$DUOL Duolingo's Social Media Collapse Signals Prolonged Weakness Ahead

Why Wall Street's "Temporary Headwind" Narrative Misses the Mark on Persistent User Engagement Decline

Introduction

At TickerTrends we specialize not just in decoding one-off social events, but understanding the duration of impact of the trends on key reported metrics.

We did this with Victoria Secret, American Eagle, and Yeti - and we’re doing it with Duolingo once again.

Duolingo has fallen over -30% since our last report with buy-side and sell-side firms citing TickerTrends as a leading source of KPI performance.

Current market sentiment reflects analysts’ broad view that Duolingo weakness is a “temporary headwind” that will fade as we move through the latter quarters of the year.

Analysts consistently reference Duolingo AI weakness as a temporary event:

TickerTrends believes the headwinds seen in Q2 2025 are not temporary and will materially affect performance for quarters to come.

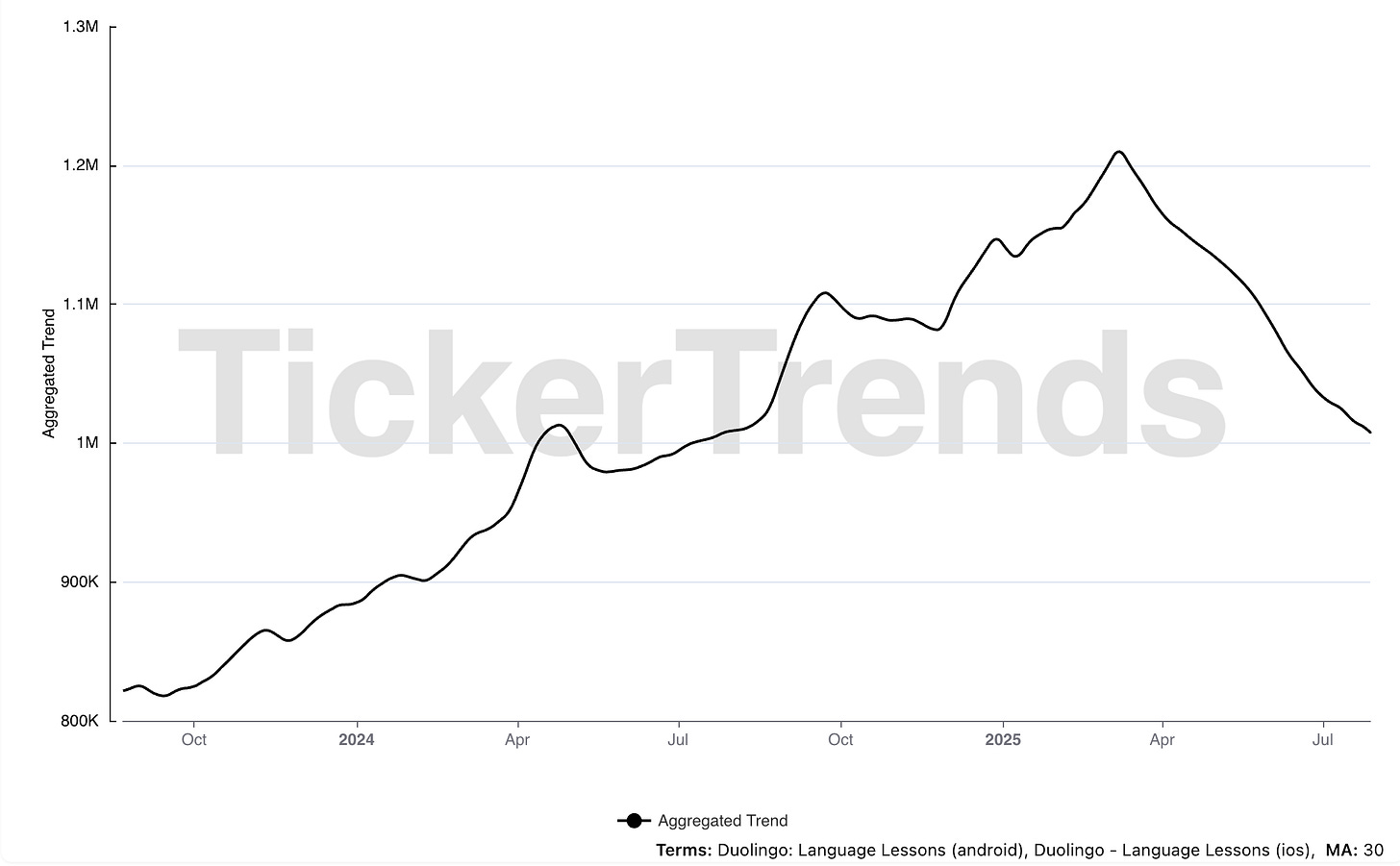

App Usage

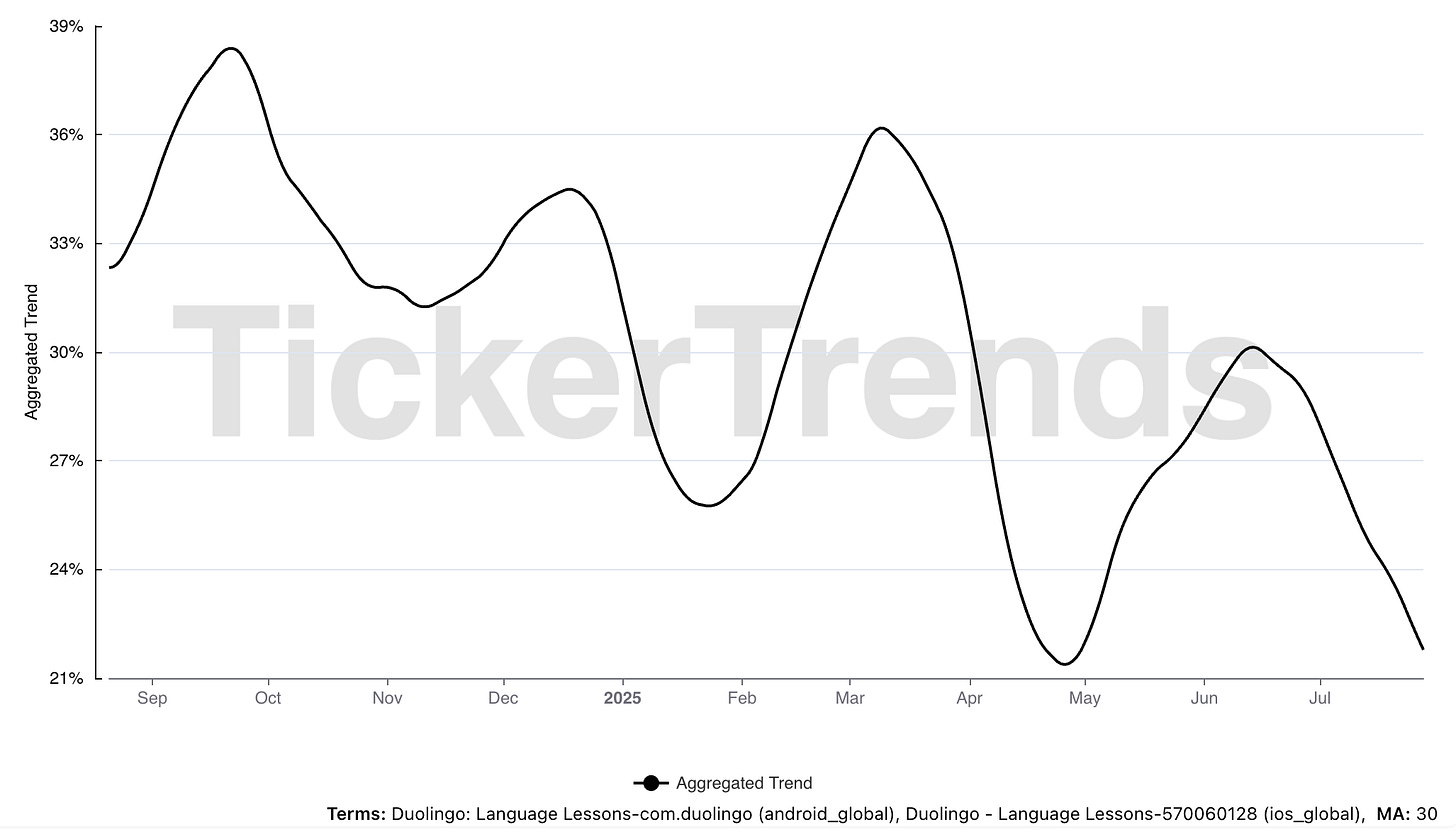

The decline in US mobile app usage has continued and has further spilled over into global DAU numbers.

YoY we can see global app usage increasingly following the impact from US usage.

Social Performance

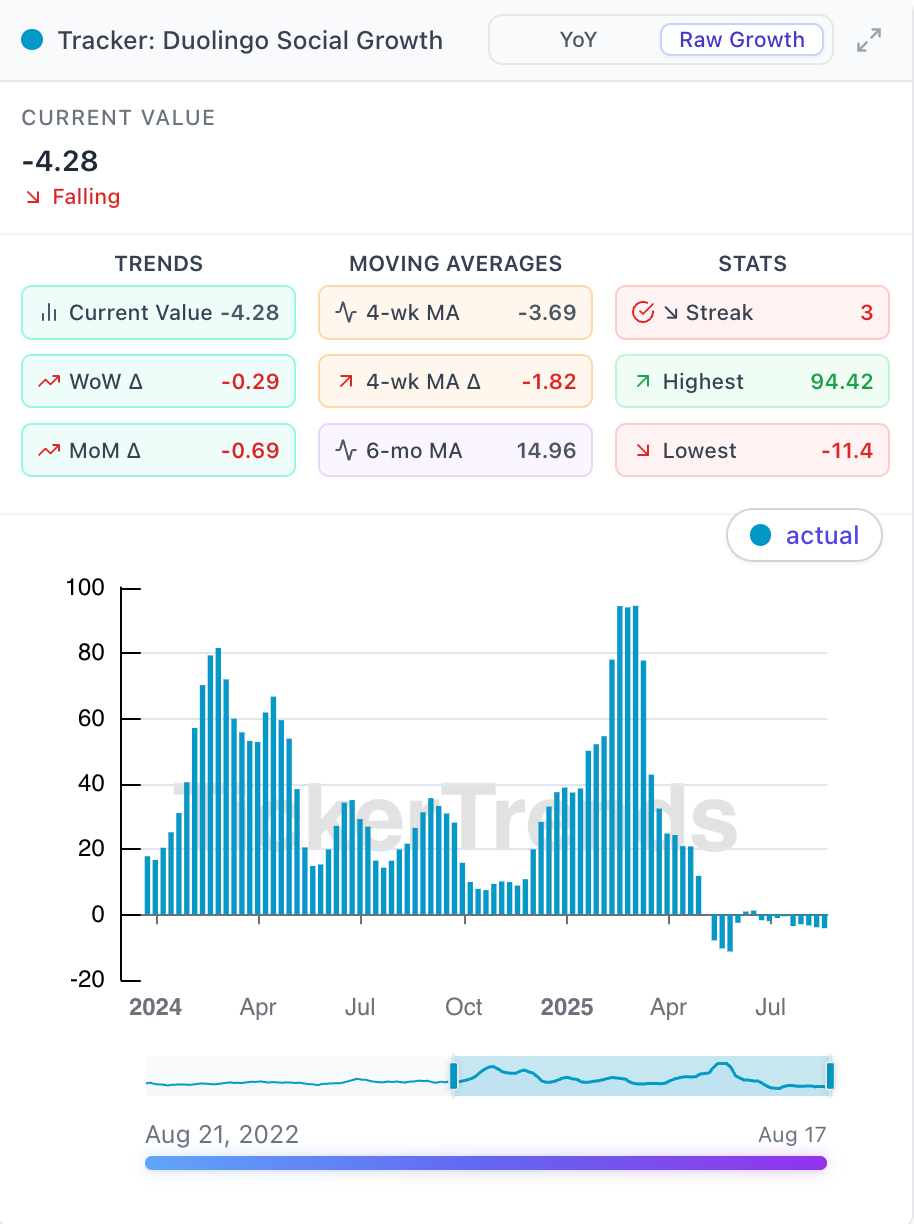

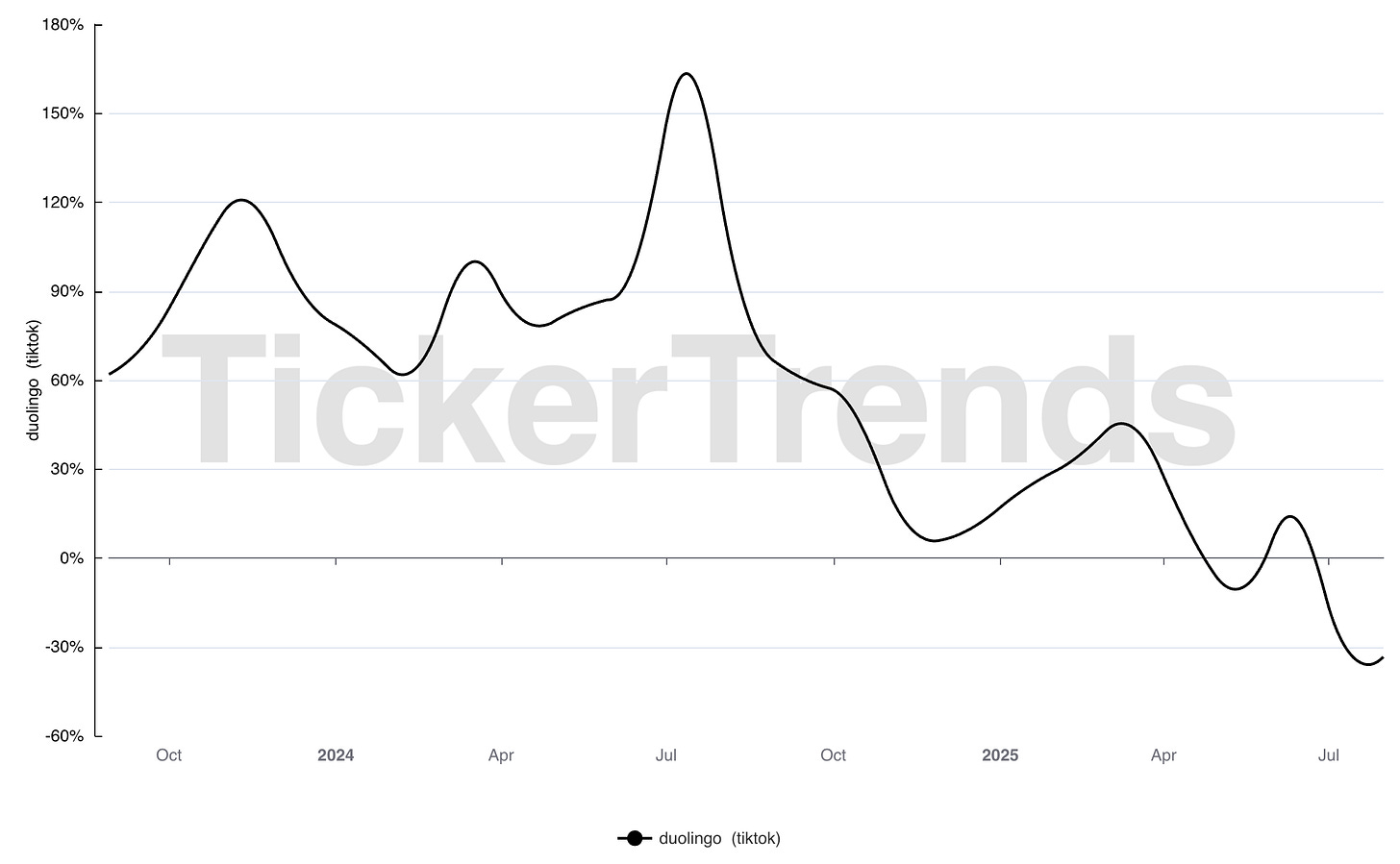

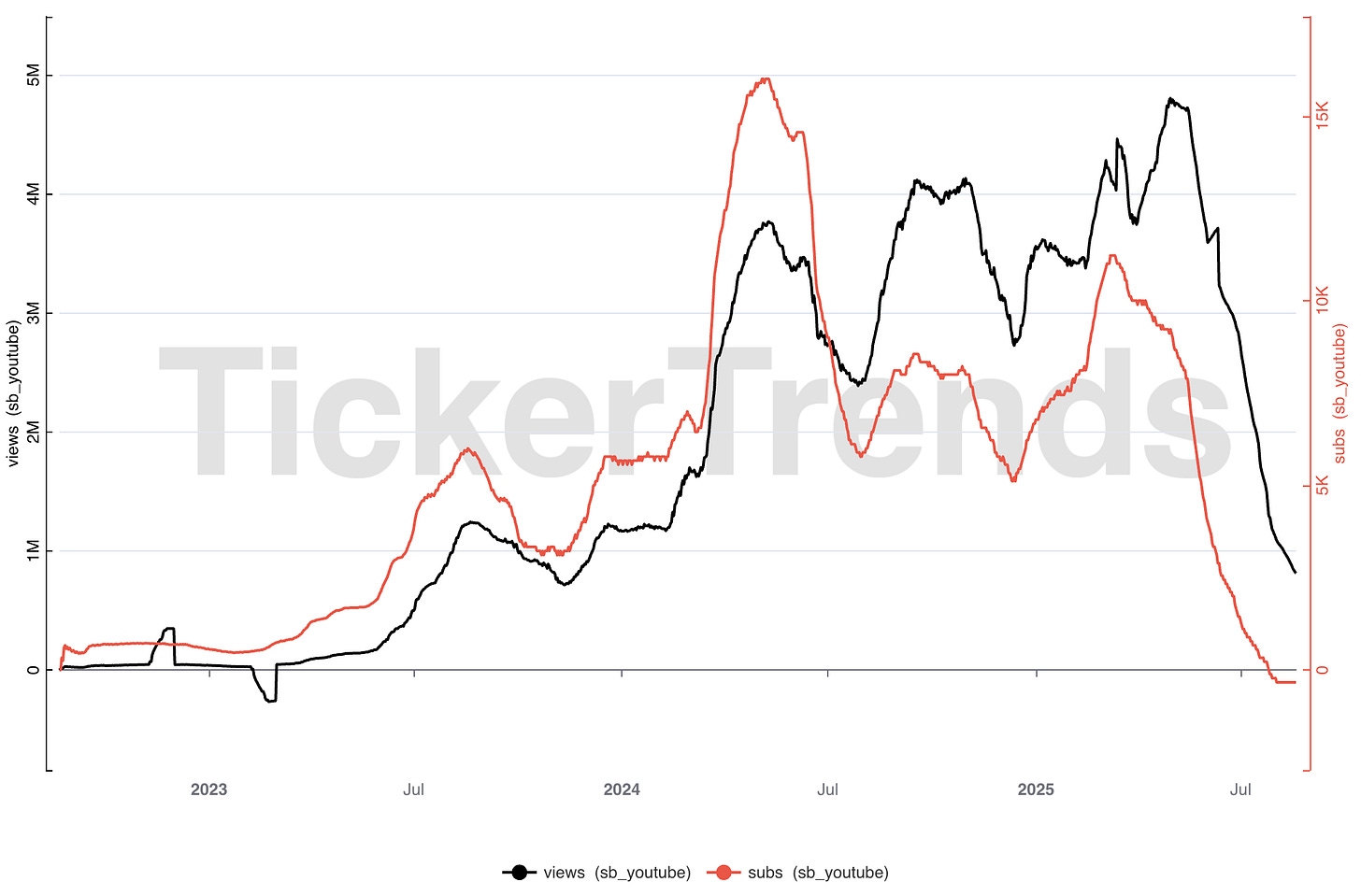

TikTok, Instagram, YouTube social metrics are still falling. We see no signs of recovery across these social platforms for either consumer sentiment or marketing impact as illustrated in our composite Social Growth Tracker.

Social media is the key growth engine for Duolingo. This is a leading indicator for DAU growth. Views convert to dollars, and Duolingo is not attracting social impressions.

New Subscriptions

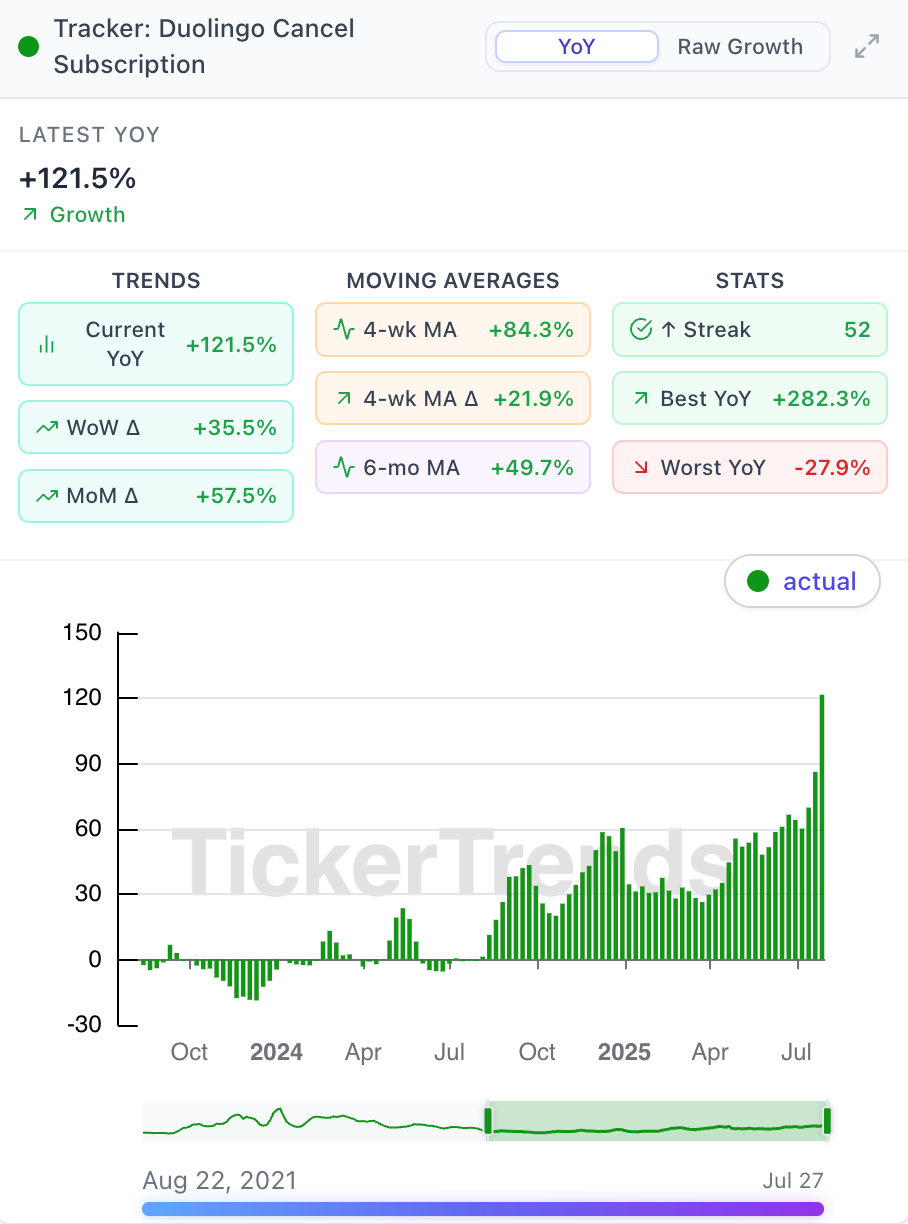

An increased rate of cancellation and fewer new subscribers are clearly visible in our Trackers, while overall web traffic continues to decline.

Negative social sentiment is only increasing churn, and new signups are not keeping up.

Zaria Parvez Leaving

The timing couldn't be worse. Duolingo's senior global social media manager, Zaria Parvez, departed on August 15th, removing the single most important figure behind the company's social transformation.

Parvez masterminded Duolingo's leap from 50,000 TikTok followers to 16 million in just over four years, creating the "unhinged" approach that became the brand's signature and generating 8 billion impressions that drove user acquisition.

Her cryptic departure announcement—"As for the what, why, who, when, and how… I'm saving all that for the book" suggests potential internal friction, particularly concerning given our data showing social momentum already stalling across all platforms.

While Duolingo plans to backfill her role and hire additional team members, TickerTrends believes replacing the knowledge and creative instincts that built their viral engine will prove exceedingly difficult, accelerating the social decline we're already tracking precisely when authentic engagement has never been more critical to user growth.

Conclusion

TickerTrends maintains a bearish outlook on Duolingo as converging data streams paint a picture of sustained weakness, not the temporary blip that consensus expects.

While traditional financial metrics often lag fundamental shifts in consumer behavior, our trackers provide real-time visibility into the deteriorating user acquisition funnel that will ultimately flow through to reported DAU and revenue figures in coming quarters.

The confluence of declining US app usage spreading globally, persistent weakness across all major social platforms, and accelerating subscription churn creates a self-reinforcing negative cycle that contradicts the Street's optimistic Q3/Q4 recovery thesis. Social virality was the engine that drove Duolingo's extraordinary growth trajectory—and that same engine is now working in reverse.

Our conviction remains high that Q2 2025 represents an inflection point, not an aberration. As other firms continue to model temporary weakness followed by normalization, TickerTrends sees structural headwinds that will persist well into 2026.

The market's eventual recognition of this reality should drive continued multiple compression as growth expectations reset to reflect the new user engagement landscape. We expect our contrarian position will be validated as the quarters progress and the "temporary" headwinds prove anything but transitory.

For KPI tracking and market impact metrics contact admin@tickertrends.io