What's Trending with TickerTrends #19

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Dutch Bros Inc ($BROS):

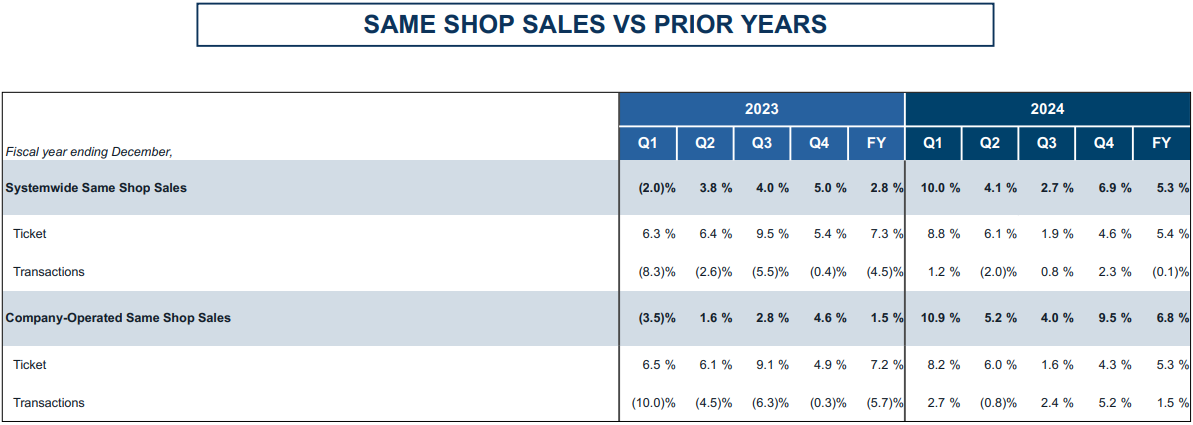

Dutch Bros, Inc. ended 2024 with an impressive fourth-quarter performance, reflecting strong operational execution and continued brand momentum. The company reported 33% year-over-year revenue growth, driven by the opening of 151 new shops, including 128 company-operated locations, and a 5.3% increase in system-wide same-store sales. Adjusted EBITDA grew 44% to $230 million, benefiting from pricing adjustments, operational efficiencies, and leverage on SG&A expenses. In Q4 alone, revenue rose 35% to $343 million, system same-store sales increased 6.9%, and company-operated same-store sales outperformed the system at 9.5%. Transaction growth was a key driver, as mobile order adoption, a growing loyalty program, and targeted marketing initiatives helped drive higher customer engagement. Adjusted EBITDA for the quarter increased 41% to $49 million, with system-wide average unit volumes (AUVs) reaching $2 million. Dutch Bros also celebrated a significant milestone in early 2025, surpassing 1,000 total shop openings.

Mobile ordering continued to gain traction, representing 8% of total sales by the end of 2024, with over 5.4 million transactions placed through the platform. Adoption was especially strong in newer markets, where mobile order penetration was more than double the system-wide average, reinforcing its potential to drive further transaction growth. The Dutch Rewards program remained a major contributor to customer retention and sales, with loyalty members accounting for 71% of transactions, a 500-basis-point increase year-over-year. The company’s focus on innovation and digital engagement also played a key role in its performance, with targeted segmentation efforts enhancing the effectiveness of personalized offers. Dutch Bros increased its paid digital advertising investments, particularly in new markets, which contributed to higher brand awareness and improved sales performance across both new and mature locations.

Limited-time promotions and seasonal offerings also contributed significantly to growth. The return of popular holiday beverages, including the Candy Cane Mocha and Hazelnut Truffle Mocha, resulted in a 40% increase in unit sales over the prior year. Dutch Bros also leveraged limited-edition merchandise drops to create additional excitement around the brand, driving traffic and strengthening customer loyalty. The company’s real estate strategy continues to be a key differentiator, with a refined site selection process and a focus on high-performing locations. Dutch Bros has actively shifted toward more capital-efficient build-to-suit leases, which has contributed to lowering per-unit capital expenditures from the 2024 peak of $1.8 million. This strategy supports the company’s goal of opening at least 160 new locations in 2025, representing 16% system growth.

Dutch Bros ended 2024 with a net cash position of $59 million, up $21 million from the previous year, and maintained $687 million in total liquidity, reinforcing its self-funding growth ambitions. While elevated coffee prices are expected to pose a challenge in 2025, with an anticipated 150 basis points of EBITDA margin pressure, the company expects to mitigate these headwinds through continued operational efficiencies and SG&A leverage. Management’s 2025 guidance projects total revenue between $1.555 billion and $1.575 billion, reflecting 21% to 23% growth, same-store sales growth of 2% to 4%, and adjusted EBITDA between $265 million and $275 million, representing 15% to 20% growth. These expectations account for the continued expansion of mobile order, the introduction of a refined food program currently in limited testing at eight locations, and the company’s focus on increasing throughput and optimizing shop-level operations.

Dutch Bros long-term growth trajectory remains strong, supported by record levels of customer engagement, strategic real estate planning, and increasing efficiencies across the business. The company’s expansion into new markets, including Texas and Florida, has yielded promising results, with strong consumer reception and sustained demand. Management remains confident in its ability to scale operations while preserving the core culture that differentiates Dutch Bros from competitors. With a robust development pipeline, a growing digital presence, and a disciplined financial approach, the company is well-positioned to continue delivering strong results and capitalizing on its significant growth runway in the years ahead.

Robinhood Markets Inc ($HOOD):

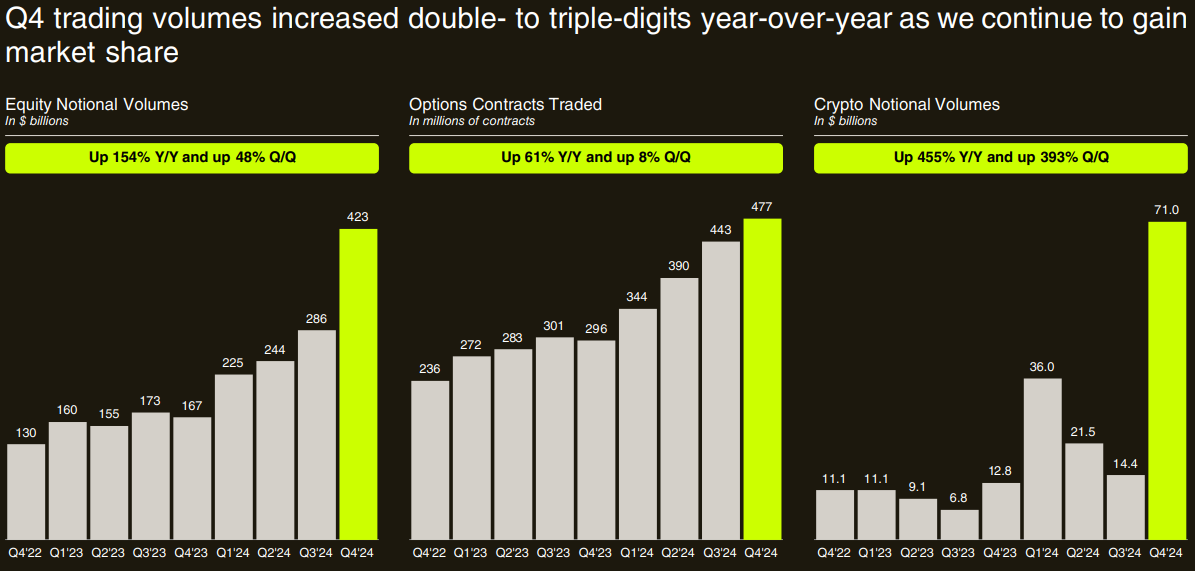

Robinhood delivered a record-setting fourth quarter and full-year 2024, surpassing $1 billion in revenue for the first time in a single quarter and reaching over $3 billion in total revenue for the year, a 58% increase from 2023. The company’s strong performance was driven by market share gains in equities and options trading, record net deposits of over $50 billion, and substantial growth in Robinhood Gold subscribers, which reached 2.6 million by year-end and are on track to approach 3 million in early 2025. The company's strategic focus remains on three key priorities: becoming the number one platform for active traders, achieving the highest wallet share among the next generation of investors, and evolving into a comprehensive global financial ecosystem. Major product launches in 2024, including the Robinhood Gold Card, the Robinhood Legend platform for active traders, and the expansion into derivatives trading, have played pivotal roles in fueling growth and customer engagement.

The financial results showcased significant operating leverage, with adjusted EBITDA surging over 160% to $1.4 billion and an adjusted EBITDA margin of 48%, underscoring the efficiency of Robinhood’s business model. The company also reported its first full-year of positive net income, with earnings per share reaching $1.56. Expenses remained well-managed, with full-year adjusted operating expenses and stock-based compensation rising just 7% year-over-year, in line with prior guidance. In addition, Robinhood has made meaningful progress on its $1 billion share repurchase program, with diluted share count expected to remain flat in 2025, enhancing shareholder value. January 2025 saw strong momentum, with net deposits hitting their second-highest month ever and trading volumes in equities, options, and crypto posting double to triple-digit growth rates compared to the prior year.

Looking ahead, Robinhood is preparing for three major product events in 2025: the Gold event in March, focused on expanding the Gold membership program and introducing advisory services; a Crypto event in June, highlighting new asset listings and innovations such as tokenization and global market expansion; and the Hood Summit later in the year, which will provide updates on active trading initiatives, including the rapid expansion of the Robinhood Legend platform. The company plans to scale the Robinhood Gold Card beyond its initial 100,000 cardholders, with a goal of doubling that number in the next few months and reaching multiples of that by year-end. Further, Robinhood is accelerating its presence in crypto, adding new tokens to its platform and leveraging its recent acquisition of Bitstamp to expand into institutional crypto trading and international markets.

The company is also investing in prediction markets and event contracts, seeing them as the future of financial engagement and news-driven trading. Despite regulatory uncertainties, Robinhood is pushing for greater clarity in this space and aims to become a leader in offering innovative financial instruments. In international markets, the company continues to scale its U.K. and EU operations, recently launching options trading in the U.K. and planning to expand product offerings based on regional demand. With a focus on technology and efficiency, Robinhood is confident in its ability to drive profitable growth while keeping operating expenses in check, leveraging artificial intelligence and automation to scale its platform without significant cost increases.

As Robinhood enters 2025, it remains committed to executing on its long-term vision of becoming a dominant force in both traditional finance and decentralized finance. With a strong roadmap, expanding product suite, and disciplined financial management, the company is well-positioned to continue delivering shareholder value and redefining the future of investing.

Trends this week:

Duolingo Inc ($DUOL):

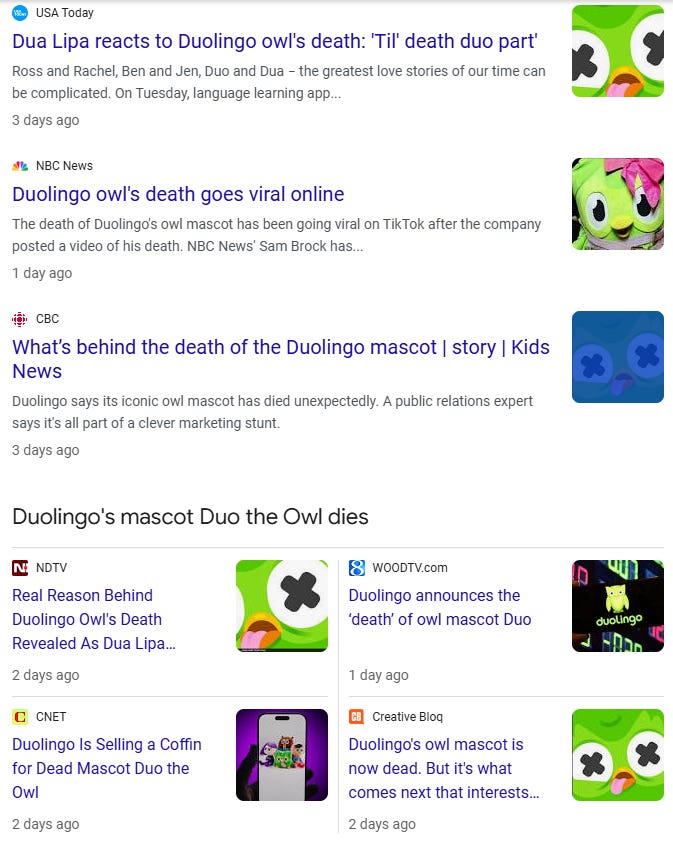

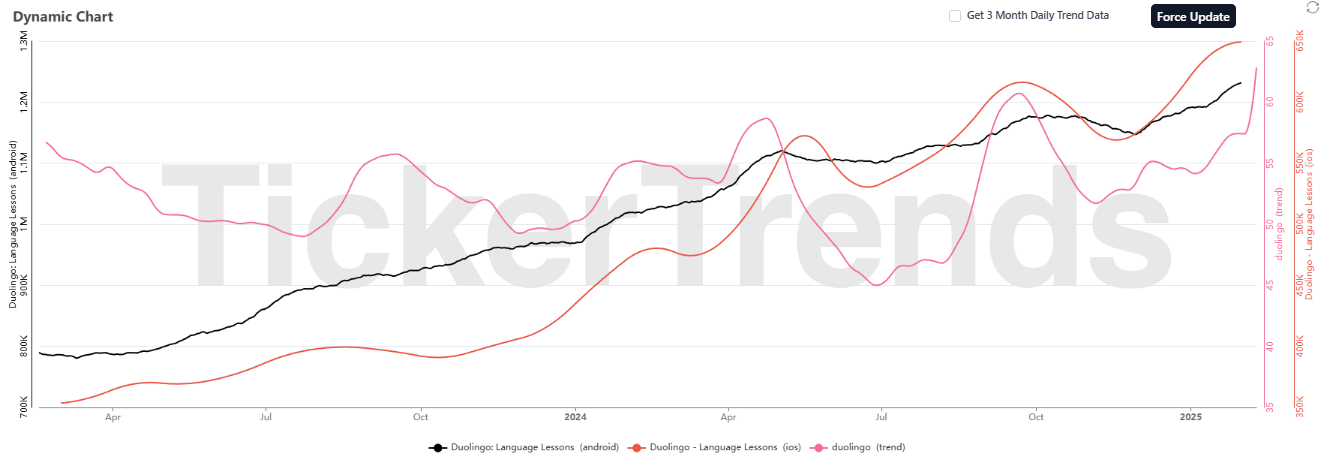

Duolingo’s decision to “kill off” its beloved green owl mascot, Duo, has taken the internet by storm, sparking a viral marketing campaign that has driven unprecedented levels of engagement. The announcement, made via social media, was met with shock, amusement, and intrigue, with Duolingo doubling down on the bit by updating its app icon to display Duo with X’s for eyes, releasing TikToks of his funeral procession, and even selling plushies in coffin-shaped boxes. The company later revealed Duo’s "cause of death"—a Tesla Cybertruck accident—while playfully offering a reward for identifying the driver. Social media was flooded with responses, including condolence messages from major brands like Hilton, Netflix, and Xbox, as well as a viral reaction from pop star Dua Lipa, who has long been the subject of Duo’s fictional infatuation.

This kind of bold marketing strategy is not new—Planters pulled a similar stunt in 2020 when it “killed” Mr. Peanut, only to resurrect him as "Baby Nut" during the Super Bowl. While Planters’ campaign had mixed reception, Duolingo has managed to elevate this approach to new heights, leveraging Duo’s already strong meme culture and snarky brand personality. The campaign has undoubtedly boosted engagement, with millions of views on Duolingo’s posts, and it’s likely to translate into increased app downloads and user activity. The company has cleverly tied the campaign into its core product, urging users to do their daily lessons to "bring Duo back to life."

This marketing play could have significant short-term benefits. Increased user engagement tends to correlate with higher subscription revenue, particularly for Duolingo’s premium services like Duolingo Plus and Super Duolingo. If this stunt leads to a surge in app downloads and re-engagement from lapsed users, investors could view it as a net positive for growth metrics. Additionally, the buzz surrounding this campaign may create an opportunity for Duolingo to introduce new features, premium offerings, or even expand into new monetization avenues.

Starbucks Corp ($SBUX):

Starbucks launched a promotional campaign on February 10, 2025, dubbed “Starbucks Monday,” offering free tall hot or iced brewed coffee to Starbucks Rewards members. The move was aimed at energizing customers recovering from a late night of Super Bowl festivities. The coffee giant encouraged customers to redeem their free drink by applying a digital coupon through the Starbucks app or by notifying a barista in-store or at the drive-thru. Non-members were also eligible for the promotion if they signed up for Starbucks Rewards on the same day.

The timing of the giveaway coincided with a widely discussed Super Bowl advertisement from Dunkin’, which took direct aim at Starbucks. Dunkin’s ad featured Ben Affleck and Bill Belichick humorously critiquing long wait times and the complexity of Starbucks’ menu, which has been a point of contention among consumers. The ad implicitly positioned Dunkin’ as a more efficient and no-frills alternative, contrasting its streamlined service with Starbucks’ often slow-moving lines and overly customized orders.

The free coffee giveaway was seen as a direct response to Dunkin’s Super Bowl ad, allowing Starbucks to reclaim the narrative and drive foot traffic to its stores. By offering a widely appealing promotion, Starbucks aimed to counteract the negative perceptions highlighted in Dunkin’s ad while simultaneously boosting digital engagement through its app. The company has been working to improve service efficiency and encourage mobile ordering, and the promotion aligned with that strategy by requiring customers to apply the coupon through the app for the most seamless experience.

Beyond public relations, the move could have financial and operational implications. While the promotion will likely increase store visits and mobile app usage, it could lead to a short-term hit to Starbucks’ revenue. Free giveaways, while effective in driving customer engagement, do not necessarily translate to long-term loyalty or sustained revenue growth unless they lead to repeat business. If customers view such promotions as one-time perks rather than incentives to return, the financial benefit could be limited.

Additionally, the decision to offer free coffee comes as Starbucks has been navigating operational challenges under its new CEO, Brian Niccol. The company has been scaling back frequent discounts and promotions in an effort to maintain premium brand positioning and protect margins. Starbucks has also been working to streamline its menu and reduce wait times, key concerns raised in its recent earnings call. By offering free coffee, the company risks conditioning customers to expect more frequent giveaways, which could contradict its broader strategy of reinforcing quality and exclusivity. If the company successfully converts one-time visitors into repeat customers and drives higher app engagement, the move could be seen as a strategic win. However, if the campaign merely generates a temporary spike in traffic without lasting engagement, it could be viewed as a reactionary measure rather than a meaningful growth driver.

Ultimately, Starbucks’ “Starbucks Monday” campaign was a well-executed marketing response to Dunkin’s Super Bowl ad, but its effectiveness in reversing recent traffic declines and strengthening brand loyalty remains to be seen. The coming months will indicate whether the promotion leads to sustained customer retention or merely serves as a short-lived boost in store visits.

JetBlue Airways Corp ($JBLU):

JetBlue Airways’ 25th-anniversary sale has generated significant buzz, drawing over 50,000 Google searches in the past week as travelers scrambled to take advantage of deeply discounted fares. The airline’s aggressive promotional campaign, which ran from February 10 to February 14, included one-way domestic flights as low as $25 and international routes to Latin America and the Caribbean starting at $79. The sale applied to flights scheduled between February 25 and June 11, with certain blackout dates in April, and excluded weekend travel.

The overwhelming response highlights how strategic pricing and time-limited deals can drive consumer engagement and elevate brand visibility. With widespread media coverage and high levels of social media activity, JetBlue successfully positioned itself as the go-to airline for budget-conscious travelers looking for an affordable getaway. The immediate impact of the campaign likely resulted in a surge in bookings, boosting short-term revenue and filling seats that may have otherwise gone unsold. While heavily discounted fares could put pressure on margins, the airline may recoup losses through ancillary sales, loyalty program sign-ups, and future repeat customers drawn in by the promotion.

The campaign’s success also puts competitive pressure on rival airlines, which may feel compelled to respond with their own fare sales to maintain market share. Increased demand could strain JetBlue’s operational capacity, particularly if flights become oversold or customer service teams struggle to manage an influx of inquiries and modifications. Investors will be closely watching to see if the short-term booking spike translates into sustained financial benefits or if deep discounting will have a lasting impact on profitability. Regardless of the long-term implications, JetBlue’s 25th-anniversary sale has proven to be a masterclass in digital marketing, using low fares and a sense of urgency to generate massive consumer interest and drive engagement.

Walt Disney Co ($DIS):

Marvel Studios’ Captain America: Brave New World has surpassed initial box office projections, bringing in an impressive $192.4 million worldwide in its opening weekend. The film, which faced skepticism due to lukewarm critic reviews and a B- CinemaScore—the lowest ever for an MCU film—still managed to outperform expectations domestically, grossing $100 million over the four-day Presidents’ Day holiday weekend. Internationally, it pulled in $92.4 million across 52 markets, securing the top spot in nearly all major regions except the UK, where Bridget Jones: Mad About the Boy took the lead.

Despite its underwhelming critical reception, Brave New World is benefiting from a combination of pent-up demand for blockbuster releases, the star power of Anthony Mackie and Harrison Ford, and the enduring pull of the Marvel brand. It also marks a return to a more grounded storytelling approach, reminiscent of Captain America: The Winter Soldier, steering away from the convoluted multiverse narratives that have fatigued audiences.

The film’s box office success, however, does not erase concerns about the future of the MCU. Marvel Studios has been on shaky ground following the financial disappointment of The Marvels, the underperformance of Ant-Man and the Wasp: Quantumania, and declining audience enthusiasm for its post-Endgame slate. The mixed reception of Brave New World raises questions about whether Marvel’s traditional formula is still as effective as it once was or if the brand needs a more radical shift to regain its former dominance.

For Disney, Brave New World’s financial success provides a much-needed boost at a time when the company has been facing challenges across multiple divisions, including streaming losses and theme park attendance concerns. The strong box office results could help restore investor confidence in Marvel’s ability to produce profitable films, particularly as Disney re-evaluates its release strategy and overall content approach under CEO Bob Iger’s leadership.

However, the real test will come in the film’s second weekend. If it suffers a steep drop similar to Quantumania, it could indicate that audience enthusiasm is front-loaded and that word-of-mouth won’t sustain long-term success. Additionally, Marvel will need to carefully assess how the film’s reception affects upcoming projects, particularly Avengers: The Kang Dynasty and Secret Wars, where Sam Wilson’s Captain America is expected to play a major role.

Beyond Brave New World, Disney must consider whether its recent shift in MCU strategy—focusing on fewer, higher-quality projects—will be enough to reverse declining audience engagement. The MCU has always thrived on interconnected storytelling, but with declining interest in spin-offs and lower-tier characters, the challenge now is rebuilding excitement while avoiding fatigue.

Overall, while Captain America: Brave New World has delivered a financial win, it also serves as a warning sign for Disney. Box office success alone is not enough to ensure the long-term health of the MCU. Disney will need to listen to audience feedback, improve creative direction, and carefully navigate its next phase of superhero storytelling to maintain Marvel’s position as a dominant force in global entertainment.

Hims & Hers Health Inc ($HIMS):

Hims & Hers made waves with its Super Bowl ad, Sick of the System, which aired during the third quarter of Super Bowl LIX, the most-watched Super Bowl ever with 127.7 million viewers. The ad framed the company as a champion for affordable healthcare, directly calling out Big Pharma, the diet industry, and regulatory systems that it claimed were failing consumers. Featuring a fast-paced montage of junk food, abdominal fat, and statistics about the rising costs of weight loss medications, the commercial positioned Hims & Hers' compounded GLP-1 drugs as an alternative to the high-priced branded versions like Wegovy and Ozempic.

The impact of the ad was immediate. Within hours, Hims & Hers reported an unprecedented 650% spike in website traffic. New customer registrations and platform activity soared to record levels, with the Hers app jumping to the number two ranking in Apple’s Health & Wellness category, a major leap from its previous position outside the top ten. Engagement data from EDO Inc. ranked the ad as the fifth most engaging commercial of the night. Investors responded just as enthusiastically, sending Hims & Hers' stock price up ~40% this week and pushing its year-to-date gains to 139.96%. The company successfully tapped into the growing consumer frustration over the high cost of weight loss medications, positioning itself as a disruptor in the industry.

The backlash, however, was just as swift. The ad quickly drew criticism from pharmaceutical giants, lawmakers, medical experts, and patient advocacy groups. The most controversial aspect was the promotion of compounded GLP-1 medications, which, while containing the same active ingredients as FDA-approved drugs, are not required to go through the FDA’s rigorous review process. The FDA had previously issued warnings against unapproved versions of GLP-1 medications, cautioning that they could pose safety risks due to the lack of oversight in their production and distribution. The agency reiterated that patients should not use compounded semaglutide if FDA-approved versions, like Wegovy, were available.

Novo Nordisk, the pharmaceutical company behind Wegovy and Ozempic, wasted no time responding. The Monday after the Super Bowl, it ran a full-page ad in The New York Times and USA Today titled Check Before You Inject, warning consumers about the potential dangers of compounded semaglutide. The ad featured a vial labeled "compounded semaglutide" alongside a syringe and cautioned that some compounded versions have been found to contain impurities or incorrect dosages. Novo Nordisk accused Hims & Hers of misleading advertising, claiming that its Super Bowl commercial irresponsibly promoted non-FDA-approved medications without properly disclosing potential risks.

The controversy quickly moved beyond the corporate battle between Hims & Hers and Novo Nordisk, drawing attention from lawmakers. Senators Dick Durbin and Roger Marshall sent a letter to the FDA, expressing concerns that the ad misled consumers by omitting key safety and side effect information. The senators argued that all prescription drug advertisements, including those for compounded medications, should be subject to the same stringent regulatory requirements as FDA-approved drugs. They signaled their intent to introduce bipartisan legislation aimed at closing any regulatory loopholes that allow companies to promote compounded drugs without the same level of oversight.

Hims & Hers, in its defense, maintained that it operates within the legal framework of pharmaceutical compounding and telehealth services. The company emphasized that it sources compounded GLP-1 medications exclusively from FDA-regulated suppliers and provides a Certificate of Analysis with every order to verify the ingredients and quality standards. The company also pointed out that compounding is explicitly permitted by the FDA and has been a longstanding practice in the pharmaceutical industry. While it acknowledged that compounded medications are not FDA-approved, it argued that consumers have the right to access more affordable weight loss solutions, especially given the high price of brand-name alternatives.

Demand for GLP-1 drugs has surged in recent years, driven by their effectiveness in treating obesity and related health conditions. As shortages of branded medications like Wegovy and Ozempic have occurred, compounded versions have become more widely available through telehealth platforms and compounding pharmacies. However, the lack of FDA oversight and concerns about inconsistent dosing and potential contaminants have fueled skepticism among medical professionals and regulatory agencies. If lawmakers succeed in tightening advertising regulations for compounded drugs, it could restrict the ability of companies like Hims & Hers to promote these alternatives as aggressively as they have. Increased FDA oversight could also make it more difficult for telehealth providers to prescribe and dispense compounded versions of GLP-1 drugs without stricter quality controls.

The controversy has also highlighted the growing influence of telehealth companies in the pharmaceutical industry. Platforms like Hims & Hers have disrupted traditional healthcare models by offering direct-to-consumer prescriptions with minimal in-person consultation. While this has expanded access to treatments, particularly for underserved populations, it has also raised concerns about the safety of medications being prescribed without direct oversight from a patient’s primary care provider. The debate over compounded GLP-1s may be just the beginning of a broader regulatory push to impose stricter controls on the rapidly growing telehealth industry.

For Novo Nordisk, the fight against compounded GLP-1s is about more than just patient safety—it’s about protecting its market dominance. The company has been aggressively fighting back against compounding pharmacies and telehealth platforms that offer semaglutide alternatives. It has ramped up production capacity to meet surging demand, filed lawsuits against compounders, and called on the FDA to enforce its patent exclusivity more strictly. The Super Bowl ad from Hims & Hers forced Novo Nordisk into a defensive position, but its swift response with the Check Before You Inject campaign shows that it will not back down in the battle to control the GLP-1 market.

The outcome of this dispute will have lasting implications for the pharmaceutical and telehealth industries. If compounded GLP-1s continue to gain traction, it could put pressure on pharmaceutical companies to lower the prices of FDA-approved weight loss medications. If lawmakers impose stricter regulations, it could curb the ability of telehealth companies to market compounded drugs as cost-effective alternatives. Hims & Hers has successfully captured public attention and positioned itself as a challenger to Big Pharma, but it now faces increased scrutiny from regulators and industry watchdogs.

The stakes are high for both sides. Consumers are demanding more affordable access to effective weight loss treatments, and companies like Hims & Hers are offering solutions that challenge traditional pharmaceutical pricing models. However, concerns over patient safety, regulatory oversight, and transparency in advertising are driving calls for reform. As the debate unfolds, the outcome will likely determine how compounded medications are marketed, prescribed, and regulated in the future, setting new precedents for the telehealth and pharmaceutical industries alike.

Walmart Inc ($WMT)

A new controversy has erupted on TikTok, dubbed “Cakegate,” as at-home bakers voice their frustration over Walmart’s ability to sell decorative heart cakes for just $25. The drama stems from the stark price contrast between Walmart’s cakes and those offered by independent bakers, some of whom charge upwards of $180 for similar designs.

The discussion gained traction after multiple small business bakers took to social media, arguing that their cakes justify higher price tags due to the quality of ingredients, time spent, and personalized craftsmanship. Some home bakers went as far as to claim that birthday cakes are a “luxury” and that Walmart’s mass-produced cakes don’t compare in taste or quality. However, this perspective sparked significant backlash, with many social media users accusing these bakers of being out of touch with the financial realities of most consumers.

Critics pointed out that Walmart’s cakes are not only affordable but also accessible to customers who might not be able to afford a high-end, custom cake. Some users highlighted their personal experiences, stating that they had purchased expensive cakes from independent bakers, only to be disappointed by the quality, dryness, or excessive frosting. Others noted that home bakers often rely on box cake mixes while charging premium prices, making Walmart’s cakes an even more attractive alternative.

The debate has been further fueled by the broader class discourse surrounding affordability, with many arguing that the backlash from home bakers feels elitist. Some TikTok users accused independent bakers of gatekeeping special occasions by insisting that only expensive cakes should be considered high-quality.

Despite the controversy, Walmart has not officially responded to the debate. However, the company continues to sell the cakes, and social media discussions suggest that many consumers are flocking to Walmart to take advantage of the deal.

While this controversy may not have a major financial impact on Walmart given its vast market share, it underscores the company’s long-standing strategy of providing affordable alternatives to high-priced goods. Just as Walmart made waves by offering budget-friendly versions of high-end fashion items—such as their recent Birkin bag dupe—this latest move highlights their ability to capitalize on consumer demand for cost-effective products.

The viral discussion around Cakegate also serves as free marketing for Walmart. Social media engagement, even when fueled by controversy, can drive foot traffic to stores as people check out the cakes for themselves. This kind of organic publicity is invaluable, especially when it reinforces Walmart’s reputation as the go-to retailer for budget-conscious shoppers.

Additionally, the backlash against at-home bakers exposes a potential shift in consumer attitudes. Customers are becoming more price-sensitive, particularly in the face of inflation and economic uncertainty. The expectation that small business owners should be supported at any cost is being challenged by a growing preference for affordability and convenience. Walmart’s ability to provide high-quality, mass-produced alternatives at a fraction of the cost puts independent sellers in a difficult position. While some consumers will always prefer artisanal, handcrafted products, many are opting for affordability, especially when the quality difference isn’t perceived as significant. Cakegate exemplifies Walmart’s dominance in the retail sector, demonstrating how its pricing power can disrupt entire market segments, from fashion to food. Whether this controversy fades or leads to lasting conversations about small business pricing models, Walmart remains well-positioned as the budget-friendly choice for consumers across the board.

Bath and Body Works Inc ($BBWI)

Bath & Body Works has launched its highly anticipated Disney Princess Collection, featuring 85 brand-new products inspired by Cinderella, Belle, Ariel, Jasmine, Tiana, and Moana. The collection, which includes fine fragrance mists, body lotions, candles, and home accessories, officially debuted on February 16, 2025, after an early access period for rewards members.

The collection’s scents reflect each princess’s personality, such as Cinderella’s gardenia and musk, Ariel’s sea salt breeze, and Moana’s tropical coconut and plumeria. Priced between $2 and $100, the collection quickly went viral, with many items selling out during the early access window. Special promotions, such as buy-three-get-three-free body care, further fueled demand.

“This is a special moment for Bath & Body Works customers and Disney fans alike,” said Maurice Cooper, the company’s Chief Customer Officer. “Scent has the power to transform our thoughts, feelings, and emotions.” This collaboration blends nostalgia with modern shopping trends, reinforcing Bath & Body Works' position as a leader in themed collections. Limited-edition releases create urgency, boost loyalty program sign-ups, and drive both in-store and online traffic.

With the collection’s rapid sell-out, future expansions featuring more Disney characters—perhaps Elsa or Rapunzel—seem likely. The overwhelming response proves the demand for pop culture-infused beauty and home products remains strong, making this collaboration a win for both brands.