. menu addition since the launch of the McCrispy sandwich in 2021, signaling a renewed focus on chicken as a growth category. According to Alyssa Buetikofer, McDonald’s Chief Marketing and Customer Experience Officer, the launch responds to "remarkable" demand across the industry for craveable chicken options. "We took our time, listened to our fans and created a product we knew they would crave," she said in the company's news release.

Although the McCrispy Strips are not identical to the once-iconic Chicken Selects — the breading is reportedly thinner and more aligned with the McCrispy sandwich texture — early taste testers have praised the new strips for their seasoned flavor reminiscent of the original favorite. Some fans still long for the exact return of Chicken Selects, but many welcomed the new offering as a worthy successor, especially paired with the new Creamy Chili Dip. The revival of chicken strips also has a deeper significance: it moves McDonald’s closer to the highly anticipated return of the Snack Wrap, a fan-favorite item discontinued in 2016. Earlier this month, McDonald’s teased that Snack Wraps would return in 2025, widely believed to be May 14. Having chicken strips once again available as a core menu item lays the groundwork for the Snack Wrap’s full comeback, since the original wraps were made using similar chicken tenders. The move comes as McDonald’s aims to solidify its position in the chicken category, a space where competitors like Chick-fil-A, Wingstop, and Raising Cane’s have captured significant consumer attention. It also responds to years of customer petitions and social media campaigns demanding the return of snack wraps and crispy chicken tenders.

In terms of pricing, McCrispy Strips will be sold in three- or four-piece options, priced between $4.99 and $5.99, and served with one or two sauces depending on the size. Beyond the Creamy Chili Dip, customers can also choose from classic McDonald's sauces like Tangy Barbecue, Honey Mustard, and Spicy Buffalo.

Reaction to the announcement has been enthusiastic, with fans flooding social media to express excitement. Food influencers like @Snackolater praised the McCrispy Strips as a "solid entry into the fast food chicken strips game," while some die-hard Chicken Selects devotees voiced mild disappointment that the original recipe wasn’t fully revived. Still, for McDonald’s, this is a notable win. After a challenging period marked by shifting consumer preferences and increased competition, the chain is clearly listening to its core fanbase. Buetikofer emphasized that McDonald’s isn’t stopping here: "The best part is we’re just getting started."

Delta Air Lines Inc ($DAL):

In a shocking mid-air incident that has gone viral, passengers aboard a Delta Air Lines flight from Atlanta to Chicago were forced to manually hold up a collapsing ceiling after panels detached during ascent. The dramatic event, which unfolded on April 14, was captured on video and widely shared across TikTok and Instagram by content creator Lucas Michael Payne, quickly attracting hundreds of thousands of views and raising questions about aviation safety and maintenance standards.

Footage from the incident shows multiple passengers reaching overhead, physically holding the ceiling panels in place while the plane continued its climb. Wires and other structural components were visible above the loosened panels, creating a chaotic and unsettling scene inside the Boeing 717 aircraft. According to passengers on board, the cabin crew was initially unable to assist due to mandatory seating during ascent, leaving travelers to stabilize the ceiling themselves for 30 to 45 minutes until flight attendants could use neon yellow duct tape to temporarily secure the panels.

Passenger accounts describe the suddenness of the collapse. Chicago resident Tom Witschy, who was on the flight, recalled hearing a loud banging sound, which he initially thought was luggage shifting, before realizing a section of the ceiling had crashed down, nearly striking an elderly woman seated in front of him. Along with other nearby passengers, Witschy acted quickly to prevent further collapse until the crew could intervene.

Delta Airlines, in a statement to The New York Post, confirmed that no injuries were reported and that the loose ceiling panel was affixed with tape so passengers no longer needed to manually hold it during the flight. After the temporary fix, the plane returned to Atlanta where passengers were deplaned, waited approximately two hours, and were rebooked onto another aircraft to complete their journey to Chicago.

As compensation, Delta reportedly offered affected passengers 10,000 air miles — roughly equivalent to $120 in value. However, the airline's gesture was widely criticized across social media and news outlets, with many arguing that such compensation was grossly inadequate given the terrifying nature of the event. Some passengers, including Witschy, indicated that they have filed refund requests due to the lost work hours and emotional distress caused by the ordeal.

Aviation experts and analysts have weighed in, noting that although the ceiling panels are cosmetic and not critical to flight operation, the incident nonetheless exposes alarming maintenance lapses. “Cosmetic or not, panels falling at 30,000 feet create panic and distrust among passengers,” said one former NTSB investigator. The FAA has not yet announced whether it will launch a formal investigation, but growing concerns around Delta’s maintenance standards are now under renewed scrutiny. This event adds to a string of Delta mishaps this year, including a February 2025 incident where a Delta aircraft overturned on landing at Toronto Pearson International Airport — albeit without serious injuries. Delta, often ranked as one of the most reliable airlines in the U.S., now finds itself grappling with public relations fallout at a time when consumer confidence in airline safety is already fragile. Despite winning accolades for on-time performance and overall reliability in 2022 and 2023, incidents like this threaten to erode that hard-earned reputation.

For passengers, the incident is more than just an inconvenience. Many described the experience as terrifying, with one traveler commenting, “I’ve always been nervous about flying, but I never imagined I’d be physically holding part of the plane together.” The event has fueled ongoing conversations about passenger rights, airline accountability, and the adequacy of compensation in extreme situations.This incident is also a reminder that, while air travel remains statistically the safest mode of transportation, visible mechanical failures — even involving non-critical parts — can have a profound psychological impact on flyers.

While no one was physically harmed in the ceiling collapse, Delta's brand has certainly taken a hit — and it remains to be seen how the airline will rebuild trust as public scrutiny intensifies. For now, passengers might find themselves glancing up a little more nervously next time they board.

Walmart Inc ($WMT):

In a crucial behind-the-scenes meeting this week, the CEOs of Walmart, Target, and Home Depot privately warned President Donald Trump that his aggressive new tariff strategy could soon cause price hikes, supply chain disruptions, and even empty shelves across America, according to multiple reports from Reuters, CBS News, CNBC, and Retail Dive. The meeting, held Monday at the White House but not listed on Trump’s public schedule, underscores the intensifying alarm within the retail sector over the economic fallout of Trump’s protectionist trade agenda — especially as the critical back-to-school, Halloween, and holiday shopping seasons approach.

Doug McMillon (Walmart), Brian Cornell (Target), and Ted Decker (Home Depot) all characterized the meeting afterward as “productive” and “constructive” in their nearly identical corporate statements. But behind the scenes, sources told CBS News and Bloomberg that the retail leaders were blunt about the risks: 145% tariffs on Chinese goods and 10% duties on imports from dozens of other countries could raise prices sharply, squeeze already-thin margins, and choke supply chains, potentially leaving store shelves understocked at the worst possible time.

The stakes are enormous. The National Retail Federation (NRF) estimates that new tariffs could strip up to $78 billion in annual spending power from U.S. consumers, hitting categories like apparel, footwear, home goods, and toys hardest. With American families already weary after years of high inflation, tariffs represent another burden that could dent consumer confidence and discretionary spending just as the retail sector’s most important months get underway.

While Walmart is somewhat better positioned than its peers — only about a third of its goods are sourced internationally, compared to around 50% for Target — the impact would still be significant. Walmart relies heavily on imports from China and Mexico, two countries at the center of Trump’s trade offensive. Executives from Walmart have acknowledged in recent earnings calls that despite their best efforts to diversify supply chains and hold prices steady, consumers are likely to see some increases, particularly on seasonal and discretionary goods.

President Trump himself, speaking to reporters later in the week, conceded that the tariffs are “very high” and admitted that many affected goods "aren't going to sell" at current price points if duties remain in place. Nonetheless, he stood by the broader strategy, describing it as necessary to "reset" unfair global trade practices and boost American manufacturing.

For Walmart specifically, the near-term implications are twofold. First, while Walmart’s grocery dominance — with two-thirds of its merchandise made, grown, or assembled in the U.S. — gives it some cushion, the imported goods side of the business faces undeniable pressure. Home goods, clothing, electronics, toys, and seasonal items could all see cost inflation heading into the peak shopping period. Second, Walmart’s historical brand promise of “Everyday Low Prices” could be tested more severely than at any point since the 2008 financial crisis. The retailer has already indicated that holding prices steady may come at the cost of margin compression, a trend that could weigh heavily on profitability if tariffs persist into 2026.

Supply chain warnings are also flashing red. With the NRF forecasting a potential 15% decline in total net import volumes by year-end, selective product shortages could become a reality, making Walmart's logistics agility more important than ever. While Walmart has invested heavily in its supply chain resilience in recent years — including domestic sourcing initiatives and improved inventory management systems — no retailer is immune to systemic bottlenecks, especially when dealing with tight holiday timelines.

Walmart’s strategy will likely focus on leveraging its domestic supply chain advantages while continuing to negotiate pricing with suppliers, expand private-label alternatives, and aggressively market itself as a value leader to inflation-fatigued consumers. Still, if tariffs stay elevated through Q3 and Q4, even Walmart’s scale and operational excellence may not fully insulate it from slowing discretionary spending and margin compression.