WOSG: Signs of a turn for luxury watches, with tariff risk the main swing factor

Luxury watch demand stabilizes as comps ease, tariffs the swing factor for WOSG into year-end

TickerTrends data shows the watch market may be stabilizing after a prolonged bear market over the last 3 years. Multiple consumer interest signals among key luxury brands is rising. For Watches of Switzerland Group ($WOSG.L), that combination sets up cleaner comps and potential upside to demand into the holiday period. The near-term swing factor is the U.S. – Swiss tariff situation. If the proposed higher duties are softened or delayed, the setup improves further.

What the alternative data says

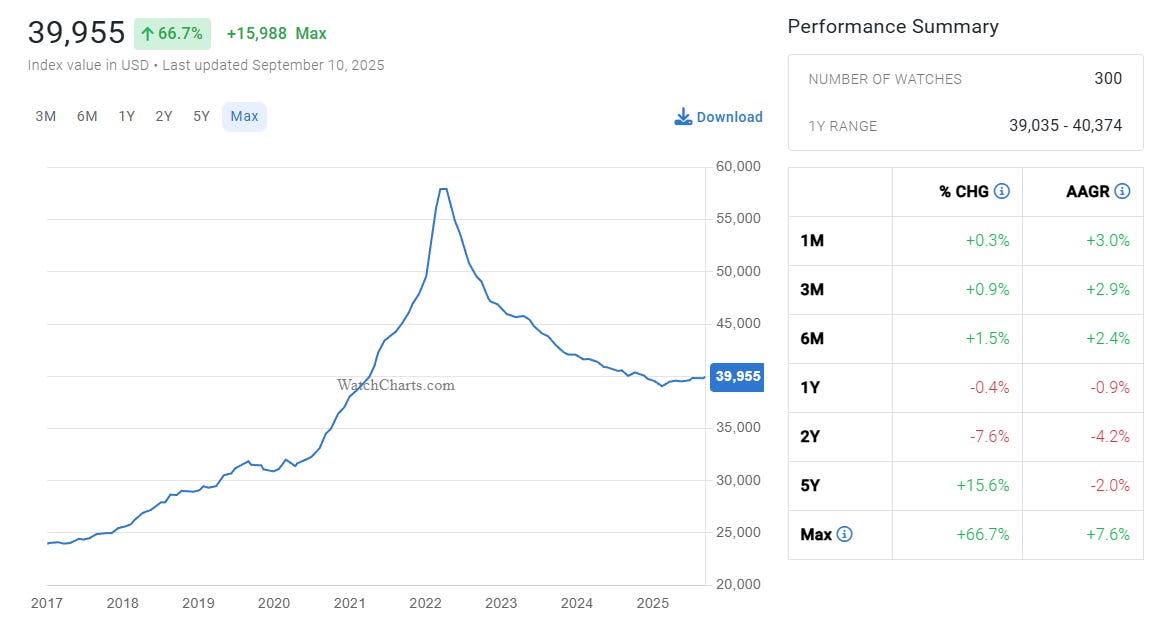

1) Secondary market prices have stopped falling.

The WatchCharts Overall Market Index sits at $39,955 and has edged higher over the last 3 to 6 months (+0.9% over 3M, +1.5% over 6M).

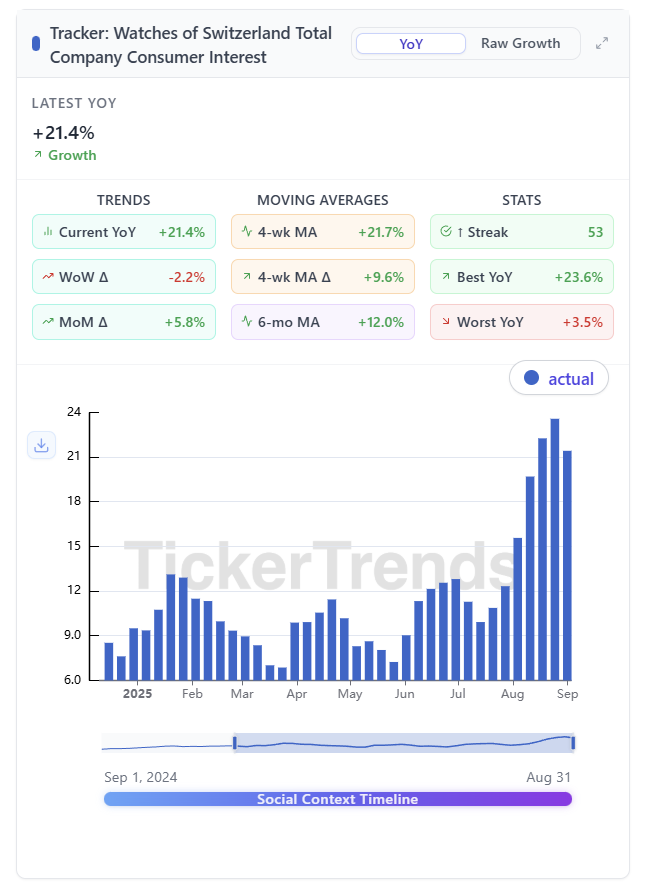

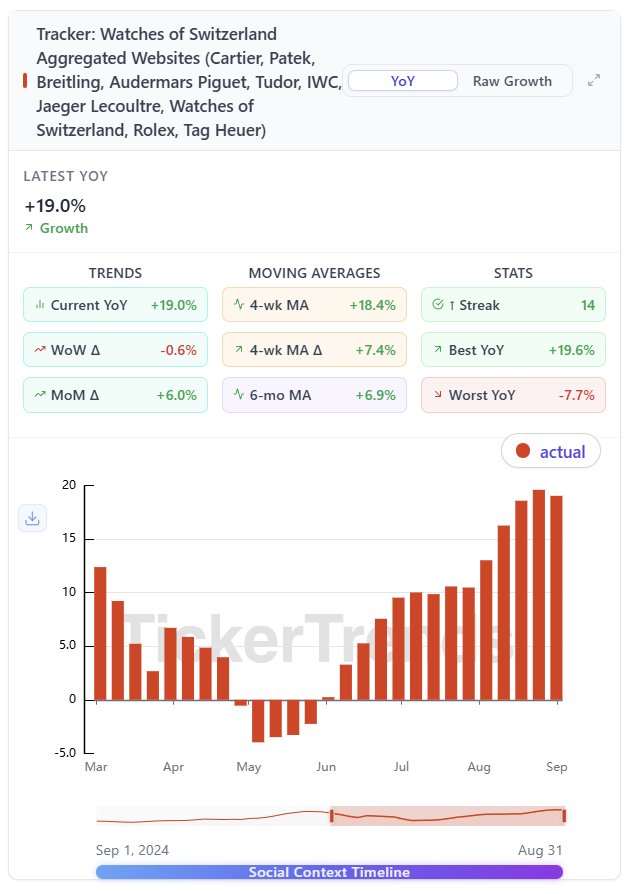

2) Interest in WOSG’s brands is accelerating.

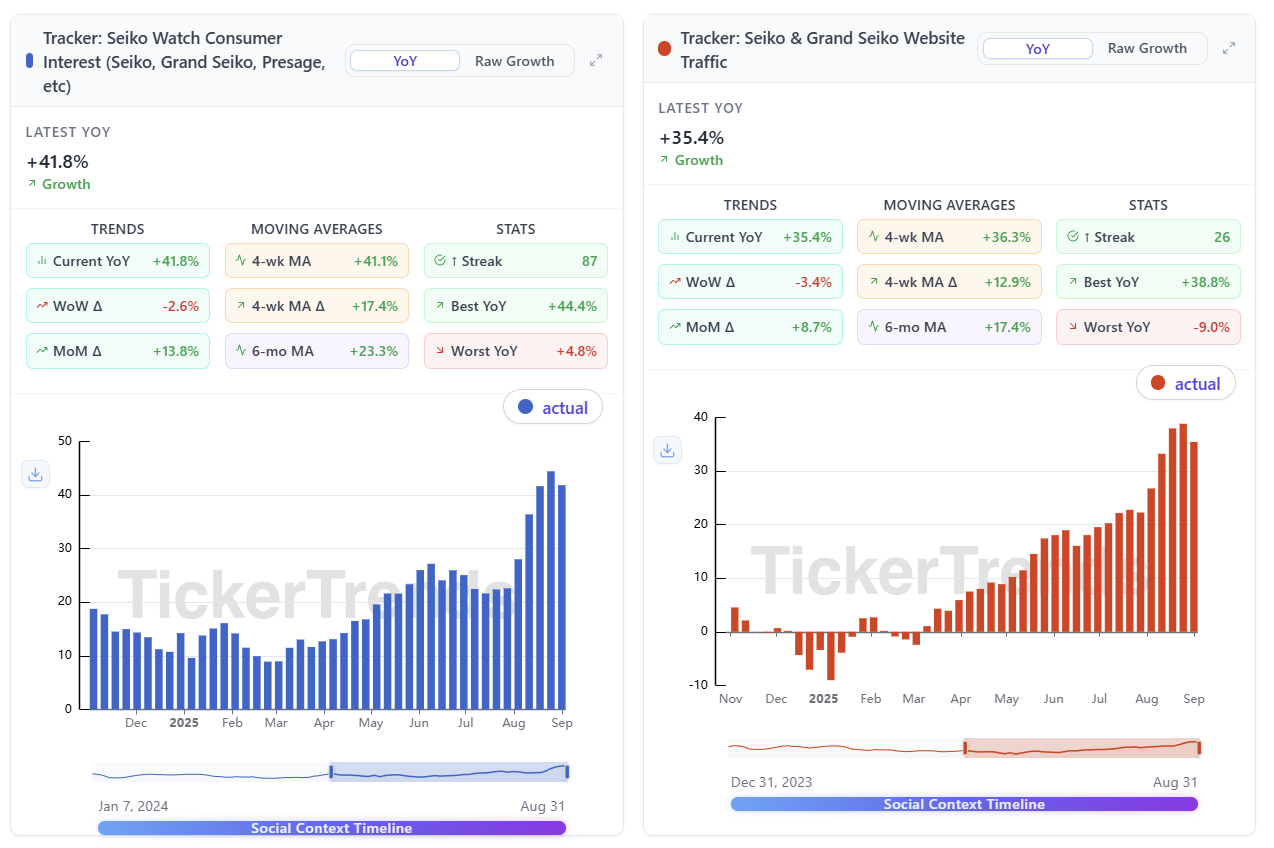

TickerTrends trackers show:

WOSG Total Company Consumer Interest: +21.4% YoY (up 5.8% in the last month alone and well ahead of the HSD YoY growth rates seen early this year)

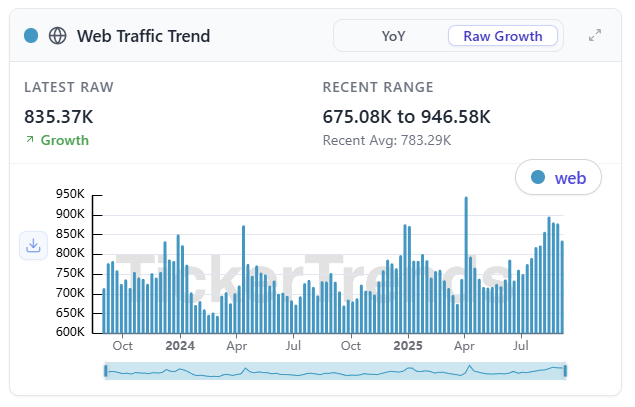

Aggregated Web Traffic for flagship brands sold by WOSG (Rolex, Omega, Cartier, Breitling, Tudor, IWC, Jaeger-LeCoultre, TAG Heuer): +19.0% YoY (up 6.0% in the last month alone)

This consistent improvement in top-of-funnel activity combined with a stabilizing watch market in terms of prices should prove to be positive for $WOSG.L.

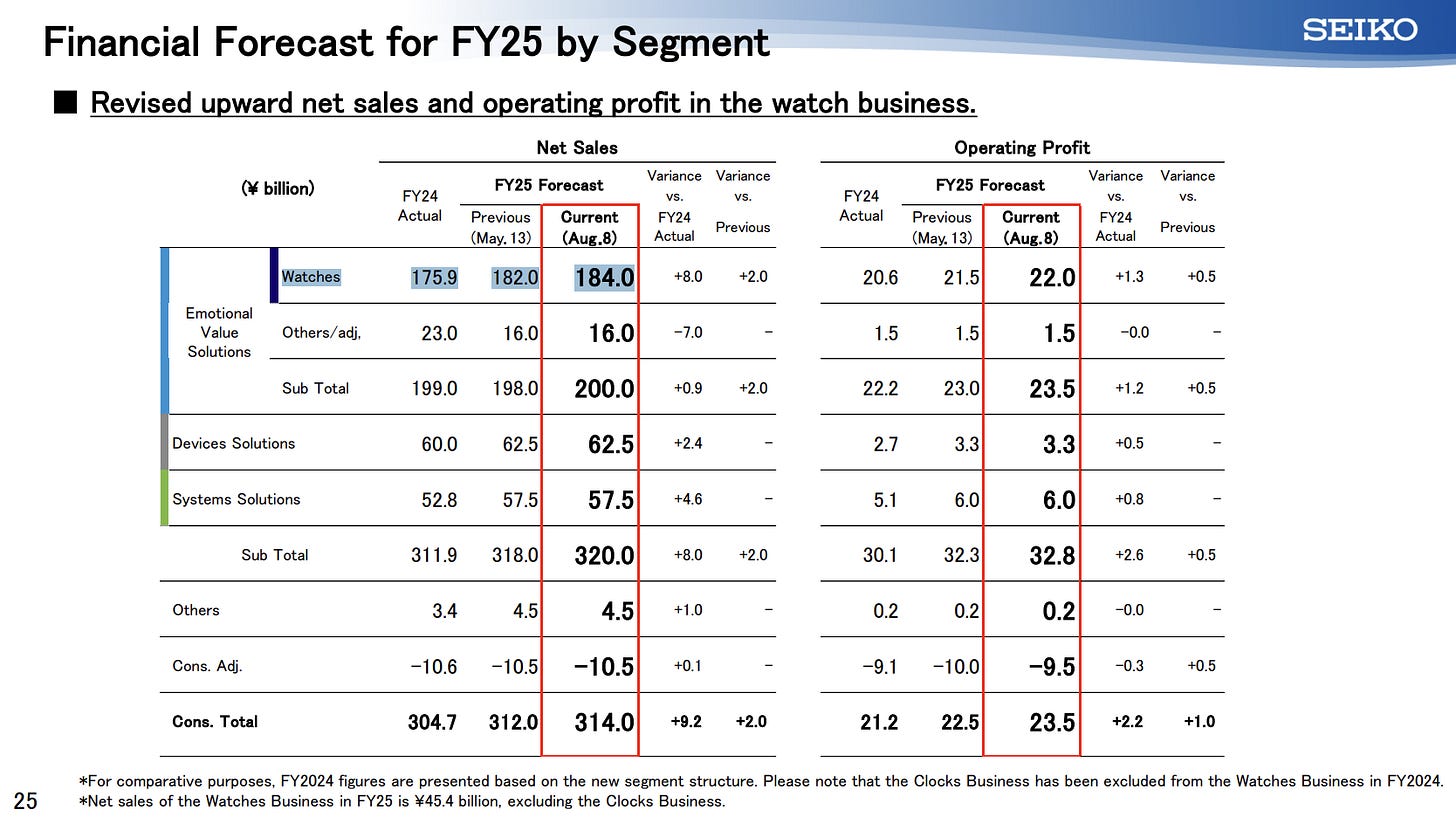

3) Category confirmation from suppliers.

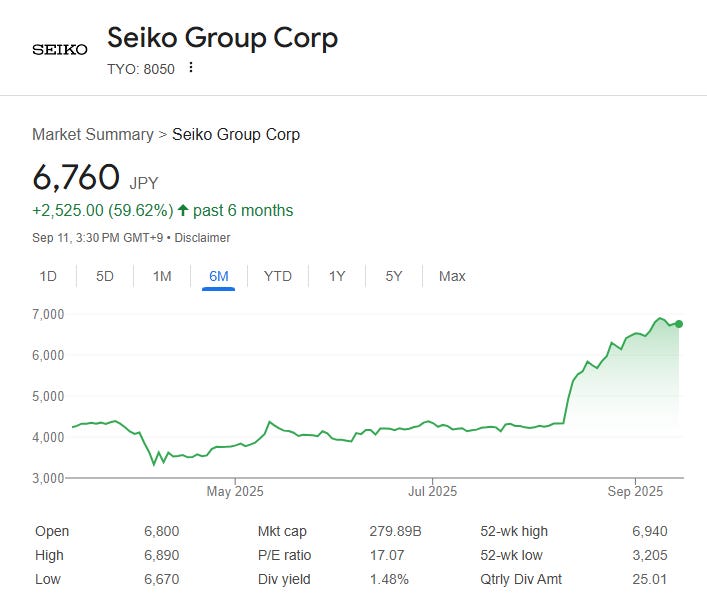

Seiko reported stronger than expected results last month, revising guidance and citing improved watch demand (+3.5% YoY to +4.6% YoY).

While Seiko is not a luxury Swiss brand like a lot of Watches of Switzerland Group’s portfolio, it is a useful read-through on broad watch appetite. We see very similar website traffic trends in Seiko ($8050.T) as we see in $WOSG.L which indicates strong watch demand across the board.

4) Macro tailwind matters for this customer segment.

A rising equity market typically boosts the wealth effect for watch buyers. Stabilizing prices plus higher brand engagement is a healthier mix for full-price sell-through, especially with global stock markets at all-time highs.

Tariffs are the main risk, but relief is plausible

The U.S. has proposed tariffs of up to 39% on certain Swiss imports, including watches. The measure is not yet final and diplomatic activity is ongoing. Recent reporting highlights active outreach by industry leaders seeking a resolution. The Rolex CEO recently hosted President Trump at the U.S. Open for example.

In anticipation, Swiss watch exports to the U.S. surged ahead of potential implementation, which could create some near-term inventory noise.

What to watch

Any official timing, scope, exemptions, or phase-in related to the U.S. tariff proposal.

Pricing behavior on the secondary market. Sustained stability in the WatchCharts index should support primary market ASPs and full-price sell-through.

TickerTrends consumer interest and aggregated website traffic trackers for real-time top of funnel demand signals.

Why this matters for WOSG

Cleaner comps and better mix. After a difficult U.S. period last year, WOSG faces easier comparisons into the holidays. Website traffic is even currently above holiday levels already. Our brand and company interest trackers turning higher suggest improved traffic, while a stable resale market reduces discounting pressure and supports margin mix.

Inventory and allocation. Stronger engagement around Rolex, Tudor, Omega, Cartier, and Breitling is a positive read on the consumer as a whole. If tariff execution is delayed or diluted, U.S. full-price sell-through should hold up. If tariffs hit at the high end of proposals without mitigation, we would expect some demand destruction and a possibly a shift towards non-Swiss brands or pre-tariff built up inventory.

Positioning and scenarios

Base case (most likely):

Tariffs are delayed, softened, or implemented below the headline level for a transitional period.

WatchCharts index remains stable to slightly higher through Q4.

TickerTrends brand interest stays positive, supporting a strong holiday traffic period for the watch industry.

Implication: modest sales re-acceleration in H2 with better gross margin mix than last year. We see how in the case of Seiko, even a modestly good outcome re-rated the earnings multiple much higher.$WOSG.L currently trades at the lower bound of its historical range at only 9x TEV/EBIT. This makes a demand acceleration in watches particularly interesting and important to pay close attention to.

Upside case:

Diplomatic outcome reduces tariff pressure materially; Swiss supply and pricing normalize.

Secondary prices grind higher as similar markets like collectibles have already surged; mid-tier and luxury watch brands continue to firm.

Implication: upside to consensus on both revenue and gross margin, with the U.S. improving faster than expected.

Downside case:

Full tariff rate implemented quickly with limited exemptions; operating margins experience some modest pressure.

Demand deferral/destruction in the U.S. until pricing resets; heavier promotional activity with a margin hit.

Implication: revenue softness in the U.S., partly offset by U.K. and non-Swiss mix.

Bottom line

Our alternative data shows improving demand signals for luxury watches and for the specific brands that drive WOSG’s business. Secondary prices have stabilized, web interest is climbing, and total digital index in luxury watches as a whole on social media platforms are experiencing healthy upward trends. With United States revenue representing 48% of Watches of Switzerland Group’s revenue in FY’25, The tariff overhang is real. There however seem like many credible paths to a softer outcome. On balance, the setup for WOSG is better than it has been in years, with a potential for a multiple re-rating higher on the back of a return to strong top-line growth after the protracted 3-year watch bear market. If these trends persist, the setup on the long side into their earnings in December look very promising. The tariff policy path likely determining whether this is a modest / muted recovery or something stronger.

This was awesome, looks like a very undervalued business, thanks for the work