What’s Trending with TickerTrends #28

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Netflix Inc ($NFLX):

Netflix delivered a strong first quarter in 2025, significantly beating analyst expectations on both revenue and earnings. The company reported normalized earnings per share of $6.61 versus the consensus estimate of $5.68, representing a 16.4% surprise. Revenue came in at $10.54 billion, slightly above expectations of $10.50 billion, marking modest top-line outperformance. The earnings beat was primarily driven by lower-than-expected expenses in the quarter, which management noted were largely due to timing and are still expected to impact full-year results.

Operating income saw a significant boost, with management reaffirming their full-year 2025 operating margin guidance of 29%, while warning that content and marketing expenses will ramp materially in Q3 and Q4. The second half of 2025 will feature major returning titles and a heavier film slate. Despite the expected increase in spend, Netflix remains committed to achieving $8 billion in free cash flow for the year and reiterated that, in the absence of material M&A, most of this cash will be returned to shareholders through buybacks.

A major theme of the call was Netflix’s long-term ambition to double revenue and triple operating income by 2030—although management was clear this was an aspirational internal target, not formal guidance. Co-CEO Greg Peters framed Netflix’s current ~$40 billion revenue and ~300 million paid memberships as just scratching the surface of its addressable market, citing that the company captures less than 10% of TV viewing hours and only 6% of consumer entertainment and ad spend in its markets. This underlines the company’s bullish outlook on long-term growth, both in subscriptions and advertising.

Netflix’s advertising business remains a critical strategic pillar. The company launched its proprietary ad tech platform in the U.S. and Canada this quarter, with plans to roll it out to 10 more markets in the coming months. Initial results have been in line with expectations, and the platform has enabled greater flexibility, targeting precision, and advertiser satisfaction. Management reiterated their goal of doubling advertising revenue in 2025 and emphasized how Netflix’s relatively small ad business gives it insulation from broader macro ad slowdowns. Longer-term, Netflix aims to bring its advertising personalization capabilities to the same level of sophistication as its renowned content recommendation engine.

Despite economic uncertainty and a potential global slowdown, Netflix has not seen any meaningful changes in subscriber retention or downgrades. The company reported strong engagement and stable churn, with its lower-priced ad-supported plan acting as a buffer against price-sensitive cancellations. Importantly, management continues to highlight that entertainment spending is typically resilient in tougher economic climates, and that Netflix offers significant perceived value, especially compared to bundled cable or other streaming services.

On the content front, Netflix reaffirmed its commitment to both large-scale original productions and curated licensed content. The platform continues to double down on global content creation with production commitments in the U.K., Korea, and Mexico. Live content is also becoming a bigger part of the strategy—especially high-impact sports and events like NFL Christmas games and the Taylor-Serrano fight in July, which the company says are powerful acquisition and retention tools despite being a small part of the viewing pie.

The company is also investing selectively in gaming and interactive content. While still early, Netflix is encouraged by engagement in categories like immersive narrative games (e.g. Squid Game: Unleashed), children’s titles (like the upcoming Peppa Pig), and party games. Games currently represent a small fraction of total investment, and management reiterated a cautious and iterative investment approach as it learns what drives real engagement and retention.

In terms of product innovation, Netflix is focused on improving content discovery and personalization. A redesigned TV homepage interface is set to launch later in 2025, alongside an interactive, generative search tool. The company is also beginning to test video podcast content and expand its creator-led premium offerings, building relationships with influencers and talent that began on platforms like YouTube.Overall, Netflix’s Q1 2025 results demonstrate strong momentum with disciplined financial execution, measured but ambitious strategic bets in ads and gaming, and growing confidence in its ability to expand margin and free cash flow.

American Express Co ($AXP):

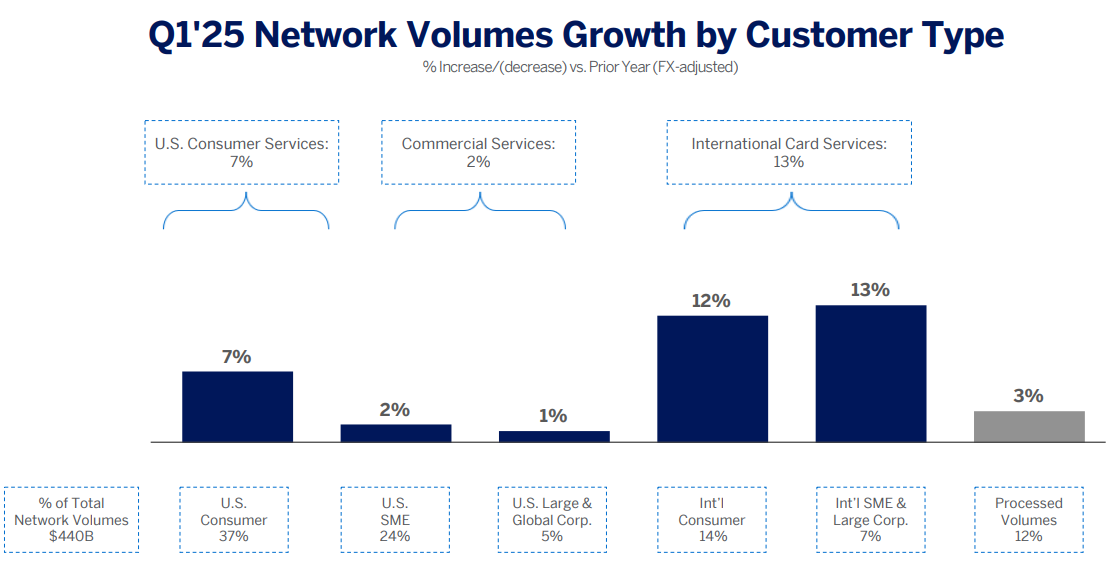

American Express reported a strong start to 2025, with first-quarter results demonstrating continued momentum in consumer spending, solid credit performance, and disciplined execution amid growing macroeconomic uncertainty. The company generated $17 billion in revenue, reflecting 8% year-over-year growth on an FX-adjusted basis—or 9% when adjusting for the leap year impact—alongside $2.6 billion in net income and earnings per share of $3.64. These results came in line with expectations and supported management’s reaffirmation of its full-year guidance, which projects 8% to 10% revenue growth and EPS between $15 and $15.50. The company’s premium-focused business model, expanding Millennial and Gen-Z customer base, and diverse revenue mix continue to be key drivers of this resilience.

American Express confirmed the stability of spending patterns across American Express's customer base. Total cardmember spending rose 6% year-over-year, or 7% excluding the leap year impact, with particularly strong growth in goods and services. While airline billings moderated slightly, restaurant and lodging spending remained robust, sustaining the broader Travel & Entertainment (T&E) category. Perhaps more notably, spending held steady throughout the quarter, with no evidence of a front-loading effect, and remained consistent in early April. Management emphasized that their affluent cardmembers have historically shown little correlation between spending habits and macro indicators like stock market performance or consumer confidence, and this trend has continued into 2025.

The company is closely monitoring evolving conditions, including the potential impacts of tariffs and labor market trends. Management noted that while the outlook has become more uncertain, their CECL reserve models now incorporate a peak unemployment assumption of 5.7%—higher than prior expectations—but still aligned with American Express’s capacity to meet its full-year targets. Importantly, executives emphasized that white-collar unemployment would have more direct implications for Amex’s cardholder base than general unemployment figures, given the company’s strong skew toward higher-income, salaried customers.

American Express's risk management discipline remains a core strength. Delinquency and charge-off rates remained below pre-pandemic levels, and newer cardmembers—those with fewer than 24 months of tenure—are showing a 30% lower delinquency rate compared to similar cohorts in 2019. Millennial and Gen-Z customers continue to be a strong source of growth, representing more than 60% of new global consumer card acquisitions and about 35% of total billed business. Their spend grew by 15% year-over-year in the U.S. and 22% internationally. Despite concerns around student loan repayments and cost-of-living pressures, this demographic continues to show strong credit profiles with average FICO scores around 750 and lower revolving balances than older cohorts.

The company has built substantial leverage into its expense base, particularly in marketing and operating costs, allowing it to scale up or down as conditions warrant. While management acknowledged the potential to reduce discretionary spending if necessary, they were clear that long-term strategic investments—such as technology upgrades and product refreshes—would not be compromised to meet short-term earnings targets. This long-term orientation was evident in their discussion of ongoing investments in SME capabilities, including the recent acquisition of Center, which complements prior investments in Kabbage and Nipendo. Together, these assets form the backbone of an evolving SME ecosystem designed to integrate payments, lending, expense management, and B2B automation.

International growth also remained strong, with billed business up 14% year-over-year across all top five markets. This performance underscores Amex’s global diversification and increasing appeal of its premium value proposition outside the U.S. The company also maintained its record pace of fee growth, with card fees increasing 20% and accounting for a significant portion of the company’s 75% revenue mix derived from spend and fees—reducing reliance on lending income and providing further insulation from credit cycles.

On the experiential front, American Express continues to deepen its competitive moat through vertical integration in high-engagement categories like dining and travel. The acquisition of Resy, Tock, and Rooam enables Amex to create a “closed-loop within a closed-loop” by connecting cardmembers and merchants directly within its platform. This is especially resonant with younger cohorts who prioritize experiences, and the success of these initiatives is evident in the growth of products like the Gold Card, which has been repositioned as a premier restaurant spending tool.

American Express enters the remainder of 2025 with strong momentum, an increasingly premium customer base, and a structurally advantaged business model that balances growth with resilience. Management’s confidence in its ability to navigate macroeconomic shifts stems from its well-diversified revenue streams, superior credit profile, and a history of strategic discipline. While risks such as tariffs, potential economic slowdowns, and labor market dynamics remain, the company appears well-positioned to deliver on its financial targets while continuing to invest for long-term shareholder value creation.

Trends this week:

Nintendo ADR ($NTDOY):

Nintendo has officially confirmed that U.S. retail preorders for the Nintendo Switch 2 will begin on April 24, 2025, after a two-week delay caused by uncertainty surrounding new tariff policies introduced by the Trump administration. Despite growing concern that these tariffs might lead to widespread hardware price hikes, Nintendo has reaffirmed that the Nintendo Switch 2 will launch at $449.99, and the Switch 2 + Mario Kart World bundle will remain at $499.99. While the core console pricing has been preserved, the pricing of several accessories has increased, highlighting Nintendo’s delicate balancing act in navigating geopolitical tensions, inflationary pressures, and consumer expectations.

The delay in preorder activity was initially triggered by aggressive reciprocal tariffs introduced by the U.S. government earlier in April. The policy imposes a 145% tariff on Chinese goods and a 10% tariff on Vietnamese products—two regions where Nintendo has historically outsourced much of its manufacturing. Although a partial rollback and a 90-day tariff pause on Vietnam was announced, the sudden policy shift created too much uncertainty for Nintendo to proceed with its original April 9 launch window. The company’s decision to postpone was driven by the need to assess supply chain costs and consumer price sensitivity, ultimately opting to maintain console prices unchanged while adjusting accessory prices modestly.

By holding the line on the headline $449.99 price tag, Nintendo avoids alienating consumers or triggering negative comparisons with its competitors—particularly Sony, which recently raised the price of PS5 models in several global markets. Maintaining price stability for the core console also protects Nintendo’s carefully managed brand equity, especially after early concerns over the Switch 2’s value proposition—concerns that arose due to a higher-than-expected $80 price tag for Mario Kart World, making it one of the most expensive base games in console history. While accessory prices have increased—by about $5 to $10 for key items like the Pro Controller ($84.99) and Dock Set ($119.99)—these are less likely to provoke widespread consumer backlash, particularly if bundled deals remain available at major retailers.

From a demand standpoint, early indicators point to robust interest. Retailers including Best Buy, Walmart, Target, and GameStop have all announced midnight openings and pre-order logistics that echo the fervor of past Nintendo launches. Best Buy, for instance, confirmed that “most stores” will open at midnight on June 5, the official release date. This high-touch, in-store rollout suggests that Nintendo expects early inventory to sell quickly—a positive signal for sell-through velocity and day-one revenue.

The Switch 2 itself appears to be a meaningful upgrade over its predecessor. It boasts a 7.9-inch HDR LCD display, improved frame rates up to 120Hz, and supports 4K Ultra HD resolution when docked, positioning it more competitively against Sony and Microsoft consoles from a hardware standpoint. It also comes with 256GB of onboard storage, eight times that of the original Switch, and new Joy-Con 2 controllers with magnetic locking and larger triggers—design tweaks likely aimed at both improving gameplay and strengthening accessory sales. These updates align well with Nintendo’s goal of creating a “strong and solid foundation” for developers, as expressed by senior director Takuhiro Dohta.

However, the company is also walking a fine line on consumer goodwill. There has been some frustration around inconsistent upgrade pricing for existing Switch titles—ranging from free to $20 for Switch 2 versions—and confusion over the use of "Game-key" cards, which in many cases do not include the full game on physical cartridges. These emerging practices, while intended to streamline costs, risk undermining the simplicity and value that has historically defined the Nintendo experience. Investors should watch how these issues evolve post-launch, particularly as social media feedback and YouTube influencers begin shaping early consumer sentiment.

Nintendo has however handled this situation extremely well. The delay and recalibration of preorder logistics in response to tariff announcements show operational agility, while the selective price adjustments reflect a clear prioritization of long-term brand and customer trust over short-term margin maximization. Nintendo is entering this next console cycle from a position of strength, with high consumer interest, disciplined execution, and a product lineup that includes not just Switch 2 hardware but marquee games like Mario Kart World (launching June 5) and Donkey Kong Bananza (launching July 17). While tariffs introduced a short-term disruption, Nintendo’s response has preserved its strategic trajectory. The unchanged launch price for Switch 2, despite cost pressures, signals confidence and pricing power, while early preorder momentum suggests strong initial sell-through potential. Investors should view the announcement as a net positive—one that reaffirms Nintendo’s capability to manage geopolitical risk while sustaining demand across a multi-generational customer base.

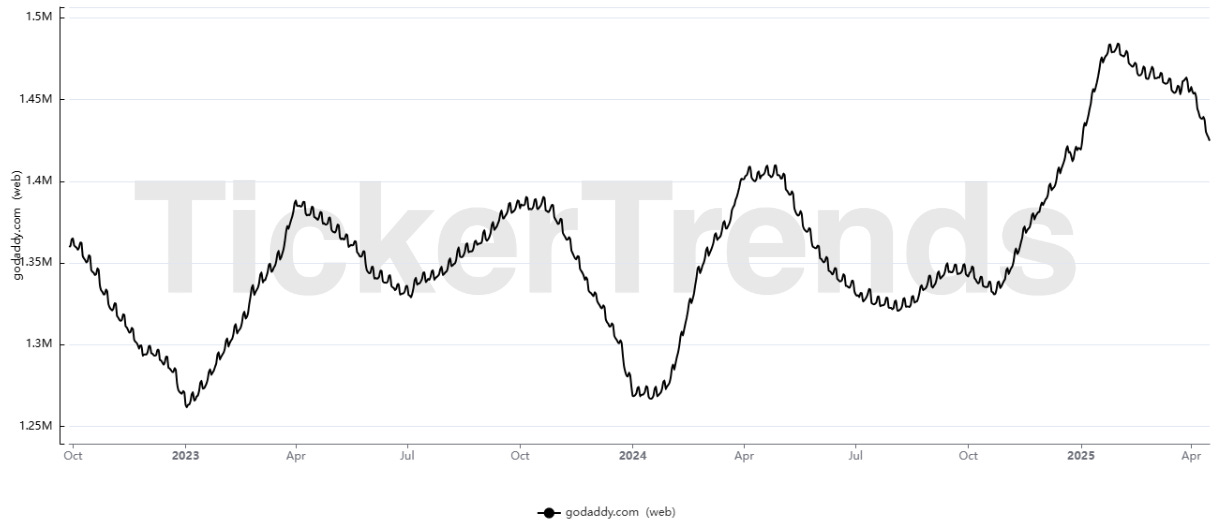

Zoom Communications Inc ($ZM) & Godaddy Inc ($GDDY):

On April 16, 2025, Zoom suffered a major global outage that disrupted its core services for nearly two hours, affecting video meetings, website access, and app functionality for tens of thousands of users. The incident, which peaked with over 67,000 outage reports on Downdetector, caused widespread disruptions to business operations, educational sessions, and virtual events. Zoom's own status page and investor portal were also inaccessible during the outage, further amplifying the confusion for users and stakeholders.

The root cause was not a cyberattack or internal system failure but a miscommunication between Zoom’s domain registrar, MarkMonitor, and registry partner GoDaddy Registry. Due to this error, the zoom.us domain was mistakenly placed under a “server hold” status—effectively disabling access to all services dependent on that domain. GoDaddy Registry, believing it had received the appropriate instruction, blocked the domain, bringing down Zoom's website, app, and meeting services. Zoom clarified that the issue was not caused by a Distributed Denial of Service (DDoS) attack or any breach in network security, but rather a domain-level administrative error.

By 5:00 PM ET, Zoom had restored service and issued an official statement thanking users for their patience. The company also provided guidance on DNS cache flushing to help users reconnect quickly. However, the brief but widespread nature of the outage led to backlash on social media, where users expressed frustration and confusion. Even major institutions like Harvard University posted advisories about the outage, recommending Microsoft Teams as a temporary alternative.

For Zoom, this incident comes at a critical time. The company, which rose to prominence during the COVID-19 pandemic, now operates in a more competitive hybrid work environment where uptime and reliability are vital differentiators. While it successfully restored services quickly and was transparent about the outage, the incident highlights its dependency on external service providers for critical infrastructure. With 300 million daily meeting participants and nearly 193,000 business customers—including Capital One, Dropbox, and Glassdoor—Zoom cannot afford service lapses that undermine trust.

This outage may prompt Zoom to reassess its domain and hosting architecture. Although domain registrars are typically low-risk partners, this event underscores the need for redundancy, contingency planning, and possibly diversification of backend infrastructure. Zoom has been positioning itself as more than just a video conferencing tool, expanding into AI-driven collaboration tools and enterprise communications. To maintain credibility in this evolving role, it must ensure that foundational services like domain resolution are fail-safe.

For GoDaddy, the fallout could be even more significant. As a global domain registrar and registry operator, GoDaddy’s primary value lies in its reliability and discretion. The fact that a clerical or protocol-level miscommunication could take down one of the world’s most essential business communication platforms is a serious reputational blow. While GoDaddy has not publicly commented in detail, Zoom’s statement clearly places the fault on GoDaddy Registry, suggesting the company unilaterally blocked the domain following incorrect communication. This could lead to contractual scrutiny, client defections, or tighter oversight of registrar practices.

This event may spark broader conversations within the tech industry about registrar accountability, especially for enterprise-level clients. As domain infrastructure is rarely top-of-mind for consumers or even IT departments, the incident shows how fragile digital ecosystems can be when foundational services are mishandled. Enterprises may now seek additional safeguards, such as monitoring tools, alerts for domain status changes, or even redundant domain failovers—services that GoDaddy and other registrars may be compelled to offer.

Both Zoom and GoDaddy will need to act swiftly to restore confidence. For Zoom, that means reinforcing its messaging around reliability, providing clearer uptime guarantees, and ensuring that domain-related failures do not happen again. For GoDaddy, it likely means implementing stricter validation protocols before enacting domain status changes, improving communication flows with registrars, and reassuring large customers that such errors are preventable in the future.

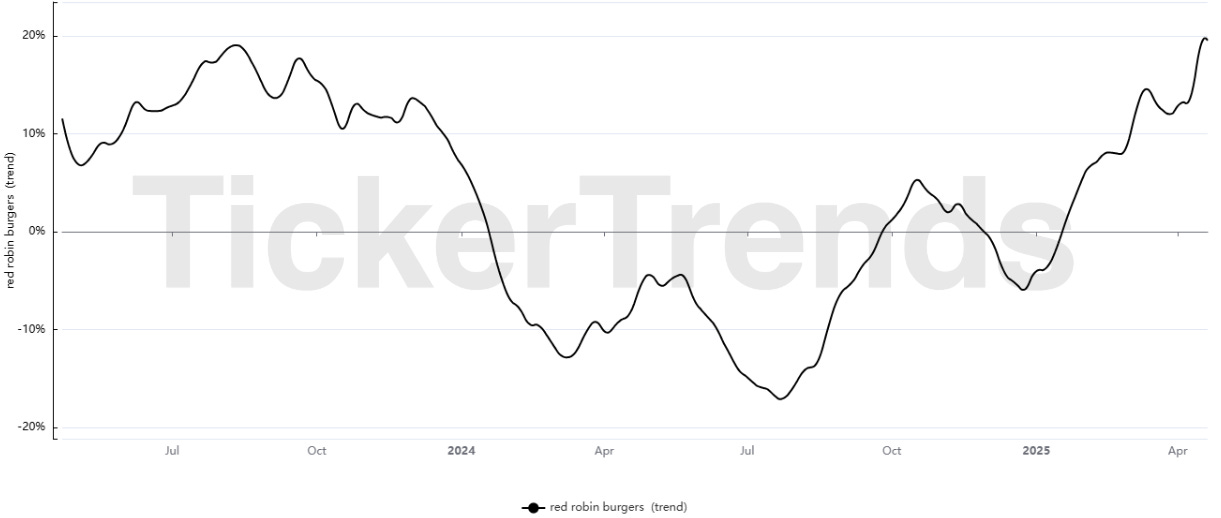

Red Robin Gourmet Burgers Inc ($RRGB):

Red Robin’s ambitious $20 “Bottomless Burger Pass” promotion, launched in honor of National Burger Month, was met with overwhelming demand—and equally overwhelming backlash—after the company’s website crashed under the strain of tens of thousands of eager customers. The pass, which promised a gourmet burger and bottomless side every day in May, sold out quickly. But the rollout was marred by widespread technical failures and checkout errors, leaving many customers frustrated and questioning the execution of the promotion.

The passes went on sale on April 17 at 11 a.m. ET and were marketed as an unbeatable value—potentially worth up to $682 if used daily. However, within minutes, Red Robin’s website buckled under an influx of more than 12 million visits, making it nearly impossible for many customers to access the purchase page. Across Reddit and X (formerly Twitter), users reported hour-long attempts to refresh the site, only to be met with errors, frozen screens, or inflated prices. Some users claimed they were charged $682—the full theoretical value of the pass—rather than the advertised $20. Red Robin later confirmed the glitch, attributing the mispricing to an error on its third-party gift card partner’s site. The company issued same-day refunds to affected customers and apologized, stating the error only impacted a small group of people who were in the middle of checkout when the inventory sold out.

Social media was quickly flooded with sarcastic memes and angry comments. “I only woke up this early to try and score a burger pass… only for the site not to load,” one user complained. Others speculated that bots scooped up the passes before real customers had a chance. One viral post suggested Red Robin had likely never seen this level of website traffic before and jokingly blamed a single overwhelmed IT staffer.

In response to the chaos, Red Robin released a public statement acknowledging the technical failures. “We did everything we could to anticipate interest in the Bottomless Burger Pass, including working with our web and gift card partners to prepare for the influx of traffic,” the company said. “But due to overwhelming excitement… our website and supporting systems crashed. We’re sorry this happened to our loyal guests.”

Despite the hiccups, Red Robin sold out of all passes. For those who missed out, the company is promoting its Red Robin Royalty Sweepstakes, which offers members a chance to win free burgers for a year. Customers who purchase both a burger and beverage while logged into their Royalty account in May will be automatically entered. New members who join during the month will also be eligible.

This promotion comes at a time when Red Robin is trying to reinvigorate traffic amid declining sales. In its most recent earnings report, the company disclosed a $39.7 million net loss in Q4 2024, up sharply from a $13.7 million loss the year before. Revenues also declined year-over-year, partly due to a shorter fiscal quarter. To further boost interest, the burger chain is rolling out a “Sizzling Summer” menu starting April 28 in the U.S., with Canadian locations following on June 9. New items include the Backyard BBQ Pork Burger, BBQ Pork Nachos, and a trio of Peach-Berry beverages, including a spiked lemonade and a peaches & cream milkshake. These limited-time offerings aim to capitalize on summer dining traffic and maintain momentum following the burger pass campaign.

Red Robin’s CEO G.J. Hart expressed optimism about the company’s burger-focused initiatives. “With more than 20 gourmet burgers on our menu, Red Robin is the authority on a great burger experience,” he said in a release. “The Bottomless Burger Pass and our new menu allow guests even more ways to enjoy our enhanced offerings.” However, the botched launch of the pass underscores the risks of digital promotions in an era of unpredictable online demand. While the idea was creative and aligned well with the brand’s core product, execution failures risk eroding customer trust—especially among tech-savvy fans expecting seamless digital interactions.

Intuit Inc ($INTU):

Thousands of Ontario families are now facing unexpected and often staggering tax bills from the Canada Revenue Agency (CRA), and many are placing the blame squarely on TurboTax, the widely used tax preparation software owned by Intuit. What began as a routine tax filing process has turned into a financial nightmare for users reassessed for tens of thousands of dollars over three years. The root of the issue lies in the incorrect application of the Ontario Childcare Access and Relief from Expenses (CARE) tax credit—a COVID-era program that allowed families to claim up to 75% of eligible childcare expenses, but only if their household income was under $150,000. Affected users say that TurboTax’s software, while appearing to guide them correctly, erroneously calculated the credit using only the lower-income spouse’s earnings on joint returns. The result? Ineligible households were granted tax credits they didn’t qualify for—and the CRA has come calling for repayment, with added penalties and interest.

Markham teacher Cheryl Wong was hit with a $10,000 bill, $8,000 of which was improperly claimed credit, plus $2,000 in interest. Another customer, Michael Ribeiro, received three separate CRA letters demanding repayment within 21 days. Tim O’Shea, a long-time TurboTax user, saw not only his own return reassessed, but also that of his daughter—who now owes more than $17,000. In all cases, the families insist they followed the software’s guidance and answered questions truthfully.

The same story is playing out across Ontario. Facebook groups, Reddit threads, and consumer forums have lit up with reports from TurboTax users receiving similar reassessment notices. One family from Pickering, with three children and $12,000 in annual childcare costs, had to dip into their education savings to pay a surprise $21,000 bill. Another user was initially charged $682—the total theoretical value of the monthly childcare credits—due to a glitch that briefly mispriced the software, though refunds were later issued.

TurboTax, for its part, denies any responsibility. The company claims there is no glitch and that all calculations were based on user-provided data. "The accurate calculation of this credit relies on user inputs," the company told Global News. TurboTax Canada’s General Manager, Stefania Mancini, doubled down on the stance in an interview with CTV, stating that the software’s guided experience works—unless users bypass key steps or decline the review process. But many users are not buying it. “Software is software,” O’Shea countered. “It should arrive at the same answer.”

This is especially troubling considering TurboTax's heavily marketed “100% accuracy guarantee.” According to its website, the company promises to reimburse users for penalties and interest caused by a TurboTax calculation error. Yet in the face of mounting reassessment cases, Intuit is reportedly only offering refunds for the cost of the software—leaving customers to cover thousands of dollars in penalties.

This isn’t the first time Intuit has faced backlash. In 2022, the company agreed to pay $141 million to settle a lawsuit brought by multiple U.S. states over deceptive marketing practices. The settlement alleged that TurboTax falsely advertised its software as “free” while funneling users toward paid versions. And just last year, the Federal Trade Commission ordered TurboTax to stop using the word “free” in its ads unless all users qualified—a move the company is now appealing. But the issue has grown beyond a single glitch in Ontario. It’s a microcosm of the broader battle between tech-powered tax preparation services and government-run solutions. In the U.S., Intuit has spent millions lobbying against IRS-run platforms like Direct File—an effort that just paid off under the Trump administration, which recently moved to kill the IRS’s free tax filing program. That platform, piloted in 2024, had earned high satisfaction ratings and was considered a threat to for-profit players like TurboTax and H&R Block. In the first quarter of 2025 alone, Intuit spent $240,000 lobbying Congress and donated $1 million to Trump’s inaugural fund.

The situation raises significant questions about accountability, software reliability, and how governments should protect taxpayers in a digital-first world. When automation fails—particularly in essential areas like tax compliance—it’s the consumer who’s left holding the bag. And in this case, it’s not a rounding error; it’s life-altering sums of money. As pressure mounts, consumer advocates and politicians may be forced to revisit the role of private software in public tax systems. For the average Canadian and American taxpayer, the message is clear: tax software may make things easier, but it's not always foolproof. Double-checking every entry—and knowing when to seek human expertise—might be the only true safeguard in an increasingly automated system.

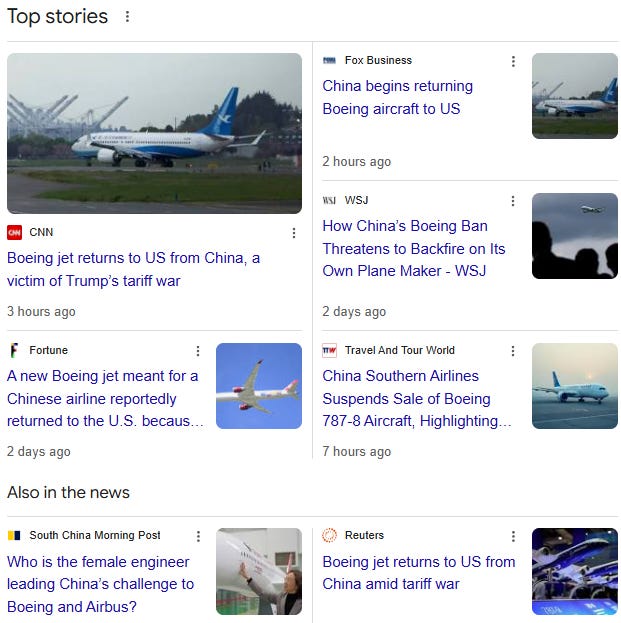

Boeing Co ($BA):

A Boeing 737 MAX jet, painted in the livery of Xiamen Airlines, has made headlines after completing an unexpected 5,000-mile return journey from China to Boeing’s Seattle production hub. The aircraft, which had been staged at Boeing’s Zhoushan completion center for final delivery, was forced back to the United States due to escalating trade tensions between Washington and Beijing. With President Donald Trump recently raising baseline tariffs on Chinese goods to 145%, and China responding with a 125% tariff on U.S. imports, including aircraft, the move reflects a broader unraveling of global aerospace trade dynamics.

This development is more than just symbolic. The returned 737 MAX, valued at approximately $55 million, is one of multiple jets that had been destined for Chinese airlines before becoming collateral damage in the widening trade war. According to aviation industry sources, at least three aircraft slated for Chinese customers were recently pulled back from Zhoushan. For Boeing, this isn't simply a rerouted delivery—it is a direct blow to its strategic ambitions in the world’s second-largest aviation market.

The 737 MAX, once Boeing’s most promising commercial aircraft, has already endured years of reputational and operational setbacks following two deadly crashes in 2018 and 2019 and subsequent global groundings. The return of the jet to the U.S. is a stark reminder that, even as Boeing seeks to rebuild trust and market share, geopolitical headwinds can upend recovery plans. The trade standoff underscores how fragile Boeing’s China strategy has become, despite years of cultivating relationships through localized infrastructure, such as the Zhoushan delivery center—the company’s first completion plant outside the U.S.

It remains unclear whether Boeing, Xiamen Airlines, or Beijing regulators made the call to return the aircraft. While Chinese officials have denied issuing a formal order blocking new deliveries from Boeing, reports from Bloomberg and The Air Current suggest that Chinese airlines are indeed walking away from deliveries to avoid the crushing financial implications of tariffs. Faced with a 125% surcharge, taking delivery of a $55 million aircraft could become commercially untenable, leading some Chinese airlines to defer or cancel deals altogether.

Boeing is one of America’s largest exporters, and China has historically been one of its fastest-growing markets. According to delivery schedules, the three major Chinese carriers—Air China, China Eastern, and China Southern—were expected to take delivery of over 175 Boeing aircraft between 2025 and 2027. If Beijing holds the line on tariffs, or retaliates further by channeling orders to Airbus, Boeing stands to lose not only revenue but also long-term strategic positioning in the region.

Moreover, Boeing’s share of the Chinese market had already been declining, in part due to ongoing tensions and in part due to domestic policy shifts in China, which has increasingly favored European competitor Airbus and accelerated support for its own emerging aircraft manufacturer, COMAC. If Boeing’s 737 MAX becomes seen as a political liability—rather than just a commercial offering—Chinese airlines and lessors may look to alternatives, further denting Boeing’s backlog.

The timing couldn’t be worse. Boeing is navigating multiple crises: quality control issues, production slowdowns, regulatory scrutiny, and financial strain. The tariff-driven disruption adds another layer of unpredictability for a company already working to stabilize its operations. Analysts have warned that if tariffs persist, more aircraft could be re-routed or remain undelivered, potentially forcing Boeing to take write-downs or re-market aircraft to other customers—an expensive and complicated process.

This incident illustrates the vulnerability of high-value manufacturing sectors—especially aerospace—to political brinkmanship. Unlike lower-cost goods that can be re-routed through third countries or warehoused until tariffs subside, commercial jets are custom-built to airline specifications and require synchronized supply chains, regulatory coordination, and financing. When trade wars flare, these precision-built products can quickly become logistical and financial orphans. The company may be forced to diversify customer concentration away from China, seek production flexibility in other regions, or engage more actively in lobbying for policy carve-outs in trade disputes. It also raises questions about the resilience of globalization in aerospace—a sector that has traditionally relied on tariff-free supply chains, joint ventures, and cross-border harmonization.

For now, the returned 737 MAX is both a physical and metaphorical symbol: a plane built to connect continents, now grounded by the politics dividing them. As Boeing re-assesses its exposure to international volatility, this incident may be remembered not just as a logistical hiccup, but as a turning point in its engagement with the Chinese market—and a warning to global manufacturers about the enduring cost of geopolitical conflict.

Eli Lilly And Co ($LLY) & Hims & Hers Health Inc ($HIMS):

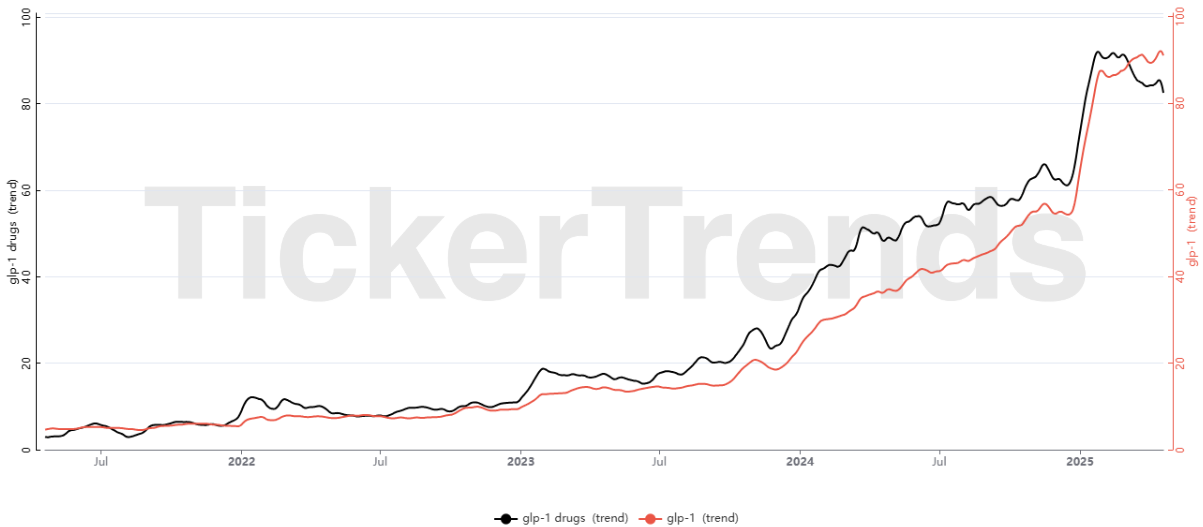

Eli Lilly’s stock surged 14% after the company unveiled strong Phase 3 data for its oral weight-loss drug orforglipron, helping diabetic patients lose an average of 16 pounds over 40 weeks without major safety concerns. The results not only reinforce Lilly’s dominance in the GLP-1-based treatment space but also mark a major leap in the pharmaceutical race to develop easy-to-administer obesity drugs. With demand for weight-loss treatments expected to power a $130 billion market by the end of the decade, the breakthrough has implications well beyond Big Pharma — particularly for consumer-focused telehealth platforms like Hims & Hers.

Lilly’s results arrived just days after rival Pfizer pulled back from its own oral GLP-1 candidate due to liver safety concerns. In contrast, Lilly's data showed no such red flags. At its highest dose, orforglipron reduced A1C by up to 1.6% and body weight by 7.9% — rivaling injectable alternatives like Novo Nordisk’s Ozempic. These figures are particularly noteworthy given that the trial was conducted in type 2 diabetes patients, a population known to lose weight more slowly than those without diabetes. Crucially, the weight loss hadn't plateaued by week 40, suggesting even greater efficacy over time.

Beyond its clinical promise, orforglipron represents a strategic coup. A pill that rivals the effectiveness of injectables could redefine access, convenience, and pricing in the obesity drug market. Analysts like Evercore’s Umer Raffat and Bloomberg Intelligence’s John Murphy believe this data sets Lilly up for a “blockbuster” launch, with regulatory filings expected by year-end for weight management and in 2026 for diabetes. Meanwhile, the company insists it is well-positioned to meet demand without the production bottlenecks that have plagued injectables like Mounjaro and Wegovy.

This rapid shift toward oral therapies has ripple effects for emerging players — especially consumer telehealth companies like Hims & Hers Health (HIMS), which has recently entered the weight-loss space by prescribing compounded or generic versions of GLP-1s via its DTC platform. While Hims has positioned itself as a more affordable and accessible channel for treatments like tirzepatide or semaglutide, the entrance of a branded, effective, once-daily pill changes the landscape.

In the short term, Lilly’s progress may widen the credibility gap between traditional pharma and platforms like Hims & Hers. Many GLP-1 prescriptions via telehealth platforms have involved compounded versions of approved drugs — legal in the U.S. only under certain FDA conditions — and come with more variability in quality. Once a high-efficacy, branded oral GLP-1 reaches the market, it may diminish demand for compounded or injectable versions among cost-sensitive but compliance-focused consumers.

On the flip side, Lilly’s innovation may create opportunity. As GLP-1 pills become mainstream and easier to distribute, platforms like Hims & Hers could serve as critical distribution and engagement engines, reaching patients who prefer remote care and brand transparency. If Lilly pursues partnerships or DTC channels to drive uptake, companies like Hims — with their expansive digital reach, conversion funnel expertise, and subscription-based business model — could play a key role in patient onboarding and adherence.

Moreover, the broader cultural and clinical validation of oral weight-loss treatments will likely accelerate consumer interest. Just as the Ozempic effect drove millions to seek treatment online, a safer, scalable pill could spark a new wave of demand. Hims & Hers has already seen surging revenue from its weight-loss program and could benefit even more if it becomes an early access point for drugs like orforglipron once approved. The company recently stated that weight-loss prescriptions are poised to become a key growth driver, and easier-to-prescribe oral options only strengthen that thesis. Still, competitive dynamics will sharpen. If Lilly launches orforglipron at a premium price and restricts it to traditional pharmacy channels, Hims & Hers may struggle to compete unless it secures its own distribution rights or branded partnerships. On the other hand, if payers and pharma companies seek broad adoption, digital-first companies could be their fastest route to scale.

In the end, the success of orforglipron validates the mainstreaming of weight-loss pharmacotherapy and underscores that this is no longer just a niche therapeutic category. For companies like Hims & Hers, it is both a threat and an opportunity — one that will hinge on execution, innovation, and their ability to integrate with a rapidly evolving clinical ecosystem. If Hims can position itself as the most trusted, frictionless, and affordable platform for accessing these new weight-loss therapies, it stands to benefit immensely from the rising tide that Lilly is helping to lift.

Nvidia Corp ($NVDA):

The Biden-to-Trump era of aggressive export controls on advanced U.S. technology, particularly AI chips has handed Huawei a rare window of opportunity. The latest casualty, Nvidia’s H20 chip, once tailored to skirt previous U.S. sanctions, is now banned indefinitely from being exported to China. This restriction not only forces Nvidia to take a $5.5 billion write-down but also cracks open the door for Chinese tech champion Huawei to seize control of its domestic AI market.

The H20 was Nvidia’s China-specific AI chip designed to comply with existing U.S. export rules by toning down performance just enough to avoid regulatory scrutiny. And yet, its high-speed connectivity, vital for AI inference tasks and possibly supercomputer applications, drew fresh concern from Washington. The new ban—imposed without a grace period—has cut Chinese tech giants like Tencent, Alibaba, and ByteDance off from a crucial component they had been stockpiling to fuel AI training and inference workloads.

Enter Huawei. In a strikingly well-timed move, the company unveiled its new Ascend 920 AI processor within days of the ban. The chip is designed to fill the vacuum left by the H20’s exit and is expected to enter mass production in the second half of 2025. While Huawei’s current-gen Ascend 910C chip achieves roughly 60% of Nvidia’s top-tier H100 in inference performance, the new Ascend 920 reportedly offers a competitive edge over the H20, featuring over 900 TFLOPs of compute and up to 4 TB/s of memory bandwidth using HBM3.

Beyond hardware, Huawei is also rolling out the CloudMatrix 384, a rack-scale AI solution positioned to rival Nvidia’s own GB200 systems—although with higher power consumption. These new offerings are strategically targeted at China’s AI cloud ecosystem, which has been expanding rapidly amid surging demand for domestic alternatives. Huawei’s readiness suggests this moment wasn’t a coincidence. Sources suggest the company had been anticipating broader U.S. restrictions and quietly developing chips like the 920 for months. With Chinese firms now shut out from Nvidia’s H20 and the MI300-series chips from AMD also facing curbs, Huawei has a captive audience—and potentially a monopoly over Chinese-made AI hardware in the near term.

This shift is emblematic of the increasingly bifurcated global tech landscape. U.S. policies aimed at suppressing China’s rise in AI—driven by national security concerns over supercomputing and military use—may end up catalyzing a deeper and faster localization of AI hardware in China. Huawei, once crippled by its own inclusion on the U.S. Entity List, now finds itself at the epicenter of China's AI comeback.

Meanwhile, Nvidia faces a complex reality. The Chinese market accounts for around 13% of its total revenue—a significant portion considering the company’s meteoric rise during the AI boom. The H20 was not its flagship chip, but it was a revenue lifeline in a politically restricted geography. With those orders evaporating and no clear timeline for export licenses, Nvidia's future China-facing AI strategy is uncertain. CEO Jensen Huang’s visit to Beijing and meeting with DeepSeek’s founder—just as the export curbs took hold—signals the high stakes of this geopolitical chessboard.

From a broader view, the situation illustrates how the U.S.–China tech rivalry is now shaping the semiconductor landscape into two parallel systems. On one end, U.S.-led firms like Nvidia and AMD, supported by deep-pocketed investments into U.S. manufacturing and innovation incentives, are powering the Western AI race. On the other, China is accelerating domestic alternatives, with firms like Huawei increasingly capable of closing the performance gap.

For Huawei, this is a reputational and commercial inflection point. If the Ascend 920 and CloudMatrix platforms prove reliable at scale, it could reshape procurement strategies not just in China but across Belt-and-Road countries or allies wary of U.S. sanctions. In the long run, the forced decoupling from Nvidia may even accelerate Chinese innovation, albeit at a higher initial cost.