What's Trending with TickerTrends #9

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

1. Dick’s Sporting Goods. ($DKS):

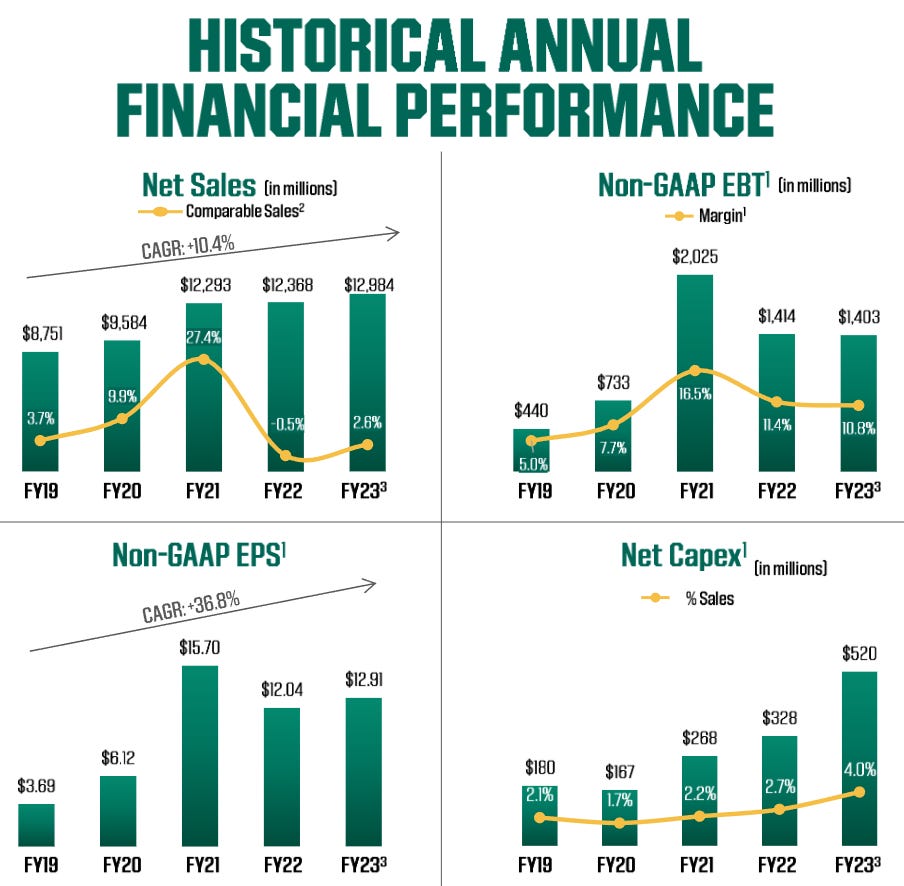

Dick’s Sporting Goods delivered another strong quarter, showcasing the effectiveness of its long-term strategies and robust execution. For Q3 2024, comparable sales increased by 4.2%, driven by a strategic focus on omnichannel capabilities and differentiated product assortments. Year-to-date consolidated net sales rose by 4.8% to $9.55 billion, with Q3 contributing $3.06 billion.

The back-to-school season was a standout, with strength across key categories such as footwear, athletic apparel, and team sports. Gross margin expanded by 67 basis points year-over-year, with merchandise margin up 84 basis points due to improved product mix and reduced promotional pressures. Earnings per share (EPS) for Q3 came in at $2.75, slightly below last year’s non-GAAP EPS of $2.85, largely impacted by calendar shifts. Inventory levels increased by 13% year-over-year, reflecting strategic investments in high-performing categories like fleece, footwear, and holiday-specific products, while clearance inventory declined significantly, demonstrating effective inventory management and reduced markdown risks. On the capital allocation front, the company repurchased approximately 35,000 shares during Q3 for $6.7 million at an average price of $194.22, with full-year repurchases expected to reach $300 million. Net capital expenditures for the quarter totaled $185 million, supporting the expansion of innovative store formats like House of Sport and Field House.

Dick’s continues to make significant progress on its strategic initiatives. Its omnichannel focus has strengthened customer engagement through digital enhancements such as the DICK’s app and website. GameChanger, its youth sports tech platform, saw notable growth with 5.5 million active users, contributing $100 million in revenue at a 30%-40% CAGR. The House of Sport concept remains central to Dick’s strategy, with 19 locations currently open and plans to expand to 75-100 by 2027. This concept has fostered strong community engagement and bolstered partnerships with major brands. Similarly, the Field House concept, a smaller-scale version of House of Sport, has 26 locations, with plans for 20 more in 2025. The company is also focusing on market expansion in Texas, highlighted by the development of a new distribution center in Fort Worth set to open in early 2026.

Management raised its full-year guidance, reflecting confidence in the company’s momentum and strategic initiatives. Full-year comparable sales growth guidance was increased to 3.6%-4.2% from prior expectations of 2.5%-3.5%, and EPS guidance was revised upward to $13.65-$13.95. Despite the shorter holiday shopping season, management expressed optimism due to strong inventory positioning and operational readiness. However, macroeconomic uncertainties and potential tariff impacts remain areas of caution. Long-term growth will be driven by increased penetration of vertical brands, which offer 600-800 basis points higher margins compared to national brands, alongside continued differentiation of product assortment, enhanced pricing models, and strategic investments in technology and store formats.

Dick’s demonstrated another quarter of strong performance, with a clear vision for future growth. Its strategic focus on omnichannel capabilities, innovative store formats, and differentiated offerings positions the company well to navigate market challenges and capitalize on opportunities. While macroeconomic uncertainties and tariffs present risks, the company’s robust inventory management, diversified supply chain, and disciplined execution provide confidence in its ability to sustain growth in the near and long term. Dick’s Sporting Goods remains a compelling investment opportunity for those seeking exposure to a leader in the retail sports and lifestyle sector.

2. Abercrombie & Fitch Co ($ANF):

Abercrombie & Fitch reported a record-breaking Q3 2024, with net sales reaching $1.2 billion, a 14% increase year-over-year, and comparable sales up 16%. This marked the company’s sixth consecutive quarter of double-digit comparable sales growth across both store and digital channels. Operating income grew by 30% to $179 million, and operating margin expanded 170 basis points to 14.8%, showcasing strong execution on both the top and bottom lines. Gross profit rate improved slightly to 65.1%, supported by higher average unit retail prices (AUR) due to reduced promotional activity, although partially offset by elevated freight costs. The company credited its success to balanced growth across regions, categories, and genders, with strong contributions from key product areas such as sweaters, jeans, dresses, fleece, and Hollister’s new collegiate collection. Abercrombie continued to excel as a lifestyle brand, broadening its appeal beyond its traditional demographic, while Hollister delivered double-digit growth by solidifying its leadership in the teen market.

Regionally, Abercrombie saw strong results in the Americas (+14%), EMEA (+15%), and APAC (+32%), reflecting effective localization efforts, particularly in markets like the UK, Germany, and China. The company’s digital channel continued to be a significant driver of sales, though in-store performance remained critical, with strong traffic trends supported by refreshed store designs and expanded physical presence. Year-to-date, Abercrombie has opened 39 stores, remodeled or right-sized 38, and closed 31. By year-end, it plans to deliver approximately 60 new stores and 60 remodels while maintaining a net-positive store count. The company emphasized its readiness for the holiday season, with tested and proven holiday assortments, well-stocked inventory, and enhanced staffing levels across stores and distribution centers.

Abercrombie’s proactive supply chain management allowed it to mitigate potential disruptions, such as longer ocean transit times and the East Coast port strike, by increasing the use of air freight. Inventory rose 16% year-over-year due to strategic stocking for Q4 sales and higher freight costs. Despite this, management assured that inventory levels remained clean and aligned with demand. Abercrombie raised its full-year outlook, now projecting 14-15% sales growth and operating margins at the high end of its previous range of 14-15%. This reflects the company’s confidence in sustaining strong momentum through the holiday season and into 2025.

Management highlighted its commitment to financial discipline and shareholder returns, repurchasing $100 million in shares during Q3 and maintaining $102 million in remaining authorization. Abercrombie’s long-term growth strategy includes leveraging its global operating model, optimizing its store fleet, and expanding digital capabilities. The company’s localized playbooks for international markets, particularly in Europe and Asia, continue to yield results, supported by targeted marketing campaigns and influencer collaborations tailored to specific demographics. Hollister complemented its digital presence with real-life activations like high school festivals, striking a balance between digital engagement and in-person experiences.

Looking ahead, Abercrombie is focused on maintaining AUR improvements, reducing promotions, and driving traffic across channels through engaging marketing and superior product offerings. The company views its agile operating model, balanced growth strategy, and healthy cash position as key enablers for sustainable, profitable growth in 2025 and beyond. Management also reiterated its ability to navigate potential headwinds, including tariff impacts and freight cost variability, while leveraging a diversified global sourcing network across 17 countries. With strong brand health, compelling product assortments, and disciplined execution, Abercrombie is well-positioned to deliver for its customers and shareholders during the critical holiday season and beyond.

Trends this week:

1. Seaboard Corp. ($SEB):

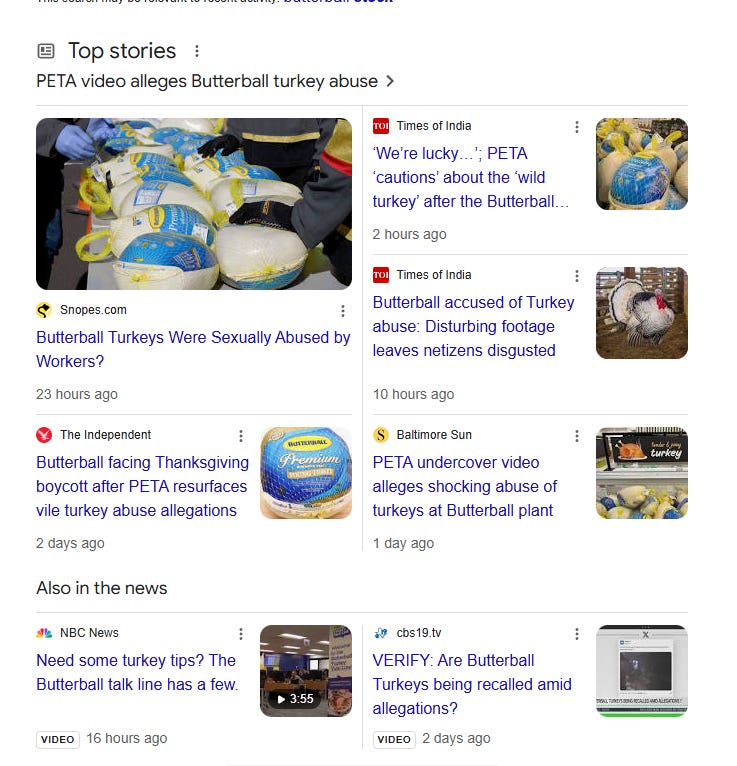

Seaboard Corporation (NYSE: SEB), a diversified conglomerate with interests in agriculture, shipping, and energy, holds a 50% stake in Butterball, LLC, the largest turkey producer in the United States. Recent events have thrust Seaboard into the spotlight following the resurfacing of a 2006 PETA undercover investigation that alleged severe animal abuse at a Butterball facility in Ozark, Arkansas. This decades-old footage, featuring graphic depictions of physical and alleged sexual abuse of turkeys, has gone viral across social media platforms like TikTok, where it became a top-20 trending hashtag. Google searches for “Butterball turkey recall” surpassed 500,000 in the week leading up to Thanksgiving, reflecting significant public outrage. Calls for a boycott have gained momentum, with consumers pledging to avoid Butterball products during one of the most critical sales periods of the year.

Butterball has responded by emphasizing that the video predates its privatization in 2006 and its subsequent certification by American Humane in 2013. The company highlighted its adherence to over 200 science-based animal welfare standards and annual third-party audits. Despite these assurances, critics, including PETA, have dismissed these certifications as inadequate, further fueling negative sentiment. The timing of the controversy, coinciding with Thanksgiving, poses immediate challenges to Butterball’s sales and reputation, raising questions about the potential impact on Seaboard’s financial performance.

For Seaboard, Butterball’s issues create both risks and opportunities. In the short term, reduced turkey sales during the holiday season could dent Butterball’s revenue, thereby affecting Seaboard’s overall earnings. With Butterball accounting for one in three turkeys served on Thanksgiving, a significant consumer shift toward competitors could exacerbate these challenges. Beyond the immediate revenue implications, the backlash could also erode Butterball’s long-term brand equity, making it harder to retain market share in the competitive poultry industry.

However, Seaboard’s diversified portfolio could mitigate the financial impact of Butterball’s struggles. The company’s operations in commodities trading, marine shipping, and energy provide alternative revenue streams, which may cushion any temporary decline in poultry earnings.

Navigating the current crisis will require Butterball to effectively address consumer concerns and rebuild trust. The company’s position as the only American Humane-certified turkey producer offers a potential marketing advantage, provided it can convincingly demonstrate its commitment to ethical practices. The long-term impact on Seaboard’s stock will depend on Butterball’s ability to stabilize its reputation and capitalize on this certification to differentiate itself from competitors.

As the controversy unfolds, investors should closely monitor Butterball’s Q4 sales figures, its crisis management efforts, and the broader sentiment surrounding its brand. While the backlash poses immediate challenges, Seaboard’s resilience lies in its diversified operations and ability to weather short-term setbacks. The balance between these risks and opportunities will ultimately shape the stock’s trajectory in the months ahead.

2. Dollar Tree ($DLTR):

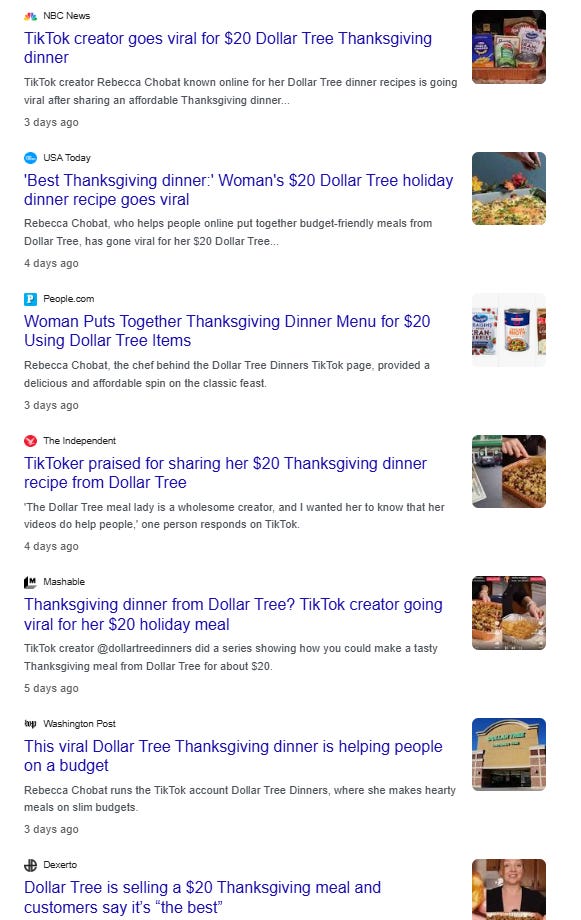

Dollar Tree (NYSE: DLTR) has captured significant attention recently, with a notable spike in interest largely attributed to the viral success of TikTok user @dollartreedinners. The creator, Rebecca Chobat, shared her $20 Thanksgiving dinner idea, showcasing how to create a three-course holiday meal using only Dollar Tree ingredients. This initiative has resonated with millions, with her video series amassing over 10 million views and thousands of comments. The content's appeal is rooted in its practicality and focus on affordability, catering to those facing financial constraints or seeking budget-friendly alternatives for Thanksgiving.

Chobat's viral content has sparked widespread interest in Dollar Tree's offerings, with customers reportedly replicating her recipes and sharing their experiences online. A heartwarming anecdote shared by fellow TikTok creator @CalebCooks highlighted a single mother of three who, inspired by Chobat's video, was able to provide her children with a "real Thanksgiving dinner" instead of relying on frozen meals. Stories like these have contributed to the positive sentiment surrounding Dollar Tree, reinforcing its role as a go-to destination for budget-conscious shoppers.

This surge in consumer interest and engagement bodes well for Dollar Tree's Q4 performance. The company could see increased foot traffic and revenue as shoppers explore its expanded grocery selection, which now includes Thanksgiving-themed items like canned turkey, stuffing mix, and pie filling. The $20 Thanksgiving dinner campaign demonstrates how Dollar Tree's value proposition resonates with its core audience, potentially driving stronger-than-expected sales in the holiday season.

However, potential risks remain, particularly regarding the impact of ongoing China tariffs. As Dollar Tree sources many products from overseas, tariff-related costs could pressure margins and complicate inventory management. While the current viral success is a strong positive indicator, the company must navigate these external challenges carefully to sustain momentum.

Overall, Dollar Tree's ability to capitalize on social media-driven trends highlights its adaptability and relevance in the modern retail landscape. If the momentum from Chobat's viral content carries forward, the company's Q4 guidance and subsequent quarters could reflect this surge in consumer interest. Investors should keep an eye on Dollar Tree’s upcoming earnings report for insights into how this viral moment translates into measurable performance, while also monitoring the potential impact of tariffs on future profitability.

3. Unusual Machines Inc. ($UMAC):

Unusual Machines Inc. (NYSE American: UMAC), a U.S.-based drone and drone component manufacturer, has experienced a meteoric rise in its stock price this week, climbing an astonishing 380.26%. This surge follows the announcement that Donald Trump Jr., son of President-elect Donald Trump, has joined the company’s advisory board. The news has sparked immense interest in the company, leading to a remarkable increase in trading activity and setting new records for the stock.

The stock’s rise began after Unusual Machines revealed Trump Jr.’s involvement, emphasizing his role in advocating for reshoring U.S. drone production and reducing dependency on foreign-made components, particularly from China. In a press release, Trump Jr. stated, “The need for drones is obvious. It is also obvious that we must stop buying Chinese drones and Chinese drone parts. I love what Unusual Machines is doing to bring drone manufacturing jobs back to the USA and am excited to take on a bigger role in the movement.” Trump Jr. is also the company’s second-largest shareholder, holding over 330,000 shares, which further aligns his interests with the company’s success.

Unusual Machines CEO Allan Evans expressed confidence in Trump Jr.’s contribution, noting, “Don Jr. joining our board of advisors provides us with the unique expertise we need as we bring drone component manufacturing back to America. He brings a wealth of experience, and I look forward to his advice and role within the company as we continue to build our business.” The company has positioned itself as a leader in reshoring production, which aligns with the president-elect’s focus on strengthening domestic manufacturing.

The company’s strategic moves come at a time of tremendous growth potential in the drone industry. The global market for drone accessories is currently valued at $17.5 billion and is projected to exceed $115 billion by 2032, according to Fact.MR. Unusual Machines aims to be a significant player in this expanding market, supported by its innovative products like the Brave F7 FPV Flight Controller and brands like Fat Shark and Rotor Riot. The company is also leveraging advanced technologies, such as HP’s Multi Jet Fusion 3D printing, to bolster its manufacturing capabilities.

While the stock’s rapid rise signals strong optimism, there are potential risks, including the possibility of heightened regulatory scrutiny given the company’s ties to the Trump family and reliance on government contracts. However, the alignment of its mission with the broader policy goals of the incoming administration could position Unusual Machines for further growth and success in the burgeoning U.S. drone market.

With a strategic vision centered on innovation, reshoring, and tapping into a rapidly growing industry, Unusual Machines has captured the market’s attention and may continue to be a key player in the evolving landscape of drone technology.

4. Krispy Kreme Inc. ($DNUT):

Krispy Kreme is celebrating the holiday season with its "Merry Grinchmas Doughnut Collection," inspired by the timeless Christmas tale How the Grinch Stole Christmas! by Dr. Seuss. Starting Friday, November 29, 2024, these festive treats will be available for a limited time at participating Krispy Kreme shops and select grocery stores. The collection introduces three all-new doughnuts inspired by the story's beloved characters and brings back two fan-favorite holiday classics.

The new additions to the collection include the Grinch Doughnut, an unglazed doughnut filled with coal-inspired Cookies & Kreme filling, dipped in Grinch-green icing, and topped with a chocolate smirk and buttercream hair, perfectly capturing the Grinch's mischievous personality. The Grinchy Claus Doughnut is an Original Glazed doughnut dipped in chocolate icing, adorned with white buttercream snow, colorful Christmas crispies, and a Grinch figurine dressed in a Santa outfit. The Cindy-Lou Who Merry Berry Tree Doughnut features an Original Glazed doughnut dipped in strawberry-flavored icing and decorated with a green buttercream Christmas tree, festive sprinkles, and a star piece.

Returning favorites include the Santa Belly Doughnut, a holiday classic filled with white Kreme, dipped in red icing, and topped with a black chocolate Santa belt and buckle, and the Holiday Sprinkle Doughnut, an Original Glazed doughnut dipped in chocolate icing and finished with festive sprinkles. Fans can also purchase special six-pack and dozen assortments featuring these doughnuts, delivered fresh daily to select grocery stores.

Krispy Kreme's global chief brand officer, Dave Skena, expressed excitement about the collection, saying, “Our Merry Grinchmas doughnuts are guaranteed to make even the Grinchiest Grinch smile. At Krispy Kreme, you’re a sweet one, Mr. Grinch!” In addition, Krispy Kreme will continue its annual tradition on December 12 with “Day of the Dozens,” offering guests a $1 Original Glazed dozen with the purchase of any dozen at regular price, available in-shop, drive-thru, or online.

It will be interesting to see if the virality of the doughnuts can be a positive for $DNUT’s stock price.

5. Macy’s Inc ($M):

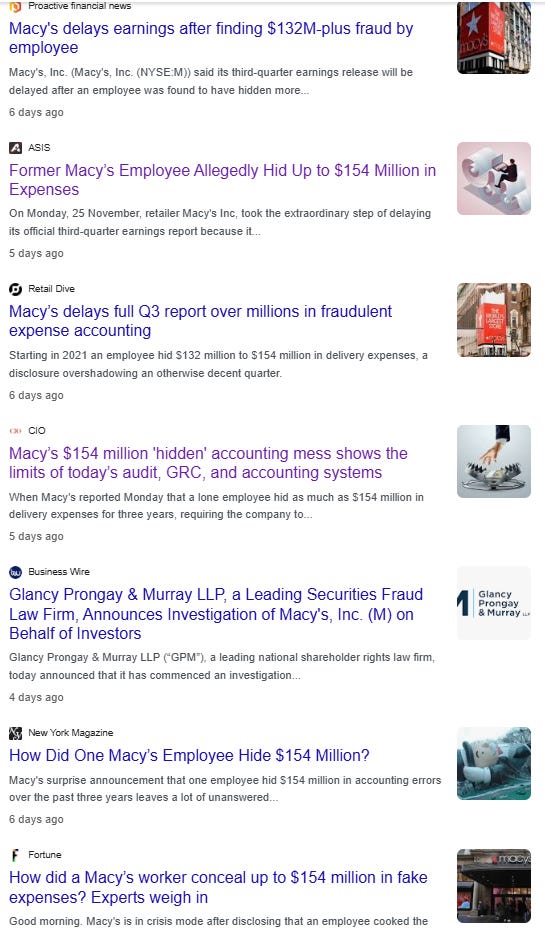

Macy’s Inc. shocked investors this week by delaying its Q3 earnings report after uncovering that a single employee had hidden between $132 million and $154 million in delivery expenses over the course of three years. This revelation has not only raised questions about Macy’s internal controls and governance but also caused a 3% drop in the company’s stock price. The accounting irregularities, described as “erroneous accounting accrual entries,” spanned from Q4 2021 through Q3 2024, according to Macy’s. The company emphasized that these actions did not affect its cash management or vendor payments and stated that the responsible individual is no longer employed.

The hidden expenses represent approximately 3% of Macy’s $4.36 billion in delivery expenses during this period. While that might seem minor relative to the company’s overall financials, the intentional manipulation raises broader concerns about corporate oversight. Experts suggest the employee’s motive was likely to improve the appearance of financial performance, possibly to secure bonuses or career advancement. The incident underscores how vulnerable even large organizations are to insider manipulation, particularly in complex areas like accrual accounting, where errors and fraudulent practices can go unnoticed for extended periods.

The delay in Macy’s earnings announcement comes at a critical time, as the company enters the high-stakes holiday season, which typically accounts for a significant portion of its annual profit. Preliminary Q3 results indicate a 2.4% year-over-year decline in net sales to $4.7 billion, with comparable sales down 1.3%. Despite this, Macy’s highlighted positive trends in its revamped "first 50" stores, which posted a 1.9% increase in comparable sales.

Analysts have mixed reactions to the potential fallout. Some, like Morningstar’s David Swartz, view the financial impact as immaterial given Macy’s annual operating expenses exceed $8 billion. However, others, including GlobalData’s Neil Saunders, argue that the incident could damage investor confidence and distract from what was otherwise shaping up to be a decent quarter. The situation also raises concerns about the effectiveness of Macy’s auditors, given that the discrepancies went undetected for years.

The immediate reaction has been negative, with shares dipping as the news broke. However, the long-term impact on Macy’s stock will depend on the company’s ability to reassure investors that it has taken robust corrective actions. Strengthening internal controls, enhancing governance practices, and rebuilding trust with stakeholders will be crucial. Additionally, with the holiday season ahead, Macy’s performance during this critical period could help offset some of the reputational damage.

This incident serves as a stark reminder of the challenges retailers face in balancing operational complexity with financial transparency. For Macy’s, the path forward will involve not only addressing the gaps in its accounting and governance systems but also demonstrating resilience in the face of heightened scrutiny. Investors will be closely watching the company’s upcoming earnings release on December 11 for clarity on the financial impact and steps taken to prevent future occurrences.

6. Walt Disney Co. ($DIS):

Disney’s “Moana 2” has made a significant impact at the box office, setting a new record for the Thanksgiving holiday with $221 million in domestic ticket sales over the five-day weekend. This achievement marks the highest Thanksgiving debut ever, surpassing previous records held by “Frozen II” and “The Super Mario Bros. Movie.” Globally, the film generated $386 million during its opening, becoming the second-highest global launch of 2024, trailing only “Deadpool & Wolverine.” The success of “Moana 2” contributed to a record-breaking Thanksgiving weekend at the domestic box office, which totaled $420 million across all films, a dramatic recovery from the $125 million recorded in 2023.

This strong performance underscores Disney’s ability to leverage its iconic franchises effectively. “Moana 2” is expected to become Disney’s third $1 billion-grossing film of 2024, following “Inside Out 2” and “Deadpool & Wolverine.” The success of the sequel also highlights the value of Disney’s decision to pivot “Moana 2” from a planned Disney+ series to a theatrical release. With the original “Moana” being the most-streamed film on Disney+ in 2023, the sequel’s box office triumph will likely enhance its streaming appeal, potentially driving increased Disney+ subscriptions and sustained engagement.

The film’s performance is particularly significant as it reinforces Disney’s dominance in family entertainment, with the family moviegoing segment projected to account for $6.8 billion in ticket sales in 2024—more than the combined totals of 2022 and 2023. Additionally, “Moana 2” exemplifies Disney’s strategy to balance theatrical and streaming efforts, signaling confidence in the enduring appeal of theatrical releases. Analysts view this as a crucial turnaround for Disney following the underperformance of titles like “Wish” and “Strange World.”

While the film has received mixed critical reviews (65% on Rotten Tomatoes), audience reception has been positive, earning an “A-” CinemaScore. This strong word-of-mouth is expected to drive repeat viewership and extended box office legs through the holiday season. However, high production and marketing costs may temper profit margins, even as the film breaks records.

For Disney stock ($DIS), “Moana 2” represents a bullish indicator. The film’s success bolsters revenue expectations for Q4 and reinforces the value of Disney’s intellectual properties. The synergy between theatrical and streaming platforms positions Disney for long-term growth, while the resurgence in family moviegoing and blockbuster success could restore investor confidence. If this momentum sustains, “Moana 2” could serve as a catalyst for Disney’s broader recovery in both its entertainment division and its overall market valuation.

7. Amazon ($AMZN):

Amazon workers across the globe staged protests during the critical holiday shopping period, Black Friday through Cyber Monday, calling for better wages, improved working conditions, and the right to unionize. The "Make Amazon Pay" demonstrations, organized by UNI Global Union and Progressive International, saw participation in over 20 countries, including the United States, Germany, India, Brazil, and Japan. Workers rallied against what they described as labor abuses, environmental neglect, and anti-democratic practices by the company.

In India, around 200 Amazon warehouse workers and delivery drivers protested in New Delhi, demanding that their basic monthly wages of 10,000 rupees (approximately $120) be increased to 25,000 rupees ($295). The protest was marked by symbolic gestures such as donning masks resembling Amazon founder Jeff Bezos. Similar strikes and demonstrations were reported across multiple regions, including Europe and South America. Protestors emphasized the need for Amazon to adopt fair labor practices, union rights, and a stronger commitment to environmental sustainability. A memorandum outlining these demands was prepared for submission to India's Labor Minister Mansukh Mandaviya.

Amazon responded to the global protests by refuting allegations of poor treatment and asserting that it offers industry-leading pay, safe working environments, and comprehensive benefits. In a statement, the company highlighted that its fulfillment and transportation employees in the U.S. earn an average base wage of more than $22 per hour and receive additional benefits such as health insurance, a 401(k) plan, and tuition prepayment programs. Amazon India similarly dismissed claims as "intentionally misleading" and reiterated its commitment to providing competitive wages and safe working conditions.

Despite these reassurances, protests continued in nations like Germany, France, and Brazil, where workers demanded higher wages and improved conditions. The demonstrations coincided with Amazon’s busiest shopping weekend, a critical period for the company, which accounted for 18% of global Black Friday sales in 2023, generating over $170 billion in holiday revenue. Organizers of the "Make Amazon Pay" campaign argued that the company’s pursuit of profit comes at the expense of workers, the environment, and democracy.

The timing of the strike, during a high-demand shopping season, aimed to exert maximum pressure on Amazon and spotlight its practices. Economists have warned that the disruptions could lead to delays in holiday deliveries, potentially affecting Amazon’s reputation with consumers. However, the full impact of the protests on Amazon's operations and finances remains uncertain. As the fifth annual "Make Amazon Pay" campaign, this year’s widespread participation highlights growing global solidarity among workers in their demands for justice and accountability from one of the world’s largest corporations.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.