What's Trending with TickerTrends #3

Your regular monitor for interesting social arbitrage ideas.

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

1. Netflix ($NFLX):

Netflix's third-quarter earnings report highlights the company's robust financial performance and strategic positioning in the competitive streaming industry. The company surpassed Wall Street expectations by adding 5.1 million subscribers, bringing its global subscriber base to 282.7 million. This growth outpaced the anticipated 4 million additions, signaling strong user engagement and content appeal. However, it's worth noting that this figure is lower than the 8.76 million subscribers added in the same quarter last year, indicating a slowing pace of growth in an increasingly saturated market.

Financially, Netflix reported revenue of $9.83 billion, slightly exceeding analyst forecasts of $9.76 billion, and a significant increase from the previous year. The operating income rose to $2.91 billion, contributing to an impressive operating margin of 30%, up from 22% a year earlier. Earnings per share also surpassed expectations, reaching $5.40 against the projected $5.12. These figures reflect Netflix's effective cost management and its ability to drive profitability even as market competition intensifies.

Content-wise, Netflix continues to invest heavily in original programming to enhance the variety and quality of its offerings. The company reports healthy engagement levels, with an average viewing time of two hours per day per member. The anticipation of popular shows returning, such as "Squid Game" Season 2 in late December, is expected to boost subscriber growth in the upcoming quarter. Additionally, production volumes are rebounding following disruptions caused by last year's industry strikes, suggesting a stronger content pipeline moving forward.

On the advertising front, Netflix's ad-supported tier is gaining traction, accounting for over 50% of new sign-ups in countries where it is available. While the company views advertising as a significant growth area, it does not expect it to become a primary revenue driver until 2026. Netflix aims to reach critical ad subscriber scale in all supported countries by 2025, reflecting a gradual but strategic expansion in this segment. Netflix's expansion of its lower-priced, ad-supported tier may attract cost-conscious consumers amid economic uncertainties. This strategy could potentially increase its market share as consumers seek more affordable entertainment options.

Netflix continues to prove its solid position in the streaming industry. The company is focusing on content expansion, cautious growth of its advertising model, and selective pricing adjustments to sustain its growth and profitability. With a promising content lineup and strategic plans in place, Netflix appears well-prepared to maintain its competitive edge.

2. Procter & Gamble ($PG):

Procter & Gamble (P&G) reported its fiscal year 2025 first-quarter results, highlighting a mixture of strong performance in key markets and challenges in certain regions and categories. The company posted net sales of $21.7 billion, a slight decrease of 1% compared to the prior year. However, organic sales—which exclude the impacts of foreign exchange and acquisitions and divestitures—increased by 2%, driven by a 1% rise in both volume and pricing. Core earnings per share (EPS) grew by 5% to $1.93, despite a 12% decrease in diluted net EPS to $1.61 due to higher non-core restructuring charges related to the substantial liquidation of operations in markets like Argentina.

North America exhibited robust growth with a 4% increase in organic sales, propelled by a 4-point volume growth and broad-based market share gains. Europe also showed strength, with organic sales growth of 3% and a 4-point volume increase. The company achieved a 30 basis point improvement in core operating margin, supported by a significant productivity enhancement of 230 basis points. P&G returned nearly $4.4 billion to shareholders, including over $2.4 billion in dividends and over $1.9 billion in share repurchases.

However, the company faced challenges in Greater China, where organic sales declined by 15% due to weakened market conditions and brand-specific headwinds.. The Asia-Pacific, Middle East, and Africa regions experienced soft market conditions, with organic sales down in the low single digits. The baby care segment is under pressure from declining birth rates, necessitating innovation to regain growth in this category.

P&G maintained its fiscal year 2025 guidance ranges, expecting organic sales growth of 3% to 5% and core EPS growth of 5% to 7%, translating to a range of $6.91 to $7.05 per share. The company anticipates a commodity cost headwind of approximately $200 million after tax, equating to $0.08 per share, which will impact its fiscal 2025 outlook. P&G plans to return $16 billion to $17 billion to shareholders during the fiscal year, including $10 billion in dividends and $6 billion to $7 billion in share repurchases.

P&G is navigating challenging conditions in certain international markets, particularly China and the Middle East, where economic volatility and consumer demand fluctuations are affecting performance. The company acknowledges these challenges but emphasizes the stability and growth in its core markets—North America and Europe—which constitute 85% of its sales. P&G is focusing on innovation and superiority across its product lines to drive future growth, with plans for strong innovation in the second half of the fiscal year.

Management expressed confidence in the stability of the majority of its business, citing consistent growth and positive market share trends in key regions. The company's strategic initiatives, including serving underrepresented consumer groups and leveraging innovation to drive market growth, are expected to contribute to sustained performance.

Trends this week:

1. Victoria’s Secret & Co ($VSCO):

Victoria's Secret was trending across on social media platforms due to the return of its fashion show after almost a 5 year hiatus. The show was headlined by Cher, Tyla and the Hadid sisters.

The show took place in New York on October 15 and was focused on inclusive values. This was a significant shift for the brand, which had previously canceled its shows due to backlash.

The show was mostly a success as it garnered over 25M views on Youtube alone and increased their YouTube subscriber base by over 800,000.

The company also saw its TikTok following surging 140% in 30 days and the likes on their posts increasing by over $49M over the same period.

Despite the show's significant traction, it has faced criticism from viewers disappointed by its simplicity and lack of flamboyance. While this is not ideal, the show's success is likely to attract a new subset of consumers who were previously unaware of the brand and had never shopped there. By keeping the brand at the forefront of consumers' minds, the show could lead to a surge in sales just before the most important quarter of the year.

Victoria's Secret has faced significant backlash in recent years, with many consumers hesitant to shop there due to controversies surrounding its former CEO and ties to Jeffrey Epstein, as well as criticisms over its lack of inclusivity. However, the new direction of the brand, as showcased in the recent show, reflects a more inclusive and modern approach, which could help rebuild its reputation and win back customers.

The show, despite lacking flamboyance, featured products that were not overly extravagant but practical and accessible, making them appealing to a wider audience. Additionally, the integration with Amazon offers a seamless shopping experience, allowing viewers to easily purchase the featured items, which could further drive sales and contribute to a stronger performance in the upcoming quarter.

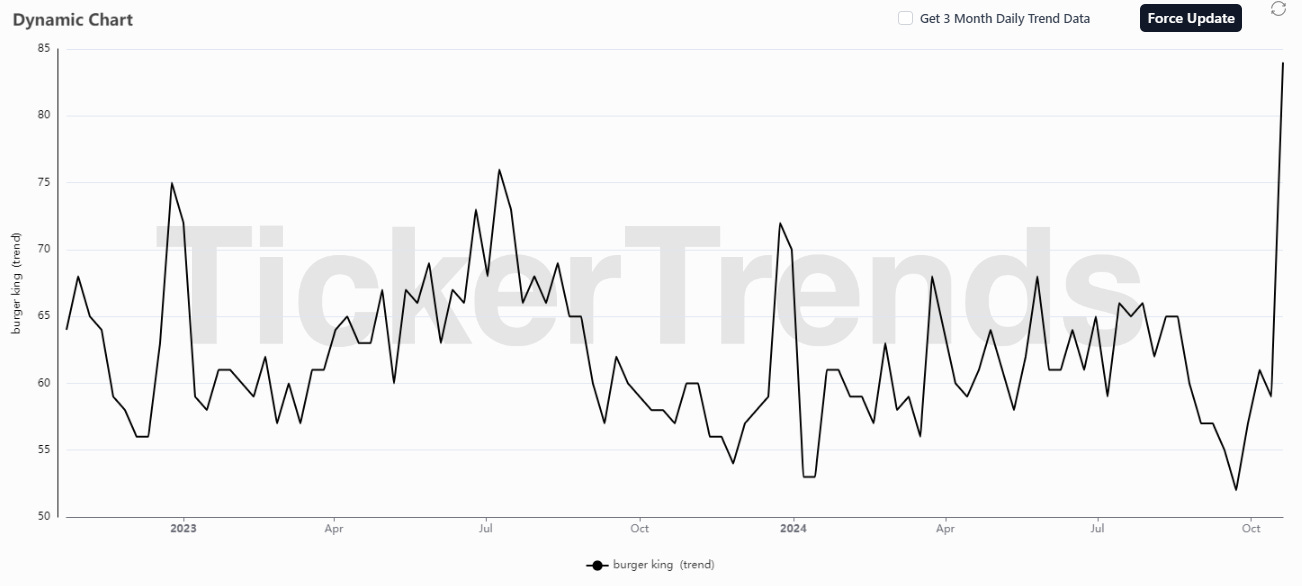

2. Burger King ($QSR):

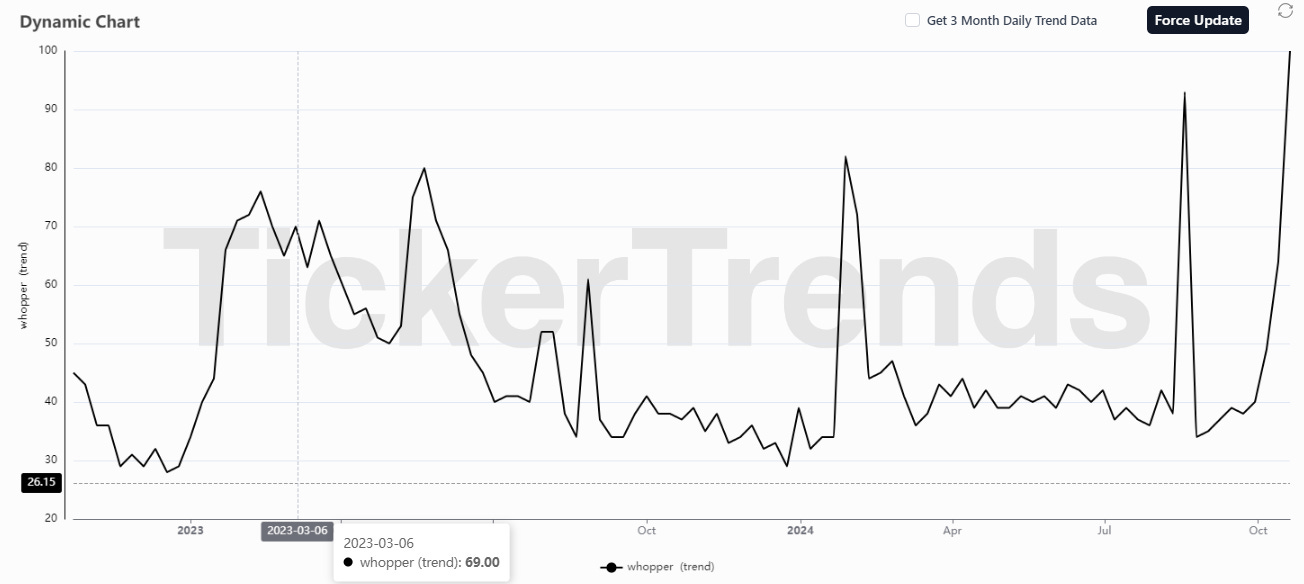

Burger King is going viral this week with its Addams Family collaboration, featuring a limited-edition menu timed perfectly for Halloween. The highlight of the offering is the Wednesday Whopper, a twist on the classic Whopper with a striking purple bun inspired by The Addams Family animated films. This collaboration has caught the attention of fast-food enthusiasts and Addams Family fans alike, with social media buzzing about the burger's vibrant look and the nostalgic connection to both the Halloween season and the characters.

While the Wednesday Whopper’s taste remains consistent with the standard Whopper, the visual appeal of the purple potato bun has captivated customers, driving conversations online.

This collaboration could present a major opportunity for Burger King. The Addams Family-themed menu, with items like Thing’s Rings and Gomez’s Churro Fries, has sparked a lot of curiosity and engagement across social platforms, contributing to an uptick in search trends. As the buzz continues to grow, the promotion aligns with the power of seasonal and pop culture tie-ins to drive consumer interest. With the integration of deals like the Buy-One-Get-One for Royal Perks members, Burger King is capitalizing on this viral moment, potentially translating social media excitement into real sales. As consumer conversations and content-sharing build momentum, Burger King’s marketing strategy showcases a well-executed social arbitrage play, leveraging nostalgia and timely pop culture to engage new and existing customers.

3. Bath & Body Works, Inc. ($BBWI):

Bath & Body Works (BBWI) has found itself at the center of a backlash this week following the release of its holiday-themed candle, Snowed In, which many online users claimed bore an uncanny resemblance to Ku Klux Klan hoods. The paper snowflake design on the candle's label was widely criticized on social media, with some referring to it as the "Klandle" due to its likeness to the infamous white hoods worn by the KKK. In response to the uproar, BBWI quickly removed the product from both its stores and website, issuing a public apology and stressing that the design was unintentional.

Despite the company's swift response, the incident has sparked a larger conversation, with some customers questioning how the design passed quality checks, while others have brushed it off as an overreaction. Resale listings for the candle have emerged on platforms like eBay, with some sellers asking up to $350 for the now-pulled product. Given that nearly 40% of Bath & Body Works’ annual sales come from its holiday-themed candles, this controversy could potentially affect the company’s reputation and sales during the crucial holiday shopping period, even as they work to manage the fallout.

The impact of this incident on BBWI’s broader consumer base remains uncertain. It is important to note that candles make ~ 40% of the total revenue for $BBWI. The company’s quick decision to remove the product and apologize might help mitigate long-term damage, but the timing could hurt sales as the holiday season kicks off.

Bath & Body Works has historically been a go-to retailer for festive products, and while loyal customers may overlook the controversy, the negative press could deter some shoppers. The company's handling of this situation and its ability to restore consumer confidence will be key in determining whether this backlash leads to a temporary hiccup or a longer-lasting effect on the brand’s performance.

4. Robinhood ($HOOD):

Robinhood announced it is expanding its offerings with a new tool aimed at more sophisticated traders. The company unveiled Robinhood Legend, a desktop-based platform designed for active traders, which features advanced charting tools for detailed stock analysis. This move reflects Robinhood's intention to cater to traders seeking more comprehensive and efficient platforms, as the current landscape has left some users frustrated with legacy trading tools.

In addition to launching Robinhood Legend, the company announced plans to soon introduce futures trading and index options to its mobile platform, with these features also expected to be integrated into Legend in the future. The addition of more advanced trading tools mark Robinhood’s continued efforts to diversify beyond its initial focus on small-dollar retail traders, which gained prominence during the "meme stock" surge of 2021. Customers will need to receive approval to trade futures, and these new offerings demonstrate Robinhood’s push to attract more seasoned traders to its platform.

These new product announcements, revealed at the HOOD Summit, reflect Robinhood's ongoing efforts to broaden its customer base and maintain relevance in the increasingly competitive brokerage space. The firm’s next earnings report, scheduled for October 30, will provide further insight into the impact of these recent expansions and the platform’s future trajectory.

5. Dominion Energy ($D):

Dominion Energy’s partnership with Amazon to develop Small Modular Reactors (SMRs) marks a yet another pivotal moment for both nuclear energy and the broader clean energy transition. As global energy demands grow and the push for carbon-free solutions intensifies, Dominion Energy’s leadership in advanced nuclear technology could position the company at the forefront of sustainable energy. This collaboration with Amazon reflects a growing recognition that nuclear power, particularly through the deployment of SMRs, will play a crucial role in meeting future energy needs while maintaining a carbon-free grid.

Unlike traditional nuclear reactors, SMRs are more flexible, quicker to build, and can be integrated closer to demand centers, making them an ideal solution for meeting localized energy needs while reducing emissions.

This development could also have significant implications for nuclear-focused ETFs like URNM (North Shore Global Uranium Mining ETF) and URA (Global X Uranium ETF). As SMRs become a viable energy solution, demand for uranium is expected to increase, benefiting companies involved in uranium mining, fuel production, and nuclear infrastructure. Both URNM and URA, which track companies engaged in uranium and nuclear energy, could see heightened interest from investors as the push for advanced nuclear technologies accelerates.

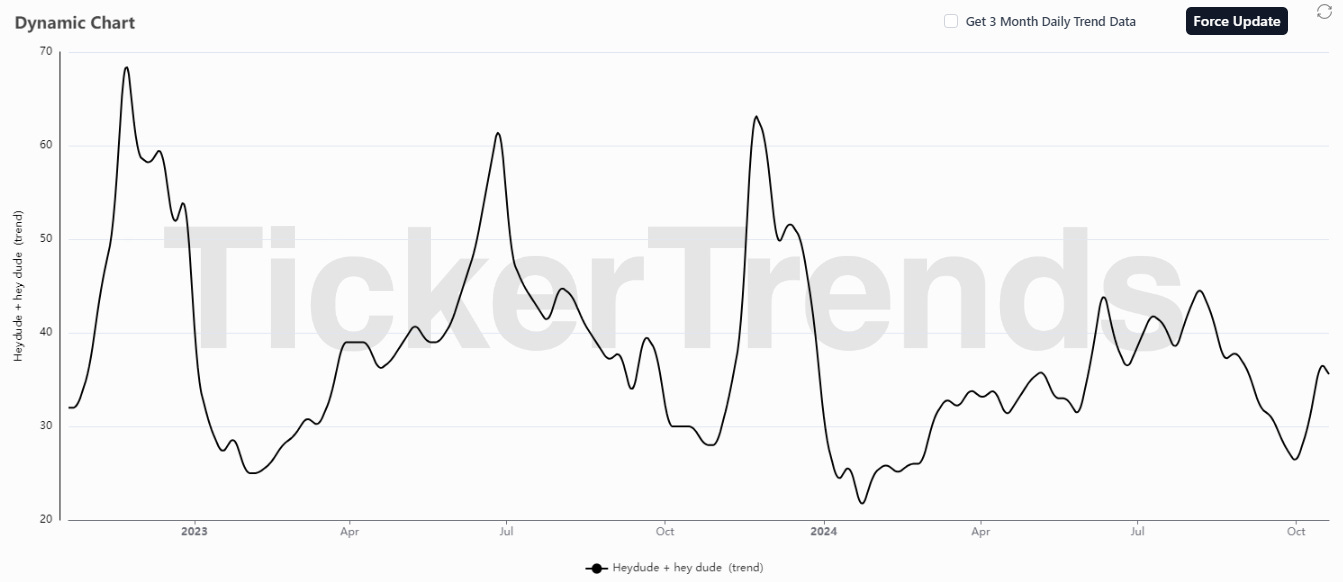

6. Hey Dude ($CROX):

Over the past six months, the Hey Dude has onboarded a new brand president and chief marketing officer, launched high-profile collaborations, and entered into long-term partnerships with key celebrities. Notably, Sydney Sweeney, the actress and producer, has become a prominent spokesperson for the brand, and Hey Dude recently teamed up with country star Jelly Roll for a limited-edition collection that sold out within minutes.

The brand heads into 2025 with a strategy focused on leveraging partnerships and unexpected collaborations. According to Paul Nugent, Hey Dude’s chief marketing officer, the goal is to surprise consumers by showing up in spaces they wouldn’t typically associate with the brand. For example, its presence at New York Fashion Week and the partnership with Sydney Sweeney are key examples of this approach. The Sweeney campaign has been Hey Dude’s most successful content launch on Instagram, while its TikTok following has now outpaced Instagram, highlighting the brand’s growing appeal among younger audiences.

Product-wise, Hey Dude continues to focus on its most popular silhouettes, the Wally and Wendy. The brand recently introduced the Comf collection, a comfort-focused upgrade to these classic styles, and just launched Wendy/Wally slippers, sherpa-lined versions of their iconic models. Sydney Sweeney will be featured in the campaigns promoting these new slippers, helping to introduce the product in a fresh context.

Despite the positive momentum the search data for Hey Dude remains weak for now. It would be interesting to see if the new strategy can lead to more demand for the company’s products. Hey Dude’s success is paramount for $CROX as the stock has been under pressure due to the underperformance by the brand.

7. Kellanova ($K):

Kellogg's is facing significant backlash and protests over its continued use of artificial dyes in popular cereals like Froot Loops and Apple Jacks, despite having previously pledged to remove these additives by 2018. The protests, which took place outside the WK Kellogg headquarters in Michigan, were driven by health activists, parents, and nutritionists, with many expressing concerns over the potential harmful effects these food dyes may have on children. While Kellogg's has removed artificial colors from its products in countries like Canada, where Froot Loops are made with natural fruit juice concentrates, the U.S. versions of these cereals still contain controversial dyes like Red 40, Yellow 5, and Blue 1, along with the chemical preservative BHT.

The growing scrutiny has been amplified by California's new School Food Safety Act, which bans several of the dyes used in Froot Loops and Apple Jacks from being served in public schools, citing potential links to hyperactivity and other neurobehavioral issues in children. This has fueled additional pressure on Kellogg's, with over 400,000 signatures being delivered to the company, calling for the removal of these additives from their U.S. products. High-profile food activists, including Vani Hari, have been vocal about the health risks these artificial ingredients pose, accusing Kellogg's of prioritizing short-term profits over the well-being of its consumers, particularly children.

As a result of this controversy, Kellogg’s reputation has taken a hit, and the company is now dealing with the potential of a consumer boycott and significant negative press. If the protests and media coverage continue to gain traction, this could lead to increased pressure on Kellogg's stock price, especially if consumers begin to turn away from its products. With competitors increasingly offering healthier alternatives free of artificial additives, Kellogg’s could see its market share erode, particularly in regions where consumer awareness and demand for natural ingredients are growing.

Additionally, ongoing bad press could harm Kellogg's ability to maintain consumer trust, particularly among health-conscious families, and could lead to a decrease in sales for some of its most popular products. If the company doesn’t take more aggressive steps to address these concerns, Kellogg's may face both financial and reputational consequences that could affect its standing in the competitive food industry.

8. Sonos Inc. ($SONO):

Sonos was trending in the audio world this week with the launch of its latest product lineup, including the Arc Ultra soundbar and Sub 4 subwoofer. The Arc Ultra is supposed to be a powerful upgrade to the original Arc, incorporating new technology from Mayht, a startup Sonos acquired in 2022. This cutting-edge Sound Motion transducer technology is being touted as one of the most significant advancements in audio engineering in nearly a century, promising a richer, more immersive sound experience than its predecessor.

This product launch is particularly notable given the recent app-related challenges that Sonos has faced. Earlier this year, Sonos delayed two product releases to focus on improving the performance of its revamped mobile app. However, the company now believes the company has reached a level of quality with the app that allows them to confidently introduce new products.

The Arc Ultra is generating considerable buzz, and for good reason. The original Arc earned high praise for its performance and has been a go-to recommendation for premium soundbars, especially for Dolby Atmos enthusiasts. However, with the release of the Arc Ultra, Sonos has confirmed that it will replace the original Arc entirely, prompting consumers to consider whether to upgrade or snag the original model at a discount, as prices for the first-generation Arc are already dropping.

For now, potential buyers are being advised to hold off on purchasing either the Arc Ultra or the discounted original Arc until reviews of the new model are in. The Arc Ultra may bring significant improvements, but if the first-generation Arc drops further in price, it could become an even better value option for those on a tighter budget. All eyes are now on how the Arc Ultra performs in real-world testing before consumers make their final decisions.

9. VF Corporation ($VFC):

Warped Tour is officially making its highly anticipated return in 2025 to celebrate its 30th anniversary, but with a twist. Unlike its traditional full-summer, cross-country tours, Warped Tour will only visit three cities next year: Washington, D.C., Long Beach, California, and Orlando, Florida. Fans have been eagerly awaiting this announcement, with the iconic punk and emo festival holding a special place in the hearts of elder emos and millennials. However, the limited dates and higher ticket prices have sparked mixed reactions from the community.

The return of the Warped Tour in 2025 could be a significant opportunity for Vans, which has long been associated with the iconic music festival. As the tour celebrates its 30th anniversary with stops in Washington D.C., Long Beach, and Orlando, it marks Vans' continued alignment with the punk, emo, and alternative music scenes that have shaped its brand identity. This three-city comeback could boost Vans' brand visibility, especially among the nostalgic millennial and elder emo crowds who grew up attending Warped Tour.

The partnership offers Vans the chance to reconnect with an audience that values authenticity and counter-culture, driving sales of its classic shoes and apparel, particularly as the festival embodies the rebellious spirit that Vans has always promoted. Moreover, Warped Tour’s emphasis on music and community engagement provides Vans with a platform to push its marketing efforts, leverage exclusive product collaborations, and expand its reach within youth subcultures.

Given the festival's enduring appeal and Vans' status as a sponsor, the 2025 Warped Tour could re-energize the brand, potentially resulting in increased demand and cultural relevance as Vans capitalizes on the tour’s massive fanbase. Additionally, the emotional connection tied to the event could spur higher engagement on social media, fueling Vans’ digital campaigns and brand awareness well beyond the live events.

10. Fubo ($FUBO):

Hulu's outage last week, which left tens of thousands of users frustrated and unable to stream live sporting events, has sparked significant backlash across platforms like X and Reddit. The outage, which occurred during key MLB playoff games, NFL, and college football broadcasts, led many users to express their dissatisfaction, with some even threatening to abandon Hulu altogether. The disruption came at a critical time for sports fans, and Hulu's inability to maintain service during these high-profile events resulted in a flurry of complaints, with over 82,000 reports on Downdetector. Users vented their frustration, with some going as far as threatening legal action, while others vowed to switch to competitors like Fubo or YouTube TV.

This negative press for Hulu could present a prime opportunity for Fubo to capitalize on. Fubo, a streaming service specifically tailored for live sports, is well-positioned to attract disgruntled Hulu subscribers who are seeking a more reliable option for streaming their favorite events. With Fubo’s current North American subscriber base under 1.5 million, even a modest influx of users could significantly bolster its growth. We can see this playing out already as Fubo has moved higher in the Top Ranked iOS apps by trumping Hulu.

The timing of this outage aligns perfectly with Fubo’s ongoing push to establish itself as a go-to platform for sports streaming. As more Hulu users contemplate switching services, Fubo's specialized sports focus and reliable streaming capabilities may offer exactly what these frustrated consumers are looking for. This situation could serve as a bullish catalyst for Fubo, allowing it to tap into a market of users actively seeking alternatives, further accelerating its growth trajectory in the live sports streaming space.

We did a deep dive on $Fubo this week. Paid subscribers can read about it here: https://tickertrends.substack.com/p/fubo-can-david-finally-slay-the-goliath-446.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.