What’s Trending with TickerTrends #35

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Lululemon Athletica Inc ($LULU):

Lululemon’s first-quarter print landed at the top end of guidance—revenue rose 8 percent in constant currency to $2.4 billion, gross margin widened 60 basis points to 58.3 percent and EPS ticked up to $2.60. Canada continued to grow (+9 percent), China accelerated 22 percent in constant dollars despite a four-point Chinese New Year headwind, and “Rest of World” grew 17 percent; meanwhile U.S. revenue managed just +2 percent as foot traffic stayed soft and consumers grew more selective, pushing total comp sales to only +1 percent. Management highlighted strong uptake of innovation capsules such as Daydrift trousers, Glow Up leggings and the Align “No Line” update, noting unaided U.S. brand awareness has reached 40 percent, up mid-30s last quarter.

The bigger story for the stock has been margin pressure from the Trump-era tariff framework. Roughly three-quarters of Lululemon’s sourcing base is still exposed to China or countries now facing a blanket 10 percent duty; assuming 30 percent incremental rates on China and 10 percent elsewhere, management now expects tariffs to shave 40 basis points from full-year gross margin and 60 bps in Q2 alone. The company is pushing mitigation levers including modest, targeted price rises rolling out this summer, dual-sourcing shifts and vendor-cost negotiations, but those actions arrive late—hence a newly guided 110-bp full-year gross-margin decline and a 160-bp hit to operating margin, double the prior outlook.

SG&A is expected to de-lever about 50 bps for the year as Lululemon keeps spending on store expansion (40–45 openings plus 40 optimisations, many in China), distribution-centre upgrades and global brand campaigns such as the “Summer of Align.” Second-quarter optics look harsher: against last year’s strongest margin compare, the company sees a 380-bp EBIT contraction and EPS of $2.85–2.90 versus $3.02, citing front-loaded tariff drag, FX headwinds and a step-up in marketing and labour hours. Inventory units are planned up low-double digits in Q2 (lapping a 6 percent decline), but dollars will rise low-20s as tariff-inflated landed costs flow through the balance sheet; management insists ageing is healthy and markdown depth is still tracking below last year, although guidance now assumes 10–20 bps more promotional expense in H2.

The top-line view remains intact 5–7 percent reported growth (7–8 percent ex-53rd week) and China still slated for 25–30 percent gains—but every extra point now carries less profit. With full-year EPS nudged to $14.58–$14.78 (from $14.95–$15.15) and Q2 set to show the steepest margin erosion, near-term sentiment may stay fragile; the stock slid more than 20 percent on the guide-down despite another $430 million of buy-backs in Q1. Longer term, Lululemon’s deep balance-sheet, premium brand elasticity and still-nascent international penetration position it to recapture leverage once tariff uncertainty clears, but investors will need evidence that U.S. traffic stabilises and mitigation levers bite before the multiple can rebuild.

Trends this week:

Tesla Inc ($TSLA):

The sudden public bust-up between President Donald Trump and Elon Musk has injected a new—and highly unpredictable—political risk premium into Tesla’s story. The two men’s tactical alliance had fueled hopes that the Trump administration would temper safety probes, back national rules for autonomous vehicles and leave intact the federal and state programs that add billions of dollars to Tesla’s bottom line. Thursday’s volley of insults on Truth Social and X shattered that narrative, erasing almost 14 percent of Tesla’s market value in a single session before bargain hunting and hints of de-escalation clawed back part of the loss on Friday.

In the near term, we see three concrete threats. First, Trump has already signaled he could “terminate” Musk’s federal contracts and subsidies. Tesla earns roughly US $2-plus billion a year selling regulatory-credit surpluses to rival automakers; a White House push to relax or pre-empt state emissions standards—especially California’s—could torpedo much of that high-margin revenue. Second, the National Highway Traffic Safety Administration and other agencies still investigating Autopilot crashes may feel freer to tighten the screws, just as Musk prepares to launch robotaxi trials in Austin later this month. Denial or delay of full self-driving approvals would undercut the autonomous-services narrative that props up Tesla’s long-term valuation.

Third, the feud complicates Tesla’s demand outlook. Over the past 18 months liberal consumers have drifted toward competing EV brands amid discomfort with Musk’s politics; bulls hoped conservative buyers would back-fill the gap. A cap-in-hand posture with the Republican base now looks doubtful if Trump continues to paint Musk as an enemy and threatens to strip EV tax credits entirely. JPMorgan estimates elimination of state-level programs alone could knock roughly US $2 billion off Tesla’s annual cash flow.

To be sure, some observers argue the rift could blow over quickly. Trump has oscillated between praise and condemnation of corporate partners in the past, often settling for a public concession or symbolic gesture. SpaceX’s indispensable role in national-security launches, and Starlink’s potential contribution to domestic broadband, give Musk leverage of his own; a tit-for-tat escalation that grounds NASA missions or sours investor sentiment toward other space assets would carry political costs for the White House, too.

Even if a truce emerges, however, the episode underscores how dependent Tesla’s multiple has become on regulatory goodwill at a moment when its core automotive business is wobbling—Q1 profit fell 71 percent amid price cuts and soft unit growth. With shares still down nearly a third from December’s postelection high, the market is recalibrating for scenarios in which carbon credits fade faster, autonomous timelines slip and federal procurement turns hostile. Wedbush’s Dan Ives calls the sell-off “overshoot,” but rivals at Goldman and Roundhill warn that Tesla’s “dream premium” will keep leaking as long as Musk and Trump trade threats.

Bottom line: political volatility has joined Chinese competition and margin compression on the list of existential worries for Tesla shareholders. The stock will remain a headline-driven trade until investors see either a public reconciliation or tangible evidence that Tesla can thrive—even under an antagonistic administration—on the strength of its product pipeline, cost discipline and charging-network moat alone.

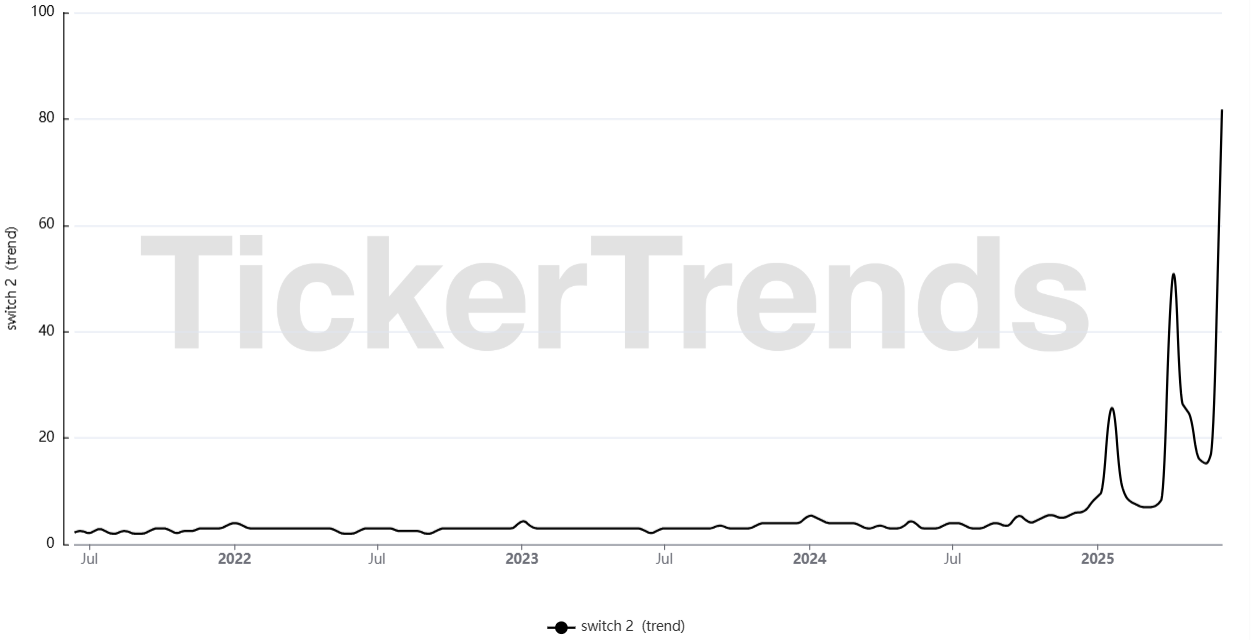

Nintendo Co Ltd ($NTDOY):

Nintendo’s second-generation hybrid handheld is off to the hottest start the console industry has ever recorded. Multiple retail-tracking and supply-chain sources say Switch 2 cleared more than three million units in its first 24 hours, tripling the PlayStation 4’s prior launch-day record of one million. Day-one sell-outs at Best Buy, Target and Walmart and shortages across Europe and Asia point to demand well above Nintendo’s own launch guidance, while Costco and other membership chains are one of the few remaining online avenues with inventory.

That burst immediately shifts the industry’s 2025 growth calculus. London analytics firm Ampere now projects the global console market to expand to US $16.5 billion this year, up from $13.4 billion in 2024, with Switch 2 responsible for the bulk of the increase . Ampere’s own unit baseline—about 13.6 million Switch 2 systems in calendar-2025—already looks conservative next to Nintendo’s internal goal of 15 million by March 2026, a target management says is achievable even under the new U.S. tariff regime . If supply keeps pace, Wedbush Securities believes the device could eclipse 20 million in its first twelve months, putting Switch 2 on track to become the fastest-selling console in history.

Unlike the 2017 launch, Nintendo deliberately front-loaded inventory to blunt scalpers. U.S. customs data show roughly 400,000 units a month shipped since January as the company built channel stock ahead of release — a move analysts credit for Thursday’s orderly, if frenzied, rollout. President Doug Bowser has pledged a “steady stream” of replenishments through the holidays, a signal that Nintendo is committing manufacturing capacity even at the risk of near-term oversupply.

Financially, Switch 2 launches into a very different cost environment. Trump-era tariffs on Vietnam- and China-made electronics would normally force a price hike, but Nintendo opted to hold the U.S. MSRP at $449 (and $499 for the Mario Kart World bundle), eating some margin and nudging accessory prices up instead. Analysts estimate the blended gross margin per unit is still north of 30 percent—comparable to late-cycle Switch—and will improve as component costs fall and an OLED model inevitably joins the line-up. Crucially, a bigger installed base by year-end means first-party software royalties and digital subscriptions (Nintendo Online, Expansion Pack) will re-accelerate, cushioning any hardware margin compression.

The early sales pop already shows up in the stock. Nintendo’s Tokyo-listed shares fell 2 percent on launch-day profit taking but recovered to finish the week up 1.36 percent as sell-side desks lifted FY-26 revenue estimates. At roughly 25× forward EPS—a discount to Sony’s 28× gaming multiple—there could be upside from both hardware momentum and a software pipeline stuffed with evergreen IP; management’s history of high 30s operating margins on first-party titles means every percentage point of software attach flows disproportionately to the bottom line.

Switch 2’s record-shattering debut confirms Nintendo retains a unique knack for turning incremental hardware upgrades into mass-market events. If supply chains hold and the late-year game slate lands, the console could drive double-digit top-line growth and expand recurring digital revenue faster than Wall Street’s pre-launch models contemplated. With global console demand awakening and the company signaling it can “meet the demand,” Nintendo enters its new hardware cycle from a position of rare operational strength—good news for shareholders looking for sustained earnings power beyond the pandemic-inflected highs of the original Switch.

Restaurant Brands International Inc ($QSR.TO):

Popeyes and McDonald’s are battling it out this week in a so-called “wrap war.” Popeyes, the fried-chicken chain owned by Restaurant Brands International (RBI), quietly began selling $3.99 Chicken Wraps (classic, spicy and honey-mustard, plus a Blackened-chicken version available only through its app) on June 3. The move jump-started a category McDonald’s plans to re-enter on July 10, when the Golden Arches will relaunch its long-dormant Snack Wrap nationwide. By beating its larger rival to market by five weeks—and trolling it on social media—Popeyes has ignited a battle for share in the portable, mid-price chicken snack segment just as summer travel pushes traffic to quick-service drive-thrus.

For Popeyes, the pre-emptive strike is calculated. Wraps leverage existing tenders and tortillas, require no new kitchen equipment and clock in at under 60 seconds assembly time—meaning units can chase incremental transactions without adding labor or cap-ex. Management typically sees limited-time chicken items lift same-store sales 2-3 percentage points; layering three SKUs (and an in-app exclusive) across late-afternoon and late-night day-parts could extend that bump through July. Each wrap also pairs naturally with the new blueberry-lemonade beverage platform, whose margins run roughly five to seven points above entrées, creating a profit kicker if attachment rates rise.

The launch also deepens Popeyes’ digital flywheel. Ordering the Blackened Wrap requires the Popeyes app, pushing guests into its loyalty program—an ecosystem that already accounts for 40 percent of U.S. sales and lowers delivery-platform commissions. Digital exclusivity, combined with playful jabs at McDonald’s, accelerates social-media buzz that has historically translated into foot traffic.

Risks remain. McDonald’s massive media weight will dominate ad channels once Snack Wraps return, and an all-out price war could erode margins across the category. Supply must be watched: each wrap uses a full tender, so an unexpected surge in demand could strain inventories ahead of football-season promotions. There’s also the question of staying power; Popeyes’ 2008 Loaded Chicken Wrap boomed and faded quickly, and management must turn early trial into repeat purchases.

Still, for RBI investors the upside is clear. A successful wrap platform diversifies Popeyes’ menu beyond the flagship sandwich, supports the chain’s smaller drive-thru-only prototypes and aligns with RBI’s target of 8-10 percent annual system-wide sales growth. Positive July comps and a spike in app downloads would signal that Popeyes can continue to gain ground in U.S. chicken even as competition intensifies—providing a fresh growth pillar alongside international expansion and Burger King’s ongoing turnaround.

AT & T Inc ($T):

AT&T has rolled out a nationwide “55-plus” wireless plan that offers unlimited talk, text and data for $40 a month on a single line—or $35 per line on two lines—plus 10 GB of hotspot data and ActiveArmor spam protection. The catch: customers must be 55 or older and enroll in autopay via a bank account, with speeds subject to slowdowns during network congestion. The pricing undercuts AT&T’s own Starter tier by roughly 40 percent and lands within $5 of T-Mobile’s long-running Essentials 55 offer, while Verizon’s comparable plan remains limited to Florida at a higher rate.

The first objective is churn containment. Older subscribers switch carriers less frequently but reacted sharply to last year’s $10–$20 price hikes; by dangling a headline $70 two-line bundle, AT&T aims to shave 5-10 basis points off post-paid phone churn (0.89 percent last quarter), a reduction worth roughly $150 million in annual retention costs. Required autopay lowers bad-debt expense and processing fees, partly offsetting the lower ARPU.

Second, the plan feeds AT&T’s convergence playbook. The carrier is bundling “2 wireless lines + Fiber or Internet Air” for under $100, encouraging households to consolidate connectivity. Management’s modeling shows every additional wireless-plus-broadband bundle lifts lifetime value by 20-plus percent; that could reignite fiber net-adds, which slowed in Q1, heading into the heavy Q3 move-in season.

Margin risk looks modest. CTIA data show 55-plus users consume 30–40 percent less mobile data than younger cohorts, and AT&T throttles speeds when cells are crowded. After factoring in autopay savings, per-line EBITDA should still sit in the low-teens range even at a $35 blended ARPU. If one million subs migrate to the tier, the top-line hit is under 0.5 percent of wireless service revenue and is largely offset by churn savings and cross-sell gains.

It will be interesting to see the reaction of the competitors. T-Mobile, which built its brand equity on senior pricing, will likely answer with loyalty perks or limited-time bill credits, not a blanket price cut that would dent its industry-leading margins. Verizon faces a tougher choice: extend its Florida-only 55-plus plan nationwide and eat a revenue hit, or risk defections as seniors comparison-shop.

The launch signals that AT&T can use targeted, rules-based discounts to defend share rather than blunt price increases across the board—critical as Trump-era tariffs threaten to raise handset costs later this summer. The stock trades near 7× forward free cash flow, a discount to Verizon and T-Mobile; evidence of reduced churn and higher fiber attach in Q3 could support a re-rating without sacrificing the low-teens EPS growth management guides for 2026.

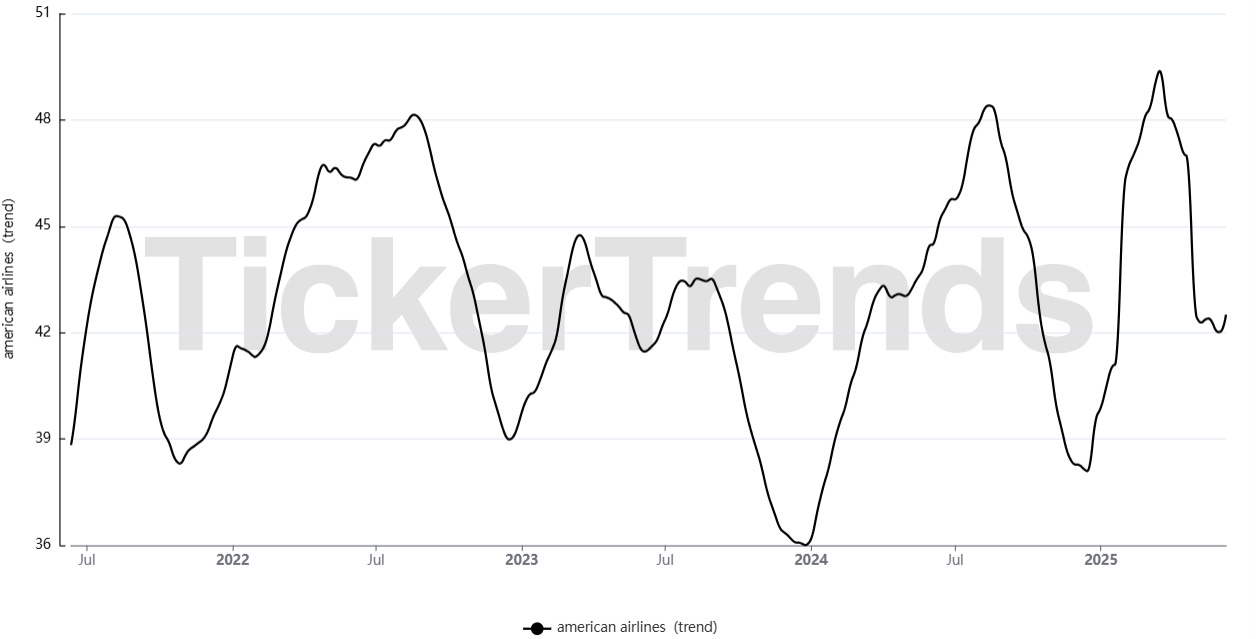

American Airlines Group Inc ($AAL):

On March 13, 2025, American Airlines Flight 1006, a Boeing 737-800 carrying 178 people from Colorado Springs to Dallas/Fort Worth, declared an emergency minutes after take-off when the crew detected severe engine vibrations. The pilots diverted to Denver International Airport and taxied toward the gate—only for the jet’s right engine to erupt in flames, filling the cabin with smoke and triggering a chaotic evacuation that left passengers scrambling onto the wings and down a jammed slide. Twelve required hospital treatment for minor injuries, and the aircraft sustained heavy fire damage.

A preliminary NTSB report released June 6 lays the blame on maintenance lapses rather than manufacturing flaws. Investigators found a safety-wire on a fuel fitting routed loosely and in the wrong position, a variable-stator-vane actuator left unsecured, and a drain line clogged with adhesive—errors that let fuel leak and pool inside the nacelle. Those faults, combined with a blocked drain, produced the vibrations that forced the diversion and ultimately fed the fire while the jet taxied.

Because the flight attendants could not reach the cockpit, they ordered an independent evacuation; but the 737-800’s over-wing exits offer no inflatable slides and rely on the flaps being lowered to shorten the drop. With the crew’s coordination broken, the flaps stayed up, stranding evacuees on the wing until firefighters arrived. One door slide also failed to deploy, an unrelated defect that now faces a separate NTSB inquiry.

For American Airlines (AAL) the maintenance findings present a reputational and regulatory hazard just as the carrier tries to convince travelers—and analysts—that its safety culture is sound after a string of incidents this year. If the final NTSB report attributes the errors to systemic shortcomings, the FAA could impose heightened oversight, mandatory retraining or civil fines, adding cost and complexity as American already grapples with tariff-driven parts inflation and tight summer schedules.

Operationally, returning a single 13-year-old 737 to service is minor in isolation, but a fleet-wide inspection directive would lift heavy-check costs and consume scarce hangar slots during peak season, squeezing second-half unit margins. Management’s next earnings call will be watched for guidance on incremental maintenance expenses and any knock-on schedule reductions.

More broadly, the episode spotlights the aging 737-800’s evacuation limitations—no wing slides and reliance on flap extension—which may spur union pressure for revised crew-communication protocols and additional recurrent training across U.S. operators. For investors, the near-term risk lies less in a one-off write-off than in potential regulatory drag and cost creep; evidence that American has tightened quality-control procedures quickly—and avoided further events—will be critical to stabilizing sentiment around the stock.

Deere & Co ($DE):

John Deere announced on May 20 that it will pour $20 billion into its U.S. factories and engineering centers over the next decade, explicitly rebutting viral stories that claimed the 187-year-old equipment maker was “freezing” domestic production. “We’re not shutting anything down,” CEO John May said in a statement, adding that the spending will fund new or expanded plants in North Carolina, Missouri, Iowa and Tennessee as well as automation, workforce training and product-development labs.

The clarification follows a widely shared MSN article titled “John Deere Freezes U.S. Manufacturing in Unprecedented Shutdown,” which alleged the company was shifting wholesale to Mexico. Deere conceded that it has ordered temporary furloughs and roughly 400 layoffs this year because of soft farm-equipment demand, and it is building a compact-loader plant in Ramos, Mexico. But management insists those moves are “unrelated to production transfers” and that 30,000 employees across 60 U.S. sites remain the backbone of its global supply chain.

Strategically, the $20 billion pledge helps blunt two sources of pressure. First, President Trump has threatened 200% tariffs on farm machinery built overseas—an existential risk if Deere ceded too much capacity abroad. Second, tight U.S. labor markets and the need for advanced automation have made long-term cap-ex planning imperative; spreading projects over ten years gives Deere room to modernize while smoothing cash-flow hits.

Investors have greeted the plan warily. While domestic reinvestment shields Deere from tariff shocks and burnishes its “Built in America since 1837” brand, it arrives as the company warns of a weaker commodity cycle: farmers are scaling back orders, which already squeezed FY 2025 guidance. Analysts will be watching whether the outlays are front-loaded (hurting free cash) or back-loaded (risking deferral if conditions worsen).

The company also faces culture-war headwinds. In February shareholders rejected a conservative proposal to curtail diversity, equity and inclusion disclosures, but Deere has nonetheless pared back high-profile social-awareness events. Balancing a Midwest manufacturing identity with pressure from both Republican officials and institutional investors will shape how much political goodwill Deere earns from its new U.S.-first narrative.

Deere’s multibillion-dollar commitment largely dispels shutdown rumors and positions the firm to navigate tariffs, currency swings and technological upgrades without abandoning its Illinois roots. The near-term investment cadence—and whether farm income rebounds—will determine if the initiative proves a competitive advantage or merely an expensive insurance policy against rising geopolitical risk.

Unusual Machines Inc ($UMAC), & Red Cat Holdings Inc ($RCAT):

On June 6, President Donald J. Trump signed three sweeping executive orders meant to “unleash American drone dominance,” jump-start electric vertical-takeoff-and-landing (eVTOL) air taxis, and scrap the 1973 ban on commercial supersonic flight over land. The centerpiece tells the FAA to issue—within 30 days—a draft rule that finally permits routine “beyond-visual-line-of-sight” (BVLOS) operations, a regulatory breakthrough Amazon, UPS, railroad inspectors and first-responder agencies have chased for years. A companion directive launches a five-site eVTOL Integration Pilot Program, promising accelerated approvals for Joby, Archer and other U.S. startups designing battery-powered “flying cars.” Simultaneously, the FAA must replace the over-Mach-1 speed limit with a modern, noise-based standard—an opening Boom Supersonic called the “regulatory keystone” for its Overture jet.

The timing is not accidental: the White House framed the moves as both an economic catalyst and a national-security imperative, pointing to Russia’s warzone reliance on cheap kamikaze drones and, most recently, Ukraine’s deep-strike swarms that damaged oil refineries near St. Petersburg in late May. Those attacks, livestreamed across social media, crystalized how low-cost quadcopters and fixed-wing drones have reshaped modern conflict—fueling bipartisan anxiety about gaps in America’s counter-UAS posture ahead of the 2026 FIFA World Cup and 2028 Los Angeles Olympics. “Drones are a disruptive technology with potential for good and for ill,” National Security Council counter-terror chief Sebastian Gorka said, adding that the U.S. must “own the skies” or risk the kind of infrastructure hits Russia just absorbed.

To blunt foreign leverage, the orders instruct every federal agency to “prioritize U.S.-manufactured UAS” and give the Federal Acquisition Security Council 30 days to publish a list of “covered foreign entities” that pose supply-chain risks. While the language doesn’t name names, analysts expect Chinese leaders DJI and Autel to land on the roster, effectively squeezing them out of federal—and, by extension, state-local—procurement. That security tilt dovetails with the Pentagon mandate to expand its Blue UAS list, fast-track domestic drone buys, and identify legacy missions ripe for unmanned replacement—a recipe that could shift billions from traditional contractors toward agile drone suppliers such as Skydio, Teal and AeroVironment.

Commercial players, meanwhile, get carrots as well as sticks. Commerce, State and Ex-Im Bank have 90 days to streamline export-control licenses, unlock loan guarantees and offer political-risk insurance for civil drones headed to friendly nations. The goal is to help U.S. manufacturers capture growth in Latin America, Africa and Southeast Asia—regions now dominated by low-price Chinese systems—while also giving allies a trusted alternative as battlefield footage from Ukraine keeps global demand for small reconnaissance and strike drones surging.

Industry lobby AUVSI called the package “historic,” yet cautioned that execution matters: BVLOS rules must be flexible enough to accommodate autonomous swarms and detect-and-avoid tech, and the promised AI-driven waiver portal must actually cut months off current approvals. Environmental groups, for their part, applauded the emphasis on electric propulsion but warned that easing supersonic restrictions could spur a new class of jets that, even if quiet, burn more fuel per passenger. The White House counters that modern composite designs and sustainable-aviation fuel goals will keep climate impacts in check—and that Americans “should be able to fly New York to L.A. in under four hours.”

By fusing deregulation, national-security safeguards and export promotion—while Ukraine’s drone war spotlights both the promise and peril of unmanned flight—the administration is betting it can vault the U.S. ahead in autonomous aviation and eVTOLs. If the FAA delivers a workable BVLOS rule, Congress funds counter-drone tech before the World Cup, and domestic manufacturers scale quickly, the U.S. drone supply chain could capture a far larger share of a market whose strategic value—and budget priority—only climbs with every high-profile strike on critical infrastructure abroad.