What's Trending with TickerTrends #8

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

1. Walmart Inc. ($WMT):

Walmart delivered a strong Q3 FY25 performance, exceeding expectations in sales, operating income, and EPS. Total sales grew 6.1% in constant currency, driven by robust e-commerce growth of 27% and a 28% increase in advertising revenue. Membership income also rose 22%, underlining the effectiveness of Walmart's evolving business model. Operating income grew faster than sales, up 9.8% in constant currency, showcasing improved profitability despite continued investments in price reductions and wages.

In the U.S., Walmart reported comp sales growth of 5.3%, with e-commerce sales up 22% and delivery sales growing nearly 50%. The company gained market share in grocery and general merchandise, driven by strong unit growth, particularly among households earning over $100,000. Sam's Club also delivered a strong quarter with 7% comp growth, aided by a 26% increase in e-commerce sales and rising membership income.

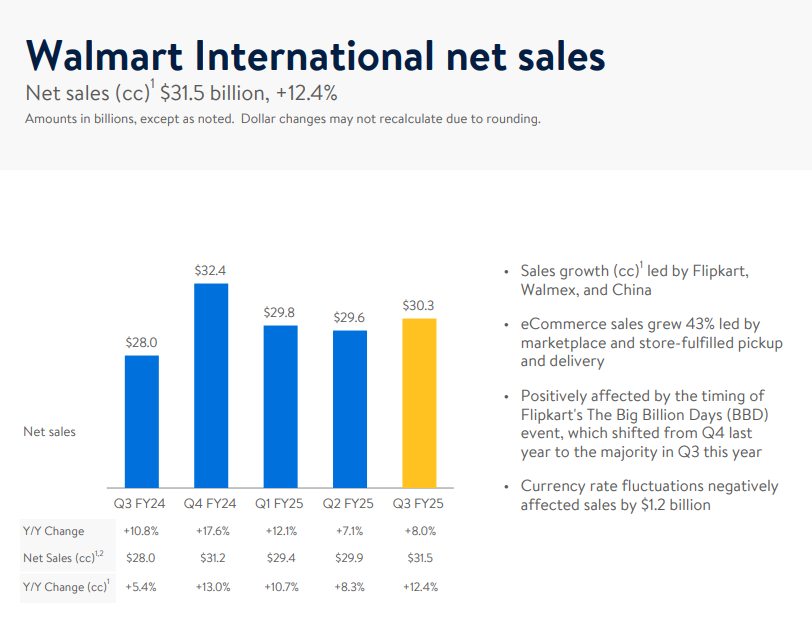

Walmart International grew 12.4% in constant currency, bolstered by strong results in Mexico, India, and China. E-commerce penetration remains a key driver, with 43% growth internationally and significant adoption of rapid delivery services in key markets.

The company's alternative revenue streams, such as advertising, membership, and marketplace, are becoming increasingly material to profitability. Membership income accounted for over half of Walmart's operating income growth, while advertising saw 28% growth globally, driven by Flipkart and Walmart Connect. Marketplace sales surged 42%, reflecting Walmart's growing e-commerce presence.

Walmart raised its full-year guidance, now expecting sales growth of 4.8%-5.1% and operating income growth of 8.5%-9.25%. The company continues to prioritize investments in automation, price competitiveness, and employee rewards to sustain its momentum and long-term profitability.

Walmart's omnichannel strategy, diversified revenue streams, and focus on efficiency and convenience are driving consistent growth, positioning the company to sustain its market share gains and profitability in an evolving retail landscape.

2. GAP Inc. ($GAP):

Check out our article on $GAP here if you haven’t already: https://blog.tickertrends.io/p/gap-gap-inc-turnaround-tickertrendsio?r=cauli&utm_campaign=post&utm_medium=web

Gap Inc. delivered a strong Q3 FY24, reflecting the success of its transformation and brand reinvigoration strategy. Net sales grew 2%, marking the fourth consecutive quarter of growth, with comparable sales up 1%. Operating margin reached 9.3%, the highest in seven years, representing a 270 basis-point improvement. Earnings per share increased by 24% to $0.72, highlighting disciplined cost management and improved margins.

Brand performance was solid across the portfolio. Old Navy maintained its streak of market share gains, with men’s and women’s categories driving growth despite flat comps due to weather-related softness in kids and baby sales, which rebounded as temperatures cooled. Activewear continued its strong momentum with double-digit growth, reinforcing Old Navy’s position as a top-five player in the $70 billion U.S. activewear market. Gap brand saw comps rise 3%, supported by strong marketing campaigns like “Get Loose” and collaborations with Madhappy and Cult Gaia. Banana Republic saw success in men’s categories, while efforts to improve women’s fit and assortments showed early progress. Athleta returned to growth, with comps up 5% driven by strong product performance in core bottoms and limited-edition drops, alongside effective marketing initiatives, including a rapidly growing presence on TikTok.

Gross margin expanded 140 basis points to 42.7%, driven by tight inventory management, lower promotions, and strong sell-through rates. SG&A totaled $1.3 billion, reflecting continued cost discipline and reduced advertising expenses. The company ended the quarter with $2.2 billion in cash, a 64% increase year-over-year, and generated $540 million in free cash flow year-to-date.

Gap Inc. raised its full-year outlook, now expecting net sales growth of 1.5%-2% (excluding the 53rd week), gross margin expansion of 220 basis points, and operating income growth in the mid-to-high 60% range compared to FY23. Strategic priorities remain focused on brand reinvigoration, enhanced customer experiences, and operational rigor. Old Navy plans to deepen its presence in activewear, leveraging its design expertise to solidify its leadership in the category.

With consistent sales growth, margin expansion, and market share gains across its portfolio, Gap Inc. is building momentum for sustainable, profitable growth into FY25 and beyond, positioning itself as a leader in the value and lifestyle space.

Trends this week:

1. Jaguar (TATAMOTORS.NS):

Jaguar’s recent rebranding campaign has ignited a mix of backlash and intrigue, with the brand unveiling a bold strategy to reinvent itself ahead of its all-electric lineup launch in 2026. The campaign, centered around the tagline “Copy nothing,” features vibrant visuals with models engaging in creative activities, but notably excludes any cars. Critics, including Tesla CEO Elon Musk and conservative commentators, derided the ad as confusing, "woke," and disconnected from Jaguar's legacy as a luxury carmaker. The rebrand also included a redesigned logo, emphasizing a minimalist aesthetic aimed at positioning Jaguar as a high-end, design-centric brand.

The campaign reflects Jaguar’s efforts to transition from its traditional image of opulence and performance to appeal to a new audience of "design-minded" and affluent individuals. The company’s managing director, Rawdon Glover, defended the strategy, citing the need to differentiate Jaguar in a competitive market and move away from “traditional automotive stereotypes.” However, some marketing professionals and consumers criticized the brand for alienating its core audience of affluent, predominantly male buyers without clearly defining its new target market.

Despite the controversy, Jaguar’s parent company, Tata Motors, saw limited immediate impact on its stock price. Analysts attribute recent share declines more to weak auto sales and broader market challenges in India than to the ad backlash. However, the campaign’s reception raises questions about Jaguar’s ability to successfully reposition itself. While the ad generated significant attention, the risk of alienating long-standing customers and failing to resonate with a new audience could impact sales as the company pivots toward high-priced electric vehicles.

For Tata Motors, Jaguar’s reinvention represents both an opportunity and a risk. If the rebranding helps establish Jaguar as a leading luxury EV brand, it could boost profits and elevate Tata Motors’ global profile. However, if the messaging and product execution fail to align with consumer expectations, the brand risks eroding its legacy without securing a foothold in the competitive EV market. Investors should monitor consumer reactions, upcoming product launches, and the broader market's response to gauge the long-term impact on Tata Motors' valuation.

2. Trump Media & Technology Group Corp ($DJT):

Trump Media & Technology Group (ticker: DJT), parent company of Truth Social, is exploring a strategic pivot into cryptocurrency services. The company filed a trademark application for "TruthFi," a potential cryptocurrency payment platform that may include services such as digital wallets, payment processing, asset management, and trading.

Reports also indicate DJT is in advanced talks to acquire Bakkt Holdings (ticker: BKKT), a struggling cryptocurrency trading platform owned by Intercontinental Exchange (ICE). The deal is rumored to be an all-stock acquisition aimed at diversifying DJT’s revenue streams beyond its social media business.

DJT's current business model, centered around Truth Social, has faced profitability challenges, with only $2.6 million in revenue and a $363 million net loss in the first nine months of 2024. However, the stock has surged amid optimism linked to Donald Trump’s recent presidential election victory, which many believe could result in crypto-friendly regulatory policies. Speculation that Trump’s administration may ease crypto regulations and appoint industry-friendly regulators further bolsters investor sentiment. Bakkt, on the other hand, has struggled with profitability and declining stock value. It recently faced a delisting warning and executed a reverse stock split to stabilize. The platform’s future viability remains uncertain.

3. Tesla ($TSLA):

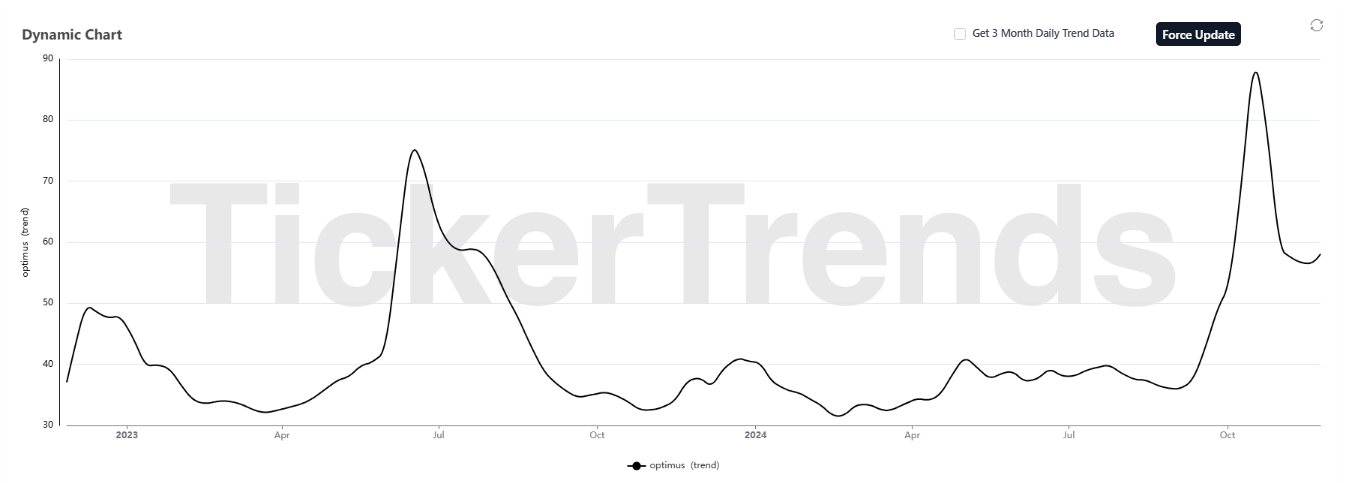

Kim Kardashian’s recent collaboration with Tesla for a photoshoot featuring the Optimus humanoid robot and Cybercab has generated significant attention—and controversy. The photoshoot, which depicted Kardashian interacting with the robot in a Tesla Cybercab, was met with mixed reactions online. Some viewers saw it as avant-garde marketing, while others derided it as dystopian and strange. Clips of Kardashian teaching the robot gestures like blowing kisses and playing games like rock-paper-scissors were shared on her social media, but the overall reception was lukewarm, with fans labeling the stunt as "weird" and "tone-deaf."

Critics have speculated about Kardashian’s motives, with some accusing her of aligning with Tesla CEO Elon Musk and, by extension, signaling support for Donald Trump. While Kardashian’s history doesn’t strongly align with progressive politics, her prior comments on Trump and collaboration with Musk—an outspoken Trump ally—fueled the speculation. However, the collaboration seems more like an attempt to promote Tesla's technology and Kardashian’s SKIMS brand than a political statement.

The Optimus robot, touted by Musk as a future household assistant and worker for "boring, repetitious, and dangerous" tasks, has yet to reach significant operational sophistication. At recent Tesla events, the robots were remotely controlled, raising questions about their readiness for market. Similarly, Tesla’s Cybercab—a fully autonomous two-seater vehicle without pedals or a steering wheel—faces skepticism over its safety and practicality. Both products remain far from commercial availability, with Tesla projecting launches in the mid to late 2020s.

Kardashian’s stunt, while boosting visibility for Tesla and her brand, has also amplified concerns about the societal implications of humanoid robots and autonomous vehicles. Some commenters raised ethical questions about technology displacing human labor, while others mocked the promotional effort as out of touch and disconnected from mainstream consumer priorities.

This collaboration highlights the intersection of celebrity influence and emerging technologies but risks alienating audiences due to its polarizing nature. For Tesla, the PR stunt underscores the company's ambition to position itself as a leader in robotics and autonomy but also draws attention to ongoing challenges in product readiness and regulatory approval. For Kardashian, while the move aligns with her brand of cultural relevance, the backlash suggests a miscalculation in gauging public sentiment.

4. PepsiCo Inc ($PEP):

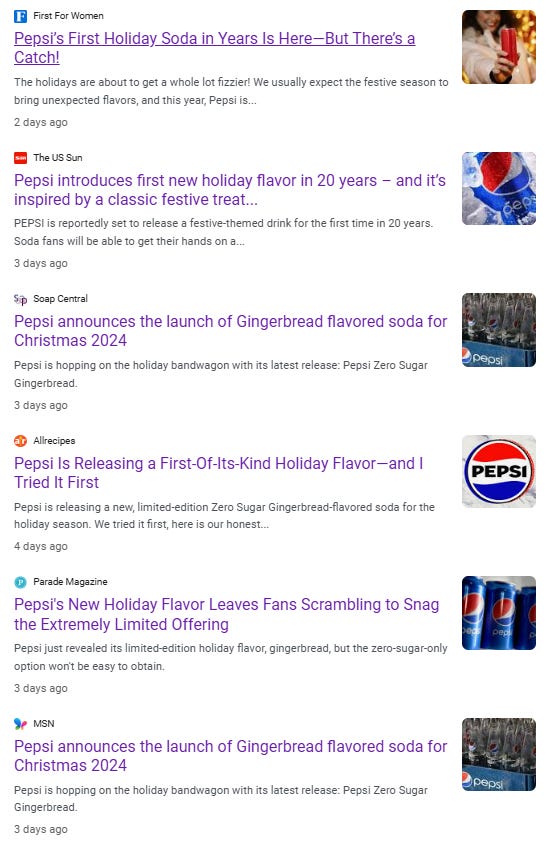

Pepsi is spicing up the holiday season with its new limited-edition flavor, Pepsi Zero Sugar Gingerbread, launching on December 4. This festive soda blends the classic cola taste with gingerbread-inspired flavors, including brown sugar, cinnamon, nutmeg, and molasses, creating a drink described as "Christmas in a can." It marks Pepsi's first true holiday-themed release since the fan-favorite Pepsi Holiday Spice in 2004, which was discontinued two years later.

The soda will be available exclusively through Pepsi's TikTok Shop or via an online giveaway on its website. Consumers can receive a free mini can by purchasing two 10-packs of Pepsi Minis on TikTok or entering the giveaway from December 4 to December 11. This exclusivity has sparked criticism among fans, many of whom feel the limited release is overly restrictive and excludes broader access to the product.

Early reviews have compared the flavor to a holiday-themed Dr. Pepper, with a sweet Pepsi base and warm, spicy notes. While some fans are thrilled by the nostalgic connection to Pepsi Holiday Spice, others are disappointed that the new soda is only available in a zero-sugar format, with complaints about the aftertaste and a desire for a full-sugar version.

Pepsi’s decision to launch this flavor exclusively on TikTok reflects a strategic move to engage younger, social media-savvy audiences while leveraging the platform's popularity for viral food trends. However, the limited availability and zero-sugar-only format have alienated some longtime fans, potentially dampening the buzz. The nostalgic appeal and uniqueness of the gingerbread flavor may offset some of these criticisms, but broader accessibility might have increased consumer enthusiasm. This release also signals Pepsi's intent to experiment with holiday-themed products, carving out space in a market traditionally dominated by cranberry-flavored sodas and seasonal beverages from competitors.

5. AMC Entertainment Holdings, Inc. ($AMC):

AMC Theatres has recently embraced innovative and viral trends to engage its audience and enhance its brand, demonstrating its ability to thrive in a competitive entertainment landscape. Alongside major campaigns like Nicole Kidman’s ongoing partnership, AMC’s knack for creating buzz-worthy moments continues to shine, as evidenced by two recent hits: the viral nacho pizza and the sing-along adaptations for Wicked.

AMC’s viral nacho pizza, a creative off-menu snack, has captured the imagination of moviegoers and TikTok audiences alike. By combining a pepperoni flatbread, nacho cheese, and pickled jalapeños, AMC has turned simple ingredients into an interactive experience. Promoted through their TikTok channel, this customizable snack not only delights in its taste but also provides customers the joy of “hacking” the menu.

The nacho pizza’s affordability ($12) and customization potential have made it a fan favorite, with moviegoers also discovering they can enhance other concessions like pretzels and hot dogs. This trend underscores AMC’s ability to leverage small, innovative ideas for viral success, driving both in-theater sales and online engagement.

Another viral effort came with AMC’s announcement of strict “no singing” policies during the highly anticipated Wicked movie musical. This decision sparked spirited debates on social media, with fans torn between respecting the cinematic experience and their urge to belt out songs like Defying Gravity. The buzz was further fueled by AMC’s playful 30-second advisory featuring themes from Wicked, cleverly engaging audiences ahead of the sing-along screenings set to launch on Christmas Day.

These efforts have paid off in spades: AMC’s TikTok presence has exploded with over 50,000 searches in the last week and more than 66,000 new followers in the past 30 days. This growth highlights the company’s successful pivot into digital spaces, where it connects with a younger, socially active audience.

Both the nacho pizza trend and Wicked campaign exemplify AMC’s strategic focus on creating shareable, culturally resonant moments. These viral hits complement their ongoing collaboration with Nicole Kidman, which CEO Adam Aron has praised as a key marketing success, and keep AMC relevant in a rapidly changing industry.

By intertwining creativity, digital engagement, and in-theater experiences, AMC continues to position itself as more than just a movie theater—it’s a lifestyle brand that understands and caters to the tastes of its audience. These recent successes build on AMC’s broader momentum, proving it’s a company that knows how to make the magic of movies extend far beyond the big screen.

6. Walt Disney Co ($DIS):

Disney announced its robust slate of theatrical releases and Disney+ streaming premieres that promise to dominate 2024 and 2025. As the media giant showcases its upcoming projects, including hit franchises and fresh content, its impact on both the entertainment landscape and streaming audience engagement is clear. Recent developments, particularly with Disney+ reaching over 60,000 searches this week, highlight Disney’s growing influence in the digital space.

Walt Disney has unveiled an impressive array of cinematic releases aimed at capturing audience attention worldwide. Following the success of Inside Out 2, Pixar’s top-grossing film in several territories, and Deadpool and Wolverine, the studio is set to release anticipated titles like Moana 2 and Mufasa: The Lion King by the year’s end.

In 2025, Disney will deliver a mix of nostalgia and innovation with live-action films such as Snow White and Lilo & Stitch. Action-packed sequels like Tron: Ares and The Amateur starring Rami Malek are expected to draw in diverse audiences, while Avatar: Fire and Ash will expand James Cameron’s epic universe. Animated favorites are also making a return, including Toy Story 5 and Incredibles 3, alongside new titles like Elio and Win or Lose from Pixar.

On the streaming side, Disney+ is strengthening its grip on audiences with a packed schedule of Marvel and Star Wars content. Upcoming shows like Skeleton Crew, starring Jude Law, and What If...? Season 3 will wrap up 2024 with fanfare. In early 2025, Marvel's animated Your Friendly Neighborhood Spider-Man will kick off a year of bold storytelling, followed by Daredevil: Born Again featuring Charlie Cox, and Ironheart, which explores the tech-versus-magic dynamic in the MCU.

The much-lauded Andor Season 2, expected in April 2025, will conclude Cassian Andor's journey leading into Rogue One: A Star Wars Story. These additions underline Disney’s commitment to delivering fresh narratives while tapping into fan-favorite characters and universes.

Disney has made significant strides in connecting with audiences on a global scale. The company’s targeted approach to social media, including platforms like Douyin and Xiaohongshu in China, highlights its efforts to localize content and expand reach. Similarly, Disney+ is thriving as a hub for both established franchises and new experimental formats. The recent surge in Disney+ searches—over 60,000 this week—demonstrates the platform's growing resonance with audiences worldwide.

By combining blockbuster theatrical releases with a robust Disney+ lineup, Disney ensures it remains at the forefront of the entertainment industry. With an eye on localization, innovative marketing, and a commitment to diverse storytelling, Disney is set to dominate screens big and small, further solidifying its global legacy.

7. Norwegian Cruise Line Holdings Ltd ($NCLH):

Norwegian Cruise Line (NCL) recently announced sweeping cancellations across its fleet, impacting nearly 40 itineraries on multiple ships, including Norwegian Jade, Norwegian Dawn, Norwegian Star, and Norwegian Jewel. These cancellations, which span late 2025 to early 2026, are part of a larger strategy to redeploy ships in response to market demand and to introduce enhanced voyages. Notably, Norwegian Jade will shift its homeport from Miami to San Diego during this period, offering 7-day cruises to the Mexican Riviera featuring popular destinations such as Cabo San Lucas, Puerto Vallarta, and Ensenada. Meanwhile, Norwegian Dawn, Norwegian Star, and Norwegian Jewel will see itineraries in Africa, Asia, South America, and the Caribbean scrapped.

Passengers affected by these changes will receive full refunds to their original payment method, along with a 10% Future Cruise Credit (FCC) that can be used for any sailings through December 2026. Norwegian is also offering compensation to travel advisors by maintaining commissions for fully paid bookings. The cruise line emphasized that the redeployment is designed to meet strong guest demand for certain destinations while enhancing the overall experience, but such large-scale changes may create frustration among passengers and travel agencies, potentially eroding consumer trust.

While announcing these changes well in advance gives passengers time to adjust their plans, the cancellations reflect challenges in NCL’s ability to accurately predict demand for specific regions and itineraries. The company has yet to reveal replacement schedules for the affected ships, adding uncertainty for passengers and partners.

From an investor’s perspective, the move highlights NCL’s strategic flexibility in reallocating resources to better-performing markets. However, frequent cancellations on this scale could raise questions about the cruise line’s operational planning and market forecasting capabilities. Customer dissatisfaction or reputational damage stemming from these disruptions could also negatively affect future bookings, impacting revenue and potentially shareholder sentiment. Although the immediate impact on NCL’s stock price may be limited, repeated instances of cancellations could weigh on the company’s valuation if they lead to reduced consumer confidence or diminished demand for future cruises. It will be essential to monitor how effectively NCL navigates this situation and whether the redeployed itineraries translate into improved financial performance.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.