What’s Trending with TickerTrends #32

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

On Holdings AG ($ONON):

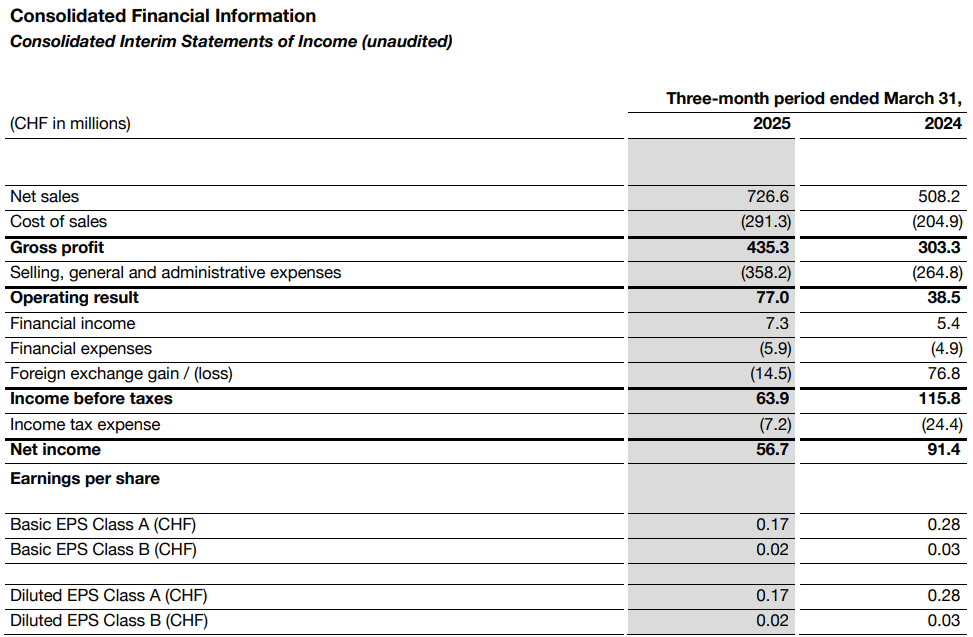

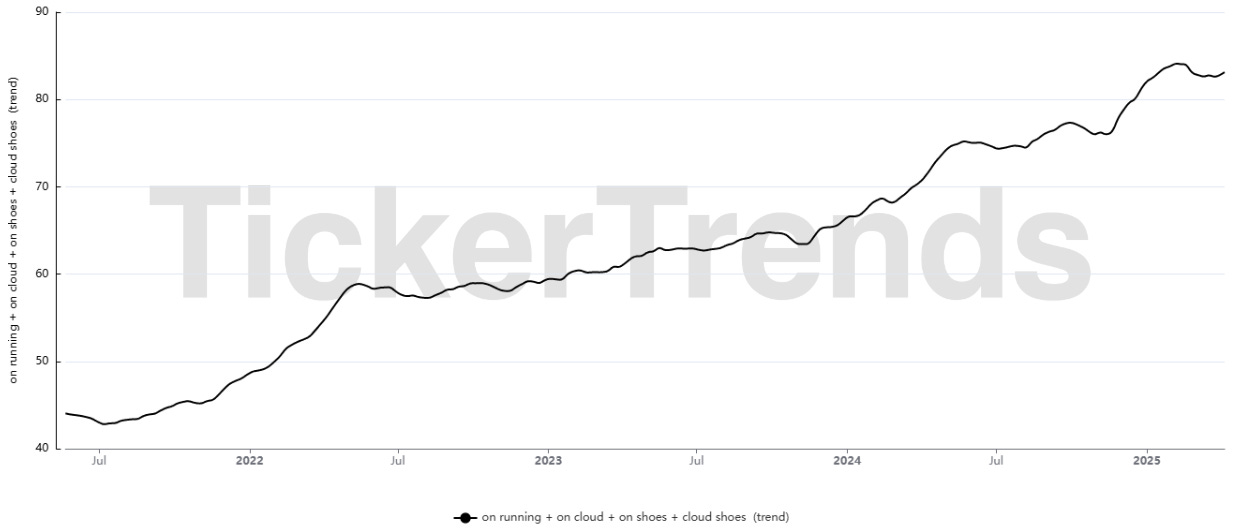

ON Holding AG reported a strong start to 2025, delivering record-breaking results in the first quarter and raising its full-year constant currency revenue guidance to at least 28% growth. Net sales reached CHF 726.6 million, a 43% year-over-year increase on a reported basis and 40% in constant currency, driven by strength across all channels and regions. The direct-to-consumer (D2C) business grew 45%, now comprising 38.1% of total revenue, while wholesale expanded 41.5%, both fueled by robust demand and effective execution. Gross margin improved to 59.9%, supported by the higher D2C mix and pricing power. Adjusted EBITDA margin rose to 16.5%, up from 15.2% last year, and net income totaled CHF 56.7 million despite FX headwinds.

The company highlighted continued brand momentum globally, attributing success to its premium positioning, innovation, and marketing campaigns featuring Roger Federer, Zendaya, and FKA Twigs. The Cloud 6, ON’s largest product launch ever, and the Cloudsurfer 2 drove strong footwear sales, while apparel sales nearly doubled, reaching CHF 38.1 million—ON’s highest-ever quarter for apparel. Growth was broad-based across geographies, with Asia-Pacific more than doubling revenue (up 130%) thanks to campaigns like “soft wins” and a new flagship store in Chengdu, China. The Americas grew 33%, bolstered by strong D2C growth and retail success in cities like Miami and Los Angeles, while EMEA rose 34%, with gains in France, Spain, and the Nordics.

Management reiterated the company’s long-term vision of becoming the most premium global sportswear brand, emphasizing operational excellence, sustainable innovation, and product differentiation. They called out transformational tech like LightSpray, a revolutionary production method that enhances flexibility and sustainability, with multiple consumer-facing launches planned this year. ON also continues to scale its retail footprint, now operating 53 stores globally, with 20 to 25 new store openings planned annually. Retail has exceeded expectations in productivity and margin, helping to fuel brand engagement and cross-channel growth.

Despite the strong Q1, the company maintained a cautious outlook for the rest of the year, citing potential macroeconomic volatility, foreign exchange headwinds, and uncertainty around U.S. tariffs—particularly the 10% Vietnam tariff currently in effect. However, management expects to mitigate these impacts through selective price increases starting in Fall/Winter 2025 and cost discipline. ON reaffirmed its gross margin outlook of 60–60.5% and adjusted EBITDA margin of 16.5–17.5% for the year, indicating confidence in brand strength and pricing power. The leadership transition from Co-CEO Marc Maurer to Martin Hoffmann is underway, with Hoffmann set to lead alongside ON’s founding team. The company is also in the process of hiring a new CFO. Overall, ON Holding is executing strongly on its growth strategy, backed by strong demand, operational scale, and increasing global brand relevance.

Nu Holdings Ltd ($NU):

Nu Holdings delivered a robust start to 2025, marked by continued expansion across Latin America, record-breaking customer growth, and strong financial performance despite macroeconomic and seasonal headwinds. The company added 4.3 million customers in Q1 alone, reaching a total of 119 million users across Brazil, Mexico, and Colombia, with nearly 100 million monthly active customers and an activity ratio above 83%. Brazil remains Nu’s most mature and scaled market, where the company now serves around 60% of the adult population, 85% of whom are active users, and nearly 60% use Nu as their primary bank. Yet Nu’s gross profit market share in Brazil remains just 5%, underscoring the large monetization potential that still lies ahead.

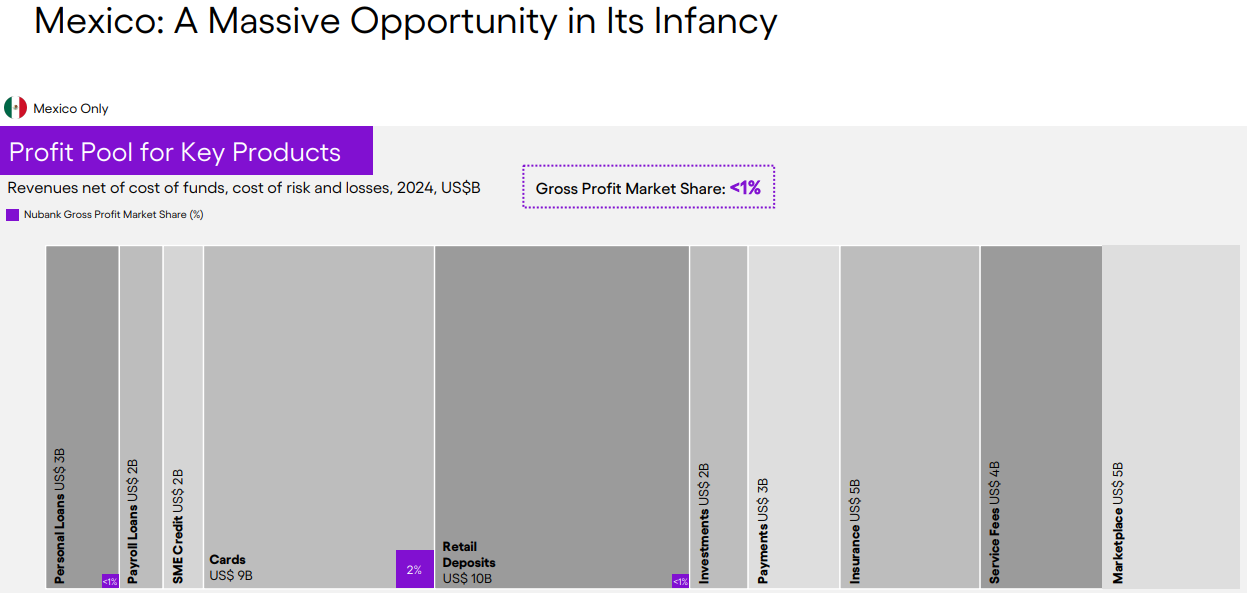

Mexico is rapidly emerging as Nu’s next growth engine. The customer base there grew 70% year-over-year to 11 million, deposits more than doubled to $5 billion (FX neutral), the credit portfolio grew 60% to nearly $1 billion, and revenues reached $245 million. Nu also secured its full banking license in Mexico, setting the stage for product expansion and faster growth. In Colombia, Nu surpassed 3 million customers, continuing its rapid build-out. Across these geographies, Nu is aggressively investing in deposit franchises to power local lending, generate data for underwriting, and enhance customer engagement.

Financially, Nu’s credit portfolio reached $24.1 billion, growing 40% year-over-year (FX neutral), led by unsecured and secured lending rather than credit cards, which had seasonally softer growth. Notably, total loan originations hit a record R$20.2 billion, up 64% year-over-year, driven by record unsecured loan volumes and strong demand for PIX financing and other transactional-based credit products. While PIX financing volumes were previously curtailed due to risk-management and NPS concerns, the company has now resumed origination with better user flows and stricter eligibility, leading to record volumes in March without sacrificing credit quality.

On the secured side, public payroll loans grew over 50% quarter-over-quarter, and FGTS loans—despite a 10-day API disruption—still showed strong traction, with Nu believed to account for 30% of FGTS originations in early 2025. The new private payroll loan product is viewed as a strategic breakthrough, allowing Nu access to segments previously dominated by legacy banks. Management expects this to expand the credit opportunity substantially, without materially cannibalizing unsecured loans in the near term.

Total deposits rose to $31.6 billion, up 48% year-over-year (FX neutral), fueled by strong performance in Mexico and Colombia. Though funding costs increased as Nu expanded local deposit bases, management expects these costs to trend downward over time as deposit bases mature and pricing is optimized. Net interest income reached a record $1.8 billion, up 34% year-over-year, but consolidated NIM fell slightly to 17.5%, largely due to Mexico and Colombia. Brazil’s NIM remained flat at 21.8%, with management emphasizing this reflects resilient unit economics, higher loan-to-deposit ratios (LDR), and portfolio mix optimization. Brazil’s net interest margin is expected to rise medium-term, even if near-term movements are not linear.

Gross profit totaled $1.3 billion, up 32% year-over-year, but down 3% sequentially due to higher credit loss allowances (CLA) and increased funding costs. Q1 is seasonally the highest for provisioning, and much of the CLA increase was driven by growth in the loan book and a recalibration of Stage 2 relative risk triggers. Risk-adjusted NIM declined to 8.2%, with three-quarters of the drop attributed to seasonal effects and the remainder to margin pressure in Mexico and Colombia. Operating efficiency improved significantly, with the efficiency ratio dropping to 24.7%, or 26.7% excluding a one-time DTA recognition.

Net income reached $557 million, up 74% year-over-year (FX neutral), translating to a 27% annualized ROE, despite Nu holding over $4 billion in excess capital. Management emphasized the importance of segmenting performance: Brazil is now being reported separately to highlight the scalability and profitability of the core digital banking model. With Brazil serving as proof-of-concept, Nu is confident Mexico and Colombia will follow similar trajectories as their deposit bases mature and scale efficiencies kick in.

Nu’s strategy remains long-term oriented. The company continues to invest heavily in platform enhancements, new products, and customer experience, rather than optimizing for short-term margins. Programs like the recently launched "Recomeço" debt renegotiation initiative are designed to increase long-term customer engagement and recoveries, rather than simply boost near-term earnings. Management reiterated that all growth is measured, deliberate, and underpinned by strong credit underwriting, robust data models, and a focus on sustainable value creation.

Trends this week:

United Health ($NU):

The situation unfolding at UnitedHealth Group (UNH) is nothing short of extraordinary — a near-instant fall from grace for what was long considered one of the most stable, powerful, and defensible franchises in corporate America. In just under a month, the company has lost nearly $300 billion in market value, a 50% collapse that has made UNH one of the worst-performing S&P 100 names since Netflix's implosion in 2022. And what’s even more jarring is how fast the narrative has flipped: from a quiet healthcare cash machine to a crisis-riddled enterprise facing a criminal investigation, executive upheaval, regulatory pressure, and deep investor mistrust.

At the core of this meltdown is the Department of Justice’s reported criminal probe into UnitedHealth’s Medicare Advantage billing practices — an investigation that, according to the Wall Street Journal, has been quietly underway since last summer. It follows a separate, ongoing civil inquiry into potential upcoding of diagnoses to inflate government reimbursement. While UnitedHealth has denied any official notification of the criminal probe and labeled the report “deeply irresponsible,” the market clearly isn’t buying it. When paired with the sudden resignation of CEO Andrew Witty, the abandonment of full-year financial guidance, and lingering fallout from the murder of executive Brian Thompson last year — a moment that galvanized public resentment against the health insurance industry — investors have understandably hit the panic button.

There’s a sense among investors and analysts that the issues go deeper than temporary earnings pressure. The collapse in share price has shaken confidence in Optum, UnitedHealth’s supposed profit engine, especially since part of the margin compression appears to stem from rising costs within its own healthcare delivery system. If Optum is no longer functioning as a margin-smoothing buffer, UnitedHealth loses its most prized competitive advantage: vertical integration.

On the Medicare Advantage front, UnitedHealth is facing both public and legislative pressure. Practices like claim denials and prior authorizations, once seen as essential tools for cost control, have come under fire, especially since the public backlash following Thompson’s killing, which reportedly involved a disgruntled provider. Add to that higher-than-expected medical utilization, especially for costly specialty care, and you have a system that was already straining before DOJ agents got involved.

The board’s decision to bring back former CEO Stephen Hemsley, widely seen as a safe pair of hands, is a clear signal that they are in full damage control mode. Hemsley is credited with building UnitedHealth into a behemoth during his 2006–2017 tenure and is now tasked with salvaging what’s left. His appointment has been applauded by analysts at Morgan Stanley and UBS, but even Hemsley’s credibility may be tested by the scope of what’s ahead — especially if legal exposure results in over $1 billion in potential fines or settlements, as some investors suspect.

Looking ahead, several strategic responses are being floated. Some expect UnitedHealth to exit less profitable Medicare markets, reprice 2026 plans more aggressively, shift plan design toward lower-cost providers, and push generic drug usage more forcefully. Others fear more drastic moves may be needed, although a full breakup of Optum and UnitedHealthcare is seen as unlikely given how deeply intertwined the two are.

To be clear, this is not an existential crisis — yet. UnitedHealth still generates $20 billion in free cash flow and remains the largest player in a sector with long-term tailwinds. But sentiment has clearly turned. What was once a cornerstone of conservative portfolios and a pillar of the Dow now trades like a distressed asset. The stock's removal from the Dow Jones Industrial Average is now a real possibility unless confidence is quickly restored.

If you're watching from the sidelines, the key questions are: How deep is the DOJ case? Can Hemsley stabilize operations before plan pricing for 2026 must be finalized? And is the integrated model still a strength, or now a liability?

Until there are clear answers — or a definitive legal resolution — UnitedHealth has shifted from a buy-and-hold giant to a complex turnaround story, one whose path forward will be closely watched not just by investors, but by regulators and the entire U.S. healthcare system.

Coinbase Global Inc ($COIN):

Coinbase’s inclusion in the S&P 500 was supposed to mark a watershed moment for both the company and the cryptocurrency industry—a milestone affirming digital assets’ growing legitimacy in mainstream finance. But that celebratory narrative has been swiftly upended by a sprawling cybersecurity scandal that raises grave questions about trust, internal controls, and the resilience of crypto platforms operating at scale.

Just days after the S&P 500 announcement, Coinbase disclosed in an SEC 8-K filing that it had suffered a significant data breach stemming from internal sabotage. Hackers had successfully bribed overseas customer support agents—reportedly located in India—to steal sensitive customer data. This wasn’t a standard phishing attack or brute-force breach; it was a targeted act of internal corruption. The attackers walked away with a trove of personal information, including full names, home addresses, phone numbers, masked bank account and Social Security numbers, government ID images, and even balance snapshots—enough data to enable sophisticated identity theft and financial fraud.

The attackers followed up with a $20 million ransom demand, threatening to publicly release the data unless Coinbase paid up. Coinbase refused and instead countered with a $20 million bounty for information leading to the attackers' arrest. CEO Brian Armstrong took to social media and public statements to express outrage, reiterate the company’s refusal to be extorted, and vow full cooperation with law enforcement.

Coinbase has framed the breach as a targeted attack on a “small subset” of users, claiming that no passwords, private keys, or actual funds were accessed. But what makes this breach so concerning is that it wasn’t just a hit on Coinbase’s infrastructure—it was a hit on its credibility. Social engineering attacks are among the most dangerous because they bypass traditional technical defenses and exploit human behavior. With enough customer data in hand, criminals can impersonate support teams, trick users into handing over crypto assets, or use the information to create convincing phishing campaigns.

One high-profile victim reportedly included Sequoia Capital senior steward Roelof Botha, a prominent member of the PayPal Mafia and one of the most influential venture capitalists in Silicon Valley. That his personal data may have been accessed raises the stakes dramatically. Not only does it highlight the breach’s reach into elite financial circles, but it also raises uncomfortable questions about how long attackers had access and whether other high-net-worth individuals were targeted.

The fact that Coinbase detected strange support log activity as early as January but didn’t go public until May 15 has triggered scrutiny over its internal response timeline and disclosure practices. While the company says it acted promptly—terminating implicated employees and strengthening fraud detection—critics may question whether the public and regulators were informed swiftly enough. The potential for SEC or FTC investigations remains an overhang.

Coinbase estimates the fallout could cost between $180 million and $400 million in remediation, reimbursements, and security upgrades. That’s a staggering sum, even for a company recently reporting over $2 billion in quarterly revenue. The breach comes at a time when Coinbase is already under pressure to diversify beyond trading fees, as its Q1 2025 results showed a 10% drop in total trading volume and a 19% quarter-over-quarter decline in transaction revenue. Despite inclusion in the S&P 500—which typically boosts a stock’s visibility and institutional ownership—Coinbase shares fell more than 6% on the day the breach was disclosed and remain volatile.

This incident also lands amid rising geopolitical and personal security concerns for crypto executives. In France, government authorities have ramped up protections for prominent crypto figures following a wave of kidnapping attempts. The growing value tied to digital assets is making executives—and now evidently even support agents—prime targets for criminal enterprises.

The bigger picture here is that as crypto matures and institutions lean in—whether through ETFs, derivatives, or regulated exchanges like Coinbase—the expectations for operational integrity rise dramatically. Investors and regulators alike will increasingly scrutinize not just Coinbase’s financial metrics, but the robustness of its internal systems, its employee oversight, and its crisis management practices.

In the end, Coinbase’s elevation to the S&P 500 is still a milestone, but it now comes with an asterisk. It reflects not just the crypto industry’s rise into mainstream finance—but also the very real, growing pains that come with scaling trust in a decentralized, high-stakes ecosystem.

Boeing Co ($BA) & General Electric Co ($GE):

Boeing’s fortunes, long troubled by safety concerns, delivery delays, and global supply chain disruptions, have taken a sharp turn during President Donald Trump’s headline-grabbing trade mission across the Middle East. In a matter of days, the aerospace giant has announced over $120 billion worth of aircraft orders—including what the White House hails as Boeing’s largest-ever widebody jet deal—thanks to a carefully choreographed diplomatic tour designed to rekindle industrial exports and reshape U.S. trade dynamics in the region.

The most recent announcement came out of Abu Dhabi, where Etihad Airways confirmed it would purchase 28 long-haul Boeing aircraft, a mix of 787 Dreamliners and 777X jets, as part of its fleet doubling strategy through 2030. The deal, while not disclosing the breakdown, follows closely on the heels of Qatar Airways’ record-breaking order earlier in the week: up to 210 widebody jets, including 130 Dreamliners and 30 777-9s, with options for 50 more. Boeing CEO Kelly Ortberg, traveling alongside Trump, called the Qatar deal “an unprecedented vote of confidence” in the company’s recovery.

All told, Boeing has booked 268 aircraft orders during the first few legs of the trip—orders that are set to shore up its long-term backlog and support its beleaguered 777X program. The 777X, which has been plagued by delays and certification issues, now sees its total backlog approaching 500 units, with growing momentum behind the 777-9 variant, due for first delivery to Lufthansa in 2026. Ortberg assured investors during a recent Barclays call that certification is on track for late 2025 or early 2026, though prior missed deadlines have sown skepticism.

Etihad’s deal also includes a major win for GE Aerospace, which will supply the engines for the new aircraft. It follows GE’s biggest engine order ever earlier in the week—also from Qatar—which underscores how the Trump-led trip is serving not just Boeing, but the broader U.S. aerospace supply chain.

Beyond commercial aviation, Trump’s Middle East tour has also generated a flurry of defense and tech deals. In Saudi Arabia, the administration announced $600 billion in military and tech contracts. In Qatar, Defense Secretary Pete Hegseth signed letters of intent for remotely piloted MQ-9B aircraft and aerial defense systems. These agreements suggest a broader regional realignment toward U.S. suppliers, potentially easing pressure on embattled manufacturers like Boeing following years of uncertainty and overseas competition.

Yet, the flurry of deals hasn’t come without political friction. In Qatar, the optics of Trump attending the signing ceremony for the record-breaking order—alongside Boeing CEO Ortberg and Emir Tamim bin Hamad Al Thani—have raised eyebrows. The controversy stems from reports that one of the Qatar-ordered Boeing 747-8s may serve, at least temporarily, as Trump’s version of Air Force One. Trump has indicated that the plane could later be donated to his presidential library, prompting bipartisan criticism of influence peddling and improper optics. Qatar’s Prime Minister dismissed those concerns as a “government-to-government” transaction.

Adding to the intrigue, the UAE deal was announced just before Trump’s departure for Abu Dhabi, the final leg of the tour. The timing signals a calculated effort to front-load Boeing’s win streak to coincide with each stop, boosting the narrative of Trump as “dealmaker-in-chief,” as the White House press release put it.

Meanwhile, Boeing’s commercial operations continue to claw back from one of the company’s darkest periods. After a turbulent 2024—marked by a midair panel blowout on an Alaska Airlines 737 MAX, a debilitating machinist strike, and delivery delays—Boeing ended the year with just 569 gross orders, down 60% from 2023. Deliveries also slumped to 348 aircraft, a 34% drop. The Middle East order spree now acts as a much-needed catalyst for Boeing to rebuild confidence with investors and customers alike.

That said, these are commitments, not deliveries. Airlines have walked away from flashy orders before. Investors remember well how pandemic-era announcements evaporated under economic stress. Still, the sheer size of the Qatar and Etihad deals, coupled with recent news that a UK airline (reported to be IAG) will acquire $10 billion worth of Boeing 787s as part of a new bilateral trade framework, is shifting sentiment.

Boeing’s stock has responded accordingly. Following the UK order and Middle East announcements, shares climbed more than 3.5%, a rare show of strength amid years of underperformance. Yet investors remain cautious. With EU tariffs looming and Trump’s “Liberation Day” tariff strategy threatening to disrupt supply chains further, Boeing’s global outlook is still fraught with risk. Then there’s the matter of Air Force One. Boeing has confirmed that the pair of 747-8s ordered under Trump’s first term are now slated for delivery in 2027—earlier than some recent projections but still far behind the original 2022 schedule. With Trump back in office, it’s possible he’ll fly on the new jets, raising even more scrutiny over his ties to Boeing, especially given that government contracts account for roughly 42% of the aerospace giant’s revenue.

In short, Boeing’s Middle East shopping spree marks a dramatic reversal for a company that just months ago looked beleaguered. The deals offer a lifeline, not just in revenue terms but in narrative terms—a public pivot from damage control to dealmaking. Still, the road ahead will be bumpy. Certification delays, trade turbulence, and political optics could yet cast shadows over what looks, for now, like a comeback moment. As Boeing bets big on reasserting dominance in the skies with the 777X and doubles down on its widebody portfolio, the market will be watching closely: are these deals the start of a new growth cycle, or a high-profile sugar rush that masks lingering structural challenges? Either way, Boeing has placed itself at the center of geopolitical and industrial strategy once again—and it may finally be flying in clearer skies.

NVIDIA Corp ($NVDA), Advanced Micro Devices Inc ($AMD), Super Micro Computer Inc ($SMCI) & Tesla Inc ($TSLA):

Donald Trump’s recent Middle East tour has also catalyzed a major repricing across several key U.S. stocks. Companies like Nvidia, AMD, Tesla, Super Micro Computer, and others saw their shares surge in response to headline-grabbing deals and a sweeping rollback of Biden-era export controls, particularly the now-defunct Framework for AI Diffusion.

For Nvidia (NVDA), the trip was a windfall. The Trump administration’s decision to rescind the AI Diffusion framework—an aggressive set of restrictions that blocked the export of high-end AI chips to many nations—has re-opened massive markets that were previously closed off. Countries like Saudi Arabia and the UAE, formerly limited to restricted quantities of chips or outright banned from importing them, are now being greenlit for purchases in the hundreds of thousands. In just one agreement, Saudi-backed Humain will acquire over 18,000 Grace Blackwell superchips, with a roadmap to purchase several hundred thousand more over five years. Separately, the Saudi Data & AI Authority (SDAIA) is deploying 5,000 Nvidia Blackwell GPUs to build a sovereign AI factory. These contracts are material, and investors noticed—Nvidia shares rose 16% for the week.

Advanced Micro Devices (AMD) is benefiting in parallel. The company is part of a $10 billion AI infrastructure project in the Middle East, supplying chips and software for data centers stretching from Riyadh to the U.S. While AMD historically lagged Nvidia in the AI arms race, its inclusion in these national-level strategic AI rollouts signals growing trust in its accelerator roadmap. Trump’s push for bilateral deals rather than blanket export frameworks likely helped AMD, whose products are being greenlit on a project-by-project basis.

Super Micro Computer (SMCI), which sells AI-optimized servers often built around Nvidia’s chips, inked a $20 billion deal with Saudi data center firm DataVolt. The magnitude of the agreement, and its visibility in Trump’s diplomatic tour, drove SMCI shares up nearly 20% intraday before moderating gains. With demand for AI data center infrastructure skyrocketing—often funded directly by sovereign wealth funds—Super Micro is emerging as a core enabler of the physical AI buildout.

Tesla (TSLA), meanwhile, used the geopolitical spotlight to advance its Starlink and robotics businesses. The Kingdom of Saudi Arabia granted approval for Starlink to be used in both maritime and aviation sectors, and Elon Musk pledged to roll out robotaxis in the region. While not directly tied to AI chip sales, these moves signal deeper commercial penetration into the Gulf, aligning with Trump’s broader strategy to make U.S. tech central to Middle Eastern modernization efforts. Tesla’s stock jumped 17% for the week.

Other U.S. tech giants—Amazon, Alphabet (through Google), Palantir, Cisco, and Qualcomm—also secured billions in commitments. Amazon Web Services and Humain pledged to jointly invest over $5 billion to build an “AI zone” in Saudi Arabia. Cisco expanded its partnership with UAE-based G42, while Qualcomm confirmed it’s entering the data center AI race, competing directly with Nvidia and AMD.

OpenAI, whose CEO Sam Altman was part of Trump’s CEO entourage, is in talks to establish a significant data center presence in the UAE. While OpenAI is private, any data center builds in partnership with Microsoft (MSFT) or its other infrastructure vendors could bolster those tickers as well.

From a policy perspective, the biggest shift is the move from rigid frameworks to bilateral, deal-based governance. Rather than apply export rules broadly, the Trump administration is signaling it will negotiate chip access based on strategic alignment. This flexibility dramatically benefits U.S. companies that have been vocal critics of the AI Diffusion rules, which they argued were hurting innovation and U.S. influence abroad. Citigroup analysts suggest the piecemeal approach could open dozens of new markets for chipmakers and data center enablers.

But there are risks. Critics in Washington, particularly China hawks, worry that countries like the UAE could become backdoor routes for high-end chips to reach adversaries like China. G42’s ties to Huawei have raised red flags, and lawmakers are calling for stricter end-use audits.

Still, for markets, the story is clear: Trump’s Middle East tour signaled the return of transactional diplomacy where CEOs are front and center—and American tech giants are the tip of the spear. Stocks like Nvidia, AMD, Tesla, Super Micro, and others may continue to rally on further announcements, especially if more Middle Eastern capital is unlocked. While some deals may take years to materialize, the short-term impact on investor sentiment and capital inflows is already profound

Airbnb Inc. ($ABNB):

Airbnb’s massive summer 2025 platform overhaul signals a pivotal shift in its identity—from a travel accommodation marketplace to a broader real-world experience and services platform. CEO Brian Chesky is no longer just pitching Airbnb as an alternative to hotels. He's positioning it as a lifestyle infrastructure company, where everything from a weekend stay to a beach volleyball session with an Olympian or an in-home massage is just a few taps away. And while the financial and operational implications are nuanced, the strategic ambition is clear: Airbnb wants to be the Amazon of the real world.

At the heart of this transformation are three major initiatives: Airbnb Services, a relaunch of Airbnb Experiences, and an app overhaul that unifies homes, services, and experiences. Among these, Airbnb Services is the most disruptive. By enabling users to book chefs, stylists, personal trainers, and more—services that aren't strictly travel-related—Airbnb is entering a hyperlocal services market with a total addressable market (TAM) in the hundreds of billions. It’s a high-risk, high-reward leap that, if successful, could significantly extend the platform’s utility beyond travel and into everyday life.

The upside is enormous. Unlike accommodations, which are episodic and tied to discretionary spending, services like haircuts, fitness, or even tutoring are recurring and habitual. If Airbnb can become a trusted layer of local discovery and fulfillment—think “Uber for everything offline”—it adds a new, more stable growth vector that is less exposed to seasonal travel trends or regulatory crackdowns on short-term rentals. The company believes these new verticals could contribute billions in revenue within five years.

However, this is not a frictionless expansion. Scaling a marketplace for in-home services brings steep logistical and reputational risks. Vetting, supply acquisition, service quality assurance, and local regulation will all pose challenges. Airbnb also needs buy-in from its host community, some of whom may be reluctant to open their homes to third-party service providers. Meanwhile, critics have flagged that these new offerings could conflict with Airbnb’s climate goals, since the company excludes experience-related emissions from its carbon accounting.

The revamped Experiences platform is arguably less novel—it’s been around since pre-pandemic days—but Chesky is betting that rebranding it around celebrity-led exclusivity and real-world community will give it new life. Experiences like a day with Patrick Mahomes or a cooking class in a zero-waste kitchen in Mexico City aim to create buzz and draw attention to the platform's depth. What’s new is the social networking layer Airbnb is adding. This reimagining hearkens back to early Facebook, but in a real-world context: group chats with fellow travelers, shared photo albums, and post-experience connections. It’s an attempt to revive the joy of shared experience in a world increasingly dominated by algorithm-driven isolation.

The long-term implications could be massive. If Airbnb can turn real-world connections into digital network effects, it might build a sticky social graph anchored in experiences rather than passive content. This would not only create a moat around its services platform but potentially increase engagement and transaction frequency in a way that few commerce platforms outside of Amazon or Uber have achieved.

Financially, the expansion comes as growth in Airbnb’s core homestay business slows. Bookings rose just 6% year-over-year in Q1—the slowest rate since the pandemic. The platform is facing saturation in key markets, pricing pressure due to cleaning fees and affordability concerns, and regulatory headwinds in places like New York and Barcelona. These new verticals are likely a hedge against stagnation, offering a path to re-accelerate topline growth without having to battle existing housing regulations.

Unlike home-sharing, which Airbnb virtually pioneered, these new marketplaces—whether for wellness, food, or social experiences—have established alternatives. Consumers already book spa services through apps like Soothe, hire chefs via local caterers, or find experiences through Viator, GetYourGuide, or even TikTok. Airbnb will need to differentiate through curation, trust, and seamless integration within its already massive user base. And even then, adoption could be slow. Ultimately, Chesky’s vision is not just about scaling services. It’s about reshaping Airbnb into a platform that monetizes time, not just space. He’s betting that people will want to book unique, memorable experiences—at home or abroad—with the same ease they now book a room. If that bet pays off, Airbnb could go from being a seasonal travel stock to a year-round consumer infrastructure company, offering investors a much longer growth runway than previously imagined. For now, it’s a compelling narrative with vast potential—if execution matches ambition.

SPDR Select Sector Fund ($XLV) & CVS Health Corp ($CVS):

The Trump administration’s new push to slash drug prices — while loud and populist in tone — marks a complex, high-stakes pivot that could radically reshape the global pharmaceutical landscape, with profound implications for U.S. consumers, European pharma companies, investors in drug stocks, and the geopolitics of intellectual property.

At the center of this policy is the executive order invoking a “Most Favored Nation” pricing model, which would effectively peg U.S. drug prices to the lowest rates offered in any developed country. This is an aggressive move that could — if fully implemented — trigger up to 90% price cuts on blockbuster drugs sold in America, especially GLP-1s like Ozempic, Wegovy, and Zepbound. Trump’s order has generated considerable investor anxiety and immediate blowback from Big Pharma, but it has also received applause from patients and populists across the political spectrum.

Pharma companies, particularly European giants like Roche, AstraZeneca, Sanofi, and Novo Nordisk, are now caught in a pressure cooker. These firms benefit from selling the exact same medications at a significant markup in the U.S., helping subsidize global R&D, executive pay, stock buybacks, and outsized margins. The executive order could hit European drugmakers' profits by 6% to 10%, according to UBS estimates, with Pfizer, Bristol Myers Squibb, Eli Lilly, and Roche among the most exposed.

To be clear, these companies are not sitting quietly. Several have threatened to withhold future manufacturing investments in Europe, using Trump’s tariff threats as leverage to push the EU for looser drug regulations and longer IP protections. The message is clear: if Europe doesn’t allow higher pricing and looser rules, they’ll shift R&D and production to the U.S. — especially if the Trump administration follows through on its plan to slap 20% tariffs on imported drugs and builds out financial incentives for onshoring.

That threat isn’t idle. Since 2020, major firms like Eli Lilly ($27B), Roche ($50B), and Johnson & Johnson ($55B) have pledged massive U.S. investments. But now they’re making it clear: if they can’t protect their pricing model globally, they’ll rethink those moves. Still, Trump’s camp, particularly HHS special adviser Calley Means, has shown zero interest in negotiating with them. “Go ahead and do it,” Means told Roche, calling their resistance “morally reprehensible.”

What’s more, Trump’s order and his anti-PBM rhetoric signal a deeper realignment. For years, pharmacy benefit managers (PBMs) — companies like CVS Caremark, OptumRx, and Express Scripts — have been blamed for jacking up drug prices by demanding high list prices in exchange for kickbacks (rebates). Trump’s latest comments show a rare bipartisan consensus forming against PBMs, but his policies still stop short of systemic reform. The structural incentives for inflated list prices remain.

From an investment perspective, this sets up a high-risk, high-volatility environment for drug stocks — particularly those with a large proportion of U.S. revenue and dependence on high list prices. Companies like Novo Nordisk (which relies heavily on GLP-1 profits from the U.S.), Pfizer, and Bristol Myers Squibb may see increased legal, regulatory, and pricing headwinds. Conversely, firms like Eli Lilly and AstraZeneca have taken a more conciliatory tone, signaling willingness to work with the administration, which may help protect their downside in the near term.

That said, markets seem skeptical the order will survive intact. Drug stocks rebounded after the announcement, signaling belief that either the policy will be watered down or legally challenged — as happened in Trump’s first term when a similar MFN initiative was blocked in court for skipping the public comment period. Still, the political optics of Trump attacking Big Pharma while pushing populist health care reform are potent, and could provide lasting pressure well into his second term.

From a macro perspective, the real danger isn’t just price caps or tariffs — it’s the potential for supply chain chaos. Generic drugmakers, who operate on razor-thin margins, are warning that tariffs on imported inputs or finished drugs could trigger shortages and further price inflation — even in the U.S. The irony is that while Trump seeks to punish Big Pharma, his actions could hurt access to cheap generics the most.

Meanwhile, European governments are being advised by progressive voices like Nick Dearden and Peter Maybarduk to treat this crisis as an opportunity — to build public pharmaceutical capacity, overhaul their IP frameworks, and invest in homegrown manufacturing. This would be a tectonic shift in the global drug economy, effectively weakening the U.S. pharmaceutical hegemony.

Trump’s executive order is not just about reducing drug prices. It’s an ideological salvo that blends economic nationalism, populist health care reform, and a willingness to kneecap multinational pharma giants for domestic gain. If he succeeds, it could permanently reshape global pharma economics, with massive implications for U.S. drugmakers, European industry, and the future of health sovereignty.

For investors, it means preparing for a world where:

Profit margins on blockbuster drugs may compress.

Tariffs and retaliatory trade policy may hit generics and APIs.

Companies heavily tied to U.S. pricing power may underperform.

New winners may emerge among firms with global diversification, strong biosimilar pipelines, or footprint in emerging markets.

Stay nimble. This fight isn’t about to end quietly — and the losers could be the ones who once printed the most cash.

Amazon.com ($AMZN):

The class-action lawsuit against Amazon over its return and refund practices has sparked widespread attention, especially after a federal judge allowed the case to proceed past the dismissal phase. Filed in September 2023 in Washington state, the lawsuit accuses Amazon of violating its own publicly stated return policies through its “advanced refund” system. Under this policy, customers can receive a refund as soon as they drop off an item for return, even before it arrives at an Amazon facility. However, according to the plaintiffs, Amazon has been quietly reversing those refunds weeks later, charging customers again despite tracking confirming that the returned item had arrived in acceptable condition. Some customers only discovered the issue after noticing unexpected charges on their bank or credit card statements, leading many to believe Amazon was acting in bad faith or programming its systems to quietly recapture refunded amounts without notifying users.

The lead plaintiff, Holly Jones Clark, along with others, claims that Amazon’s practices amount to breach of contract and unlawful conversion of funds. The judge overseeing the case agreed the claims are substantial enough to move forward, writing that the plaintiffs had plausibly alleged that Amazon was taking money from customers without due process. Although the lawsuit has not yet reached the stage of class certification, it is being pursued on behalf of a nationwide class of consumers who returned items within Amazon’s stated time frame but were recharged afterward without proper justification. Until the class is certified, affected consumers are not officially part of the lawsuit, and no settlement claim forms are available yet.

The case underscores how Amazon’s well-publicized convenience can potentially mask serious systemic flaws. Customers have described scenarios in which Amazon’s own customer service chat logs confirmed that returns were received but failed to explain why refunds had been rescinded. In some instances, Amazon’s automated customer service systems issued new refunds once pressed, but without clarification or a formal apology. This lack of transparency, the lawsuit claims, leaves consumers to police their own financial transactions and undermines trust in the platform. The broader concern is that Amazon’s refund structure, while appearing customer-friendly on the surface, relies heavily on automation and algorithmic enforcement, creating gaps where human oversight is lacking and customers are left financially vulnerable.

In court filings, Amazon has defended its practices by stating that some items were returned in damaged condition or never arrived at their warehouses. It has also stressed that the return window and item condition must be respected, otherwise refunds can be reversed. But critics argue that Amazon’s refund policy is inconsistently enforced and disproportionately favors the company, especially when the burden of proof falls on the consumer. The plaintiffs allege that Amazon has flooded the discovery process with a mass of documents to stall proceedings, further complicating efforts to obtain accountability.

For consumers wondering whether they might benefit from a potential settlement, the answer is not yet clear. Class certification has not been granted, meaning individuals who were affected by these practices are not yet automatically eligible for compensation. If and when the class is certified, official notices will be sent out with instructions on how to file a claim. In class-action cases of this nature, affected consumers are typically included by default unless they choose to opt out, and compensation—if awarded—varies widely depending on the size of the settlement and number of claimants. Some past cases have yielded only modest payouts, but the legal implications for Amazon could be far-reaching if the court finds a pattern of misconduct.

Ultimately, this lawsuit represents a test of accountability for a company that commands immense trust from consumers. Amazon’s return policies have long been a cornerstone of its customer service reputation, and if these allegations are proven true, it could call into question the integrity of one of its most consumer-facing systems. The case also highlights the importance of transparency and corporate responsibility in an era where automation governs much of the customer experience. For now, affected customers are encouraged to keep detailed records of their returns and bank statements, as the outcome of this case could determine whether they’ll be eligible for a future payout—and whether Amazon will be forced to rethink the automation driving its refund operations.

Walmart Inc ($WMT):

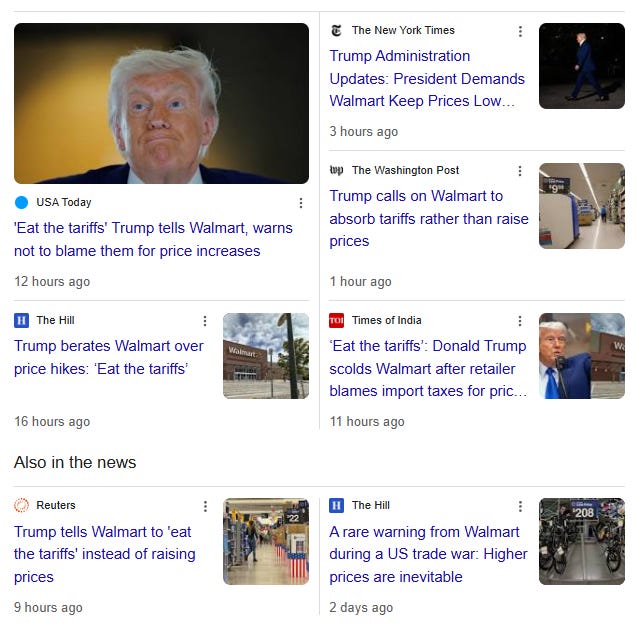

President Donald Trump’s latest clash with the corporate world came to a head on May 17, 2025, when he directly criticized Walmart for attributing price increases to his sweeping tariff agenda. In a Truth Social post, Trump demanded that Walmart “eat the tariffs” rather than pass the costs onto customers, arguing that the retail giant made billions in profits last year and should absorb the hit instead of blaming his administration’s trade policies. His comments came just two days after Walmart executives warned that despite efforts to shield consumers, prices on a range of products—from groceries to baby gear—would inevitably rise due to the cost burden from tariffs, some of which reached levels not seen since the 1930s.

Walmart CEO Doug McMillon and CFO John David Rainey explained that while the company has done its best to hedge and delay the impact, the scope of the tariffs—especially on Chinese goods and essentials like bananas, coffee, and aluminum-dependent products—makes it impossible to fully absorb the increases given their already narrow margins. During the company’s earnings call, McMillon reiterated Walmart’s commitment to low prices but acknowledged that categories like car seats, strollers, and electronics sourced from China are particularly vulnerable. Rainey noted that some bananas imported from Costa Rica have already gone up by 8%, and car seats priced at $350 could soon rise by $100.

Trump, however, was unmoved. In his post, he dismissed the retailer’s claims and suggested that both Walmart and China should bear the cost of tariffs, promising that “customers will be watching.” The president’s statement coincided with his administration’s recent decision to reduce previously announced 145% tariffs on Chinese goods to 30% for a temporary 90-day period, and to ease other rates on imports from nations like Mexico and Canada. Despite this truce, Walmart and other major retailers remain deeply affected, scrambling to manage costs and logistics amid a volatile policy landscape.

The retailer’s situation is emblematic of broader industry strain. Over the past several months, major companies like Procter & Gamble, Stanley Black & Decker, and Mattel have announced or signaled their own price hikes in response to tariffs. But Walmart’s case is particularly significant because of its scale—serving more than 150 million Americans weekly and acting as a bellwether for national consumer trends. While two-thirds of its merchandise is sourced domestically, the remaining third—often general merchandise and electronics—relies on a complex global supply chain, particularly with China. Walmart opted not to pause Chinese imports during the most recent tariff flare-up, preferring to maintain supplier relationships and prevent empty shelves during critical sales periods like back-to-school season.

Walmart’s latest earnings underscore the mixed results of navigating this fraught environment. The company reported a 12.7% year-over-year drop in quarterly profit to $4.45 billion, while still beating analyst expectations on adjusted earnings per share. Revenue rose modestly by 2.5% to $165.61 billion, with U.S. comparable sales up 4.5% and e-commerce surging 22% globally. Still, Walmart declined to issue a formal profit outlook for the current quarter, citing ongoing tariff uncertainty. The retailer maintained its full-year guidance from February, but executives emphasized that volatility in trade policy remains the biggest risk to its forecast.

Behind the policy conflict is a deeper tension between Trump’s aggressive “America First” trade stance and the practical realities of global supply chains. Trump has used tariffs as a blunt tool to encourage domestic manufacturing and reduce dependence on imports, but businesses argue the measures create uncertainty and inflate costs, especially for low-margin retailers. While Trump touts consumer protection as his goal, critics warn that the tariff burden ultimately trickles down to customers—something even large retailers like Walmart, with massive buying power and logistical sophistication, can’t entirely avoid.

Trump’s rebuke of Walmart also comes with political implications. The president has long positioned himself as a populist fighting for the American consumer, but his combative approach with business leaders has at times alienated corporate allies. By publicly calling out one of the most influential companies in the country, Trump may be signaling a broader strategy: pressure companies to maintain price discipline in exchange for regulatory or trade concessions. However, this strategy risks backfiring if companies respond by curbing investment or scaling back operations, especially in uncertain economic conditions.

Ultimately, the standoff between Trump and Walmart highlights a critical economic question: who should bear the cost of protectionist trade policy? While the administration insists that China is footing the bill for tariffs, retail CEOs argue otherwise, pointing to real-world price hikes and squeezed margins. As the 90-day tariff pause unfolds and companies like Walmart brace for another potential wave of trade disruptions, consumers could soon be left paying the price—despite presidential assurances to the contrary.