Zumiez ($ZUMZ) Alternative Data Overview | TickerTrends.io

The TickerTrends Social Arbitrage Hedge Fund is currently accepting capital. If you are interested in learning more send us an email admin@tickertrends.io .

Ticker: $ZUMZ

Sector: Apparel

Company Description: Zumiez Inc. operates as a specialty retailer of apparel, footwear, accessories, and hardgoods for young men and women. The company provides hardgoods, including skateboards, snowboards, bindings, components, and other equipment. It operates stores in the United States, Canada, Europe, and Australia under the names of Zumiez, Blue Tomato, and Fast Times. It operates zumiez.com, zumiez.ca, blue-tomato.com, and fasttimes.com.au e-commerce websites. Zumiez Inc. was founded in 1978 and is headquartered in Lynnwood, Washington.

Zumiez ($ZUMZ): Reviving Streetwear through Collabs, Events, and Rising Trends

Historical Results — Struggles with Sales

Zumiez ($ZUMZ), a major player in the streetwear and skateboarding retail space, has faced significant challenges over the past few years. In fiscal 2023, the company reported a sharp decline in revenue, falling to $875.49 million, an 8.65% decrease from the $958.38 million reported in 2022. These figures were even more stark when compared to 2021, when Zumiez generated $1.18 billion — a sign of the difficulties the retailer has faced amid shifts in consumer behavior and a more competitive landscape. As a result, same-store sales have seen declines, putting pressure on the company to rethink its strategy to regain relevance and market share.

Recent consumer trends however have potentially reshaped this reality for Zumiez. A combination of various consumer trends, from influencer collaborations, streetwear, skateboarding, and Y2K fashion trends has begun to reignite consumer interest. This article aims to analyze how Zumiez may be a beneficiary of these tailwinds, potentially positioning the brand in a good spot for potential future growth.

Zumiez’s Influencer Strategy — Sam & Colby, Junior H, and more

One of the most successful partnerships in Zumiez’s recent strategy is with popular YouTubers Sam and Colby. Their streetwear brand, XPLR, which stands for “Explore,” perfectly aligns with Zumiez’s core audience — adventurous, young, and socially conscious consumers. XPLR merch, now carried at Zumiez, has driven increased foot traffic and online sales for the retailer, attracting the large, engaged fanbase of Sam and Colby. Sam and Colby held a meet and greet with their fans at Zumiez on June 8, 2024, where the first 500 shoppers got an autographed poster.

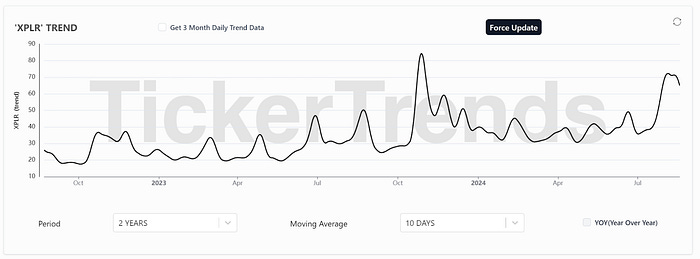

Through events like meet-and-greets, exclusive product drops, and behind-the-scenes content, Zumiez has created a buzz around the XPLR merchandise. These activations have been a hit on platforms like YouTube and TikTok, and Google Search data shows a steady rise in queries for “XPLR” especially after the collaboration, indicating growing interest from both fans and streetwear enthusiasts. Similarly, YouTube search volumes related to Sam and Colby have surged and Zumiez has seemed to stablize as well, further amplifying the collaboration’s success.

Y2K Fashion Resurgence, Streetwear Interest, and Zumiez’s Role

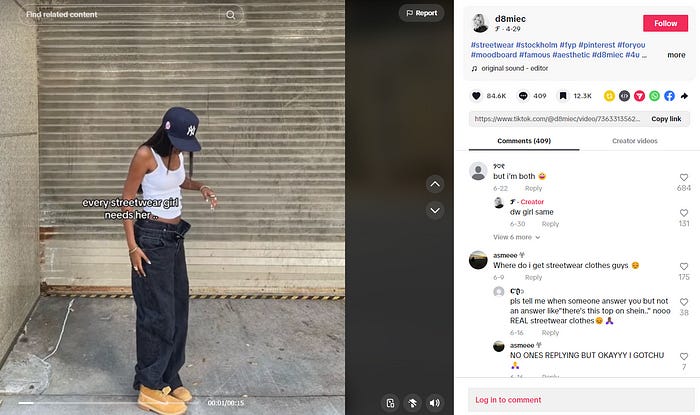

The Y2K fashion trend, characterized by the bold, eclectic styles of the late 1990s and early 2000s, has made a comeback. Zumiez has been quick to capitalize on this revival, offering collections that align with Y2K aesthetics, including baggy jeans, graphic tees, and other retro-inspired pieces from brands like Dickies and Champion. With Y2K culture making waves among Gen Z and young millennials, Zumiez is positioned well to tap into this growing market.

Tiktok hashtag volume shows a clear rise in searches for terms like “y2kaesthetic”. and “streetwear,” with Zumiez seemingly benefiting from the nostalgia-driven craze as evidenced by surging Google Search volume interest as shown below.

Additionally a new movie “A24” is set to be released on December 6 and it centers on Y2K. The movie, directed by Kyle Mooney, features prominent actors and actresses, such as Rachel Zegler. This might even further bolster the Y2K fashion trend. As a result, Zumiez could see an even greater demand for its Y2K-themed collections, driving foot traffic to stores and boosting online sales.

Streetwear Culture and Skateboarding’s Resurgence

Streetwear has long been synonymous with Zumiez, with its roots in skateboarding, hip-hop, and punk subcultures. This fashion style prioritizes individuality and bold designs, perfectly complementing Zumiez’s product range. The brand’s connection to streetwear and skateboarding remains a defining aspect of its identity. Google Search interest for “streetwear” has started to rise again year-over-year, after declining for over a year prior.

and “streetwear,” with

Consumer Google Search interest for terms relating to these streetwear and loose fit, baggy clothes is certainly evidenced in the data shown. In particular, many Reddit subreddit daily growth trends stand out, such as r/Streetwear, r/Zumiez, and r/Skateboarding with significantly higher volume of daily growth recently.

Skateboarding’s inclusion in the 2024 Paris Olympics propelled the sport into the global spotlight, reigniting a lot of interest in the hobby.

Zumiez may stand to benefit from this being the premier skateboarding retailer, with the potential for increased sales in skateboards, apparel, and accessories directly linked to skateboarding culture.

Blue Tomato and Fast Times: Stagnant Brands within Zumiez

While Zumiez is capitalizing on partnerships and recent consumer fashion trends, some of its other segments, such as Blue Tomato and Fast Times, have struggled to find momentum. Blue Tomato, the European retailer specializing in snow, surf, and skate gear, has shown limited growth since being acquired by Zumiez in 2012. Similarly, Fast Times, an Australian skateboarding retailer acquired in 2015, has faced challenges in expanding its market share.

Although Zumiez does not provide detailed revenue breakdowns for each brand we can try to model out an indication of what a synthetic Google Search term value would look like for all three brands as shown below. We still see decent year-over-year growth after a long period of stagnation/decline.

Conclusion

Zumiez appears to be making a strong comeback, propelled by collaborations with influencers like Sam and Colby, and by tapping into major cultural trends like Y2K fashion, streetwear and skateboarding. Social media buzz indicates that the brand is experiencing heightened consumer interest. With the majority of data sources — Google Search, Youtube Search, Reddit, Tiktok and more rising for terms relating to Zumiez, we can see a clearer picture of what to expect for the company and the $ZUMZ stock price in general.

While its subsidiary brands, Blue Tomato and Fast Times, face challenges, Zumiez’s core brand is well-equipped to capitalize on the rising trends that define today’s streetwear and skate culture. With the right strategy, Zumiez has the potential to return to growth and re-establish itself as a leader in the streetwear and skateboarding retail space.

Discord Link: https://discord.gg/dGEW4Pyacd

Hedge Fund Enquiries: admin@tickertrends.io

Follow Us On Twitter: https://twitter.com/tickerplus