What’s Trending with TickerTrends #30

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Meta Platforms Inc ($META):

Meta Platforms reported a robust start to 2025, delivering $42.3 billion in revenue for the first quarter, up 16% year-over-year, with operating income reaching $17.6 billion and a 41% margin. Advertising remains the core driver of the business, with ad revenue growing 16% and the average price per ad rising 10%, supported by ongoing improvements in AI-powered ad delivery. Meta’s Advantage+ suite and the rollout of its new GEM ads recommendation model have already led to a 5% improvement in ad conversions on Reels. These advancements are central to Mark Zuckerberg’s vision of transforming advertising into an AI-driven performance engine, where businesses simply input their objectives and budgets, and Meta’s systems handle the rest. Ad conversion rates continue to grow faster than impressions, reinforcing Meta’s strong post-IDFA recovery in direct response advertising performance.

The company’s ambitious pivot to AI is shaping every layer of its business. Zuckerberg outlined five key areas of opportunity: AI-enhanced advertising, more engaging content, business messaging, Meta AI, and AI devices. Threads, Meta’s Twitter-like product, saw a 35% increase in time spent, while Facebook and Instagram engagement also climbed meaningfully. Much of this was attributed to AI-powered recommendation systems, now increasingly supported by Meta’s in-house large language models (Llama). Threads became the first app to test Llama for content ranking, and Meta reported a 4% lift in engagement. Meta’s AI efforts are also beginning to personalize content and generate more interactive, tailored experiences, pointing toward a future where users consume—and create—content alongside generative agents.

Meta AI, the company’s conversational assistant, has nearly one billion monthly active users across apps, led by strong adoption on WhatsApp. A standalone Meta AI app has launched, particularly targeting U.S. users where WhatsApp has less penetration. Zuckerberg views the assistant as a future central computing interface, comparable in value and importance to the smartphone era. Early use cases center around search, productivity, and entertainment. While monetization will come later, Meta is building a long-term path that includes product recommendations, advertising, and premium features. Hardware is increasingly a part of this ecosystem, with Meta’s Ray-Ban smart glasses seeing a 3x jump in sales and significant voice assistant usage. The company plans new releases later this year with added features like real-time translation, underscoring its bullishness on wearable AI as a future computing platform.

Spending is accelerating to support these ambitions. CapEx guidance was raised to $64–$72 billion for 2025, up from a prior $60–$65 billion, largely due to data center expansion and rising hardware costs amid global tariff uncertainty. Notably, much of the infrastructure build still supports Meta’s core ads and engagement products, not just generative AI. Meanwhile, expense guidance was slightly lowered, reflecting cost discipline outside of infrastructure and Reality Labs. Meta continues to stress that compute demand still outpaces supply across teams. While it has partnered with AWS and Azure for model hosting, Meta is funding its own training infrastructure to retain control and ensure performance tailored to its use cases.

Regulatory risks remain a concern, particularly in Europe, where the EU has ruled that Meta’s ad-free subscription model violates the DMA. The company warned this could significantly harm its user experience and revenue starting in Q3 if forced to comply before or during its appeal. Still, Meta is well-positioned with ample financial flexibility, strong ad momentum, and growing user engagement across platforms. With Reality Labs continuing to post ~$4 billion quarterly losses, Meta is banking on the long-term payoff of glasses and other spatial computing investments. In totality, the company appears to be executing from a position of strength, and its aggressive AI strategy signals confidence in shaping the next era of the consumer internet.

Microsoft Corp ($MSFT):

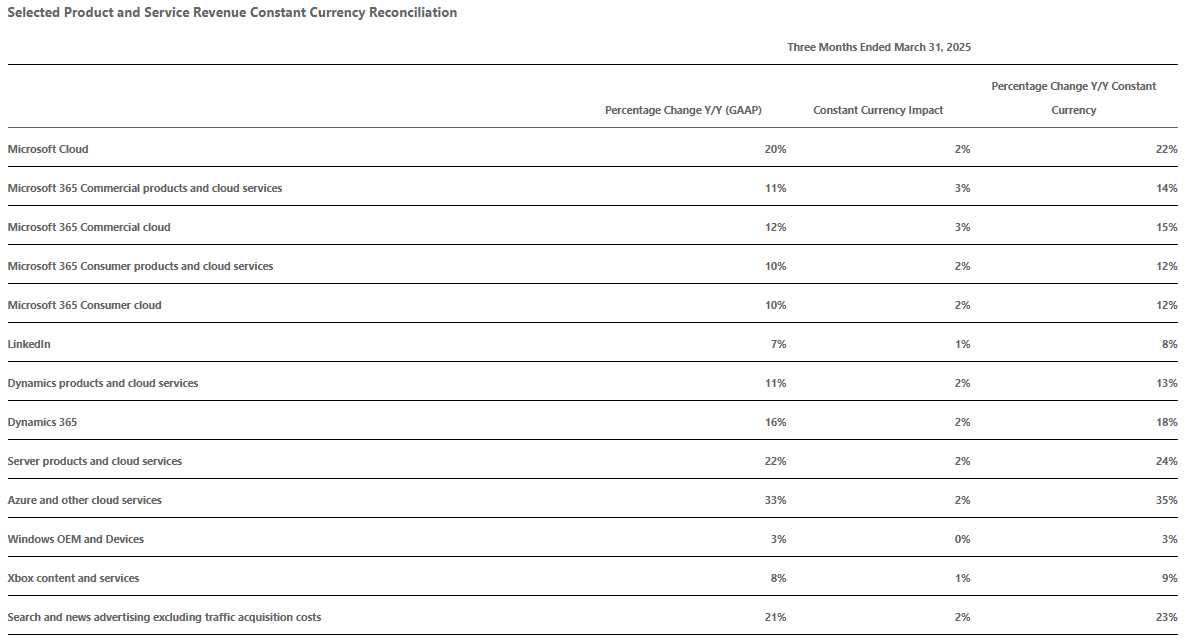

Microsoft delivered a standout fiscal Q3 2025 performance, driven by accelerating demand across its core cloud, AI, and productivity businesses. Total revenue reached $70.1 billion, up 13% year-over-year, with Microsoft Cloud contributing $42.4 billion, up 22% in constant currency. The cloud unit saw strong growth across Azure infrastructure, data workloads, and AI services, including a surge in demand for Microsoft's AI Foundry and the widespread use of its developer platform tools such as GitHub Copilot, which now serves over 15 million users. Azure’s AI-related workloads added 16 points to growth, with usage scaling significantly due to strong enterprise interest and partnerships with firms like OpenAI. Microsoft’s infrastructure buildout continues at a blistering pace, though supply is still struggling to meet AI demand in some regions.

Satya Nadella emphasized Microsoft’s unique position at the intersection of AI innovation and cloud infrastructure, describing cloud and AI as foundational to increasing business productivity and output. Microsoft is rapidly deploying new AI agents across its product suite, including specialized copilots for sales, customer service, and workplace productivity. Microsoft 365 Copilot adoption has tripled, and more than 230,000 organizations have used Copilot Studio to build custom agents. These innovations are contributing to broader enterprise adoption and larger deal sizes, particularly among returning customers. Microsoft is also investing heavily in AI-enhanced tools across security, low-code development, and collaboration—highlighting its strategy of embedding AI functionality throughout its ecosystem.

Amy Hood highlighted that Azure’s non-AI workloads were the primary source of revenue upside in the quarter, underlining continued growth from cloud migrations and legacy workload modernization, particularly in enterprise and scale customer segments. AI services revenue growth was also strong, but the beat came from improved execution in core services. Microsoft Fabric and Cosmos DB saw accelerated adoption, and PostgreSQL usage has now spread to 60% of the Fortune 500. These data services are key enablers for AI applications and signal Microsoft’s deeper entrenchment into mission-critical enterprise workloads. Azure growth was 33% overall, including 16 points from AI, with expectations for 34-35% constant currency growth in Q4, despite some anticipated capacity constraints.

Capital expenditures reached $21.4 billion for the quarter, reflecting Microsoft’s commitment to scale its infrastructure in step with customer demand, though Amy Hood noted that 2026 will bring a slower pace of CapEx growth with a shift toward shorter-lived assets tied more directly to revenue. While GPU and power constraints remain localized challenges, Microsoft continues to make strides in efficiency. System-wide software improvements are allowing the company to extract more performance per unit of power, with AI cost per token already halving. This allows for better capital efficiency even as AI workloads expand rapidly. Amy Hood also reassured investors that Microsoft’s AI margins are well ahead of where cloud margins were at similar stages of adoption.

Microsoft’s broader business continues to show momentum. LinkedIn surpassed one billion members with growing engagement across content and premium services, including 75% quarter-over-quarter growth in SMB subscriptions. Gaming revenue climbed 5%, with PC Game Pass revenue up 45%, cloud gaming hitting a new record, and strong performance from IP like Minecraft. Search and advertising revenue ex-TAC surged 21%, aided by partnerships and growing adoption of AI-curated experiences in Bing and Edge. Microsoft’s multi-pronged strategy—combining leading AI research, deep enterprise ties, a broad product portfolio, and a disciplined financial approach—positions it to continue compounding growth, even as it warns of tight AI supply in the near term.

Trends this week:

Take-Two Interactive Software Inc ($TTWO):

Rockstar Games confirmed this week that Grand Theft Auto VI will now release on May 26, 2026, shifting it out of the expected fall 2025 window and removing it from Take-Two Interactive’s current fiscal year entirely. While the studio cited its usual commitment to quality, the delay is also tied to Rockstar’s desire to avoid the brutal crunch conditions that plagued development cycles in the past—especially around Red Dead Redemption 2. It is being reported that many within the studio had long considered the fall 2025 timeline unrealistic and emphasized that, while overtime hasn’t been eliminated entirely, employee sentiment around working conditions has significantly improved. The management is prioritizing long-term health—both of the product and the team building it.

This delay has short-term consequences for Take-Two. A 7% dip in the stock immediately followed the announcement as investors recalibrated expectations for the year ahead. That said, Take-Two remains up nearly 50% over the past 12 months, and the new release date for GTA 6 sets the company up to lead with its most important title at the start of a new fiscal year. While a few quarters of softness may follow, the long-term thesis remains intact: GTA 6 is poised to be one of the most lucrative releases in entertainment history. And if the rumored $100 launch price turns out to be true, it could generate revenues that dwarf even GTA V, the best-selling game of the past decade.

The $100 price point, while unconfirmed, has stirred discussion across gaming forums and social media. Surprisingly, many players seem open to the idea, citing Rockstar’s track record and the expectation that GTA 6 will offer hundreds of hours of immersive gameplay. This sentiment reflects a shift in consumer thinking: for certain flagship titles, a premium price may now feel justifiable. But it also sets a precedent. If Rockstar proves it can launch at $100 and still move tens of millions of copies, other AAA publishers will be tempted to follow. That could drive average game prices higher across the board and spark a larger conversation about accessibility and value in the industry.

From a macro perspective, this development could trigger a fresh wave of spending across the sector. Studios that were holding back their release schedules to avoid clashing with GTA 6 may now greenlight holiday 2025 launches, and marketing budgets are expected to reaccelerate as the countdown to May 2026 begins. At the same time, GTA 6’s rumored development budget—estimated to exceed $2 billion—will raise the bar for what counts as “AAA,” potentially deepening the divide between mega-publishers and mid-sized developers. The stakes are growing, and Rockstar’s decisions are likely to shape not just the next year of releases, but the economics of the entire gaming landscape going forward.

What happens next will come down to execution. If GTA 6 lives up to expectations—and if consumers embrace the higher price tag—it could validate Rockstar’s gamble and set a new benchmark for what the most ambitious games can charge. For Take-Two, the short-term dip may prove inconsequential if the company is able to extend the lifecycle of GTA 6 the way it did with GTA V and Online. But if quality or timing falters, the backlash could be swift, especially as pricing expectations rise. The next 12 months will be about managing that risk, keeping fans engaged, and ensuring that when the game finally arrives, it delivers a generational leap that justifies every extra dollar and every added month.

Novo Nordisk A/S ($NVO), Eli Lilly And Co ($LLY), CVS Health Corp ($CVS):

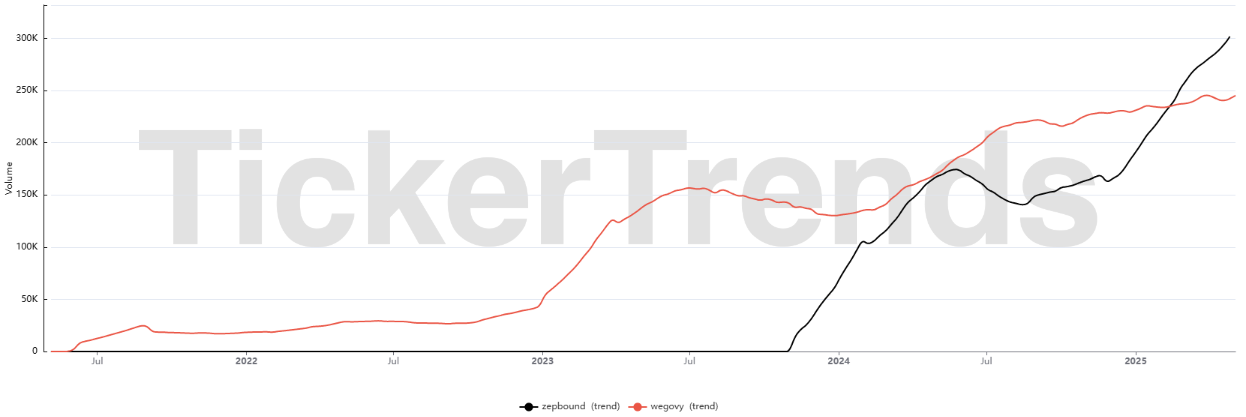

This week, CVS Caremark has named Novo Nordisk’s Wegovy as the preferred weight-loss injection on its commercial formulary starting July 1, 2025. The move pushes Eli Lilly’s Zepbound off CVS’s largest weight-loss drug plan, delivering a material win to Novo just as pricing pressure and formulary positioning are becoming central battlegrounds for GLP-1 dominance.

With over 100 million covered lives, CVS Caremark is the largest pharmacy benefit manager (PBM) in the United States. Its endorsement effectively positions Wegovy as the go-to weight-loss treatment for a sizable chunk of the insured U.S. population. The ripple effects were felt immediately. Eli Lilly’s shares fell 11% following the announcement, a rare setback for a company that has otherwise ridden tirzepatide’s dual diabetes and weight-loss indications to record-breaking revenue. The market's response reflected more than just formulary disappointment—it signaled a concern that Wegovy could now pull further ahead in the race for U.S. obesity market share.

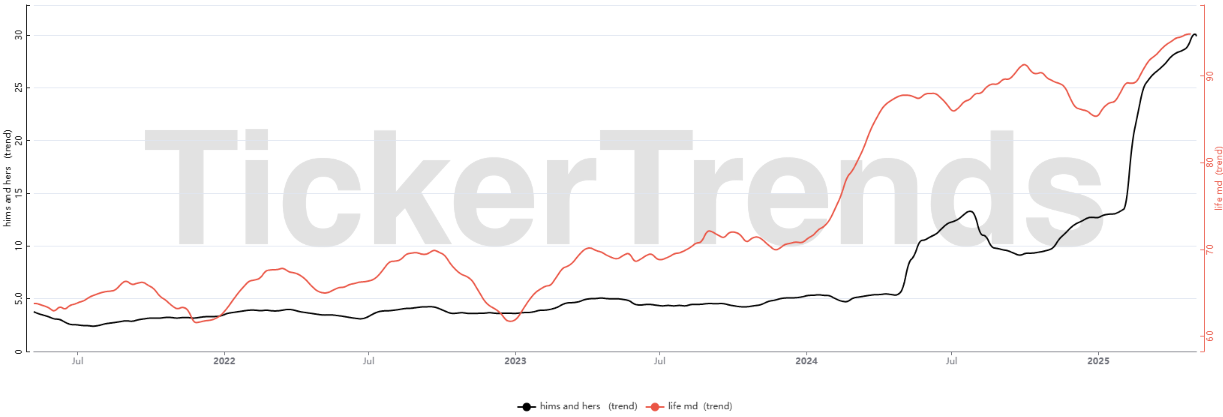

Novo Nordisk seized the moment. The company announced the CVS partnership in lockstep with expanded distribution through its direct-to-consumer NovoCare Pharmacy, allowing cash-paying patients to access Wegovy for $499/month—down from a previous $650/month. The launch is also integrated with three telehealth partners—Hims & Hers, LifeMD, and Ro—further bolstering Novo’s reach in the increasingly important digital prescribing space. This multi-channel offensive shows how Novo is aggressively leveraging both price concessions and accessibility to gain strategic ground. Wegovy, once plagued by supply chain bottlenecks and inventory shortfalls, now looks primed to dominate both the insured and out-of-pocket segments of the weight-loss market.

The impact of this decision stretches beyond just Novo and Lilly. Hims & Hers, LifeMD, and Ro—three of the most prominent telehealth operators distributing GLP-1s—stand to benefit significantly from the expanded access and streamlined logistics of working directly with NovoCare Pharmacy. These platforms can now bypass retail delays and deliver Wegovy directly to patients, strengthening their consumer proposition in what has become the most competitive therapeutic segment in healthcare. With consumer demand outstripping supply and awareness continuing to rise, CVS's move gives these companies a powerful boost heading into what is expected to be another explosive year of GLP-1 adoption.

Eli Lilly now faces a formidable challenge. Though Zepbound (tirzepatide) has shown superior weight-loss efficacy in clinical trials compared to semaglutide, CVS's decision underscores how price and distribution infrastructure are just as critical as clinical data when it comes to payer relationships. Lilly has historically leaned on the superior performance profile of tirzepatide, but Novo’s willingness to negotiate more aggressively appears to have won over the country’s largest PBM. In response, Lilly may be forced to re-evaluate its pricing strategy or risk similar exclusions from other formularies—a shift that could materially impact future growth.

Meanwhile, Ro, LifeMD, and Hims & Hers will need to walk a fine line. Their relationship with Novo gives them immediate access to a broader market and ensures product availability. But it also tightens their supply chain dependency on one manufacturer. If Wegovy faces renewed shortages or regulatory scrutiny, these platforms could find themselves exposed. Still, the benefits today far outweigh the risks, especially given CVS’s reach and the logistics advantage of working through NovoCare.

The implications of CVS’s decision extend beyond the three companies most directly involved. The broader GLP-1 industry may be entering a new era where access, price transparency, and fulfillment logistics dictate market leadership just as much as molecule efficacy. For Novo, this is a major strategic win that positions Wegovy to remain the flagship weight-loss drug in the U.S. For Eli Lilly, it represents a rare stumble in a story of relentless GLP-1 momentum. For telehealth partners, it opens the door to faster growth and greater relevance—at least for those aligned with the right manufacturer. As payer preferences shift, the next phase of the GLP-1 drug war may come down to scale, logistics, and price discipline more than science alone.

Amazon.com Inc ($AMZN):

Amazon has walked back internal discussions around displaying the cost of tariffs on its platform after a direct intervention from President Donald Trump, underscoring the tense intersection of corporate transparency and political optics in an era of rising protectionism. The controversy stems from a report by Punchbowl News indicating that Amazon was considering showing U.S. tariff costs beside prices on certain items, a move the White House quickly condemned as a politically charged attempt to undermine the administration’s trade agenda.

The report alleged that Amazon’s low-cost spinoff, Amazon Haul—launched to compete with Chinese juggernauts Shein and Temu—had floated the idea of itemizing tariff impacts for shoppers, particularly in light of the end of the $800 exemption for de minimis imports from China. The idea would have provided explicit visibility into how much of an item’s price was driven by the Trump administration’s sweeping tariffs, which now place a baseline 10% duty on most imports and a 145% rate on goods from China. Such a move could have shifted consumer perception and potentially redirected public ire away from retailers and toward U.S. trade policy.

But Amazon, which represents a significant share of U.S. e-commerce and counts Chinese sellers as nearly half its merchant base, quickly reversed course. Spokesperson Tim Doyle confirmed the company had evaluated such an approach for Haul but insisted it was “never approved and is not going to happen.” Importantly, Amazon made clear it had no intention of implementing the policy on its main site, deflecting concerns about any broad consumer-facing campaign on tariff impacts.

The response from Washington was swift. White House Press Secretary Karoline Leavitt accused Amazon of engaging in a “hostile and political act” and framed the reported plan as an attempt to shift blame for inflationary pressures onto the administration. Trump, informed of the news early Tuesday, personally called Amazon founder Jeff Bezos to express his frustration. According to multiple senior officials, Trump was “pissed” over the implication that Amazon would make tariff costs visible to consumers and described the call as “terrific,” praising Bezos for resolving the issue quickly.

Commerce Secretary Howard Lutnick echoed the administration's tone, downplaying the economic impact of a 10% tariff and accusing Amazon of manufacturing controversy. “The only price that would really change is something we don’t make here, like a mango,” Lutnick said, ignoring the broader effect of steep China-specific tariffs on a wide range of goods including clothing, electronics, and household staples.

Amazon’s decision comes as other platforms such as Shein and Temu have already implemented price adjustments and visible import charges due to the new tariff landscape. These companies, which ship directly from Chinese factories, have had to adjust to the policy environment rapidly, often passing some of the new costs onto consumers. Temu in particular now displays an added import fee at checkout, offering a clearer picture of the financial strain the tariffs place on cross-border e-commerce.

While Amazon insists the tariff display discussion never extended beyond the Haul platform and was unrelated to White House pressure, the timing of the reversal tells a different story. The administration has made tariffs a cornerstone of its domestic manufacturing push, and transparency on their cost impact threatens to undermine political messaging that tariffs are economically harmless.

Senate Minority Leader Chuck Schumer took the opposite view, calling on more companies to disclose tariff-related costs to customers. “People deserve to know the impact tariffs have on their finances,” he said on the Senate floor, highlighting the widening partisan divide on trade transparency.

The episode also reopens a long-simmering and often contradictory relationship between Trump and Bezos. Though previously adversaries—with lawsuits, public insults, and sharp policy clashes over Amazon’s Pentagon contract and The Washington Post’s editorial stance—Bezos has made visible efforts to improve relations in Trump’s second term. Amazon donated to Trump’s second inauguration, Bezos attended the event, and the company is reportedly producing a documentary about First Lady Melania Trump.

Despite the temporary resolution, the implications for Amazon—and the broader e-commerce landscape—are significant. As tariffs tighten and exemptions disappear, cost pressures on platforms reliant on Chinese sourcing will only grow. While Amazon avoided political fallout this time, the company and its rivals will continue grappling with how to address consumer price sensitivity in a politically charged climate.

Berkshire Hathaway Inc Class B ($BRK.B):

Warren Buffett, the 94-year-old Oracle of Omaha, stunned the investment world on Saturday by announcing he would step down as CEO of Berkshire Hathaway at the end of 2025. While Greg Abel had long been identified as the eventual successor, the timing of the announcement—made unceremoniously at the tail end of a five-hour Q&A session during Berkshire’s annual meeting—took even insiders by surprise. Abel, who oversees all non-insurance businesses at Berkshire, was sitting next to Buffett on stage and had no advance notice. Only Buffett’s two children, Susie and Howard, had been informed ahead of time.

Buffett’s retirement marks the end of a 60-year reign during which he transformed a struggling textile mill into one of the world’s most powerful conglomerates. During that period, Berkshire Hathaway’s stock delivered an astronomical 5,502,284% return, compounding at nearly 20% annually—double the long-term average of the S&P 500. A $10,000 investment in 1965 is now worth over $500 million. But beyond the numbers, Buffett’s methodical discipline, ability to withstand market hysteria, and long-term value investing philosophy turned him into a cult figure among retail and institutional investors alike.

The stock has reflected that devotion. Berkshire's Class A shares are up 20% year-to-date, even as the broader market, represented by the S&P 500, has declined. But with Buffett’s announcement now official, the question is whether Berkshire shares will experience short-term pressure as markets grapple with the emotional and strategic weight of this transition. While Buffett reassured shareholders that he has “zero intention” of selling a single share and said he believes Berkshire’s future will be even brighter under Abel’s management, investor behavior doesn’t always align with logic. The near-term risk stems from the premium Berkshire commands—valued at around 1.8x book value, much of which is attributed to investor trust in Buffett’s judgment, especially in how he deploys capital.

Abel, for his part, carries credibility. A Canadian native and longtime Berkshire insider, he has quietly run a substantial part of the conglomerate for years. On Saturday, Abel reiterated that the company’s $347.7 billion cash pile is an “enormous asset,” providing flexibility and resilience in a volatile macro environment shaped by inflation, tariffs, and rising geopolitical uncertainty. His remarks echoed Buffett’s longstanding principle that having a “fortress balance sheet” is Berkshire’s best defense against future shocks. Buffett was more philosophical about the mountain of cash, saying that attractive opportunities “don’t come along in an orderly fashion” and that Berkshire’s patience in waiting for the right deals is part of what sets it apart. Despite that, Berkshire did not repurchase shares in Q1, and Buffett again passed on multiple potential acquisitions, including a mysterious $10 billion deal that ultimately didn’t make the cut.

Berkshire’s Q1 results also offered a mixed snapshot. Operating profits fell 14.1% year-over-year to $9.64 billion, driven by weakness in insurance. Net income, which includes swings in equity investments, dropped 64% to $4.6 billion. But the cash position hit a record, and shareholders showed little concern as they gave Buffett a prolonged standing ovation when he made his announcement. As the transition unfolds, investors will be watching to see whether Abel can match Buffett’s steady hand in navigating crises and seizing rare opportunities.

Longtime observers note that Berkshire’s decentralized model, consisting of over 189 businesses across rail, insurance, energy, consumer staples, and finance, won’t change overnight. Abel is expected to retain the culture of autonomy that has allowed Berkshire’s subsidiaries to flourish. But he’ll face a very different capital allocation challenge. While Buffett was famous for scooping up distressed assets during crises—most notably during the 2008 financial meltdown—Abel has yet to show how he might deploy hundreds of billions of dollars

There’s also the possibility that Buffett’s departure triggers a more aggressive capital allocation approach. Abel may eventually deploy capital in ways that Buffett resisted—either through more frequent acquisitions or shareholder returns. Whether that unlocks new value or introduces more risk is an open question. But the market may begin to recalibrate how it values Berkshire, less as a Buffett-led vehicle and more as a giant, cash-rich holding company led by a skilled, but lower-profile, executive.

United Parcel Service Inc ($UPS):

UPS and the U.S. Postal Service are set to eliminate tens of thousands of jobs in 2025, signaling a deepening shift in the logistics and delivery sector as new Trump-era tariffs, declining mail volumes, and automation reshape operational priorities. The two iconic delivery giants—often seen as bellwethers of broader economic health—are undertaking dramatic restructuring efforts, which could have ripple effects across local economies, consumer services, and labor relations.

UPS plans to lay off 20,000 workers—more than 4% of its global workforce—and shutter 73 facilities by the end of June. The announcement, delivered during the company’s Q1 earnings call, is part of what CEO Carol Tomé described as “the largest network reconfiguration in UPS history.” This sweeping overhaul aims to cut $3.5 billion in costs this year alone, fueled by a mix of automation, consolidation, and strategic disengagement from unprofitable business—chief among them, Amazon. While Amazon accounted for nearly 12% of UPS revenue in 2024, a new agreement will reduce that volume by more than 50% by mid-2026. Tomé was blunt in her assessment, stating that the Amazon fulfillment center outbound volume “is not profitable for us, nor a healthy fit for our network.”

Automation is another central pillar of the transformation. UPS plans to fully or partially automate 400 facilities, with 64% of volume already running through automated systems in Q1. Innovations include robotic sortation, automatic labeling, and trailer loading/unloading technologies, which will allow UPS to operate with greater precision during demand fluctuations. However, this modernization effort comes at the cost of tens of thousands of jobs, disproportionately affecting operational roles in sorting, transport, and delivery.

For the metro Atlanta area—where UPS is headquartered in Sandy Springs—the impact could be acute. Economists warn of a local domino effect on consumer spending, housing, and retail employment. Emory University’s Thomas Smith noted that the layoffs may be an early signal of a broader economic slowdown, though he stopped short of calling it a recession. “The economy is interconnected,” he said. “Those 20,000 jobs that are lost are going to lead to lower consumption across the Atlanta metro area—that could impact other people’s jobs.”

UPS is also facing fierce pushback from the Teamsters Union, which represents roughly 330,000 of the company’s 490,000 workers. The union is invoking a contractual obligation requiring UPS to create 30,000 union jobs under its current national master agreement. While Teamsters President Sean O’Brien acknowledged UPS can trim corporate roles, he made clear the union would not tolerate cuts to “hard-fought, good-paying Teamsters jobs,” threatening a bitter labor battle if contract violations occur. “UPS will be in for a hell of a fight,” O’Brien warned.

UPS insists that customers will not experience delivery disruptions despite the cuts and automation. Behind both announcements is the unrelenting impact of Trump’s revived trade tariffs, especially on Chinese imports. UPS cited the new trade regime in its earnings report as a key factor behind diminished volume—especially among smaller business clients—and heightened uncertainty in global shipping. UPS’s decision to aggressively shrink its footprint while embracing a leaner, more automated model could become a blueprint for other shipping and logistics companies under margin pressure from tariffs, e-commerce volatility, and labor costs.

For now, consumers are likely to see minimal immediate disruption, but workers in the logistics sector face mounting uncertainty. The Teamsters are preparing for a protracted battle, UPS is moving full speed toward automation, and USPS is shedding jobs to keep its long-troubled books afloat. These changes mark a pivotal moment in the evolution of how goods—and the people who move them—are valued in the American economy. Whether the cost savings can outpace the societal consequences remains to be seen.

Hims & Hers Health Inc ($HIMS):

Hims & Hers Health shares surged over 23% on Tuesday after the company announced a landmark partnership with Novo Nordisk to offer the blockbuster weight-loss drug Wegovy on its telehealth platform. The deal represents a dramatic shift in the GLP-1 landscape, with Hims moving from compounded semaglutide to selling the branded version, now that Wegovy has returned to full supply status and is no longer on the FDA’s drug shortage list. The partnership comes at a time when compounding pharmacies are being forced to stop selling knockoff versions following a court ruling, marking a pivotal moment in the tightening regulation around GLP-1 distribution.

Under the agreement, Hims customers will be able to purchase Wegovy through Novo’s own NovoCare Pharmacy for $599 per month bundled with a Hims membership, which includes services like nutrition coaching, 24/7 provider access, and monthly telehealth visits. This direct channel to branded Wegovy offers patients a legal and reliable alternative to compounded semaglutide, positioning Hims as a scalable and FDA-compliant platform in the lucrative obesity treatment market. Novo’s Dave Moore said the collaboration is part of a broader strategy to meet patients “where they are” and noted that the companies are developing a long-term roadmap combining Hims’ digital reach with Novo’s pharmaceutical pipeline.

The move also sends a strong signal that Novo now has adequate supply to fully serve U.S. demand. Moore emphasized that all dose levels are available and the partnership is intended to eliminate gray-market compounding and reinforce the legitimacy of the branded product. The announcement follows a federal judge’s ruling that outsourcing facilities and smaller compounders must halt semaglutide production by May 22, closing a major legal and regulatory loophole that had allowed companies like Hims and Ro to generate meaningful revenue from off-label, lower-cost semaglutide.

In parallel, Hims also announced it would sell Eli Lilly’s Zepbound via its platform, although Lilly clarified it does not have a formal collaboration with Hims. Still, the access playbook is similar: direct-to-consumer availability of branded GLP-1 drugs to cash-paying patients who either lack insurance or face limited reimbursement. Consumers will now be able to access Wegovy through three major telehealth platforms—Hims, Ro, and LifeMD—at prices ranging from $499 to $599 per month. All three companies experienced outsized stock moves following the news, with LifeMD surging 36% intraday and Ro, which is private, expected to see a spike in customer traffic and conversions.

This expanded availability marks a critical shift in the distribution model for GLP-1 drugs. With demand far outstripping insurance coverage and compounding channels being shut down, the entry of Novo into telehealth via direct-to-consumer platforms signifies a recognition that cash-pay models are now a strategic priority. For Hims, it validates the platform’s ability to scale demand and secure exclusive pharmaceutical relationships—something that could give the company long-term pricing power and brand equity in the growing obesity treatment category.

The economics of the deal are also likely to be favorable for Hims. At $599 per month, Hims is charging a $100 premium over the $499 price available directly through NovoCare or Ro, justified by the bundled services and subscription layer. While margins on branded drugs will be lower than on compounded versions, the scalability, compliance, and marketing upside may offset the hit to gross margins. Moreover, Hims CEO Andrew Dudum’s comment that “we’re doing that at scale and partnering with an industry leader who believes in the same future” hints that this partnership could extend to other chronic disease categories.

For Novo, this partnership helps protect the pricing power and integrity of its GLP-1 franchise by undercutting the gray market and repositioning the drug as widely accessible—even to those without insurance. With full supply restored, the Danish drugmaker is trying to regain control over how Wegovy is distributed and ensure patients receive an approved and consistent experience. It also reduces reputational risk as more patients access the medication through regulated channels.

From an industry perspective, this development is a turning point. Telehealth firms, once seen as fringe operators relying on compounding and aggressive marketing, are now fully integrated into the official distribution playbook of the world’s largest pharmaceutical firms. The fact that Novo is working directly with platforms like Hims, Ro, and LifeMD—and publicly endorsing these collaborations—suggests that digital health is no longer just a marketing channel, but a primary sales infrastructure.

Looking ahead, Hims may continue to face questions about profitability, but the ability to sign distribution deals with major pharma names, navigate regulatory headwinds, and shift from gray market offerings to FDA-approved drugs puts the company on firmer strategic ground. The announcement may also accelerate M&A chatter in the space, particularly around platforms with proven conversion and retention infrastructure for chronic medications. For investors, the 23% jump in HIMS shares underscores both the size of the opportunity and the confidence in Hims’ execution capabilities. While Eli Lilly has opted for a looser affiliation, Hims’ alignment with Novo—and its move to secure a price tier higher than competitors—suggests that the company is aiming not just to participate in the GLP-1 boom, but to define how it's delivered.

With a solidified partnership, regulatory clarity, and a massive addressable market still underserved by traditional insurance systems, Hims may now be one of the best-positioned digital health players in the post-compounding era of obesity care.

Nvidia Corp ($NVDA):

Nvidia stock surged this week after a series of earnings and spending updates from its largest customers—Microsoft, Meta, Amazon, and Alphabet—confirmed that fears of a slowdown in AI infrastructure spending were not only overblown but entirely backward. Instead of a pullback, the hyperscalers are doubling down on capital expenditures, with some raising their guidance by billions of dollars. These announcements provide a sharp rebuttal to market skepticism, reinforce Nvidia’s positioning at the heart of the AI ecosystem, and reframe capex not as cyclical tech expenditure, but as the new foundational layer of digital infrastructure.

Meta Platforms raised its 2025 capex guidance from $62.5 billion to $68 billion, specifically citing “additional data center investments to support our artificial intelligence efforts.” Microsoft reported $21.4 billion in capex for the March quarter and guided higher for the June quarter, on pace to top $80 billion for the fiscal year. Amazon, which had previously been rumored to be curtailing spending, instead posted a 75% year-over-year jump in Q1 capex to $24.3 billion and confirmed it’s targeting $100 billion for 2025, with the bulk directed at AWS and AI-related infrastructure. Alphabet maintained its $75 billion capex outlook. Collectively, these companies—Nvidia’s biggest customers—are deploying over $300 billion toward infrastructure, and AI is at the center of that allocation.

Not only does this level of sustained and growing capex spending validate the long-term demand for Nvidia’s GPUs, but it also resolves the most pressing near-term bear case: that AI investment had peaked or would be delayed due to macroeconomic uncertainty, tariffs, or internal reprioritizations. Instead, hyperscalers are racing to build the AI backbone of the next decade, and Nvidia’s dominance in the training and inference space means it remains the key arms dealer in this digital arms race.

Microsoft, which alone accounts for 15% of Nvidia’s revenue, saw Azure cloud revenue accelerate to 33% year-over-year growth with 16 points of that driven by AI services. Meta, contributing another 14% to Nvidia’s top line, is increasing capex not just to support compute but to tackle the rising cost of infrastructure hardware—effectively underwriting Nvidia’s pricing power. Amazon and Alphabet, each contributing over 10% of Nvidia’s sales, both confirmed strong demand pipelines. Despite building custom chips like Trainium, Amazon still relies heavily on Nvidia’s H100 and soon-to-launch B100 GPUs for high-performance workloads.

The result of these spending confirmations is a broad re-rating of Nvidia’s forward outlook. While the stock is still off its highs—down roughly 25% from its peak—it now trades at just 26x forward earnings and under 40x trailing earnings, valuations that look increasingly compelling given its 74.99% gross margins and market share dominance in AI accelerators. This spending boom also reverberates across Nvidia’s supply chain and the broader hardware ecosystem. Arista Networks, Vertiv, Broadcom, Supermicro, Dell, and TSMC all posted gains this week. These firms supply components, cooling, servers, networking, and silicon that form the physical foundation of hyperscale compute. Nvidia sits atop this pyramid, and the positive guidance from its partners suggests that revenue visibility into late 2025 and even 2026 is now considerably stronger than previously believed.

Crucially, Nvidia has also navigated a transition period with discipline. While U.S. export restrictions and fears over China’s role in the GPU market remain risks, the bulk of Nvidia’s incremental growth is coming from U.S. and Europe-based demand. CEO Jensen Huang has maintained pricing discipline and secured long-term orders from cloud and enterprise buyers. With the B100 set to launch soon, and demand already reportedly outstripping supply for the H100, Nvidia is managing an environment where scarcity persists despite multi-billion-dollar foundry orders.

Moreover, AI capex has graduated from being a discretionary line item to a strategic imperative. As Microsoft’s Satya Nadella put it, “We want to make sure that the regional data center build-outs match demand. We’ve always made these adjustments.” The idea that this spending is cyclical or temporary is being dismantled by quarter after quarter of rising commitments. As hyperscalers prepare for a world where AI powers every interaction, search query, and business process, Nvidia’s role as the enabling hardware layer makes it a structural winner.