What's Trending with TickerTrends #18

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Tapestry Inc. ($TPR):

If you haven’t checked out our article about Tapestry Inc., published on December 19, 2024 you can check it out here: https://blog.tickertrends.io/p/tpr-coachs-cultural-revival-navigating?r=4ioql1&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false. The stock is up ~26% since.

Tapestry Inc. delivered a strong second-quarter performance, surpassing expectations with accelerated revenue and earnings growth. CEO Joanne Crevoiserat and CFO Scott Roe emphasized the company’s disciplined approach to brand building, which resulted in record-breaking quarterly revenue, significant margin expansion, and a substantial increase in earnings per share. Revenue grew by 5% year-over-year, outpacing guidance across all regions, while EPS reached $2.00, representing a 23% increase from the prior year and exceeding prior guidance by $0.30. Gross margin expanded by 280 basis points, reflecting strong pricing power, operational efficiencies, and disciplined cost management. Operating margin also improved by 210 basis points, driven by enhanced profitability at Coach. The company generated $890 million in free cash flow during the quarter and raised its full-year guidance to $1.2 billion. Tapestry also reaffirmed its commitment to shareholder returns, executing a $2 billion share repurchase program, which will return over 100% of free cash flow to shareholders in fiscal 2025.

Coach was the primary driver of Tapestry’s success, with revenue growing 10% at constant currency, fueled by strong handbag sales and a surge in new customer acquisition. The Tabby and New York handbag families continued to perform exceptionally well, with no single platform accounting for more than 10% of sales, underscoring the brand’s diverse growth engines. Coach’s ability to attract and retain Gen Z and millennial consumers was a standout, with these cohorts representing nearly 60% of new customers. The brand also saw notable expansion in its digital and brick-and-mortar channels, with digital sales increasing to one-third of total revenue. The company maintained strong pricing discipline, achieving mid-teens AUR growth globally, including double-digit increases in North America. Coach’s gross margin expanded by 270 basis points, while operating margin grew by 210 basis points, reflecting both strong consumer demand and disciplined cost management.

Kate Spade, on the other hand, faced challenges, with revenue declining 10% year-over-year. However, gross margin expanded due to reduced promotional activity and a more streamlined product assortment. The brand is undergoing a strategic reset under new CEO Eva Erdman, who is focused on refining the brand’s positioning and improving customer engagement. Tapestry is taking decisive action to reinvigorate Kate Spade by reducing handbag style counts by 15% to enhance product clarity and increase desirability. The company is also ramping up marketing investments to build brand heat, with a particular focus on reaching younger consumers through targeted campaigns. While the turnaround is expected to be a multi-quarter process, early signs of improvement are evident, and Tapestry remains committed to restoring Kate Spade to sustainable long-term growth.

Stuart Weitzman continued to face headwinds, with revenue declining 16% year-over-year, primarily due to softness in Greater China and North America. Global wholesale sales were impacted by shipment timing, although point-of-sale trends remained strong, growing over 20%. The brand is focused on increasing relevancy, enhancing customer engagement, and improving financial performance over the long term. While results remain challenged, management is confident in the strategic steps being taken to stabilize the brand.

Geographically, Tapestry experienced strong growth across key regions. North America posted a 4% revenue increase, driven by double-digit growth at Coach. Greater China returned to growth, with revenue rising 2% in the quarter, significantly outpacing the industry and highlighting the success of the company’s brand-building strategies. Tapestry is seeing strong engagement among Gen Z consumers in China, reinforcing its long-term growth potential in the region. Europe delivered an outstanding 42% revenue increase, reflecting strong traction across all brands and channels, while other regions in Asia, including South Korea, Australia, and Malaysia, saw 11% growth. Japan was the only notable soft spot, with sales declining 5%.

Following the strong quarter, Tapestry raised its full-year guidance, now expecting revenue to exceed $6.85 billion, representing 3% year-over-year growth. EPS guidance was also lifted to a range of $4.85 to $4.90, reflecting 13-14% growth from the prior year. Operating margin is now projected to expand by 100 basis points, primarily driven by gross margin improvements as a result of higher pricing power and cost efficiencies. The company’s strategic investments in digital marketing, consumer engagement, and AI-powered pricing are continuing to enhance profitability. Despite a planned increase in SG&A expenses, particularly in marketing investments at Kate Spade, the company remains committed to disciplined cost management. Additionally, Tapestry expects to generate $1.2 billion in free cash flow for the full year and will continue prioritizing shareholder returns through share buybacks and dividends.

Tapestry’s long-term outlook remains strong, underpinned by Coach’s sustained momentum, Kate Spade’s ongoing turnaround, and the company’s ability to drive efficiency while making targeted investments for future growth. The company’s confidence is reflected in its ability to raise guidance while simultaneously increasing marketing investments. With a robust innovation pipeline, a disciplined approach to brand-building, and continued operational improvements, Tapestry is well-positioned for consistent growth and value creation in the years ahead.

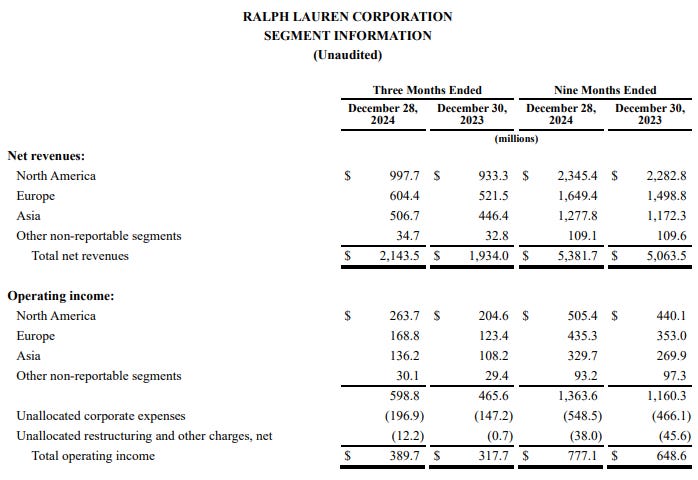

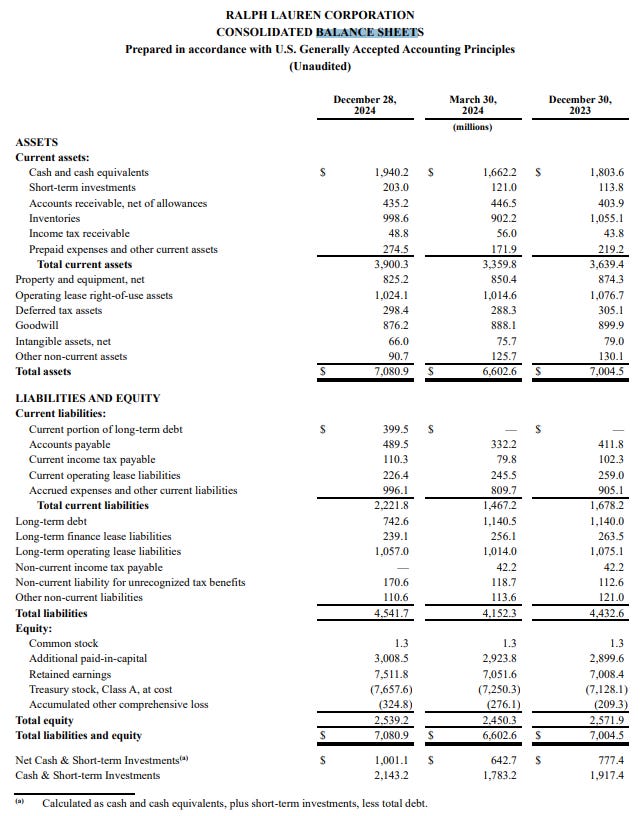

Ralph Lauren Corp ($RL):

Ralph Lauren Corporation delivered an exceptionally strong third-quarter performance, surpassing expectations across all key metrics. Revenue grew 11% year-over-year, exceeding guidance, driven by double-digit growth in all geographies and strong demand across channels. Direct-to-consumer (DTC) sales were a major highlight, with comps rising 12% as full-price penetration increased and promotional activity was reduced. Retail performance was led by brick-and-mortar stores, which saw double-digit comp growth, while digital sales also improved. The company’s wholesale segment returned to growth, with North America wholesale revenue increasing 6% and Europe wholesale rising 14%, supported by strong reorders and well-managed inventory positions. The strength in the business was further reflected in an adjusted gross margin expansion of 190 basis points to 68.3%, fueled by double-digit AUR growth, lower promotional activity, and favorable product mix.

CEO Patrice Louvet credited the quarter’s success to the company’s long-term brand elevation strategy, which focuses on three core pillars: strengthening the Ralph Lauren lifestyle brand, driving core product growth while expanding high-potential categories, and deepening engagement in key global cities through its consumer ecosystem model. The brand’s growing global desirability was evident in its record-breaking customer acquisition, with 1.9 million new consumers added to its DTC business, a low double-digit increase from the prior year. Consumer sentiment remained strong, with increases in brand consideration, purchase intent, and net promoter scores, particularly among younger, high-value consumers. Marketing initiatives played a key role in driving demand, including Ralph Lauren’s high-impact Summer of Sports campaign, the Hamptons fashion event, and the "Very Ralph" documentary launch in Shanghai, which generated 67 billion impressions.

Growth was broad-based across regions, with Europe and Asia leading the way. Europe revenue grew 16% year-over-year, with double-digit growth in Germany, France, Italy, and Spain. The UK market returned to growth, benefiting from increased brand momentum. Asia revenue increased 15%, with China sales rising more than 20%, fueled by strong consumer demand, strategic marketing activations, and growth in digital and brick-and-mortar channels. Japan also saw strong low double-digit growth, supported by domestic consumer demand and increased inbound tourism. North America revenue increased 7%, with both retail and wholesale performing above expectations. Notably, North America wholesale returned to growth as sell-in more closely aligned with sell-out trends, indicating a stabilizing business.

High-potential categories such as women's apparel, handbags, and outerwear continued to gain traction, growing 20% year-over-year. Handbag sales exceeded expectations, driven by the success of the Polo ID bag, which introduced new seasonal colors and fabrications. Outerwear, including quilted and puffer jackets, also performed well, while women's apparel benefited from increased brand focus and dedicated marketing campaigns. Ralph Lauren’s ability to drive high full-price penetration while reducing discount rates by more than 500 basis points underscored its success in executing a premium pricing strategy.

The company maintained a disciplined approach to expense management while continuing to invest in strategic priorities. Adjusted operating margin expanded 230 basis points to 18.7%, with operating profit rising 27%. Marketing expenses represented 7.1% of sales, consistent with Ralph Lauren’s long-term plan to increase brand investment. The company ended the quarter with $2.1 billion in cash and short-term investments, while net inventory declined 5%, highlighting its ability to meet strong consumer demand without overstocking.

Ralph Lauren raised its full-year revenue growth guidance to 6-7% in constant currency, up from its previous 3-4% outlook, reflecting its strong year-to-date performance. The company also expects full-year operating margin to expand by 120-160 basis points, with gross margin forecasted to improve by 130-170 basis points. Foreign currency is expected to be a slight headwind, impacting both revenue and margins by 30-50 basis points for the full year. For the fourth quarter, revenue is projected to grow 6-7% in constant currency, though foreign exchange effects are expected to create a 300-basis-point drag. The company plans to continue reducing promotional activity while maintaining strong AUR growth.

Ralph Lauren also discussed its next-generation transformation (NGT) project, which aims to enhance supply chain and inventory management capabilities through a global ERP system, predictive buying and allocation tools, and upgraded warehouse management. The implementation is expected to begin in fiscal 2027, with further updates on cost and timeline to be shared in future quarters.

Trends this week:

Sony Group Corp ($6758.T):

Sony’s PlayStation Network (PSN) suffered a widespread and prolonged outage over the weekend, leaving millions of gamers around the world unable to access online multiplayer, digital game purchases, and other network-dependent services. The outage, which began late Friday evening, quickly became a major issue for PlayStation users, especially those looking to participate in weekend events for popular games like FC 25 and Call of Duty. Reports of connection issues flooded DownDetector, with over 640,000 complaints registered by early Saturday, and the problem persisted for more than 24 hours before being fully resolved.

The outage affected all PlayStation platforms, including the PS5, PS4, and even older systems like the PS3 and PS Vita, as well as PlayStation’s online store, account management, and video services. Gamers attempting to access digital titles found themselves unable to launch games they had previously purchased due to PlayStation’s license verification system, which requires an internet connection to validate ownership. In some cases, even players with physical game discs reported issues, as the all-digital PS5 Slim and PS5 Pro appeared unable to connect to external disc drives. This led to renewed criticism of digital-only gaming and concerns over the increasing dependence on online authentication.

Sony acknowledged the issue on social media late Friday night, stating that they were aware of the problem and working on a solution. However, the company provided little follow-up information over the next several hours, leading to frustration from users who felt left in the dark. The lack of communication from Sony only fueled speculation about the nature of the outage, with some drawing comparisons to the infamous 2011 PSN hack, which resulted in a 24-day downtime and a massive security breach exposing the personal data of 77 million users. While there was no indication that this latest outage was caused by a cyberattack, the extended silence from Sony led to growing frustration among gamers.

The timing of the outage was particularly disruptive, as the weekend is when many players participate in special in-game events and tournaments. FC 25’s highly competitive “Weekend League” in Ultimate Team mode was impacted, forcing EA to extend the event for affected players. Similarly, Call of Duty: Black Ops 6 and Warzone were in the middle of a double XP weekend, meaning players looking to level up their characters and unlock rewards were unable to do so. Other online games like Fortnite, Roblox, and Marvel Rivals also experienced widespread disruptions.

Social media was quickly flooded with complaints, memes, and jokes from PlayStation users. Many pointed out that they pay for PlayStation Plus, which costs up to £119.99 per year, and expected better service reliability. Some users demanded compensation, with one player posting on X (formerly Twitter), “Let’s be real; everyone deserves this month’s PS Plus for free. Paying monthly for the network to be down on a weekend is belligerent.” Another joked, “PlayStation Network down, time to get to know my wife of 5 years.” The outage also prompted an unexpected marketing opportunity for Krispy Kreme, which offered free Original Glazed doughnuts at select locations on Saturday evening, calling it “sweet relief” for gamers who had been forced offline.

While some players began regaining access to PSN on Saturday afternoon, the outage was not fully resolved until Sony officially announced its restoration just before midnight on Sunday. The company did not provide any details about the cause of the disruption but issued a brief statement apologizing for the inconvenience. As compensation, Sony offered all affected users an extra five days of free PlayStation Plus access, a small gesture that left many still frustrated by the prolonged downtime.

The incident reignited concerns about the growing reliance on digital services in the gaming industry. The fact that even single-player digital games were unplayable due to license verification checks highlighted the risks of an always-online ecosystem. Many gamers argued that physical game ownership remains crucial, as those with digital libraries were completely locked out of their purchases for an extended period. Others called for Sony to improve its server stability and provide better transparency during outages.

While the outage has now been resolved, it serves as a reminder of how dependent modern gaming has become on network connectivity. For Sony, the backlash from this incident may push the company to rethink its communication strategy during technical failures and potentially address concerns regarding digital game access in future system updates. Meanwhile, gamers are left hoping that another prolonged disruption does not happen anytime soon—especially with major upcoming releases and online events on the horizon.

Walt Disney Co ($DIS):

The first trailer for The Fantastic Four: First Steps has taken the internet by storm, racking up over 202 million views across all platforms within its first 24 hours. This makes it one of the most successful Marvel Studios trailer launches in recent history, second only to Deadpool & Wolverine and Spider-Man: No Way Home. The overwhelming response to the trailer signals massive anticipation for the Marvel Cinematic Universe’s (MCU) long-awaited reboot of The Fantastic Four, which is set to hit theaters in July 2025.

To celebrate the trailer's release, the film’s cast—Pedro Pascal as Reed Richards (Mr. Fantastic), Vanessa Kirby as Sue Storm (The Invisible Woman), Joseph Quinn as Johnny Storm (The Human Torch), and Ebon Moss-Bachrach as Ben Grimm (The Thing)—made a public appearance at the U.S. Space and Rocket Center in Huntsville, Alabama. The event, which featured the cast unveiling the trailer in front of a live audience, became the most-watched Marvel livestream on YouTube, further solidifying the film’s status as one of the most highly anticipated projects of Marvel’s Phase 6.

The Fantastic Four has had a tumultuous journey in live-action film history. Originally published in 1961 by Stan Lee and Jack Kirby, The Fantastic Four has long been considered one of Marvel’s most important properties. However, the team’s transition to the big screen has been rocky. The 2005 and 2007 films starring Ioan Gruffudd, Jessica Alba, Chris Evans, and Michael Chiklis were met with lukewarm critical reception, despite their commercial success. The 2015 reboot, Fant4stic, was a critical and financial disaster, with behind-the-scenes conflicts, heavy studio interference, and a narrative that failed to capture the spirit of Marvel’s First Family.

Now, under the guidance of Marvel Studios President Kevin Feige and director Matt Shakman (WandaVision), The Fantastic Four: First Steps aims to finally do justice to the beloved superhero team. Unlike previous adaptations, this film leans heavily into a retrofuturistic aesthetic inspired by the 1960s space race, which aligns with the team's origins in the Silver Age of comics. The trailer hints at an alternate Earth filled with mid-century modern technology, suggesting that the Fantastic Four may exist in a pocket universe rather than the main MCU timeline. This creative choice allows Marvel to keep the Fantastic Four distinct from its other superheroes while setting up their eventual integration into larger crossover events.

One of the most talked-about moments from the trailer is the reveal of Galactus, the cosmic entity who devours planets. Fans have been eager to see how the MCU would handle such a massive character, especially given the disappointment surrounding Fantastic Four: Rise of the Silver Surfer (2007), which depicted Galactus as a nebulous space cloud rather than the towering, humanoid cosmic force from the comics. The new trailer makes it clear that Marvel Studios is staying true to the source material, presenting Galactus in all his terrifying glory. This also raises questions about how The Fantastic Four will fit into the greater MCU narrative, as Galactus could play a significant role in upcoming films like Avengers: Doomsday and Avengers: Secret Wars.

Another highlight of the trailer is the chemistry between the film’s four leads. Pedro Pascal’s casting as Reed Richards has been met with widespread excitement, as the actor’s charismatic performances in The Mandalorian and The Last of Us have cemented him as a fan-favorite leading man. Vanessa Kirby, known for her work in The Crown and Mission: Impossible – Fallout, brings a regal presence to Sue Storm, while Joseph Quinn, fresh off his breakout role as Eddie Munson in Stranger Things, seems to be embracing the playful, rebellious nature of Johnny Storm. Meanwhile, The Bear star Ebon Moss-Bachrach is taking on the role of Ben Grimm, with early glimpses suggesting that his version of The Thing will be both emotionally compelling and true to the comics.

On social media, excitement for The Fantastic Four: First Steps has been massive. The film trended at #1 on X (formerly Twitter) and YouTube, with hashtags related to the movie, its stars, and even specific characters like Galactus generating nearly 500,000 mentions. Marvel fans have praised the trailer’s visual style, tone, and world-building, with many expressing optimism that this will finally be the definitive Fantastic Four adaptation. Some have also noted that the retro aesthetic gives the film a unique identity within the ever-expanding MCU.

Despite the overwhelmingly positive reception, some fans remain cautious. Given the MCU’s recent struggles, including the underperformance of several Phase 4 and 5 films, The Fantastic Four needs to deliver a truly standout film to restore faith in the franchise. However, early signs suggest that Marvel is pulling out all the stops to ensure this reboot succeeds where previous attempts have failed.

As Marvel Studios prepares to officially introduce The Fantastic Four to the MCU, anticipation will only continue to build. If the trailer’s record-breaking performance is any indication, The Fantastic Four: First Steps is poised to be one of the biggest blockbusters of 2025. Whether it lives up to the hype remains to be seen, but one thing is certain—the Fantastic Four are finally getting the spotlight they deserve.

PDD Holdings Inc. ($PDD):

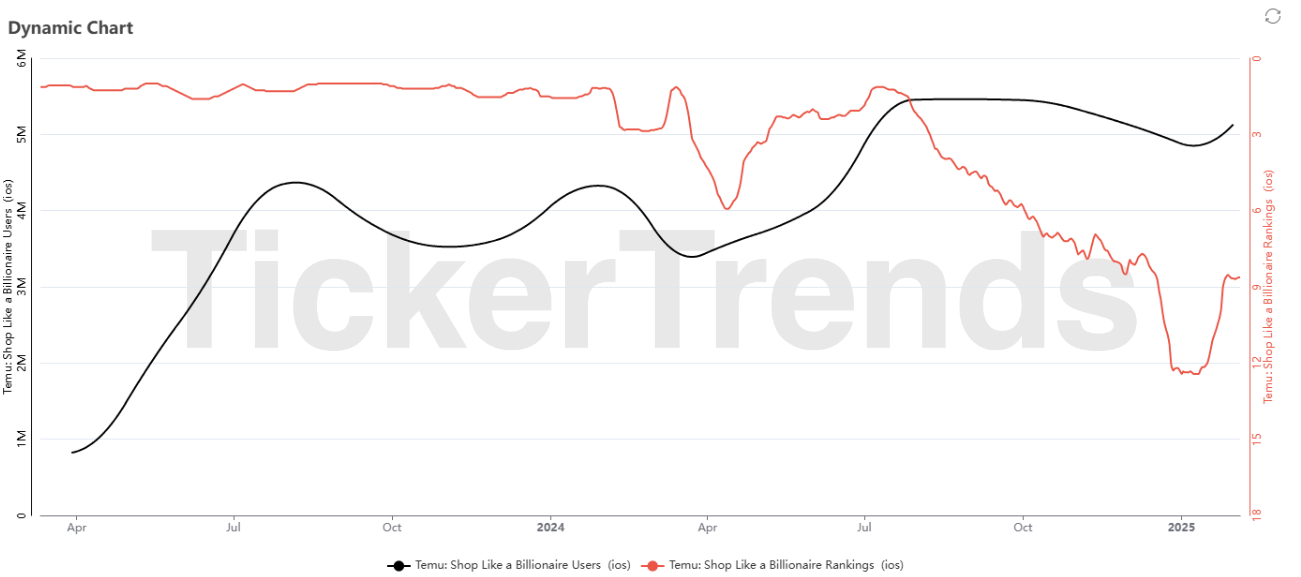

President Donald Trump has reinstated the de minimis tariff exemption, allowing shipments valued under $800 from China to enter the U.S. without customs duties or inspections. This decision reverses his earlier move to eliminate the exemption as part of his administration’s 10% tariff on Chinese imports, which took effect earlier this week. The de minimis rule, originally part of the Tariff Act of 1930, was intended to allow small, low-value imports to bypass tariffs. However, when Congress raised the threshold from $200 to $800 in 2016, the provision became a major advantage for Chinese e-commerce giants like Shein and Temu, which ship directly from suppliers in China to American consumers—avoiding tariffs and customs oversight.

The decision to remove the de minimis exemption earlier this week had caused immediate disruption in global e-commerce logistics. The U.S. Postal Service (USPS) temporarily suspended shipments from China, citing confusion over the new rules. The change also threatened to increase prices on Shein and Temu products, slow down delivery times, and force these retailers to shift their business models—either by absorbing higher costs, raising prices, or rerouting shipments through third-party countries to avoid direct China-to-U.S. tariffs. Analysts had warned that millions of American consumers, particularly younger shoppers who rely on ultra-cheap goods from Shein and Temu, would be affected by price hikes and longer wait times.

Trump’s executive order reinstating de minimis ensures that these packages will continue entering the U.S. duty-free, at least temporarily. The exemption will only be removed again once the U.S. Commerce Department establishes a system to efficiently collect tariff revenue on low-value imports. While this delay provides short-term relief for e-commerce retailers, it leaves uncertainty about the long-term future of de minimis and whether companies like Shein and Temu will need to permanently alter their supply chains.

The decision to reinstate the exemption comes amid broader concerns from both Republican and Democratic lawmakers, who argue that the de minimis loophole is exploited by foreign companies to evade U.S. trade laws and customs oversight. Critics also worry that it enables imports of counterfeit goods, unsafe products, and even illicit substances like fentanyl, which are harder to monitor under the current system. The House Select Committee on the Chinese Communist Party had previously flagged Temu’s business model as heavily dependent on de minimis, raising concerns about compliance with U.S. labor laws, including the ban on forced labor from China’s Xinjiang region.

As Chinese e-commerce firms navigate these shifting trade policies, some have already begun adapting. Reports suggest Temu is shifting towards U.S.-based warehouses to reduce dependence on China-based sellers, while Shein has started sourcing more products from countries like Brazil and Turkey. These adjustments may help mitigate risks associated with future tariff changes but could also impact their ability to maintain ultra-low prices.

In addition to the de minimis debate, Trump has signaled further trade actions, announcing plans to introduce reciprocal tariffs on multiple countries. While he has not specified which nations will be targeted, he argues that the U.S. should match the tariffs imposed by foreign governments on American goods. Trump’s recent trade policies also include a 25% tariff on Canadian and Mexican imports, though its implementation has been delayed for 30 days as his administration negotiates new border agreements with both countries.

For now, Shein and Temu have avoided an immediate pricing crisis, but with growing bipartisan support for closing the de minimis loophole, their business models could still face significant challenges in the near future.

Alibaba Group Holding Limited ($BABA):

Alibaba has denied reports that it plans to invest in DeepSeek, a rising Chinese AI startup. Yan Qiao, an Alibaba vice president, dismissed the rumors on WeChat, calling them "fake news", despite speculation that the company was considering a $1 billion investment. However, while Alibaba is not directly investing in DeepSeek, its cloud computing unit has integrated DeepSeek's AI models into its platform, joining Microsoft, Amazon, Huawei, and Tencent in offering DeepSeek’s models to customers.

Alibaba Cloud users can now access DeepSeek’s latest AI models, such as DeepSeek-V3 and DeepSeek-R1, via its PAI Model Gallery, allowing them to train, deploy, and run AI applications without coding. DeepSeek’s models, known for their efficiency and low development costs, have drawn attention as a competitive alternative to OpenAI’s GPT-4o and Meta’s Llama-3.1-405B. The move highlights Alibaba’s push to expand its AI ecosystem while competing with both foreign AI giants and domestic Chinese tech rivals.

DeepSeek has quickly gained traction in the global AI market, surpassing ChatGPT in downloads on the U.S. App Store, which has led to increased scrutiny from both American and Chinese tech firms. Alibaba, which recently launched its own Qwen 2.5-Max model, claims that its AI system outperforms DeepSeek’s on several benchmarks. The race for AI supremacy in China is intensifying, with companies like Huawei, Tencent, and ByteDance rapidly upgrading their own models in response to DeepSeek’s rise.

While Alibaba is leveraging DeepSeek's technology for cloud services, it remains to be seen how the Chinese AI landscape will evolve as companies jockey for dominance in the competitive AI market.

United Airlines Holdings Inc ($UAL):

A United Airlines flight from Houston to New York was evacuated on February 2, 2025, after flames were seen bursting from one of the aircraft’s wings just before takeoff at George Bush Intercontinental Airport (IAH). The Airbus A319, operating as Flight 1382 to LaGuardia (LGA), was forced to abort takeoff when passengers and crew noticed a fire near the engine. Video footage taken by passengers captured the terrifying moment flames shot from the wing, sparking panic among those on board. A flight attendant initially instructed passengers to stay in their seats, but as concern grew, an emergency evacuation was initiated. All 104 passengers and five crew members safely exited the aircraft via slides and stairs, with no injuries reported. The Houston Fire Department responded but did not need to extinguish a fire, as the flames had already dissipated. The FAA has launched an investigation into the cause of the incident, though details on what triggered the engine issue remain unclear.

This incident comes at a time when United Airlines is expanding its regional network and working to strengthen its reputation for reliability. However, mechanical failures and in-flight emergencies can significantly impact customer trust, investor confidence, and regulatory scrutiny. While United has made strides in improving its public image, passenger confidence may be shaken by such a serious safety issue. A fire during takeoff raises concerns about maintenance standards and aircraft reliability, and travelers may hesitate to book flights with United, especially on routes using the same aircraft model.

With the FAA investigating, United could face increased scrutiny over its aircraft maintenance procedures. If a mechanical failure or maintenance oversight is found to be the cause, new safety inspections or regulations could be imposed, leading to increased operational costs and potential delays. Additionally, if the issue is related to the Airbus A319 model itself, broader industry repercussions could follow, impacting not just United but other carriers using the same aircraft.

Beyond regulatory concerns, this incident could have financial implications for United Airlines. Negative press and passenger concerns could affect United’s stock price and future earnings, while potential grounding of similar aircraft could disrupt flight schedules and increase costs. Competitors like Delta and American Airlines may capitalize on the situation, promoting their own safety records and reliability to attract concerned United customers.

While this event poses a challenge, United has the resources to recover if it responds effectively. Transparent communication, reassurances about safety measures, and proactive engagement with regulators could help rebuild trust. If the airline fails to address concerns thoroughly, however, it risks long-term reputational and financial damage. For now, United must work quickly to manage the fallout, ensure passenger confidence, and prevent similar incidents in the future.

Build-A-Bear Workshop ($BBW):

Build-A-Bear’s After Dark Valentine's Day Collection is making waves with its latest Cuddly Cougar gift sets, designed exclusively for adults and available through the brand’s 18+ Bear Cave microsite. Tapping into the kidulting trend, where nostalgic childhood brands introduce playful, grown-up twists, the collection has quickly gained attention for its humorous yet stylish take on Valentine’s Day gifting. The Cuddly Cougar comes in four unique styles, including a faux fur coat, a sparkly pink sequin dress, an ‘On the Prowl’ tee with denim, and a Romantasy Book Club edition, which features a plush wine glass and book-themed accessories. These sets cater to a growing market of adults looking for fun, creative, and unconventional gifts beyond traditional chocolates and flowers.

In addition to the Cuddly Cougar, the After Dark collection also includes 11 other plush gift sets, including the viral Lovable Lion in a ‘Zaddy’ t-shirt, which has gained over 2 million views across social media. The campaign has been a massive hit, with the trailer video amassing 3.5 million views on TikTok in just five days. While some online comments have questioned the brand’s edgier approach, the overall response has been positive, with many fans praising Build-A-Bear for embracing humor, self-expression, and unique personalization options.

This expansion into the adult gift market demonstrates Build-A-Bear’s ability to evolve beyond its traditional family-friendly image while maintaining strong brand loyalty. The Bear Cave microsite, launched in 2019, serves as a dedicated space for mature-themed plush and novelty gifts, allowing Build-A-Bear to engage with adult consumers in a fresh, creative way. With high social engagement, viral success, and growing demand for experiential gifting, the After Dark collection is proving that Build-A-Bear is more than just a childhood favorite—it’s a brand that knows how to keep up with cultural trends and redefine gifting for all ages.

iShares Bitcoin Trust ETF ($IBIT):

If the newly announced U.S. Sovereign Wealth Fund (SWF) includes Bitcoin, it could mark a historic shift in how digital assets are viewed at the government level. The potential inclusion of Bitcoin in a national reserve fund would legitimize it as a strategic asset, placing it alongside gold, U.S. Treasury bonds, and other traditional reserve holdings. This move would signal to global markets that Bitcoin is not just a speculative investment but a legitimate store of value, potentially leading to increased institutional adoption and regulatory clarity.

A government-backed Bitcoin reserve could also drive massive capital inflows into the cryptocurrency market. Analysts estimate that if the SWF allocates just 3% of its projected $4.8 trillion fund, this could bring around $150 billion into Bitcoin, representing approximately 1.5 million BTC at current prices. A more aggressive 10% allocation could result in $500 billion worth of Bitcoin purchases, potentially pushing Bitcoin’s price well beyond $100,000 and accelerating its path to becoming a global macro asset. This scale of investment would outpace even the largest institutional purchases seen in the Bitcoin space so far.

The move could also spark a domino effect among other sovereign wealth funds and institutions. Already, major funds like Norway’s $1.8 trillion SWF and Abu Dhabi’s sovereign fund have started investing in Bitcoin and digital asset infrastructure. If the U.S. government officially accumulates Bitcoin, other nations and institutional investors may feel pressured to follow suit, fearing they will be left behind in the next phase of financial evolution. This could further legitimize Bitcoin as a hedge against inflation, particularly in an era of rising government debt and fiscal uncertainty.

However, short-term volatility is almost inevitable. Bitcoin’s price has already reacted sharply to Trump’s tariffs on China, Mexico, and Canada, and speculation over the SWF’s Bitcoin holdings could lead to further market swings. If traders anticipate government accumulation, Bitcoin’s price could surge in the short term, but any hesitation or regulatory pushback could cause a sharp pullback. Furthermore, political risk remains a major factor—while the current administration is crypto-friendly, a future government could reverse course, potentially liquidating Bitcoin holdings, which could send shockwaves through the market.

The regulatory and political implications of this move could be profound. With Commerce Secretary Howard Lutnick and Crypto Czar David Sacks evaluating Bitcoin’s potential role, the U.S. could move toward a more pro-crypto regulatory environment. This could result in clearer rules regarding Bitcoin’s classification, tax incentives for long-term Bitcoin holders, and expanded federal mining initiatives. At the same time, critics, including BitMEX co-founder Arthur Hayes, warn that government-controlled Bitcoin reserves could be a double-edged sword—offering stability in the short term but introducing risks if policymakers decide to sell.

If the U.S. moves forward with Bitcoin integration into its sovereign wealth fund, it could be one of the most significant developments in Bitcoin’s history. It would not only drive institutional demand and increase price stability but also position Bitcoin as a permanent fixture in the global financial system. However, with major uncertainties still lingering, investors and policymakers alike will be watching closely to see how this plays out. If successful, Bitcoin could transition from a volatile speculative asset to a cornerstone of sovereign financial reserves, forever changing the narrative around digital assets.