What's Trending with TickerTrends #7

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

1. Shopify Inc. ($SHOP):

Shopify's third-quarter 2024 earnings highlighted the company's remarkable performance and solidified its position as a leading player in the global commerce ecosystem. With revenue increasing by 26% year-over-year to $2.2 billion and a gross merchandise volume (GMV) growth of 24%, Shopify demonstrated its ability to sustain robust growth across multiple verticals and geographies. The results marked the fifth consecutive quarter of GMV growth exceeding 20%, reflecting strong demand from existing merchants and notable traction in international markets like Europe, which saw GMV grow by more than 35%.

A key driver of Shopify's success this quarter was the continuous enhancement of its product offerings. The company introduced innovative features such as Shopify Flow, which automates merchant workflows, and AI-powered suggestive replies in Shopify Inbox, which significantly improves customer interaction efficiency. Shopify also expanded its Shopify Tax product to the UK and EU, automating complex tax compliance processes for merchants. These advancements not only streamline operational efficiencies for merchants but also reinforce Shopify’s reputation as a comprehensive and indispensable platform for commerce.

The company's focus on international growth yielded impressive results, with cross-border GMV representing approximately 14% of total GMV and the number of international merchants increasing by 36% year-over-year. Notable partnerships with major global brands like Watches of Switzerland and The Body Shop underscore Shopify's expanding influence in international markets. Meanwhile, Shopify's offline retail solutions, such as the Tap to Pay feature in multiple countries, fueled a 27% year-over-year growth in offline GMV, demonstrating the platform’s ability to capture value across diverse sales channels.

Shopify’s efforts to penetrate the enterprise segment are also paying dividends. The company onboarded prominent brands like Reebok, Off-White, and Victoria’s Secret, highlighting its growing appeal to large-scale, complex enterprises. Shopify's modular solutions, such as Commerce Components and enhanced data migration tools, provide flexibility and efficiency that resonate with enterprise clients. The company reported 16 enterprise launches during the quarter, with some brands completing migration in record time, showcasing Shopify’s capability to handle large-scale implementations efficiently.

Financially, Shopify’s operating income more than doubled compared to the same quarter last year, and free cash flow margin expanded to 19%. These results underline Shopify’s ability to achieve growth while maintaining financial discipline. The company is strategically reinvesting in areas such as enterprise, international expansion, and AI-powered innovations, setting the stage for sustained long-term growth.

Shopify’s outlook remains optimistic as the company anticipates a strong Q4, traditionally its busiest period due to holiday sales. With expectations of mid-to-high 20s percentage growth in revenue and a continued focus on supporting merchants during the peak season, Shopify is well-positioned to maintain its upward trajectory. The combination of consistent innovation, international growth, and a robust enterprise strategy ensures Shopify remains a dominant force in the evolving commerce landscape.

2. Walt Disney Co ($DIS):

The Walt Disney Company delivered a strong performance for the fourth quarter and full fiscal year 2024, showcasing the effectiveness of its strategic pivot to growth across core segments. CEO Bob Iger reflected on the company's progress over the past two years, highlighting Disney's renewed focus on creativity, operational excellence, and expanding its global reach. These efforts have positioned the company for sustained growth, with guidance for high single-digit adjusted EPS growth in fiscal 2025, accelerating to double digits in fiscal 2026 and 2027.

Disney’s streaming business continues to be a standout, ending the quarter with 174 million core Disney+ and Hulu subscriptions, driven by strong content and platform integration. The upcoming introduction of an ESPN tile on Disney+ in December 2024 marks the next phase of its direct-to-consumer strategy, with plans for ESPN’s flagship standalone product launch in early fall 2025. The company is leveraging technological advancements such as anti-password sharing initiatives and enhanced personalization features, spearheaded by Adam Smith, formerly of YouTube, to boost engagement, reduce churn, and optimize monetization.

Disney’s strategic focus on quality content is paying dividends, with two $1 billion box office hits, Inside Out 2 and Deadpool & Wolverine. Upcoming releases like Moana 2, Mufasa: The Lion King, and Avatar: Fire and Ash underline a robust pipeline poised to drive further success across streaming and theatrical channels. Bob Iger emphasized the multiplier effect of Disney’s content ecosystem, where successful films elevate engagement on streaming platforms, merchandise, parks, and more.

The Parks and Experiences division remains a vital growth driver, despite temporary disruptions from hurricanes in Florida and softness in international markets like Shanghai. Domestic parks have shown resilience, with expectations of gradual consumer strengthening. Future growth is underpinned by targeted investments, including new attractions and expansions at existing locations, the launch of the Disney Treasure cruise ship, and continued bookings momentum into 2025.

Disney’s advertising strategy leverages a proprietary ad tech stack and integrated offerings across linear and streaming platforms. While linear networks continue to face structural challenges, live sports and differentiated audience delivery have kept the segment relevant. The company’s deal with DIRECTV and its ability to sell differentiated inventory through partnerships with platforms like Google and YouTube further highlight Disney’s adaptability.

While international markets continue to grow, Disney is taking a measured approach to investing in local content. Bob Iger emphasized the importance of ensuring high returns on content investments, particularly in EMEA and APAC, before scaling further. The company's reliance on globally resonant franchises provides a competitive advantage over peers, allowing it to drive international subscriber growth without disproportionately high content costs.

CFO Hugh Johnston reiterated confidence in Disney’s ability to achieve its ambitious EPS and margin targets, driven by incremental growth in subscribers, pricing optimization, and international expansion. The company remains disciplined in balancing capital allocation between high-return projects, such as park expansions, and broader growth initiatives like direct-to-consumer investments.

Trends this week:

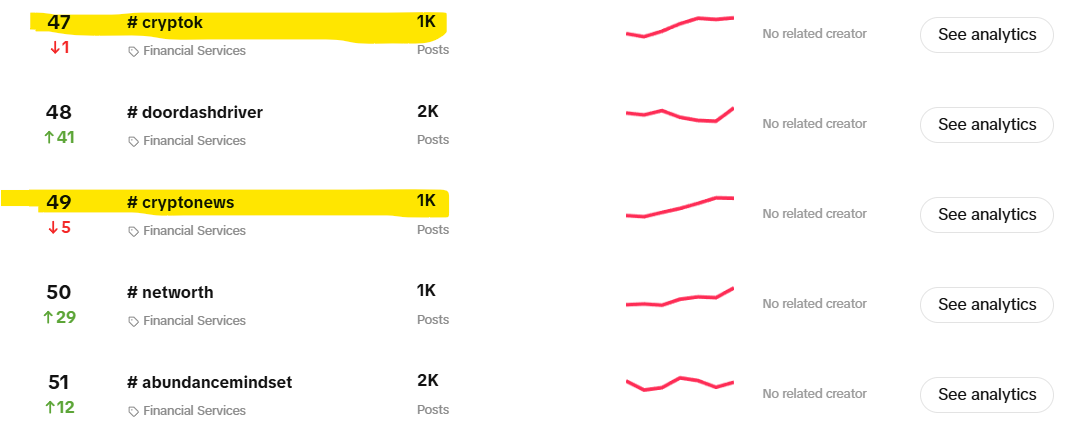

1. Cryptocurrency:

The cryptocurrency market has experienced a remarkable resurgence in activity and investor interest following Donald Trump's re-election, with Bitcoin leading the charge. Bitcoin’s price reached an all-time high of $93,375.40 on November 13, 2024, fueled by heightened optimism about the incoming administration's pro-crypto stance. Google Trends data showed a surge in Bitcoin-related searches over the last few days, signaling renewed retail and institutional enthusiasm. This spike in search interest aligns closely with Bitcoin's bullish price action, which saw the digital asset climb from $70,000 to over $80,000 within days, reflecting the market's confidence in favorable regulatory and policy shifts under the new administration.

The political backdrop has bolstered this optimism. Donald Trump, who had previously criticized cryptocurrencies during his first term, has made a dramatic pivot, actively advocating for the adoption of pro-crypto policies. His campaign included promises to create a national Bitcoin stockpile, appoint crypto-friendly regulators, and establish the United States as a global crypto hub. These policy commitments, coupled with market excitement over a friendlier regulatory environment, have strengthened investor sentiment across the crypto space.

Retail investors, too, are making their presence felt. The recent price action has drawn in new participants, with search interest and trading volumes reflecting heightened retail activity. Historically, retail investors have been a driving force in Bitcoin’s bull runs, and their renewed interest signals the potential for a sustained market rally. However, analysts caution that the market remains volatile, with the potential for sharp corrections.

The cryptocurrency market is riding a wave of optimism driven by political developments, strong market dynamics, and surging public interest. Bitcoin’s record-breaking price and the accompanying spike in search trends underline the growing importance of external factors such as regulatory clarity and macroeconomic policies in shaping market behavior. As the sector continues to evolve, these trends highlight the interconnectedness of market sentiment, political shifts, and digital asset performance, setting the stage for an exciting phase in the cryptocurrency landscape.

2. Lululemon ($LULU):

Lululemon and Disney have teamed up for a limited-edition 34-piece collection that is taking the internet—and stores—by storm. Featuring classic Lululemon designs adorned with nostalgic Disney imagery, the collaboration has generated significant buzz, with fans flocking to social media platforms like TikTok and Instagram to share their excitement. The collection blends Lululemon’s signature high-performance apparel, such as the Align High-Rise Pant and Define Jacket, with playful Disney motifs, including Mickey and Minnie Mouse. Prices range from $58 for accessories like the iconic Everywhere Belt Bag to $158 for fleece hoodies, making the collection accessible to a wide audience.

The launch was accompanied by the "Happily Ever Active" campaign, featuring celebrities and athletes like NBA player Jordan Clarkson and former The Bachelor star Matt James, further amplifying its reach. Social media posts featuring these ambassadors celebrating movement and nostalgia alongside Mickey Mouse have driven engagement across platforms. The collection’s focus on nostalgia and joy resonates deeply with consumers, particularly Millennials and Gen Z, who associate Disney with childhood memories.

The virality of the collection has led to strong initial sales, with select pieces selling out within hours of launch. The collaboration has also expanded its availability to Disney retail locations and global markets, which could sustain its momentum. This partnership positions Lululemon to tap into Disney's massive fanbase while reinforcing its reputation as a lifestyle brand that transcends fitness apparel.

For Lululemon's stock, the collaboration presents several potential positives. The heightened consumer interest could boost revenue in the short term, while the brand’s ability to create cultural moments like this strengthens its equity in the long term. Furthermore, the campaign aligns with Lululemon's strategy to engage younger, digitally active demographics, which are crucial for sustained growth. As Lululemon continues to innovate through collaborations and expand its global presence, this partnership could serve as a template for future cross-brand initiatives that drive both consumer loyalty and shareholder value.

3. Mattel Inc. ($MAT):

Mattel has recently found itself at the center of an unusual controversy surrounding its highly anticipated Wicked movie-themed dolls. A misprint on the packaging mistakenly directed consumers to an adult website rather than the intended official promotional site for Universal Pictures’ upcoming Wicked movie. This incident has sparked widespread attention across social media and news outlets, with parents and collectors voicing concerns about the appropriateness of the packaging. The error, involving a URL linking to Wicked Pictures, a producer of adult content, is particularly damaging given the family-friendly nature of both the Wicked franchise and Mattel's brand.

In response, Mattel issued an apology, describing the incident as an "unfortunate error" and advising consumers to discard or obscure the packaging. The company has also pulled the dolls from major retailers like Amazon, Target, and Walmart, while it evaluates how to address the error, either by reprinting packaging or providing corrective stickers. However, this has inadvertently driven demand for the misprinted dolls, which are now being sold for up to $2,100 on secondary markets like eBay.

The incident poses risks to Mattel's reputation and financial performance. While the packaging misprint may seem like an innocent oversight, it highlights potential weaknesses in Mattel's quality control and product rollout processes. This is particularly concerning as the holiday shopping season approaches, a crucial period for toy manufacturers. The costs associated with recalling and correcting the misprinted dolls could impact the company's margins in the short term, especially given the extensive distribution of the product.

Public backlash has been mixed, with some seeing the situation as an embarrassing mistake and others criticizing Mattel for the lapse. The timing of the controversy, just weeks before the Wicked movie’s release, could dampen the otherwise significant retail momentum that the collaboration was expected to generate. Analysts suggest the impact on Mattel’s long-term revenue will depend on how quickly and effectively the company addresses the situation.

In a broader context, the incident may lead to heightened scrutiny of Mattel’s future licensing collaborations, especially for properties targeting children and families. While it is unlikely to cause sustained harm to the company's overall brand, the controversy serves as a reminder of the risks inherent in managing high-profile partnerships. Investors will likely watch closely for updates on the resolution of the issue, as well as the company’s holiday sales performance, to assess whether this misstep has any lasting effects.

4. McDonald’s ($MCD):

If you have been following WTWT, you know $MCD has been mentioned almost every week. Well, here we are again, the McDonald's Holiday Pie is back for the 2024 holiday season, sparking excitement among fans of this custard-filled seasonal treat. First introduced in 1999, the pie has become a beloved holiday tradition, featuring a creamy vanilla custard nestled in a flaky, buttery crust and topped with a festive sugar glaze and rainbow sprinkles. This annual favorite returned to select locations nationwide on November 15, with availability expected through the holiday season while supplies last. Fans can check the McDonald’s app to confirm local availability.

The Holiday Pie’s reappearance has ignited social media buzz, with influencers and food reviewers sharing their excitement and tracking its rollout across the U.S. TikTok creators like @markie_devo have tipped fans on where to find the pie, turning its limited availability into a festive treasure hunt. For many, this dessert has transcended its status as a menu item to become a nostalgic part of holiday traditions, with its sweet, custard-filled center and colorful sprinkles evoking fond memories of family gatherings and seasonal celebrations.

The popularity of the Holiday Pie is a testament to the power of seasonal menu items in creating excitement and boosting sales. Research from Technomic reveals that nearly 60% of consumers are more likely to order seasonal menu items, and McDonald’s has leveraged this by positioning the Holiday Pie as an annual event. Social media activity around the pie not only builds anticipation but also strengthens its association with holiday nostalgia and warmth.

From a business perspective, the Holiday Pie exemplifies McDonald’s ability to use limited-time offerings to drive foot traffic and engagement. Seasonal items like this pie capitalize on nostalgia and exclusivity, drawing in both loyal customers and new ones eager to partake in the festive tradition. As McDonald's enters the critical holiday sales period, the buzz surrounding the Holiday Pie highlights its effectiveness in creating small yet meaningful holiday moments that resonate with customers year after year.

5. Amazon ($AMZN):

Amazon has launched Amazon Haul, a budget-friendly online storefront designed to compete with popular low-cost platforms like Shein and Temu. This mobile-exclusive store offers a wide array of unbranded products, including apparel, electronics, and home goods, all priced under $20, with many items below $10. The platform promises free shipping on orders over $25, while orders below that threshold incur a $3.99 fee. Delivery times range from one to two weeks, a shift from Amazon's hallmark rapid shipping model, as products are shipped from China.

The launch of Amazon Haul is a direct response to the growing popularity of Chinese discount platforms, particularly among Gen Z shoppers. These platforms have thrived on offering ultra-low-priced goods, often at the expense of environmental and regulatory scrutiny. By creating Haul, Amazon aims to leverage its existing reputation for trust and safety while addressing consumer demand for affordable products. Unlike its competitors, Amazon emphasizes that Haul’s sellers are pre-screened to ensure product compliance and authenticity.

Amazon Haul’s design mirrors its rivals, featuring grid-based product displays, playful visual cues like fire emojis for “crazy low prices,” and an assortment of budget-friendly staples. Products range from $1.79 iPhone cases to $4.99 table runners and $3.21 winter gloves. While the storefront may cannibalize some sales from Amazon's primary platform, experts suggest this is a strategic move to retain value-seeking customers rather than losing them to external rivals.

The timing of this launch is notable, given potential headwinds from U.S. policy changes. The Biden administration’s crackdown on Chinese imports and president-elect Donald Trump’s proposed 60% tariff on Chinese goods could impact pricing for Haul’s inventory. Nevertheless, Amazon is pressing forward, betting on its ability to compete in the value retail segment without compromising its broader market dominance.

The launch of Amazon Haul also raises questions about the platform's visual standards. Critics have pointed out the prevalence of low-quality or AI-manipulated product images on the storefront, which may detract from Amazon's reputation for quality. However, the company asserts it is monitoring these issues and will take corrective action as needed.

For Amazon, Haul represents an effort to reclaim the value retail market and appeal to younger, budget-conscious shoppers. While the long-term success of this initiative depends on regulatory developments and consumer adoption, Amazon Haul is well-positioned to challenge its competitors with its combination of affordability, trust, and innovation. As the holiday season ramps up, this new storefront could become a significant player in the discount retail space, keeping Amazon firmly in the race for cost-conscious consumers. It would be interesting to see whether the Amazon Haul cannabalises Amazon’s traditional ecommerce business.

6. Netflix:

Netflix’s live broadcast of the highly anticipated boxing match between YouTuber-turned-boxer Jake Paul and former heavyweight champion Mike Tyson shattered records, drawing over 60 million households worldwide and peaking at 65 million concurrent streams. Held at AT&T Stadium in Arlington, Texas, the event also achieved an impressive $18 million in gate revenue, making it the largest boxing gate outside of Las Vegas in history.

The co-main event, featuring Katie Taylor and Amanda Serrano, further cemented the night as historic, becoming the most-watched professional women’s sporting event in U.S. history with 50 million households tuning in. Netflix touted the event as a major success, with its impact dominating social media and sparking a wave of excitement for the platform’s push into live sports.

However, the event also exposed significant challenges for Netflix in the live-streaming arena. Numerous viewers reported buffering issues, streaming glitches, and low-resolution video, with some unable to access the event altogether. Outages were widely shared on social media, drawing sharp criticism. Fans expressed concerns over Netflix’s ability to handle upcoming live events, including its NFL doubleheader debut on Christmas Day.

The technical hiccups were reminiscent of issues Netflix faced during its "Love Is Blind" reunion livestream, underscoring the growing pains of transitioning into live sports. Despite this, the record-breaking viewership demonstrates Netflix's potential in the space. As the platform continues to expand its live sports portfolio—including deals with the WWE and NFL—resolving these technical issues will be crucial to maintaining its reputation and leveraging its audience of over 283 million subscribers.

The night also highlighted the power of spectacle in driving viewership, with Paul’s promotional antics and Tyson’s legendary status attracting a wide audience beyond boxing enthusiasts. While the fight itself received mixed reviews, the event’s success solidified Netflix’s foray into live sports, offering a glimpse into its ambitions to compete with traditional sports broadcasters. As Netflix refines its infrastructure and strategy, the platform’s entry into live sports promises both opportunities and challenges ahead.

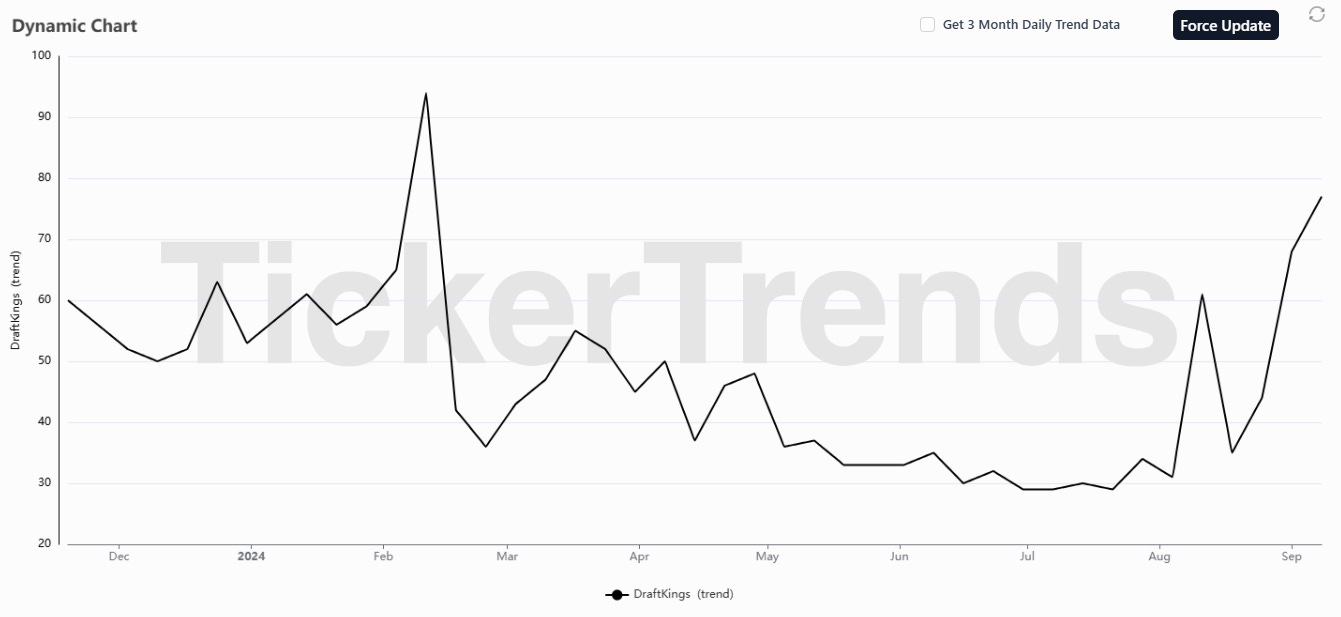

7. DraftKings Inc ($DKNG):

The highly anticipated Jake Paul vs. Mike Tyson boxing match, streamed live on Netflix, generated immense interest across the sports and entertainment landscape, driving over 100,000 Google searches in the last week alone. This surge in online attention underscores the significant engagement and curiosity surrounding the event, which DraftKings (DKNG) strategically leveraged through its promotional tie-ins. The platform’s $25K prediction pool and “Bet $5, Get $200 in Bonus Bets” offer positioned DraftKings to capitalize on the event’s widespread appeal, attracting both seasoned bettors and newcomers eager to engage with the fight.

The heightened search volume reflects not only the fight's popularity but also the broader demand for interactive experiences tied to such events. DraftKings likely benefited from this digital momentum, as many searchers converted into users exploring betting markets for the fight. This influx of traffic and new account sign-ups drove immediate engagement on the platform, with users participating in unique betting markets such as victory methods and round predictions.

Beyond short-term gains, the fight allowed DraftKings to enhance its brand positioning in the competitive sports betting industry. By aligning with a globally-discussed event, the company reinforced its reputation as a go-to platform for high-profile sports wagering. While promotional investments like free-entry pools and bonus bets may impact short-term profitability, they are essential for capturing new users and fostering long-term loyalty. The significant online interest in the fight, as evidenced by Google search trends, highlights the growing importance of digital engagement strategies in the sports betting market, positioning DraftKings to thrive amid increasing competition.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.