What's Trending with TickerTrends #5

Your regular monitor for interesting social arbitrage ideas.

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

1. Visa ($V):

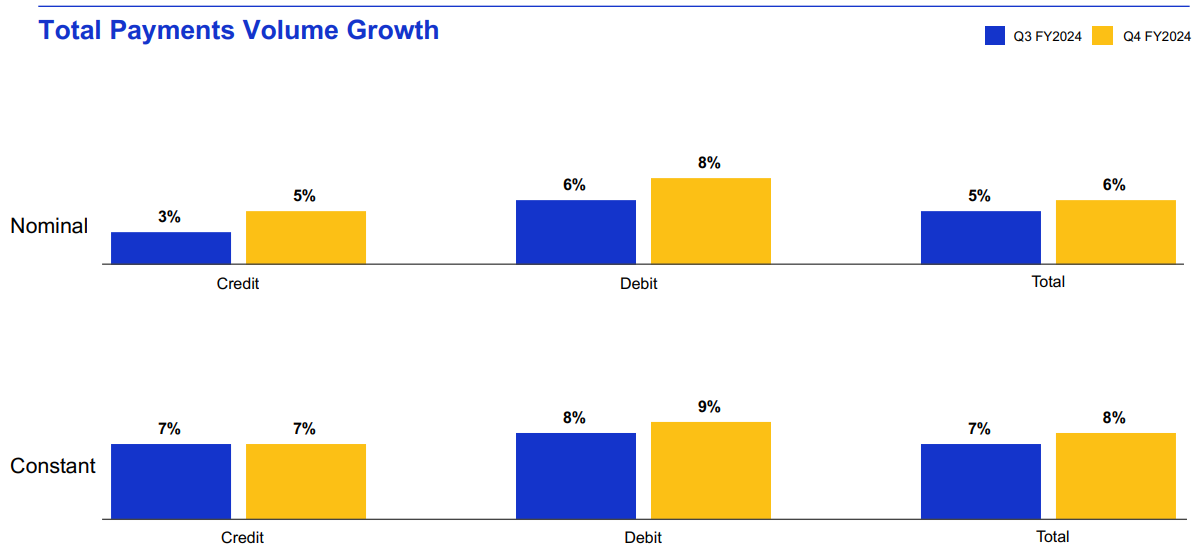

Visa reported robust financial performance, product innovation, and strategic growth areas across both traditional payment channels and new areas such as account-to-account (A2A) transactions. Visa reported Q4 net revenue of $9.6 billion, up 12% year-over-year, and EPS growth of 16%. Core metrics also showed solid growth, with global payments volume up 8% year-over-year, U.S. payments volume up 5%, and international volume up 10%. Cross-border volume, excluding intra-Europe, rose by 13%, reflecting Visa’s strong position as global travel activity and cross-border transactions continue to recover.

CEO Ryan McInerney highlighted Visa's focus on expanding consumer payment solutions and deepening client relationships through innovations like Visa A2A, a new account-to-account payment solution launching in the U.K. by 2025, which targets bill payments and allows a wider ecosystem of banks and fintechs to leverage Visa's network. Visa also reported impressive progress in “Tap to Pay” adoption, with more than 2 billion transactions in fiscal 2024, and noted further growth in global transit payments, an area where the company is adding new cities and transit systems.

Visa’s new flows and value-added services showed particular strength, with revenue growth of 22% year-over-year. Visa Direct, which enables real-time payments across borders, grew by 38%, driven by its expansion into areas like P2P payments and commercial B2B solutions. In commercial payments, Visa's B2B Connect platform grew significantly, with a nearly 60% increase in transacting banks. Partnerships with companies like Revolut, DailyPay, and Travelex further demonstrated Visa's reach in new flow areas, underscoring its goal of extending capabilities across multiple transaction types and platforms.

CFO Chris Suh indicated that Visa expects stable growth in payment volumes, though incentives are projected to increase due to high renewal activity. The company also sees additional potential in value-added services, supported by recent acquisitions like Featurespace, an AI-driven fraud protection company, which will enhance Visa's security offerings. Suh noted that fiscal 2025 guidance assumes a steady economic environment, with pricing initiatives expected to take effect in the latter half of the year. Overall, Visa remains focused on leveraging its core strengths, expanding its digital services, and enhancing security and client engagement to drive sustainable growth in an evolving payments ecosystem.

2. Amazon ($AMZN):

Amazon's CEO Andy Jassy and CFO Brian Olsavsky reported record-setting results, including $158.9 billion in revenue, up 11% year-over-year, and an unprecedented $17.4 billion in operating income, marking a 56% increase from the prior year. These impressive figures were underpinned by Amazon’s focus on strategic improvements across its retail, AWS, advertising, and fulfillment segments.

Amazon’s North American and International retail segments grew by 9% and 12%, respectively, reflecting enhancements in fulfillment infrastructure. Key developments included expanding regional inventory distribution and advancing robotics to reduce costs and enhance delivery speeds. This quarter saw a significant expansion in same-day delivery options, reaching over 40 million customers and representing a 25% year-over-year increase. Such improvements align with Amazon’s commitment to meeting consumer demand for lower-cost, essential goods and fast delivery times.

AWS continued its growth trajectory, reaching $27.5 billion in revenue, a 19.1% increase year-over-year, propelled by rapid expansion in its AI offerings. Jassy highlighted the multibillion-dollar AI segment within AWS, which is experiencing triple-digit growth and scaling faster than AWS in its early years. Amazon is investing heavily in custom AI chips like Trainium2 and Inferentia to provide cost-effective, high-performance solutions for large-scale AI workloads. AWS’s deep partnership with NVIDIA, alongside its proprietary AI infrastructure, positions Amazon to capture long-term growth in the burgeoning AI space.

Amazon’s advertising segment also saw substantial gains, with revenue growing 18.8% to $14.3 billion. Growth was driven by strong demand for Sponsored Products and new generative AI tools, including AI-powered video capabilities. Amazon’s advertising reach and performance across the customer journey have solidified its position as a top advertising platform, enabling brands to optimize engagement from top-funnel awareness to point-of-sale.

Amazon’s dedication to expanding Prime member benefits, such as grocery delivery and fuel discounts, led to continued growth in Prime memberships. This focus on lower average selling price (ASP) products and everyday essentials resulted in increased order volumes and larger baskets, improving Amazon’s shipment economics and overall customer loyalty.

In the international segment, Amazon achieved a significant operating income increase to $1.3 billion and a 390 basis-point improvement in operating margin. Jassy confirmed Amazon’s commitment to achieving North American-level margins internationally through improved cost efficiencies and an expanding Prime offering, catering to both established and emerging global markets.

Looking ahead, Amazon projects 2024 capital expenditures to rise to approximately $75 billion, primarily driven by the growing generative AI demand within AWS. Jassy described generative AI as a “once-in-a-lifetime” opportunity, expected to deliver substantial long-term returns. Amazon’s strategic focus on cloud and AI infrastructure, as well as its unmatched fulfillment speed, selection, and customer-centered approach, reinforces its leadership across multiple markets and positions it well for sustained growth.

3. Apple ($AAPL)

In Q4 2024, Apple reported record-breaking revenue of $94.9 billion, representing 6% growth year-over-year. Key highlights included strong performance in iPhone, iPad, Mac, and Services. iPhone revenue reached $46.2 billion, with growth in all regions, particularly in the U.S., the Middle East, and South Asia. Apple’s new feature, Apple Intelligence, which combines generative AI capabilities with personal context, was launched this quarter, showing promising early adoption rates. The introduction of the iPhone 16 lineup, equipped with advanced cameras and powered by A18 and A18 Pro chips, was noted as a pivotal driver of iPhone’s growth.

Mac revenue rose to $7.7 billion, with the recent launch of the M4 silicon lineup contributing to customer demand. Maestri highlighted that the Mac installed base reached an all-time high, with strong customer satisfaction ratings. The iPad segment also performed well, generating $7 billion in revenue, up 8% from the previous year. This growth was attributed to high demand in both developed and emerging markets, with over half of iPad buyers being new to the product.

Apple’s Wearables, Home, and Accessories segment brought in $9 billion, experiencing a 3% year-over-year decline. However, strong customer satisfaction and an expanding installed base indicated steady demand. The company launched the Apple Watch Series 10, which introduced enhanced health features, such as sleep apnea notifications, while AirPods Pro 2 gained traction due to new hearing health capabilities. Apple Vision Pro, Apple’s spatial computing product, continued to expand, with more than 2,500 native spatial apps available for users.

Apple’s Services segment achieved a record revenue of $25 billion, a 12% increase year-over-year, with significant strength across categories such as Apple TV+, Apple Pay, and Apple Arcade. Apple TV+ continued to garner award recognition, while Apple Pay expanded its reach globally. Services growth was fueled by Apple’s vast installed base of active devices, with double-digit growth in paid subscriptions and increased customer engagement.

Apple reported a gross margin of 46.2% for the quarter, with Services gross margin at 74% and Products gross margin at 36.3%. Operating expenses were in line with guidance, and operating cash flow reached a September quarter record of $26.8 billion. Maestri provided guidance for the upcoming December quarter, projecting low to mid-single-digit revenue growth and double-digit growth in the Services segment.

Trends this week:

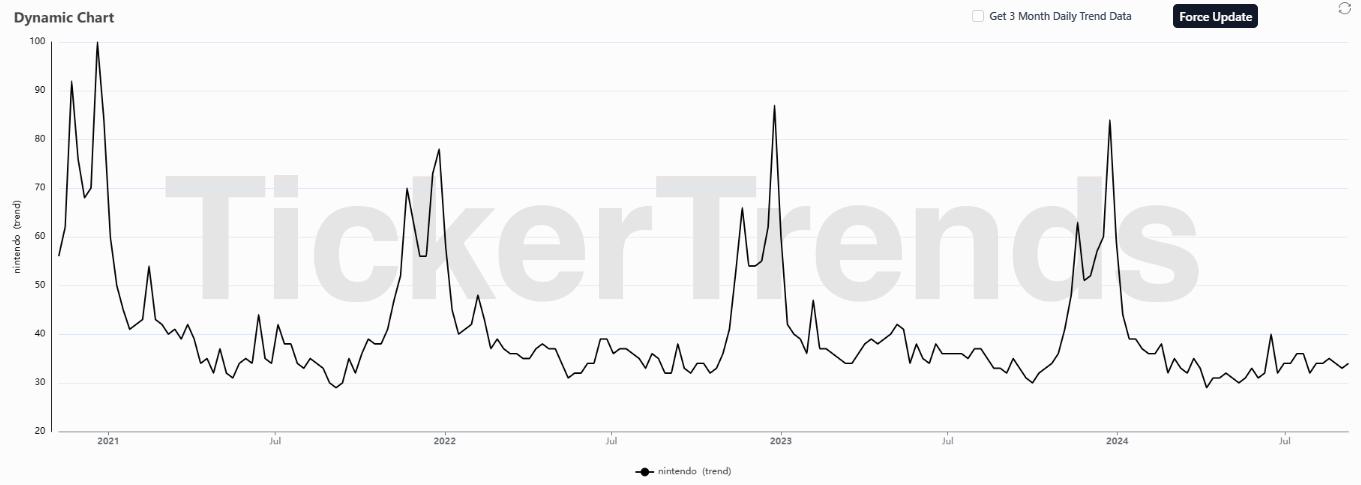

1. Nintendo Music ($NDTOY):

Nintendo Music is the company’s newly launched app, available on iOS and Android exclusively for Nintendo Switch Online members, providing access to an extensive collection of soundtracks from Nintendo's iconic games. This dedicated platform allows fans to explore playlists based on game titles, curated themes, characters, and gameplay scenarios like boss battles or pivotal moments. Offering both online streaming and offline playback, the app appeals to dedicated gamers and casual fans alike, with a catalog that currently includes Super Mario Bros. Wonder, The Legend of Zelda: Ocarina of Time, and Animal Crossing: New Horizons, among others.

By focusing on game music, Nintendo effectively taps into nostalgia, allowing players to relive memorable moments from beloved titles, which can encourage replaying the games themselves. The app’s integration with the Nintendo Switch Online membership adds value to the subscription, potentially boosting retention rates and attracting new users. Additionally, with options for playlist customization, looping, and even recommendations based on play history, Nintendo Music brings a personalized experience that could further deepen brand loyalty.

As Nintendo expands its music library and introduces more features, the app has the potential to create a new revenue stream, transforming music from its vast gaming portfolio into a standalone asset. By capitalizing on its 40-year legacy of game soundtracks and iconic themes, Nintendo Music could strengthen Nintendo's ecosystem, making it an integral part of the fan experience and further solidifying its position in the gaming industry.

2. Alphabet ($GOOGL):

In a recent, almost cartoonishly absurd legal twist, Russia has fined Google a whopping two undecillion rubles — a number so large, not even the Kremlin can say it out loud. That's right, Google has been ordered to pay a penalty equivalent to $20 decillion (that's a two with 36 zeroes), a fine bigger than all the wealth in the world combined and 10 billion trillion times the company's own net worth.

The charge comes from a Russian court ruling, ostensibly because Google’s YouTube restricted access to 17 Russian state media channels. With each passing day, the fine continues to grow exponentially due to Google’s non-payment.

Google’s Russian subsidiary isn’t exactly open for business; it declared bankruptcy in 2022 after having its assets seized, leading Google to all but abandon operations in Russia. But that hasn’t stopped the company from enforcing restrictions on Russian media in line with Western sanctions. Dmitry Peskov, a spokesperson for the Kremlin, admitted he couldn’t even pronounce the number but urged Google to pay up or else “correct the situation.”

It’s hard to predict where this game of astronomical fines will lead, but we might expect more of these “symbolic” numbers to mount up. In the grand scheme, this move seems to highlight the deteriorating relationship between Russia and the Western tech companies still accessible to Russian citizens. Google still operates search and other services in Russia, but if the trend of fines and retaliatory restrictions continues, we might see more platforms blocked or slow-rolled into unavailability.

3. Super Micro Computer ($SMCI):

Super Micro Computer Inc. (SMCI), a tech firm specializing in AI server hardware, saw its stock plunge by 45.50% this week following the resignation of its auditor, Ernst & Young (EY). EY cited its inability to rely on the company’s financial statements or representations from management, a development that compounds SMCI’s already controversial standing. The company is grappling with an ongoing Department of Justice (DOJ) investigation and allegations of financial misconduct from activist short-seller Hindenburg Research, which previously accused the company of accounting manipulation and undisclosed transactions.

EY’s resignation, disclosed in an SEC filing, came after the firm flagged concerns over “governance, transparency, and completeness” in SMCI’s financial reporting. The timing has only worsened matters, as SMCI has yet to file its 10-K annual report for the fiscal year ending June 30, 2024, further raising questions about the company's financial practices and governance. SMCI has attempted to address these issues by forming a special committee to conduct an internal review with the help of forensic accounting firm Secretariat Advisors, though EY’s resignation suggests that the findings only heightened suspicions.

Amid the turmoil, SMCI’s stock has suffered a sharp decline, reversing much of the optimism that once surrounded the company. It has already endured a 20% drop earlier this year after its delayed annual report filing. With a market cap that once soared to $67 billion on the strength of its AI data center ambitions, the current crisis has put the company’s future on an unstable footing. Management now faces an uphill battle in regaining investor trust, finding a new auditor, and addressing the DOJ investigation while simultaneously trying to keep its core business running smoothly.

SMCI has scheduled a business update for November 5, coinciding with the U.S. Election Day, hoping to assuage investor concerns and provide clarity on its financial health. As it stands, the company’s challenges paint a troubling picture, and the success of its AI server ventures may hinge as much on financial transparency and governance improvements as it does on its technology.

4. Victoria Secret ($VSCO):

We have covered Victoria’s Secret quite extensively. You can read our post here: https://tickertrends.substack.com/p/victoria-secret-does-it-finally-have?r=4ioql1

The 2024 Victoria’s Secret Fashion Show made a powerful comeback in New York City on October 15, marking its first event since a six-year hiatus. The show, streamed live on Prime Video and across the brand’s YouTube, Instagram, and TikTok platforms, captivated audiences with an electrifying lineup featuring iconic models like Tyra Banks and Alessandra Ambrosio alongside fresh faces such as Paloma Elsesser and Devyn Garcia. Musical guests Cher and Tyla elevated the event's glamour, helping Victoria’s Secret reach a global audience and generate an impressive $304.8 million in media impact value (MIV), nearly rivaling the entire New York Fashion Week’s impact.

Victoria’s Secret has since maintained this momentum by leveraging a strong social media strategy. On November 1st, the brand saw another surge in engagement, gaining more than 100,000 new followers after teasing a potential collaboration with singer Sabrina Carpenter. This growth reflects the brand's continued ability to captivate audiences and sustain interest through strategic collaborations and targeted social media presence, underscoring Victoria’s Secret's successful reinvention in 2024.

5. Wendy’s ($WEN):

Wendy’s recently announced the closure of 140 U.S. restaurants in the coming months, following a similar wave of 100 closures earlier this year. The decision, according to CEO Kirk Tanner, is part of a strategic move to shutter “outdated and underperforming” locations that aren’t aligned with the brand’s growth goals. While Wendy’s did not disclose specific locations, Tanner emphasized that these closures are spread across the country and were identified through a comprehensive review process focused on profitability, sales potential, and overall brand representation. The closures, however, will be balanced by an ambitious expansion plan: Wendy’s intends to open between 250 to 300 new restaurants worldwide this year, featuring modernized designs and enhanced tech solutions.

In line with this plan, Wendy’s is also rolling out a new incentive structure for developers in the U.S., Canada, and Latin America. These initiatives align with the company's focus on a sustainable growth model for 2025, ensuring that all new builds are strategically located to optimize customer engagement and profitability. Complementing these growth efforts, Wendy’s has deepened its partnership with Coca-Cola, expanding its beverage options and leveraging Coca-Cola’s Freestyle machines for customizable drink choices. A recent $1 drink promotion further underscores Wendy’s efforts to remain competitive in an increasingly challenging fast-food landscape.

This expansion and modernization come as Wendy’s grapples with slower sales growth, with same-store sales in the U.S. rising less than 1% in the first half of the year. Rising menu prices and cautious consumer spending have contributed to the lukewarm growth. Notably, Wendy’s isn’t alone in recalibrating its footprint; other major chains, including Denny’s and Red Lobster, have also been downsizing or restructuring due to similar financial pressures. Denny’s plans to close 150 locations by 2025, while Red Lobster recently filed for bankruptcy protection, following several store closures.

Wendy’s stock responded positively to the announcement, with a 3.5% increase, suggesting investor confidence in the chain’s commitment to maintaining quality and strategically expanding its presence. As Wendy’s balances closures with new openings, the fast-food chain continues to fine-tune its restaurant portfolio to meet changing consumer demands and maximize brand impact.

6. Adidas ($ADDYY):

Adidas and Kanye West, known as Ye, have reached a settlement, ending a two-year legal dispute that began when the sportswear brand severed ties with the rapper over his controversial remarks in 2022. This resolution means both parties have withdrawn all legal claims, with no financial settlement involved. Adidas CEO Bjorn Gulden confirmed that “no money is going either way, and we both move on.” Gulden explained that both sides weighed their grievances and ultimately decided to conclude the legal battle, a significant shift from Adidas’s initial stance after terminating their partnership due to West’s comments.

Adidas and Ye’s collaboration began in 2014 and produced the iconic Yeezy brand, a massive success in streetwear. However, Adidas abruptly ended the partnership in 2022 after West’s remarks triggered widespread backlash. Since then, Adidas has been gradually selling off its remaining €1.2 billion Yeezy inventory, with a portion of proceeds going toward anti-discrimination initiatives, including Adidas’s own anti-hate foundation launched earlier this year.

Despite the separation, Yeezy products continue to command high resale value, with demand still robust across many markets. Meanwhile, Adidas has seen growth in other areas, such as Greater China and North America, where its brand image has improved. In Adidas’s recent earnings report, the company highlighted increased sales across its Samba, Gazelle, and Campus ranges, demonstrating renewed momentum outside of the Yeezy brand.

The settlement allows Adidas to turn a page and focus on its core strategies in the competitive sportswear market. The final batches of Yeezy products will be sold by the end of 2024, with proceeds supporting anti-discrimination causes. As Adidas moves on from this era, it strengthens its commitment to social responsibility and aims to solidify its position in the industry, leveraging the lessons learned from one of the most high-profile partnerships in sportswear history.

7. Dropbox Inc. ($DBX):

Dropbox has announced a significant restructuring, resulting in layoffs impacting 20% of its workforce, equivalent to 528 employees, amid efforts to focus on AI and streamline operations. In a statement, CEO Drew Houston took “full responsibility” for the decision, which aims to address areas of “over-investment” and create a “flatter, more efficient” organizational structure. Houston acknowledged the difficulty of the layoffs, adding that these changes reflect the company’s need to stay competitive in a rapidly evolving tech landscape.

Affected employees will receive 16 weeks of severance pay, Q4 2024 stock vesting, healthcare benefits, and job placement services, with the total cost of layoffs estimated to fall between $63 million and $68 million. These expenses will primarily be disbursed in Q4 2024, with remaining costs recognized in early 2025.

Dropbox’s financial performance has faced headwinds, reporting only 1.9% revenue growth year-over-year to $634.5 million in Q2, marking the slowest growth period in its history. Although Dropbox has been investing heavily in AI, particularly in its Dash AI search tool developed with Nvidia, the company has struggled with a shrinking market share as rivals like Box and Google Drive have expanded their services. Recent share buybacks, amounting to $540 million in the first half of this year and an additional $868 million still available, underscore Dropbox’s strategy to support its stock amidst market volatility.

Houston’s statement pointed to intensified competition as an indication of the need for “more urgency, aggressive investment, and decisive action.” With further announcements on strategic priorities for 2025 expected soon, Dropbox is aiming to pivot towards new technologies to revitalize its core business and capture growth opportunities in an increasingly AI-driven industry.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.