What’s Trending with TickerTrends #34

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Gap Inc. ($GAP):

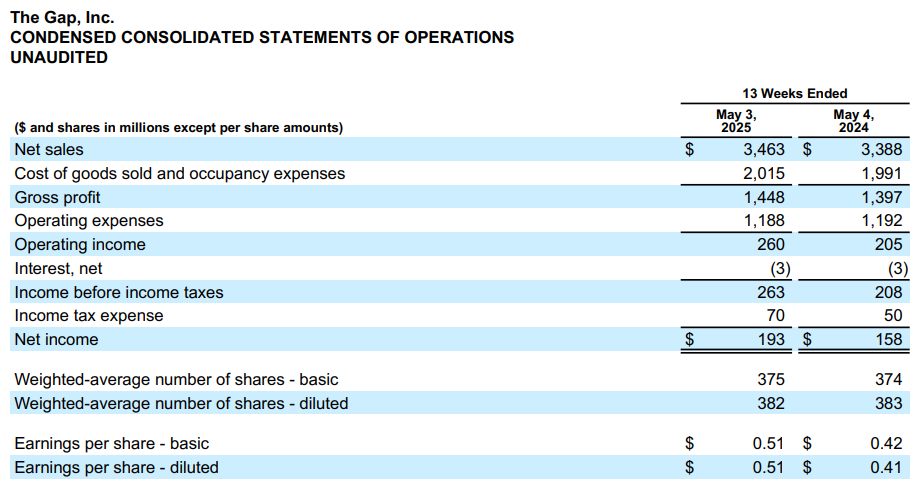

Gap Inc. delivered a surprisingly strong first-quarter performance for fiscal 2025, beating analyst expectations across several key financial metrics. The company reported $3.5 billion in revenue, reflecting a 2% year-over-year increase, and earnings per share of $0.51—significantly higher than the $0.44 consensus estimate. Operating margin also improved to 7.5%, up 140 basis points, while online sales increased 6% and now comprise 39% of the total revenue mix. Brand-level performance was mixed, with Old Navy and Gap brand sales rising modestly, while Banana Republic and Athleta saw continued declines. Overall, the quarter signaled operational improvement and a more disciplined promotional strategy under CEO Richard Dickson.

However, despite the upbeat financials, investor sentiment turned sharply negative due to Gap’s warnings over potential tariff-related headwinds. In the earnings call, management disclosed that new tariffs imposed by the Trump administration could add between $250 million and $300 million in product costs. Even after mitigation, Gap expects a potential $100 million to $150 million impact on operating income, primarily in the second half of the fiscal year. The severity of this guidance triggered a ~20% drop in Gap’s stock during, wiping out much of the goodwill from the earnings beat and marking its worst single-day performance in three years.

The tariff concerns also brought renewed focus to Gap’s sourcing strategy. While the company has made notable progress in reducing its exposure to China—now under 10% of product sourcing—executives said they intend to bring that figure below 3% by the end of 2025. Longer term, Gap is targeting a structure in which no single country accounts for more than 25% of its sourcing footprint by the end of 2026. This diversification is intended to de-risk the supply chain, but transitioning away from China entirely could create friction in speed-to-market and margin pressures in the near term.

Although the company reiterated its full-year sales guidance of 1% to 2% growth and 8% to 10% operating income expansion, those projections do not incorporate the impact of tariffs. Management acknowledged that the second quarter would likely see flat net sales, and analysts are now revisiting their models to account for the potential hit to profitability in the back half of the year. While the first quarter proved that Gap is regaining some operational momentum under new leadership, the uncertainty introduced by tariff policy threatens to derail that progress and weighs heavily on investor confidence.

For investors, the mixed messaging—strong underlying business performance offset by significant macro headwinds—makes the Gap story more complex heading into the remainder of 2025. Execution on supply chain diversification and margin protection will be critical, and any updates on tariff exemptions or sourcing reconfigurations could act as catalysts. Until then, Gap may find itself in a valuation tug-of-war between improving brand health and geopolitical risk.

Abercrombie & Fitch Co ($ANF):

Abercrombie & Fitch opened fiscal 2025 with another record quarter, posting 8 percent year-over-year revenue growth to $1.1 billion and a 9.3 percent operating margin. The top line was driven by balanced geographic gains—Americas +7 percent, EMEA +12 percent, APAC +5 percent—but brand performance diverged sharply. Hollister delivered its eighth consecutive quarter of double-digit expansion, rising 22 percent on a combination of higher units and higher average unit retail (AUR). By contrast, Abercrombie brands fell 4 percent on a 10 percent comparable-sales decline as the company intentionally cleared winter carry-over inventory and lapped last year’s exceptional wedding-shop launch. Gross margin compressed 440 basis points, more than half from excess freight locked in during 2024’s Red Sea rerouting; disciplined cost control and lower incentive compensation produced 140 basis points of operating-expense leverage, limiting EBIT erosion. Diluted EPS landed at $1.59 versus $2.14 a year ago, and the balance sheet remains robust with $511 million in cash and $1.1 billion of remaining repurchase authorization—$200 million, or roughly 5 percent of shares outstanding, was retired in the quarter.

Management reiterated that the core “read-and-react” playbook—which shortens design-to-floor lead times and flexes purchases weekly—should allow Abercrombie to pivot quickly from clearance to trend-driven receipts. Early reads on swimwear, active and new silhouettes give the team confidence Abercrombie sales will inflect back to growth in the second half, while Hollister plans to layer graduation-themed capsules and back-to-school assortments on top of an already strong demand curve. Store strategy supports that goal: the company will be a net opener again in 2025, adding about 60 new stores and 40 remodels, with particular emphasis on smaller urban Abercrombie prototypes such as the recent Williamsburg, Brooklyn location. Importantly, traffic remains positive across channels and regions, suggesting price elasticity rather than demand is the near-term pressure point.

Guidance now calls for full-year revenue growth of 3 to 6 percent (up from 2 to 6 percent prior) but trims operating-margin expectations to 12.5 – 13.5 percent. The single biggest swing factor is the U.S. tariff framework announced in March: Abercrombie is modeling a 10 percent duty on all U.S. imports and a 30 percent rate on China-sourced goods, which together represent roughly a $70 million headwind. After active negotiations with vendors, modest geographic sourcing shifts (China will fall to low-single-digit volume) and continued SG&A discipline, management expects to offset about $20 million, leaving a net 100-basis-point drag on margin. No broad-based ticket increases are planned; instead, the company will lean on lower inventory, faster turns and targeted promotions to protect AUR.

For investors, the thesis hinges on whether Abercrombie can execute a smooth hand-off from Hollister-led growth to a more balanced two-brand engine before freight and tariff pressures fully normalize. The stock already discounts some moderation: even at the new midpoint, EPS of $10 still implies a healthy high-teens return on equity and leaves ample free cash flow—management is targeting another $400 million of buybacks this year. If Abercrombie’s back-half merchandising adjustments land and tariffs prove less onerous than feared, incremental operating leverage could re-rate the multiple. Conversely, a prolonged promotional cycle at Abercrombie or further trade-policy surprises would test the durability of margins that, even after the guide-down, sit well above pre-transformation peaks.

Trends this week:

Steve Madden Inc ($SHOO):

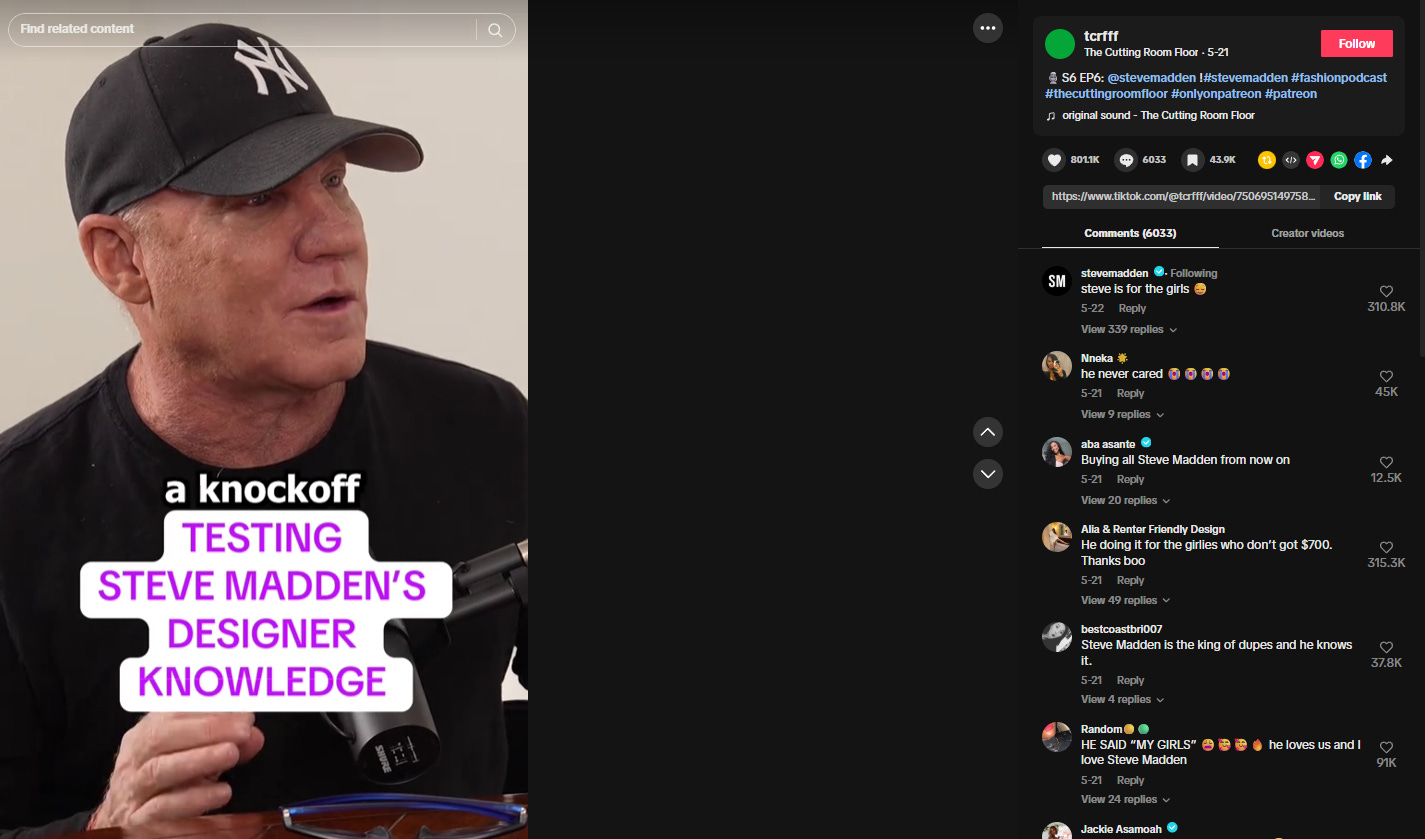

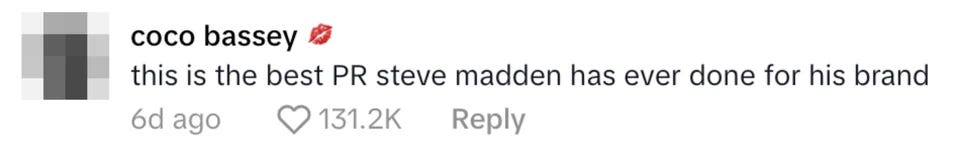

Steve Madden’s candid, hour-plus sit-down on Recho Omondi’s The Cutting Room Floor didn’t just amuse fashion insiders—it detonated on Gen-Z TikTok. In the eight days after the first clip hit social media, the brand’s TikTok handle picked up a little over 60,000 new followers and the three most-circulated excerpts have amassed roughly 25 million combined views, according to platform dashboards and Axios tracking. The conversation—equal parts memoir and industry critique—landed squarely on users’ For-You pages and quickly spun into hundreds of reaction videos that treat Madden less as a CEO than a folk hero for budget-conscious shoppers.

What resonated? First, his unapologetic defense of “dupes.” Madden cheerfully identified the luxury silhouettes he has “nicked,” likened the practice to the Beatles’ borrowing from Motown, and called $700 PVC jelly sandals “absurd.” Second, he offered a blunt macro tutorial: U.S.–China tariffs, he argued, will push shoe prices higher while destroying more domestic jobs than they save—especially once immigrant labor shortages are factored in. Finally, he spoke unflinchingly about his 2002–05 prison term for securities fraud, noting he now employs several former inmates. The combination of transparency and swagger has turned a potential PR minefield into a masterclass in brand authenticity.

Fundamentals, however, remain the gating factor for any sustained re-rating. Steve Madden entered 2025 with solid momentum (Q1 EPS $0.60 vs. Street $0.45) and an 11-12 percent operating-margin history, but China still accounted for roughly 70 percent of pair volume last year. Management has already warned that a prospective 30 percent China tariff would carve as much as 150 basis points off gross margin if fully passed through. The company is accelerating production moves to Mexico, Brazil and Cambodia, yet admits the transition will take multiple seasons.

Longer term, the viral moment could yield durable benefits. The interview effectively positions Madden as the patron saint of “attainable luxury,” a space where social approval is earned not by exclusivity but by democratizing trends. If that narrative sticks, the brand’s large, mid-price women’s assortment and fast-turn supply chain become competitive weapons, particularly as department stores rationalize shelf space and social commerce links SKU discovery directly to checkout.

For investors, the setup is a tug-of-war between near-term cost inflation and new demand catalysts. The upside case: viral buzz boosts full-price sell-through into back-to-school and holiday, outpacing any tariff drag that survives vendor negotiations. The bear case: gross-margin compression from trade policy and freight offsets incremental revenue, turning the podcast pop into a fade. Either way, management just received a rare gift—millions of unpaid impressions turning dupe culture into brand equity. Converting that attention into profitable, tariff-resilient growth is the next test, and one the market will be watching closely.

Walmart Inc. ($WMT), Murphy USA Inc ($MUSA), Caseys General Stores Inc ($CASY), ARKO Corp. ($ARKO) & Alimentation Couche-Tard Inc ($ATD.TO):

Walmart is accelerating into the forecourt business. In March the retailer said it will open or remodel more than 45 “Walmart Fuel & Convenience” stations this year, lifting its wholly-owned network past 450 sites across 34 states. The new pumps will appear mainly at supercenters that lack a legacy Murphy USA kiosk, and—crucially—anyone can fill up, with Walmart + members getting up to 10 cents per gallon off. Dave DeSerio, the executive in charge of the format, told Modern Retail that the chain intends to double last year’s build pace and then “rapidly accelerate” expansion over the next five years.

The strategy is less about pennies of fuel margin than about keeping price-sensitive drivers inside the Walmart ecosystem at a moment when tariffs and inflation threaten core grocery profitability. Industry consultants estimate a mature big-box forecourt sells 5–7 million gallons annually; at even one cent of contribution per gallon, this year’s 45 additional sites could add roughly $2–3 million to operating income while funneling millions of extra trips into adjacent supercentres. Internal studies quoted by RetailWire show well over 60 percent of gas buyers also walk into the store on the same visit, giving Walmart a low-cost traffic engine exactly when it is warning that new China tariffs may lift shelf prices.

The move is a direct challenge to Costco, where members-only fuel accounted for about 12 percent of total company sales in 2024. Costco has responded by extending hours at most sites to 10 p.m.—four hours past club closing—to deepen stickiness while EV adoption remains gradual. Because Costco’s pumps remain gated behind a $60 membership, Walmart’s open-access model represents the first large-scale test of whether cheaper gas can lure value shoppers away from the warehouse club format.

Walmart is not the only discounter muscling in. Sam’s Club continues to expand its own forecourts inside the membership fence, while Dollar General is piloting more than 40 fuel centers across the South after a decade-long experiment in Alabama. Analysts at Quartz frame the broader push as a hedge: traditional gas remains a predictable cash generator until charger density, battery range and charger-dwell economics make EV forecourts viable at scale.

For specialty fuel retailers the competitive heat is already visible. Murphy USA, which still operates 1,100 kiosks on Walmart lots but lost exclusivity in 2016, reported a 4 percent same-store gallon decline in Q1 2025 and blamed “heightened channel competition” on its earnings call.

Rural-weighted Casey’s General Stores tells a different story—same-store fuel gallons rose 1.8 percent and total fuel gross profit jumped 17 percent in its latest quarter as customers drawn by pizza and sandwiches filled up “out of convenience.” Management argues that its small-town footprint leaves little overlap with big-box rivals, and the stock has outperformed, up more than 35 percent year-over-year.

Elsewhere, pressure is mounting. ARKO Corp. logged mid-single-digit retail-fuel volume declines and warned of “price competition in metropolitan markets,” while Circle K owner Alimentation Couche-Tard saw U.S. same-store fuel volumes fall 3 percent last quarter amid what it called “cautious spending and heavier traffic to big-box discounters.” Both operators point to M&A and food-service differentiation as their best defense against a Walmart–Costco price war.

Elf Beauty Inc ($ELF):

E.l.f. Beauty has just placed its biggest wager to date on prestige skin care, agreeing to buy Hailey Bieber’s three-year-old Rhode line for an upfront $800 million in cash and stock and a performance-linked earn-out that could lift the price to $1 billion. The deal values Rhode at roughly 3.8-times its $212 million trailing-twelve-month sales and is expected to close in E.l.f.’s fiscal second quarter of 2026, with Bieber remaining chief creative officer and “strategic adviser.”

Strategically, the purchase vaults E.l.f. out of the mass aisle—where its products sell for as little as $3 at Walmart and Target—and into the faster-growing prestige channel just as Rhode prepares to roll into Sephora in the United States, Canada and the U.K. this autumn. Management argues that Rhode’s minimalist ten-SKU portfolio, TikTok-viral “peptide lip treatment” and 11-million-strong Instagram community provide a celebrity halo without the wholesale mark-ups that typically accompany luxury beauty, echoing E.l.f.’s mantra of “making the best of prestige accessible.”

Financially the acquisition is material: Rhode’s revenue equals about 16 percent of E.l.f. 's own $1.3 billion fiscal-2025 sales and should restore double-digit top-line momentum after fourth-quarter growth slowed to 4 percent—its weakest clip since 2019. On the deal call, executives framed the multiple as justified by Rhode’s three-year compound annual growth rate north of 100 percent and its direct-to-consumer gross margins, which run higher than E.l.f.’s 69 percent company average. If Rhode hits its earn-out targets, E.l.f. believes the brand can surpass $500 million in annual sales within three years.

The timing also reflects tariff calculus. Roughly three-quarters of E.l.f.’s production still comes from China, and management estimates a 30 percent blanket tariff would add about $50 million to annual costs; at a mooted 145 percent rate the hit would be “much higher.” With no clarity on Washington’s trade policy, the company withdrew its fiscal-2026 outlook and will raise shelf prices by $1 in August—only the third increase in its 21-year history. Rhode’s higher ticket and largely domestic fulfilment help hedge that exposure while E.l.f. builds secondary capacity outside China.

Rivals have been here before, with mixed results. Estée Lauder paid $2.8 billion for Tom Ford last year and earlier spent $1.7 billion to take full control of Deciem; L’Oréal’s $2.5 billion purchase of Aesop remains the benchmark for prestige skin care multiples. Coty’s $600 million outlay for 51 percent of Kylie Cosmetics in 2019, however, proved a cautionary tale when sales momentum faded once the celebrity novelty cooled. Analysts such as TD Cowen’s Oliver Chen and former Mad Rabbit CFO Drew Fallon have already questioned whether Rhode can sustain its hype beyond Bieber’s own social reach—concerns that explain the three-year earn-out structure.

Execution risk therefore centres on integration. E.l.f. 's edge lies in a rapid product-development engine and an influencer-savvy marketing playbook that could expand Rhode’s range well beyond its ten hero products while preserving the “glazed-donut skin” aesthetic that resonates with Gen Z. Management says Sephora rollout will be “selective and experiential,” avoiding over-distribution that could dilute the brand’s premium positioning; longer term, international doors such as Boots and Watsons are on the radar.

The market has taken the news positively as the stock has climbed 40.52% this week. No competitor has issued a formal response yet—Ulta reports earnings this week and Estée Lauder is still digesting its own acquisitions—but if Rhode’s forecast “rocket-ship” trajectory materialises it could spur a fresh round of celebrity-led M&A as legacy houses chase younger audiences. In that scenario E.l.f. either cements its reputation as beauty’s most agile disruptor—or, if the glaze wears off, risks repeating Coty’s mis-step on Kylie. The $1 billion bet means the market will get an answer sooner rather than later.

Starbucks Corp ($SBUX):

Starbucks’ is launching four “Strato” Frappuccinos—Salted Caramel Mocha, Strawberry Matcha, Brown Sugar and the Fourth-of-July-themed Fireworks. It appears that these drinks are tailor-made for TikTok: each drink is built in layered colour bands, crowned with cold foam and (in the Firework’s case) bursting raspberry “pearls.” Yet from a store-operations standpoint the timing is awkward.

Only three months ago headquarters trumpeted a “menu simplification” meant to cut wait times and reduce barista stress, removing nine legacy Frappuccinos and four food items. The new recipes reverse that logic: a single Firework Frappuccino involves at least five build steps and multiple syrups, exactly the sort of labour-intensive order the simplification initiative was supposed to limit. Front-line reaction has been swift. Reddit threads frequented by partners label the drinks “12-step monsters” and predict ticket times will spike during July’s peak iced-beverage rush. The resentment lands atop a separate flash point: Starbucks’ mid-May dress-code reset, which now mandates solid-black tops and prescribed denim or khaki bottoms. Workers say the policy rolls back long-standing self-expression freedoms, disproportionately affects queer and non-binary staff who tailor clothing to fit, and arrived without consultation just as stores were already coping with scheduling cuts. More than 100 locations staged walkouts or “sip-ins” the week the code took effect.

From an operational lens the two moves compound each other. A restrictive wardrobe that many partners must purchase out-of-pocket, plus a July menu scripted for Instagram rather than throughput, risks dragging morale—and with it service scores—into the height of cold-beverage season, the company’s most profitable quarter. Longer ticket times erode the convenience promise that underpins Starbucks’ $9 billion U.S. cold-drink franchise, and social chatter about understaffed lines feeds the very “vibe” concerns new CEO Brian Niccol has pledged to fix.

Financially, short-term sales could still pop: limited-time Frappuccinos historically add 30–50 basis points to quarterly U.S. comp growth when marketing syncs with summer traffic. But the incremental dollars will come with higher labour minutes per transaction just as wage inflation is accelerating. Store-level margin may compress unless Starbucks adds labour hours—something it has tried to avoid amid profit-improvement targets.

Labour relations are the larger wild card. The dress-code dispute has already become a rallying cry for Workers United, which is organising votes at roughly 500 U.S. stores; pairing that flashpoint with a high-complexity drink line gives organisers fresh talking points about corporate indifference to partner workloads. Any uptick in petitions or walkouts through July would add legal costs and reputational friction at a moment when Starbucks is trying to reset its image with younger consumers. The Strato Frappuccinos may delight customers’ cameras and lift unit sales for a few weeks, but they arrive at the price of internal credibility. Coupled with a dress-code edict that many partners view as regressive, the launch threatens to deepen the gap between headquarters’ “simplify and streamline” narrative and day-to-day reality behind the bar—an execution risk investors should watch through the summer comp-sales print.

Madison Square Garden Sports Corp ($MSGS) & Madison Square Garden Entertainment Corp. ($MSGE):

Madison Square Garden Sports (MSGS) and Madison Square Garden Entertainment (MSGE) enter the summer with solid operational momentum and a rare catalytic tail-wind: the New York Knicks’ deepest playoff run in a decade. MSGS, which owns the Knicks and Rangers, reported fiscal-third-quarter revenue of $424.2 million and adjusted operating income (AOI) of $36.9 million, down year on year because the 2024 quarter included more regular-season dates, but the company nevertheless extracted roughly 11 percent more revenue per home game thanks to higher premium-seat mix and dynamic pricing. Average in-arena spend per attendee—tickets, suites, concessions and merchandise—rose to an estimated $183 from about $165 last season, underscoring management’s success at monetising every visit.

MSGE, the fee-collector that operates the Garden itself, is benefiting from the same pricing power with less volatility. Third-quarter sales climbed 6 percent to $242.5 million and AOI jumped 50 percent to $57.9 million, gains driven by a richer concert calendar and a six-percent increase in per-cap food-and-beverage spend; every extra dollar a fan drops at a concession stand flows almost entirely to MSGE’s bottom line.

That operating leverage grows geometrically in the post-season. Secondary-market data show upper-bowl seats for the Eastern Conference Finals starting near $300 and running well into four figures, while courtside inventory routinely lists above $20,000. A single sold-out playoff night therefore generates roughly $10-to-12 million of incremental revenue for MSGS between gate, suites, hospitality and in-house merchandise, and throws off about $3-to-4 million to MSGE through arena-licence fees and concession royalties. Almost 90% of that revenue is contribution margin because player salaries are fixed and the Garden’s overhead is already covered by regular-season activity.

Through Game 5 the Knicks have already banked seven home dates, worth an estimated $70-plus million to MSGS and MSGE combined. Should the series reach a Game 7, each additional Garden night would add another $8 to 10 million of high-margin revenue to MSGS and roughly $2 million to MSGE. A Finals berth—three guaranteed home games—could lift MSGS’s full-year AOI by about $25 million, or eight percent, and nudge MSGE’s by three to four percent, providing an earnings jolt in a quarter that historically leans on concerts rather than sports. Those upside numbers arrive before accounting for knock-on effects such as incremental sponsorship activations and national broadcast bonuses.

The equity market has started to price in some of that optionality. MSGS trades at barely eight times forward AOI, a steep discount to recent minority NBA transactions that have cleared well above 16 times; a Finals appearance would highlight the Knicks’ media reach just as the league negotiates a new national rights package expected to triple average annual fees. MSGE’s multiple is cushioned by an ongoing buy-back that has already taken $40 million of stock off the market this fiscal year, amplifying any incremental profit from playoff concessions.

Execution risk, however, remains. A Knicks exit in six games would erase the incremental earnings outlined above, while postseason staffing bonuses and security costs skim roughly ten percent off each playoff dollar. The Rangers’ second-round elimination also limits the dual-franchise upside MSGS enjoyed in 2022. Still, the franchise momentum is difficult to ignore: the Knicks set a regular-season attendance record, local RSN ratings surged, and the new tunnel-club and jersey-patch sponsorship inventory sold out at double-digit price increases.

Taken together, a prolonged Madison Square Garden spotlight would give both stocks a narrative spark at precisely the moment analysts are hunting for consumer-leisure names with visible second-half catalysts. MSGS captures the lion’s share of the financial upside through ticketing and sponsorship, MSGE skims a healthy slice via arena economics, and investors get an early read in July when the companies update guidance to reflect however far the Knicks ultimately go.