What's Trending with TickerTrends #2

Your regular monitor for interesting social arbitrage ideas.

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

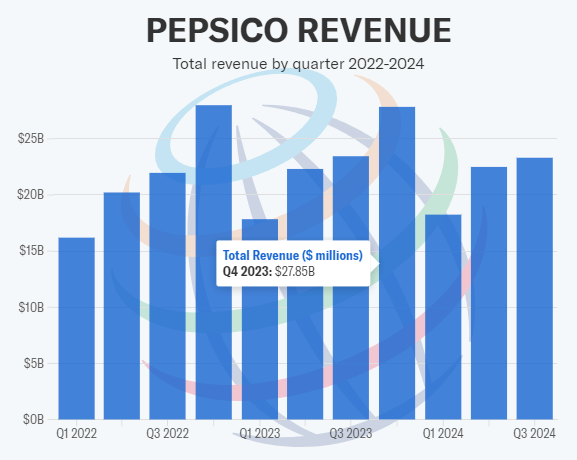

1. Pepsico ($PEP):

PepsiCo’s revealed mixed results in its Q3 2024 earnings report, with the company facing several challenges. PepsiCo slightly beat expectations on adjusted earnings per share, reporting $2.31 versus the $2.30 expected. However, revenue fell short, coming in at $23.3 billion, below the expected $23.8 billion. Organic revenue growth was also weaker than anticipated at 1.3%, compared to the projected 3%.

Key pressure points were found in PepsiCo’s North American segments—Frito-Lay, Quaker Foods, and Beverages—all of which underperformed due to price sensitivity among consumers amid inflation and rising borrowing costs. The snack business in particular faced a notable challenge, with volume declining 1.5% as higher pricing for snacks (up 40% since 2021) hurt demand.

Despite these struggles, PepsiCo's international business showed growth in markets like Southeast Asia, India, and Brazil, though that was offset by weaker performance in China. The company is also expanding into healthier options with brands like SunChips and PopCorners and announced a $1.2 billion acquisition of Siete Foods, a fast-growing Hispanic-focused snack brand, which could fuel future growth.

PepsiCo maintained its guidance for at least 8% EPS growth, which analysts see as impressive given the tough macro environment. However, lower sales guidance for the year signals ongoing challenges, particularly in North America.

2. Domino’s ($DPZ):

Domino's reported strong retail sales growth in the US, up 6.6% through the first three quarters of 2024, significantly outpacing the broader quick-service restaurant (QSR) pizza category, which grew by less than 2%. Same-store sales also saw a 3% increase in Q3 2024, marking four consecutive quarters of growth.

However, international performance was less robust, with 6.5% retail sales growth through the first three quarters, but only 0.8% same-store sales growth in Q3. Macro pressures and geopolitical issues have impacted international markets, leading the company to lower its guidance for global net store growth and same-store sales growth to 1-2% for 2024 and 2025.

Despite these challenges, Domino's maintained a strong operating profit growth of 8% year-to-date, excluding foreign exchange impacts. The introduction of new products, like Mac & Cheese, and continued innovation have been well-received, while the company’s focus on affordability with programs like Emergency Pizza 2.0 aims to address softness among lower-income customers in the delivery segment.

Looking ahead, Domino's is confident in achieving 3% US same-store sales growth in Q4, driven by a robust marketing strategy and upcoming product launches, including Emergency Pizza 2.0 and a new pasta offering. The company’s decision to expand its partnership to include DoorDash, alongside Uber, could also help boost sales, particularly as the aggregator channel grows.

3. JP Morgan ($JPM):

JPMorgan Chase reported strong financial performance in Q3 2024, with net income of $12.9 billion and earnings per share (EPS) of $4.37. Revenue grew by 6% year-on-year, reaching $43.3 billion. The bank also maintained a healthy 19% return on tangible common equity (ROTCE) and a solid capital position, with a CET1 ratio of 15.3%.

Despite the positive results, credit costs increased to $3.1 billion, driven largely by rising net charge-offs in card services, reflecting some challenges in the consumer credit environment. Expenses also increased by 4% year-on-year, primarily due to higher compensation and employee growth, potentially impacting future profitability.

The Consumer & Community Banking (CCB) segment saw a 3% decline in revenue year-on-year, while the Commercial & Investment Bank (CIB) and Asset & Wealth Management (AWM) segments delivered stronger results. Notably, AWM revenue was up 9%, achieving record quarterly revenues and significant asset growth, with assets under management (AUM) rising to $3.9 trillion, a 23% increase year-on-year.

JPMorgan’s share repurchase program remained active, with $6 billion in net common share repurchases during the quarter. However, management indicated caution regarding the deployment of excess capital, with a preference for patience in the current market environment.

Looking ahead, CFO Jeremy Barnum mentioned expectations of sequential declines in net interest income (NII) ex markets in Q4 2024, driven by the yield curve and stabilization in deposit balances. Expenses are expected to grow due to inflation and investments in areas like technology and private banking.

Overall, the company remains focused on disciplined capital deployment, long-term investments, and navigating a competitive environment in capital markets.

4. Wells Fargo ($WFC):

Wells Fargo reported solid results for Q3 2024, with net income of $5.1 billion and diluted earnings per share (EPS) of $1.42. The company demonstrated strong profitability, delivering a return on equity (ROE) of 11.7% and a return on tangible common equity (ROTCE) of 13.9%. Fee-based revenue grew by 16% during the first nine months of the year, reflecting successful revenue diversification efforts.

The company returned significant capital to shareholders, repurchasing $3.5 billion in common stock during the quarter and increasing its dividend by 14%. Wells Fargo also maintained a strong capital position, with a Common Equity Tier 1 (CET1) ratio of 11.3%.

However, challenges remain, particularly with average loan balances declining due to weak commercial loan demand and economic uncertainty. Net interest income (NII) fell by 2% quarter-on-quarter, impacted by increased pricing on sweep deposits and customers migrating to higher-yielding deposit products. Additionally, the commercial real estate office market remains weak, with expected charge-offs in this segment.

On the positive side, credit performance improved, with net loan charge-offs decreasing to 49 basis points of average loans, and the allowance for credit losses decreased by $50 million. Wells Fargo continues to make strategic investments in consumer and small business banking, leading to growth in checking accounts and mobile active users.

Looking ahead, Wells Fargo’s full-year 2024 NII is expected to decline approximately 9% compared to 2023, and expenses are projected to total around $54 billion. The company continues to focus on efficiency while balancing necessary investments in risk and regulatory areas.

Overall, Wells Fargo delivered strong results in Q3 2024 but faces headwinds from economic uncertainty, weak loan demand, and challenges in commercial real estate.

Trends this week:

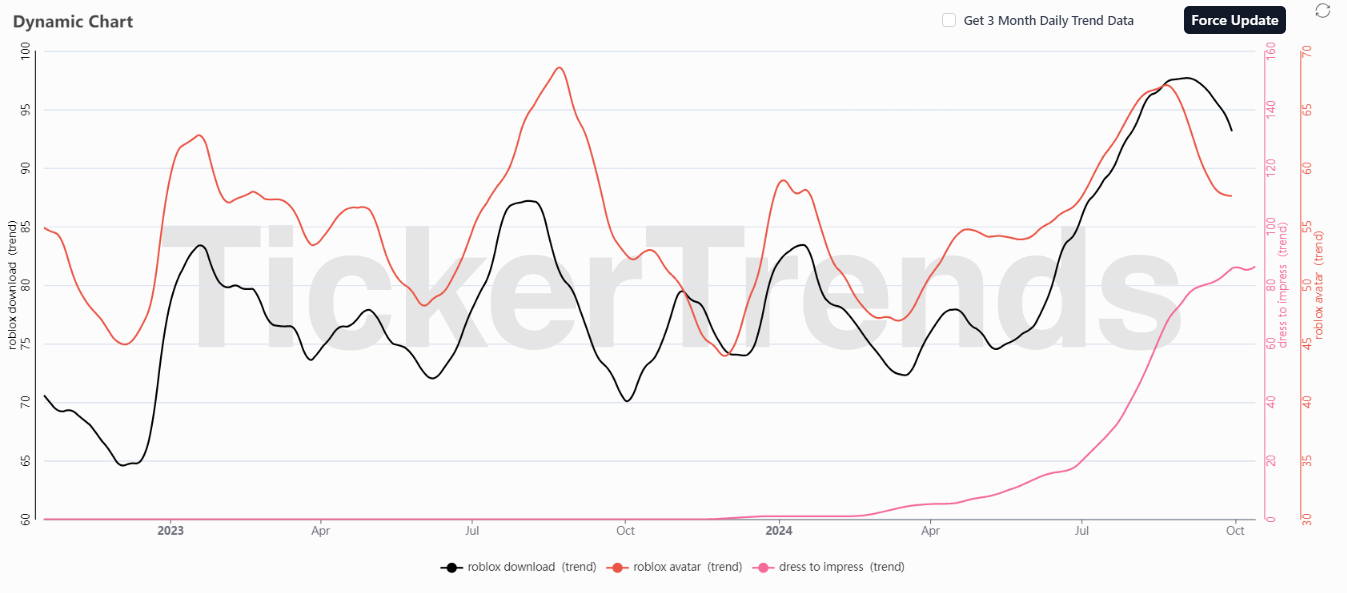

1. Roblox ($RBLX):

Roblox is facing serious allegations from a report by Hindenburg Research, which accuses the company of inflating key metrics like daily active users (DAUs) and failing to protect young users from inappropriate content. You can read the allegations here: https://x.com/HindenburgRes/status/1843633084421317019.

The report claims Roblox misleads investors by exaggerating user engagement by as much as 42%, with suggestions that bot accounts and multiple profiles per user inflate the platform's DAUs and engagement hours. Hindenburg also highlighted major safety concerns, describing the platform as unsafe for children, citing instances of sexual predators, inappropriate content, and poor moderation.

Roblox strongly refuted these allegations, labeling the report as "misleading" and emphasizing that Hindenburg is a short-selling firm with a vested interest in damaging the company’s reputation. Roblox explained that its DAU metrics are calculated based on unique registered accounts per day and clarified that their methodology reflects true platform engagement. The company also defended its commitment to safety, outlining the extensive trust and safety measures in place to protect users and maintain civility on the platform. They reiterated that millions of users experience the platform safely every day.

Roblox dismissed Hindenburg’s claims regarding user metrics as distortions and reaffirmed its efforts to ensure a safe environment for younger users, while pointing out the report's potential bias due to the firm’s financial interests in short-selling Roblox stock. You can read their full response here: https://s27.q4cdn.com/984876518/files/doc_news/2024/Oct/08/hindenburg-statement-final.pdf

Roblox stock dropped on Tuesday after the report was published but has since recovered. Our data looks extremely positive for Roblox and it should be interesting to see how this situation plays out.

2. Wendy’s ($WEN):

We covered Wendy's Krabby Patty Kollab with Wendy’s last week and it has since gone viral with the stock up over 6% on the week.

The reviews have been mixed with a lot of consumers questioning Wendy’s execution and a lack of branding but the conversation around the collaboration has gained millions of views on all social media platforms especially Tiktok and could lead to the company raising guidance on its October 31st earnings call.

3. GAP Inc ($GAP):

Gap has launched a new collaboration with Cult Gaia, a Los Angeles-based women-owned brand, in a 35-piece collection for women and kids. The collection, available online and at select Gap stores, combines Gap’s timeless essentials with Cult Gaia’s sculptural, modern aesthetic, offering a range of stylish denim, sweaters, leather jackets, and statement coats. The partnership highlights Gap’s focus on viral, high-profile collaborations following previous successful launches like the Dôen capsule. This collection includes both women’s and kids’ styles, with matching silhouettes and standout pieces such as embroidered sweatshirts.

This collaboration could boost Gap's earnings by driving both buzz and sales through its association with a cult-favorite brand like Cult Gaia, which is known for trendy, influencer-backed designs.

Previous collaborations have sold out quickly, and the same is expected for this collection, contributing to an uptick in sales, engagement, and positive sentiment surrounding Gap, potentially improving their upcoming earnings performance.

4. Victoria Secret ($VSCO):

Victoria's Secret is making a high-profile comeback with its first fashion show since 2018, headlined by Cher and featuring an all-women lineup of performers. This move marks a significant shift for the brand, which had previously canceled its shows due to backlash over inclusivity and declining viewership. The 2024 event, set to take place in New York on October 15, will focus on rebranding the iconic runway spectacle with a modern lens, incorporating elements fans loved, like glamor, music, and fashion, while aiming to align with more inclusive values.

This highly anticipated return is expected to generate substantial buzz, not only from the star-studded lineup—including Cher and K-pop star Lisa from Blackpink—but also from the brand’s commitment to evolving its image. The excitement surrounding the event could boost Victoria's Secret's visibility and contribute positively to the company’s financial performance over the coming months, potentially driving increased sales and enhancing brand perception, which could reflect positively in their earnings especially as the show is going to be telecasted live on all social media platforms.

5. Bandai Namco Holdings Inc. (7832.T):

Sparking! Zero continues to be a huge success for Bandai Namco with the game getting an extremely positive overall rating on Steam.

The game has been out for less than a week and has already broken the record for the most played fighting game of all-time on Steam.

It is important to note that Bandai’s Q3 guidance is dependent on the success of the game and the way the things are going at the moment, it won’t be surprising to see a raise in guidance. The success of the game should also help the company to get more attention for its Diama series further helping the stock price.

6. McDonald’s ($MCD):

The launch of McDonald's new Chicken Big Mac in the U.S. continues to gain traction for the company. This is an important strategic move for the fast-food giant, both in terms of product innovation and market excitement. Having been tested in international markets like the UK and Australia, the Chicken Big Mac offers a twist on the iconic Big Mac by replacing the traditional beef patties with tempura-battered chicken.

The Chicken Big Mac's limited-time availability has generated buzz, increased foot traffic, and encouraged repeat visits. The sandwich's U.S. debut comes at a time when McDonald's is leaning heavily into viral moments—teasing new products on social media, such as with the "Not not a Big Mac" post, which has already sparked interest from customers. This virality is crucial, as it could help boost McDonald's sales during the sandwich's availability and possibly lead to sustained interest in other menu items or future product releases.

With other promotional items like the return of the Boo Buckets and new collaborations such as the Crocs Happy Meal, McDonald's is aligning itself with the growing trend of leveraging nostalgia and novelty to enhance brand loyalty. The viral potential of the Chicken Big Mac, combined with these marketing efforts, positions the company for a potentially strong close to 2024.

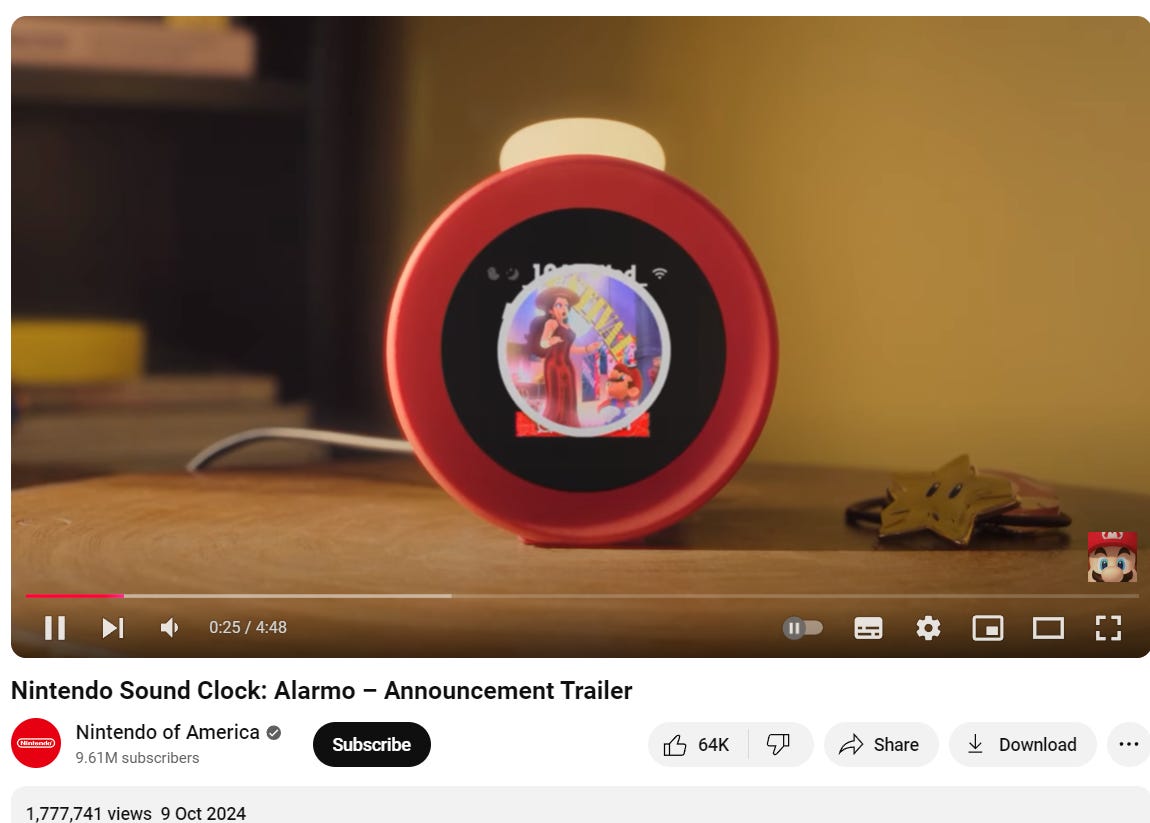

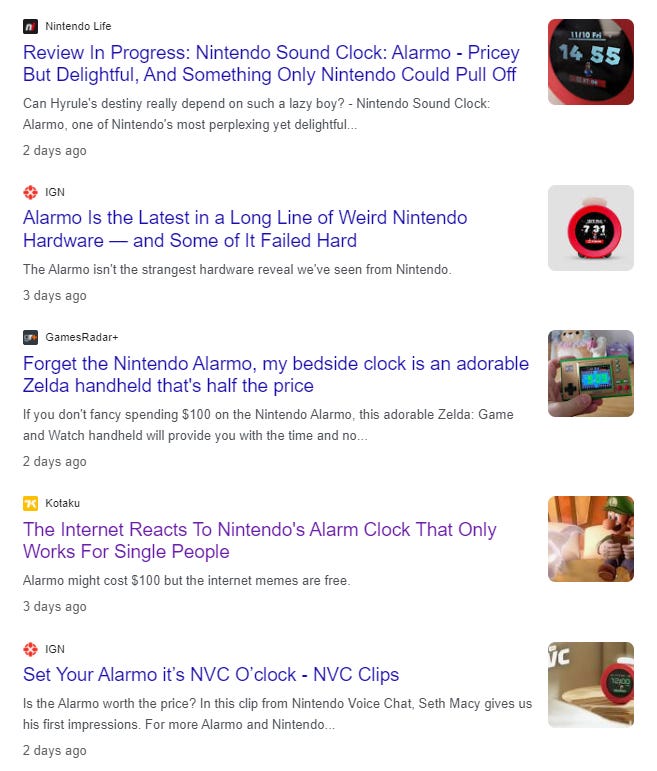

7. Nintendo (7878.T):

Nintendo introduced its Sound Clock: Alarmo, an interactive alarm clock. Alarmo responds to the user’s body’s movement with game sounds, so one can feel like they are waking up in the game world itself. Users can set an alarm inspired by five Nintendo games, with more alarms on the way as free updates as they become available.

Nintendo’s new "Alarmo" clock has gone viral for its quirky features and timing, launching just as fans were eagerly anticipating news about the rumored Switch 2 console. The $100 clock, which wakes users with Mario coin sounds and Pikmin chirps, is already sold out in pre-orders, with resales popping up at double the original price on platforms like eBay.

Despite its whimsical charm, early reviews have poked fun at Alarmo’s impracticality for couples. The clock's sensor, which is designed to detect when users get out of bed to stop the alarm, struggles when multiple people are present. As a result, it may restart if one person leaves the bed but another remains, creating some amusing reactions online. Many fans are baffled by the decision to release such a gadget at this moment, leading to a mix of both hype and humor surrounding the product.

While Alarmo may not have a direct impact on Nintendo’s financials like a console release would, the buzz it’s generating certainly keeps the brand top-of-mind. Its viral nature aligns with Nintendo’s strategy of creating unique, conversation-starting products, helping maintain public engagement while the gaming community waits for larger announcement

8. Crocs Inc. ($CROX):

Crocs' announced a collaboration with pet supply company BARK, by introducing "Pet Crocs," that could enhance the company’s brand visibility and market share.

As part of the annual Croctober campaign, the launch includes dog-sized versions of its iconic clogs, available in vibrant glow-in-the-dark colorways such as “Green Slime” and “Dragon Fruit.” This campaign comes at a time when consumer spending on pets is projected to reach $150.6 billion in 2024, highlighting the growing demand for unique pet-related products.

The launch leverages the power of the "pet influencer" market, where owners purchase trendy accessories for their pets and share these purchases widely on platforms like Instagram and TikTok, creating free marketing for Crocs.

Crocs hopes to tap into the lucrative pet industry but also solidifies its image as a playful, unconventional brand that isn’t afraid to experiment. These limited-time products can create scarcity, drive traffic to stores and online platforms, and ultimately translate to higher sales. The buzz is further amplified by the option for pet owners to buy matching human-sized clogs, enhancing the shareability factor on social media.

Pet Crocs have been requested by pet owners for a long time and knock-offs have done extremely well in the past.

It would be interesting to see if this collaboration follows the success of similar viral pet products as it could potentially boost quarterly earnings and bolster investor confidence in Crocs’ ability to stay ahead of consumer trends.

9. Krispy Kreme ($DNUT):

Krispy Kreme's announced its partnership with McDonald’s to bring its iconic doughnuts to the fast-food chain’s Chicago-area restaurants, starting on expansion strategy for the doughnut brand. This move, which will see Krispy Kreme's products available in over 12,000 McDonald's locations by 2026, provides the doughnut company with a massive new distribution channel and access to millions of additional consumers.

This collaboration addresses one of the top consumer requests: more convenient access to Krispy Kreme doughnuts. By integrating into McDonald’s, Krispy Kreme can tap into McDonald's vast, established customer base, further increasing its reach. McDonald's strong foot traffic and extensive drive-thru service allow Krispy Kreme to leverage a broader network than its own retail outlets and grocery store partners. For Krispy Kreme, this also means reducing dependency on its standalone stores while increasing brand visibility in more locations, including those where Krispy Kreme may not have had a direct presence before.

Additionally, the promotional strategy of offering free Original Glazed doughnuts to customers who present a McDonald's receipt during the launch week can boost sales for both companies, driving cross-traffic between the brands. Such partnerships are also effective at enhancing customer loyalty through co-branded promotions and incentivizing repeat visits.

This expansion into McDonald’s aligns with Krispy Kreme’s ongoing growth strategy, which focuses on creating more points of access through partnerships and its digital business. With the potential to serve fresh doughnuts daily in thousands of new locations, this deal is expected to significantly impact Krispy Kreme’s sales and brand exposure, particularly in key U.S. markets

10. Tesla ($TSLA):

Tesla’s "We, Robot" event focused on the company's advancements in autonomy and AI, providing a glimpse into its futuristic transportation solutions. Held across five themed areas, including a BBQ zone, arcade games, and a Cybertruck smash station, the event aimed to immerse attendees in Tesla's vision for the future. CEO Elon Musk arrived in a Robotaxi to kick off the event, which included references to "Master Plan Part 4," though no official document was released yet.

The highlight was the Robotaxi/Cybercab, an autonomous, two-seat vehicle with butterfly doors, no steering wheel or pedals, and a price point below $30,000. Tesla plans to begin production of this vehicle before 2027, promoting its affordability and lower operational costs. The event also introduced the RoboVan, a versatile autonomous vehicle that can transport goods or people and is adaptable for uses such as school buses or RVs.

Tesla's focus on full self-driving (FSD) technology was a major point, with plans to roll out unsupervised FSD in Texas and California by 2025, starting with Model 3 and Model Y. Tesla emphasized that its AI has been extensively trained to handle countless driving scenarios, aiming to make autonomous vehicles significantly safer than human drivers.

The event also featured Optimus, Tesla's humanoid robot, which interacted with attendees, serving drinks with remote human assistance. Priced between $20,000 and $30,000, Optimus is envisioned as an autonomous assistant for household tasks and even personal companionship.

The "We, Robot" event highlighted Tesla's ongoing commitment to pioneering autonomous technology, with ambitious plans to revolutionize transportation, enhance safety, and expand AI-driven solutions across various sectors.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.