What’s Trending with TickerTrends #26

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. Join us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Trends this week:

Dominos Pizza, Inc. ($DPZ):

Domino’s Pizza has announced a new partnership with DoorDash that will allow customers to order Domino’s directly through the DoorDash app, with uniformed Domino’s drivers fulfilling the deliveries. The nationwide rollout is set to begin in May across the United States, with a Canadian expansion expected later in the year. This move follows a pilot program already underway at select locations and marks the second major aggregator relationship for Domino’s, following its 2023 agreement with Uber Eats.

This partnership represents a significant evolution in its delivery strategy. Historically, the brand resisted third-party platforms in favor of controlling the customer experience through its own channels. However, rising competition, shifting consumer habits, and pressure on same-store sales have led to a more open approach. CEO Russell Weiner previously highlighted the potential of aggregator partnerships as a "$1 billion opportunity," and this DoorDash deal could accelerate that trajectory.

The strategic benefits are multifaceted. First, Domino’s gains immediate exposure to DoorDash’s 42 million monthly active users, including 22 million DashPass and Wolt+ members who could now order Domino’s with reduced or waived delivery fees. This expanded visibility—especially in suburban and rural areas—is expected to drive incremental sales by reaching customers who may not use Domino’s proprietary app or website. Domino’s retains operational control by using its own drivers for fulfillment. This preserves the brand’s delivery infrastructure and ensures consistency in service quality, while tapping into the reach of the aggregator ecosystem. It also helps Domino’s avoid the costly third-party delivery fees that often cut into restaurant margins.

This move could help turn around sluggish delivery sales. In the most recent quarter, Domino’s reported a 1.4% decline in U.S. delivery same-store sales, while carryout sales rose 3.2%. Adding DoorDash to its distribution network may help reverse that trend by reigniting delivery volume, especially as the company continues aggressive store openings across the country.

While Domino’s charges a slight premium on its menu through aggregator platforms, the increased volume and customer acquisition potential could outweigh the margin impact. With aggregator sales currently representing just 2.7% of total orders via Uber Eats, the DoorDash integration could meaningfully boost that figure over the next year.

Roblox Corp. ($RBLX):

Roblox has officially launched Rewarded Video Ads and announced a major partnership with Google to scale its advertising business through Google Ad Manager. The new ad format allows users to watch 15–30 second full-screen video ads in exchange for in-game perks such as power-ups, currency, or extra lives. Brands can now buy these ads both directly from Roblox and programmatically via Google’s advertising tools, marking a significant step in Roblox’s effort to monetize its massive Gen Z audience.

This collaboration by Roblox is a strategic expansion of its immersive ad ecosystem, positioning the platform as a serious contender in the $500+ billion global digital ad market. With 85.3 million daily active users, most of whom are over the age of 13, Roblox now gives advertisers an efficient and scalable way to reach Gen Z where they are most engaged—within immersive gaming experiences. The partnership with Google brings several advantages. By integrating with Google Ad Manager, Roblox taps into a vast network of brands and agencies already using Google's ad tech stack. This streamlines the media buying process and significantly expands Roblox’s reach to advertisers who may have found it difficult to access the platform previously. It also supports other immersive formats like branded billboards, which will roll out on Google’s ad network in the coming months.

Early tests of the Rewarded Video Ads have shown strong performance, with over 80% ad completion rates—well above industry averages. This suggests a high level of user acceptance, especially when ads are tied to tangible in-game benefits. By ensuring that these ads don’t interrupt gameplay but instead offer a value exchange, Roblox preserves the user experience while unlocking new monetization channels for creators. Additionally, Roblox has partnered with leading measurement firms like Nielsen, DoubleVerify, and Integral Ad Science to give advertisers more transparency and confidence in campaign performance—crucial for brand safety and ROI.

Advertising is still a nascent revenue stream for Roblox, but with the addition of Rewarded Video and broad integration with Google’s ad ecosystem, it could soon become a major growth driver. The market will be looking closely at the upcoming earnings calls to see how ad revenue contributes to the top line and offsets any deceleration in bookings from Roblox’s virtual currency (Robux). The partnership with Google signals a new chapter in its monetization strategy, opening the door to high-margin ad revenue while enhancing its value proposition for developers and advertisers alike. This move could support long-term revenue diversification and profitability as the company continues evolving beyond its core gaming roots.

Nintendo ADR ($NTDOY):

Nintendo has officially delayed the U.S. pre-order launch of the highly anticipated Switch 2 console, which was originally scheduled for April 9. In a statement to the media, the company cited “the potential impact of tariffs and evolving market conditions” as the reason for the delay. Notably, the console’s global launch date of June 5 remains unchanged.

The move follows the announcement of sweeping new tariffs by U.S. President Donald Trump earlier in the week. The new trade policy includes a 34% tariff on electronics imported from China and a 46% tariff on those from Vietnam—two countries where Nintendo has historically produced and relocated much of its hardware manufacturing. These duties significantly raise the cost of bringing the Switch 2 into the U.S. market.

While Canadian and European pre-orders are moving ahead as planned, the delay in the U.S. raises questions about whether Nintendo might increase the console’s price to offset new costs. The Switch 2 is currently priced at $449.99 in the U.S., and bundles, accessories, and game prices are already drawing criticism for being 30% more expensive than the original Switch. With games like Mario Kart World retailing for $79.99 and accessories such as the camera and extra controllers carrying premium prices, the added pressure from tariffs could further complicate Nintendo’s pricing strategy.

The uncertainty could mean one of two things: a price hike on the base console or tighter availability as Nintendo potentially reallocates inventory to untaxed markets like Canada and the EU. Some U.S. buyers have already discussed the possibility of crossing the border into Canada to secure early pre-orders at the original price. Nintendo previously shifted production from China to Vietnam to sidestep tariffs during the first Trump administration, only to now find Vietnam also caught in the crossfire. Analysts argue that moving manufacturing to the U.S. is not a viable solution in the short term due to high labor and component costs, long build times, and potential political reversals.

Despite the turbulence, hands-on previews of the Switch 2 have been positive, with praise for its upgraded specs, 120Hz refresh rate, and GameChat features. Still, the lack of compelling launch titles and the possibility of delayed or more expensive U.S. availability could temper initial sales momentum.

MercadoLibre Inc ($MELI):

Mercado Libre has officially launched its free streaming platform, Mercado Play, on Smart TVs across Latin America. The app is now available for download on Samsung (Tizen), LG (webOS), Android TV, and Google TV, allowing users to stream movies, series, and documentaries directly on their television without the need for extra devices or complicated setup. With this expansion, the platform aims to become a central entertainment hub in the region, reaching millions of users who prefer streaming on the biggest screen in their homes.

Since launching in mid-2023, Mercado Play has grown rapidly, going from one million monthly viewers in January 2024 to more than four million today. Its catalog now includes over 2,500 titles and more than 15,900 hours of curated content. In addition to on-demand entertainment, the service has expanded into live event streaming, having broadcast the Euro Cup semifinal, the Olympic Games, and the Buenos Aires Trap music festival. Despite the app for Smart TVs being in a testing phase and not formally announced, over 800,000 people downloaded it, demonstrating strong organic demand and anticipation.

Mercado Play operates under the FAST model—Free Ad-Supported Streaming Television—offering access to a wide variety of content without charging users. Instead, it is supported by advertising. Users can access Mercado Play through their Mercado Libre accounts, but in many cases, logging in is not even required to begin streaming. The service includes high-profile titles such as “Spider-Man: Far From Home,” “The Devil Wears Prada,” “Black Swan,” “Bad Boys for Life,” and “Jumanji,” as well as classic and cult TV series like “The Office,” “Yellowstone,” “Dr. House,” “La Niñera,” and “Twin Peaks.” The interface has been praised for being fast and intuitive, although it currently lacks the option to create a watchlist—something users hope will be added soon.

According to Pablo García, Vice President of Loyalty & Entertainment at Mercado Libre, the goal is to break down access barriers to quality content in Latin America. With the Smart TV rollout, over 72 million televisions across the region are now compatible with Mercado Play. García emphasized that the platform’s growth in audience and content catalog reflects the value users place on having a subscription-free streaming alternative. The expansion of Mercado Play is not just a play for viewers, but also a strategic move into the digital advertising market. With its growing audience, Mercado Libre is offering new campaign formats through Mercado Ads, allowing advertisers and partners to engage users in a high-impact environment. The integration with Mercado Libre’s broader ecosystem also gives the platform a unique advantage by combining entertainment, commerce, and advertising in one place.

With Mercado Play now available on the most popular Smart TV platforms in Latin America, Mercado Libre is solidifying its position as more than just an e-commerce leader. It is building a multi-layered digital ecosystem where entertainment, security, and shopping converge. As streaming services grow increasingly fragmented and expensive, Mercado Play offers a compelling alternative for viewers seeking accessible content without the subscription fees.

Warner Bros Discovery Inc ($WBD):

Minecraft’s cinematic debut is experiencing explosive success. First and foremost, the film’s $301 million global debut — $157 million of which came from domestic ticket sales — is the studio’s biggest opening since Deadpool & Wolverine in July 2024 and now holds the record for the highest domestic opening of any video game adaptation. This windfall gives Warner Bros. much-needed momentum after a difficult start for cinemas in 2025, which had been marked by underperforming releases like Snow White and Mickey 17. With the box office down 13% year-over-year before Minecraft, the film’s success narrowed the deficit to just 5% and revived confidence across Hollywood that theatrical releases can still be major cultural and financial events.

For Warner Bros., this hit validates the studio’s bet on Minecraft, a title that had languished in development for over a decade. It also serves as a win for studio leadership under Michael De Luca and Pamela Abdy, as well as for producer Mary Parent at Legendary, who championed the hiring of Jared Hess as director. More importantly, it proves the viability of high-concept, youth-skewed adaptations rooted in modern IP — especially when paired with broad, family-friendly appeal and smart theatrical rollout strategies.

The movie, produced with a $150 million production budget (not including marketing) is already looking like a smart investment. Its strong audience scores (B+ CinemaScore, 87% on Rotten Tomatoes audience score, A grades from under-25s) and the energized fanbase suggest that Minecraft could enjoy strong legs throughout the spring and early summer. It also opens the door for a sequel or even a franchise universe, which would be a major IP addition to Warner Bros.’ portfolio. In terms of global branding, Warner Bros. has also made inroads in China — where Minecraft topped the weekend box office — a notable accomplishment given the growing challenges of Hollywood films in that market.

The spillover effects extend to the studio’s marketing, streaming, and merchandising arms. A wave of Minecraft merchandise, possible collaborations with Xbox and Mojang (both Microsoft-owned), and cross-platform content opportunities could follow, turning this into a multi-dimensional success similar to what The Super Mario Bros. Movie accomplished for Universal and Nintendo. Strategically, the success could prompt Warner Bros. to double down on other youth-anchored IP projects, re-evaluate languishing video game or digital-era properties in its vault, and invest further in audience-first storytelling instead of executive nostalgia. It also provides a template for how to craft theatrical experiences that feel like events — especially among Gen Z and Gen Alpha, whose enthusiastic participation (chanting “Chicken Jockey!” in theaters, viral memes) fueled the communal buzz around the release. Ultimately, A Minecraft Movie could go down as a defining moment for Warner Bros. in the 2020s — a reset not just in terms of financial results, but in how the studio thinks about its audience, adapts IP, and creates cultural phenomena in an era where theatrical and digital ecosystems continue to blur.

Tesla Inc ($TSLA):

A new viral meme has pulled Tesla into controversy once again, this time over claims that the company’s iconic “T” logo resembles a Ku Klux Klan (KKK) hood when flipped upside down. The claim emerged after a TikTok video from user @thedisciplinedfatkid began circulating widely across social media. In the video, the user rotates the Tesla logo and draws attention to what he suggests looks like the pointed hood traditionally worn by KKK members. The video rapidly gained momentum, triggering widespread debate and mixed reactions.

Online commentary intensified as users reposted the video on platforms like X with messages expressing disbelief, shock, and even humor. Many stated they were unable to “unsee” the resemblance, while others dismissed the meme as an overreach or conspiracy. The image was even modified by some users to add stylized “eye holes,” further enhancing the controversial visual. What began as a fringe comparison quickly became a trending discussion point, with memes and reactions flooding timelines.

The controversy arrives at a particularly sensitive time for Tesla and its CEO Elon Musk. It coincides with a growing wave of protests across the United States targeting Musk’s role in the Trump administration as head of the newly formed Department of Government Efficiency (DOGE), where he has advocated for aggressive budget cuts. The backlash has extended beyond government criticism and into the corporate sphere, with protesters calling for boycotts and raising concerns about Tesla’s political alignments.

Fueling the public discourse further was a recent interview in which Kanye West appeared wearing an all-black outfit that resembled KKK attire, a move that ignited condemnation and added a racial and political dimension to ongoing controversies. The proximity of the Tesla logo meme to this appearance has led some observers to connect the two incidents, suggesting a broader cultural undercurrent of anxiety around symbolism, celebrity influence, and institutional associations with hate imagery.

Originally, Tesla’s logo was designed to symbolize a cross-section of an electric motor, and the company has long emphasized its futuristic, clean energy mission. The “T” is also a nod to the pioneering inventor Nikola Tesla. Yet the flipped-image interpretation has created an alternative narrative that the automaker now finds itself contending with, regardless of the original design’s intent.

Media outlets have been quick to note that such interpretations often gain traction in the current age of viral internet culture, where symbolism and speculation can rapidly outpace rational context. Commentators have also pointed out that this is not the first time Tesla or its CEO has been at the center of meme-driven controversy. Still, the scale and timing of this current viral moment have made it one of the more heated brand discussions Tesla has faced.

Adding further weight to a turbulent week for the company, news also broke that David Lau, Tesla’s long-serving vice president of software engineering, is stepping down. Lau, who has been with the automaker for over a decade and held his current role since 2017, reportedly informed colleagues of his decision, according to Bloomberg. His team has been central to software development across Tesla’s vehicles, cloud services, and manufacturing operations. Neither Lau nor Tesla has issued public comments about the resignation.

Meanwhile, Tesla shares suffered a sharp decline, closing nearly 10% lower as escalating trade tensions between the U.S. and China roiled the markets. China announced retaliatory tariffs against the U.S. following President Trump’s recent wave of new trade duties, a move that impacts companies like Tesla with global supply chains. The resulting investor reaction reflects concerns not just about Tesla’s PR challenges, but also its exposure to international trade policies and shifting economic alliances.

While some commentators have dismissed the logo meme as exaggerated or unfounded, others argue that the controversy speaks to deeper societal tensions and the increasing role that brand perception and social media play in corporate accountability. As Tesla navigates this moment, it faces not only a test of its public relations agility but also renewed scrutiny of the cultural associations and responsibilities carried by global brands in a hyperconnected world.

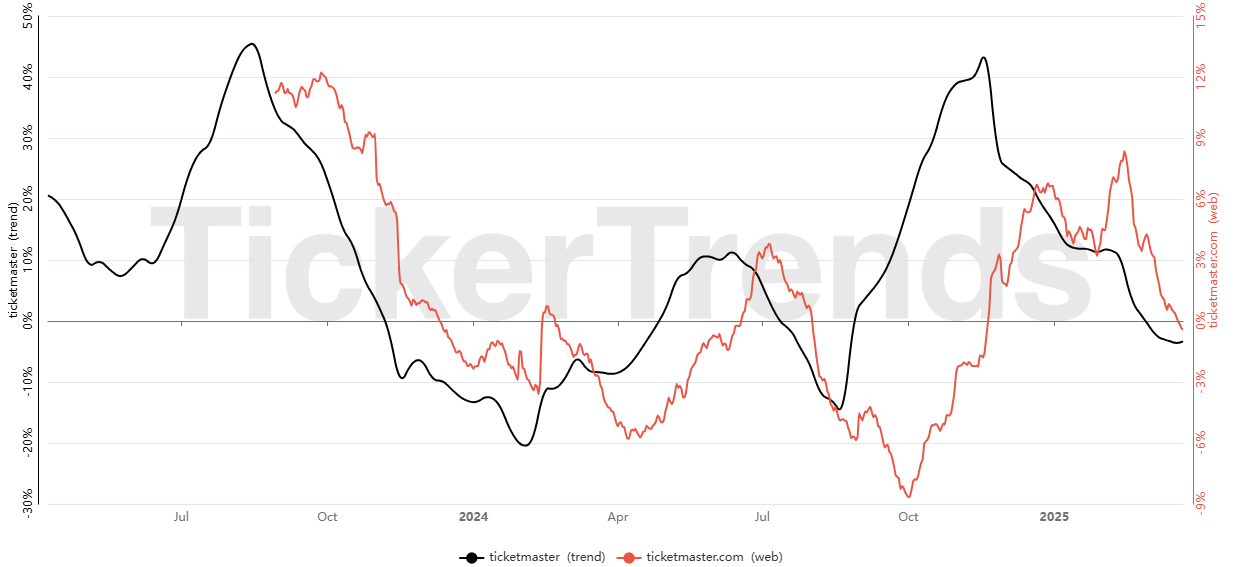

Live Nation Entertainment Inc ($LYV):

President Donald Trump signed a new executive order on March 31, 2025, aimed at cracking down on ticket scalping and reforming the U.S. live entertainment ticketing industry. The directive was signed during an Oval Office ceremony, where the president was joined by longtime supporter and rock musician Kid Rock. The executive order focuses primarily on eliminating the use of bots in ticket purchasing, enhancing transparency in pricing, and ensuring that existing laws such as the BOTS Act are enforced more rigorously.

Trump’s order came in response to widespread frustration from both artists and fans over ticket reselling practices, particularly those involving automated bots that purchase large quantities of tickets the instant they go on sale, only to relist them at exorbitant prices on secondary marketplaces. The president referenced how a ticket originally priced at $100 could end up selling for $2,000 on resale platforms, saying this not only deprives fans of fair access but distorts the market and enriches scalpers at the expense of consumers.

Kid Rock, dressed in a red, white, and blue outfit, praised the move as a significant first step, noting that fans of all political stripes have been affected by inflated ticket prices for years. He emphasized the issue of bots cornering the market on premium seats and called for eventual legislation to cap resale prices. “There’s plenty of money to go around. Nobody’s going to lose here,” he said, reinforcing the idea that artists, venues, and fans can all benefit from fairer systems.

The executive order directs several federal agencies to act swiftly. Treasury Secretary Scott Bessent and Attorney General Pam Bondi have been tasked with ensuring that ticket scalpers comply with IRS tax regulations and other relevant laws. The Federal Trade Commission has also been directed to coordinate with the Department of Justice and state attorneys general to enforce competition laws within the concert and entertainment space. Moreover, the FTC is instructed to enforce the Better Online Ticket Sales (BOTS) Act of 2016, which prohibits the use of bots to circumvent ticketing systems—a law that, to date, has only been enforced once.

Trump’s order also mandates a review of pricing transparency and calls for measures to make sure consumers see the full cost of tickets, including fees, from the start of the purchasing process. It encourages the agencies involved to evaluate whether new legislation may be needed and to present a comprehensive report within six months detailing what actions have been taken.

The order received swift praise from major players in the ticketing and entertainment industry. Live Nation Entertainment, parent company of Ticketmaster, released a statement supporting the order, saying, “Scalpers and bots prevent fans from getting tickets at the prices artists set, and we thank President Trump for taking them head-on.” The company reiterated its support for reforms such as stricter enforcement of the BOTS Act and caps on ticket resale prices.

StubHub, a major ticket resale platform, also issued a statement applauding the president’s actions. “We welcome more transparency, safety, and competition to improve the industry for fans and further protect them from a live entertainment monopoly,” a spokesperson said.

The National Independent Venue Association (NIVA) added their voice to the growing support, commending the order as a necessary step to protect fans, artists, and independent businesses from predatory practices in the ticketing market. NIVA’s executive director, Stephen Parker, emphasized that the executive order addressed the two most pressing issues in the industry: bots and the market dominance of companies like Live Nation.

Despite the strong industry support, some observers were skeptical about whether the order would bring meaningful change. Critics pointed to the fact that the FTC is an independent agency, and therefore its enforcement agenda cannot be directly dictated by the president. However, most agree that the executive order adds momentum to the growing movement calling for systemic reforms in how live entertainment tickets are sold and resold.

The controversy surrounding the industry is not new. In recent years, Live Nation and Ticketmaster have been repeatedly scrutinized for monopolistic behavior. During the Biden administration, the DOJ filed a major antitrust lawsuit against the companies, alleging they stifled competition and harmed both artists and consumers. The lawsuit followed a public outcry after a disastrous ticket sale rollout for Taylor Swift’s “Eras” tour, which saw fans unable to secure tickets while resellers flipped them for several times the face value.

Trump’s executive order marks a renewed effort to address those frustrations from the highest level of government. It combines consumer protection, competition enforcement, and digital regulation in a bid to level the playing field for concertgoers. The White House is also using this policy to signal support for middle-class Americans who increasingly find themselves priced out of attending live events due to a system that favors bots and brokers over fans. With bipartisan support building around ticketing reforms, the executive order could be a sign of further legislative changes to come.