What's Trending with TickerTrends #16

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Netflix Inc ($NFLX):

Netflix delivered a strong performance in Q4 2024, reporting revenue of $10.25 billion, which slightly exceeded consensus estimates. The company added an impressive 19 million subscribers during the quarter, driven by a diverse and compelling content slate that included live events such as NFL games and Jake Paul's fight, as well as highly anticipated series like Squid Game Season 2. Despite the challenges posed by wildfires in Southern California, which impacted many in the industry, Netflix confirmed that there were no significant delays in content delivery or any meaningful impact on its 2025 cash spending plans. The company emphasized its commitment to supporting affected cast and crew members while keeping productions on track.

The subscriber growth was broad-based, with strength seen across all regions and content categories. While live events like the NFL games and Jake Paul's fight generated significant buzz and engagement, they were not the primary drivers of subscriber additions. Instead, Netflix attributed the strong performance to its global content portfolio, which included a mix of returning favorites and new releases. Titles like Squid Game Season 2, Carry-On, and Black Doves continued to perform well, demonstrating the platform's ability to retain viewers and attract new ones. The company also highlighted the success of its ad-supported plan, which now represents over 55% of sign-ups in countries where it is available. Ad revenue doubled year-over-year, and Netflix plans to further expand its ad tech capabilities in 2025, starting with the rollout of its own ad server in the U.S. and other markets.

On the content front, Netflix remains focused on live events and selective sports rights, such as the FIFA Women's World Cup in 2027 and 2031, which align with its strategy of offering high-profile, event-driven programming. However, the company reiterated that full-season sports rights remain economically challenging and are not a priority at this time. The success of original films like Carry-On, which amassed 313 million view hours and generated significant social media buzz without a theatrical release, underscored Netflix's ability to create cultural moments and attract large audiences directly on its platform. The company also announced plans to release Narnia in IMAX theaters in 2026 as a special event, though it emphasized that this does not signal a shift in its overall theatrical strategy, which remains focused on delivering exclusive first-run movies to Netflix subscribers.

In the gaming space, Netflix is making steady progress, with titles like Squid Game: Unleashed driving engagement and reaching the top of app store charts in multiple countries. The company sees gaming as a complementary content category that enhances the overall Netflix experience and is investing in narrative games, party games, and kid-friendly content. While the impact on subscriber growth and retention is still relatively small, Netflix is committed to scaling its gaming offerings in a disciplined manner, aligning investments with member benefits and engagement trends.

Financially, Netflix expects to increase its content spending to $18 billion up from $17 billion in 2024, as it continues to invest in original programming, live events, and global expansion. The company guided operating margins of 12%-14% for the year, reflecting a balance between growth investments and margin expansion. Netflix remains confident in its long-term monetization opportunities, noting that it currently captures only 6% of the estimated revenue opportunity in its served markets. With a strong content pipeline, including returning hits like Stranger Things, Wednesday, and Squid Game, as well as new projects from acclaimed creators, Netflix is well-positioned to continue growing its subscriber base and increasing its share of the global entertainment market. The company also plans to release engagement reports twice a year, starting in July 2025, to provide more transparency into viewer behavior and content performance. Overall, Netflix's Q4 results and outlook reflect its ability to navigate challenges, innovate in content and advertising, and deliver value to both subscribers and investors.

Trends this week:

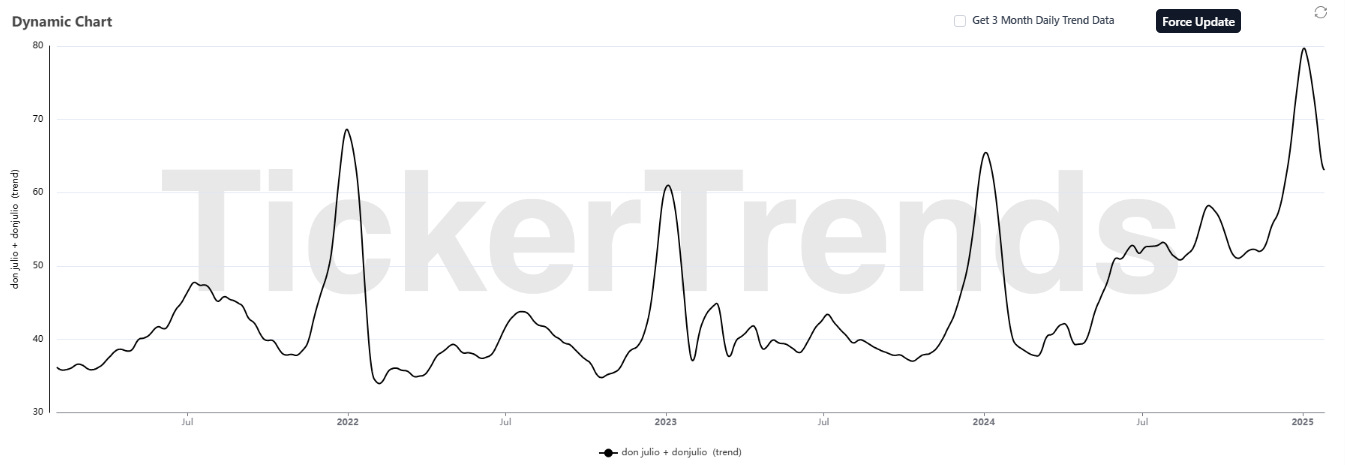

Diageo plc ($DEO):

Don Julio tequila and Popeyes Louisiana Kitchen have announced a collaboration that has already generated significant buzz ahead of its official debut on January 31, 2025. The partnership, teased through a cryptic video posted on social media, showcases Don Julio tequila bottles alongside Popeyes’ iconic takeout boxes, all set to the backdrop of a DJ spinning Latin-inspired beats. The video ends with the tagline, “The kitchen is heating up for the big game. Party starts 1.31.25,” sparking widespread speculation and anticipation.

The timing of the announcement is strategically aligned with Super Bowl LIX, set to take place on February 9, 2025, in New Orleans, Popeyes’ birthplace. Social media platforms, including Instagram and TikTok, have exploded with playful guesses about the nature of the collaboration. Fans have floated ideas ranging from tequila-glazed chicken and spiked lemonade to family meals paired with mini Don Julio tequila bottles.

The announcement has also sparked humor and curiosity online. Comments like, “Chicken-flavored tequila? Or tequila-flavored chicken?” and “I need an invite to the party cause what’s happening??” reflect the public’s excitement and the potential for a unique food and beverage pairing. The collaboration is being positioned as a bold fusion of flavors and cultures, aligning Don Julio’s premium tequila with Popeyes’ distinctive Cajun-inspired cuisine.

This partnership comes at a time when cross-brand collaborations are gaining traction in the food and beverage industry, especially those that blend the appeal of alcohol with popular fast-food offerings. By launching this collaboration ahead of one of the biggest cultural and sporting events of the year, Don Julio and Popeyes aim to capitalize on the festive atmosphere surrounding the Super Bowl and New Orleans’ rich culinary traditions.

While the exact details of the collaboration remain under wraps, the announcement has already succeeded in capturing widespread attention. The pairing of Don Julio’s reposado tequila, known for its notes of vanilla, stone fruit, and cinnamon, with Popeyes’ bold, savory menu items holds significant potential to create a memorable and innovative dining experience. Fans and industry observers will be watching closely for the full reveal, as the collaboration has the potential to set new standards for creative partnerships in the food and beverage space.

United Airlines Holdings Inc ($UAL) & Boeing Co ($BA):

A United Airlines flight traveling from Lagos, Nigeria, to Washington, D.C., was forced to make an emergency landing back in Lagos early Friday following a technical issue and what the airline described as “unexpected aircraft movement.” The Boeing 787-8, operating as Flight UA613, departed Lagos at 11:59 p.m. local time on Thursday and returned to Murtala Muhammed International Airport at 3:22 a.m. Friday.

The incident resulted in injuries to several passengers and crew members. According to United Airlines, four passengers and two flight attendants sustained injuries severe enough to require hospitalization, though all six were later discharged. The Federal Airports Authority of Nigeria (FAAN) reported that an additional 27 passengers and five crew members suffered minor injuries and received first aid before being released.

Video footage from the flight, verified by NBC News, shows significant disarray in the passenger cabin, with meal trays and other items scattered across the floor. Some sections of the aircraft’s headliner appeared to have separated from the ceiling. Flight data from Flightradar24 indicated that the aircraft experienced abrupt speed reductions during the flight, dropping from over 500 knots to 40 knots at one point.

The FAAN stated that the airline’s medical team and firefighters were prepared for the aircraft’s return and that the plane itself did not sustain major damage. United Airlines has confirmed that it is cooperating with aviation authorities in Nigeria and the United States to investigate the incident and determine its cause.

The Boeing 787-8 involved in the incident, registered as N27903, was built in 2012. It is worth noting that in 2024, the Federal Aviation Administration (FAA) ordered inspections for numerous Boeing 787s after a Latam Airlines jet experienced a sudden midair drop, raising concerns about safety issues related to this aircraft model.

This incident adds to the growing scrutiny of Boeing 787 safety and highlights the importance of thorough investigations into technical issues. United Airlines has assured passengers and authorities that it is taking necessary measures to address the situation and prevent similar occurrences in the future.

Nvidia ($NVDA):

Nvidia shares faced pressure last week following the debut of DeepSeek R1, a generative AI model from a Chinese AI lab that claims to rival industry leaders like OpenAI’s ChatGPT and Meta’s Llama while requiring significantly lower capital investment. Nvidia (NASDAQ: NVDA) saw its stock dip over 3% on Friday, closing at $142.62, although the share price still managed to record weekly gains.

DeepSeek R1, backed by the Chinese quant firm High-Flyer, was developed using 50,000 Nvidia H100 GPUs, highlighting the intricate dynamics of U.S.-China trade restrictions on advanced AI chips. This revelation has raised questions about the necessity of massive capital expenditures by U.S. tech giants like Microsoft, Meta, and Alphabet in the AI space. While these firms are ramping up spending on data center capabilities and AI infrastructure, DeepSeek's ability to achieve competitive results with comparatively leaner resources has drawn attention.

Market analysts have noted the potential implications for Nvidia, whose fortunes have soared alongside surging demand for its AI-focused GPUs. Yardeni Research commented that while U.S. firms could learn from DeepSeek’s approach to designing more cost-efficient AI systems, this trend could challenge Nvidia's dominant position in AI hardware. Conversely, JPMorgan’s Joshua Meyers dismissed concerns over AI budgets as “overdone,” suggesting that DeepSeek's efficiency might stem more from necessity than an inherent technological edge, given China’s restricted access to cutting-edge U.S. chip technology.

DeepSeek’s announcement is significant in light of escalating tensions between the U.S. and China over advanced chip exports. U.S. export controls have aimed to limit Chinese access to Nvidia’s high-performance GPUs, but DeepSeek’s reported stockpile of 50,000 H100 chips underscores the difficulty of fully restricting advanced AI hardware to China.

The emergence of DeepSeek has introduced new competitive dynamics to the AI landscape. The U.S. tech giants, collectively dubbed the "Magnificent 7," will report their December-quarter earnings soon, and their commentary on AI-related investments will likely offer insights into whether DeepSeek’s approach is influencing industry practices. Nvidia’s upcoming earnings report on February 26 will also be a critical indicator of how the company plans to navigate these developments.

While Nvidia remains a leader in AI hardware, DeepSeek’s ability to produce cutting-edge AI models with constrained resources raises questions about the future trajectory of AI development and the financial strategies of industry players. The market’s reaction to Nvidia’s stock price in the coming weeks will serve as a barometer of how significant these competitive pressures are perceived to be.

Samsung Electronics Co Ltd (005930.KS):

The Samsung Galaxy S25 Ultra, unveiled at the 2025 Galaxy Unpacked event, has quickly attracted attention for its notable upgrades and refined design. This flagship smartphone aims to dominate the premium market with cutting-edge hardware, innovative software, and a focus on user experience. While early impressions highlight its strengths, some questions remain about its practicality and performance in real-world scenarios.

Samsung's camera system continues to be a major selling point for the Galaxy S25 Ultra, particularly with the introduction of a 50MP ultrawide lens. This addition offers enhanced detail and dynamic range, doubling as a macro camera for ultra-close shots. The 200MP main sensor returns, delivering impressive resolution, while dual telephoto lenses provide versatility for zoom photography. Low-light performance has seen improvements, though the ultrawide camera still falls short of the main lens in image quality. Reviewers have praised the camera’s ability to capture dramatic shots but have noted occasional noise in shadows, particularly in challenging lighting conditions.

The Snapdragon 8 Elite processor powers the S25 Ultra, offering a 37% improvement in CPU performance and a 30% boost in GPU capabilities over its predecessor. This makes the device one of the most powerful on the market, complemented by Samsung’s AI-driven features. Tools like Call Transcript and Circle to Search enhance multitasking and personalization, though some users have reported that these features require a learning curve and better integration with third-party apps. The AI functionality is sophisticated but not always intuitive, which may limit its immediate appeal to less tech-savvy users.

Design refinements make the Galaxy S25 Ultra more ergonomic despite its large size. Rounded corners, flat edges, and a lighter frame contribute to a more comfortable grip, while thinner bezels create a more immersive experience for the 6.9-inch AMOLED display. These changes, though subtle, add a level of polish that sets the S25 Ultra apart from its predecessors, addressing concerns about the bulkiness of previous models.

The Galaxy S25 Ultra competes directly with the Google Pixel 9 Pro XL and the iPhone 16 Pro Max in the premium smartphone segment. When it comes to photography, the S25 Ultra’s ultrawide lens excels in capturing dramatic, detail-rich images, but it lags behind the Pixel 9 Pro XL in macro photography. In terms of battery life, the iPhone 16 Pro Max outlasts the S25 Ultra by two hours in video playback tests, despite having a smaller battery. This highlights Apple’s efficiency with hardware-software integration, a key area where Samsung is striving to catch up. Additionally, the Pixel 9 Pro XL’s 16GB of RAM gives it an edge in handling demanding AI tasks, compared to the S25 Ultra’s 12GB configuration.

Pricing and promotions are a strong draw for early adopters of the Galaxy S25 Ultra. Samsung is offering trade-in discounts of up to $600, a free upgrade from 256GB to 512GB of storage, and complimentary Galaxy Buds Pro 3, valued at $249. These incentives make the S25 Ultra more accessible, especially for users upgrading from older models. However, a point of contention is the removal of Bluetooth functionality from the included S Pen. Conflicting reports about the availability of a standalone Bluetooth-enabled S Pen have caused confusion among potential buyers, particularly given the phone’s $1,199 starting price.

Initial reviews of the Galaxy S25 Ultra have been largely positive, with many praising its camera system, processing power, and refined design. The ultrawide camera has been singled out as a highlight, capable of producing striking images in various scenarios. However, some areas, such as noise in low-light photography and the usability of AI features, remain points of concern. The device’s performance and appeal will likely hinge on Samsung’s ability to address these issues and deliver a seamless user experience.

The Galaxy S25 Ultra represents Samsung’s continued push for innovation and dominance in the flagship smartphone market. Its standout features, including the upgraded camera system and powerful processor, make it a compelling choice for photography enthusiasts and power users. However, with strong competition from Apple and Google, Samsung will need to focus on refining its software and addressing consumer concerns to fully capitalize on the S25 Ultra’s potential.

Tesla Inc ($TSLA):

In February 2018, Elon Musk's SpaceX took an unconventional step in space exploration by launching a cherry-red Tesla Roadster aboard the Falcon Heavy rocket's maiden flight. The Roadster, Musk's personal vehicle, was not entirely unmanned—its "driver," Starman, a mannequin dressed in a spacesuit, became an enduring symbol of the stunt. Designed as a test payload, the car's trajectory placed it in an elliptical orbit around the Sun, taking it beyond Mars and eventually into the asteroid belt.

Recently, this whimsical endeavor resurfaced in the news when astronomers mistook the Roadster for an asteroid. On January 2, 2025, the Minor Planet Center (MPC), affiliated with the Harvard-Smithsonian Center for Astrophysics, officially registered a new near-Earth object as “2018 CN41,” a designation reserved for asteroids. The object was noted for passing within 150,000 miles of Earth, closer than the Moon’s orbit, raising concerns about its potential to collide with the planet.

However, less than 17 hours later, the MPC retracted the discovery, acknowledging that the object was not an asteroid but Musk’s Tesla Roadster. The error, brought to light by astronomers collaborating globally, underscored challenges in distinguishing artificial objects from natural celestial bodies. The MPC cited the unique Sun-centric orbit of the Roadster, unlike typical satellites, as a key factor in the oversight.

This mix-up sparked discussions about the growing issue of untracked artificial objects in deep space. While satellites in Earth’s orbit are closely monitored by agencies like the U.S. Space Force, deep space remains largely unregulated. Experts, including Jonathan McDowell of the Harvard-Smithsonian Center for Astrophysics, warned that such untracked objects could complicate efforts to monitor near-Earth asteroids. He pointed out the risk of misallocating significant resources, such as launching a space probe to study what turns out to be a discarded spacecraft.

SpaceX's publicity stunt has also reignited calls for greater transparency in deep-space operations. Scientists advocate for a centralized repository of positional data for artificial objects, which could prevent similar errors in the future. Despite these concerns, the Roadster continues to capture public imagination. Its latest near-Earth encounter has been a reminder of Musk's knack for blending audacity with humor in his ventures.

As for Musk, he weighed in on the incident via his platform, X (formerly Twitter), with a characteristically casual remark: “My car is orbiting Earth and Mars 🤷♂️.” While the Roadster’s orbit poses no immediate risk to Earth, its trajectory remains a reminder of the unconventional milestones that now populate the annals of space exploration.

The incident has also highlighted the role of citizen scientists in modern astronomy. The initial discovery of the object, submitted by a Turkish amateur astronomer known as “G.,” exemplifies the critical contributions of non-professionals in identifying and tracking celestial phenomena. While G. admitted disappointment upon learning that the object was Musk's Roadster and not a near-Earth asteroid, he noted the value of refining observational databases and mitigating future errors.

Costco Wholesale Corp ($COST):

Rev. Al Sharpton and the National Action Network rallied at an East Harlem Costco in a show of support for the company’s commitment to diversity, equity, and inclusion (DEI) practices, amidst growing backlash against such initiatives. Sharpton, joined by about 100 supporters, staged the "buy-cott" event in response to President Donald Trump’s recent executive order that rolled back DEI programs across federal agencies, labeling them “illegal discrimination” and calling for a return to “merit-based opportunity.” Attendees received $25 Costco gift cards to make purchases during the event, underscoring their stance to back companies that prioritize inclusivity.

Costco’s DEI practices have come under scrutiny, with 98% of its shareholders recently rejecting a proposal from the National Center for Public Policy Research urging the company to evaluate the potential risks of its DEI initiatives. Critics argued that such practices undermine meritocracy and expose the company to legal and financial risks. However, Costco’s board of directors and CEO Ron Vachris stood firm, defending DEI as vital to the company’s success and declaring that no hiring quotas were in place. Vachris emphasized that Costco’s approach ensures equal opportunities for all employees and refused to change its policies in response to external pressures.

The event at Costco unfolded against a backdrop of intensifying national debates on DEI. Conservative groups, emboldened by the Supreme Court’s 2023 decision against affirmative action in college admissions, have increasingly targeted corporate diversity policies through shareholder proposals. Major companies like Walmart and Starbucks face similar challenges, though most proposals receive minimal support from shareholders.

Adding to the company’s challenges, Costco is also facing potential labor unrest. Over 18,000 unionized employees represented by the Teamsters are prepared to strike if a new contract isn’t agreed upon by January 31. Union members, who account for about 5% of Costco’s workforce, are demanding higher wages and better benefits to reflect the company’s record-breaking profits, which reached $7.4 billion in 2024—a 135% increase since 2018. The union claims that Costco, known for its profitability and strong employee retention, has failed to meet its proposals despite benefiting from significant growth during the pandemic.

Costco’s dual challenges—a shareholder backlash against DEI and looming labor disputes—could be daunting for many companies. However, experts believe the retailer is well-positioned to withstand these pressures, citing its strong brand equity, loyal customer base, and strategic decision-making. The company’s steadfast defense of its DEI initiatives, coupled with its careful negotiation approach with the union, reflects a commitment to its values and long-term growth strategy. Whether it can navigate these challenges without significant disruption remains to be seen, but Costco’s track record suggests it is prepared to hold its ground.

McDonald’s Corp ($MCD):

McDonald’s has teamed up with Pokémon to bring fans a nostalgic yet profitable collaboration with Pokémon-themed Happy Meals. This limited-time promotion, running through February 2025, offers customers a chance to collect exclusive Pokémon Trading Card Game (TCG) cards alongside fun extras. Each Happy Meal includes a booster pack containing four of the 15 collectible Pokémon cards, a themed poster, and a sticker sheet to decorate the poster. Some Happy Meals purchased through the McDonald’s app also come with bonuses for the Pokémon TCG Pocket mobile game, such as 24-pack hourglasses and 12 wonder hourglasses.

The card lineup includes fan-favorite Pokémon like Charizard, Pikachu, Rayquaza, Dragonite, Umbreon, and Miraidon, making this set a must-have for collectors. The booster packs are already fetching high prices on secondary markets like eBay, with holographic cards from the set, such as Pikachu, selling for up to $30. Entire crates of booster packs are reportedly being sold for between $600 and $800, underscoring the enthusiasm for this promotion.

The campaign is designed to evoke nostalgia among Pokémon fans while providing new ways to engage with the brand. McDonald’s has also rolled out collectible Happy Meal boxes featuring dragon-type Pokémon like Charizard, Rayquaza, and Roaring Moon. For Pokémon GO players, the collaboration includes in-game activations with special PokéStops and Gyms at McDonald’s locations, offering opportunities to catch rare Pokémon and participate in five-star raids during specific weeks through March 2025.

This isn’t the first time Pokémon cards have driven a frenzy. The popularity of these collectibles often leads to significant resale value and even competitive bidding on online marketplaces. With McDonald’s serving as the platform for this latest Pokémon craze, fans young and old are flocking to get their hands on these cards, cementing the collaboration as a cultural and commercial success.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.