What’s Trending with TickerTrends #21

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

Earnings Recap:

Hims & Hers Health Inc. ($HIMS):

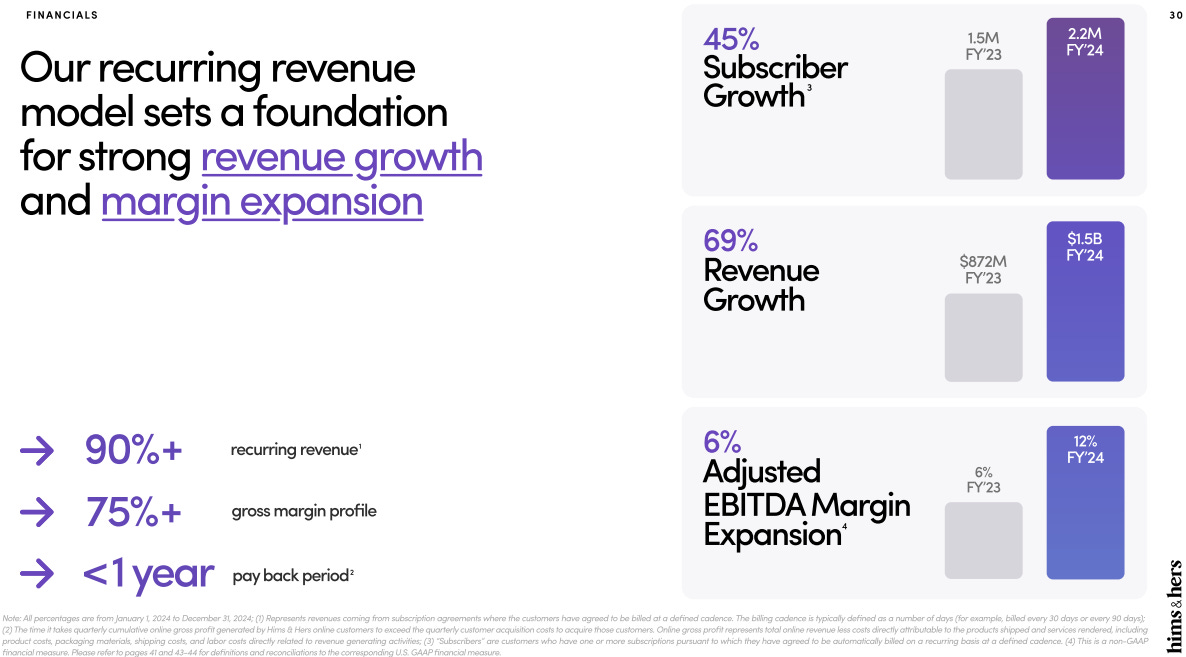

Hims & Hers reported a record-breaking Q4 2024, closing the year with $481 million in revenue, up 95% YoY, and $1.5 billion in full-year revenue, reflecting a 69% YoY increase. The company’s subscriber base expanded to 2.2 million, a 45% YoY growth, with over 55% of users adopting personalized treatments. Adjusted EBITDA for Q4 was $54 million with an 11% margin, while full-year adjusted EBITDA reached $177 million, with margins doubling YoY to 12%. Although gross margins declined slightly due to the expansion of GLP-1 weight loss treatments and pricing adjustments, management expects margin recovery in Q2 2025, driven by volume-driven cost efficiencies. Free cash flow generation remained strong, with nearly $200 million in free cash flow for 2024, and the company ended the year with over $300 million in cash and short-term investments.

A key driver of growth was Hims & Hers’ expansion into lab diagnostics and personalized medicine. The company recently acquired a whole-body at-home lab testing provider, enabling testing for biomarkers related to heart health, hormone levels, liver function, thyroid health, and prostate issues. This will significantly enhance personalization of treatments and expand service offerings into new specialties such as menopause support and low testosterone treatments. Additionally, the acquisition of a Menlo Park peptide facility strengthens its domestic supply chain and positions Hims & Hers at the forefront of preventative medicine, metabolic health, and recovery science.

The weight loss business has become a major growth driver, with GLP-1 treatments contributing $225 million in revenue in 2024, despite launching mid-year. The oral weight loss drugs surpassed a $100 million run rate in just seven months, highlighting strong demand. In mid-2025, the company plans to launch liraglutide, further diversifying its weight loss portfolio. For 2025, Hims & Hers expects at least $725 million in revenue from its weight loss category, excluding commercially available semaglutide, which it will discontinue in Q1 due to regulatory changes.

To support these expansions, Hims & Hers is making major investments in pharmacy and fulfillment infrastructure. The company is expanding sterile compounding capabilities, increasing automation across its facilities, and broadening its ability to deliver thousands of personalized treatments. Additionally, Hims & Hers recently hired a new Chief Technology Officer (CTO) to further accelerate AI and technology advancements.

Marketing efficiency remains a key strength, with the company leveraging its growing brand equity to reduce customer acquisition costs. In Q4, marketing spend was 46% of revenue, reflecting a five-percentage-point improvement YoY. Hims & Hers plans to capitalize on culturally relevant moments, including high-profile national campaigns such as its Super Bowl ad, to increase brand awareness and drive organic customer acquisition.

Looking ahead, Hims & Hers projects Q1 2025 revenue between $520 million and $540 million, representing 87%-94% YoY growth. Full-year 2025 revenue is expected to be between $2.3 billion and $2.4 billion, reflecting a 56%-63% increase YoY. The company also expects adjusted EBITDA of $270 million to $320 million, with margins expanding to 13% for the full year. Hims & Hers remains on track to achieve 20%+ margins by 2030, driven by marketing efficiency, AI-driven personalization, and economies of scale.

Despite regulatory challenges in the weight loss market, Hims & Hers remains confident in its long-term growth strategy. The company appears to be well-positioned to capture market share in the evolving weight loss category through its holistic approach to obesity management, integrating medication, lifestyle changes, and personalized coaching. With continued innovation in AI, diagnostics, and pharmacy automation, Hims & Hers is disrupting traditional healthcare models, offering consumers affordable, high-quality, and hyper-personalized treatments at scale. Investors should watch for updates on the liraglutide launch, AI advancements, and regulatory developments throughout 2025.

Warby Parker Inc ($WRBY):

We recently did a deep dive on Warby Parker’s business, if you haven’t read it check it out here: https://blog.tickertrends.io/p/wrby-warby-parker-unlocking-growth?r=cauli&utm_campaign=post&utm_medium=web&showWelcomeOnShare=false

Warby Parker delivered strong fourth-quarter results, achieving its highest revenue growth quarter since 2021, with a 17.8% year-over-year revenue increase to $190.6 million. For the full year, revenue grew by 15.2% to $771.3 million, driven by 21.4% growth in retail revenue and 3% growth in e-commerce, marking the first full year of positive e-commerce growth since 2021. The company ended 2024 with 2.51 million active customers, representing a 7.8% year-over-year increase. Average revenue per customer rose by 6.8% to $307, fueled by an increased mix of premium lenses, contact lens growth, and higher-priced frames.

Retail expansion was a key contributor, with 39 net new stores opened in 2024, bringing the total count to 276. Retail productivity increased to 102.1% in Q4 and 101.4% for the full year. Additionally, Warby Parker expanded its insurance business, integrating Versant Health and adding over 30 million in-network lives, which is expected to drive future growth. Contact lens sales increased 36% year-over-year, reaching 10% of total revenue, while eye exams grew 41%, now accounting for 5% of revenue. Gross margin improved to 54.2% in Q4 and 55.5% for the full year, benefiting from higher-margin lens sales and improved efficiencies from in-house optical labs. Adjusted EBITDA for Q4 was $13.8 million (7.3% margin), up from $9.4 million in the prior year. For the full year, adjusted EBITDA grew to $73.1 million (9.5% margin), reflecting a 170 basis point margin expansion. Free cash flow generation was strong at $35 million for the year, and the company ended 2024 with $254 million in cash.

Looking ahead to 2025, Warby Parker plans to drive customer-led growth by increasing marketing investments, expanding its store base with 45 new locations—including five Target shop-in-shops—and scaling its insurance business. The company projects 14-16% revenue growth, targeting $878 million to $893 million in revenue and a further 150 basis point adjusted EBITDA margin expansion to approximately 11%. Store productivity is expected to improve moderately, while e-commerce is projected to grow in the mid-single digits.

Key strategic initiatives include enhancing the digital shopping experience with AI-driven personalization tools, increasing contact lens penetration, and expanding holistic vision care services such as video-assisted eye exams and retinal imaging. The company also sees significant long-term potential in smart glasses and AI-powered eyewear and is closely monitoring advancements in the space. Management remains confident in Warby Parker’s ability to sustain growth through its omnichannel model, innovative product offerings, and expanding customer base. The company’s disciplined cost management, strategic investments, and continued execution of its long-term vision position it well for ongoing market share gains in the $68 billion U.S. optical industry.

Trends this week:

Netflix Inc ($NFLX):

On March 1, 2025, WWE’s Elimination Chamber event at the Rogers Centre in Toronto delivered a seismic shock to the wrestling world, as John Cena, a 16-time world champion and perennial fan favorite, executed a stunning heel turn. After securing victory in the men’s Elimination Chamber match—earning a shot at Cody Rhodes’ Undisputed WWE Championship at WrestleMania 41—Cena’s actions in the closing moments of the show flipped the script on his decades-long legacy as WWE’s ultimate good guy. As Rhodes rejected an offer from Dwayne “The Rock” Johnson to become his corporate champion by selling his soul, Cena, prompted by a subtle signal from The Rock, unleashed a brutal assault on Rhodes. The attack, which included a low blow, a Rolex-wrapped fist to the face, and a beating with the championship belt, left Rhodes bloodied and the audience reeling. Joined by rapper Travis Scott, Cena and The Rock stood tall as the show faded to black, cementing one of the most unforgettable moments in recent WWE history. The segment, now available for free on WWE’s YouTube channel, has since gone viral, sparking widespread discussion and analysis across social media and wrestling communities.

WWE went to great lengths to protect the surprise of Cena’s turn. According to reports from Fightful Select, the heel turn was a closely guarded secret backstage, with the segment originally listed third on the card before being shifted to the main event slot to maximize its impact. Paul “Triple H” Levesque, WWE’s Chief Content Officer, personally oversaw the production of the closing moments, limiting knowledge of the angle to a select few. This meticulous planning paid off, as the moment caught both fans and many within the company off guard, amplifying its emotional and cultural resonance.

The Rock, speaking at the post-show press conference, emphasized the fluidity of the angle, noting that the creative team had prepared for multiple outcomes based on crowd reaction. He also hinted at Travis Scott’s potential for deeper involvement, revealing the rapper’s enthusiasm for the physicality of the moment, which saw him participate in the beatdown. Meanwhile, Cena, ever the enigmatic figure, appeared at the press conference only to drop the microphone and walk out without a word, leaving his motivations shrouded in mystery. The immediate aftermath has seen WWE lean into the narrative shift, updating Cena’s official roster biography to reflect his new alignment with The Rock. Gone are references to his “hustle, loyalty, and respect” ethos, replaced with a stark acknowledgment of his betrayal: “When it seemed like Cena would go down as the greatest hero in WWE history, he shocked everyone when he sold his soul to The Rock at Elimination Chamber 2025.”

This moment could lead to a massive boost for $TKO as Cena embarks on the final year of his in-ring career, a retirement tour he announced in 2024. However, fans hoping for an immediate follow-up will have to wait, as Cena is not scheduled to appear on the March 3 episode of WWE Raw on Netflix, having flown to Africa to resume filming a movie. His next advertised appearances are set for later in March, leaving room for the storyline to simmer and speculation to build ahead of WrestleMania 41 in Las Vegas on April 19-20.

The viral nature of Cena’s heel turn—evidenced by over 500,000 Google searches for “Elimination Chamber” and 200,000-plus for “John Cena” in the days following the event—signals a significant cultural moment for WWE, one that could have substantial implications for its broadcast partner, Netflix.

WWE Raw’s transition to Netflix in January 2025 marked a new era for the company, and the platform’s international reach has already broadened the audience for WWE’s weekly programming. While Elimination Chamber aired on Peacock in the U.S. and Netflix internationally, the free YouTube upload of Cena’s turn serves as a strategic teaser, driving interest toward the premium content that will unfold on Netflix-broadcast Raw and SmackDown episodes in the coming weeks.

The Rock’s earlier appearances on Raw’s Netflix premiere and at Bad Blood had drawn mixed reactions, but his role in this angle demonstrates a long-term vision that could pay dividends as WrestleMania season ramps up. With Cena and The Rock—two of wrestling’s biggest crossover stars—now intertwined in a high-stakes narrative, Netflix stands to benefit from heightened viewer engagement, particularly among casual fans drawn in by the star power and controversy.

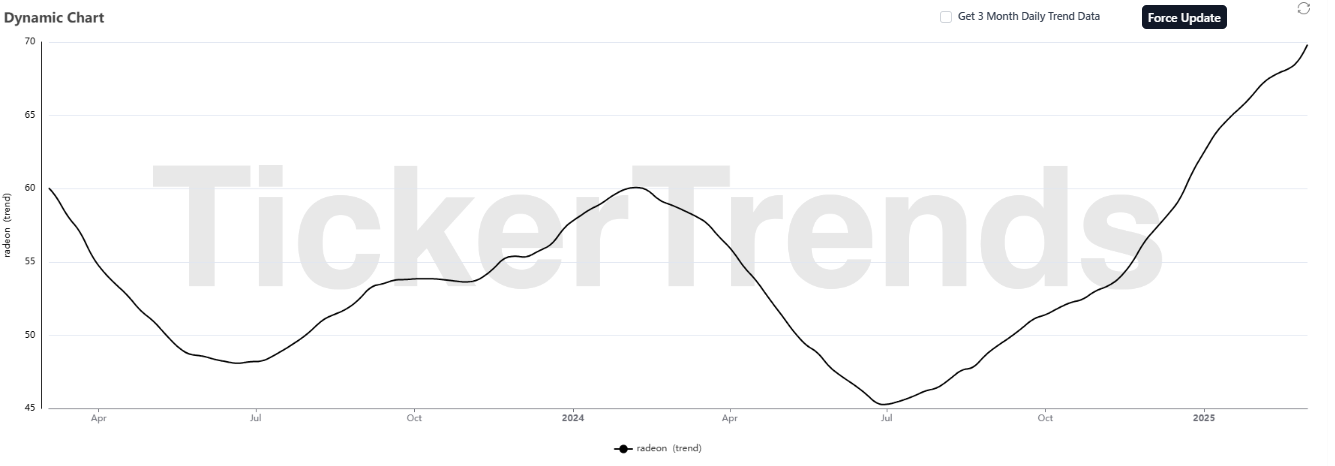

Advanced Micro Devices Inc ($AMD):

On February 28, 2025, AMD announced the upcoming release of its Radeon RX 9070 and 9070 XT graphics cards, set to hit the market on March 6. Priced at $549 and $599 respectively, these midrange GPUs are positioned to compete directly with NVIDIA’s RTX 5070 ($549 MSRP) and RTX 5070 Ti ($749 MSRP). Built on AMD’s new RDNA 4 architecture, the cards promise solid performance for 4K and 1440p gaming, bolstered by 16GB of GDDR6 memory and the introduction of FidelityFX Super Resolution 4 (FSR 4), an AI-powered upscaling technology. The announcement comes at a time when NVIDIA’s high-end RTX 5090 and 5080 cards have seen strong demand despite steep prices, while its midrange offerings have faced supply challenges and price inflation. AMD’s decision to target the midrange segment with competitive pricing could appeal to gamers seeking value in a market where GPU costs have steadily climbed.

The Radeon RX 9070 and 9070 XT bring several technical advancements to the table. The 9070 XT features 64 compute units, 64 ray tracing accelerators, and 128 AI accelerators, with a boost clock of 2.97 GHz and a power draw of 304 watts. The base 9070, meanwhile, offers 56 compute units, 56 ray tracing accelerators, and 112 AI accelerators, clocking in at 2.52 GHz and consuming 220 watts. Both cards support PCIe 5.0, DisplayPort 2.1a, and HDMI 2.1b, though they rely on standard 8-pin power connectors rather than the newer 12VHPWR standard. AMD claims the 9070 XT delivers 51% better 4K performance than the Radeon 6900 XT and 26% more than NVIDIA’s RTX 3090 across 30 games at max settings, while the 9070 is said to outpace the RX 6800 XT by 38% and the RTX 3080 by 26%. These comparisons, however, lean on older cards rather than NVIDIA’s current RTX 40 or 50 series, leaving some questions about real-world competitiveness until independent benchmarks emerge next week.

A key feature of these GPUs is FSR 4, which uses machine learning to enhance upscaling and frame generation, aiming to rival NVIDIA’s DLSS. AMD cites impressive gains, such as boosting Warhammer 40,000: Space Marine 2 from 53 fps to 182 fps at 4K with FSR 4 enabled. The technology will launch with support for over 30 titles, expanding to 75 by year-end, including major games like Call of Duty: Black Ops 6 and Horizon: Forbidden West. Beyond gaming, the cards’ updated media engine supports 8K/80fps encoding and decoding, while their AI capabilities show gains in tools like DaVinci Resolve (34% faster than the RX 7900 GRE). Additionally, AMD’s driver-level HYPR-RX upscaler promises performance boosts in unsupported titles, and an improved Fluid Motion Frames 2.1 aims to enhance frame generation across a broader range of games. These features signal AMD’s intent to close the gap with NVIDIA in both performance and software ecosystem.

For AMD, the RX 9070 series represents a strategic play in the consumer GPU market, though its broader financial picture is increasingly dominated by data center revenue. In recent years, AMD’s growth has been driven by its EPYC processors and Instinct accelerators for AI and high-performance computing, with data centers now accounting for the majority of its earnings. Gaming GPUs, while still a significant segment, are less critical to AMD’s bottom line than they once were. That said, a successful launch could bolster the Radeon brand’s reputation and market share, particularly among midrange buyers frustrated by NVIDIA’s pricing and availability woes. AMD has emphasized strong launch availability, a contrast to NVIDIA’s recent supply struggles, which could help maintain the $549 and $599 MSRPs—at least initially. Partner cards from manufacturers like XFX, Sapphire, and Asus will handle distribution, as AMD won’t offer a reference design.

The release’s impact on AMD’s revenue may be modest compared to its data center segment, but it carries longer-term implications. A strong showing could solidify AMD’s position as a viable alternative to NVIDIA in the midrange, potentially pressuring NVIDIA to adjust pricing or accelerate its own lower-tier RTX 50-series releases, such as the rumored RTX 5060. It also sets the stage for AMD’s teased RX 9060 series, expected in Q2 2025, which could target budget-conscious gamers with sub-$400 pricing. While not a make-or-break moment for AMD’s financials, the RX 9070 and 9070 XT launch reinforces its commitment to the gaming market, offering a competitive option that could resonate with cost-sensitive consumers and keep the Radeon name relevant in an NVIDIA-dominated landscape. Full performance reviews, due around the March 6 launch, will determine whether these cards live up to their promise and deliver meaningful gains for the company’s gaming division.

Robinhood Markets Inc. ($HOOD) & Coinbase Global Inc. ($COIN):

On March 2, 2025, President Donald Trump announced via Truth Social that the U.S. would establish a "Crypto Strategic Reserve" featuring a range of cryptocurrencies, including Bitcoin, Ethereum, XRP, Solana, and Cardano. The announcement sparked an immediate market reaction, with Bitcoin rising approximately 10% to peak above $94,000, Ethereum gaining around 12% to briefly surpass $2,500, and the other named coins—XRP, Solana, and Cardano—surging by 30%, 20%, and over 50%, respectively. Trump’s initial post highlighted XRP, Solana, and Cardano, stating that his January executive order on digital assets directed the Presidential Working Group to advance this reserve, aiming to position the U.S. as the "Crypto Capital of the World." A follow-up post clarified that Bitcoin and Ethereum would be central to the reserve, reflecting Trump’s evolving stance from a former crypto skeptic to a prominent advocate. This shift builds on his campaign promises and contrasts with the Biden administration’s regulatory crackdown on the industry.

The market response was swift and substantial, adding roughly $300 billion to the global crypto market capitalization within hours, according to CoinGecko. XRP climbed to $2.86, overtaking Tether (USDT) to become the third-largest cryptocurrency by market cap at $163.9 billion, while Cardano hit $1.02 and Solana reached $174.37. Bitcoin, despite a 7% decline over the past month, rebounded from a recent dip below $80,000—its lowest since early November—to reclaim the $93,000 level. Ethereum followed suit, reversing a month of sluggish performance. The rally came after a period of uncertainty tied to Trump’s trade policies and a lack of crypto-specific catalysts, with Bitcoin recording its worst monthly performance since February 2022. Trump’s upcoming White House Crypto Summit on March 7 is anticipated to provide further details on the reserve’s structure and implementation, which could sustain or amplify this momentum.

The concept of a strategic crypto reserve differs from Trump’s earlier idea of a Bitcoin stockpile, which focused on retaining seized assets rather than actively acquiring new ones. The executive order from January suggested the reserve might initially use cryptocurrencies confiscated through law enforcement, with the U.S. already holding an estimated $19 billion in Bitcoin. However, a reserve implies potential government purchases, a move that could require congressional approval and significantly boost crypto prices by increasing demand. Critics, including some economists, caution that such a policy could expose taxpayers to crypto’s volatility, potentially benefiting existing holders more than the broader economy. Proponents, like Sen. Cynthia Lummis, argue it could bolster federal revenue and reduce national debt if the assets appreciate, though the inclusion of multiple coins has drawn ire from Bitcoin maximalists who favor a singular focus on BTC.

For companies like Coinbase and Robinhood, which rely heavily on transactional volumes for revenue, Trump’s announcement could prove a boon. Coinbase, a leading U.S. crypto exchange, and Robinhood, a trading platform with a growing crypto segment, typically see profit spikes during periods of heightened market activity. The price surges following Trump’s posts likely drove a flurry of speculative trading, as investors rushed to buy the named cryptocurrencies—Bitcoin, Ethereum, XRP, Solana, and Cardano—anticipating further gains. This increased trading volume directly boosts these firms’ transactional fees, a core revenue driver. Coinbase, for instance, reported strong Q4 2024 results tied to crypto surges, and analysts suggest this event could mirror that trend. Robinhood, which has expanded its crypto offerings, also stands to benefit as retail investors capitalize on the rally.

Looking ahead, the reserve’s development could sustain this advantage for Coinbase and Robinhood. If the government begins purchasing cryptocurrencies, it would likely increase liquidity and prices, encouraging more trading activity. The upcoming crypto summit may clarify regulatory frameworks, potentially easing restrictions that have hampered these platforms under prior administrations. A more crypto-friendly SEC, led by Trump appointee Paul Atkins, could further reduce barriers, enhancing user confidence and transaction volumes. However, risks remain: market volatility could temper gains if the reserve’s execution falters, and political shifts might alter its trajectory. For now, though, the immediate market enthusiasm positions Coinbase and Robinhood to capitalize on heightened speculation, likely bolstering their profitability in the short term as traders react to Trump’s bold crypto vision.

Corsair Gaming Inc ($CRSR):

On February 21, 2025, Corsair Gaming’s Vice President of Finance, Ronald van Veen, stirred the gaming community during a company earnings call by suggesting that Grand Theft Auto VI (GTA 6) would launch on consoles in fall 2025, with a PC release following in early 2026. This comment, made in the context of discussing upcoming game releases that could boost hardware sales, initially fueled excitement among fans eager for clarity on GTA 6’s long-awaited arrival. Corsair, a well-known manufacturer of PC components, peripherals, and pre-built systems, seemed poised to hint at insider knowledge, given its stake in the PC gaming market. However, the company quickly backtracked, with a representative clarifying to IGN that van Veen’s remarks were speculative and not based on any official information from Rockstar Games or its parent company, Take-Two Interactive. This retraction, reported by IGN’s Wesley Yin-Poole and echoed across gaming news outlets, left fans more confused than ever about the game’s release timeline, particularly for the unconfirmed PC port.

The incident unfolded against the backdrop of Take-Two’s reaffirmed commitment to a fall 2025 console launch for GTA 6 on PlayStation 5 and Xbox Series X|S, as stated in their recent financial updates. Take-Two CEO Strauss Zelnick has emphasized Rockstar’s historical strategy of prioritizing console releases to drive hardware sales, with PC versions typically following months or even years later—GTA 5, for instance, took 19 months to reach PC after its 2013 console debut. Van Veen’s initial projection of an early 2026 PC release suggested a shorter gap, aligning with growing speculation that Rockstar might accelerate its PC rollout given the platform’s rising prominence. Corsair’s clarification, however, dashed those hopes, reinforcing that no concrete timeline exists beyond the console window. This ambiguity has frustrated PC gamers, who remain in the dark about when—or if—they’ll experience GTA 6, especially as Rockstar has yet to officially address a PC version.

For Corsair, this episode carries mixed implications as the company navigates a financial resurgence after a challenging period. Following a significant bear market run—its stock plummeted from a 2020 IPO high of over $50 to below $10 by late 2022—Corsair has shown signs of recovery, buoyed by renewed demand for gaming hardware. The anticipation surrounding GTA 6, one of the most hyped titles in gaming history, presents a potential opportunity for Corsair. A PC release, whenever it occurs, would likely drive sales of high-performance components like GPUs, CPUs, and peripherals, as players upgrade their rigs to handle the game’s expected graphical demands. Van Veen’s comment, though speculative, subtly positioned Corsair as a brand attuned to gaming trends, potentially boosting investor and consumer confidence in its relevance to the PC gaming ecosystem.

However, the backtrack could pose risks to Corsair’s credibility. The initial statement sparked headlines and fan speculation, only for the company to admit it lacked insider insight, which might frustrate stakeholders expecting more authoritative commentary from a firm tied to the PC market. This misstep comes at a delicate time as Corsair works to solidify its comeback, with recent quarters showing improved revenue from gaming peripherals and systems. A successful GTA 6 PC launch in 2026—or later—could still catalyze a sales surge, especially if Corsair capitalizes on the hype with targeted marketing or bundled offerings. Yet, the company must tread carefully to avoid further speculative blunders that could undermine its regained momentum. For now, Corsair remains a bystander to Rockstar’s plans, its fortunes tied to the broader uncertainty surrounding GTA 6’s PC fate, while fans continue to grapple with the lack of clarity from all parties involved.

Citigroup Inc ($C):

This week reports surfaced of a staggering operational error at Citigroup, where a client’s account was mistakenly credited with $81 trillion instead of the intended $280. The incident, which occurred in April 2024, was first detailed by the Financial Times and quickly picked up by outlets like Yahoo Finance, Business Insider, Coinstelegram, and India Today. According to the accounts, the error stemmed from a manual input mistake exacerbated by a cumbersome backup system interface. Two employees initially overlooked the transaction, and it wasn’t until 90 minutes later that a third employee detected the discrepancy, prompting a reversal that took several hours to complete. Classified as a “near miss”—a banking term for errors corrected before funds are lost—no money left Citigroup, and the bank disclosed the incident to the Federal Reserve and the Office of the Comptroller of the Currency (OCC). Citigroup emphasized that its detective controls identified the error between two internal ledger accounts and that preventative measures ensured no external impact, a point reiterated in statements to multiple news sources.

This blunder is part of a broader pattern of operational mishaps at Citigroup, casting a shadow over CEO Jane Fraser’s efforts to overhaul the bank’s risk management systems since taking the helm in 2021. Historical precedents include the 2020 accidental transfer of $900 million to Revlon creditors, which triggered hefty fines and the exit of then-CEO Michael Corbat, and a 2022 “fat finger” error that sparked a $322 billion European stock market sell-off, resulting in a $78 million fine from British regulators. More recently, in 2023, U.S. regulators imposed a $136 million penalty for insufficient progress in addressing risk and data governance issues, following a $400 million fine in 2020. Internal reports cited by the Financial Times noted 10 near misses of $1 billion or more in 2023, down from 13 the previous year, suggesting some improvement but highlighting persistent vulnerabilities. Citigroup has responded by investing heavily in automation and compliance, with CFO Mark Mason acknowledging the need for better technology and data quality in regulatory reporting.

For investor confidence, this $81 trillion error poses a nuanced challenge. While no financial loss occurred, the incident reinforces a narrative of operational fragility at Citigroup, a bank already under intense regulatory scrutiny. Investors have reason to question the efficacy of Fraser’s “Transformation” initiative, which employs 12,000 staff to modernize systems and appease regulators. The bank’s stock has remained relatively steady, buoyed by broader market dynamics, but repeated high-profile errors—amplified by headlines like “Citi’s $81 Trillion Blunder” from Yahoo Finance—could erode trust over time. The sheer scale of the mistake, dwarfing global GDP benchmarks (e.g., U.S. GDP at $29.72 trillion), underscores the potential for systemic risk if controls fail more catastrophically. Analysts suggest that while Citigroup’s market position as a major player (with a $147 billion market cap) provides some buffer, sustained incidents could pressure its valuation, especially in a sector where precision is paramount.

For Citigroup itself, the implications are more immediate. The error fuels regulatory skepticism, with figures like Sen. Elizabeth Warren previously arguing the bank is “too big to manage.” It may accelerate demands for stricter oversight or growth restrictions, as seen in past regulatory responses. The bank’s ongoing $1 billion risk management overhaul, touted by Fraser and supported by tech head Tim Ryan, faces heightened scrutiny—investors and regulators alike will watch whether these investments yield tangible improvements. Operationally, the reliance on manual processes, as revealed by the Brazil transaction glitch, signals a need for faster automation, though the 2023 reduction in near misses offers a glimmer of progress. Ultimately, Citigroup must prove it can move beyond these headline-grabbing missteps to restore faith, or risk a slow bleed of investor confidence in an industry unforgiving of repeated stumbles.

FedEx Corp ($FDX):

FedEx Flight 3609, a Boeing 767 cargo plane en route from Newark Liberty International Airport to Indianapolis, encountered a bird strike shortly after takeoff, leading to a dramatic emergency landing. The incident occurred around 8 a.m. Eastern Time when the aircraft, departing Newark, collided with a bird, causing significant damage to its right engine and igniting a fire. Videos circulating on social media captured the plane in the air with flames erupting from the engine, and additional footage showed it landing back at Newark at 8:07 a.m. with the fire still burning. The crew promptly declared an emergency and executed a safe return to the airport, a maneuver completed within nine minutes of takeoff, according to FlightAware data. The Port Authority of New York and New Jersey reported no injuries among the three crew members aboard, and air traffic was briefly halted as a precaution before resuming normal operations.

FedEx issued a statement acknowledging the bird strike, praising the crew’s response: “Our B767 crew declared an emergency and returned safely to Newark after dealing with the resulting engine damage, including an engine fire. The training, expertise, and professionalism demonstrated by our FedEx pilots was exemplary.” The Federal Aviation Administration (FAA) confirmed the engine damage and noted that the aircraft remained disabled on a runway as of that morning, with an investigation underway alongside the National Transportation Safety Board (NTSB). Eyewitness accounts, such as that of New York resident Mike Bova, described a chaotic scene with the plane appearing unstable and debris falling, initially sparking fears it was a passenger flight. Another witness, Sofiane Zeblah, reported seeing the fire start midair while driving near the airport, expressing relief at the safe outcome.

The incident adds to a string of recent aviation events that have heightened public scrutiny of flight safety in North America, including a deadly midair collision in January and a Delta crash in Toronto in February. Despite these occurrences, experts like John Cox emphasized to NBC News that aircraft like the Boeing 767 are designed to operate on one engine, and pilots are well-trained for such scenarios, ensuring a safe landing. The FAA’s 2023 data, reporting over 19,600 bird strikes nationwide, indicates these incidents are common, though they rarely result in emergencies of this magnitude. For FedEx, a Memphis-based logistics giant reliant on its air fleet for timely deliveries, this event underscores both the robustness of its pilot training and the persistent challenge of wildlife hazards in aviation.

For FedEx, the implications are multifaceted but likely contained. The swift, injury-free resolution mitigates immediate financial or reputational damage, and the company’s commendation of its crew reinforces its operational preparedness. However, with its air operations critical to its $92 billion revenue stream—largely driven by express shipping—any disruption at a hub like Newark, one of the busiest U.S. airports, could ripple through its network. The disabled aircraft and ongoing FAA/NTSB investigation may temporarily strain fleet availability, though FedEx’s scale (over 700 aircraft) suggests it can absorb such an event without significant long-term impact. Public perception, already sensitive amid recent aviation incidents, could pose a minor risk to customer confidence, but FedEx’s framing of the incident as a success story—backed by expert assurances of aviation safety—should temper concerns. The investigation’s findings could prompt FedEx to enhance bird strike mitigation measures, aligning with industry trends toward improved wildlife management at airports, while its operational resilience remains a key asset in maintaining market trust.

Hims & Hers Health, Inc. ($HIMS):

On February 21, 2025, the U.S. Food and Drug Administration (FDA) announced that the shortage of semaglutide, the active ingredient in Novo Nordisk’s blockbuster weight-loss drugs Ozempic and Wegovy, had been resolved, effectively ending a period where compounding pharmacies like Hims & Hers Health could legally produce cheaper alternatives. This decision, detailed across reports from Investor’s Business Daily, Reuters, Fierce Pharma, and others, triggered an immediate 26% plunge in Hims & Hers stock, dropping it from a recent high of $72.98 to $41.41 by February 24. The FDA’s ruling grants compounders a 60-to-90-day grace period—until April or May, depending on their regulatory status—to cease production, aligning with Novo Nordisk’s confirmation that its supply now meets or exceeds U.S. demand. Hims, a telehealth company that rode the wave of semaglutide’s popularity, saw its stock soar over 200% in early 2025, fueled by sales of compounded versions priced at $165-$200 monthly versus Wegovy’s $1,349 list price. However, the stock’s subsequent 45% crash over five days reflects investor uncertainty as this key revenue stream faces an imminent cutoff.

Hims & Hers had capitalized on the semaglutide shortage, declared in 2022, which allowed compounders to fill gaps left by Novo’s constrained supply. The company’s sales surged—94% in 2022, 65% in 2023, and 69% in 2024 to $1.48 billion—with GLP-1 drugs like semaglutide contributing $225 million in 2024 alone, or roughly 15% of revenue, per CFO Yemi Okupe’s statements. The FDA’s resolution, however, shifts the landscape. Hims reported a robust Q4 on February 24, with earnings of 11 cents per share on $481.1 million in sales, beating estimates, yet its stock fell double digits as it warned it may halt compounded semaglutide sales by mid-2025. CEO Andrew Dudum outlined a pivot to personalized GLP-1 doses and oral weight-loss options (combining drugs like bupropion and naltrexone), projecting $725 million in weight-loss revenue for 2025 within a $2.3-$2.4 billion total. Still, the loss of standard semaglutide doses—31% of projected 2025 sales—casts doubt on sustaining such growth.

For Hims & Hers, this regulatory shift poses both a challenge and an opportunity. The FDA’s decision threatens a business model that thrived on affordability, with compounded GLP-1s driving a 650% traffic spike post-Super Bowl ad, per Fierce Pharma. Analysts like Citi’s team suggest Hims’ 56-63% growth forecast for 2025 seems aspirational without semaglutide, given limited growth outside this category. Yet, Hims is adapting—acquiring a peptide facility and Trybe Labs in February 2025 to bolster personalized medicine and testing capabilities, signaling a broader health platform strategy. The company’s historical focus on men’s wellness (e.g., erectile dysfunction) and recent expansion into weight loss and women’s health provides diversification, but the semaglutide exit could shrink margins if higher-priced branded drugs or less profitable alternatives dominate. Legal challenges from compounders, like the Outsourcing Facilities Association’s suit against the FDA, and potential leniency from Trump’s FDA pick, Dr. Marty Makary, tied to low-cost drug advocate Sesame, might offer Hims a lifeline, though outcomes remain uncertain.

The broader implication hinges on execution. Hims’ stock, trading at a lofty 87x price-to-earnings ratio post-crash, reflects a premium vulnerable to erosion if weight-loss momentum falters. Competitors like Novo Nordisk (up 6.2% post-FDA news) and Eli Lilly, which cut Zepbound prices on February 25, intensify pressure by enhancing supply and affordability. Hims’ ability to retain customers via personalization—mirroring hormone replacement therapy markets, as MMIT’s Jayne Hornung notes—could mitigate losses, but affordability gaps ($200 vs. $1,000+ monthly) may push patients to branded options or illicit markets, per Ivim Health’s Taylor Kantor. With $270-$320 million in projected 2025 profits, Hims has a cushion, but its roller-coaster stock ride underscores a pivotal moment: successfully pivoting to a sustainable model will determine if it remains a telehealth leader or fades as a one-hit wonder in the GLP-1 boom.