What’s Trending with TickerTrends #33

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

Amer Sports, Inc. ($AS):

Amer Sports delivered a strong start to fiscal 2025, with first-quarter revenue growth of 23% year-over-year, driven by broad-based momentum across its three segments—Technical Apparel, Outdoor Performance, and Ball & Racquet. Particularly noteworthy was the margin expansion, with adjusted operating margins improving nearly 500 basis points to 15.8%, supported by favorable product mix, robust direct-to-consumer (DTC) growth, and gross margin expansion to 58%. Management raised full-year guidance for revenue growth to 15%–17% and EPS to $0.67–$0.72, reflecting confidence in the business’s trajectory despite macro headwinds, including tariff uncertainty.

The outlook remains positive, with upward revisions across all key business segments. Technical Apparel, led by Arc'teryx, is now expected to grow 20%–22%, supported by strong DTC comps, global store productivity, and the accelerating women's and footwear categories. Outdoor Performance is guided to grow in the mid-teens, underpinned by surging demand for Salomon sneakers, which crossed $1 billion in annual sales in 2024 and continue to benefit from both performance and sport-style launches. While Winter Sports Equipment is expected to grow at a slower pace, its lower weighting within the segment allows Salomon soft goods growth to drive both topline and margin expansion. Ball & Racquet is expected to grow mid-single digits, with the Wilson Tennis 360 concept gaining traction, particularly in China, where the company will nearly double its dedicated store count in 2025.

One of the biggest drivers of Amer Sports’ momentum is Salomon’s accelerating global presence in footwear. Consumer response to recent launches like the XT-WHISPER and Aero Glide 3 has been exceptionally strong, and management believes the brand’s unique design and performance features position it to take significant share in the $180 billion global sneaker market. Salomon DTC growth remains robust, especially in Greater China and APAC, and the company sees additional long-term potential in key U.S. cities like New York, San Francisco, and Los Angeles. Meanwhile, Arc’teryx continues to outperform through elevated store formats and product extensions like footwear and women’s apparel, with strong engagement in mountain town locations and urban luxury settings like the Peninsula Hotels.

Despite U.S. tariff headwinds, Amer Sports management remains confident in their ability to mitigate impacts through pricing power, vendor renegotiation, and supply chain agility. Tariff exposure is relatively limited given the company’s global footprint—only 26% of revenue is U.S.-based—and management expects negligible 2025 P&L impact under the current tariff structure. Even under more extreme tariff scenarios, the impact is estimated at just $0.05 of EPS for the full year. Overall, Amer Sports’ strong brand portfolio, premium positioning, and DTC execution continue to power revenue and profitability growth, with long-term targets underpinned by sustained momentum in China, accelerating global demand for technical sneakers, and structural margin expansion.

Deckers Outdoor Corp ($DECK):

Deckers Brands' recent earnings call provided a detailed look at how the company is navigating model transitions at HOKA, tariff headwinds, and strategic wholesale expansion while maintaining its strong brand momentum—particularly in both HOKA and UGG. While HOKA’s headline revenue growth guidance for the quarter was tempered by macro uncertainty and tariff exposure, management emphasized that unit volumes remained healthy even as average selling prices (ASPs) came under pressure due to promotional activity around the transition from the Bondi 8 to the Bondi 9 and from the Clifton 9 to the Clifton 10. Importantly, the company highlighted that while pricing promotions weighed on top-line revenue, consumer demand and volume growth remained resilient, especially in wholesale channels.

Despite this promotional headwind and incremental costs from newly imposed U.S. tariffs, Deckers maintained a cautiously optimistic framework for HOKA, indicating that in a normalized environment, mid-teens growth remains the expected trajectory. The $150 million estimated tariff burden is a gross number and does not account for mitigation, with management indicating that up to half of the impact could be offset through pricing power and cost-sharing with vendors. However, price adjustments will only take effect post-Q1, meaning the initial quarterly guide reflects the full gross burden. Management is approaching 2025 with prudence, citing uncertainty around U.S. consumer spending and macroeconomic conditions, but reiterated confidence in both the product pipeline and brand positioning.

International markets continue to be a significant growth lever for HOKA, with international revenue mix rising from 30% to 34% year-over-year. While exact 2026 targets were not provided, management suggested that international growth will remain robust and could move toward 37% of HOKA’s revenue mix in the coming year. The recent launch of updated models like the Bondi 9 and Clifton 10 was well-received globally, and the Arahi 8 is generating strong early feedback. Inventory was intentionally built up ahead of potential tariff escalations and to support a European distribution center transition, which will result in higher-than-usual inventory at quarter-end, though the company stressed its inventory remains lean and tightly managed overall.

Deckers reaffirmed its goal of a balanced 50/50 split between direct-to-consumer (DTC) and wholesale for HOKA. While DTC comps were pressured in the quarter—partly due to consumers seeking out new models in physical stores—this was not viewed as indicative of a strategic shift but rather a function of natural consumer behavior during product transitions. The wholesale expansion has been methodical, driven by productivity metrics and selective partnerships, including pilots with Journeys and deeper placements in sporting goods and athletic specialty accounts both in the U.S. and internationally. New retail formats such as mono-brand shops in Asia and future retail footprint expansion in the U.S. will complement this selective wholesale strategy.

Meanwhile, UGG delivered a strong fourth quarter, exceeding expectations across regions and channels. Management emphasized that UGG is no longer merely a cold-weather slipper brand; its product assortment now includes sandals, sneakers, clogs, and hybrid categories, which are resonating with a broader demographic, including men—whose purchases are outpacing women’s. Notably, this performance came despite a scarcity-driven inventory strategy, further illustrating strong consumer demand and the brand’s pricing power. As a result, gross margins remained elevated, reinforcing the health of the UGG business heading into FY 2026.

Deckers Brands is executing a multi-pronged strategy to maintain strong growth across its portfolio despite headwinds from tariffs and economic uncertainty. HOKA’s product pipeline and global resonance, paired with a deliberate wholesale expansion strategy and a robust international footprint, position the brand for continued success. Similarly, UGG’s reinvention as a year-round lifestyle brand with appeal across genders further supports the company’s bullish long-term outlook. While near-term macro pressures are acknowledged, management’s measured tone and confidence in the brands’ momentum suggest that Deckers remains on solid footing besides the short term headwinds.

Trends this week:

Duolingo Inc ($DUOL):

In a matter of weeks, Duolingo (NASDAQ: DUOL) has gone from a beloved edtech darling with cult-like brand equity to a case study in reputational risk and overzealous AI messaging. The controversy began in April 2025 when CEO Luis von Ahn publicly announced Duolingo would become an “AI-first” company. Internal memos and public comments indicated the company would increasingly rely on generative AI to create new language courses and planned to “gradually stop using contractors to do work AI can handle.” The tone was unapologetically aggressive: hiring would only occur “if a team cannot automate more of its work,” and AI fluency would be evaluated in employee performance reviews. These statements triggered immediate and widespread criticism across social media and user forums. Longtime users—many with multi-year learning streaks—announced cancellations, citing disillusionment with the company’s pivot away from human educators and authentic instruction.

While Duolingo attempted to clarify its stance days later, stating AI would “not replace what our employees do” and that the company was continuing to hire at prior rates, the walk-back came across to many as reactive damage control rather than a substantive change in strategy. Sentiment across Reddit, X (formerly Twitter), and TikTok—a platform where Duolingo once dominated with its viral mascot-driven marketing—shifted decisively. The core concern wasn't just about AI, but rather the perceived erosion of Duolingo’s ethos as a human-centered learning platform.

For investors, this could have tangible implications. Duolingo's growth flywheel—predicated on high user engagement, strong net promoter scores, and a virally loved brand—relies heavily on its perception as a trustworthy and delightful tool for learning. The backlash raises the risk of increased churn, especially among premium subscribers, and challenges Duolingo’s ability to sustain low customer acquisition costs. Anecdotal evidence points to a wave of cancellations, particularly among highly engaged users with streaks exceeding 1,000 days. These users form the core of Duolingo’s paid subscriber base, and their attrition could signal deeper retention risks ahead.

More structurally, the company now finds itself in a branding dilemma. Duolingo’s decision to double its course offerings using AI—adding 148 new language pathways primarily for non-English speakers—was an efficiency play. But questions about quality have quickly followed. Users have complained of poorly pronounced AI voiceovers and generic content, reinforcing a growing skepticism toward generative AI’s ability to replicate pedagogically sound, culturally nuanced instruction. If product quality declines, it could reduce daily active usage—a metric closely tied to monetization and Duolingo’s ad business.

There is also competitive risk. Alternatives like Babbel, Busuu, and even decentralized tools like italki or library-subsidized platforms are seeing renewed interest. Several users who left Duolingo explicitly cited switching to these services, praising their more human-centric approach or interactive learning models. If Duolingo is unable to retain its halo effect—especially among Gen Z, where it built its viral brand—the company could see its user funnel erode.

Alphabet Inc. ($GOOG):

At its 2025 I/O developer conference, Google delivered a sweeping set of announcements designed to reposition the company as a frontrunner in the race to dominate the AI landscape. The centerpiece of the event was the nationwide rollout of “AI Mode” in Search, which replaces traditional link-based results with conversational, generative responses. This overhaul marks Google’s most aggressive step yet toward transforming its core product in the face of mounting competitive pressure from OpenAI, Microsoft, and now even Apple. However, while the company emphasized that generative features will expand the use cases for search, many investors remain concerned that the new interface could cannibalize advertising revenue—a business that currently accounts for more than 75% of Alphabet’s total revenue.

To hedge against these monetization risks, Google is launching premium subscription services centered on its Gemini AI model family. The new $249.99/month “AI Ultra Plan” offers access to advanced tools like Deep Think and Project Mariner, along with 30TB of cloud storage and YouTube Premium. This high-end tier follows a broader trend among AI leaders—including OpenAI and Anthropic—to offset rising inference costs with paid offerings. With more than 150 million subscribers across its various services, Google is increasingly relying on direct monetization to support the margin structure of its costly AI infrastructure investments. But the plan’s price tag and limited user base raise questions about how scalable this premium model really is.

The Gemini platform itself has been deeply embedded across the Google ecosystem, now integrated into Chrome, Gmail, Maps, Calendar, and Docs. Gemini 2.5 Pro and Flash models are central to Google’s strategy of creating a “universal AI agent”—one that can reason, plan, and take actions across apps, services, and devices. The rollout of personal context features, including personalized Gmail replies and AI-powered calendar planning, highlights Google's attempt to make AI indispensable in everyday productivity. However, this deep integration with user data introduces privacy considerations that could draw regulatory attention, especially in the EU and California.

Despite the ambition on display, investors noted that many of Google’s product announcements were overlapping or poorly delineated—raising concerns about focus and cohesion. The distinction between Search Live and Gemini Live, for example, was unclear even to technical attendees. While Google’s scale and distribution across Android and Chrome give it a strategic advantage, the company's tendency to “launch everything at once” could undermine its ability to execute with discipline. In an AI landscape increasingly defined by elegant, single-purpose experiences—like OpenAI’s ChatGPT or Perplexity—Google must prove that its sprawling approach can translate into real-world usage and durable revenue streams.

Tesla Inc. ($TSLA):

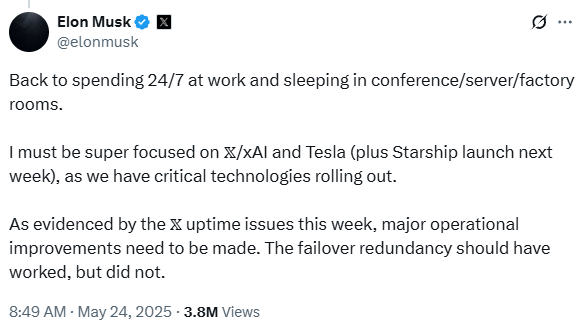

Elon Musk declared this week that he is stepping away from politics to refocus on Tesla, X, and his other ventures could mark a pivotal moment for the electric vehicle maker. After months of distraction in Washington—where Musk played a controversial role in the Trump administration's “Department of Government Efficiency”—he is now signaling a return to “war time” leadership. For Tesla investors, this could be the most bullish development in months. Tesla’s stock, which had suffered amid falling sales, margin pressure, and public backlash over Musk’s political affiliations, has rebounded over 40% since his announcement on April 22 that he would scale back his government role. The rally reflects renewed hope that a focused Musk can reinvigorate Tesla’s execution engine just as it faces intensifying competitive threats.

Tesla’s fundamentals remain under pressure. Analysts now expect Tesla’s 2025 unit sales to decline year-over-year, reversing prior forecasts for growth. Margin compression, weak Cybertruck adoption, and eroding demand in key international markets—especially China and Europe—have added to investor anxiety. Tesla’s once-ambitious plans to introduce a $25,000 mass-market car appear indefinitely shelved, creating a strategic vacuum. But Musk has shifted the narrative. At recent appearances, including a headline-grabbing video call to the Qatar Economic Forum and a tense CNBC interview, he doubled down on Tesla’s pivot to autonomy. He declared the company is on track to deploy fully driverless vehicles in Austin by the end of June, with plans to scale to hundreds of thousands by the end of 2026.

This aggressive push into robotics and AI reflects Musk’s latest attempt to leapfrog Tesla into a new S-curve of growth. While Alphabet’s Waymo and Amazon’s Zoox already have robotaxis on public roads, Musk insists Tesla’s vertically integrated full self-driving stack will prevail. He even projected a future in which humanoid robots and autonomous Teslas could help drive Tesla’s valuation to $30 trillion—an astronomical figure that only underscores how deeply tied investor sentiment remains to Musk’s personal vision. If he delivers on even a fraction of this roadmap, it would transform Tesla from a car company into a true AI robotics platform, potentially resetting its valuation framework.

Still, this vision hinges on execution, a trait Musk has struggled with in recent years. Angry Elon—historically a catalyst for deep focus and product breakthroughs—is back, according to fans and even Wall Street observers. His vow to sleep again in factory and server rooms signals a return to the high-intensity work ethic that propelled Tesla to profitability in 2019 and led to its meteoric rise during the pandemic. Whether this iteration of Musk can convert ambition into tangible results remains to be seen, but the timing is critical. Tesla is losing EV share globally, and shareholder patience is wearing thin after years of autonomous vehicle promises that have yet to materialize at scale.

The risk, of course, is that this renewed focus is another short-term pivot. The company’s reputation remains vulnerable to Musk’s unpredictability, and its exposure to broader macro pressures—from higher interest rates to Chinese competition—has not gone away. Yet, if Musk truly follows through on his stated plan to prioritize Tesla over politics, and can deliver even modest success in deploying driverless cars within the next 12 months, it could restore faith in Tesla’s long-term narrative. For now, markets are signaling cautious optimism—but the next few quarters will be the ultimate test of whether “Angry Elon” still has his edge.

DICK’s Sporting Goods Inc ($DKS) & Foot Locker Inc ($FL):

DICK’S Sporting Goods announced on May 15, 2025, that it will acquire Foot Locker in a $2.4 billion deal, creating one of the largest global players in the sports retail industry. Under the terms of the agreement, Foot Locker shareholders will receive either $24 in cash or 0.1168 shares of DICK’S common stock per share. The acquisition will bring together over 3,200 stores across more than 20 countries, expanding DICK’S reach internationally for the first time and giving it a firm grip in sneaker culture and lifestyle-oriented sportswear.

Foot Locker will operate as a standalone business unit within the DICK’S portfolio and retain its core banners such as Kids Foot Locker, Champs Sports, WSS, and atmos. DICK’S expects to generate between $100 million to $125 million in cost synergies through procurement and sourcing efficiencies and says the transaction will be accretive to earnings in the first full fiscal year post-close, excluding one-time integration costs. The deal is expected to close in the second half of 2025, pending regulatory and shareholder approval.

This acquisition comes at a time of turbulence in the athletic retail space. Foot Locker has struggled with falling mall traffic, declining sales, and a strained relationship with Nike, which had pivoted to a direct-to-consumer strategy. However, Nike recently recommitted to wholesale partnerships under its new CEO, which could enhance Foot Locker’s brand access going forward—especially with DICK’S operational backbone and broader consumer base. Investors are betting that DICK’S disciplined execution and efficient omnichannel model can revitalize Foot Locker’s lagging performance.

Strategically, the move allows DICK’S to diversify its consumer exposure beyond performance-driven athletes to include sneaker enthusiasts and lifestyle shoppers, especially in international markets where Foot Locker generates roughly 30% of its revenue. Analysts view the deal as a mixed bag: while the scale and expanded footprint offer upside, they caution that integrating an underperforming retailer brings cultural and operational risks. Critics, including UBS, flagged the long history of retail acquisitions failing due to mismatched systems and strategies.

Still, the combined entity will have substantially more leverage with key suppliers like Nike and Adidas—footwear alone represents more than half of Foot Locker’s business and nearly 40% of DICK’S. With this acquisition, DICK’S solidifies its dominance in the U.S. sports retail market and takes a major leap forward in global sneaker retail. The success of the deal will ultimately hinge on whether DICK’S can modernize Foot Locker without compromising what makes the brand unique to its core consumers.

Apple Inc ($AAPL):

On May 23, 2025, U.S. President Donald Trump dramatically escalated his trade agenda by threatening to impose a 25% tariff on Apple and other smartphone makers if their devices sold in the U.S. are not manufactured domestically. In parallel, he also proposed a sweeping 50% tariff on all goods imported from the European Union, a move aimed at forcing broader trade concessions from key allies. The announcement, which rattled markets and erased over $100 billion from Apple’s market cap early in the session, signals a renewed push for reshoring high-tech manufacturing—even if the economic and logistical hurdles appear insurmountable in the near term.

Trump’s ultimatum to Apple specifically targeted iPhones manufactured in India, which the company has ramped up as part of its China diversification strategy. On a recent earnings call, Apple CEO Tim Cook had indicated that most iPhones sold in the U.S. this quarter would be made in India, with Vietnam handling much of the output for iPads and MacBooks. Trump expressed dissatisfaction, warning that any devices not built on U.S. soil would face punitive tariffs. The White House followed up by extending that threat to Samsung and other smartphone manufacturers, reinforcing that the policy would apply industry-wide to avoid favoritism.

These threats raise several potential red flags, at least in the short term. First, analysts like Dan Ives of Wedbush Securities have reiterated that U.S.-based iPhone production is economically infeasible under current conditions, estimating it would raise the price of a flagship iPhone to around $3,500 and take five to ten years to establish an equivalent domestic supply chain. While Apple has pledged over $500 billion in U.S. investments, including a new server factory in Texas and expanded data centers, these efforts fall short of building the end-to-end ecosystem required for mass iPhone production. The risk is that Apple may be forced to absorb higher tariff-related costs or pass them onto consumers, compressing margins or dampening demand.

More broadly, the tariff proposal represents a significant overhang for consumer tech equities and global trade stability. While it’s unclear whether Trump has the legal authority to levy company-specific tariffs without congressional approval, experts note he may attempt to invoke emergency powers under IEEPA (the International Emergency Economic Powers Act), a tool previously used to enact sweeping China tariffs. The courts are currently reviewing the scope of these powers in a related case, and the outcome could define the feasibility of targeting Apple in this manner.

For Apple investors, the short-term implications are clear: volatility is likely to persist. Apple was already managing a $900 million tariff headwind this quarter, and further trade restrictions could significantly amplify those costs. Longer-term, the company may accelerate plans to shift additional production to non-Chinese countries like India and Vietnam—but that won't appease the administration's new reshoring demands. If these tariffs are enacted, Apple and other device makers could face meaningful disruptions to their global production models, undermining years of cost-optimized supply chain development and raising strategic uncertainty across the tech sector.

Ultimately, the proposed tariffs should be seen less as economic policy and more as a form of political brinkmanship—yet one with real market consequences. Whether these threats are bluffs or a prelude to implementation, the impact on sentiment is already being felt. Apple, whose valuation rests on tight margins, predictable growth, and global logistics prowess, now finds itself in a precarious position, one that could redefine the outlook for U.S.-based tech manufacturing and its associated equities for years to come.

Steve Madden Ltd ($SHOO):

On May 22, 2025, Steve Madden, founder and design head of his eponymous footwear brand, took a public stance against the Trump administration’s escalating tariff regime, bluntly stating that those pushing the policy “fundamentally do not understand what they’re doing.” His comments came during a wide-ranging interview on The Cutting Room Floor podcast, where he warned that tariffs targeting Chinese imports—including a proposed 25% levy on iPhones and a 30% tariff on other goods—are inflating consumer prices and undercutting the very economy they claim to defend. Madden emphasized that trade with China has led to job creation in more desirable sectors, arguing that Americans benefit more from roles in marketing, design, and e-commerce than from returning to low-wage factory work.

The remarks were not merely ideological; they echo the underlying financial stress Steve Madden Ltd. has been navigating. In early May, the company pulled its 2025 financial forecast, citing “macroeconomic uncertainty” due to tariffs. On the most recent earnings call, CEO Edward Rosenfeld acknowledged that while 71% of Madden’s U.S. imports were sourced from China in 2024, that figure is expected to fall to the mid-teens by fall 2025 and to the mid-single digits by spring 2026. The company is already deep in the process of diversifying its supply chain in response to geopolitical and cost risks, notably after Trump’s re-election reignited tariff escalation.

While Madden’s defiant tone may resonate with a younger, digitally savvy consumer base and generate viral attention on platforms like TikTok, his criticism also highlights a growing tension between fashion brands and nationalist trade policy. Footwear brands—particularly those operating in the mid-tier accessible luxury segment like Steve Madden—are acutely exposed to rising import costs. Unlike luxury brands with wider margins or vertically integrated giants like Nike, Madden’s reliance on outsourced manufacturing and price-sensitive consumers makes it particularly vulnerable. Tariffs could erode profitability or force undesirable price hikes, both of which could damage brand equity during key retail cycles such as back-to-school and holiday seasons.

The company’s strategic response to the tariffs has been relatively swift. By accelerating production relocation to countries outside China and locking in “meaningful discounts” with suppliers, management is trying to shield margins and maintain pricing flexibility. Still, if Trump’s tariff threats materialize at their full proposed scale, Madden’s sourcing diversification alone may not be enough to offset the cumulative impact on costs and supply chain complexity. Furthermore, broader industry sentiment remains cautious, as analysts warn that reshoring efforts—even when politically popular—come with steep logistical and technological barriers.

Politically, Madden’s comments drew a sharp rebuke from the Trump administration. A White House spokesman dismissed his concerns, noting that Madden “should stick to pontificating about pump-and-dump fraud schemes,” referencing his past securities fraud conviction. This response, while personal and inflammatory, underscores the administration’s zero-tolerance stance on corporate resistance to its reshoring agenda and suggests that companies like Steve Madden may find themselves increasingly caught in the crossfire between policy ambition and economic feasibility.

Ultimately, for Steve Madden the brand, this moment presents both a challenge and a public-relations opportunity. While supply chain disruptions and pricing pressure remain critical risks, Madden’s outspoken critique may galvanize loyalty from consumers who view his stance as authentic, particularly among younger demographics skeptical of government overreach. The company’s next earnings report will be a crucial test of whether its mitigation efforts are enough to hold the line in what is rapidly becoming a tariff-driven retail landscape.

Warby Parker Inc ($WRBY):

Google’s announcement at its 2025 I/O developer conference that it is entering the smart glasses market through its new Android XR platform, with Warby Parker as a flagship design partner, marks a significant milestone for both companies. Google will invest up to $150 million in the collaboration—half in product development and half as an equity stake in Warby Parker—underscoring the tech giant’s long-term commitment to making wearable AI mainstream. Warby Parker, a digitally native eyewear company known for style, affordability, and direct-to-consumer innovation, now finds itself at the forefront of a potentially game-changing product category: intelligent, AI-powered eyewear.

The immediate market reaction reflected investor enthusiasm, with Warby Parker’s shares spiking by over 15% following the announcement. The surge is rooted not just in the partnership’s prestige, but in its financial implications. Roth Capital analyst Matt Koranda called it a “clear positive,” projecting it could modestly boost Warby’s 2026 sales and Adjusted EBITDA. By combining Warby’s sleek design sensibilities and retail distribution with Google’s technical acumen—particularly its Gemini AI model—this partnership could offer a new revenue stream that aligns with Warby’s brand ethos while helping the company expand beyond traditional eyewear and into the next generation of consumer hardware.

Strategically, this collaboration positions Warby Parker in a high-growth, high-margin segment adjacent to its core business. Smart glasses are projected to grow from a novelty to a utility, particularly as consumers acclimate to AI-driven wearables. The potential to raise average order values, attract early adopters, and re-engage customers with new product cycles every 18–24 months is appealing. While the first iteration won’t arrive until “after 2025,” likely meaning early 2026, that timeline aligns with analysts’ expectations that Warby’s revenue growth will reaccelerate as it regains omnichannel momentum and leans into high-margin innovation.

Importantly, Google’s choice of Warby Parker and Gentle Monster as launch partners also signals a philosophical shift from the tech-centric, function-first failure of Google Glass. This time, the aesthetic and lifestyle fit is just as critical as the technology. That plays directly to Warby Parker’s strengths. Unlike Meta’s Ray-Ban partnership, which centers around an existing fashion giant with an established distribution channel, Warby’s vertically integrated retail and e-commerce model could allow for faster iteration, price agility, and greater brand control. With Google providing financial backing and hardware expertise, Warby isn’t absorbing typical risks associated with launching a new tech product line.

Yet some uncertainty remains. It is still unclear how the pricing will compare to Meta’s Ray-Ban Meta smart glasses, which range from $299 to over $500 with prescription lenses. Nor is it known whether Warby’s involvement will eventually become exclusive or just one of several parallel partnerships. Still, even conservative forecasts suggest that modest sales of 50,000–90,000 units in 2026 could move the needle on Adjusted EBITDA. For a brand serving over 2.6 million active customers, even a 2–3% penetration rate into smart glasses represents meaningful upside.

In a market increasingly dominated by multifunctional, AI-enhanced devices, the integration of Warby Parker’s design-forward sensibility into Google’s AR ambitions gives the eyewear brand a rare chance to become a hardware player without compromising its fashion and retail DNA. If executed well, the partnership could help Warby Parker redefine its category, appeal to a tech-immersed customer base, and ultimately transition from an eyewear brand to a lifestyle technology company with broader relevance in the coming AI-native world.