What's Trending with TickerTrends #17

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

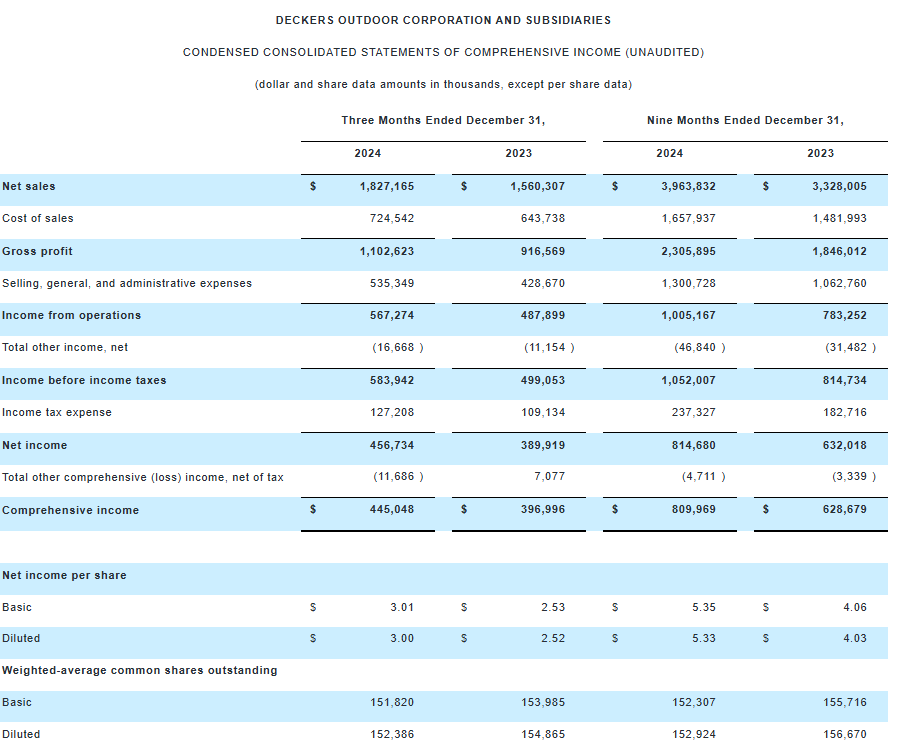

Earnings Recap:

Deckers Outdoors Inc. ($DECK):

Deckers reported a record-breaking Q3 FY2025, with revenue climbing 17% year-over-year to $1.83 billion, exceeding expectations. The company saw significant growth across its two powerhouse brands, UGG and HOKA, with both continuing to drive consumer demand despite a highly promotional retail environment. Gross margins improved to 60.3%, benefiting from higher full-price sell-through, while diluted earnings per share (EPS) rose 19% to $3.00.

UGG posted a standout quarter, generating $1.24 billion in revenue, a 16% year-over-year increase. Growth was balanced across both direct-to-consumer (DTC) and wholesale channels, with international markets outpacing domestic sales. Demand was particularly strong for key styles, including the Tasman, Ultra Mini, and Goldenstar Clog, while the brand’s marketing collaborations with celebrities and major retailers like Selfridges and Nordstrom further strengthened brand momentum. Notably, UGG’s men's business showed significant traction, supported by a Post Malone-led campaign that generated over 3 billion impressions. Deckers also announced plans to phase out its Koolaburra brand, discontinuing its standalone product line and website by the end of FY2025 to streamline operations and sharpen focus on higher-growth opportunities.

HOKA continued its strong trajectory, with revenue surging 24% year-over-year to $531 million. The brand saw robust gains in DTC (up 27%) and wholesale (up 21%), particularly in international markets, including China. Deckers highlighted the successful launch of the Kaha Frost collection, which performed exceptionally well globally and secured high-profile recognition, including awards from GOGO Shanghai and Italian Vogue. The company also laid the groundwork for upcoming major releases, including the Bondi 9, Clifton 10, and Cielo X1, which are expected to fuel continued growth in fiscal 2026.

Beyond its core brands, Deckers is actively expanding its international footprint, with HOKA stores opening in key global markets, including Shanghai, Tokyo, and Paris. The company emphasized its disciplined marketplace management strategy, carefully controlling distribution to maintain brand prestige and pricing power. HOKA’s increasing presence in performance running, trail, and lifestyle categories continues to position it as a dominant force in the athletic footwear industry. Meanwhile, UGG’s diversification beyond its traditional boots segment is helping sustain year-round demand, with sneakers, sandals, and hybrid footwear gaining traction.

Deckers raised its full-year revenue guidance to just over $4.9 billion, reflecting 15% growth—its fifth consecutive year of mid-teens or higher revenue expansion. However, management noted that Q4 will likely see a slower growth rate due to strong early-season sales pulling demand forward into Q3. The company also anticipates some headwinds from increased freight costs, foreign exchange fluctuations, and a return to more normalized markdown levels, particularly as it transitions older HOKA models ahead of new launches. Despite these factors, Deckers remains confident in its long-term growth strategy, with a focus on brand-building, disciplined marketplace management, and maintaining top-tier operating margins.

With its strong financial position—including $2.2 billion in cash and no outstanding borrowings—Deckers continues to invest in international expansion, new product innovations, and its high-margin DTC business. Management emphasized its commitment to sustainable growth, reinforcing its vision of HOKA becoming a dominant player in the global performance footwear market and UGG evolving into a year-round lifestyle brand. As Deckers enters the final stretch of fiscal 2025, it remains well-positioned to continue delivering industry-leading profitability and long-term shareholder value.

Apple Inc. ($AAPL):

Apple Inc. (NASDAQ: AAPL) posted impressive Q1 FY2025 earnings, with revenue rising 4% year-over-year to an all-time high of $124.3 billion. The company also achieved a record earnings per share (EPS) of $2.40, marking a 10% increase from the previous year. The growth was largely driven by a strong performance in Apple's Services segment, which reached a record $26.3 billion in revenue, reflecting a 14% year-over-year increase. This marked a continued trend of expanding the company’s services footprint, underpinned by solid customer engagement and growing paid subscriptions, which now exceed one billion across its platform.

Apple’s total active device install base crossed 2.35 billion during the quarter, highlighting the increasing scale and stickiness of its ecosystem. In terms of product sales, iPhone revenue held steady at $69.1 billion, driven by strong performance in multiple regions, including emerging markets such as Latin America, the Middle East, and South Asia. The iPhone 16 series, with its advanced features such as Apple Intelligence, played a key role in this success. Markets where Apple Intelligence has been rolled out performed better on a year-over-year basis than those where it has not yet launched. The company noted that its active install base of iPhone users grew to an all-time high, and the iPhone 16 family has outpaced its predecessor, the iPhone 15, in terms of upgrades.

Apple’s Mac and iPad businesses also saw significant growth during the quarter. Mac revenue increased by 16% year-over-year, totaling $9 billion, largely driven by demand for new products like the M4-based MacBook Pro, Mac Mini, and MacBook Air. The company also saw strong double-digit growth across all geographic regions, underpinned by the performance of the M4 chips and their AI capabilities. Similarly, iPad revenue grew by 15% to $8.1 billion, fueled by strong demand for the new iPad Mini and iPad Pro models. The success of these devices indicates that Apple's strategy of integrating its custom silicon with its software is resonating with consumers, as both Macs and iPads benefit from powerful performance and AI-driven features.

In the wearables, home, and accessories segment, Apple generated $11.7 billion in revenue, a slight decline of 2% from the previous year. Despite this, Apple’s wearables, such as the new Apple Watch Series 10, continue to see strong adoption, particularly in health-related features such as the new hearing health tools and sleep apnea notifications, which have garnered significant attention. The company also reported record engagement on Apple TV+, with the platform's subscriber base continuing to grow. The second season of "Severance" and the upcoming debut of "Formula 1" starring Brad Pitt are just some of the exciting new programming Apple TV+ subscribers can look forward to in the coming months.

Apple’s Services segment continues to perform exceptionally well, reflecting the company's increasing focus on this high-margin business. Services revenue reached $26.3 billion in Q1 FY2025, an all-time record, driven by growth across all geographic regions and service offerings. Apple’s paid subscription base continues to expand, and the launch of new services like the Find My service for lost luggage is further strengthening its service ecosystem.

While Greater China saw a decline of 11% year-over-year, Tim Cook, Apple’s CEO, expressed optimism regarding the long-term potential of emerging markets. India, in particular, saw record-breaking sales during the quarter, and Apple continues to expand its retail presence in the country. The company is set to open four new stores in India, and it remains focused on increasing its footprint in other high-growth regions, including Saudi Arabia, where the company plans to open flagship stores beginning in 2026.

Apple remains financially strong with a cash balance of $141 billion and net cash of $45 billion after returning over $30 billion to shareholders through dividends and share repurchases. The company has repaid $1 billion in maturing debt and reduced its commercial paper by $8 billion, further enhancing its strong balance sheet. Looking ahead to Q2 FY2025, Apple expects low-to-mid single-digit revenue growth, with Services continuing to drive robust growth. The company projects gross margins to remain strong, between 46.5% and 47.5%, despite foreign exchange headwinds.

Apple’s strategic investments in AI, premium devices, and services are expected to drive continued growth. The rollout of Apple Intelligence and the expansion of the services business underscore Apple’s commitment to delivering transformative and personalized experiences for users while maintaining financial discipline. The company’s deepening customer engagement and broadening ecosystem suggest that Apple is well-positioned to capitalize on future growth opportunities, particularly in emerging markets, where it has ample runway to increase market share.

Trends this week:

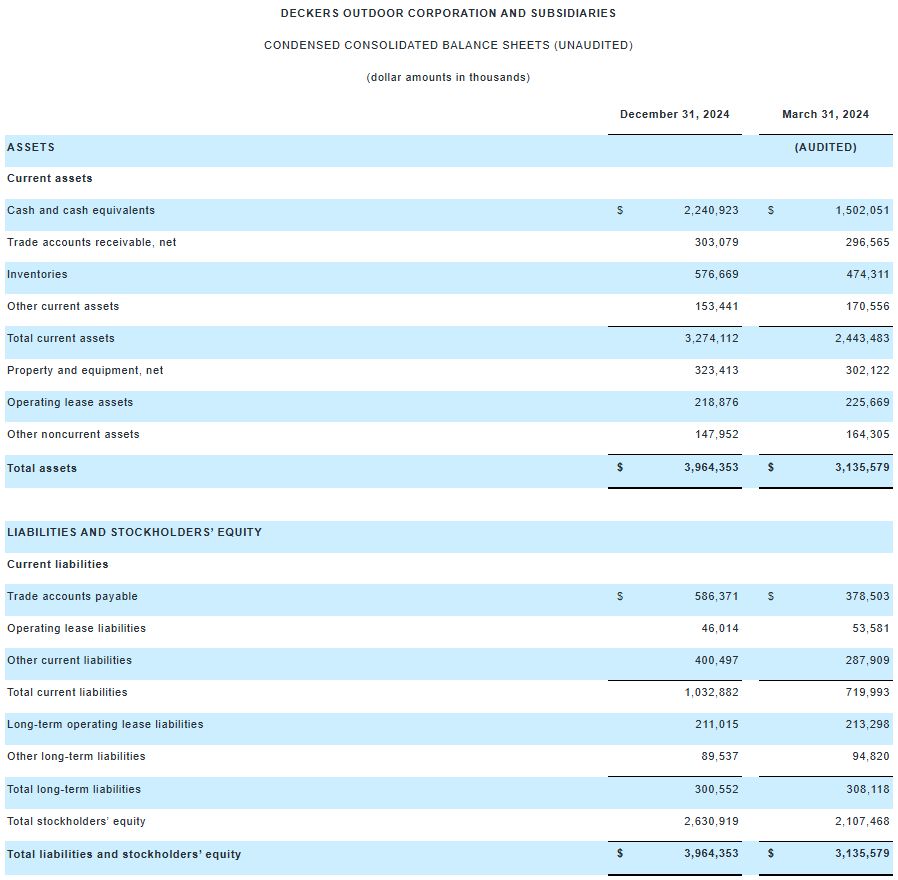

American Airlines Group ($AAL):

The midair collision between American Airlines Flight 5342 and a U.S. Army Black Hawk helicopter near Ronald Reagan Washington National Airport (DCA) on January 30, 2025, resulted in the deaths of all 67 people on board both aircraft. The American Eagle regional jet, traveling from Wichita, Kansas, was on its final approach to DCA when it collided with the military helicopter conducting a training exercise out of Fort Belvoir, Virginia. The wreckage of both aircraft was found in the Potomac River, with search and recovery operations ongoing.

Investigators are examining air traffic control procedures, with early reports highlighting that only one controller was managing both airplane and helicopter traffic instead of the usual two. Concerns are being raised about whether the Black Hawk exceeded its authorized altitude and whether miscommunication or a lack of proper separation protocols contributed to the disaster. This incident marks the deadliest U.S. aviation disaster since 2001, drawing national attention to flight safety procedures in the congested D.C. airspace.

The crash claimed notable victims, including several elite figure skaters, their coaches, and families returning from a competition. The entire crew of Flight 5342, including Captain Jonathan Campos and First Officer Sam Lilley, also perished. The U.S. Army lost three personnel, including Capt. Rebecca Lobach, Chief Warrant Officer Andrew Eaves, and Staff Sgt. Ryan O'Hara. The National Transportation Safety Board (NTSB), along with the FAA and the U.S. Army, is leading the investigation, with a preliminary report expected in 30 days.

Politically, the crash has sparked controversy after President Donald Trump suggested that diversity hiring policies (DEI initiatives) might have contributed to the incident, despite the investigation being in its early stages. His comments have drawn criticism from aviation and military experts, who emphasize that the focus should remain on air traffic control operations and pilot communications rather than broader hiring policies.

For American Airlines, this disaster could have significant financial and reputational implications. The airline's stock price may experience volatility as investors assess potential legal and operational risks. Additionally, lawsuits from victims’ families could lead to costly settlements, and insurance premiums are expected to rise. The airline may also face intense regulatory scrutiny, potentially resulting in new safety measures or policy changes for regional carriers operating in high-traffic airspaces. While commercial aviation in the U.S. has maintained an excellent safety record, this tragedy could prompt a reassessment of air traffic control staffing, military flight operations near major airports, and overall risk management in the aviation sector.

TKO Group Holdings Inc ($TKO):

IShowSpeed’s surprise entry into the WWE Royal Rumble 2025 was a strategic move by WWE and TKO Group Holdings to leverage his massive social media following and drive engagement. Despite being eliminated quickly after taking a brutal spear from Bron Breakker, Speed’s brief in-ring appearance went viral, generating millions of impressions across X (Twitter), YouTube, and TikTok. WWE’s decision to include Speed aligns with its broader strategy under TKO Group Holdings (the parent company of WWE and UFC) to tap into influencer marketing, attract younger demographics, and expand its digital footprint.

From a business perspective, this event highlights WWE’s increasing reliance on crossover celebrity involvement to boost ratings, social media engagement, and premium live event buys. Speed’s involvement, like Logan Paul’s before him, reinforces WWE’s strategy of integrating digital-first personalities into its storytelling to reach Gen Z audiences. This could encourage TKO to further partner with major streamers, YouTubers, and influencers, possibly expanding WWE’s content offerings beyond traditional wrestling audiences.

For TKO Group Holdings, this move reflects its broader effort to enhance shareholder value by diversifying WWE’s revenue streams. If Speed’s appearance results in a significant sustained viewership spike, this could set a precedent for more streamer-wrestler crossovers, increasing sponsorship opportunities, advertising revenue, and premium subscription growth on platforms like Peacock and WWE Network.

However, there are risks involved. While Speed’s appearance went viral, some fans and wrestlers might not be thrilled with social media influencers taking spots in marquee matches over full-time talent. Additionally, Speed’s history of controversies could pose reputational risks for WWE if not managed properly. TKO must balance engagement-driven stunts with maintaining the credibility of WWE’s in-ring product. Overall, WWE and TKO Group Holdings will likely see short-term benefits from increased social engagement and media coverage, but long-term success depends on how well these influencer collaborations translate into sustained fan engagement, network subscriptions, and merchandise sales. If the numbers support it, expect WWE to lean further into influencer-driven storytelling, bringing in more high-profile streamers, YouTubers, and even esports figures to future events.

Nvidia Corp ($NVDA):

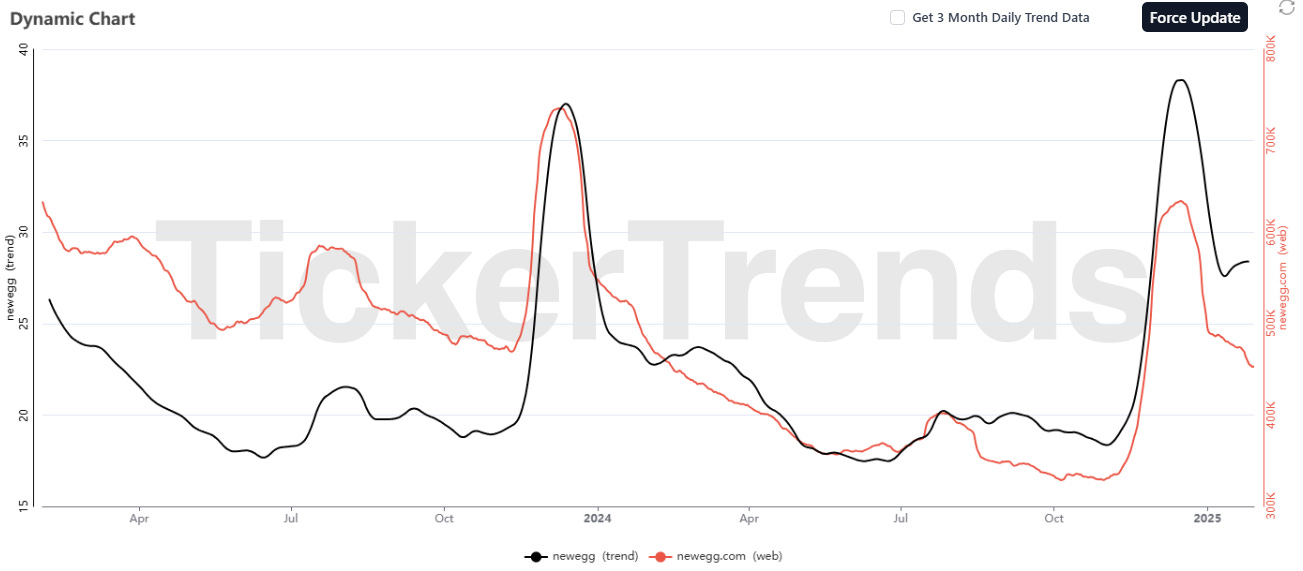

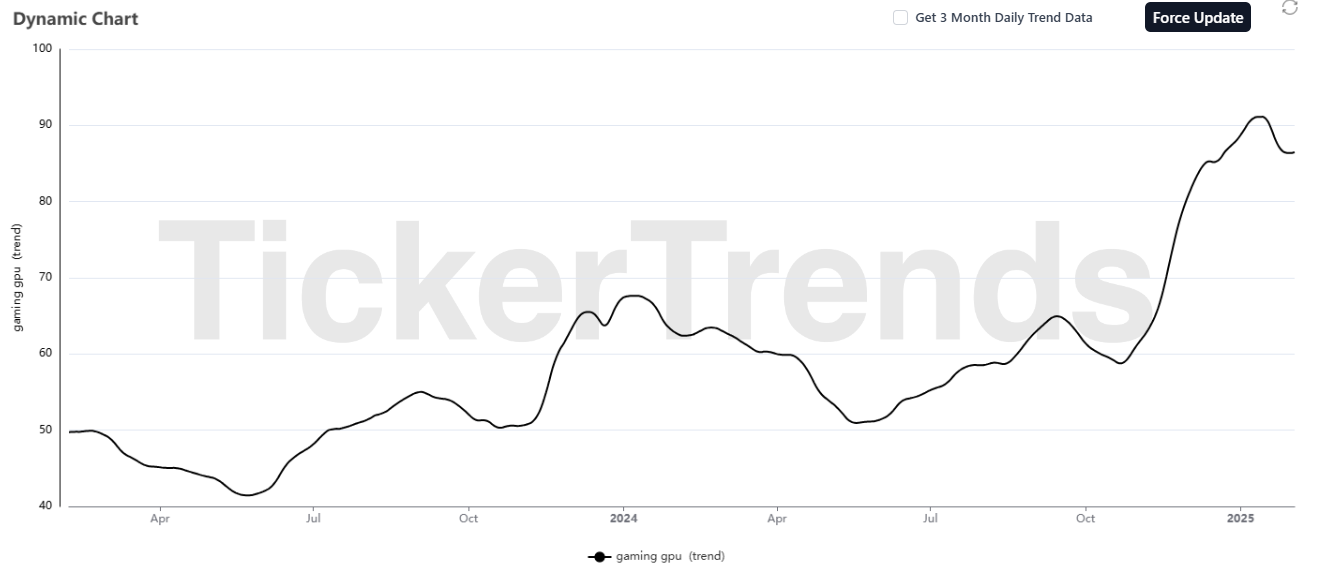

Nvidia's RTX 5090 and RTX 5080 GPUs sold out almost instantly, causing frustration among gamers and reinforcing accusations that the company executed yet another "paper launch" with extremely limited stock. Retailers such as Overclockers UK and Newegg reported that their inventory disappeared within minutes, while Newegg saw a 10x surge in traffic as eager buyers scrambled to secure a card. However, the stock situation was so dire that some stores didn't even receive a single unit of the RTX 5090, and scalper bots managed to scoop up a significant portion of available inventory, particularly in Europe, where the entire Founders Edition stock was wiped out before the cards even became available to the public.

This launch highlights Nvidia’s continued dominance in the high-end gaming GPU market, but it also exposes a deep disconnect between supply and demand. The company's GPUs have consistently been in high demand at launch, and this cycle of limited stock, scalping, and inflated resale prices has become a familiar pattern. While Nvidia’s gaming division generates massive consumer interest, it’s worth noting that gaming accounts for less than 10% of Nvidia’s total revenue. The company’s primary growth driver is now AI and data centers, with massive demand for chips like the H100 and upcoming Blackwell-based enterprise GPUs. This means that while Nvidia benefits from the buzz surrounding these GPU launches, the company’s core financial strength lies elsewhere, and it has little incentive to prioritize ramping up production of gaming GPUs.

The real winners from this launch could be retailers like Newegg, which benefit from increased traffic, brand exposure, and an uptick in prebuilt gaming PC sales that bundle these GPUs. However, even with this short-term spike, financial data and alternative data indicators suggest that retailers are still operating in a weak overall market, with gaming-related sales failing to offset broader consumer electronics slowdowns. If Newegg and other retailers can convert this demand into more high-margin sales of complete gaming systems, they may be able to capitalize on the hype, but if availability remains poor, it could push frustrated consumers toward alternatives—or even towards the growing cloud gaming market, where hardware ownership is less of a necessity.

For Nvidia, this launch underscores both the strength of its brand and the inherent risks of extreme supply shortages. While the scarcity effect can drive short-term premium pricing and increase demand, prolonged shortages could lead to consumer frustration and push gamers toward competitors like AMD’s upcoming RDNA 4 GPUs, which are expected to launch in March. Nvidia has faced backlash in the past over pricing and stock issues, and while the company is too dominant in the GPU space to face any real existential threat, it risks damaging its reputation among core gaming enthusiasts if stock shortages become a long-term problem.

Looking ahead, attention is shifting to the RTX 5070 and RTX 5070 Ti, which are expected to launch in February and March, respectively. Unlike the 5090 and 5080, these models cater to a broader audience, offering a better balance of performance and affordability. If Nvidia can ensure better availability for these cards, it could mitigate some of the frustration surrounding the higher-end models. However, given the repeated stock issues with every major launch, gamers should temper their expectations and prepare for another frustrating waiting game.

Ultimately, while the RTX 50-series launch has been a PR success in terms of hype and demand, it raises critical questions about Nvidia’s long-term gaming strategy. With AI and enterprise computing now at the heart of its business, gaming GPUs may increasingly become a lower priority, leading to fewer restocks, higher prices, and persistent shortages. Whether Nvidia chooses to address these concerns or continues to focus its efforts on data centers and AI dominance remains to be seen, but one thing is clear—gamers are being forced to adapt to a market where supply and affordability are far from guaranteed.

Sanrio Co Ltd ($8136.T):

Hello Kitty Island Adventure has officially expanded beyond Apple Arcade to Nintendo Switch and PC, bringing Sanrio’s iconic characters to a wider audience. While the game’s cute aesthetic and nostalgic appeal remain intact, reviews suggest that its repetitive gameplay and mobile-first design hold it back from being a truly great life-sim experience. The game leans heavily on gift-giving mechanics, requiring players to grind daily interactions with island residents to unlock quests and progress the story. Unfortunately, this structure leads to a slow, gated experience that many players find frustrating rather than engaging.

One of the biggest criticisms centers around the lack of meaningful customization. While players can decorate homes and craft items, the available options feel limited and disconnected, making it hard to create a personalized world. Additionally, questing and collection mechanics quickly become monotonous, with rewards that often feel underwhelming and uninspired. This repetitive structure suggests that Hello Kitty Island Adventure may struggle to retain long-term engagement outside of its core Sanrio fanbase.

The Switch and PC versions highlight issues that were less noticeable on mobile, where the game functioned more as a casual time-filler. On consoles and PC, however, the lack of depth and heavy reliance on daily progression gates make the experience feel underwhelming compared to other cozy games like Animal Crossing: New Horizons. While Sanrio fans may still find joy in interacting with beloved characters, the game’s design choices limit its mass-market appeal beyond this niche audience.

The expansion to Nintendo Switch and PC could have positive financial implications for Sanrio. The game’s launch across more platforms could drive higher sales and further cement Hello Kitty's digital presence, reinforcing the character’s global brand power. Given that Sanrio has been aggressively expanding its licensing business, a successful transition into gaming could open doors to future projects in the interactive entertainment space.

However, the mixed reception of the gameplay itself raises concerns about retention and monetization. If the repetitive mechanics and limited depth lead to early player drop-off, it could impact the game’s long-term success and potential future licensing deals. A lackluster performance might deter game developers from investing in similar projects, limiting Sanrio’s ability to leverage its IP in gaming beyond mobile-centric experiences.

Frontier Group Holdings Inc ($ULCC):

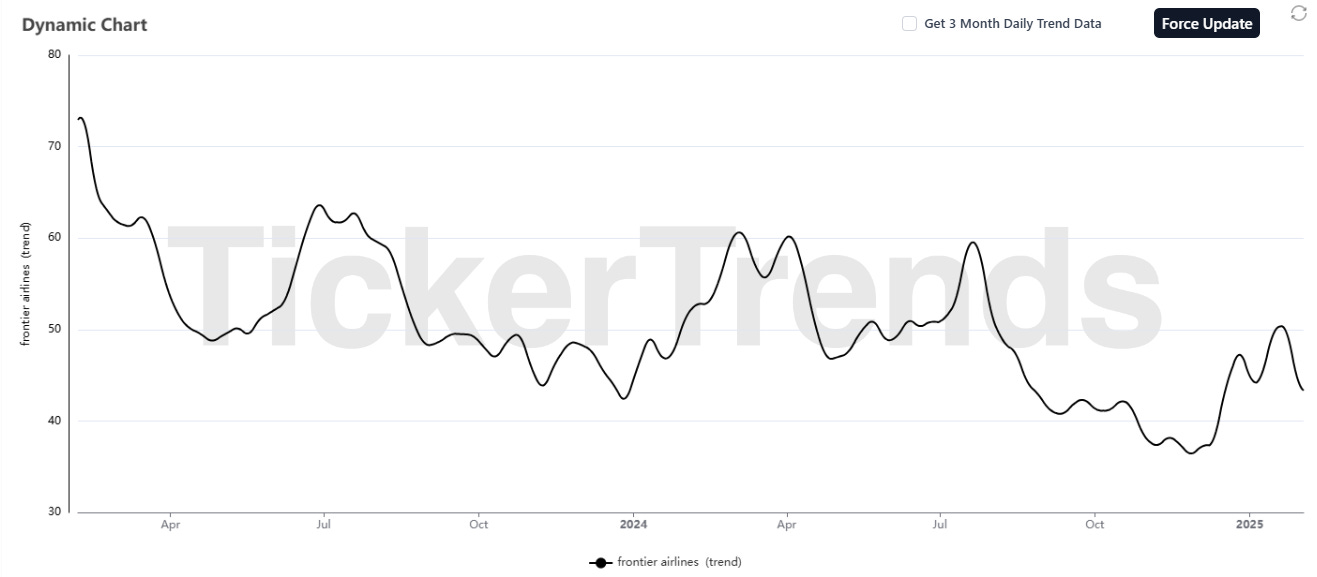

Frontier Airlines faced an IT outage that briefly grounded all its flights across the U.S., causing short-term disruptions but ultimately resolving without prolonged impact. The outage lasted around 20 minutes, with the FAA lifting its advisory after just six minutes. However, even brief ground stops like this can contribute to reputation issues and customer dissatisfaction, particularly for a low-cost carrier that operates on tight margins and high passenger volume.

Beyond the operational setback, the bigger story for Frontier is its ongoing attempt to merge with Spirit Airlines (NYSE: SAVE), which is currently navigating bankruptcy. Frontier has made a second bid to acquire Spirit, positioning itself as a stronger alternative to Spirit’s standalone restructuring plan. The airline argues that a merger would create a more competitive low-cost carrier, benefiting customers and stakeholders through cost synergies and expanded route networks. However, Spirit's board has so far rejected Frontier's offer, citing that its existing bankruptcy exit strategy provides better shareholder value.

This move comes at a time when budget airlines are struggling, with Spirit facing over $1 billion in upcoming debt payments and U.S. carriers seeing weaker-than-expected fare growth. The failed JetBlue-Spirit merger, blocked by regulators over antitrust concerns, has left Spirit in a vulnerable position, potentially giving Frontier leverage to strike a better deal if Spirit’s financial situation worsens. Meanwhile, Frontier's stock saw a slight uptick following the merger proposal, signaling some investor optimism.

For Frontier, a successful acquisition of Spirit could help it scale operations, reduce competition in the ultra-low-cost segment, and improve pricing power. However, if Spirit proceeds with its standalone plan and emerges highly leveraged, it may struggle to remain competitive, potentially leading to another merger attempt or further restructuring. While Frontier (NASDAQ: ULCC) may see short-term volatility, a completed merger with Spirit could strengthen its market position and long-term financial outlook.

Alibaba Group Holding Ltd ($BABA):

Alibaba's release of its Qwen 2.5-Max AI model, claiming to outperform DeepSeek-V3, OpenAI's GPT-4o, and Meta's Llama-3.1-405B, could lead to a significant escalation in the global AI arms race. The launch's timing—on the first day of the Lunar New Year—suggests Alibaba felt pressured by DeepSeek's rapid ascent, which has rattled global tech markets and caused a sharp selloff in AI-related stocks. DeepSeek's ability to deliver competitive AI at lower costs has forced major players, both in China and internationally, to accelerate their own AI development cycles.

Alibaba's new Qwen2.5-VL model, which incorporates multimodal capabilities like document parsing, video understanding, and software control, is also a direct response to DeepSeek and OpenAI’s latest advancements. The fact that Qwen outperformed OpenAI’s GPT-4o and Anthropic’s Claude 3.5 Sonnet in key benchmarks adds credibility to its claims. However, concerns remain about censorship and government oversight in Chinese AI models, which could limit their adoption outside of China.

The competitive dynamics between Alibaba, DeepSeek, and ByteDance (owner of TikTok) are reshaping the AI market in China, and by extension, the global AI landscape. ByteDance recently upgraded its own AI model, claiming superiority over OpenAI's o1 model, further heating up competition. These rapid advancements highlight China’s ability to innovate despite U.S. chip export restrictions, suggesting that rather than slowing down Chinese AI, U.S. sanctions may have fueled alternative research focused on efficiency.

Alibaba’s stock rose 9% this week, indicating investor optimism about its AI ambitions. However, the broader AI market remains volatile—DeepSeek’s rise earlier this week contributed to Nvidia’s stock plunging 17%, as investors worried about the impact of more cost-efficient AI models on high-margin hardware sales.

For Alibaba, Qwen’s success could strengthen its AI business and bolster its cloud division, which has been lagging behind Amazon AWS and Microsoft Azure. It also reinforces China’s push toward AI self-sufficiency, potentially shifting the AI balance of power. However, global adoption of Chinese AI models remains uncertain due to concerns over data security, regulatory risks, and geopolitical tensions, especially as the U.S. reviews DeepSeek and Qwen2.5-Max for national security implications. AI efficiency could become more critical than raw computational power, as demonstrated by DeepSeek and Alibaba’s cost-effective models. If Chinese AI firms can deliver comparable results with fewer chips, this could redefine enterprise AI strategies and undercut U.S. AI firms’ reliance on expensive GPU clusters. This new phase in the AI race suggests that the future of AI dominance may not be dictated solely by who has the most computing power, but by who can optimize resources the best.

Starbucks ($SBUX):

Starbucks' decision to cut 30% of its menu and reinstate its paying-customer-only policy marks a significant shift in its business strategy. CEO Brian Niccol, known for his turnaround work at Chipotle, has outlined a “Back to Basics” approach aimed at tackling the company's declining sales and operational inefficiencies. This shift mirrors historical examples, such as McDonald’s early decision to simplify its menu, as depicted in the 2016 movie The Founder.

Starbucks has long positioned itself as a "third place"—a space between home and work—but this identity has come under strain due to changing consumer habits, long wait times, and security concerns. The company is now opting to prioritize efficiency over inclusivity, reinforcing the idea that a cluttered menu and an open-door policy for non-paying guests have added friction to its operations. The decision to streamline its food and beverage offerings is aimed at reducing bottlenecks, speeding up service, and improving the customer experience.

At the same time, Starbucks is closing stores and laying off workers, signaling that these changes are about more than just the menu—they reflect a broader restructuring. Additionally, the return of ceramic mugs and in-store refills is an effort to reignite Starbucks’ classic coffeehouse culture, which has eroded over the years. Whether these moves will resonate with customers remains to be seen. While some consumers appreciate a more focused, high-quality menu, others are voicing concerns that a smaller selection and stricter policies could alienate regulars.

Beyond Starbucks, this shift reflects larger trends in the café industry. In Paris, New York, and other global cities, there is an ongoing cultural debate between traditional coffeehouses and new-wave cafés that cater to a grab-and-go culture. The loss of “third places”—neutral, welcoming spaces for conversation, work, or relaxation—has been exacerbated by economic pressures, real estate costs, and a shift to digital interactions. The decline of public spaces, from libraries to department stores, has left fewer options for people seeking a place to exist outside of home or work.

Financially, Starbucks' stock has faced pressure due to four consecutive quarters of declining same-store sales, making this transformation critical for investor confidence. While cutting menu complexity and enforcing new policies may improve profitability, the risk is that customers could push back against a more transactional experience, especially in markets where community and atmosphere are key selling points.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.