YETI’s TikTok-Fueled Momentum Could Challenge the Street’s Flat Revenue View

Camino Craze: Viral Tote Bag Drives Surge in YETI Demand Ahead of Q2 Earnings

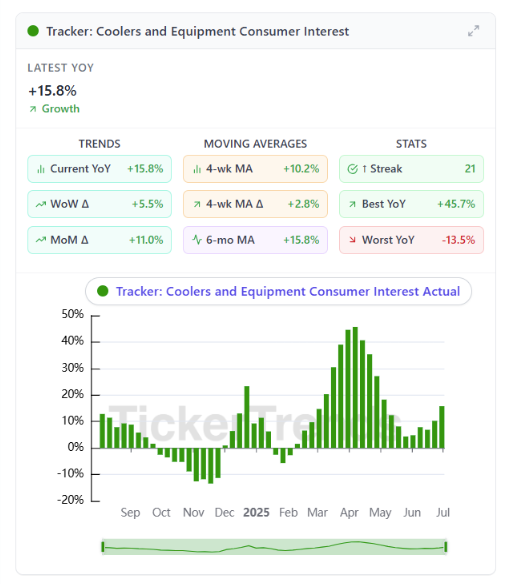

YETI’s Camino tote bag is going viral all over social media and our real-time tracker data is pointing high for the brand leading our overall “Coolers and Equipment” segment tracker +15.8% YoY, with week-over-week and month-over-month accelerations of 5.5% and 11.0% over the respective periods. Based on current social traction, these numbers are likely to settle even higher when the dust settles.

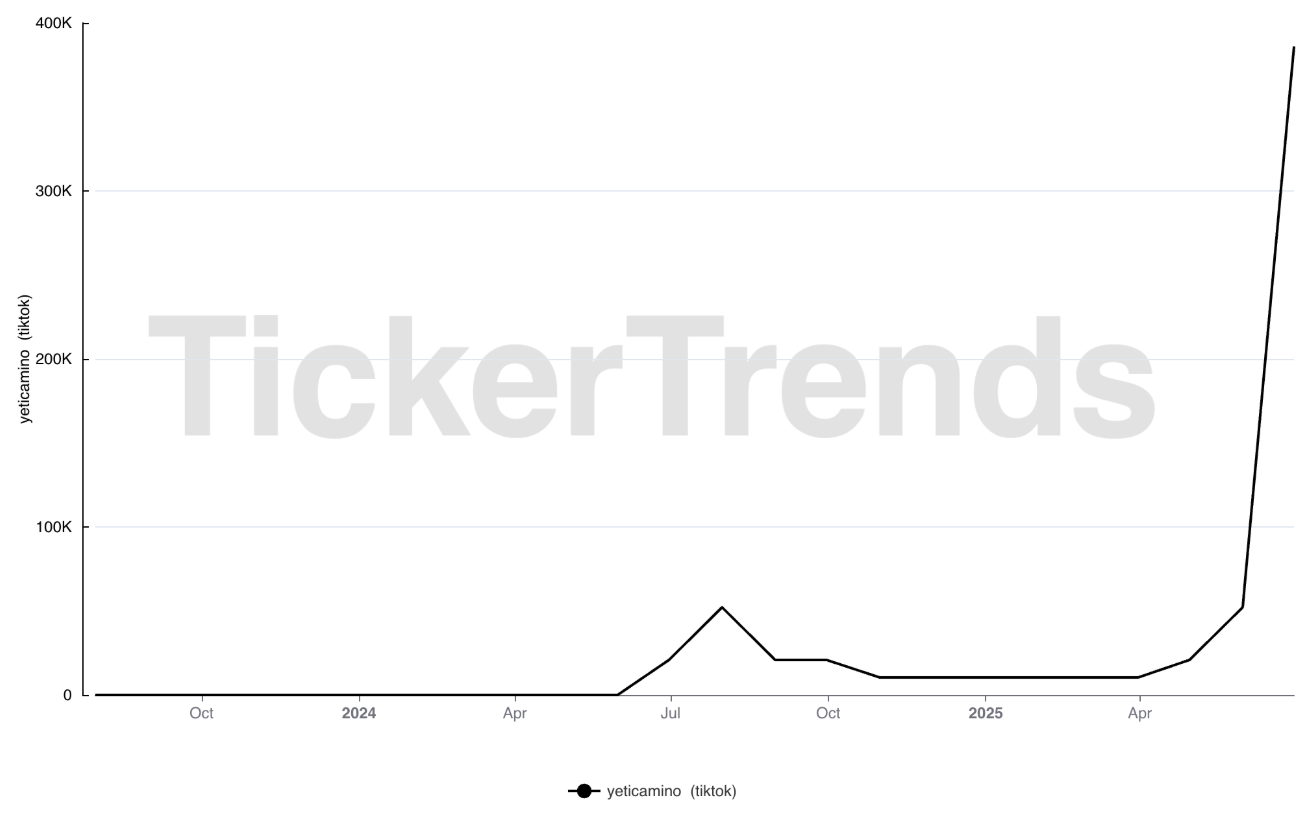

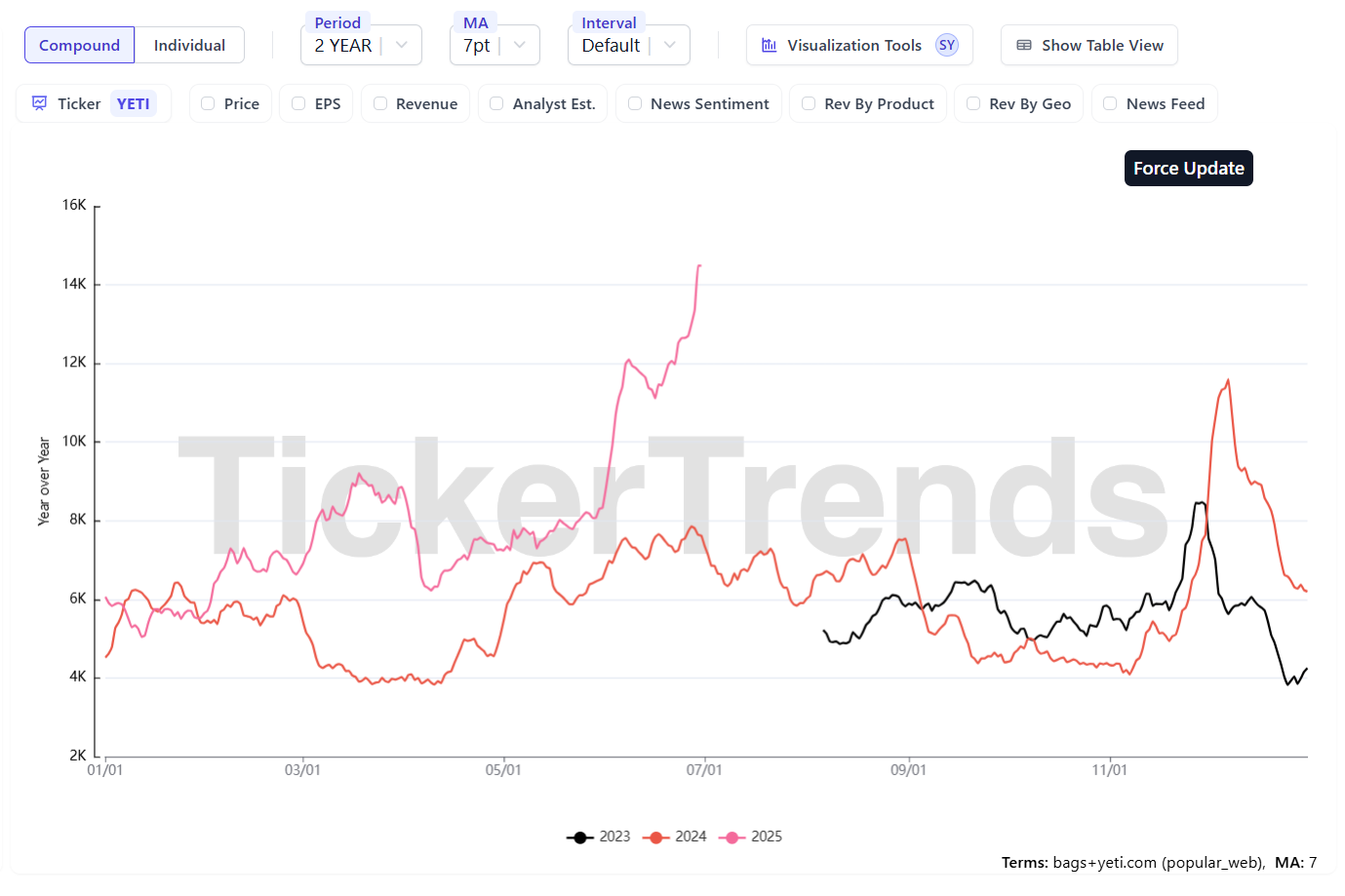

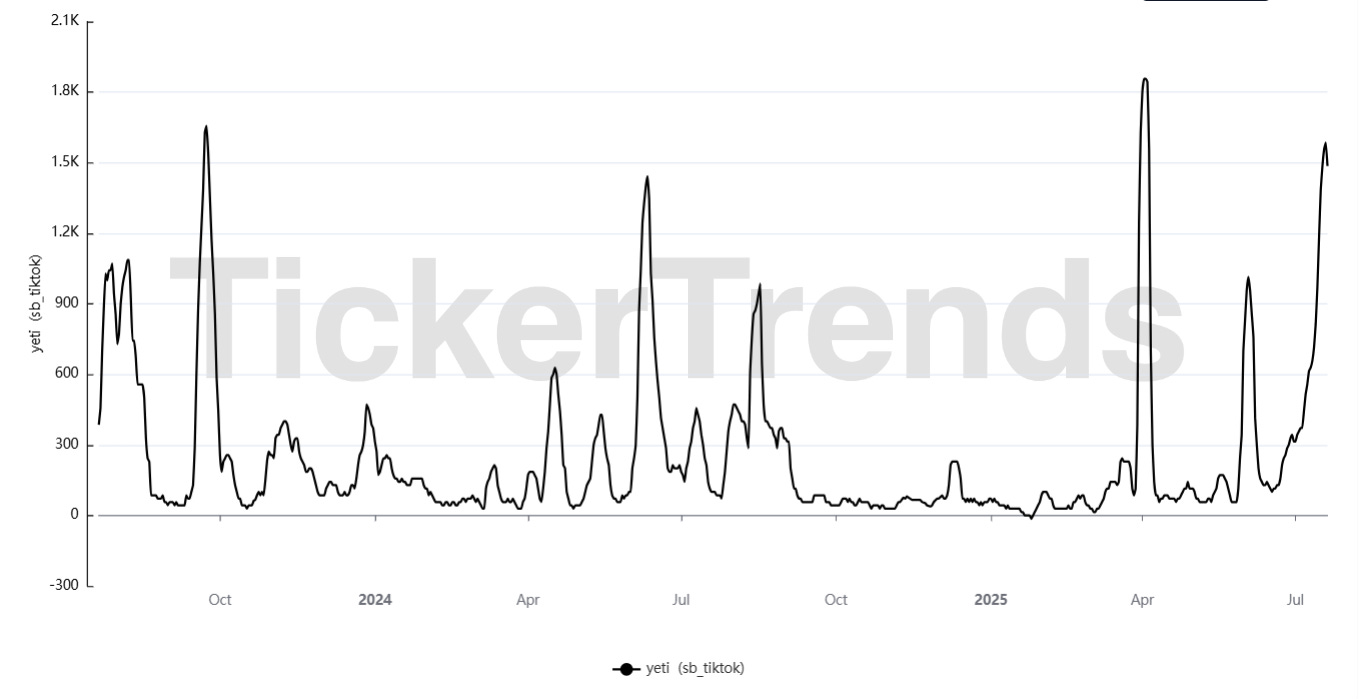

TikTok average daily impressions for #yeticamino climbing roughly 7x since May and are continuing strong in the most recent months worth of data. TikTok users are raving about how the Yeti Camino 35 is the “bag of the summer” or “the new mom bag.”

This momentum is not limited to social media noise. According to our data:

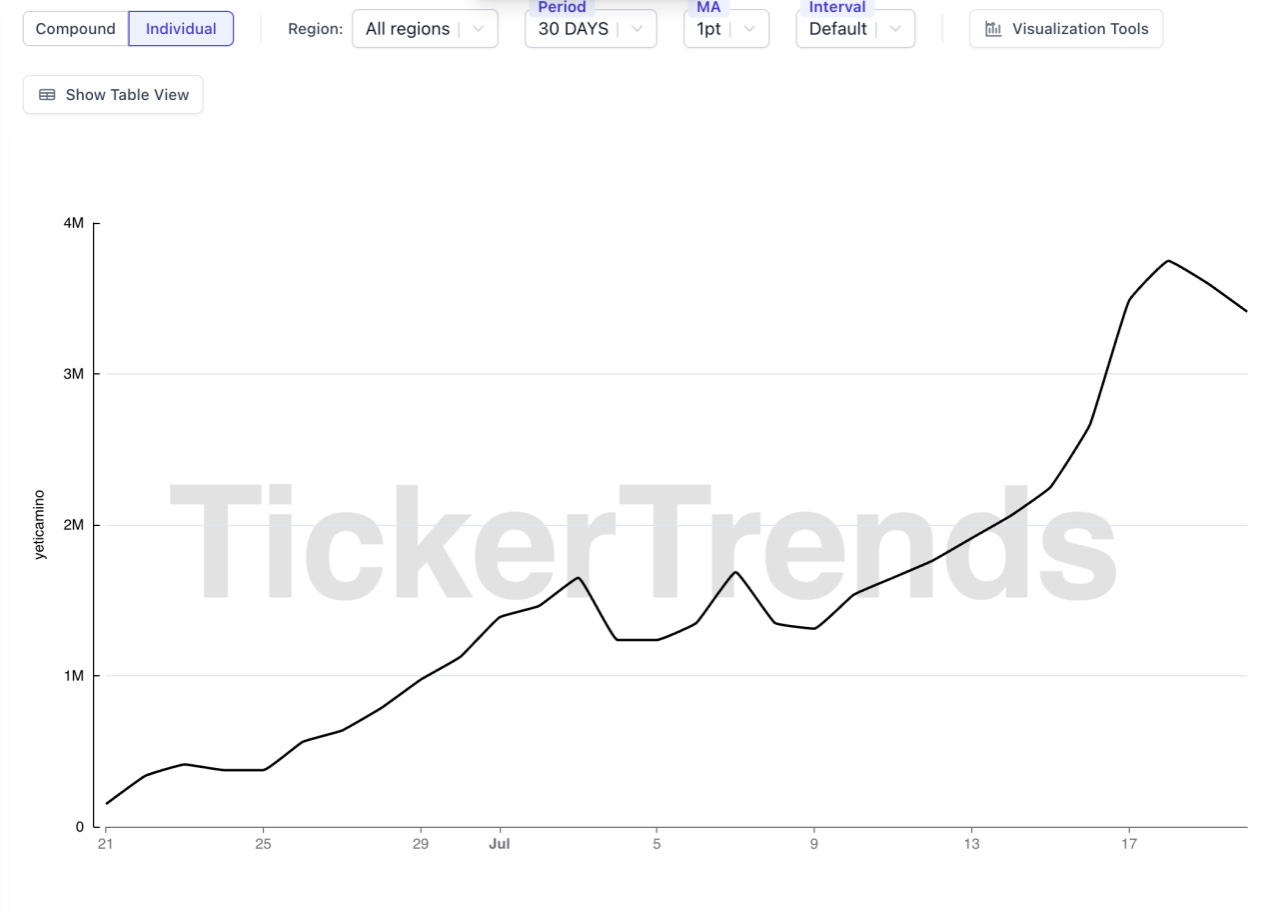

Yeti.com web traffic is up ~20% YoY, with the site now averaging 35,000 more daily visitors than the same time last year. This is in addition to subdomain data such as yeti.com/bags rising more year-over-year.

The @yeti TikTok account is gaining 1–2K new followers per day, compared to just a few 100 per day a year ago.

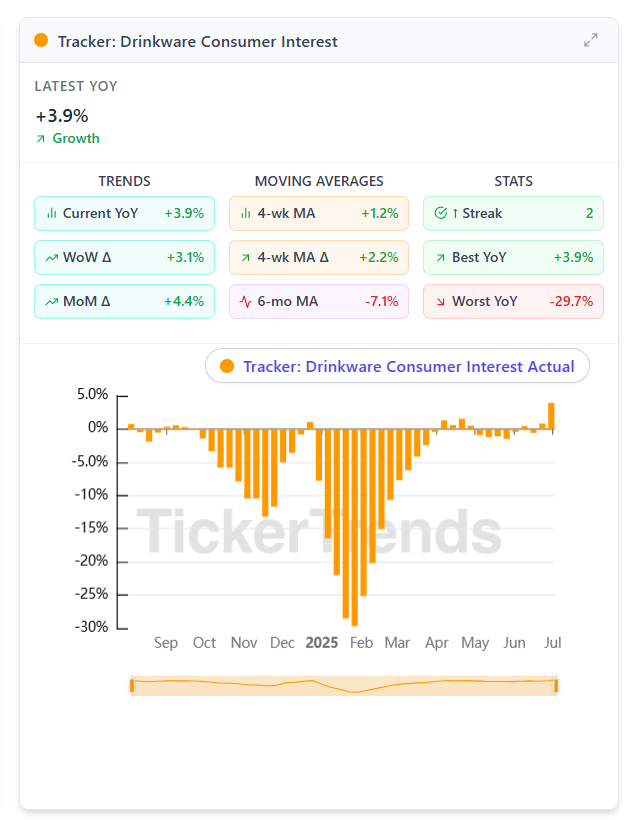

Drinkware interest has also flipped positive in our tracker, a sign that strength may not be isolated to one SKU or category, but rather a broad based renewed interest in the Yeti brand.

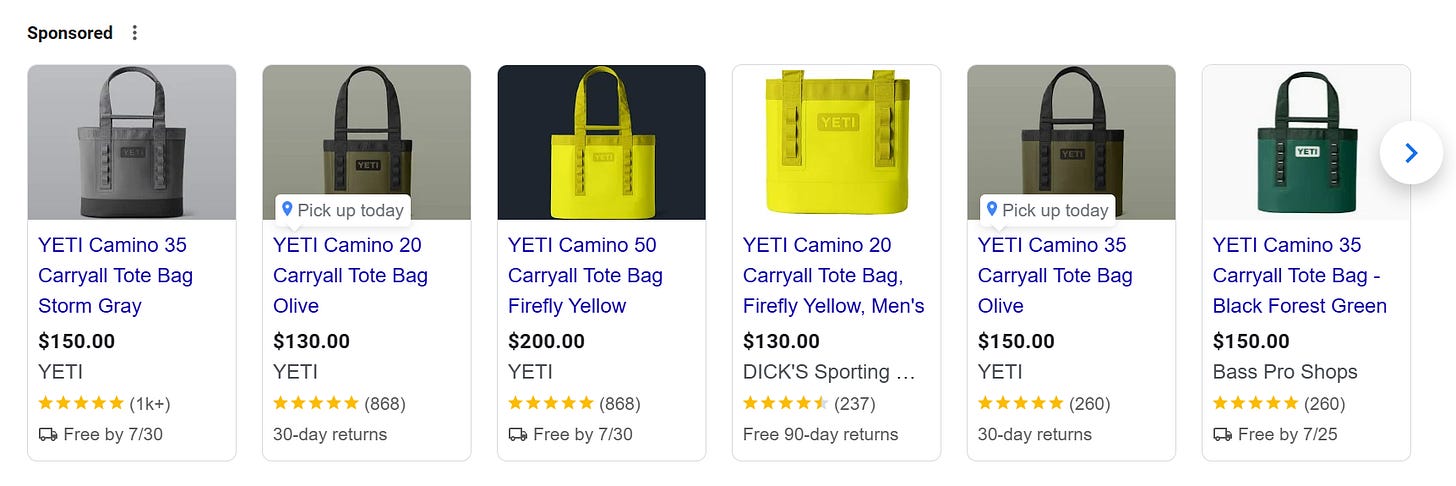

The Camino bag stands out not only for engagement but also for its financial leverage. Priced at $130 to $150, it’s significantly above the average selling price (ASP) of most YETI SKUs. Several styles and colors are currently out of stock in major metro areas, with consumers driving to different stores to find them. While potentially not yet material enough to drive a full category infle its own, its popularity is likely contributing to the recent uptrend in equipment-related demand.

Street Expectations May Be Out of Sync

Sell-side consensus still reflects softness. Analysts are forecasting a 0.4% revenue decline in FY’25 Q2 and just a 2.8% YoY increase in FY’25 Q3. Yet our composite consumer demand data is rising, not falling, across key channels.

Although tariff risks remain a structural headwind, current digital and behavioral signals suggest that recent product-level virality may allow Yeti to pass on higher prices if they need to, although it remains a key risk to monitor. Continued strength in web traffic, combined with sequential acceleration in consumer trackers, could put upward pressure on analyst revenue forecasts as well as future company commentary/guidance if the trend persists.

Positioning View

YETI’s stock has often responded to changes in consumer momentum before earnings revisions catch up. With both the Coolers & Equipment and Drinkware segments now inflecting upward in our trackers, and TikTok-driven brand reach widening rapidly, this sets up an actionable long opportunity ahead of Q2 results reported on August 7, 2025. If demand translates to sell-through at retail and e-commerce levels, the Street’s flat Q2 view may prove too conservative.

Please email admin@tickertrends.io to gain access to our entire KPI dashboard which includes coverage of over 100 unique KPIs available on TickerTrends Enterprise: https://tickertrends.io/enterprise