What's Trending with TickerTrends #12

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

1. Nike ($NKE):

Nike reported its fiscal Q2 2025 results, showcasing mixed performance as the company embarks on a strategic repositioning under newly reinstated CEO Elliott Hill. Total revenue for the quarter was $12.4 billion, a decline of 8% year-over-year on a reported basis and 9% on a currency-neutral basis.

Nike Brand revenue fell 7% to $12 billion, with declines across all geographic regions, while Converse revenue dropped 17% to $429 million. Nike Direct revenue was down 13% to $5 billion, driven by a 21% decrease in digital sales and a 2% decline in physical stores. Wholesale revenue also declined, falling 3% to $6.9 billion. Gross margin contracted 100 basis points to 43.6%, primarily due to higher markdowns and unfavorable channel mix. Net income was $1.2 billion, a decrease of 26%, with diluted EPS declining 24% to $0.78.

The results reflect challenges in both consumer demand and operational shifts as Nike seeks to reignite brand momentum. Elliott Hill, in his first earnings call since returning as CEO, emphasized the need to return to Nike’s roots by leading with sport and placing athletes at the center of decision-making. Hill outlined immediate priorities, including focusing on sport-led product innovation, rebalancing investments to inspire consumer demand, and strengthening relationships with wholesale partners. Nike is also restructuring its portfolio, concentrating on high-volume franchises such as Pegasus and Jordan while introducing new models like Vomero 18 and Pegasus Premium. The company is aiming to transition from a promotional-driven approach to a pull-market model that prioritizes premium pricing and a more curated consumer experience.

Brand marketing investments have increased, highlighted by renewed sports partnerships with the NBA, NFL, and FC Barcelona, as well as successful campaigns tied to events like the WNBA Championship and the World Series. Wholesale partners such as Dick’s Sporting Goods, Foot Locker, and JD Sports have expressed optimism about Nike’s commitment to providing better product access and marketing support. Despite the focus on resetting the business, inventory levels remain elevated, particularly in North America and Greater China. Nike has taken steps to manage this, including aggressive efforts to reduce aged inventory and recalibrate supply with demand.

Looking ahead, the company expects near-term results to remain under pressure. Revenue for Q3 is forecasted to decline in the low double-digits, with gross margin expected to contract by 300 to 350 basis points due to ongoing inventory liquidation and wholesale discounts. While these actions will weigh on short-term performance, Hill and CFO Matt Friend emphasized that the decisions are aimed at positioning Nike for sustainable, profitable growth. The leadership remains confident that a renewed focus on sport, innovation, and stronger wholesale partnerships will drive long-term value, even as the company navigates a challenging retail environment.

2. Birkenstock ($BIRK):

Birkenstock delivered strong results for Q4 FY2024, demonstrating robust growth across its channels, regions, and product categories. Revenues for the quarter increased by 22% year-over-year in constant currency, reaching €456 million. This performance was driven by balanced growth in both B2B, which rose 26%, and DTC, which grew 18%. For the full fiscal year, revenues totaled over €1.8 billion, marking a 22% increase from FY2023 and surpassing the company's guidance of 20% growth. This growth reflects a combination of strong global demand, higher volumes, and an 8% increase in average selling price (ASP), supported by product mix enhancements and selective price increases.

The B2B channel continued to perform well, with 90% of growth attributed to existing wholesale partners expanding shelf space and adding new product categories. DTC remained a key focus area, particularly through the digital channel, which accounts for 90% of DTC revenues. The company opened 20 new retail stores during the fiscal year, bringing its total global footprint to 67 stores, with plans to increase the number by 50% in FY2025. Recent store openings in Paris, Chengdu, and Austin have exceeded expectations, contributing significantly to incremental growth.

Regionally, the Americas experienced a 19% revenue increase for the year, fueled by strong B2B demand and growing DTC sales, including the success of newly opened stores. Europe achieved 21% growth, supported by strategic distribution improvements, increased brand awareness, and the success of closed-toe products, which outpaced sandal growth by over 2.5 times. The APMA region was the fastest-growing segment, with revenues rising 42%, driven by expanded retail presence, new online initiatives, and strategic partnerships.

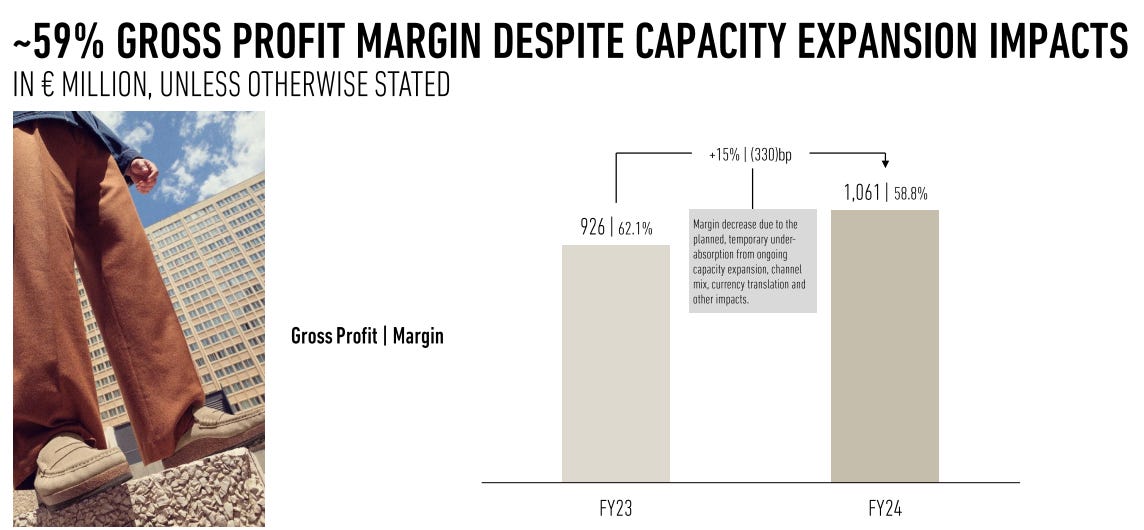

Gross profit for Q4 stood at 59%, representing a normalized trend after adjustments in the prior-year quarter. Full-year gross margin was 58.8%, down 330 basis points due to temporary under-absorption costs related to expanded production capacity and a higher B2B mix. Adjusted EBITDA for the quarter reached €125 million, up 31% year-over-year, with a margin of 27.4%. Full-year adjusted EBITDA increased by 50% to €555 million, with a margin of 30.8%, slightly above the company’s guidance.

The company’s strategic investments in production facilities, including the Pasewalk factory, are expected to meet rising demand while driving efficiency gains. Birkenstock’s closed-toe category now accounts for one-third of its business, growing at over twice the rate of sandals. Additionally, the outdoor and professional product lines, including water-ready and orthopedic footwear, are gaining traction as new growth drivers.

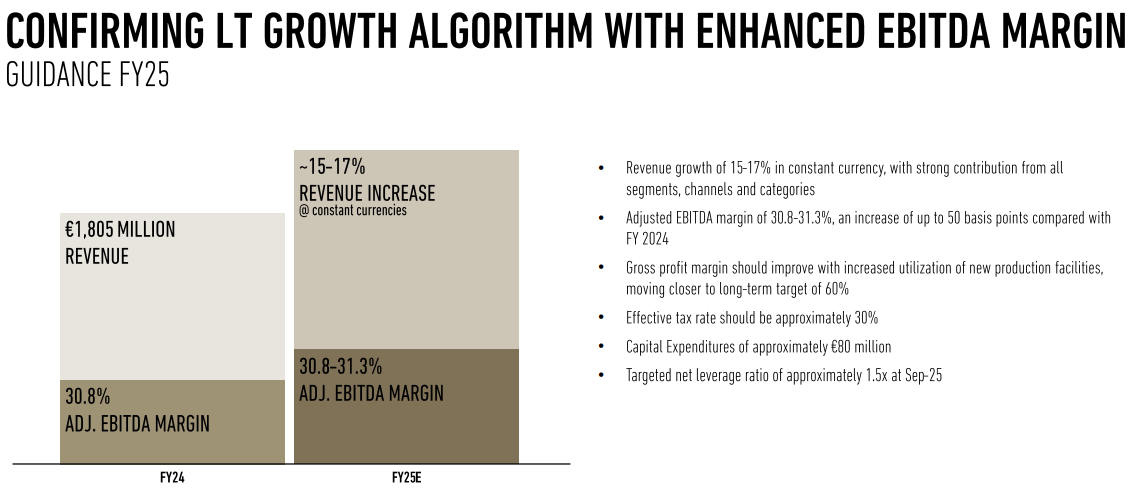

For FY2025, the company has set a revenue growth target of 15% to 17% and anticipates slight improvements in gross margins due to better utilization of production capacity. Adjusted EBITDA margin is expected to range between 30.8% and 31.3%. Birkenstock plans to invest approximately €80 million in capital expenditures, primarily to expand production facilities and retail presence. The APAC region remains a significant white space opportunity, with plans to double the retail footprint and further penetrate markets like China, Southeast Asia, and Japan.

Birkenstock continues to demonstrate resilience and long-term growth potential through disciplined distribution, operational efficiency, and strategic investments in product innovation and geographic expansion. The company remains committed to delivering sustainable growth and strong profitability as it enters FY2025.

Trends this week:

1. Sega Sammy Holdings Inc. ($6460.T):

The success of Sonic the Hedgehog 3 at the box office underscores the enduring appeal of the franchise, its effective cross-media adaptation strategy, and its potential impact on Sega Sammy Holdings' brand and financial health. The film debuted with an impressive $62 million domestically, exceeding initial projections of $55–60 million and marking the second-best December opening for a PG-rated film since The Chronicles of Narnia: The Lion, the Witch, and the Wardrobe in 2005. This performance surpasses the $58 million debut of the first Sonic film (2020) and aligns closely with the $72 million opening of Sonic 2 (2022). Strong critical and audience reception, including an “A” CinemaScore and an impressive 98% audience score on Rotten Tomatoes, further solidifies its potential for long-term success, particularly during the holiday season.

The movie benefits from strategic drivers, including its cross-media synergy, which leverages Sonic's robust brand presence in video games, TV series, and previous films. The addition of Keanu Reeves as Shadow the Hedgehog broadens its appeal to older audiences, while Jim Carrey’s dual role adds humor and nostalgia. The film’s narrative balances Sonic's comedic energy with Shadow's brooding mystery, creating a compelling storyline for diverse demographics. These elements, coupled with a production budget of $122 million, position the film for profitability and sustained momentum as it launches internationally during Christmas.

Sonic the Hedgehog 3 could contribute significantly to its non-gaming revenue streams. The Sonic film franchise has already generated $725 million globally, with ancillary revenue from home entertainment and merchandise exceeding $180 million. The movie’s success also enhances Sega’s ability to monetize its intellectual property (IP) and aligns with its broader strategy to expand Sonic into new media, including the planned Sonic 4 movie in 2027. Furthermore, the film bolsters game sales, with upcoming titles like Sonic X Shadow Generations likely to benefit from heightened interest in the franchise.

Additionally, Sega Sammy is exploring a Netflix-style gaming subscription service, leveraging its flagship IPs like Sonic, Persona, and Yakuza. The success of Sonic 3 strengthens the case for such a service, which could generate recurring revenue and enhance Sega’s competitive position. The movie’s performance also reflects Sega’s broader efforts to revive its brand and re-establish itself as a leader in entertainment. By combining strong film success with high-demand gaming IPs, Sega demonstrates its ability to adapt and thrive in a crowded market.

Despite its success, Sega must address challenges, including the risk of market saturation and the need to maintain quality across its media properties. International success will be critical, requiring tailored marketing strategies for regions like Asia, where Sonic has significant potential. Competition from other multimedia franchises, such as Mario and Pokémon, also necessitates strategic differentiation. Nevertheless, Sonic the Hedgehog 3 positions Sega Sammy for sustained growth, increased brand equity, and a stronger foothold in the global entertainment industry.

2. Amazon ($AMZN):

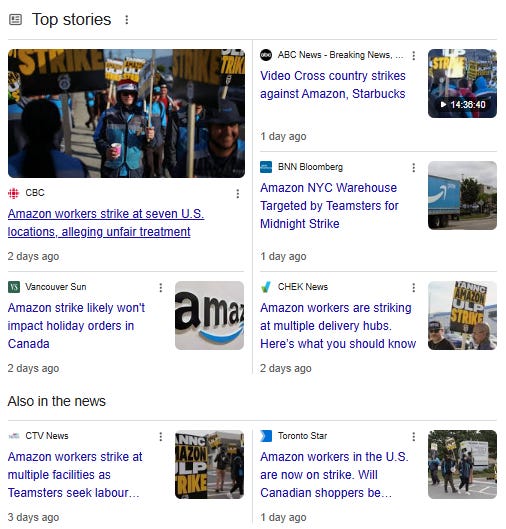

10,000 Amazon workers are on strike this week, the largest against Amazon to date. The strike comes at a critical time during the holiday shopping season. Workers at seven Amazon facilities across cities like New York, Atlanta, and San Francisco are demanding higher wages, better benefits, and safer working conditions, accusing the company of unfair labor practices and exploitative working conditions. The Teamsters union has been central to the organization's efforts, focusing on delivery drivers and warehouse workers, although Amazon disputes their representation claims.

The company has countered that the strike is unlikely to impact its operations, citing its extensive logistics network, contingency plans, and partnerships with third-party carriers like UPS. Amazon also claims that many of the protesters are not direct employees but rather outsiders brought in by the union to create a false narrative. Nonetheless, the strike underscores growing labor unrest and increasing scrutiny of Amazon's labor practices, particularly around its demanding work conditions and its resistance to unionization efforts.

For Amazon’s stock, the implications are complex. On the one hand, the strike has not materially disrupted its operations, as confirmed by the company, and its shares were up 1.8% on the day of the strike. This reflects investor confidence in Amazon's ability to maintain its logistical dominance and navigate labor challenges. However, the broader implications of the strike could weigh on the stock in the medium to long term. Persistent labor disputes, regulatory scrutiny, and potential legal outcomes—such as the National Labor Relations Board’s classification of Amazon as a "joint employer"—could increase costs and affect margins.

Amazon has already committed $2.1 billion to raise pay for fulfillment and transportation employees, increasing base wages to around $22 per hour. While this move demonstrates the company’s ability to respond to labor pressures, it also highlights the potential for rising costs if unionization efforts gain traction or if additional facilities join the movement. Moreover, the strike’s high-profile nature may embolden labor organizing efforts at other Amazon locations and beyond, creating further headwinds.

The strike could signal increasing labor risks, which might necessitate higher operational costs to mitigate. While the immediate impact on deliveries and operations appears minimal, prolonged labor unrest could erode Amazon’s efficiencies, a key pillar of its business model. On the other hand, Amazon’s strong logistics network and market position provide resilience against localized disruptions, which could reassure investors in the near term. While Amazon’s stock has shown short-term resilience, it would be interesting to see how the company navigates these labor disputes and whether they signal a broader trend of increasing union activity that could impact long-term profitability.

3. Yum! Brands, Inc. (NYSE: $YUM):

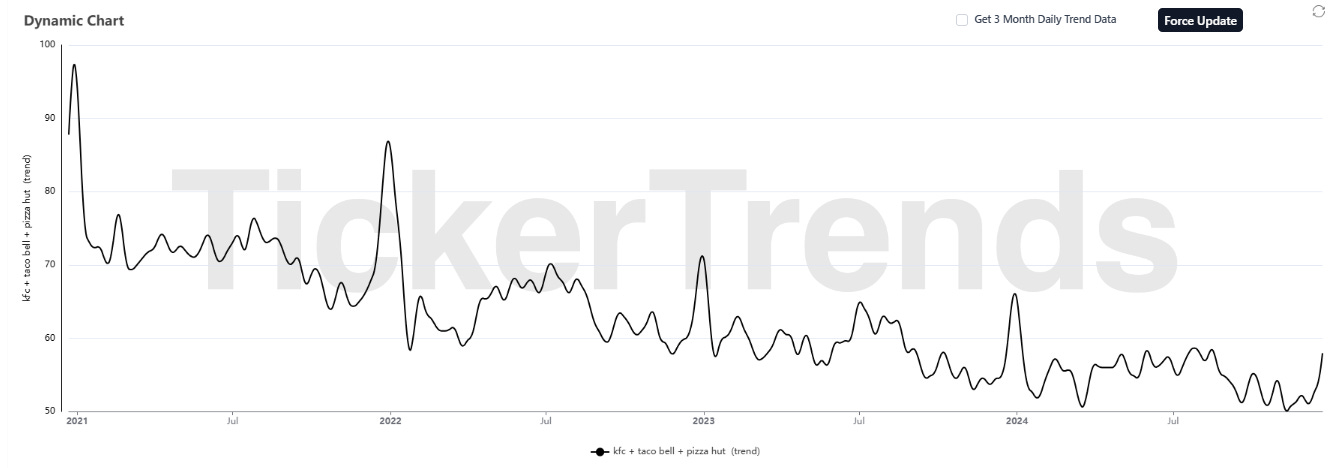

Taco Bell's launch of Crispy Chicken Nuggets is a noteworthy addition to the brand's menu and has gone viral this week, showcasing Yum! Brands' ($YUM) continued efforts to innovate within its portfolio.

With a unique recipe featuring jalapeño buttermilk-marinated chicken breaded in tortilla chips and breadcrumbs, paired with three new dipping sauces, the product positions Taco Bell to participate in the competitive fast-food chicken segment. Early reviews have highlighted the product's bold flavors and dipping sauce quality, suggesting it could resonate with consumers seeking alternatives to traditional chicken nugget offerings.

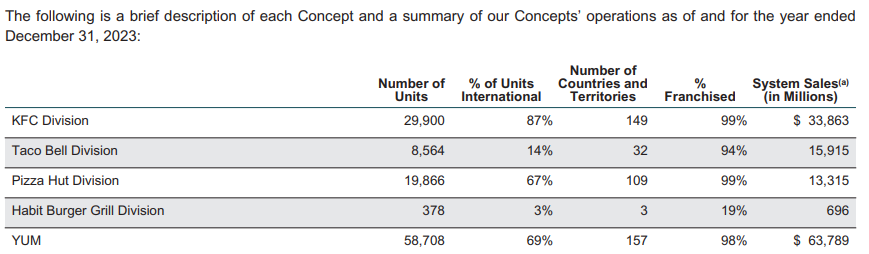

However, while the new menu item may create buzz and generate incremental sales, its impact on Yum! Brands' overall performance is likely to be limited. Taco Bell accounts for less than 25% of Yum! Brands' total revenue, with the company’s broader portfolio—including KFC and Pizza Hut—dominating its financial results. Even if the chicken nuggets perform well, the revenue contribution from this single product within Taco Bell’s division is unlikely to significantly influence Yum! Brands' consolidated earnings.

Moreover, the fast-food chicken segment is highly competitive, with established players like Chick-fil-A, McDonald's, and Wendy's holding strong market positions. For Taco Bell, the challenge lies in distinguishing itself in a space where consumer loyalty runs deep. While the nuggets add variety and appeal to the menu, the product alone is unlikely to drive substantial shifts in market share or materially affect Yum! Brands' financials.

Investors should view this launch as part of Taco Bell’s broader innovation strategy rather than a transformative moment for Yum! Brands. The rollout may support modest same-store sales growth within Taco Bell and reinforce its reputation for menu creativity, but it is unlikely to be a needle-moving initiative for the parent company.

From an investment perspective, the success of this product could provide a small boost to Taco Bell’s performance, but Yum! Brands' overall trajectory will continue to be driven by the performance of its larger divisions, including KFC, which contributes the majority of its revenue. As such, while the product demonstrates Taco Bell's ability to innovate, it remains a minor factor in Yum! Brands' larger financial picture.

4. Netflix Inc (NYSE: $NFLX):

Netflix’s acquisition of the U.S. broadcasting rights for the 2027 and 2031 FIFA Women’s World Cups marks a pivotal shift in the streaming giant’s strategy to diversify its content offerings and expand its total addressable market (TAM). Traditionally known for its extensive library of on-demand TV series and films, Netflix is now making significant inroads into live sports broadcasting, a space historically dominated by networks like ESPN and Fox Sports. This bold move aims to capture new audiences, enhance subscriber retention, and position Netflix as a more comprehensive entertainment platform.

The decision to secure exclusive rights to the FIFA Women’s World Cup underscores Netflix’s recognition of the growing popularity of women’s sports globally. The Women’s World Cup is one of the most prestigious events in sports, as evidenced by Spain’s victory in the 2023 tournament, which drew millions of viewers across various platforms. Netflix’s plans to offer immersive coverage, including live matches, star-studded studio shows, and exclusive documentaries highlighting the culture and players of women’s football, are designed to capitalize on this momentum and attract sports enthusiasts to its platform.

This venture into live sports significantly expands Netflix’s TAM by introducing its services to a new segment of consumers. Sports fans who have traditionally relied on cable or other streaming platforms now have a compelling reason to subscribe to Netflix. Furthermore, Netflix’s plan to integrate live sports with its storytelling capabilities—through documentaries about top players and the evolution of women’s football—leverages its established strength in original content creation. This approach ensures that Netflix’s sports offerings extend beyond live broadcasts to provide engaging, year-round narratives that resonate with viewers.

Netflix’s foray into live sports is not limited to soccer. The company has already made significant moves in this space, including broadcasting NFL Christmas Day games, streaming a high-profile boxing match between Mike Tyson and Jake Paul, and signing a 10-year, $5 billion deal for WWE’s flagship show Monday Night Raw. These initiatives reflect Netflix’s broader ambition to build a robust sports portfolio and compete with platforms like Amazon Prime Video and Apple TV+, which have also invested in live sports to drive subscriber growth.

While these developments present significant opportunities, they also come with challenges. Streaming live sports requires substantial investment in technology and infrastructure to ensure seamless user experiences. Additionally, the high cost of acquiring sports broadcasting rights must be balanced with subscriber growth to justify these expenditures. However, the immense popularity of events like the Women’s World Cup, coupled with Netflix’s global reach, provides a promising foundation for success.

By venturing into live sports, Netflix is evolving into a more versatile entertainment platform. This strategy not only diversifies its revenue streams but also strengthens its competitive edge in an increasingly crowded streaming market. With its blend of live sports, original content, and a focus on storytelling, Netflix is well-positioned to capture new audiences, retain existing subscribers, and solidify its leadership in the streaming industry. This transformative phase reflects Netflix’s commitment to innovation and its readiness to meet the changing preferences of consumers worldwide.

5. Eli Lilly And Co (NYSE: $LLY):

The FDA's approval of Eli Lilly's Zepbound (tirzepatide) as the first and only prescription medication for moderate-to-severe obstructive sleep apnea (OSA) in adults with obesity represents a significant advancement in addressing obesity-related conditions. This approval builds upon Zepbound's prior indication for weight loss, broadening its therapeutic scope and highlighting its dual benefits. As a GLP-1 receptor agonist with dual GIP/GLP-1 activation, Zepbound promotes substantial weight loss while effectively improving sleep-related breathing disruptions.

Clinical trials underpinning the approval, notably the SURMOUNT-OSA study, demonstrated that Zepbound reduced breathing interruptions by up to 25–29 events per hour compared to placebo. Remarkably, approximately 50% of participants experienced remission of OSA symptoms after one year. Additionally, participants saw significant weight reductions of 18%–20%, equivalent to 45–50 pounds, alongside secondary health benefits such as improved blood pressure and reduced inflammation, critical factors for mitigating cardiovascular risks.

The approval presents a promising market opportunity, with OSA affecting an estimated 30 million people in the U.S., a large portion of whom also struggle with obesity. Importantly, the decision could drive insurance coverage, particularly among Medicare beneficiaries who currently receive weight-loss drug coverage only when used for other conditions. Zepbound’s pricing, at $1,060 per month, may be offset by Eli Lilly's discount programs and insurance adoption, potentially increasing accessibility for patients.

This development solidifies Eli Lilly’s position as a leader in addressing obesity-related comorbidities. While competitors like Ozempic and Wegovy dominate the weight-loss market, Zepbound's unique indication for sleep apnea differentiates it from other GLP-1 medications, giving Lilly a strategic advantage. Furthermore, the dual-activation mechanism of Zepbound enhances its appeal in a competitive therapeutic landscape.

However, challenges remain. Regulatory warnings about thyroid cancer risks, gastrointestinal side effects, and potential mental health impacts may require careful management to ensure sustained adoption. Additionally, broader market penetration will depend on the expansion of insurance coverage and affordability for patients. Future competition from other drugs with similar indications could also influence Zepbound’s market share.

This approval signifies incremental revenue growth and bolsters its cardiometabolic portfolio. By addressing an unmet need in sleep apnea, the company expands its total addressable market (TAM) and strengthens its leadership in obesity-related therapeutics. This development is likely to enhance investor confidence, with analysts potentially revising upward their projections for Zepbound’s long-term sales performance. Overall, the approval represents a significant milestone for Eli Lilly, aligning with its strategic goals and reinforcing its competitive position in a rapidly evolving market.

6. Walt Disney Co ($DIS):

The announcement of the Bluey feature film and expanded partnership with Disney marks a significant milestone for the beloved Australian animated series and could hold some intriguing implications for Disney. Joe Brumm, the creator of Bluey, will write and direct the movie, slated for a 2027 global theatrical release under Disney's banner. This expansion of Bluey from a hit television series into the realm of theatrical films and theme park experiences underscores Disney's strategic move to deepen its content portfolio and attract multigenerational audiences.

The Bluey movie will extend the adventures of the Heeler family, known for resonating with both children and adults through its heartfelt storytelling. With its global appeal, Bluey has become a cultural phenomenon, claiming the title of the most-watched series on Disney+ globally in 2024, with over 50.5 billion minutes streamed in the U.S. alone. Its inclusion in Disney parks and cruises, alongside interactive experiences and character meet-and-greets, represents a significant extension of the brand's reach. Starting in January 2025, Bluey and her sister Bingo will feature in Disney Cruise Line voyages originating from Australia and New Zealand, followed by park appearances.

This collaboration aligns well with Disney's strategy to monetize iconic intellectual properties across multiple platforms. By acquiring theatrical rights to the Bluey movie and integrating the characters into Disney parks and cruises, the company enhances its ability to drive foot traffic, increase merchandise sales, and strengthen Disney+ subscription growth. With Bluey's established global fanbase and $2 billion estimated brand valuation, this partnership is poised to generate substantial incremental revenue streams for Disney.

For Disney's stock, the Bluey partnership reinforces the company’s reputation for leveraging strong IP to fuel growth. The brand’s integration into Disney’s broader ecosystem is likely to attract families worldwide, creating new opportunities for monetization. Investors may see this as a bullish signal for Disney’s content strategy, particularly as the company seeks to rebound from previous challenges and focus on delivering long-term shareholder value. If executed effectively, this expanded partnership with Bluey could help Disney capture additional market share in the highly competitive family entertainment sector.

7. Starbucks Corp ($SBUX):

The ongoing Starbucks workers' strike, involving over 10,000 unionized baristas across the U.S., signals a major labor dispute that could have significant implications for the company and its stock. Workers are protesting unresolved issues regarding wages, staffing, and schedules, with walkouts starting in key cities such as Los Angeles, Chicago, and Seattle and potentially expanding to hundreds of locations nationwide by Christmas Eve. This five-day strike, during the holiday season—one of the busiest times for Starbucks—poses a threat to sales and intensifies public scrutiny over the company’s labor practices.

The union, Starbucks Workers United, is pushing for immediate wage increases, citing inflation and high living costs. Starbucks has countered with an offer of no immediate wage hikes and a 1.5% annual increase in future years, which the union has deemed insufficient. Despite nine bargaining sessions since April and agreements on various non-economic topics, negotiations remain at an impasse. Compounding the issue are hundreds of labor practice complaints filed against Starbucks with the National Labor Relations Board (NLRB), including allegations of union-busting tactics such as firing union supporters and holding "captive-audience" meetings.

This labor unrest comes at a challenging time for Starbucks, which has struggled with falling sales and declining customer traffic, exacerbated by price increases and boycotts. Under new CEO Brian Niccol, the company is working on a turnaround strategy aimed at simplifying menus, overhauling cafes, and restoring "coffee house culture." However, the strike risks undermining these efforts by damaging the company’s reputation and disrupting operations during a critical sales period.

For investors, the strike and its fallout could present downside risks to Starbucks' stock in the near term. Prolonged labor disputes may lead to higher operating costs if wage concessions are granted or further strikes ensue. Additionally, negative publicity could erode customer goodwill and impact brand loyalty. On the other hand, resolving these issues could strengthen Starbucks' long-term positioning by fostering better employee relations and improving operational efficiency.

Ultimately, this labor dispute highlights the growing influence of worker unions in shaping corporate policy and the need for Starbucks to strike a balance between profitability and employee satisfaction to maintain its competitive edge. Investors will be closely watching how the company navigates this critical juncture, as its handling of the strike could significantly impact its stock performance and market perception.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.