What's Trending with TickerTrends #13

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io. Join our Discord here for more discussion.

TickerTrend’s Monday Monitor is our overview of interesting social arbitrage event-driven trades and companies that could potentially benefit from these. We aim to find the best ideas driven by social arb. If you have any interesting ideas, feel free to contact us on X or join our Discord.

Enjoy!

Disclaimer. This newsletter is provided for informative purposes only. No significant due diligence has (yet) been performed on the names on this list. This overview does not constitute advice; always do your own due diligence.

Thanks for reading TickerTrends. Subscribe for free to receive new posts. Also, subscribe to our platform and support our work.

Important notice: We would like to continue to publish WTWT on a weekly basis, but we need a more critical mass. If you value this service, please like and hit the “share” button below. Thank you.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Earnings Recap:

You can get the transcripts for all earnings calls here: https://www.tickertrends.io/transcripts. This week there were no prominent companies that reported earnings.

Trends this week:

1. Walmart Inc ($WMT):

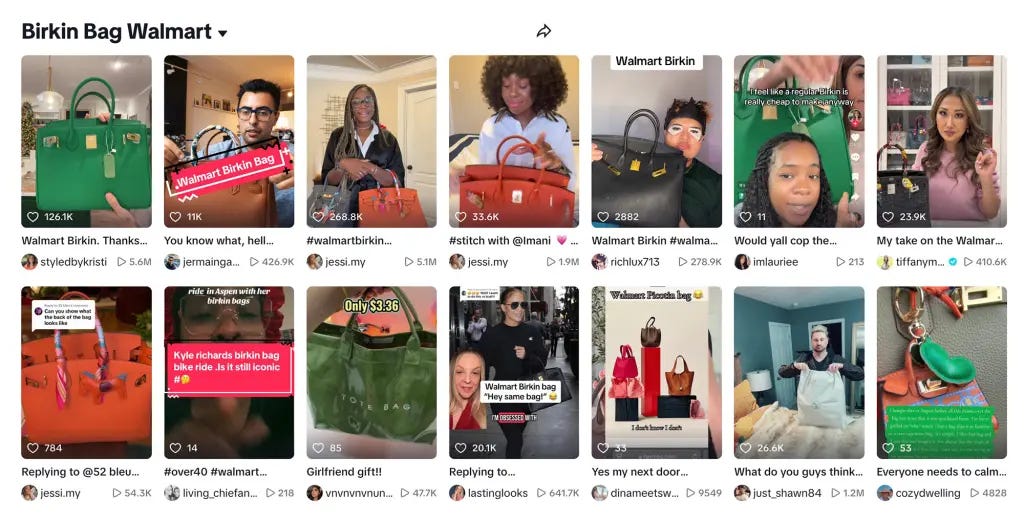

The "Walmart Birkin," also known as the "Wirkin," has taken the fashion and social media worlds by storm this week. Priced between $78 and $102, this handbag has gone viral on platforms like TikTok, amassing over 200,000 Google searches and becoming the subject of numerous haul videos and debates. As a dupe of the iconic Hermès Birkin bag, which costs between $9,000 and $225,000, the "Walmart Birkin" offers budget-conscious consumers a chance to emulate high-end fashion at a fraction of the price. This trend has resonated widely, with users celebrating its affordability and poking fun at the exclusivity of luxury items.

The virality of the "Walmart Birkin" stems from its cultural resonance, combining the democratization of fashion with humor about luxury branding. Social media users have propelled the trend, framing the bag as an accessible alternative to an item typically reserved for the ultra-wealthy. Its affordability, paired with the ease of online shopping, has made it an instant sensation. However, despite the widespread attention and short-term surge in demand, the impact on Walmart's financial performance is expected to be minimal. Walmart’s annual revenue exceeds $600 billion, making it unlikely for a single product category, especially one driven by third-party sellers, to significantly influence its earnings.

The bag’s limited availability, coupled with its status as a third-party marketplace item, further diminishes its potential financial impact on Walmart. Although the trend brings attention to Walmart’s e-commerce platform, the revenue generated from commissions on third-party sales is not substantial enough to move the needle for a company of Walmart's size. The cultural buzz, however, reinforces Walmart’s position as a retailer that appeals to a broad audience, including younger, trend-driven shoppers.

This trend also highlights Walmart’s ability to adapt to viral moments and stay relevant in a competitive retail landscape. The "Walmart Birkin" draws attention to the company’s growing e-commerce marketplace and underscores its ability to leverage cultural phenomena to attract new customers. At the same time, the trend raises questions about sustainability and intellectual property, as Hermès may pursue legal action against sellers for trade dress infringement, potentially drawing scrutiny to Walmart's third-party marketplace practices.

For investors, the "Walmart Birkin" is more of a cultural talking point than a financial catalyst. While the buzz may bring short-term attention to Walmart’s e-commerce efforts, it is unlikely to materially affect the company’s earnings or stock price. Walmart's stock performance is driven by macroeconomic factors, consumer spending trends, and overall operational efficiency rather than fleeting viral moments. However, this trend does highlight Walmart’s growing influence in the e-commerce space, which supports its long-term strategy of competing with Amazon and other online retailers. The "Walmart Birkin" underscores Walmart's adaptability and relevance in modern retail, a positive signal for its ability to thrive in a fast-changing marketplace.

2. Roblox Corp ($RBLX):

Roblox RPG game Jujutsu Infinite is also going viral this week and has become a sensation among anime and gaming enthusiasts. Based on the popular anime and manga series Jujutsu Kaisen, the game combines immersive storytelling and RPG mechanics, allowing players to create their own sorcerer characters and engage in dynamic combat. The excitement surrounding the game has translated into a spike in search interest, with over 200,000 Google searches for "Jujutsu Infinite codes" in December 2024 alone.

The appeal of Jujutsu Infinite lies in its integration of a gacha system, where players use "spins" to unlock powerful cursed techniques and innate abilities. These spins, essential for progression in the game, have been made more accessible through promo codes released by the developers. This has led to a scramble among players to redeem active codes such as "BACK_UP_AGAIN", "TOP_SECRET", and "MERRY_CHRISTMAS," which offer spins and double experience bonuses. With codes frequently updated and promoted across social media and platforms like Discord, the game has managed to sustain its virality and player engagement.

While Jujutsu Infinite's surge in popularity reflects the broader appeal of anime-themed games on Roblox, it also highlights the influence of gacha mechanics and frequent code updates in driving player retention. The spike in search interest demonstrates the strong demand for accessible gaming experiences tied to beloved franchises like Jujutsu Kaisen. The trend underscores the growing synergy between anime fandoms and gaming platforms, further cementing Roblox as a hub for creative adaptations of popular series. For those following the gaming world, Jujutsu Infinite's rise is a clear example of how viral trends and community engagement can propel a title to mainstream success.

3. Nintendo Co., Ltd. ($7974.T):

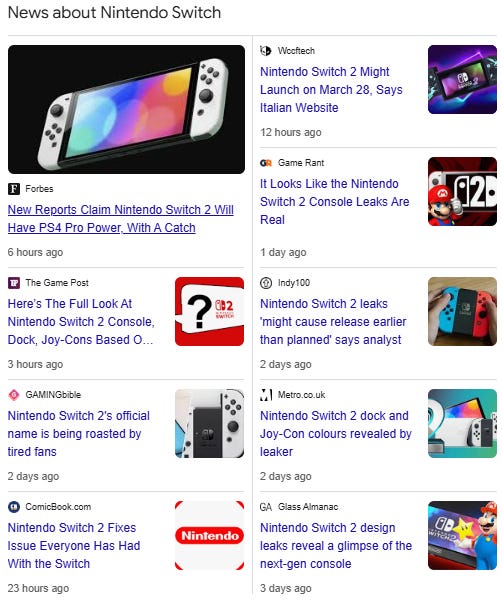

The gaming world is abuzz with excitement as the long-anticipated Nintendo Switch 2 inches closer to its official reveal, potentially as soon as January 2025, according to various leaks and insider reports. Nintendo, known for its secrecy, has refused to provide any official details about the console, but a flood of leaks has kept the speculation alive. Fans and industry insiders are eagerly discussing everything from its rumored specs to its design and launch date.

The most prominent rumor suggests that the Nintendo Switch 2 will feature a significant hardware upgrade, with docked mode offering performance comparable to the PS4 Pro. This marks a generational leap from the current Switch, which is often compared to PS3-era technology. However, in handheld mode, performance is rumored to align more closely with the base PS4. While some fans have expressed disappointment that the handheld mode may not utilize the full capabilities of the hardware, others argue that Nintendo’s success has never hinged on raw power. The current Switch, with its stylized visuals and first-party exclusives, has sold an astonishing 146 million units, making it the third best-selling console of all time.

Leaked images and 3D renders have provided a glimpse of what the Switch 2 might look like. Rumors point to magnetic Joy-Con attachments, a sturdier U-shaped kickstand, and an overall more modern design. If true, these features address long-standing complaints about the original Switch, such as the infamous Joy-Con drift issue. Reports indicate that the new Joy-Cons will utilize magnetic hall effect joysticks, which are less prone to wear and tear. Fans have praised these potential upgrades, seeing them as necessary quality-of-life improvements for the next generation.

Another hot topic is the console’s alleged support for NVIDIA DLSS Super Resolution and ray reconstruction, allowing for 4K output in docked mode. While the rumored cap of 30 FPS for 4K games has disappointed some, others believe the trade-off is justified given Nintendo’s focus on affordability and accessibility. Backward compatibility with existing Switch games has been confirmed, ensuring a smooth transition for players with extensive digital libraries.

On social media, reactions to the leaks and rumors are a mix of excitement and skepticism. Many fans are thrilled by the idea of an upgraded console that maintains the Switch’s hybrid nature, with one user noting, “If it keeps the portability and just runs a little better, I’m all in.” Others worry about pricing, with rumors suggesting the Switch 2 may launch at a premium compared to its predecessor. “I hope they don’t price themselves out of the market—part of the Switch’s charm was that it was affordable,” another user commented.

Industry analysts are optimistic about the Switch 2’s prospects, projecting sales of 15–17 million units in its first year and 80 million by 2028. However, they caution that clear differentiation from the original Switch will be crucial to avoid a repeat of the Wii U’s branding missteps. Many fans share this concern, urging Nintendo to market the new console as an entirely new system rather than an incremental upgrade.

With Nintendo reportedly planning a reveal before March 2025, fans are bracing for what could be a landmark moment in gaming. The company’s focus on innovation and unique gameplay experiences, rather than competing directly with Sony and Microsoft on raw power, has always set it apart. If the rumors are accurate, the Switch 2 could strike the perfect balance between performance, portability, and price, ensuring it becomes another blockbuster hit in Nintendo’s storied history. As one fan succinctly put it, “The Switch 2 doesn’t need to be a powerhouse—it just needs to be Nintendo.”

4. Eli Lily And Co ($LLY):

Mounjaro, Eli Lilly's groundbreaking weight-loss drug, has again gone viral this week, fueled by none other than tech billionaire Elon Musk. Taking to X (formerly Twitter) in a playful post on Christmas Day, Musk referred to himself as "Ozempic Santa" but later clarified that he actually uses Mounjaro. His endorsement has sparked widespread discussions on social media, shining a spotlight on the growing popularity of GLP-1 medications for weight loss and their potential to revolutionize public health.

Mounjaro, generically known as tirzepatide, was originally developed to manage type-2 diabetes by regulating blood sugar. However, its FDA approval for weight management in late 2023 under the name Zepbound has catapulted it into the limelight as a more effective alternative to Novo Nordisk’s Ozempic (semaglutide). Musk's revelation that he prefers Mounjaro due to fewer side effects and better results has reignited the debate over GLP-1 drugs and their role in tackling obesity.

Mounjaro's popularity highlights its effectiveness. Studies, including a peer-reviewed report in JAMA Internal Medicine, have shown that users of tirzepatide achieve significantly greater weight loss compared to semaglutide users. With celebrity endorsements from figures like Musk and Whoopi Goldberg, who also credited the drug for her dramatic weight loss, Mounjaro has cemented its place in the cultural zeitgeist.

The viral moment has not only boosted public awareness of GLP-1 medications but also reignited discussions about accessibility and affordability. Musk’s call to make these drugs "super low cost to the public" has resonated widely, given that Mounjaro costs over $1,000 per month without insurance. Many on social media echoed Musk’s sentiment, urging for policy changes to make these medications more accessible to those who need them most.

While Mounjaro's rise to fame is undoubtedly a triumph for Eli Lilly, it also reflects the growing demand for innovative solutions to combat obesity and related health conditions. As lawmakers consider expanding Medicare and Medicaid coverage for weight-loss drugs, Mounjaro’s viral success underscores the need for affordable options that can deliver meaningful health outcomes. This week's spotlight on Mounjaro illustrates not just its efficacy but its potential to reshape how society approaches weight management and public health.

5. Norwegian Cruise Line Holdings Ltd ($NCLH):

Norwegian Cruise Line experienced a tragic incident as a 51-year-old passenger went overboard from the Norwegian Epic during a seven-night Western Caribbean voyage. The incident occurred on Thursday, December 26, while the ship was traveling from Ocho Rios, Jamaica, to Nassau, Bahamas. Despite immediate search and rescue efforts, including assistance from the nearby Holland America Line’s Zuiderdam and oversight from the Bahamas Rescue Coordination Center, the passenger was not found, and the search was called off later that evening. The man, whose name has not been released, was traveling with a large group, including family members who are being supported by Norwegian Cruise Line during this challenging time. The circumstances of his fall remain unclear, though some witnesses speculated he may have jumped overboard—a claim not confirmed by officials.

Incidents like these are rare but raise ongoing concerns about safety and emergency response protocols in the cruise industry. With 19 reported overboard cases this year across various operators, such tragedies, while infrequent, can draw significant media attention. However, the immediate impact on Norwegian Cruise Line’s stock is expected to be minimal. The cruise line’s prompt and thorough response to the incident demonstrates adherence to international maritime safety standards, which could mitigate potential reputational damage. Similar incidents in the industry have historically not led to significant financial repercussions for cruise operators, as investors typically focus on broader market trends, such as consumer demand, fuel prices, and geopolitical conditions.

Norwegian’s proactive communication, including public expressions of support for the victim’s family, may also help contain any fallout. While the tragedy is deeply unfortunate, it is unlikely to deter most consumers who consider cruising a safe and enjoyable vacation option. The company’s reputation as a leading cruise operator remains strong, supported by its established safety measures and operational protocols. The incident may prompt renewed discussions across the industry about enhancing passenger safety and implementing additional measures to prevent overboard incidents in the future, but it is unlikely to materially affect Norwegian Cruise Line’s financial performance or stock price in the short term.

6. Bank of America Corp ($BAC), Well Fargo & Co ($WFC) & JPMorgan & Chase Co ($JPM):

The Consumer Financial Protection Bureau (CFPB) has filed a lawsuit against Bank of America, JPMorgan Chase, Wells Fargo, and Zelle’s operator, Early Warning Services LLC, accusing them of failing to adequately protect users from fraud on the Zelle payment platform. Since Zelle's launch in 2017, the CFPB alleges that over $870 million has been lost by customers due to insufficient safeguards, poor identity verification processes, and inadequate fraud prevention measures. The suit contends that fraud complaints were often dismissed, leaving victims without recourse and allowing repeat offenders to continue exploiting the system.

The CFPB's lawsuit seeks restitution for affected consumers, a civil monetary penalty, and operational changes to improve fraud prevention on Zelle. This marks a significant regulatory challenge for the banks, which collectively dominate Zelle’s operations, accounting for the majority of its transactions. The lawsuit comes amidst ongoing criticism of Zelle’s vulnerability to fraud and its lack of transparency in handling fraud claims.

Zelle and the banks involved have pushed back strongly, labeling the lawsuit as meritless and politically motivated. Early Warning Services asserts that its multi-layered fraud prevention measures have reduced scam reports by nearly 50% in 2023, and that the majority of Zelle transactions occur without issues. JPMorgan Chase and Bank of America echoed these sentiments, emphasizing Zelle’s popularity and utility for millions of users.

For Bank of America, JPMorgan Chase, and Wells Fargo, this lawsuit could result in operational changes, reputational challenges, and potential financial penalties. While Zelle has been a cost-effective and widely used platform for digital payments, scrutiny from regulators may force these banks to invest more heavily in fraud prevention measures, potentially increasing operating costs. However, with over 143 million users and a dominant market presence, the banks are likely to maintain Zelle's popularity, especially as fraud-related issues have impacted a small percentage of transactions.

The timing of the lawsuit, filed in the final weeks of the Biden administration, could influence its trajectory. The incoming Trump administration may deprioritize or even dismiss the case, aligning with its historical approach to reducing regulatory pressures on financial institutions. If the case proceeds, it could set a precedent for stricter oversight of peer-to-peer payment systems, forcing banks to rethink their strategies in managing digital platforms like Zelle. Despite these risks, the banks' substantial customer base and Zelle's popularity suggest limited immediate financial fallout, though longer-term reputational risks remain.

7. PayPal Holdings Inc ($PYPL):

PayPal’s browser extension Honey is at the center of a major controversy following allegations from YouTube creator MegaLag, who accused the tool of exploiting influencers, misleading consumers, and engaging in deceptive business practices. In a video titled "Exposing the Honey Influencer Scam," which has amassed over 9.4 million views, MegaLag claims that Honey manipulates affiliate links to redirect commissions away from creators and into its own pockets. By using a standard practice called "last-click attribution," Honey allegedly overrides affiliate links when users interact with its pop-ups at checkout, even if no discount is applied. This behavior has reportedly deprived influencers of revenue they would otherwise earn from their promotional efforts, raising serious ethical concerns in the affiliate marketing ecosystem.

The allegations extend to Honey’s coupon offerings, with claims that the extension prioritizes lesser-value discounts or fails to apply better deals available on other platforms. MegaLag also pointed to Honey’s historical advertising practices, which once claimed it could find “every working promo code on the internet.” Regulatory scrutiny from the National Advertising Division in 2020 led Honey to discontinue such advertisements, but the legacy of those claims continues to fuel skepticism. PayPal, which acquired Honey for $4 billion in 2020, has defended the tool, asserting that it follows industry norms and offers valuable services to both consumers and merchants. The company emphasized that the responsibility for coupon availability lies with merchants, and it highlighted Honey’s role in reducing cart abandonment and increasing sales conversion rates.

Influencers have been vocal in their responses to the controversy. Markiplier, a prominent YouTuber, has cited his distrust of Honey, noting that he declined sponsorship offers from the platform years ago due to concerns about its financial transparency. Linus Tech Tips similarly severed ties with Honey over its affiliate link practices. These reactions, coupled with MegaLag’s claims, underscore broader issues in the influencer marketing landscape, where creators often lack the resources or knowledge to fully investigate the brands they endorse. This scandal raises questions about the accountability of creators and the ethical standards of companies operating in the affiliate marketing space.

For PayPal, the controversy poses a significant reputational risk. Honey has been a cornerstone of PayPal’s strategy to drive customer loyalty and e-commerce growth, but these allegations could tarnish its image among users and influencers. Investors may view the controversy as a potential threat to PayPal’s broader fintech ambitions, especially if it leads to regulatory scrutiny or a loss of trust among consumers. While PayPal has maintained that Honey adheres to established industry practices, the backlash may force the company to reevaluate its affiliate marketing policies and increase transparency to rebuild confidence.

The potential fallout for PayPal’s stock hinges on how the company addresses these allegations and whether further revelations emerge. If the controversy escalates, it could prompt regulators to examine Honey’s business model more closely, adding pressure on PayPal to implement changes. Conversely, swift action to address concerns and strengthen trust with creators and consumers could help mitigate the long-term impact. As the situation evolves, PayPal’s response will be critical in determining how this controversy shapes the future of its popular browser extension and its overall market position.

Thanks for reading What’s Trending with TickerTrends. Subscribe for free to receive new posts and support our work.

TickerTrends Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.