What's Trending with TickerTrends #6

Your regular monitor for interesting social arbitrage ideas.

Your regular monitor for interesting social arbitrage ideas.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week the most prominent companies to report were the following and these are the highlights from the calls:

1. Celsius Holdings, Inc. ($CELH):

Celsius Holdings, Inc. reported its third-quarter 2024 financial results on November 6, 2024. The company experienced a revenue decline to approximately $265.7 million, down from $384.8 million in the same period the previous year. This decrease was primarily attributed to a $123.9 million reduction in sales to its largest distributor, which was undergoing inventory optimization.

Despite the revenue drop, retail sales of Celsius products in the U.S. MULO Plus with Convenience channels grew by 7.1% year-over-year for the thirteen-week period ending September 29, 2024, as reported by Circana. International sales also saw a significant increase, rising 37% to $18.6 million compared to $13.6 million in the third quarter of 2023.

Gross profit for the quarter decreased by $71.9 million to $122.2 million, with a gross profit margin of 46.0%, down from 50.4% in the same period last year. This decline was influenced by promotional allowances and incentives that did not align with the company's sales to distributors during the quarter.

In terms of market share, Celsius' energy drink category dollar share in MULO Plus with Convenience for the four-week period ending October 6, 2024, was 11.6%, a slight increase from the previous year. Sales to Costco rose by 15% during the quarter, while sales to Amazon increased by 21% year-over-year, reaching approximately $27.0 million.

The company also announced the acquisition of Big Beverages Contract Manufacturing, a strategic move aimed at enhancing supply chain control and accelerating innovation cycles. Additionally, Celsius expanded its international presence, with sales in Canada, the UK, and Ireland exceeding expectations, and new market entries in Australia and New Zealand during the third quarter.

2. Hims and Hers Health Inc. ($HIMS):

Hims & Hers Health, Inc. (NYSE: HIMS) announced its third-quarter 2024 financial results on November 4, 2024. The company reported a significant revenue increase of 77% year-over-year, reaching $401.6 million, up from $226.7 million in the same period the previous year. This growth was primarily driven by a substantial rise in subscribers and enhanced online revenue per average subscriber.

The company's net income for the quarter was $75.6 million, which included a $60.8 million tax benefit related to the release of a tax valuation allowance, partially offset by current period tax expense. This compares to a net loss of $7.6 million in the third quarter of 2023. Adjusted EBITDA also saw a significant increase, reaching $51.1 million, up from $12.3 million in the same quarter last year.

Subscriber growth was robust, with the total number of subscribers reaching 2.0 million by the end of the quarter, a 44% increase from the previous year. The average order value (AOV) also rose to $147, a 48% increase from $99 in the third quarter of 2023.

Gross margin for the quarter was 79%, compared to 83% in the same period last year. The slight decline in gross margin was attributed to the company's investments in expanding its personalized solutions and enhancing its platform capabilities.

Hims & Hers has raised its full-year 2024 revenue guidance to a range of $1.460 billion to $1.465 billion and adjusted EBITDA guidance to a range of $173 million to $178 million. The company expects fourth-quarter 2024 revenue to be between $465 million and $470 million, with adjusted EBITDA ranging from $50 million to $55 million.

3. E.l.f. Beauty Inc. ($ELF):

e.l.f. Beauty, Inc. (NYSE: ELF) announced its Q2 fiscal 2025 financial results on November 6, 2024, reporting significant growth across key metrics. The company achieved a 40% year-over-year increase in net sales, totaling $301.1 million, marking the 23rd consecutive quarter of net sales growth and market share gains. Adjusted EBITDA rose by 15% to $69 million, with an adjusted EBITDA margin of 23%. Gross margin improved by approximately 40 basis points to 71%, driven by cost savings, favorable foreign exchange impacts, and international price increases.

International sales surged by 91%, now accounting for 21% of total net sales, up from 16% in the previous year. This growth was fueled by expansion into new markets, including a significant launch in 1,600 Rossmann stores in Germany, where e.l.f. quickly became the top cosmetics brand in those locations. Digital consumption increased nearly 40% year-over-year, with digital channels contributing 20% of total consumption, up from 17% the prior year. The Beauty Squad Loyalty Program expanded to 5.3 million members, reflecting a 30% year-over-year growth. Despite a 5% decline in the overall color cosmetics category, e.l.f. outperformed with a 16% increase in U.S. tracked channel consumption and gained 195 basis points in market share. The brand is now the number one U.S. color cosmetics brand in unit share and number two in dollar share.

e.l.f. holds six of the top 10 new product launches in mass cosmetics for 2024 and three of the top 10 SKUs across both mass and prestige. The company launched its largest e.l.f. SKIN awareness campaign to date, "Divine Skintervention," and released "Get Ready With Music, The Album," featuring 13 original songs by emerging global artists.

e.l.f. Beauty has raised its fiscal 2025 outlook, projecting net sales growth of approximately 28% to 30%, up from the previous guidance of 25% to 27%. Adjusted EBITDA is expected between $304 million to $308 million, reflecting a 29% to 31% growth from the prior year. Gross margin is anticipated to improve by approximately 30 basis points year-over-year. e.l.f. Beauty's strong performance in Q2 fiscal 2025 underscores its strategic focus on international expansion, digital engagement, and innovative product offerings, positioning the company for continued growth in the global beauty market.

Trends this week:

1. McDonalds ($MCD):

McDonald's has recently introduced its Spicy Chicken McNuggets which has generated significant consumer excitement, with the item returning to select markets on November 4, 2024. This limited-time offering, featuring a crispy tempura coating spiced with cayenne and chili pepper, has been a fan favorite since its initial launch in 2020.

Historically, the reappearance of Spicy Chicken McNuggets has positively impacted McDonald's sales. For instance, in 2020, the introduction of these nuggets contributed to a 13.6% increase in U.S. same-store sales during the first quarter of 2021.

Similarly, in 2021, new menu items, including the spicy nuggets, helped McDonald's surpass Wall Street expectations, with same-store sales jumping 12.7% in the third quarter.

While the current reintroduction has sparked enthusiasm, its effect on McDonald's stock price remains to be seen. McDonald’s has seen a surge in demand mostly owing to smart collaborations and reintroduction of its various previously successful menu items.

The company's stock performance is influenced by various factors however, including overall financial health, market conditions, and broader economic trends. However, the buzz surrounding the Spicy Chicken McNuggets could potentially boost sales in participating markets, which may positively influence investor sentiment.

The return of Spicy Chicken McNuggets has historically driven sales growth for McDonald's. While it's uncertain how this will affect the stock price in the current context, the strong consumer response suggests a potential positive impact on the company's financial performance.

2. Tesla ($TSLA):

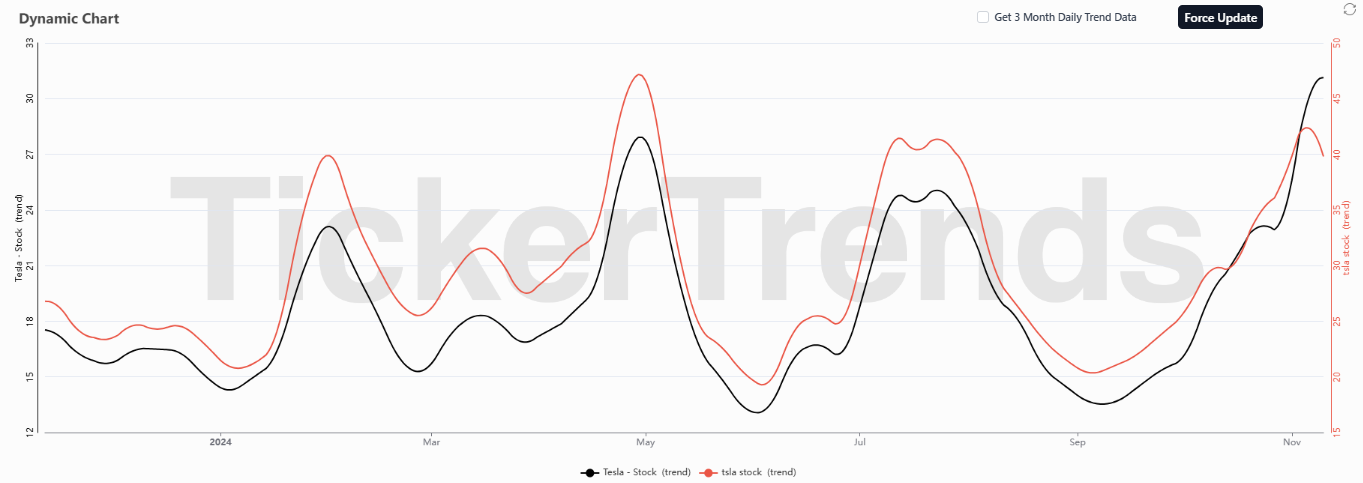

Tesla's stock has experienced a remarkable surge, climbing over 32% this week and surpassing a $1 trillion market capitalization. This rally coincides with Donald Trump's recent presidential election victory, which investors anticipate will usher in policies favorable to Tesla and its CEO, Elon Musk. Musk's substantial support for Trump's campaign, including significant financial contributions, has strengthened their alliance, leading to expectations of a regulatory environment that could benefit Tesla's operations.

The market's reacted to Tesla's status as a quintessential social arbitrage stock, where investor sentiment and external events significantly influence its valuation. Following the election results, Tesla's stock became a focal point, with over 220,000 searches on Google as investors connected the political developments to potential advantages for the company. This heightened interest reflects the dynamic interplay between political outcomes and market performance, particularly for companies like Tesla that are closely associated with influential figures and emerging technologies.

Analysts suggest that the new administration's policies could lead to reduced regulatory hurdles and increased support for autonomous vehicle initiatives, areas where Tesla is actively expanding. Additionally, potential trade policies favoring domestic manufacturing may further bolster Tesla's market position. However, some caution that changes in electric vehicle subsidies could impact the broader EV market, though Tesla's established presence may mitigate these effects.

Tesla's recent stock performance exemplifies the impact of political developments on market dynamics. The company's close association with the incoming administration has fueled investor optimism, driving significant gains and highlighting the importance of social arbitrage in investment strategies.

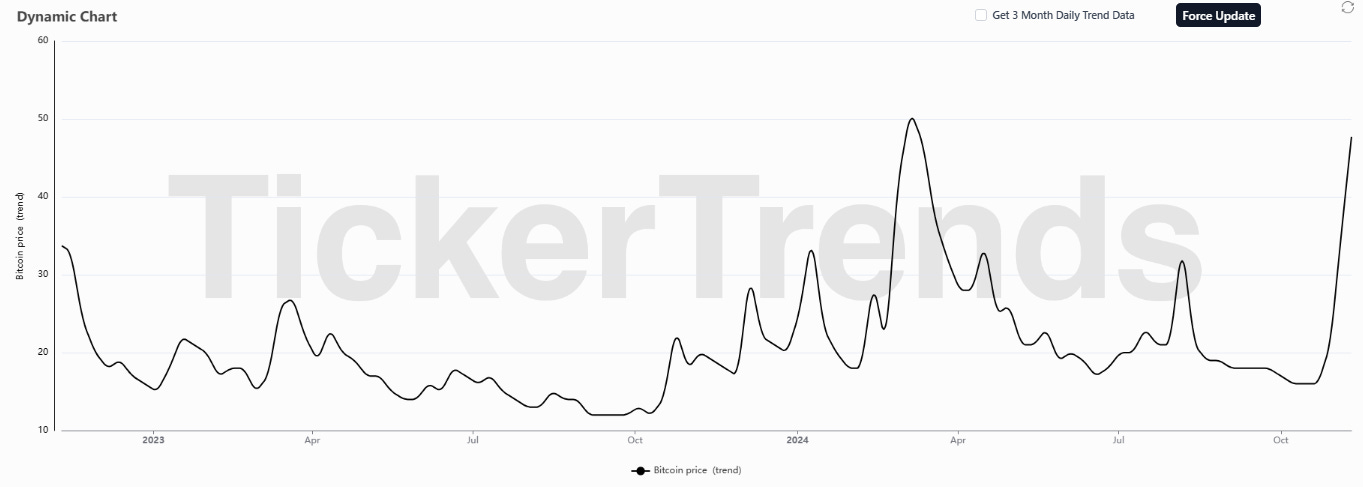

3. Bitcoin ($IBIT):

Bitcoin's price has surpassed $80,000 for the first time, significantly influenced by Donald Trump's decisive victory in the U.S. presidential election. Trump's campaign promises to transform the U.S. into the "crypto capital of the planet" have bolstered investor confidence, leading to an over 80% increase in Bitcoin's value this year. This bullish sentiment is further supported by Trump's plans to create a strategic Bitcoin stockpile and appoint digital asset-friendly financial regulators, indicating a potential easing of regulations on the cryptocurrency industry.

The election outcome has also positively impacted other cryptocurrencies, including Dogecoin, which has seen gains partly due to endorsements from prominent Trump supporter Elon Musk. Market analysts suggest that if the Trump administration follows through on its deregulatory stance toward cryptocurrencies, Bitcoin's price could climb to as high as $100,000. However, they caution that the market remains susceptible to significant selloffs, which could adversely affect smaller investors.

In the wake of the election, there has been a notable increase in retail investor interest in cryptocurrencies. Bitcoin's new all-time high has served as a compelling advertisement for the crypto market, attracting a wave of new buyers. Historically, retail investors have played a crucial role in Bitcoin's bull runs, and their renewed participation could signal the beginning of a new market cycle.

Despite the positive momentum, some retail investors remain cautious, still reeling from past market collapses, such as the FTX implosion, which eroded trust in the crypto industry. However, Trump's victory and his pro-crypto stance may alleviate regulatory concerns, particularly regarding the Securities and Exchange Commission's (SEC) previous enforcement actions under Chair Gary Gensler. Trump has pledged to replace Gensler with a more crypto-friendly figure, potentially paving the way for a more supportive regulatory environment.

As retail investors re-enter the market, their participation could drive further increases in Bitcoin's price. The combination of a favorable political climate, renewed investor interest, and potential regulatory easing creates a conducive environment for Bitcoin's continued growth. However, investors should remain vigilant, as the market is still prone to volatility, and informed decision-making is essential to navigate the evolving landscape of cryptocurrency investments.

4. Robinhood ($HOOD):

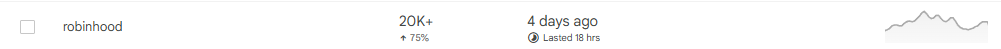

Robinhood Markets Inc. has experienced a surge in activity and interest, following the results of the election positioning itself for potential growth in the evolving financial landscape.

Increased User Engagement and Trading Activity

Robinhood has reported a significant uptick in user engagement, with over 20,000 searches this week. This surge is attributed to the platform's introduction of presidential election event contracts and the surge in crypto, allowing users to speculate on the outcomes of the 2024 election between Kamala Harris and Donald Trump. This innovative feature has resonated with users, leading to record trading volumes. Notably, Robinhood reported that 400 million election contracts were traded overnight during the election period, highlighting the platform's capacity to handle high-volume trading scenarios and potentially leading to the upcoming quarter being really good.

Potential Regulatory Shifts Favoring Cryptocurrency Trading

The Trump administration's pro-cryptocurrency stance could positively impact Robinhood's cryptocurrency offerings. Reports indicate that Trump's transition team is considering appointing Dan Gallagher, Robinhood's Chief Legal Officer and a former SEC commissioner, as the new SEC Chair. Gallagher is known for his supportive views on financial innovation and a more lenient approach to cryptocurrency regulation

Such a leadership change at the SEC could lead to a more favorable regulatory environment for cryptocurrency trading platforms like Robinhood, potentially facilitating the approval of new crypto assets for trading on their platform.

Implications for Robinhood's Stock Performance

The combination of increased user engagement and the prospect of a more crypto-friendly regulatory environment bodes well for Robinhood's stock performance. The platform's ability to attract and retain users through innovative offerings, coupled with potential regulatory approvals for expanding its cryptocurrency portfolio, positions it for sustained growth. Investors could see these developments enhance Robinhood's market position and profitability in the coming months.

The increased user activity and potential expansion of its cryptocurrency offerings could drive substantial growth and positively impact its stock performance moving forward.

5. Walt Disney Co ($DIS):

Disneyland Resort has announced the return of its cherished hand-pulled candy canes for the 2024 holiday season, continuing a tradition that began in 1968. These meticulously crafted confections will be available on select dates at two locations within the resort:

Candy Palace and Candy Kitchen in Disneyland Park:

November 29

December 1, 3, 8, 10, 15, 17, 22, and 24

Trolley Treats in Disney California Adventure Park:

November 30

December 2, 4, 9, 11, 16, 18, 23, and 25

Given the limited daily production—typically fewer than 150 candy canes per day—Disneyland employs a mobile waitlist system to manage demand. Guests can add their names and phone numbers at the respective candy locations to receive a text notification with a designated return time for purchase. This system helps alleviate long queues and ensures a fair distribution of these sought-after treats.

Each candy cane is a substantial 18 inches in length and weighs approximately five ounces. They are handcrafted from pulled sugar and peppermint extract, offering a unique texture and flavor that distinguishes them from mass-produced versions. Guests have the opportunity to observe the candy-making process through display windows on Main Street U.S.A. in Disneyland Park and Buena Vista Street in Disney California Adventure Park.

The candy canes are priced at $20 each, with a purchase limit of one per guest per day. No discounts apply, and they are not available through mobile ordering. Due to their popularity, it's advisable for guests to arrive early to secure a spot on the waitlist.

This enduring holiday tradition not only delights guests with a sweet treat but also offers a glimpse into the artistry of candy making, reinforcing the festive spirit that Disneyland Resort is renowned for during the holiday season.

6. Starbucks ($SBUX):

Starbucks' annual Red Cup Day is a highly anticipated event marking the start of the holiday season. On this day, customers who purchase a handcrafted holiday beverage receive a complimentary reusable red cup, which they can use for future discounts and bonus rewards. In 2024, Red Cup Day is scheduled for Thursday, November 14.

The holiday menu, launching on November 7, features returning favorites like the Peppermint Mocha and introduces new items such as the Cran-Merry Orange Refresher. These seasonal offerings are available in festive holiday cups, adding to the celebratory atmosphere.

In addition to the holiday beverages, Starbucks is releasing a new collection of holiday merchandise, including various mugs, tumblers, and cold cups with designs that evoke holiday ornaments and peppermints. Notably, the 40-ounce Berry Pink Glitter Stanley Tumbler is among the standout items this season.

Starting November 7, Starbucks will eliminate extra charges for non-dairy milk customizations, leading to price reductions for many modified drinks. This change reflects the company's commitment to accommodating diverse customer preferences.

Red Cup Day has become a cherished tradition, symbolizing the beginning of the festive season for many Starbucks patrons. The reusable red cups not only serve as collectibles but also promote sustainability by encouraging customers to reduce waste. Bringing a clean reusable cup to a participating Starbucks store grants a 10-cent discount on beverages, plus 25 bonus stars for Starbucks Rewards members using the Starbucks app.

7. TJ Maxx ($TJX):

Based on the recent trends, TJX Companies (owner of T.J. Maxx, Marshalls, and HomeGoods) appears to be positioned as a strong earnings play moving forward, driven by a significant surge in TikTok interest and social media engagement.

Across popular hashtags like #tjmaxx, #tjmaxxfinds, #homegoods, and #homegoodsfinds, there has been a consistent increase in posts and interactions, reflecting a high level of consumer engagement with these brands. Notably, interest levels peaked in recent months, suggesting strong brand visibility and customer enthusiasm around these retailers. This increase in social media activity indicates a growing trend of shoppers sharing their “finds,” especially during key shopping seasons.

The sustained high engagement on platforms like TikTok, where users frequently post content around bargain finds and seasonal decor, highlights TJX’s appeal among budget-conscious consumers looking for quality at lower prices. As holiday shopping ramps up, this trend is likely to amplify, driving foot traffic to stores and positively impacting sales.

The strong social media presence also implies potential tailwinds for same-store sales and customer acquisition, particularly if TJX capitalizes on this momentum with targeted marketing or digital campaigns. This level of consumer-driven promotion can serve as a catalyst for earnings beats, especially if management aligns inventory with trending items frequently highlighted by shoppers online.

Overall, TJX stands to benefit from these organic, social media-driven promotions. This aligns well with a potential earnings play, as the heightened social interest could translate into robust financial performance, especially during the holiday season.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.