What’s Trending with TickerTrends #27

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

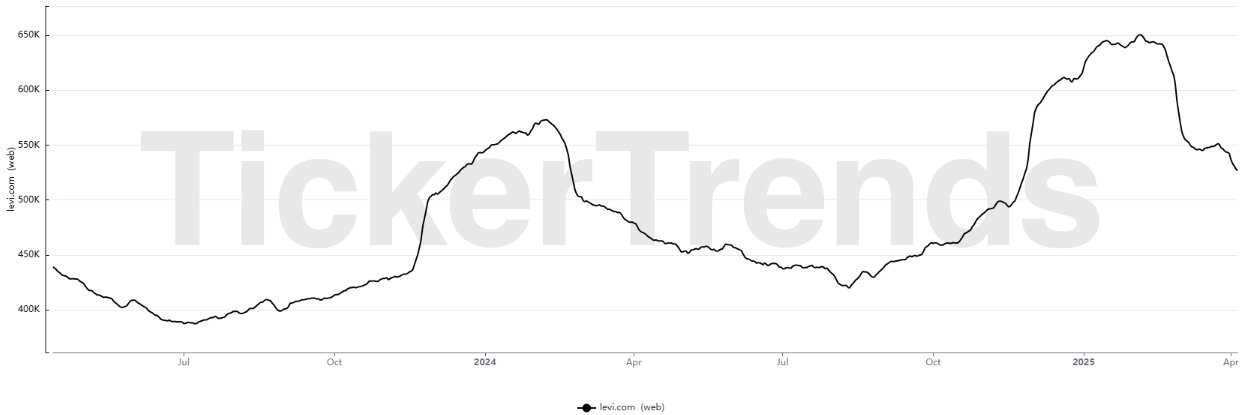

Levi Strauss & Co ($LEVI):

Levi Strauss & Co. delivered a strong start to fiscal 2025, reporting first-quarter results that exceeded expectations across sales, margins, and earnings per share. Organic net revenue grew 9% year-over-year, driven by a 12% increase in Direct-to-Consumer (DTC) sales and a 5% rise in global wholesale revenue. The company’s transformation into a DTC-first, lifestyle-led business is gaining momentum, with DTC now accounting for 52% of total net revenue, up from 50% a year ago. Notably, e-commerce sales grew 16% and company-operated stores also delivered positive comps, fueled by strong traffic, higher conversion, and increased average unit retail (AUR). The U.S. market saw an 8% increase in revenue, while international markets, which now account for nearly 60% of Levi’s total business, grew 9%, with strength across Europe, Asia, and Mexico.

The Levi's brand grew 8% and gained market share in both men's and women's categories, bolstered by culturally resonant campaigns like the REIIMAGINE collaboration with Beyoncé and a capsule collection celebrating Bob Dylan. The women’s business accelerated to double-digit growth and now comprises 38% of total revenue, aided by viral product launches like the Cinch Baggy jeans, which surpassed 200 million views on TikTok. In line with its lifestyle pivot, the tops category grew 7%, and newer segments such as dresses and outerwear outpaced the rest of the business. The brand’s premiumization efforts continued with the global launch of the elevated Blue Tab collection and the introduction of a new denim-linen hybrid fabric.

Levi’s reported a record gross margin of 62.1%, up 330 basis points year-over-year, supported by lower product costs, favorable channel mix, and more full-price selling. Operating margin rose to 13.4%, a 400-basis-point improvement, while adjusted diluted EPS surged 52% to $0.38. While inventory was up 7%, the company described it as healthy and well-positioned to meet upcoming seasonal demand. Levi’s also returned $81 million to shareholders via dividends and share repurchases and has raised its quarterly dividend by 8% to $0.13 per share.

The company reaffirmed its full-year outlook, excluding any impact from the recently announced U.S. tariffs, which introduce a high level of uncertainty. While leadership is still evaluating the full impact, it emphasized that Levi’s is approaching the challenge from a position of strength, with diversified sourcing across 28 countries, deep vendor relationships, and a strong balance sheet. Approximately 1% of U.S. imports come from China, and mid-to-high single-digit percentages come from Vietnam. Levi’s plans to mitigate the tariff impact through cost efficiencies, collaboration with stakeholders, and selective pricing adjustments.

Looking ahead to Q2, Levi’s expects organic revenue growth of 3.5% to 4.5%, gross margin expansion of 80 to 100 basis points, and adjusted EPS of $0.11 to $0.13, including a $0.03 headwind from FX and higher taxes. Although Q2 is typically the company’s seasonally weakest quarter, management anticipates continued strength in DTC, improvement in European wholesale performance, and sustained demand in key international markets. Levi’s reiterated its commitment to its long-term goals of reaching $10 billion in annual revenue and 15% operating margin, positioning itself as a resilient, premium lifestyle brand with global reach.

Trends this week:

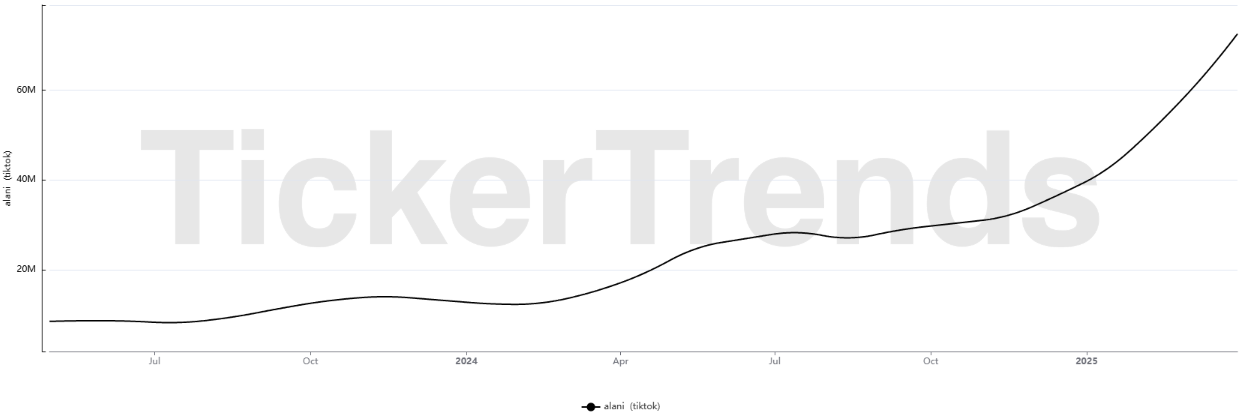

Celsius Holdings Inc. ($CELH):

The Alani Nu Peach Sticker Peel Challenge has emerged as a viral trend on TikTok, captivating users with its interactive and playful nature. Participants attempt to peel off a sticker from the Alani Nu Juicy Peach energy drink can, revealing hidden messages or designs underneath. This challenge has not only increased consumer engagement but also boosted brand visibility across social media platforms.

The challenge is driven by the unique packaging design of Alani Nu's Juicy Peach flavor, which features a peelable sticker that invites consumer interaction. This innovative approach to packaging has sparked curiosity and encouraged users to share their experiences online, further amplifying the brand's reach. The trend aligns with Alani Nu's strategy to create a lifestyle brand that resonates with a younger, social media-savvy demographic.

In February 2025, Celsius Holdings announced its acquisition of Alani Nu, aiming to expand its product portfolio and strengthen its position in the energy drink market. The popularity of the Peach Sticker Peel Challenge could positively impact Celsius's stock by demonstrating Alani Nu's strong brand engagement and innovative marketing strategies. The acquisition could boost Celsius's revenue by more than 40%, reflecting the potential for significant growth driven by Alani Nu's dynamic consumer appeal.

The success of the Alani Nu Peach Sticker Peel Challenge exemplifies the power of interactive marketing in today's digital landscape. By fostering consumer participation and leveraging social media platforms, Alani Nu has created a buzz that not only enhances its brand image but also contributes to the growth prospects of Celsius Holdings.

Revolve Group Inc ($RVLV):

Revolve is experiencing a notable surge in trend-driven momentum in early 2025, propelled by a combination of strategic marketing initiatives, timely product offerings, and a deep understanding of its target demographic. The brand's recent success can be attributed to its adeptness at capturing the zeitgeist of contemporary fashion, particularly through its emphasis on festival-inspired collections and influencer collaborations. Events like Coachella 2025 have served as pivotal platforms for Revolve to showcase its latest designs, aligning with the brand's reputation for curating styles that resonate with the festival-going crowd.

A significant driver of Revolve's current momentum is its robust influencer marketing strategy. By partnering with a diverse array of social media personalities, Revolve has effectively expanded its reach and engagement, fostering a sense of community and aspirational lifestyle among its consumers.

Revolve's emphasis on festival fashion, as seen in its Revolve Festival, showcases its commitment to blending music, fashion, and community. The event not only highlighted exclusive capsule collections but also reinforces the brand's position at the intersection of lifestyle and fashion. This In addition to its marketing prowess, Revolve's product strategy has played a crucial role in its recent success. The brand has adeptly tapped into prevailing fashion trends, offering collections that blend contemporary aesthetics with nostalgic elements. For instance, the resurgence of 'Cool Girl Western' and '2000s Boho' styles within Revolve's offerings reflects a keen awareness of consumer preferences and a commitment to delivering relevant, trend-forward pieces.

Furthermore, Revolve's investment in owned brands has contributed to its market differentiation and financial performance. By developing and promoting in-house labels, the company has achieved greater control over its supply chain and product margins, with owned brands accounting for a significant portion of net sales.

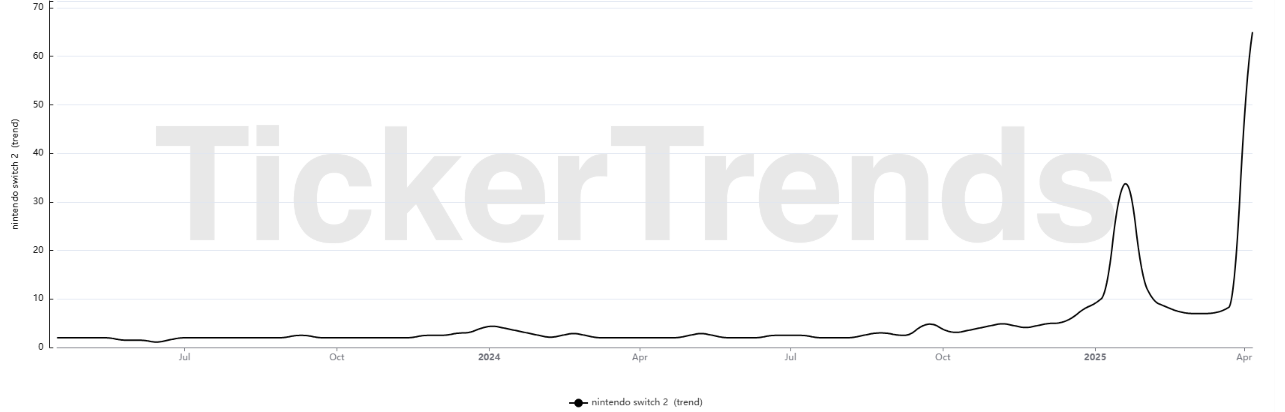

Nintendo ADR ($NTDOY):

Nintendo has announced a delay in the release of its highly anticipated Switch 2 gaming console in China, citing the need to “assess demand” before moving forward. This decision follows an earlier move by the company to postpone preorders in the U.S., triggered by newly imposed tariffs under President Donald Trump’s trade policy, which have disrupted the company's international rollout strategy. Although the Switch 2 is still set to launch on June 5 in Japan, Europe, and other select markets, China—the world’s largest gaming market by revenue—will not be part of the initial wave. Notably, Tencent, which distributed the original Switch in China, has declined to confirm whether discussions are currently underway with Nintendo for the Switch 2.

The delay in China appears to be a tactical decision influenced by economic headwinds and rising geopolitical complexity. A steep 125% U.S. tariff on goods imported from China has made the cost structure for Nintendo’s supply chain significantly more uncertain. Compounding this, a previously proposed 46% tariff on imports from Vietnam—where Nintendo has shifted significant production in recent years—posed a similar risk. However, a temporary 90-day reduction in the Vietnam tariff rate to 10% has given Nintendo a window of opportunity. According to Bloomberg, Nintendo is now rapidly shipping consoles from Vietnam to the U.S., aiming to build a stockpile of “millions” of units before the tariff rate potentially spikes again. This strategic stockpiling may allow the company to maintain its $449.99 price point for the U.S. launch—though analysts warn that if tariffs increase again, pricing may need to be adjusted upward, potentially to $500 or more.

This sequence of events poses several implications for Nintendo and its stock. On one hand, the ability to temporarily avoid higher tariffs and build inventory could help Nintendo satisfy launch demand in key Western markets without compromising margins too severely in the short term. However, the uncertainty around trade policy—particularly given the volatility of U.S.-China and U.S.-Vietnam relations under Trump’s economic agenda—raises concerns about longer-term profitability and supply chain stability. Moreover, the delayed launch in China removes a critical piece of Nintendo’s global strategy. With more than 700 million gamers, China represents an enormous addressable market, and any postponement in its market entry gives rival platforms more room to capture consumer interest.

Still, the Switch 2’s hardware upgrades and software slate are generating significant excitement. The device’s custom Nvidia GPU with AI enhancements, a 7.9-inch LCD at 1080p, and 256GB of storage, coupled with exclusive launch titles like Mario Kart World and Donkey Kong Bananza, are drawing strong early demand signals. Nintendo is clearly betting on a robust first-party software lineup and improved online functionality, such as GameChat, to drive adoption despite geopolitical frictions.

For investors, the situation presents a nuanced picture. While the tariffs have injected short-term volatility and execution risk, Nintendo’s proactive efforts to manage inventory, combined with a strong product pipeline, suggest that the company remains well-positioned to meet its revenue targets in core markets. If the stock sees any weakness on fears of the China delay, it may represent a buying opportunity for long-term holders who believe in the company’s broader strategy of global expansion, IP monetization, and growing digital engagement. However, the risk of further tariff escalations or continued exclusion from the Chinese market remains a material overhang.

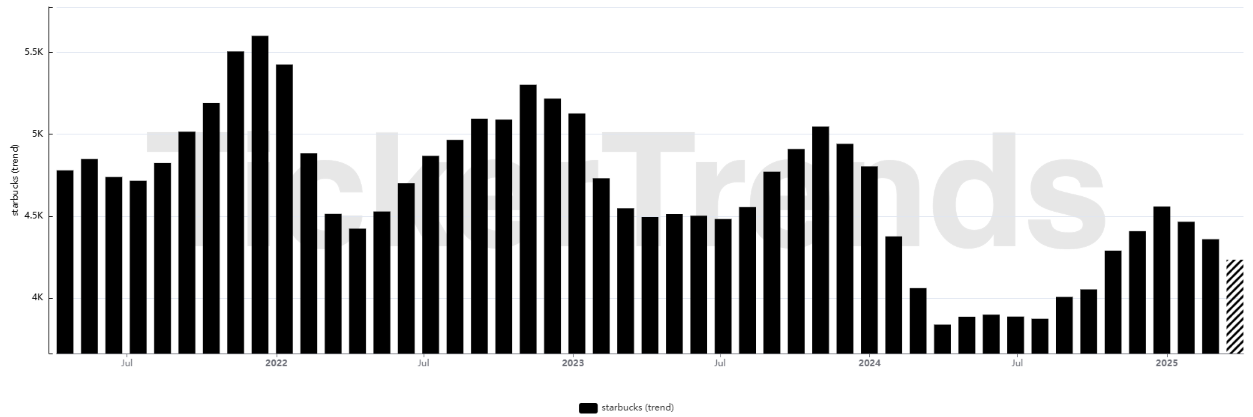

Starbucks Corp ($SBUX):

A new Starbucks policy aimed at improving customer connection has unexpectedly gone viral on TikTok, but not entirely for the reasons the company may have intended. The initiative, which encourages baristas to write personalized messages or uplifting notes on customers’ cups, has sparked a wave of TikTok videos showcasing how baristas are reacting to the policy—ranging from heartfelt participation to sardonic humor. While Starbucks has long allowed and occasionally promoted the idea of personalized messages, the new push appears to formalize this into a more consistent expectation across stores, particularly in the U.S. and Canada. However, the internet has taken the trend in a more comedic direction.

On TikTok, several videos featuring Starbucks cups with blunt, sarcastic, or wildly absurd messages written by seemingly "over it" baristas have racked up hundreds of thousands of views. One viral video shows a customer receiving a cup that simply says, “You’ll be fine. Or not. Life’s chaos,” while another features a drink labeled “You spent $7 on coffee instead of going to therapy again.” In some cases, customers are even collecting these cups like memes, with comments praising the honesty or deadpan wit of the baristas. The trend has struck a chord on TikTok, with users posting hauls of their drinks and ranking the funniest or most unhinged messages.

Behind the humor, the virality of this trend seems to reflect a broader cultural dynamic: Gen Z and younger millennials, who make up a significant portion of Starbucks' customer base, are deeply responsive to personalization and emotionally resonant—or darkly comedic—experiences. The TikTok algorithm, which favors visual storytelling and relatability, has helped these short videos explode in popularity, especially when the messages reflect the chaotic energy and existential humor characteristic of much Gen Z content. Some Starbucks locations have reportedly leaned into the trend, while others appear to be dialing it back as employees express fatigue.

What began as a genuine effort to increase human connection and brand warmth has, in typical TikTok fashion, morphed into a semi-ironic social media phenomenon. For Starbucks, the unintended virality may still offer a net positive. The brand is once again at the center of a massive wave of free publicity, and even if some baristas are playfully rebelling, the buzz reinforces Starbucks as a relevant, culturally embedded brand. The app data and search trends for Starbucks continue to decline with the surge in popularity of competitors like Dutch Bros.

Amazon.com Inc. ($AMZN):

Amazon is facing increasing pressure from President Trump’s sweeping tariff agenda, prompting CEO Andy Jassy to warn that the days of cheap everyday goods on the platform could be numbered. In a recent interview with CNBC, Jassy acknowledged that tariffs on Chinese and other foreign imports may force sellers on Amazon to hike prices, potentially reshaping consumer expectations in the near term. He was careful to avoid directly criticizing China, but the implications were clear: with import duties reaching 125% on Chinese goods and 46% on Vietnamese exports, the company's supply chain faces steep cost increases that will likely be passed on to consumers.

While Jassy emphasized Amazon's ongoing efforts to mitigate price spikes through strategic inventory buys and renegotiated supplier contracts, he did not rule out the possibility of higher prices. With over half of Amazon’s third-party sellers based in China, these sellers are already reacting. Many are scaling back inventory, pausing advertising spend, and raising prices by as much as 30%. Some, like seller David Fong, have publicly stated they can no longer rely on the U.S. market and are shifting resources to Europe, Canada, and Mexico. Others warn that if the tariff climate doesn’t improve, U.S.-oriented manufacturing will need to be relocated to more favorable regions like Vietnam or Mexico, further complicating Amazon’s logistics.

Meanwhile, a broader economic threat looms as well. Andy Jassy noted that while Amazon hasn’t yet seen a meaningful change in consumer behavior, the uncertainty surrounding tariffs could have a cooling effect on demand, driving inflation and depressing spending. This sentiment was echoed by analysts who believe Amazon might try to absorb some costs initially, but would eventually be forced to adjust pricing or risk margin erosion. The company has also reportedly canceled wholesale orders from several Asian suppliers, another sign of how disruptive these tariffs could be to its business model.

As consumers become increasingly cost-conscious, Amazon’s value proposition may come under pressure. Jassy said the company is in regular contact with the Trump administration, sharing concerns and advocating for stability, but it remains to be seen whether that dialogue will lead to policy shifts. As the world's largest online marketplace adjusts to geopolitical and economic turbulence, its ability to maintain low prices — a cornerstone of its brand — could be tested in ways not seen since its founding.

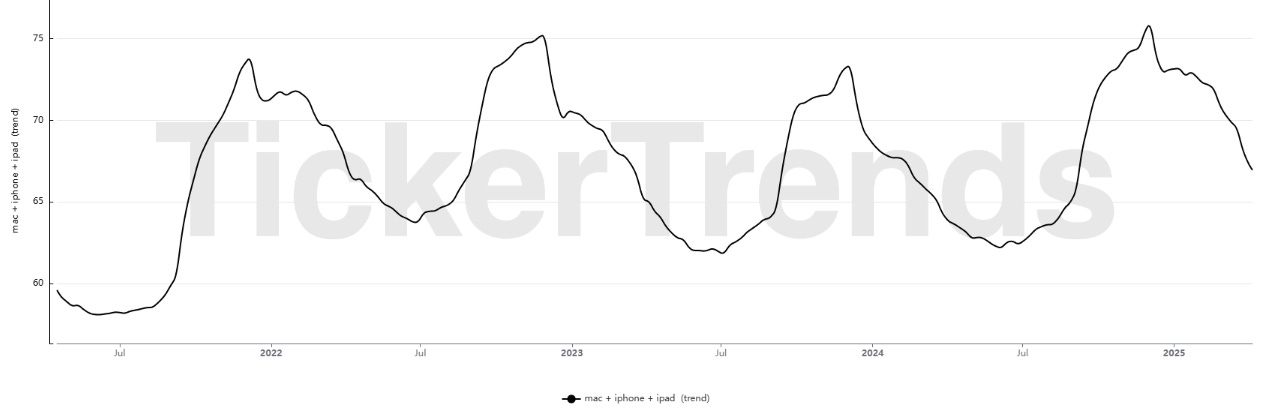

Apple Inc ($AAPL):

A new wave of iPhone 17 leaks is igniting conversations across the tech community, with particular attention focused on a peculiar new case design for the iPhone 17 Pro models. Leaked renders shared by reliable source Majin Bu suggest Apple may be moving toward a significant redesign—one that includes a wide, edge-to-edge camera bar stretched across the top rear of the device. What’s grabbing attention, however, is that the accompanying case has a bracing element that visually splits the camera bar into two halves. This structural choice appears not just unconventional but potentially divisive for longtime iPhone users accustomed to Apple’s minimalist aesthetic. The reaction online has been swift, with tech influencers and fans expressing both curiosity and concern over what this might mean for usability, balance, and overall design coherence.

Adding to the intrigue is the rumored introduction of the iPhone 17 Air, which leaked hands-on images suggest could be the thinnest iPhone ever made. Clocking in at just over 5.4mm thick, it represents a major shift in Apple’s design priorities. Instead of being a direct replacement for the Plus model, the Air looks to focus on portability, opting for a single camera lens and a more streamlined footprint. The design has drawn comparisons to the now-defunct Google Nexus 6P with its pronounced top camera bar, but with a far more refined aesthetic.

Across the lineup, Apple appears to be pushing boundaries in both design and performance. The Pro and Pro Max are expected to feature new rectangular camera housings with a tri-lens setup, including upgraded 48MP telephoto sensors and support for dual-camera video recording and even 8K footage—features aimed at turning iPhones into full-fledged production tools. Under the hood, the A19 Pro chip will power the premium models, offering generational performance and efficiency gains thanks to TSMC’s latest 3nm node.

The buzz is further amplified by the rumored shift in build materials: Apple may revert to aluminum frames from the current titanium used in iPhone 15 Pro models. This has raised eyebrows, as some view it as a step backward in luxury design, though others point to potential benefits in weight and heat dissipation. The models are also expected to get internal design changes for improved cooling, including the introduction of vapor chamber systems.

There’s also speculation around iOS 19, which is reportedly being developed to include customizable UI elements, an idea influenced by Apple’s Vision Pro interface. Combined with Wi-Fi 7 chips and Apple’s in-house modem (C1), the entire iPhone 17 family signals a step closer to a fully vertically integrated Apple device experience. As anticipation builds for the September launch, many are wondering whether these dramatic hardware changes will be enough to reignite excitement in a smartphone market that’s grown increasingly saturated. The strange case design may initially divide opinion, but if Apple can deliver the same seamless user experience it’s known for, it could once again redefine what people expect from their smartphones. Either way, Apple’s bold choices for the iPhone 17 lineup guarantee the tech world will be watching closely.

Mattel Inc ($MAT):

Mattel has unveiled a groundbreaking addition to its Barbie Signature collection: a Ken doll modeled after NBA superstar LeBron James. This marks the first time a professional male athlete has been featured as a Ken doll, launching the company's new "Kenbassadors" line, which celebrates influential male role models. The LeBron James Ken doll is a collaborative effort between Mattel and the LeBron James Family Foundation. The figure showcases James in his signature off-court style, featuring a blue-and-white varsity jacket adorned with his iconic number "23," tailored checkered pants, and Nike Terminator High sneakers. Accessories include Beats headphones, sunglasses, a fanny pack, and a wristwatch resembling Audemars Piguet’s Royal Oak Offshore, reflecting James's known affinity for luxury timepieces.

Notably, the doll stands an inch taller than the standard Ken, aligning with James's 6'9" stature . Personal touches pay homage to his roots and philanthropic efforts, including a "We Are Family" T-shirt and an "I Promise" wristband, referencing his foundation's commitment to education and community support in Akron, Ohio. LeBron James expressed his enthusiasm for the project, stating, "As a young kid, I was fortunate to have role models who not only inspired me but also showed me what's possible through hard work and dedication. Now, as an adult, I understand how vital it is for young people to have positive figures to look up to.

The LeBron James Kenbassadors doll is set to release on April 14, 2025, priced at $75. It will be available through Mattel's official website and select retailers, including Target, Amazon, and Walmart. This collaboration signifies a strategic move for Mattel, aiming to diversify its product offerings and appeal to a broader audience. By featuring a prominent male athlete, the company expands the traditional scope of its Ken doll line, potentially attracting sports enthusiasts and collectors alike.

The introduction of the "Kenbassadors" series aligns with Mattel's ongoing efforts to reflect contemporary cultural icons and promote positive role models. This initiative may pave the way for future collaborations with other influential figures, further enhancing the brand's relevance and resonance in today's market.

Moreover, the partnership with the LeBron James Family Foundation underscores Mattel's commitment to social responsibility, intertwining product development with philanthropic endeavors. This approach not only enriches the brand's narrative but also fosters a deeper connection with consumers who value corporate social engagement. As Mattel continues to innovate and adapt to evolving consumer interests, the LeBron James Ken doll represents a significant step toward inclusivity and cultural representation within the toy industry.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.