What’s Trending with TickerTrends #20

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Walmart Inc. ($WMT):

Walmart closed out fiscal year 2025 on a strong note, reporting 5.2% sales growth and a 9.4% increase in adjusted operating income in constant currency. The company continues to gain market share across income levels and geographies, reinforcing its position as a value leader. Transaction counts and unit volumes increased in all key markets, reflecting Walmart’s ability to serve a broad customer base. Management highlighted three core drivers of growth: maintaining low prices, expanding convenience through e-commerce and fulfillment improvements, and scaling higher-margin businesses such as membership, marketplace, and advertising. Despite ongoing macroeconomic challenges, Walmart demonstrated that its strategy of balancing cost efficiency with targeted investments is paying off.

One of the most notable takeaways from the call was Walmart’s ability to grow profit faster than revenue. While merchandise category mix remains a headwind due to a higher share of grocery and health & wellness sales, Walmart is offsetting this with improved profitability in its newer businesses. Membership income rose 21% to $3.8 billion, while Walmart Connect advertising revenue grew 27% to $4.4 billion. Additionally, the marketplace business in the U.S. expanded 37%, with Walmart Fulfillment Services (WFS) reaching a record penetration of nearly 50%. These digital profit streams are allowing Walmart to invest in pricing and wages while still delivering operating margin expansion.

E-commerce remains a major growth driver, with global online sales up 16% in Q4 and U.S. e-commerce growing 20%. Importantly, Walmart’s digital operations are becoming more profitable. The company reported incremental e-commerce margins of 11%, nearly double its overall enterprise margin, due to a combination of higher-margin marketplace sales, increased advertising revenue, and improvements in fulfillment efficiency. Walmart has significantly reduced its net delivery costs per order and now reaches 93% of U.S. households with same-day delivery. Expedited shipping is gaining traction, with over 30% of store-fulfilled deliveries now including an additional fee for one-hour or three-hour service. This trend is helping Walmart monetize convenience while strengthening its competitive position.

AI and automation were another key focus area, with Walmart continuing to integrate technology to drive efficiencies across the business. The company highlighted two major AI-driven initiatives: an internal tool called "Wally," which assists merchants in identifying root causes of inventory issues, and AI-powered coding assistance that saved 4 million developer hours last year. These investments are improving speed and accuracy in operations, leading to cost savings that will support Walmart’s long-term growth objectives. Additionally, Walmart’s ongoing investments in supply chain automation are expected to lower fulfillment costs and further enhance its ability to offer faster and more reliable delivery services.

Another important strategic development is the announcement that PhonePe, Walmart’s fintech subsidiary in India, is preparing for an IPO. PhonePe has grown into a dominant player in digital payments, with 310 million daily transactions and total payment volume reaching $1.7 trillion. A successful IPO could unlock significant value for Walmart and provide capital to expand its financial services offerings in India. This move also aligns with Walmart’s broader strategy of leveraging digital platforms to create new revenue streams beyond traditional retail.

On the capital allocation front, Walmart increased its dividend by 13%, the largest hike in over a decade, signaling confidence in future cash flow generation. The company also plans to accelerate share buybacks in FY 2026 while continuing to invest in technology, automation, and new store openings in key international markets. CapEx is projected to be in the range of 3% to 3.5% of sales, with a focus on supply chain improvements and fulfillment capacity expansion.

Walmart expects sales growth of 3-4% and operating income growth of 3.5-5.5%, excluding the impact of the VIZIO acquisition and the leap year. The company acknowledged ongoing macroeconomic uncertainties but remains optimistic about its ability to drive consistent performance. Management highlighted that January was the strongest comp month of Q4, indicating solid momentum heading into the new fiscal year. Consumer behavior has remained stable, and Walmart continues to attract higher-income shoppers who are trading down. While inflation remains a factor, particularly in food categories like eggs and beef, Walmart’s extensive rollback program and strong inventory management position it well to maintain its value leadership.

Walmart’s acquisition of VIZIO is another move aimed at strengthening its digital ecosystem. The addition of VIZIO’s SmartCast platform will enhance Walmart Connect’s advertising capabilities, enabling the company to further monetize its digital traffic. Management expects the acquisition to be accretive to earnings by FY 2027, with near-term integration costs weighing slightly on operating income in the first half of FY 2026.

Birkenstock Holding PLC ($BIRK):

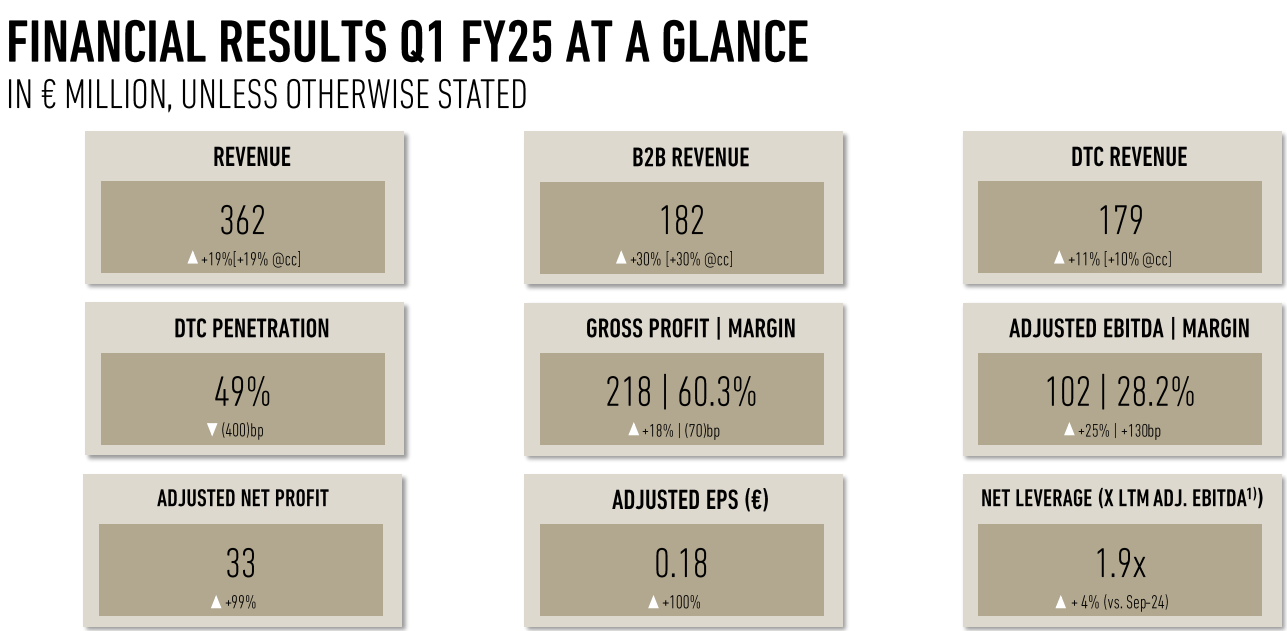

Birkenstock delivered a strong start to fiscal year 2025, exceeding expectations with 19% revenue growth in Q1, which was above the high end of the company’s full-year target of 15%-17%. This growth was fueled by double-digit volume growth and mid-single-digit increases in average selling price (ASP), with particularly strong momentum in closed-toe shoes, the APAC region, and owned retail stores. The company continues to execute on its long-term strategy of becoming a year-round brand, leveraging its strong brand positioning and strategic wholesale partnerships.

One of the most notable aspects of this quarter was the accelerated demand for closed-toe silhouettes, which grew at twice the pace of the overall business, increasing their share of revenue by 600 basis points. Twelve of the top 20 best-selling styles were closed-toe, spanning clogs, lace-up shoes, and boots, solidifying Birkenstock’s transition beyond a traditional summer sandal brand. The Americas and EMEA regions both saw significant traction in clogs, with closed-toe products representing nearly two-thirds of revenue in the Americas. The shift to closed-toe shoes also drove higher ASPs, reinforcing the premiumization trend within the brand.

APAC was the fastest-growing segment, up 47% and now accounts for 13% of total revenue, up from 10.5% a year ago. Growth in APAC was driven by expanding retail presence and wholesale partnerships, including 19 new mono-brand partner doors and two new company-owned stores. Notably, Greater China contributed 30% of APAC revenue, and the company is still in the early stages of its rollout there. Birkenstock is steadily building brand awareness in China, with its first owned store opening in Chengdu in October and a successful Shanghai pop-up set to become permanent. Management remains confident that APAC will continue to grow at double the pace of the total business in the coming quarters.

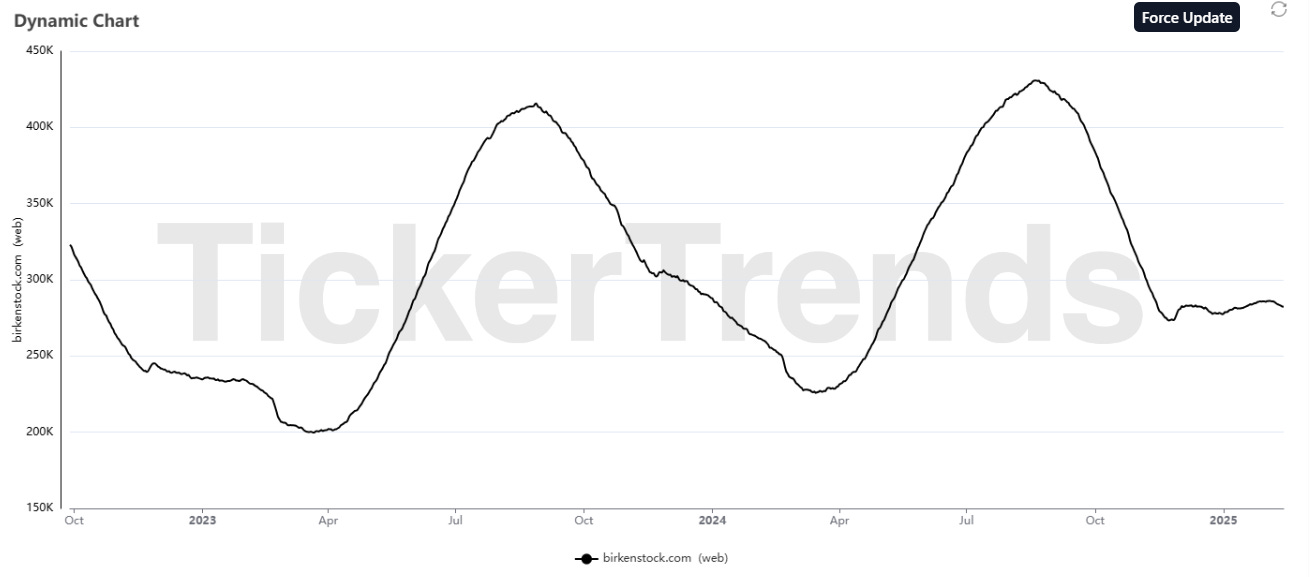

Birkenstock’s B2B channel saw outstanding 30% growth, reflecting strong wholesale partnerships and a pull-driven strategy where retail partners are allocating more shelf space to the brand. Over 90% of the B2B growth came from existing partners, demonstrating increasing demand for Birkenstock products within established wholesale accounts. Sell-through at key wholesale partners increased up to 40% year-over-year at full price, while inventory levels rose only 10%, keeping stock-to-sales ratios healthy. The DTC business, which grew 10%, benefited from record website traffic during the holiday gifting season, particularly for Boston clogs and shearling styles. Management expects DTC growth to outpace B2B in the second half of the year, as the company opens additional stores and expands its digital capabilities. The company-owned retail business was up 70%, albeit from a small base, and four new stores were opened in Q1, bringing the global total to 71 stores, with plans to approach 100 stores by year-end.

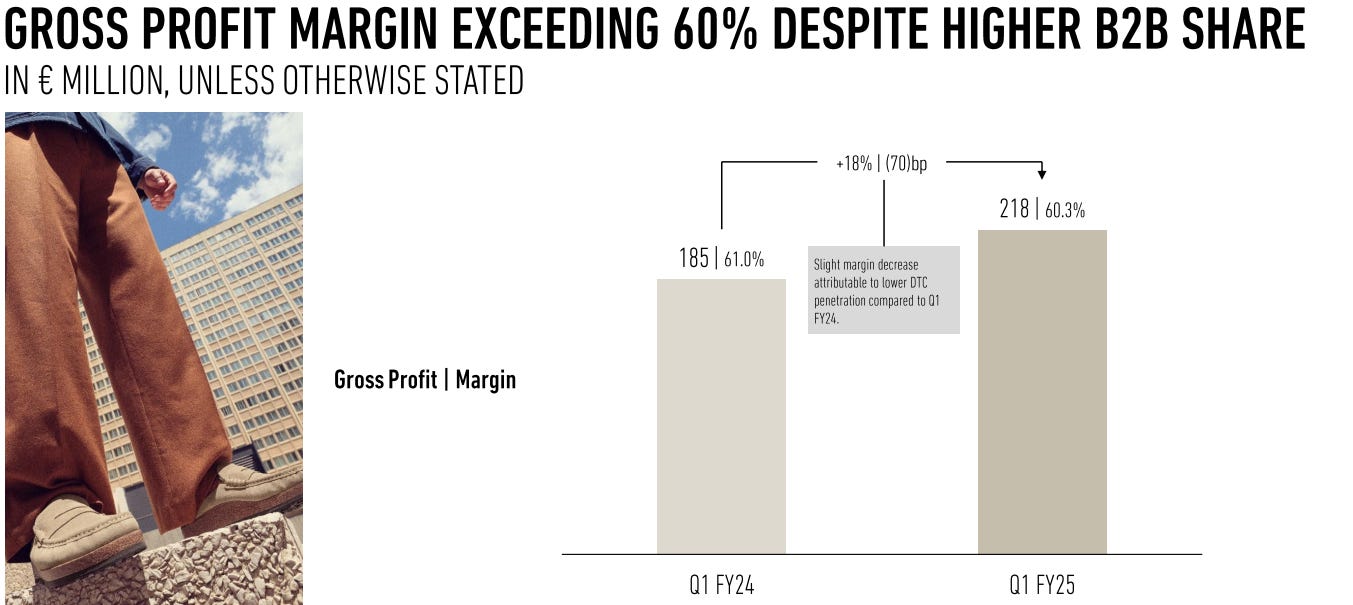

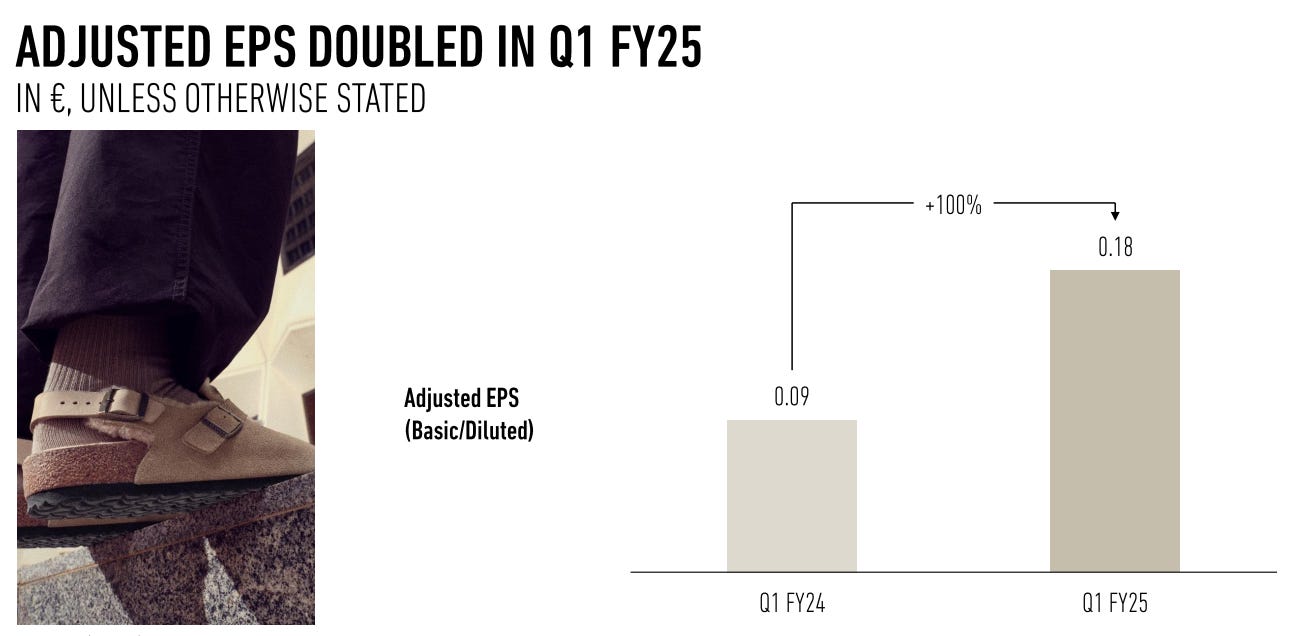

Birkenstock’s gross margin was 60.3%, down 70 basis points year-over-year, primarily due to a higher mix of B2B revenue. However, operating efficiencies helped drive EBITDA margin expansion, with Q1 EBITDA rising 25% to €102 million, leading to a 130 basis point increase in EBITDA margin to 28.2%. Adjusted net profit nearly doubled to €33 million, and earnings per share jumped 100% to €0.18. Importantly, inventory-to-sales ratios improved to 39% from 42% last year, and days sales outstanding (DSO) decreased to 15 from 19, reflecting strong cash flow management. The company also invested €90 million in CapEx, focused on increasing production capacity in Pasewalk, Görlitz, and Arouca to support future growth.

Management reiterated its full-year guidance of 15%-17% revenue growth and expects gross margin to improve as factory utilization increases and efficiency gains materialize. Adjusted EBITDA margin is expected to expand by 50 basis points to a range of 30.8%-31.3%, while net leverage is projected to decline to 1.5x by year-end. Q2 is expected to be heavily weighted toward B2B shipments as wholesale partners prepare for the spring/summer season, leading to typical seasonal gross margin fluctuations. However, the company expects DTC growth to accelerate in the back half of the year as it opens new retail stores and expands digital sales.

Management acknowledged uncertainties surrounding tariffs, inflation, and global economic conditions but remained confident in its ability to offset cost pressures through pricing adjustments and operational efficiencies. The company has historically taken targeted, surgical price increases by style, rather than broad hikes, which has helped maintain strong full-price sell-through rates. The company's shift toward a year-round brand, increased penetration in APAC, and expansion of owned retail stores all point to a long runway for growth.

Trends this week:

Build-A-Bear Workshop, Inc. ($BBW):

A recent birthday party at Build-A-Bear Workshop has gone viral for all the wrong reasons, sparking widespread conversation on social media and bringing unexpected attention to the brand. The incident, which was first shared on Reddit and later resurfaced on TikTok, involved a mother who invited children to a Build-A-Bear celebration, only for the guests to discover that their custom-made stuffed animals were not theirs to keep. Instead, the birthday girl’s mother collected all the bears as gifts for her daughter, leaving many children confused and upset. The story quickly gained traction, with millions engaging in discussions about party etiquette, proper communication, and the logistics of hosting a Build-A-Bear event.

While the situation itself was not orchestrated by Build-A-Bear, it could inadvertently work in the company’s favor by bringing significant brand awareness and reinforcing the importance of booking official Build-A-Bear parties. Many parents, previously unaware of the structured offerings available through the company, are now learning that Build-A-Bear provides dedicated birthday party packages designed to ensure a seamless and enjoyable experience for all guests. These official events clarify expectations from the outset, ensuring that each child leaves with their own creation, while also offering structured activities and special perks that enhance the celebration.

The viral nature of the story has also positioned Build-A-Bear at the forefront of this social discussion, serving as free publicity that keeps the brand top of mind for parents planning upcoming birthdays and special occasions. With millions engaging in conversations about the brand, this unexpected exposure could drive an increase in party bookings and foot traffic to Build-A-Bear locations. Additionally, the controversy highlights the emotional connection people have with the Build-A-Bear experience, reinforcing the idea that a bear is not just a toy, but a cherished memory.

As the story continues to gain momentum, Build-A-Bear has the opportunity to lean into this viral moment by subtly reinforcing the value of its official party packages through marketing efforts and social media engagement. Whether through promotions, increased visibility of its structured offerings, or playful acknowledgment of the situation, the brand can turn an internet controversy into a business advantage. In the end, what started as a mishandled birthday party has become a moment of widespread awareness garnering over 200M impressions for Build-A-Bear, solidifying Build-A-Bear’s reputation as the go-to destination for memorable, well-organized celebrations.

Delta Air Lines Inc ($DAL):

Delta Air Lines is facing mounting legal and reputational challenges following the crash landing of Flight 4819 at Toronto Pearson International Airport. The incident, which resulted in the aircraft flipping over and catching fire, has led to multiple lawsuits from passengers alleging negligence on the part of Delta and its subsidiary, Endeavor Air. Two passengers have already filed lawsuits in U.S. courts, citing physical and emotional trauma, with more legal actions likely to follow. The lawsuits claim that improper flight crew training and operational mismanagement contributed to the crash, raising serious concerns about Delta’s safety protocols.

Beyond the legal implications, Delta's initial response—offering passengers $30,000 each as compensation—has been met with skepticism. While positioned as a goodwill gesture, legal experts suggest it may be an attempt to minimize potential payouts by discouraging passengers from pursuing further litigation. The offer also raises questions about Delta’s liability, particularly under the Montreal Convention, which allows passengers to claim up to $200,000 in damages without the airline needing to be found negligent. If negligence is proven, Delta could face even higher financial penalties.

The airline's reputation has also taken a hit, as video footage of the crash has circulated widely, fueling public concerns over air travel safety. The fact that the plane flipped on landing, despite clear weather conditions, has led to scrutiny over Delta’s pilot training standards and aircraft maintenance procedures. The crash comes at a time when the airline industry is already under intense regulatory scrutiny following multiple high-profile aviation incidents.

Additionally, Delta’s communication strategy has drawn criticism. While the airline has defended the qualifications of its flight crew, its reluctance to provide detailed comments on the litigation has left many unanswered questions. Passengers who experienced the harrowing ordeal, including being doused in jet fuel and hanging upside down in their seats, are unlikely to be satisfied with vague corporate statements.

The long-term impact of this incident on Delta’s business remains uncertain, but the airline is now dealing with legal battles, potential regulatory investigations, and a damaged public image. If further evidence emerges indicating systemic failures, Delta could face significant financial and operational consequences, including increased scrutiny from aviation regulators and a loss of consumer confidence. The crash serves as a stark reminder that even industry giants are not immune to safety lapses, and the way Delta handles the aftermath will be critical in determining its ability to restore trust among passengers.

Celsius Holdings Inc ($CELH):

Celsius Holdings Inc. has announced its largest acquisition to date, acquiring Alani Nutrition LLC for $1.8 billion in a cash-and-stock transaction. The deal, backed by a $1 billion debt package led by UBS Group AG, is expected to close in the second quarter of 2025. This acquisition marks a significant milestone for Celsius as it seeks to solidify its position in the competitive energy drink market and expand its footprint in the growing health and wellness segment.

The acquisition of Alani Nutrition comes at a pivotal time when the energy drink industry is experiencing a shift toward "better-for-you" alternatives. Consumers are increasingly opting for functional beverages with added health benefits, such as zero-sugar, vitamin-enriched, and natural energy drinks. Celsius has capitalized on this trend by positioning itself as a healthier alternative to traditional energy drink giants like Red Bull and Monster Beverage. The addition of Alani Nu, a brand that has built strong brand loyalty among Gen Z and millennial women through influencer marketing, further strengthens Celsius’s position in this growing category.

Alani Nu, founded in 2018 by fitness influencer Katy Hearn, has demonstrated rapid growth, achieving $600 million in revenue in 2024, with a 78% year-over-year increase in U.S. retail and convenience store sales. Its focus on sugar-free energy drinks, supplements, and protein products aligns well with Celsius’s broader vision of creating a functional lifestyle brand. This acquisition also follows a broader industry trend of consolidation and expansion within the energy drink market. Keurig Dr Pepper recently acquired Ghost Lifestyle for over $1 billion, and Molson Coors secured a majority stake in Zoa, signaling increased competition among beverage giants looking to capture the lucrative energy drink segment.

Celsius is funding the transaction with a combination of debt and equity. The $1 billion financing package includes a $900 million term loan and a $100 million revolving credit facility, allowing the company to maintain liquidity while pursuing long-term growth. The transaction is expected to be accretive to cash earnings per share (EPS) within the first year of ownership, with projected cost synergies of $50 million over the next two years.

Following the acquisition, Celsius will expand its market share in the $23 billion energy drink industry from 11% to approximately 16%. The integration of Alani Nu will also diversify Celsius’s product offerings beyond energy drinks, adding protein shakes, bars, and supplements to its portfolio. This expansion not only enhances cross-selling opportunities but also mitigates risks associated with reliance on a single product category. However, some analysts have raised concerns about potential overlaps between Celsius and Alani Nu's consumer base. Both brands have strong followings among young, health-conscious women, which could lead to cannibalization rather than incremental sales growth. Additionally, as Alani Nu’s success has been largely driven by social media trends, its long-term customer retention remains uncertain.

Despite concerns, Celsius’s leadership remains optimistic about the deal. CEO John Fieldly emphasized that the acquisition allows Celsius to better compete with major industry players by leveraging multi-brand pricing strategies and expanding its retail presence. The deal also enhances the company’s ability to innovate within the functional beverage space, a segment that continues to see strong consumer demand. Celsius has already demonstrated its ability to scale rapidly, growing revenue from $17 million a decade ago to $1.4 billion in 2024. The integration of Alani Nu presents an opportunity to sustain this momentum by broadening the brand’s reach, tapping into adjacent product categories, and further strengthening its retail and distribution capabilities. The deal indicates Celsius’s aggressive expansion strategy as it seeks to become a dominant force in the energy and wellness beverage sector.

Wendy’s Co ($WEN):

Wendy’s launched its Thin Mints Frosty, a limited-time dessert combining its classic chocolate or vanilla Frosty with a minty cookie crumble sauce inspired by Girl Scout Thin Mints. Timed with National Girl Scout Cookie Weekend (February 21-23), the rollout includes over 4,200 locations hosting Girl Scout troops selling cookies, plus an app-based Thin Mints Frosty Adventure game starting February 24, offering daily prizes and a $10,000 sweepstakes entry. The dessert, priced between $2.49 and $3.79, has already stirred social media chatter tied to the annual cookie season kickoff.

While not a groundbreaking innovation, the Thin Mints Frosty taps into the proven appeal of limited-time offerings (LTOs) and nostalgia-driven partnerships. Wendy’s aims to boost Q1 foot traffic and digital engagement, leveraging the Girl Scout brand to draw families and younger demographics. The app game adds a layer of interactivity, potentially increasing mobile orders, which often carry higher tickets than in-store purchases. Early buzz suggests it could resonate with its audience with many social media users voicing their opinions.

The initiative could pay off by driving incremental sales in a typically slow post-holiday period. Desserts offer high margins—often above 30%—and the cookie booth tie-in might pull in impulse buyers. Social media traction, fueled by the Girl Scout connection, provides free exposure to the company who has been struggling to gain meaningful share.

However, overlapping with actual Thin Mint availability risks confusing customers, and supply chain hiccups could derail momentum. The app game’s $10,000 prize might spark interest, but it’s competing in a saturated digital space. Wendy’s leadership is banking on the Girl Scout tie-in to amplify brand goodwill, though the lack of novelty raises questions. The company’s muted response to past LTO critiques suggests confidence in the formula, but details on projected sales lift remain vague. Customers craving Thin Mints might just buy the cookies instead, leaving the Frosty as a secondary draw.

Microsoft Corp ($MSFT):

Microsoft has just unveiled Majorana 1, its latest quantum computing chip, and it’s already sparking a mix of excitement and skepticism across the tech industry. This breakthrough in quantum computing is being hailed as a major step forward, with Microsoft claiming it could bring industrial-scale quantum computers within reach in years, not decades. But with Google, IBM, and other tech giants already deep in the quantum race, the question remains: is this a defining moment for Microsoft, or just another overhyped announcement?

At the heart of Majorana 1 is a completely new approach to quantum computing, leveraging topological qubits that, in theory, are far more stable and resistant to errors than traditional qubits. If successful, this chip could allow Microsoft to build a quantum computer with a million qubits, a key milestone that could unlock computing power beyond anything seen today. Unlike standard quantum chips that require extremely precise control mechanisms, Microsoft claims that its topological qubits will be more scalable and practical for real-world applications in industries like AI, cryptography, material science, and drug discovery.

However, not everyone is convinced just yet. Microsoft’s history in quantum computing has been bumpy, with a 2018 research paper on Majorana particles retracted in 2021 due to a lack of conclusive evidence. While the Nature paper accompanying this new announcement shows progress, experts remain cautious. Jay Sau, a physics professor at the University of Maryland, called it a “significant achievement,” but admitted it still isn’t conclusive proof of Microsoft’s claims. Similarly, Eli Levenson-Falk, a physicist at USC, pointed out that the experimental results in Microsoft’s research could have alternative, less groundbreaking explanations—suggesting that more validation is needed before the industry can fully embrace Microsoft’s approach.

Microsoft’s announcement comes at a crucial moment in the quantum computing race, with Google and IBM pushing their own advancements. Google’s “Willow” quantum chip, introduced last year, is currently considered the industry leader in terms of demonstrating complex quantum calculations, even if commercial applications remain distant. IBM has also been aggressively expanding its quantum roadmap, working toward large-scale fault-tolerant quantum computers by 2033.

The implications of a successful million-qubit quantum computer are massive. Microsoft claims that such a system could revolutionize multiple industries, solving problems that classical computers would take millions of years to compute. From developing new pharmaceutical drugs and designing self-healing materials to enhancing artificial intelligence and redefining cybersecurity, the potential applications are nearly limitless.

But reaching that point isn’t just about making a chip—it’s about proving that it works at scale. Microsoft now faces the challenge of turning theoretical advancements into practical, scalable solutions. The tech giant will need to demonstrate clear, repeatable results to prove that Majorana 1 truly offers a better path to quantum computing than existing methods. Investors and industry watchers will be looking for real-world performance data, peer-reviewed confirmations, and successful pilot programs before fully embracing Microsoft’s claims.

American Airlines ($AAL):

An American Airlines flight from New York to New Delhi was unexpectedly diverted to Rome’s Leonardo da Vinci International Airport due to a bomb threat, marking another serious security scare in the aviation industry. Flight AA292, a Boeing 787-9 Dreamliner, was midway through its journey when the airline received an email warning of a possible bomb on board. The decision to divert the aircraft over the Caspian Sea and reroute it to Rome was taken in coordination with security authorities, despite the threat ultimately being deemed non-credible.

Upon entering Italian airspace, the flight was escorted by two Italian Air Force Eurofighter jets, a standard protocol for aviation security threats. After a safe landing at 5:30 PM local time, the plane was thoroughly inspected, passengers were deboarded, and no explosives were found. However, due to crew rest requirements, the flight was delayed overnight and was scheduled to resume its journey to New Delhi the following day.

The aviation industry has seen an increasing number of bomb threats targeting commercial flights, leading to heightened security protocols and emergency diversions. While passenger safety is always the top priority, such incidents create significant operational disruptions, increased costs, and reputational challenges for airlines. This incident could impact American Airline’s global reputation, particularly in international markets like India and Europe, where the airline is looking to expand. The forced diversion caused delays, inconvenience for nearly 200 passengers, and operational costs associated with security checks, overnight accommodations, and re-routing of crew and passengers. This is especially critical as airlines compete for lucrative long-haul routes, and any perception of heightened risk or poor handling of security threats could impact traveler confidence.

Beyond the immediate financial hit from the diversion, American Airlines could face higher security costs, potential compensation claims from passengers, and regulatory scrutiny. Depending on the origin of the email threat, authorities in the U.S., Italy, and India may launch an investigation into the credibility and source of the threat, further drawing the airline into legal and compliance matters.

With increasing competition in the transatlantic and transpacific markets, American Airlines will have to reassure passengers about its security measures and ability to handle such situations efficiently. This will likely lead to stricter protocols for handling in-flight threats, including increased coordination with law enforcement agencies and better communication with passengers during emergencies.

While American Airlines handled the situation professionally, ensuring the safety of passengers and crew, the ripple effects of such security threats cannot be ignored. The airline now faces reputational challenges, potential regulatory scrutiny, and operational disruptions that could affect customer trust and booking decisions in key markets. In the hyper-competitive airline industry, security concerns—whether credible or hoaxes—can shape public perception and influence passenger preferences. As bomb threats and other security incidents become more frequent, airlines like American must strengthen their crisis response strategies, invest in real-time threat assessment capabilities, and communicate transparently with passengers.

UnitedHealth Group Inc ($UNH):

UnitedHealth Group is under intense scrutiny following reports that the U.S. Department of Justice (DOJ) has launched a civil fraud investigation into the company's Medicare Advantage billing practices. The probe focuses on whether UnitedHealth inflated diagnoses in patient records to secure higher Medicare payments, an issue that has been at the center of regulatory concerns for years. This latest development has already shaken investor confidence, with UnitedHealth’s stock plunging nearly 12% this week.

While UnitedHealth has denied the allegations, calling them “outrageous and false,” the timing of the investigation comes at a critical moment. Medicare Advantage is a major revenue driver for the company, contributing nearly 28% of its total revenue. Any regulatory action or financial penalties could significantly impact earnings, not just for UnitedHealth but for the entire Medicare Advantage sector. This probe also adds to growing regulatory pressure on the company. In addition to this fraud investigation, UnitedHealth is already facing an antitrust investigation related to its growing dominance in the healthcare space. The company’s planned $3.3 billion acquisition of Amedisys was challenged by regulators in late 2024, raising concerns that UnitedHealth’s influence in the industry could stifle competition.

For UnitedHealth, the immediate concern is reputational damage and increased regulatory scrutiny. Even if the allegations prove to be unfounded, the investigation could lead to stricter oversight, compliance costs, and potential changes in Medicare reimbursement models. This is particularly relevant as the Biden administration has been focusing on reducing overpayments in Medicare Advantage, signaling a broader push for cost containment in government healthcare programs.

The entire Medicare Advantage industry could also be affected, as the probe may prompt regulatory reforms aimed at tightening payment practices. Companies like Humana (HUM), CVS Health (CVS), and Centene (CNC), which also have large Medicare Advantage portfolios, could see increased scrutiny and possible changes in how risk adjustments are calculated. While UnitedHealth remains a dominant force in the healthcare sector, this probe introduces a new level of uncertainty that could weigh on its stock performance and future strategic moves. The company’s response in the coming weeks will be critical in restoring market confidence and addressing concerns from regulators and investors alike.