What's Trending with TickerTrends #15

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Taiwan Semiconductor Mfg. Co. Ltd. ($TSM):

Taiwan Semiconductor Manufacturing Company (TSMC) delivered a strong fourth-quarter 2024 earnings report, marked by robust revenue and earnings growth that surpassed Wall Street expectations. The company reported revenue of $26.88 billion, a 37% year-over-year increase, and earnings per share of $2.24, reflecting a 56% rise from the prior year. These results underscore TSMC’s pivotal role in the global semiconductor industry, driven by its leadership in advanced manufacturing technologies such as 3-nanometer and 5-nanometer processes. Advanced technologies accounted for 74% of the company’s wafer revenue in the quarter and 69% for the full year, a substantial increase from 58% in 2023.

TSMC attributed its impressive growth to the surging demand for high-performance computing (HPC) and AI-related chips. HPC contributed 53% of TSMC’s quarterly revenue, increasing 19% sequentially, while smartphone revenue grew 17% to account for 35% of the total. However, Internet of Things (IoT) and digital consumer electronics (DCE) platforms saw declines, underscoring the company’s reliance on AI and HPC as its primary growth drivers. AI accelerators—comprising GPUs, ASICs, and HBM controllers—accounted for a mid-teens percentage of the company’s 2024 revenue, and TSMC forecasts that revenue from these accelerators will double in 2025, signaling continued robust demand.

For 2025, TSMC projects a revenue increase in the mid-20% range in U.S. dollar terms, driven by a favorable demand environment for its AI-related technologies. The company remains confident in its ability to achieve a compound annual growth rate (CAGR) of approximately 20% in revenue over the next five years, with AI accelerators expected to grow at a mid-40% CAGR during the same period. This optimistic outlook is supported by the company’s extensive investments in capacity expansion and technology leadership. TSMC plans to increase its capital expenditures to $38 billion–$42 billion in 2025, with approximately 70% allocated to advanced process technologies and the remainder focused on specialty technologies, advanced packaging, and testing capabilities.

Operationally, TSMC continues to expand its global footprint. The company’s first Arizona fab began volume production of N4 process technology in late 2024, with the second Arizona fab and a third fab in the planning stages. Additionally, its Kumamoto fab in Japan started production in late 2024, and a second specialty fab is under development. TSMC also announced progress on its European fab in Dresden, Germany, which will focus on automotive and industrial applications. Despite higher costs associated with overseas fabs, TSMC assured investors of its commitment to maintaining a long-term gross margin of 53% or higher, aided by its operational efficiency and pricing strategies.

While geopolitical risks remain a concern, particularly with regard to China, TSMC’s management emphasized that recent U.S. export restrictions on advanced chips are expected to have a manageable impact. Moreover, the company has expressed confidence in its partnership with the U.S. government and its ability to secure support under the CHIPS Act. CEO C.C. Wei highlighted TSMC’s critical role in enabling global semiconductor supply chains and its commitment to delivering sustainable and profitable growth for shareholders.

With a strong quarter behind it, TSMC’s strategic focus on AI, HPC, and advanced technology leadership positions it well for continued success. The company’s robust financial performance, coupled with its forward-looking investment in leading-edge technologies and global expansion, underscores its dominance in the semiconductor industry. As shares trade at approximately 19.8 times projected 2025 earnings with a dividend yield of 1.3%, TSMC presents a compelling case for growth-oriented investors, despite lingering geopolitical risks.

Trends this week:

Sonos Inc ($SONO):

Sonos is undergoing a significant leadership overhaul as it seeks to recover from the fallout of a disastrous app redesign and regain its standing in the competitive audio technology market. This week marked a sea change for the company, beginning with the sudden departure of CEO Patrick Spence, who had been at the helm since Sonos went public in 2018. Spence was replaced by interim CEO Tom Conrad, a longtime board member with extensive experience in product and technology roles at Pandora, Snap, and Quibi. Conrad’s temporary appointment signals a concerted effort by the board to reset the company’s trajectory while searching for a permanent leader.

The leadership shakeup did not stop there. Chief Product Officer Maxime Bouvat-Merlin, who had been with the company since 2023, also exited this week, with the role being eliminated entirely. Conrad has assumed direct oversight of the product organization, citing his own product and technology background as a reason to streamline leadership. The changes reflect Sonos’ acknowledgment of the central role that poor product decisions played in the company’s recent struggles. Notably, Bouvat-Merlin had faced criticism for his role in the botched app rollout and subsequent internal reorganizations that disrupted longstanding team dynamics.

Adding to the upheaval, Chief Commercial Officer Deirdre Findlay has announced plans to leave the company, though her departure timeline remains uncertain. Findlay, who oversaw marketing, customer experience, and go-to-market strategies, had come under scrutiny for overseeing high-profile yet ineffective marketing campaigns, such as an expensive New York City subway campaign for Sonos' Ace headphones. These campaigns failed to resonate with consumers as app-related issues overshadowed the company’s product lineup.

The root of Sonos' troubles dates back to May 2024, when it launched a redesigned mobile app touted as a major upgrade. However, the release was plagued with bugs, missing features, and accessibility issues, sparking widespread customer backlash. Spence, who initially defended the app, later admitted the rollout had been mishandled and pledged to improve quality assurance processes. Despite these promises, Sonos experienced a 4% drop in annual revenue, significant layoffs, and a damaged reputation.

Interim CEO Conrad has taken swift action to address these issues and rebuild trust. His leadership has already boosted morale within the company, with employees expressing renewed optimism about Sonos’ commitment to returning to its core strengths. Conrad’s email to staff emphasized accountability and a renewed focus on delivering high-quality products and experiences.Conrad faces the challenge of stabilizing the company while navigating its recovery from last year’s missteps. Sonos remains committed to its app ecosystem and cloud-dependent products, which will require careful execution to regain customer loyalty. The board’s recent moves demonstrate a clear mandate to prioritize innovation and financial performance while reinforcing the company’s position in the competitive audio hardware market.

These leadership changes mark a pivotal moment for Sonos. With a seasoned interim CEO at the helm and a clear focus on correcting past mistakes, the company is taking decisive steps to repair its reputation and chart a path forward. The coming months will reveal whether these changes are enough to restore customer confidence and set Sonos back on a growth trajectory.

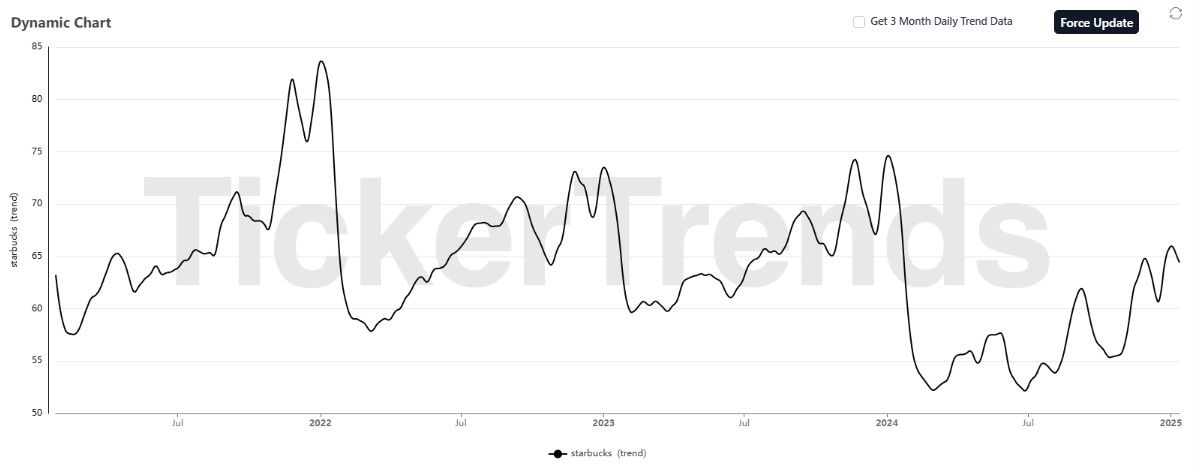

Starbucks ($SBUX):

Starbucks has sparked significant debate this week with its decision to reverse its 2018 open-door policy, which allowed anyone to use its restrooms and store spaces without making a purchase. The move, effective January 27, represents a dramatic shift in the company's approach to its role as a community hub, often seen as a "third place" outside of home and work. The reversal comes after years of navigating the complexities of balancing inclusivity, customer experience, and safety concerns.

Initially implemented following a public relations crisis in 2018—when two Black men were arrested at a Philadelphia Starbucks while waiting for a business meeting—the open-door policy was heralded as a progressive step toward inclusivity. It allowed non-paying visitors to use Starbucks facilities, addressing broader concerns about racial bias and access to public spaces. However, in recent years, the policy has faced mounting challenges. Employees and customers reported instances of unruly behavior, including drug use and disruptions that compromised safety and detracted from the store atmosphere. In 2022, Starbucks closed 16 stores in major cities due to safety concerns, a decision that underscored the difficulties of managing open access.

Under its new code of conduct, Starbucks will now limit the use of its spaces to paying customers. The rules, which will be prominently displayed in company-owned North American locations, prohibit not only the use of facilities without a purchase but also behaviors such as smoking, vaping, drug use, and panhandling. Starbucks spokesperson Jaci Anderson framed the changes as necessary to prioritize paying customers and improve the overall environment in stores, aligning with broader industry trends where similar policies are already in place. To offset some criticism, Starbucks will introduce perks like free coffee refills for customers who choose to stay in-store, with drinks served in reusable or personal cups.

The decision has reignited discussions about the broader issue of public bathroom access—or the lack thereof—in the United States. With only eight public toilets per 100,000 people, far fewer than countries like Iceland and Switzerland, Americans have increasingly relied on private businesses like Starbucks for restroom access. Critics argue that this privatization of a basic public need disproportionately affects marginalized communities, delivery drivers, and those experiencing homelessness, forcing many to resort to humiliating or unsanitary alternatives.

Starbucks' new policy reflects a growing trend among businesses toward prioritizing efficiency and profitability over fostering a community-oriented atmosphere. Over the years, the coffee giant has shifted its focus, with 70% of its U.S. locations now featuring drive-thrus, a model that emphasizes convenience over the leisurely in-store experience the brand once championed. This evolution has raised concerns about the decline of "third places," which sociologist Ray Oldenburg described as essential spaces for social connection and community well-being.

While Starbucks’ decision has drawn criticism for its potential social impact, it also highlights the broader failure of public infrastructure to address basic human needs. Advocates hope this moment will spur cities and states to invest in public restrooms, pointing to successful models like Portland, Oregon’s "Portland Loo," a self-cleaning, accessible facility. Without such investments, however, Starbucks’ policy change risks exacerbating inequities and leaving many with even fewer options.

Under the leadership of CEO Brian Niccol, who joined from Chipotle, Starbucks is attempting to revitalize its brand and recapture its identity as a welcoming coffeehouse. However, this balancing act between creating a safe, controlled environment and serving as a community resource underscores the challenges of aligning corporate goals with public expectations in a rapidly changing cultural and economic landscape. Whether this policy shift will achieve Starbucks’ aim of improving customer experience remains to be seen, but it undeniably reflects the tension between private enterprise and public responsibility in modern America.

Capital One Financial Corp ($COF):

Capital One customers have been grappling with significant disruptions after a technical outage involving a third-party vendor, Fidelity Information Services (FIS), began early Thursday, January 16. The issue, which has impacted account services, deposits, and payment processing, has caused delays for consumers, small businesses, and commercial banking customers. Despite the bank’s assurance that systems were gradually being restored, the outage extended into its third day, leaving many customers unable to access funds, view transactions, or make payments.

By Friday afternoon, reports of outages on platforms like Downdetector showed some improvement, dropping from nearly 4,000 in the morning to approximately 2,800 by mid-afternoon. However, the frustration among customers has been palpable. Many took to social media to vent their concerns, with some sharing stories of not receiving paychecks or being unable to access essential services. Capital One responded to customer complaints on social platforms, repeatedly apologizing and emphasizing their efforts to resolve the issue “around the clock.”

The financial institution initially projected that most services would be restored by Friday morning, but by Saturday, January 18, the company acknowledged the delay. In a public statement, Capital One announced “substantial progress” in resolving the issue, claiming full functionality for most accounts while continuing to work on restoring service for remaining customers. The bank also reassured customers that accounts remained secure and pledged to cover “all reasonable fees” incurred due to the outage.

This outage adds to an already challenging period for Capital One, which is facing a $2 billion lawsuit from the Consumer Financial Protection Bureau (CFPB). The federal watchdog accuses the bank of misleading customers by not notifying them of higher interest rate account options, potentially costing millions of account holders significant earnings. Capital One has refuted the claims and promised to fight the charges in court.

The timing of the outage couldn’t be worse for the financial giant, as it coincides with broader criticisms of corporate accountability in the banking sector. Customers expressed concerns not only about the immediate inconvenience but also about the potential long-term impact on trust in the institution. Some customers lamented the challenges of depending on large banks for essential services, with several pointing out the lack of updates during critical periods of the outage.

Capital One’s public messaging has aimed to reassure its customers, but the incident highlights vulnerabilities in modern banking systems reliant on external service providers. The company’s acknowledgment of the issue’s severity and promise to cover fees offers some relief, but it remains to be seen how this disruption will affect the bank’s reputation and customer loyalty in the long run.

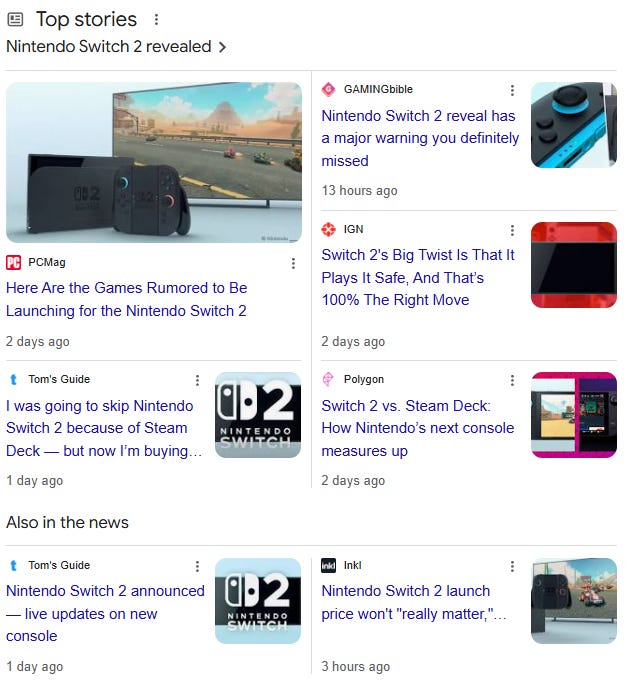

Nintendo Co., Ltd. ($7974.T):

The Nintendo Switch 2 has been officially announced, putting to rest months of speculation and rumors about the next iteration of Nintendo’s popular hybrid console. Revealed through a short trailer, the Switch 2 builds on the successful formula of its predecessor, combining the hybrid handheld-home console design with new features, improved hardware, and backward compatibility for most games from the original Switch. The console aims to refine rather than reinvent the gaming experience, signaling a shift in Nintendo's strategy toward enhancing what already works.

The Switch 2 comes with upgraded hardware that positions it closer to the performance of the PlayStation 4 Pro, promising smoother gameplay, better graphics, and improved frame rates. Its refined design includes a U-shaped stand for tabletop play, magnetic Joy-Con connections, and additional USB-C ports, all while retaining the versatile hybrid model that allows players to transition seamlessly between docked and handheld modes. Backward compatibility is a major feature of the Switch 2, ensuring that most games from the original Switch library will work on the new system. However, Nintendo has acknowledged that certain titles may not be fully compatible, sparking some concerns among fans.

Pricing for the Switch 2 has not been confirmed, but industry analysts widely predict it will launch at $400. This price is considered a sweet spot for balancing affordability with the console’s upgraded features. Some experts suggest the price could rise to $500 if demand and supply constraints allow Nintendo to capitalize on early adopters. Preorders have already begun in limited regions, and with demand expected to be high, securing a unit early is recommended.

The reveal trailer teased a few key games for the Switch 2, including a new Mario Kart title with expanded features like 24-player races. The highly anticipated Metroid Prime 4: Beyond is also in development, alongside speculation about a new 3D Mario game and sequels to dormant franchises such as F-Zero. Backward compatibility with the original Switch library ensures a robust game lineup at launch, though some peripheral-dependent titles, such as 1-2 Switch and Nintendo Labo, may not be supported. Enhanced hardware capabilities are also expected to improve the performance of existing games, offering shorter load times and better visuals.

Nintendo’s decision to focus on incremental improvements rather than radical innovation marks a significant strategic shift. Unlike the Wii and Wii U, which relied on unique gimmicks to stand out, the Switch 2 prioritizes refining the core features that made the original console a success. This approach ensures a smoother transition for existing Switch owners while appealing to both casual and hardcore gamers.

Despite the excitement surrounding the announcement, some concerns remain. The acknowledgment that certain games may not be compatible raises questions about the completeness of the backward compatibility feature. Additionally, the durability of magnetic Joy-Con connections and the reliance on flash cartridges have been points of discussion. Price sensitivity is another potential hurdle, as a launch price above $400 could limit the console’s accessibility to a wider audience.

Nintendo will provide more details about the Switch 2 during a dedicated Nintendo Direct on April 2, 2025. This event is expected to showcase additional games, technical specifications, and possibly the console’s release date. The Switch 2 is anticipated to launch later in the year, likely in time for the holiday season.

The Nintendo Switch 2 represents a calculated evolution of its predecessor, addressing hardware limitations and maintaining the core elements that made the original console a massive success. While it may lack the revolutionary gimmicks of past Nintendo systems, its focus on refinement positions it as a strong contender in the next generation of gaming. For longtime fans and newcomers alike, the Switch 2 is set to deliver another memorable chapter in Nintendo’s storied history.

Mattel Inc ($MAT):

A limited edition Barbie honoring Aaliyah sold out within hours of its release on what would have been the late R&B singer’s 46th birthday. The collectible doll, part of Mattel’s Barbie Music Series, pays tribute to the legendary artist whose life was tragically cut short at 22 in a plane crash on August 25, 2001, shortly after filming the music video for her song “Rock the Boat.”

Retailing at $55, the Aaliyah Barbie was initially available through Mattel Creations, a platform for collectible items, and was exclusive to subscription-paying Barbie collectors. It was also listed on Target’s website, where preorders quickly sold out, though more will become available on January 26. The doll is additionally listed on Amazon’s UK site. This overwhelming demand underscores the enduring fascination with Aaliyah and her music, which has continued to captivate fans more than two decades after her passing.

The doll’s design draws inspiration from Aaliyah’s music video for “One in a Million,” showcasing her iconic style with black faux-leather pants, a crop top, a zipped vest, detached sleeves, and signature statement shades. A collaboration between the Barbie Design team and Aaliyah’s brother, Rashad Haughton, ensured the doll authentically reflected her essence and legacy. Haughton expressed in a press release how his sister’s childhood love for Barbie dolls was an early expression of her dreams, stating, “She would make them sing, dance, and perform little concerts… My sister would be ecstatic to see her legacy celebrated this way, empowering fans to dream big and believe they can be anything their hearts desire.”

Krista Berger, senior vice president of Barbie, highlighted Aaliyah’s transformative impact on the R&B genre and the music industry in the 1990s, calling it an honor to celebrate her in the Barbie Signature Music Series. This series also includes tributes to other musical icons such as Stevie Nicks, Gloria Estefan, and Tina Turner.

Born in Brooklyn and raised in Detroit, Aaliyah rose to fame with her debut single “Back and Forth” in 1994. Over her career, she released four albums, three of which went platinum posthumously. Her influence on music and fashion remains significant, and this commemorative Barbie cements her legacy, ensuring her impact continues to inspire future generations. Fans still have a chance to secure the collectible when it returns for sale at Target later this month.

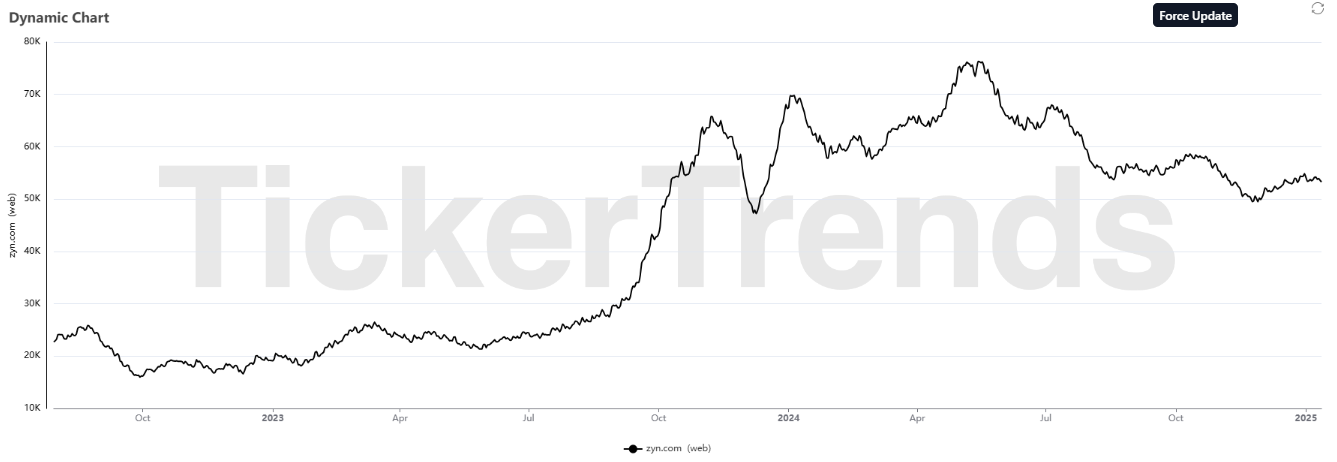

Philip Morris International Inc. ($PM):

The FDA has authorized the marketing of 20 ZYN nicotine pouch products, making them the first nicotine pouches to receive such approval in the U.S. This decision, following an extensive scientific review, underscores that ZYN pouches pose a lower risk of cancer and other serious health conditions compared to cigarettes and traditional smokeless tobacco products. The authorization comes with strict conditions aimed at reducing youth exposure, though it does not classify the products as "safe" or "FDA approved." ZYN, owned by Philip Morris International (PMI) through its acquisition of Swedish Match, has seen explosive growth in popularity, driven by online communities and user testimonials. However, this growth has been accompanied by lawsuits, regulatory scrutiny, and political attention due to concerns about youth use and marketing practices.

For PMI, ZYN is a central part of its strategy to transition to a smoke-free future, with the company projecting the U.S. nicotine pouch market to triple by 2030. While the FDA approval strengthens PMI’s market position, challenges remain, including supply chain constraints, legal risks, and potential regulatory actions against flavored nicotine products. Lawsuits alleging health risks and marketing practices targeting youth add further pressure, echoing past legal troubles faced by Altria with Juul. These risks could temper PMI’s ability to fully capitalize on ZYN’s success.

The implications for Turning Point Brands (TPB) and its ALP nicotine pouches, a new entrant launched in partnership with Tucker Carlson, are notable. While ALP positions itself as a "moist" alternative to ZYN with politically charged branding aimed at conservative consumers, it lacks FDA approval. This regulatory gap could limit ALP’s ability to compete effectively and expose it to legal and enforcement challenges, particularly in an environment where the FDA is increasingly cracking down on unauthorized nicotine products. ALP’s niche marketing strategy could carve out a segment of the market, but without FDA authorization, it faces significant hurdles.

Overall, ZYN’s FDA authorization consolidates its market leadership and enhances its competitive edge, potentially leaving limited room for new entrants like ALP. Turning Point Brands may leverage ALP’s unique branding to attract a loyal customer base, but its growth prospects are constrained by the lack of regulatory clearance and heightened scrutiny of nicotine products. Both companies operate in a challenging and tightly regulated market, where compliance and public health concerns are critical to long-term success.

Duolingo Inc ($DUOL):

The looming TikTok ban, to be decided by the U.S. Supreme Court, has led to unexpected ripple effects, including a surge in American users flocking to the Chinese social app Xiaohongshu, known as RedNote. This migration has spurred a spike in Mandarin learners on Duolingo, with the language-learning platform reporting a 216% increase in new U.S. users studying Mandarin compared to last year. The irony of TikTok users moving to another Chinese-owned platform highlights their defiance of U.S. concerns about data security.

RedNote, now the most downloaded free app on Apple’s App Store, has seen a 200% year-over-year increase in downloads and welcomed over 700,000 new users within two days. Duolingo’s playful marketing campaign, including posts addressing "TikTok refugees," has amplified this trend. Shares of Duolingo have jumped, reflecting the company’s success in capitalizing on the cultural and technological shifts driven by the impending TikTok ban.

While Duolingo and RedNote benefit from the fallout, the migration underscores the complexities of the U.S. legislation targeting foreign-owned apps. The "Protecting Americans from Foreign Adversary Controlled Applications Act" enables restrictions on platforms deemed security threats, raising the possibility that RedNote could face similar scrutiny. Despite the controversy, TikTok users’ willingness to embrace RedNote and learn Mandarin reflects a mix of spite and adaptability, reshaping the digital and cultural landscape.