What’s Trending with TickerTrends #23

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

DICK’S Sporting Goods Inc ($DKS):

Dick’s Sporting Goods delivered a strong fourth-quarter performance, with comparable sales increasing 6.4%, marking a robust finish to fiscal year 2024. The company’s full-year revenue reached $13.4 billion, driven by a 5.2% increase in comps, reflecting both higher average ticket sales and increased transactions. This momentum allowed Dick’s to continue gaining market share, securing nearly 9% of the fragmented $140 billion sporting goods industry.

The company's gross margin expanded, supported by higher merchandise margins and lower shipping costs, resulting in an EBIT margin of 10.2% for Q4 and 11.3% for the full year. Earnings per share (EPS) came in at $14.05 for the year, a 10.5% increase compared to the prior year on a 52-week basis. In Q4, EPS was $3.62, down slightly from $3.85 last year, due to the absence of a 53rd week and a calendar shift.

Dick’s continues to capitalize on key industry trends, particularly the growing enthusiasm for sports in the U.S. The upcoming 2026 FIFA World Cup, 2028 L.A. Olympics, and the 2031 Rugby World Cup are expected to sustain long-term demand. In response, the company is making significant investments in digital and in-store experiences to maintain its competitive edge.

Three key growth initiatives are central to Dick’s strategy. First, repositioning real estate and store formats, including the expansion of House of Sport, Field House, and Golf Galaxy Performance Centers. House of Sport locations continue to outperform, with $35 million in year-one omnichannel sales and 20% EBITDA margins. By 2027, the company expects to operate 75-100 House of Sport locations. Second, footwear remains a major focus, with Dick’s leveraging its premium, full-service footwear decks in 90% of stores. Footwear penetration has grown to 28% of total sales, a 900 basis point increase over the past decade, with half of that growth occurring in the last three years. Ecommerce remains a multi-billion-dollar growth opportunity, with the company investing in technology enhancements, RFID inventory management, and its Dick’s app to accelerate online sales.

Beyond its core retail business, Dick’s sees two long-term high-margin growth opportunities in its GameChanger and Dick’s Media Network initiatives. GameChanger, a SaaS-based youth sports platform, generated over $100 million in revenue in 2024, achieving a 40% CAGR since 2017. Meanwhile, Dick’s Media Network is leveraging Scorecard loyalty program data and GameChanger's live-streaming to create a high-value advertising platform. These initiatives are expected to contribute meaningfully to gross margin expansion in the coming years.

For fiscal 2025, Dick’s expects comparable sales growth of 1% to 3%, a 10% three-year comp stack, and gross margin expansion of approximately 75 basis points. Full-year EPS is projected at $13.80 to $14.40, supported by strong product assortments and continued market share gains. Despite macro uncertainties, management expressed confidence in consumer demand and reaffirmed that the company remains well-positioned for long-term growth.

Dick’s remains committed to strategic investments and shareholder returns. The company increased its dividend by 10% to $4.85 per share and announced a new $3 billion share repurchase program. Additionally, net capital expenditures are projected at $1 billion in 2025, with a focus on store renovations, supply chain improvements, and technology investments.

Overall, Dick’s Sporting Goods demonstrated resilience and strong execution in Q4 2024, with momentum heading into 2025. The company’s strategic focus on omnichannel retail, footwear expansion, and digital growth positions it well to sustain long-term profitability and gain additional market share.

Build-A-Bear Workshop, Inc. ($BBW):

Build-A-Bear Workshop reported another record-breaking year in fiscal 2024, marking its fourth consecutive year of revenue and profit expansion. The company’s total revenue grew 3.6% to $496 million, driven by strong retail store performance and international expansion, despite headwinds from tariffs and a shifting macroeconomic environment. Pretax income increased 5.1% to $67 million, and EPS grew to $3.81 due to improved profitability and aggressive capital returns to shareholders.

The retail segment remained a key growth driver, with net retail sales increasing 4.7% in Q4. Notably, store traffic was up 3%, significantly outperforming the broader retail sector, where traffic declined by nearly 1%. Build-A-Bear also continued to expand its partner-operated and franchise locations, opening 30 new international locations across 10 countries, including Italy, Mexico, Norway, and Colombia. The company’s commercial revenue (wholesale and international franchise operations) grew 20.5%, demonstrating strong demand for Build-A-Bear’s brand globally.

A major highlight was the expansion of the company’s experiential retail footprint, including the launch of a first-of-its-kind Hello Kitty and Friends Build-A-Bear Workshop in Los Angeles and additional stores in tourist-heavy locations such as Windsor (UK), Chicago’s Michigan Avenue, and Hershey, Pennsylvania. The company also announced plans to open a flagship location in Orlando’s ICON Park in 2026, aiming to capture heavy foot traffic from major theme parks like Walt Disney World and Universal Studios.

The company’s digital transformation strategy continues to advance, focusing on omnichannel enhancements. Build-A-Bear upgraded its e-commerce fulfillment capabilities, extended order cutoff windows for key holidays, and launched a same-day delivery partnership with Uber, which drove a tenfold increase in same-day shipped orders in the past few months. The record-your-voice online feature was also fully digitized, leading to double-digit growth in this high-margin SKU.

Build-A-Bear continues to diversify its offerings, particularly through adult-focused and collectible products, which now account for 40% of total sales. The After Dark Collection, including the viral Cougar Bear launch, generated over 1 billion media impressions. The Mini Beans collectible plush line, which has sold 1.25 million units, is now set to expand into wholesale distribution in 2025, presenting another growth opportunity.

Despite a strong outlook for fiscal 2025, tariffs remain a potential headwind, particularly given that China still accounts for under 50% of Build-A-Bear’s inventory. To mitigate risks, the company accelerated inventory purchases for 2025 and continues to diversify its supply chain. Management expects revenue to grow at a mid-single-digit rate in 2025, driven by at least 50 new net store openings, mostly through international partnerships. However, pretax income is expected to range from a slight decline to low single-digit growth, as tariffs, minimum wage increases, and healthcare costs could add up to $10 million in expenses.

Build-A-Bear remains committed to shareholder returns, increasing its quarterly dividend by 10% to $0.22 per share and repurchasing 6% of its outstanding shares in 2024. Over the past four years, the company has returned more than $130 million to shareholders, surpassing its market cap from four years ago.

Trends this week:

Tesla Inc ($TSLA):

Tesla, once a symbol of progressive innovation and environmental consciousness, is undergoing an unprecedented shift in brand perception. Traditionally, Tesla’s primary consumer base consisted of environmentally conscious liberals and tech-savvy individuals eager to embrace the future of transportation. However, recent political developments—specifically Elon Musk’s deepening ties with Donald Trump and his role in dismantling government agencies through tDOGE—have alienated a portion of Tesla’s traditional consumer base while simultaneously attracting conservatives and MAGA-aligned buyers. This shift raises two key questions: Can increased Republican support for Tesla compensate for declining Democratic and moderate consumer interest? And how will this trend impact Tesla's stock price amid a volatile market environment?

Over the past year, Tesla’s stock has suffered significantly, with its market value dropping over 50% from its peak in December 2024. While some of this decline can be attributed to macroeconomic factors such as rising competition, production slowdowns, and declining orders from key markets (Europe and China), the political backlash against Musk has intensified Tesla’s brand crisis. Democratic and moderate consumers, historically Tesla’s core buyers, are abandoning the brand due to Musk’s increasing alignment with Trump and controversial policy stances. The “Tesla Takedown” protests, organized primarily in Democratic-leaning cities, have drawn significant media attention, with some demonstrations escalating to vandalism at Tesla showrooms and charging stations. As a result, Tesla has lost a significant portion of its traditional customer base, with surveys indicating that Democratic favorability towards Tesla has dropped by 22 percentage points.

Conversely, Tesla is seeing a surge in popularity among Republican buyers, marking a stark reversal from its previous consumer demographic. Influential conservative figures such as Donald Trump, Sean Hannity, and high-profile MAGA influencers have publicly purchased Teslas as a show of support for Musk. Trump himself bought a red Tesla Model S, turning the vehicle into a political statement rather than just a luxury item. Sean Hannity and other MAGA figures have followed suit, encouraging their audiences to buy Teslas as an act of political allegiance. Recent polling data from Stifel and Morning Consult indicate that Republican interest in Tesla has risen by 16 percentage points, while Democratic interest has plummeted. For the first time, Tesla buyers are more likely to be Republican than Democrat, signaling a major brand shift.

Despite this growing conservative customer base, Tesla still faces significant risks that could impact its stock performance. While increased Republican support could stabilize demand in the U.S., it does not immediately resolve key investor concerns. Tesla’s declining international demand remains a major headwind, with sales in China and Europe dropping sharply. In January 2025, European Tesla sales fell 45% year-over-year, reflecting growing competition from Chinese automakers and falling consumer confidence in the brand. Additionally, Tesla’s supply chain remains vulnerable to Trump’s tariff policies, which could increase costs and further erode profit margins.

The market is weighing whether the brand’s political shift will result in sustained sales growth or further alienation of key markets. While conservative support may provide a temporary boost in U.S. sales, it is unclear whether this trend will translate into long-term profitability, given that Republican consumers have historically been less likely to adopt EVs. Tesla’s ability to navigate political controversy while maintaining strong global demand will ultimately determine its stock trajectory. If Musk’s alignment with Trump continues to drive away progressive consumers without significantly increasing purchases from conservative buyers, Tesla’s stock could face further downside pressure. However, if Tesla successfully rebrands itself as an American innovation leader rather than just an EV company, it could unlock a new market of conservative buyers who were previously hesitant to purchase an electric vehicle.

Southwest Airlines Co ($LUV):

Southwest Airlines’ decision to eliminate its long-standing “bags fly free” policy has sparked significant backlash from both passengers and industry experts, raising concerns about the airline’s future customer loyalty, operational efficiency, and overall brand identity. This move, driven by pressure from Elliott Investment Management, which acquired an 11% stake in Southwest, is part of a broader strategy to increase profitability by aligning more closely with competitors like Delta, United, and American Airlines. However, the decision has been met with outrage from loyal customers, analysts, and even competitors mocking Southwest for abandoning what many saw as the airline's most distinctive and consumer-friendly feature.

For decades, Southwest’s “bags fly free” policy set it apart from other major airlines, helping it cultivate a loyal customer base that appreciated the airline’s simple, no-hidden-fees approach. The policy was seen as a key pillar of Southwest’s brand identity, and the airline had previously stated that eliminating it would cause more harm than good. In September 2024, Southwest’s own internal research indicated that charging for checked bags would reduce demand more than it would generate revenue, making its sudden reversal feel like a betrayal to customers who trusted the airline’s commitment to transparency and affordability.

The backlash was immediate and intense. Major news outlets and analysts heavily criticized the move. TheStreet.com published a piece titled "RIP Southwest Airlines: You Did This to Yourself," emphasizing how this policy shift could permanently damage customer perception. Texas Monthly declared, "With the End of ‘Bags Fly Free,’ Southwest Airlines Breaks Another Promise to Customers." CBS News aviation analyst Henry Harteveldt warned, “This is how you destroy a brand. This is how you destroy customer preference. This is how you destroy loyalty.” The Points Guy called the announcement a "seismic shift" that will shake the foundation of Southwest’s relationship with its customers. Social media reactions were overwhelmingly negative, with comments like “HELL NO,” “Probably won’t be flying them again,” and “Big mistake” trending online.

Beyond the customer loyalty crisis, Southwest’s decision could also introduce new operational challenges. Many travelers who previously checked their bags for free will now attempt to bring more luggage as carry-ons, overloading overhead bins and leading to delays as passengers are forced to gate-check bags at the last minute. Aviation expert Gary Leff pointed out that this shift will result in "longer lines at check-in, frustrated customers, and flight delays" due to the increased volume of carry-ons. CNBC reported that Southwest warned employees to expect longer transaction times and more congestion at airport kiosks.

The fast turnaround time of Southwest flights has been one of its key operational advantages, enabling the airline to maximize aircraft utilization and keep costs low. By introducing more boarding and baggage-handling complications, the new policy could slow down operations and increase costs, potentially negating the financial benefits of baggage fees.

The decision to eliminate free checked bags is just one of many changes that Southwest has implemented in response to activist pressure from Elliott Investment Management. Other changes include moving from open seating to assigned seating, with additional fees for preferred seats; reducing Rapid Rewards earnings for most customers unless they purchase higher-priced fares; rolling out new “Basic fares” with restrictions, similar to basic economy offerings at legacy airlines; and laying off 15% of corporate employees (1,750 jobs) as part of a cost-cutting effort.

While these changes are intended to boost profitability, they have made Southwest less distinguishable from its competitors, weakening its unique selling proposition. Many experts warn that Elliott Investment’s push for short-term gains could damage Southwest’s long-term customer trust and loyalty, ultimately leading to declining bookings and revenue erosion. However, despite the customer outrage, investors reacted positively to Southwest’s announcement. The airline’s stock rose nearly 11% this week, even as other airlines like Delta, United, and American saw declines. Seaport Research Partners raised its price target on Southwest to $39, arguing that investor activism is reshaping the company into a more profitable business model however the social data looks very negative.

Southwest’s policy reversal has created an opening for competitors like Delta, United, and Spirit Airlines to attract disillusioned Southwest customers. Amtrak trolled Southwest on social media, posting, “We’re the only ones doing free baggage now.” Delta, United, and Spirit executives have all stated that they see an opportunity to win over former Southwest flyers who are unhappy with the baggage policy change. Retailer Aldi even joined in, posting a viral video showing a customer filling suitcases with groceries, humorously suggesting an alternative use for checked luggage now that it "doesn’t fly for free." The next few months will determine whether Southwest can weather the storm of customer backlash or if this decision will lead to a more permanent decline in brand loyalty and revenue. There are three key outcomes that could unfold. First, Southwest may see an immediate revenue boost from baggage fees, but if enough customers switch to other airlines, the long-term damage could outweigh the benefits. If Southwest starts seeing a decline in bookings, it may be forced to walk back some of these changes—potentially at the cost of looking even more inconsistent.

Second, if more passengers attempt to carry on their luggage, the increase in boarding times and flight delays could disrupt Southwest’s efficiency—one of its main competitive advantages. If delays worsen, passenger satisfaction will decline even further, making the policy change even more damaging.

Third, Southwest may lose cost-conscious leisure travelers who previously justified paying slightly more for flights due to the free bags. However, the airline may attract more business travelers or frequent flyers willing to pay for premium perks, aligning its business model more closely with competitors.

Southwest’s abandonment of its most iconic customer-friendly policy is one of the most controversial decisions in its history. While shareholders and activist investors are celebrating the potential revenue gains, customers are voicing outrage, and the airline’s brand loyalty is at risk. The biggest long-term risk is that Southwest could lose its core identity, alienating customers who previously chose it for its simplicity and transparency. If the backlash translates into declining bookings, the airline may be forced to reconsider its strategy or implement additional perks to retain customers. Ultimately, Southwest’s ability to navigate this transition without suffering operational breakdowns, reputational damage, or a drop in passenger demand will define its financial future. The airline is making a high-stakes bet—but whether it pays off or backfires spectacularly remains to be seen.

American Airlines Group Inc ($AAL):

American Airlines is under heightened scrutiny after a dramatic incident in which an engine fire forced passengers to evacuate Flight 1006 at Denver International Airport. The Boeing 737-800, originally bound for Dallas-Fort Worth from Colorado Springs, had to divert to Denver due to reported engine vibrations. After landing and taxiing to the gate, the aircraft’s engine suddenly ignited, sending thick black smoke billowing into the air and forcing an urgent evacuation. Eyewitness footage captured passengers standing on the plane's wing, while others escaped via emergency slides. Although all 172 passengers and six crew members survived, 12 individuals were hospitalized with minor injuries.

This incident is yet another high-profile aviation scare for American Airlines, adding to a growing list of concerning events within the industry. It comes at a time when aviation safety is in the spotlight following a series of alarming crashes and mechanical failures in recent months. A few weeks ago, an American Airlines regional jet collided midair with a U.S. Army Black Hawk helicopter near Washington, D.C., tragically killing 67 people. In January, a medical jet operated by an American Airlines subsidiary crashed into a Philadelphia street, claiming six lives. These incidents, along with additional crashes involving other carriers such as Delta, have fueled growing concerns about airline safety and maintenance protocols.

While the cause of the engine fire is still under investigation by the Federal Aviation Administration (FAA) and the National Transportation Safety Board (NTSB), the incident is a public relations blow for American Airlines. The airline has been attempting to rebuild customer trust following previous safety scares and operational disruptions. If investigations reveal any systemic maintenance failures or negligence, American Airlines could face regulatory scrutiny, legal challenges, and further reputational damage. In a broader context, this series of aviation mishaps has contributed to a decline in consumer confidence in air travel. A recent survey by The Points Guy found that 65% of Americans are now more apprehensive about flying due to recent safety concerns, despite 72% still believing that air travel remains statistically safe. Many travelers have already started altering their flight plans, opting for direct flights, switching airlines, or avoiding air travel altogether.

Adding to the industry-wide turbulence, Delta Airlines disclosed this week that it is experiencing slower demand, partially attributed to recent high-profile safety incidents. The airline acknowledged that recent events have made some travelers hesitant, impacting its revenue forecasts.

We had covered this exact scenario in our What’s Trending with TickerTrends #18.

American Airlines is now in damage control mode, emphasizing its commitment to passenger safety and thanking first responders for their quick actions. However, the airline must take tangible steps to reassure both regulators and travelers. This could involve additional aircraft inspections, transparent updates on maintenance protocols, and efforts to improve pilot and crew training to handle emergency situations effectively.

The airline industry as a whole is facing a difficult period, exacerbated by staffing shortages, aging fleets, and growing concerns about air traffic controller workloads. The FAA has also been operating under stress due to recent government budget cuts, including layoffs of critical maintenance and compliance workers. With air traffic at record levels post-pandemic, any lapse in safety oversight can have catastrophic consequences.

Capri Holdings Ltd ($CPRI):

Donatella Versace has stepped down as creative director of Versace after nearly three decades, in what appears to be a forced transition orchestrated by Capri Holdings, the brand’s parent company. While officially framed as a leadership succession, insiders suggest her exit was the result of tensions with Capri’s executives, particularly amid declining sales and strategic disagreements. Donatella, who took over the brand after the tragic murder of her brother Gianni Versace in 1997, has been the face of the label, turning it into a global powerhouse of bold, extravagant fashion. However, her departure signals a major shift for the brand and fuels speculation that Capri may be preparing to sell Versace, possibly to Prada.

Capri Holdings acquired Versace in 2018 for $2 billion, aiming to transform it into a multibillion-dollar luxury brand. However, the company has struggled to achieve that goal, with Versace’s revenue declining to approximately $810 million in 2024. The broader slowdown in the luxury sector has compounded Capri’s challenges, leading to a credit rating downgrade to "junk" status by S&P Global Ratings. In response, Capri has been looking for ways to restructure, and a sale of Versace could be a logical move to generate cash and stabilize its finances.

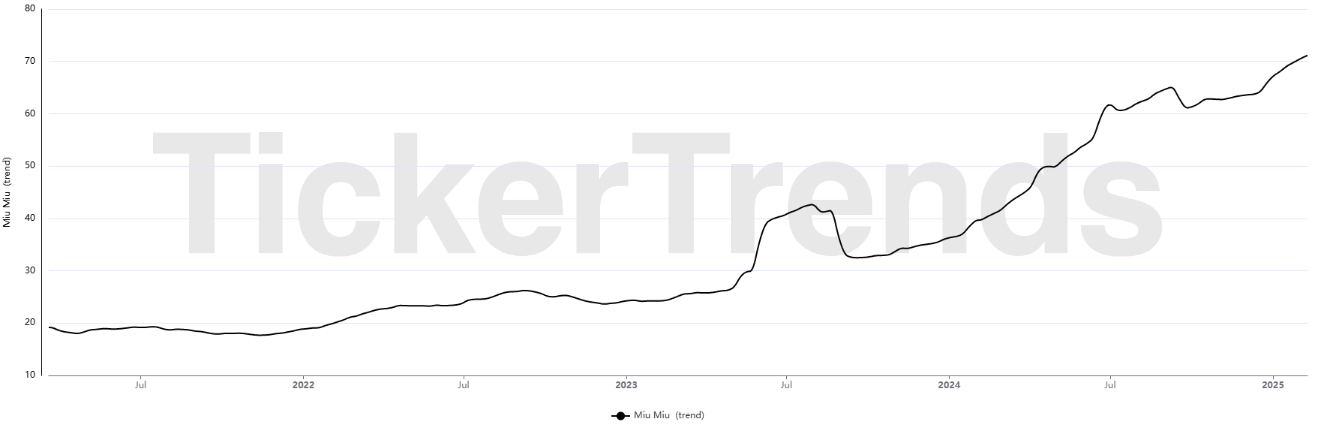

Reports indicate that Prada is a potential buyer, which would bring Versace back under Italian ownership. Prada’s recent success with Miu Miu, which saw a 97% sales increase last year, suggests that it has the expertise to revitalize a struggling luxury brand. However, integrating Versace into Prada’s portfolio would be complex. Versace’s high-glamour, maximalist aesthetic contrasts sharply with Prada’s more understated, intellectual approach to fashion. The challenge for Prada, if it proceeds with the acquisition, will be to modernize Versace without diluting its bold identity.

For Capri, selling Versace would provide a much-needed financial cushion. The company’s core brands, Michael Kors and Jimmy Choo, have struggled to maintain growth, and offloading Versace could allow Capri to refocus its resources. However, parting with Versace would also mean losing its most prestigious asset, potentially weakening Capri’s long-term market position. The company initially aspired to become a luxury conglomerate similar to LVMH or Kering, but without Versace, it risks becoming a mid-tier fashion group with limited high-fashion credibility.

Donatella’s transition to a ceremonial role as chief brand ambassador suggests she will remain the public face of Versace, but her departure from design leadership raises questions about the brand’s future direction. Dario Vitale, formerly of Miu Miu, will take over as creative director, a move that could signal a more structured, corporate approach to design rather than the high-energy, celebrity-driven branding that defined Donatella’s era. Whether this shift will resonate with Versace’s core customers remains uncertain.

The handling of Donatella’s exit also risks alienating some of Versace’s most loyal supporters. Celebrities and fashion insiders have expressed their admiration for her contributions, and there is a possibility that consumer sentiment could turn against Capri’s decision. If Versace struggles under new leadership, it will further validate concerns that the brand's creative essence was tied too closely to Donatella to survive without her.

Ultimately, Capri Holdings faces a defining moment. If it sells Versace, it could gain short-term financial relief but lose its strongest brand. If it retains Versace and fails to execute a successful turnaround, the brand could continue to underperform. Meanwhile, if Prada or another buyer takes over and revitalizes Versace, Capri may be seen as having abandoned a valuable asset too soon. The next few months will determine whether Donatella’s departure marks a new beginning for Versace—or the start of its decline under corporate control.

Spotify Technology SA ($SPOT):

Andrew Tate has had some of his content removed from Spotify after public pressure, including an online petition that garnered over 100,000 signatures. The streaming platform took down his “Pimping Hoes” podcast after determining it violated company policies that prohibit content promoting hate, harassment, or dehumanization. However, other Tate-related content remains on Spotify, including a course titled “How to Get Girls Fast and Easy,” which promotes misogynistic and manipulative ideas about relationships. The decision to remove certain content while allowing other episodes to remain has reignited debates about Spotify’s content moderation policies and whether the company is doing enough to address harmful content on its platform.

The removal of Tate’s content follows growing scrutiny of his influence and the broader cultural impact of his rhetoric. He and his brother, Tristan, face serious criminal charges in Romania, including human trafficking and rape, which they have denied. They are also under investigation in the UK and Florida for similar allegations. The controversy surrounding Tate has intensified after reports that Kyle Clifford, a man who murdered three women in the UK, had searched for Tate’s content just hours before committing the crime. Prosecutors at Clifford’s sentencing hearing argued that Tate’s ideology fueled his violent misogyny, raising concerns about the real-world consequences of the content he produces.

Spotify’s decision to remove select Tate episodes appears to be a calculated move to address backlash without making a sweeping statement about his presence on the platform. The company maintains that it does not remove content based on an individual’s personal conduct outside of its services but does enforce policies against material that incites harm or promotes hate. This selective enforcement, however, could put Spotify in a difficult position. If more users and advocacy groups continue to call for his complete removal, the company may have to decide whether it is worth keeping his content at all.

This situation echoes Spotify’s past controversies over content moderation, most notably its handling of Joe Rogan’s podcast, which faced widespread criticism for spreading COVID-19 misinformation. In that case, artists like Neil Young and Joni Mitchell removed their music from the platform in protest, forcing Spotify to navigate a complex balancing act between free expression and corporate responsibility. The Rogan controversy did not lead to his removal, but Spotify later adjusted its policies on medical misinformation, suggesting that it is willing to make changes when public pressure mounts.

For Spotify, this latest controversy could have broader implications for its brand reputation and user trust. As one of the largest audio streaming platforms, it faces increasing scrutiny over the types of voices it chooses to amplify. If the petition against Tate’s content continues to gain traction, it could force Spotify to take a firmer stance or risk being seen as complicit in promoting harmful ideologies. At the same time, removing all of Tate’s content could trigger backlash from his supporters, many of whom view efforts to deplatform him as evidence of censorship.

There is also the question of whether this controversy could affect Spotify’s business model. Unlike Rogan, who has an exclusive deal with the company, Tate’s content is hosted by third-party distributors, meaning new episodes could continue to appear unless Spotify actively moderates them. The platform’s handling of this issue will likely set a precedent for how it deals with controversial figures in the future. If Spotify chooses to keep Tate’s remaining content while quietly removing the most extreme episodes, it risks being caught in a cycle of public outrage and reactionary takedowns. The broader issue at play is whether platforms like Spotify have a responsibility to take stronger action against individuals whose content has real-world consequences. With more companies facing pressure to moderate their platforms, Spotify’s handling of the Andrew Tate controversy could influence how other streaming services navigate similar situations. Whether the company takes further action or tries to ride out the backlash, its response will shape the ongoing debate over content moderation.

Starbucks Inc ($SBUX):

Starbucks has been ordered to pay $50 million in damages to Michael Garcia, a California delivery driver who suffered severe burns from a scalding hot tea spill at a drive-thru. The Los Angeles County jury found Starbucks negligent in handling the drink, which resulted in third-degree burns to Garcia’s penis, groin, and inner thighs. The incident occurred in February 2020 when Garcia, picking up a Postmates order, received a cardboard carrier with three Venti-sized "medicine ball" teas. One of the drinks was allegedly placed insecurely, causing it to fall and spill its contents onto his lap. Despite undergoing multiple skin grafts and medical treatments, Garcia has been left with permanent disfigurement and chronic pain.

The jury's decision highlights ongoing concerns about Starbucks' safety protocols, particularly regarding the handling of hot beverages. Garcia’s attorneys argued that Starbucks failed to implement proper safeguards to prevent such incidents and emphasized the lasting physical and emotional toll the injury has had on their client. Starbucks, however, has announced plans to appeal the ruling, calling the $50 million damages "excessive" and maintaining that it adheres to the highest safety standards in its stores. This case draws comparisons to the infamous McDonald's hot coffee lawsuit from the 1990s, in which an elderly woman was awarded damages after suffering severe burns from an overheated beverage. While that case is often cited as an example of excessive litigation, it also led to broader discussions about corporate responsibility in serving hot drinks safely. Similarly, Starbucks' legal battle could prompt increased scrutiny over how the company and other fast-food chains ensure customer safety, particularly in drive-thru settings where handling hot drinks can be more precarious.

The financial implications for Starbucks remain uncertain, as the company will likely fight the verdict in appellate court. However, beyond the immediate legal battle, this case could have wider repercussions. Starbucks may face increased liability concerns, leading to potential changes in operational procedures, such as reinforcing drink carriers, securing lids more effectively, or lowering beverage temperatures. If Starbucks loses on appeal, other customers who have suffered similar injuries may be encouraged to pursue legal action, increasing the company’s exposure to further lawsuits. Moreover, the public perception of Starbucks could be affected, particularly if this case becomes a focal point in consumer safety debates. While some may see the verdict as justified, others could argue that such lawsuits contribute to rising costs and more stringent policies that ultimately impact all customers. Starbucks has already faced backlash in recent years over labor disputes, store closures, and pricing concerns. Another high-profile legal case could add to its reputational challenges, particularly if the appeal process drags on and continues to generate negative headlines.

Investor sentiment could also be influenced by the case, especially if it signals broader risks related to customer safety claims. Although a single $50 million payout is unlikely to significantly impact Starbucks' financial standing, repeated incidents of this nature or a wave of similar lawsuits could create long-term legal and operational costs. Shareholders may push for clearer safety measures to avoid future liabilities, and analysts could reevaluate Starbucks’ risk factors in their financial assessments. The company will need to balance damage control with potential operational reforms. If the company is forced to make changes to how it handles hot beverages, it could lead to a ripple effect across the industry, prompting competitors to reassess their own safety procedures to avoid similar legal battles. The outcome of Starbucks’ appeal will determine whether this case remains an isolated incident or becomes a precedent that influences industry-wide practices.

Regardless of the final legal resolution, the Starbucks lawsuit underscores the growing scrutiny that major corporations face over customer safety and corporate accountability. As consumers become more aware of their rights, businesses may need to take extra precautions to avoid costly legal disputes that could harm their reputation and bottom line.

Crocs Inc ($CROX):

The BAPE x Crocs collaboration has taken the sneaker and streetwear world by storm, and as we covered in last edition, the hype has only intensified. This collection, featuring Crocs’ Classic Clog silhouette wrapped in BAPE’s signature ABC Camo print, has been one of the most anticipated footwear drops of the year. With colorways in Chai (Olive), Oxygen (Blue), and Carnation (Pink), the fusion of BAPE’s streetwear heritage with Crocs’ casual and comfortable design has resonated with sneakerheads and casual wearers alike. The inclusion of BAPE-branded Jibbitz charms featuring the Ape Head, Baby Milo, Shark, and Tiger motifs has further solidified the collaboration’s unique identity, making each pair more than just a clog but a statement piece. The first release on March 8, 2025, through BAPE’s online store sold out instantly, leading to an even greater frenzy for the wider drop on March 12, exclusively via the Crocs App. The demand was so high that the Crocs App skyrocketed to the #1 spot on the App Store, highlighting how far Crocs has come from its early days as a functional, polarizing footwear brand to now being a cultural phenomenon.

Adding to the exclusivity and viral success, a fourth, blacked-out variant of the BAPE x Crocs Classic Clog was revealed to be a friends-and-family exclusive. Designed with the same ABC Camo motif in a tonal black and grey colorway, this ultra-limited edition pair has only fueled further demand and speculation about potential future collaborations between the two brands. This collaboration underscores how Crocs has successfully embedded itself into the streetwear ecosystem. From previous partnerships with Dragon Ball Z, Pokémon, and CLOT to this latest BAPE crossover, Crocs has transformed into a must-have brand for fashion-forward consumers. BAPE, on the other hand, benefits from the hype cycle that limited-edition drops generate, further elevating its relevance in a competitive streetwear market.

As resale prices climb and demand shows no signs of slowing, this release could mark a turning point for both brands. For Crocs, it solidifies its standing in sneaker culture, proving that its collaborations can command the same level of attention as major sneaker releases. For BAPE, this could be the resurgence it needs to reclaim its former dominance in the streetwear space.

With the collection selling out instantly and social media flooded with posts from fans and resellers, the BAPE x Crocs collaboration is undoubtedly one of the biggest footwear events of the year. Whether this partnership leads to future collaborations remains to be seen, but one thing is certain—Crocs is no longer just about comfort; it’s about culture.